Market Analysis and Insights:

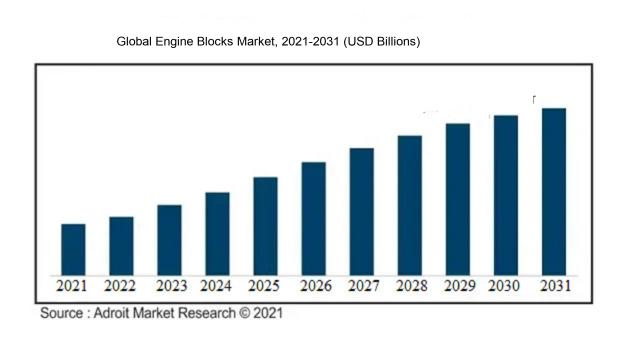

The market for Engine Blocks was estimated to be worth USD XX billion in 2021, and from 2021 to 2031, it is anticipated to grow at a CAGR of XX%, with an expected value of USD XX billion in 2031.

The market for engine blocks is being driven by a variety of factors. Primarily, the expansion of the automotive industry is playing a crucial role in driving the demand for engine blocks. As the automotive sector continues to grow, there is an increasing need for engine blocks, which is fueling market expansion.

Moreover, advancements in manufacturing processes have led to the development of lighter and more efficient engine blocks, improving fuel efficiency and reducing emissions. This progress has ened demand for engine blocks in the market. Additionally, the growth in consumer disposable income has resulted in higher vehicle ownership, consequently benefiting the engine blocks market. Furthermore, strict government regulations on emissions and fuel efficiency have compelled automotive manufacturers to adopt sophisticated engine block technologies, further boosting market growth. Lastly, the rising popularity of electric vehicles has created a specialized market for engine blocks as they are essential in hybrid and plug-in electric vehicles. Overall, these factors are expected to continue supporting the growth of the engine blocks market in the foreseeable future.

Engine Blocks Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD XX billion |

| Growth Rate | CAGR of XX% during 2021-2031 |

| Segment Covered | By Type, By Application, By Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Cummins Inc., Mahle GmbH, Aisin Seiki Co. Ltd., Honda Motor Co. Ltd., Toyota Motor Corporation, General Motors Company, Ford Motor Company, Mitsubishi Motors Corporation, Volkswagen AG, and BMW AG. |

Market Definition

Engine blocks, commonly referred to as cylinder blocks, serve as the primary structural element of an internal combustion engine. These crucial components host cylinders, pistons, and various essential engine parts, delivering durability, reinforcement, and a foundation for their functionality.

The core elements within internal combustion engines, known as engine blocks or cylinder blocks, play a pivotal role in the functionality of these systems. They act as a fundamental support structure and enclosure for critical engine elements like pistons, crankshafts, and cylinder heads. Engine blocks are primarily designed to offer essential support, enhance durability, and maintain stability for these components, ensuring their optimal operation under the extreme pressures and temperatures generated during the combustion process. Furthermore, engine blocks play a crucial role in facilitating the efficient circulation of coolant and oil, thereby enabling effective cooling and lubrication processes. Ultimately, engine blocks are essential components that significantly contribute to the overall performance and longevity of an engine, marking them as indispensable elements in various automotive and machinery applications.

Key Market Segmentation:

Insights On Key Type

V Engine

The V Engine type is expected to dominate the Global Engine Blocks Market. This type of engine configuration is widely used in various applications due to its balanced design and excellent power output. The V Engine offers improved performance and efficiency compared to other engine types. Its unique V-shaped formation allows for compact packaging and smooth operation, making it a popular choice in both automotive and industrial sectors. With advancements in technology and increasing demand for high-performance vehicles, the V Engine part is projected to remain dominant in the Global Engine Blocks Market.

Inline Engine

The Inline Engine type, although not expected to be the dominating part in the Global Engine Blocks Market, still holds a significant market share. Inline engines are known for their simplicity, reliability, and cost-effectiveness. They have a linear cylinder arrangement, typically in a straight line, which allows for easy maintenance and repair. Inline engines are commonly found in small vehicles, motorcycles, and industrial applications. While not as powerful as V Engines, they offer good fuel efficiency and low emission levels. Despite facing competition from other parts, the Inline Engine part continues to maintain its position in the Global Engine Blocks Market.

Boxer Engines

The Boxer Engines type, while not predicted to be the dominant player in the Global Engine Blocks Market, holds its own niche market. Boxer engines feature horizontally opposed cylinders that provide a lower center of gravity and improved balance. This design offers a smoother and more balanced power delivery, suitable for applications that require specific performance characteristics, such as sports cars and aircraft. Boxer engines are known for their distinctive sound and handling characteristics. Although their market share may be smaller compared to other parts, the unique features of Boxer Engines continue to attract enthusiasts and niche markets in the Global Engine Blocks Market.

Insights On Key Application

Commercial Vehicle

The Commercial Vehicle application is expected to dominate the Global Engine Blocks Market. Commercial vehicles, such as trucks, buses, and vans, have a higher demand for engine blocks compared to passenger vehicles. This is primarily due to the heavy-duty nature of commercial vehicles and their requirement for robust and durable engine components. Additionally, the increasing adoption of electric commercial vehicles is driving the demand for engine blocks, particularly for hybrid and range-extended vehicles. The commercial vehicle sector is also witnessing growth in emerging markets, where transportation and logistics industries are expanding. Hence, the Commercial Vehicle part is expected to be the dominant force in the Global Engine Blocks Market.

Passenger Vehicle:

In contrast, the Passenger Vehicle application is expected to have a smaller share in the Global Engine Blocks Market compared to the Commercial Vehicle part. While passenger vehicles also require engine blocks, their demand is relatively lower than that of commercial vehicles. This is primarily due to the differences in usage patterns, with passenger vehicles typically having lighter loads and less intense operating conditions. Additionally, the growing trend towards electric passenger vehicles, which often have simplified powertrain configurations, is expected to impact the demand for engine blocks in this part. Nonetheless, the Passenger Vehicle part still plays a significant role in the Global Engine Blocks Market, as millions of passenger vehicles are manufactured and sold worldwide each year.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Engine Blocks market. This region encompasses emerging economies such as China, India, and Japan, which have a significant presence in automotive manufacturing. The growing industrialization, urbanization, and increasing disposable income in these countries have resulted in a surge in automobile production and sales. Additionally, the rise of electric vehicles in the region has further augmented the demand for engine blocks. Moreover, Asia Pacific has a robust supply chain network, advanced manufacturing capabilities, and favorable government policies supporting the automotive industry, which further contribute to its dominance in the global market.

North America

North America is a significant player in the global engine blocks market. It is home to established automotive manufacturers and technological advancements in engine block production. The region has a high demand for vehicles, particularly in the United States and Canada, driven by a strong consumer base and the need for personal transportation. Furthermore, the presence of key engine block manufacturers and strong collaboration between automotive companies and suppliers enhance North America's position in the market. However, Asia Pacific's rapid growth and the increasing demand for automobiles in emerging economies give it an edge over North America in terms of market domination.

Europe

Europe is another important region in the global engine blocks market. It is known for its strong automotive industry, with countries such as Germany, France, Italy, and the United Kingdom playing a major role. Europe boasts advanced manufacturing technologies and a highly skilled workforce, contributing to the production of high-quality engine blocks. The region is also witnessing a shift towards electric and hybrid vehicles, driving the demand for engine blocks suitable for these alternative powertrain systems. However, despite its strengths, Europe faces fierce competition from Asia Pacific and the increasing presence of emerging manufacturing hubs in other regions, which limit its dominance in the global market.

Latin America

Latin America is a growing market for engine blocks, primarily driven by the automobile industry in countries like Brazil, Mexico, and Argentina. The region's large consumer base, coupled with increasing disposable income and urbanization, has led to a rise in vehicle ownership and production. However, Latin America's market dominance is limited compared to Asia Pacific due to factors such as slower technological advancements, economic volatility, and political instability. The region also faces competition from other emerging markets, which impacts its overall share in the global engine blocks market.

Middle East & Africa

The Middle East & Africa region has a relatively smaller presence in the global engine blocks market compared to other regions. Factors such as limited automobile manufacturing and lower disposable income levels in several countries hinder the growth of the market in this region. However, countries like South Africa and the United Arab Emirates have witnessed a rise in vehicle production and sales, stimulating the demand for engine blocks. Despite these positive developments, the Middle East & Africa region is unlikely to dominate the global market due to its smaller market size and insufficient infrastructural support for the automotive industry.

Company Profiles:

Prominent entities within the worldwide Engine Blocks industry are pivotal in the fabrication and provision of engine blocks, integral elements of automobile engines. They bear the responsibility of upholding top-tier manufacturing processes, adhering to established benchmarks, and catering to the varied demands of a global clientele.

Prominent companies in the engine blocks industry comprise Cummins Inc., Mahle GmbH, Aisin Seiki Co. Ltd., Honda Motor Co. Ltd., Toyota Motor Corporation, General Motors Company, Ford Motor Company, Mitsubishi Motors Corporation, Volkswagen AG, and BMW AG. Recognized for their proficiency in engine block production, these firms engage in continuous research and development endeavors to deliver cutting-edge and top-notch products. Their active involvement in shaping the engine blocks sector is evident through their dedication to bolster market influence via pioneering approaches, collaborations, and strategic business consolidations.

COVID-19 Impact and Market Status:

The worldwide market for engine blocks has experienced a notable decrease in demand as a result of the disturbances brought about by the Covid-19 pandemic.

The global engine blocks market has faced significant repercussions due to the COVID-19 pandemic. Lockdown measures and restrictions on movement led to the closure or reduced operations of manufacturing facilities worldwide, causing disruptions in the supply chain. Consequently, the production and availability of engine blocks were directly impacted, resulting in market delays and shortages. Moreover, reduced consumer spending and economic uncertainty contributed to a decline in automobile demand, affecting the need for engine blocks. The automotive sector, a key consumer of engine blocks, witnessed a substantial drop in sales, leading to decreased orders for manufacturers. Additionally, the implementation of social distancing and safety measures in production facilities further slowed down output, widening the supply-demand gap. While the market is expected to gradually recover as economies stabilize, it may take some time to return to pre-pandemic levels of production and demand.

Latest Trends and Innovation:

- In January 2021, Cummins Inc. unveiled a new series of engine blocks called the X12, which are lighter and more fuel-efficient, meeting the needs of the heavy-duty truck market.

- During the second quarter of 2020, Mahle GmbH announced the acquisition of Kokusan Denki Co., Ltd., a Japanese manufacturer of engine blocks, to expand its product portfolio and strengthen its presence in the Asian market.

- In March 2019, General Motors introduced a new engine block design with active fuel management technology, allowing for improved fuel efficiency and reduced emissions in their vehicle lineup.

- Volvo Group, in November 2020, announced the development of its engine blocks using a 3D printing process, resulting in lighter components and improved performance.

- Ford Motor Company unveiled their new Power Stroke diesel engine blocks in September 2021, featuring advanced turbocharging technology to enhance power and efficiency for their trucks.

- In July 2018, Toyota Motor Corporation partnered with Denso Corporation and Bosch to develop high-efficiency engine blocks for hybrid vehicles, aiming to reduce fuel consumption and emissions.

- Hyundai Motor Company, in February 2020, introduced a new engine block design for their Sonata model, featuring a unique thermal management system to improve fuel efficiency and reduce engine wear.

- Fiat Chrysler Automobiles merged with Groupe PSA in January 2021, forming Stellantis N.V., which resulted in the consolidation of engine block manufacturing operations and increased collaboration in technology innovation.

Significant Growth Factors:

The Engine Blocks Market is influenced by various growth factors such as advancements in technology, the surge in demand for electric vehicles, and the increased manufacturing of robust and lightweight materials.

The engine blocks industry is poised for substantial growth in the foreseeable future, driven by a multitude of factors. The global surge in automobile manufacturing and sales is a primary catalyst propelling the demand for engine blocks. As the automotive sector continues its expansion, the necessity for engines and their components, including engine blocks, is seeing a corresponding uptick. Moreover, the increasing preference for lightweight engine elements is playing a pivotal role in spurring market expansion. Engine blocks crafted from lightweight materials, notably aluminum, are favored for their capacity to augment fuel efficiency and reduce overall vehicle mass.

Furthermore, the escalating emphasis on fuel efficiency and stringent emission standards is fostering the uptake of engine blocks featuring advanced designs and technologies like compacted graphite iron (CGI) blocks, renowned for their superior strength and enhanced heat dissipation characteristics. The rise in electric vehicle (EV) adoption is also opening avenues for engine block manufacturers to innovate solutions tailored for hybrid and electric powertrain systems. Lastly, the burgeoning aftermarket sector, with its demand for engine block replacements and upgrades, is a significant contributor to market growth. In essence, the confluence of factors such as the expansion of the automotive industry, lightweighting initiatives, fuel efficiency mandates, EV integration, and aftermarket requirements is anticipated to propel the engine blocks market growth in the impending years.

Restraining Factors:

Constraints such as the scarcity of raw materials and elevated production expenses serve as impediments to the engine blocks market.

The engine blocks industry is currently encountering several impediments that could hinder its progress. A significant factor contributing to this is the escalating focus on alternative fuels and electric vehicles, which is diminishing the requirement for conventional internal combustion engines. Moreover, stringent emission standards are compelling manufacturers to invest in more intricate and costly engine technologies, resulting in increased financial pressures. The market is also witnessing a trend towards utilizing lightweight materials like aluminum or composites in engine construction to enhance fuel efficiency. Nonetheless, these materials might present challenges in terms of cost and longevity. Additionally, geopolitical circumstances such as trade conflicts and tariffs are impacting the global supply chain, creating uncertainties within the industry. Despite these obstacles, the engine blocks sector also presents avenues for expansion. The escalating demand for commercial vehicles, particularly in emerging markets, is fueling the necessity for engine blocks. Furthermore, advancements in technology and innovative engine designs have the potential to bring about more effective and long-lasting engine blocks tailored to the changing requirements of the automotive sector.

Key Segments of the Engine Blocks Market

Type Overview

• The V Engine

• Inline Engine

• Boxer Engines

Application Overview

• Passenger Vehicle

• Commercial Vehicle

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America