Engineering Software Market Analysis and Insights:

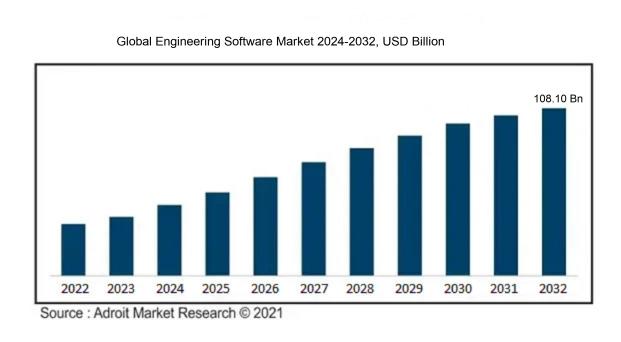

In 2023, the size of the worldwide engineering software market was estimated at USD 45.20 billion. The market is expected to grow at a compound annual growth rate (CAGR) of 11.5% from its estimated USD 50.08 billion in 2024 to USD 108.10 billion by 2032.

The Engineering Software Market experiences significant growth due to ened demands for increased automation and improved efficiency within design and manufacturing operations. As engineering projects grow more intricate, there is a corresponding need for sophisticated tools that facilitate simulation, modeling, and effective data management, resulting in a greater uptake of software solutions. The rise of technologies like cloud computing, artificial intelligence, and the Internet of Things (IoT) further promotes collaboration and enhances real-time data analytics, fueling market expansion. Additionally, the growth of sectors such as construction, automotive, and aerospace drives the necessity for tailored engineering software to maintain accuracy and adhere to regulatory requirements. The pressures of globalization encourage companies to innovate and optimize their processes, thus amplifying investments in engineering software. Moreover, the increasing emphasis on sustainability and environmentally friendly engineering practices has led to the creation of software that aids in the development of sustainable designs and procedures, marking it as a key factor in the market's growth.

Engineering Software Market Definition

Engineering software encompasses a range of specialized applications developed to aid in the design, simulation, evaluation, and oversight of engineering initiatives. Such tools significantly improve efficiency, precision, and teamwork among different branches of engineering.

Engineering software plays a crucial role in advancing the design, assessment, and oversight of intricate projects in numerous fields such as civil, mechanical, and electrical engineering. It allows for advanced simulations that enable engineers to see potential results and fine-tune designs without the hazards involved in creating physical prototypes. This software enhances workflow efficiency, fosters team collaboration, and automates repetitive tasks, significantly boosting productivity. Additionally, it assists in maintaining adherence to industry standards and regulations, promoting the development of safer and more sustainable engineering solutions. As technological advancements progress, the dependence on engineering software is increasing, solidifying its status as an essential asset in contemporary engineering practices.

Engineering Software Market Segmental Analysis:

Insights On Deployment

Cloud

The Cloud deployment model is anticipated to dominate the Global Engineering Software Market due to its significant advantages in flexibility, scalability, and cost-effectiveness. With the increasing shift towards digital transformation across industries, businesses are looking for solutions that facilitate remote access and collaboration. Cloud-based engineering software allows users to engage in real-time project management and share resources seamlessly, which is particularly advantageous in today’s fast-paced environment. Furthermore, the ease of integration with other cloud services enhances operational efficiency, making it an attractive option for organizations aiming for innovation and collaboration. As a result, cloud computing in engineering software is on an upward trend, forecasted to surpass other deployment forms significantly.

On-premises

The On-premises deployment model has traditionally been favored by organizations that prioritize data security and control over their software environment. Businesses operating in sectors such as aerospace, defense, and finance often prefer this approach because it allows for strict adherence to regulatory compliance and security protocols. Additionally, some organizations are concerned about the reliability of internet connectivity and prefer to rely on robust internal infrastructures for critical operations. While the on-premises model comes with higher upfront costs and maintenance responsibilities, it offers significant tactical advantages for companies that possess the resources for effective in-house management.

Insights On Component

Software

The Global Engineering Software Market is expected to witness significant growth driven primarily by the software component. The continuous innovation and enhancements in engineering software solutions cater to an extensive range of applications like computer-aided design (CAD), computer-aided manufacturing (CAM), and product lifecycle management (PLM). Industry demands for efficient design processes, improved productivity, and enhanced collaboration tools further solidify the position of software as a dominating force. The rising adoption of cloud-based solutions and advanced analytics also plays a critical role in favor of software, making it integral for businesses seeking competitive advantages in engineering projects.

Services

The services component of the Global Engineering Software Market is crucial, primarily focusing on providing support, maintenance, and consulting services related to engineering software. With businesses increasingly looking for customized solutions and expert guidance, the demand for services continues to grow. These services enhance the user experience by ensuring proper deployment, integration, and ongoing support, ultimately contributing to improved functionality and customer satisfaction. Furthermore, as engineering software becomes more complex, organizations require specialized services to maximize their investment, leading to steady demand in this area that supports software efficiency and usability.

Insights On Application

Product Design & Testing

Product Design & Testing is anticipated to dominate the Global Engineering Software Market primarily due to the rising demand for innovative product solutions across various industries. The need for efficiency, speed, and accuracy in designing and testing products is driving companies to adopt advanced engineering software that enhances their capabilities. As organizations continually strive to shorten product development cycles while maintaining high quality, robust design and testing tools have emerged as essential components of the engineering workflow. The growing emphasis on product lifecycle management, coupled with the integration of automation and AI technologies, further propels this ahead of others, ensuring it remains a critical focus area for engineering software providers.

Design Automation

Design Automation is increasingly significant within the engineering software landscape as it allows for the streamlining of repetitive design tasks, which is crucial in enhancing productivity and reducing errors. Organizations leverage this technology to automate complex design processes, leading to faster project completion and lowered costs. As the demand for quick-turnaround solutions rises, the adoption of design automation tools is expected to grow, supporting the overall engineering workflow. This 's importance lies in its ability to integrate with existing systems, fostering collaboration and ensuring consistent design quality across projects.

Plant Design

Plant Design plays a vital role in sectors such as energy, manufacturing, and construction, where efficient layouts and processes are crucial for operational effectiveness. The growing complexity of such industries necessitates robust software solutions that facilitate the planning and design of large-scale facilities. This area is characterized by its focus on improving resource utilization and minimizing operational downtime, making it integral to successful project delivery. Although it may not dominate the market, its significance continues to increase in line with industry demands for physical infrastructure and regulatory compliance in design processes.

Drafting & 3D Modeling

Drafting & 3D Modeling remains a foundational aspect of engineering software, catering to various disciplines that require precise technical drawings and visual representations. This application allows engineers and architects to produce detailed schematics, enhancing communication among stakeholders. Despite developments in automation and design technology, the need for high-quality, accurate drafting and modeling tools persists, making this an enduring area of growth. As industries evolve, so too does the necessity for sophisticated modeling capabilities aimed at improving visualization, collaboration, and design accuracy, ensuring that it retains a solid position within the engineering software market.

Global Engineering Software Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Engineering Software market due to its rapid industrialization and significant investments in infrastructure development across countries like China, India, and Japan. The region houses a large number of engineering firms and tech companies that are consistently adopting innovative software solutions to enhance productivity and drive growth. The rising demand for advanced software tools in sectors such as construction, automotive, and manufacturing further propels this growth. Additionally, the shift towards digital transformation and smart technologies fuels the adoption of engineering software, positioning Asia Pacific as the leading region in this industry.

North America

North America remains a strong contender in the Global Engineering Software market, primarily driven by its advanced technological infrastructure and the presence of key players in the engineering software domain. The region benefits from high R&D investments and a skilled workforce, leading to innovations that push the boundaries of engineering capabilities. Moreover, industries such as aerospace, automotive, and construction in this region have a well-established need for sophisticated software solutions, thereby maintaining a steady demand for engineering software.

Europe

Europe showcases a robust engineering software market, characterized by stringent regulations and compliance standards across various industries. Countries like Germany, France, and the UK are at the forefront, embracing digitalization and advanced manufacturing processes. The European market is also marked by collaboration between educational institutions and industry players to foster innovation. However, it faces challenges like economic fluctuations and a slower growth rate compared to the rapidly evolving Asia Pacific market, resulting in a smaller share of the global market.

Latin America

Latin America is a developing market for engineering software, propelled by increasing investments in infrastructure and manufacturing sectors. While the region exhibits growth potential, it faces hurdles such as economic instability and limited access to advanced technologies. Countries like Brazil and Mexico are making strides in software adoption, but overall, the pace is slower compared to more developed regions. As businesses in Latin America continue to adapt to modern technologies, there is hope for gradual improvement in the engineering software market.

Middle East & Africa

The engineering software market in the Middle East & Africa is experiencing emerging growth, primarily fueled by infrastructural development initiatives and a focus on smart city projects. While the region presents significant opportunities, especially in countries like the UAE and South Africa, it is also encumbered by challenges such as skill shortages and reliance on foreign technology. Economic diversification efforts are taking place, but the market remains smaller compared to North America and Asia Pacific, limiting its competitive edge in the global landscape.

Engineering Software Competitive Landscape:

Major contributors in the worldwide engineering software sector propel both innovation and rivalry by creating sophisticated tools that optimize design, simulation, and manufacturing workflows. Moreover, they pursue strategic alliances and acquisitions to broaden their market presence and enhance technological integration.

Prominent figures in the Engineering Software Market comprise Autodesk, Dassault Systèmes, Bentley Systems, Siemens Digital Industries Software, ANSYS, PTC, Hexagon AB, Altair Engineering, SAP, and IHS Markit. Other important entities include MathWorks, COMSOL, Oracle, ESRI, Trimble, Nemetschek Group, SolidWorks, Siemens PLM Software, EPLAN, Abaqus, and Cadence Design Systems. Furthermore, notable contributions arise from BAE Systems, Cisco Systems, AVEVA Group, and Intergraph.

Global Engineering Software COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly fast-tracked the integration of digital technologies within the Global Engineering Software sector, leading to an increased need for improved tools for remote collaboration and project management.

The engineering software landscape has been significantly transformed by the COVID-19 pandemic, catalyzing a rapid shift towards digital transformation in various sectors. As remote work became commonplace, there was a notable increase in the demand for collaborative and cloud-centric engineering tools, enabling teams to sustain their productivity despite being geographically separated. This evolution has encouraged software developers to improve functionalities that support virtual teamwork, enhance project management, and allow for the seamless exchange of real-time data. Furthermore, sectors like construction and manufacturing have begun to leverage simulation and modeling technologies more extensively to refine operations and mitigate the supply chain challenges that arose during the pandemic. Although certain areas saw initial slowdowns due to delays in projects, the overall industry witnessed a resurgence as businesses acknowledged the necessity for resilient software solutions to adapt to ongoing challenges. As a result, investments in engineering software are projected to rise, propelled by the demand for innovation, efficiency, and the ability to withstand future uncertainties in a post-pandemic environment.

Latest Trends and Innovation in The Global Engineering Software Market:

- In April 2023, Autodesk announced its acquisition of Innovyze, a leader in water infrastructure software. This move aims to enhance Autodesk's portfolio by integrating advanced water management solutions into its existing product lines.

- In February 2023, Siemens Digital Industries Software launched the latest version of its Xcelerator platform, which features enhanced capabilities for digital twin technology. This innovation aims to streamline product development processes across various engineering sectors.

- In January 2023, Bentley Systems completed its acquisition of certain assets of the cloud-hosted small-world software from General Electric. This acquisition is intended to bolster Bentley's offerings in the utility sector.

- In March 2023, ANSYS, a global leader in engineering simulation software, introduced new features in its ANSYS Discovery product that utilize generative design technology, marking a significant advancement in simulation-driven product design capabilities.

- In July 2023, Hexagon AB announced a strategic partnership with Amazon Web Services (AWS) to enhance its geospatial software offerings, enabling more robust cloud capabilities and analytics tools for engineering applications.

- In November 2022, Dassault Systèmes revealed the acquisition of 3DEXCITE, moving to enhance its visualization and immersive experiences in product marketing and engineering design workflows.

- In August 2023, PTC launched a new set of generative design capabilities within its Onshape cloud CAD platform, which allows engineers to create optimized designs faster by automating complex processes.

- In December 2022, Altair Engineering, a global leader in computational science and artificial intelligence, announced its acquisition of RapidMiner to enhance its machine learning and data analytics capabilities within engineering processes.

- In May 2023, SolidWorks, a subsidiary of Dassault Systèmes, announced an update to its SolidWorks 2023 release to include enhanced collaboration tools, improving teamwork and project management for engineering teams.

- In September 2023, MathWorks announced significant updates to its MATLAB software, including advanced AI and machine learning toolboxes aimed at optimizing engineering simulations and design processes for its users.

Engineering Software Market Growth Factors:

The expansion of the engineering software sector is fueled by innovations in automation, a rising need for improved design efficiency, and the incorporation of artificial intelligence alongside cloud computing technologies.

The engineering software sector is undergoing significant growth, influenced by several crucial drivers. Primarily, the ened demand for sophisticated simulation and modeling applications across diverse fields such as automotive, aerospace, and construction is a key factor contributing to market growth. Additionally, the rapid advancement in digital transformation—characterized by the integration of technologies like the Internet of Things (IoT) and Artificial Intelligence (AI)—is enhancing software functionalities, leading to more efficient project management and better-informed decision-making.

Furthermore, the increasing acceptance of cloud solutions is promoting greater collaboration and adaptability, thereby simplifying software access for users in varying locations. The escalating focus on sustainability and energy efficiency has also prompted investments in engineering software that fosters environmentally friendly design and process enhancement. Furthermore, the ongoing push towards automation, coupled with the necessity for more streamlined operations, is driving firms in the engineering sector to adopt these tools.

As companies strive to boost product innovation and minimize time-to-market, there is a growing need for powerful engineering software capable of supporting these objectives. Lastly, the rising utilization of Building Information Modeling (BIM) in construction and infrastructure projects underscores the demand for advanced planning and analytical tools, creating a conducive environment for sustained growth in the engineering software industry.

Engineering Software Market Restaining Factors:

Significant challenges within the engineering software industry encompass elevated development expenses, swift advancements in technology, and a deficiency of qualified experts.

The Engineering Software Market encounters numerous challenges that may hinder its expansion and development. A primary obstacle is the substantial investment required for software development and ongoing maintenance, which often discourages small to medium enterprises from integrating advanced engineering solutions. Additionally, the swift pace of technological progress requires continuous updates and user training, creating added operational complexities and potential disruptions. Compatibility hurdles with older legacy systems can further complicate the shift to modern platforms, leading to hesitation from organizations wary of committing to extensive upgrades. Moreover, concerns regarding data security and the potential for intellectual property theft can slow the adoption of cloud-based engineering tools, as organizations emphasize the protection of proprietary data. The necessity for regulatory compliance and the integration with various enterprise systems add further layers of difficulty, impacting the overall user experience. Nevertheless, the market is still witnessing positive development, fueled by innovations in artificial intelligence and automation that boost efficiency and productivity. As businesses increasingly appreciate the long-term advantages of incorporating state-of-the-art engineering software, the sector stands on the brink of substantial growth and evolution, fostering enhanced collaboration, more efficient processes, and better project outcomes across diverse industries.

Key Segments of the Engineering Software Market

By Deployment

• Cloud

• On-premises

By Component

• Software

• Services

By Application

• Design Automation

• Product Design & Testing

• Plant Design

• Drafting & 3D Modeling

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America