Market Analysis and Insights:

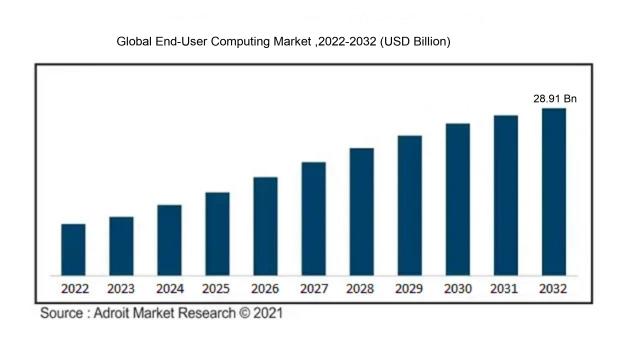

The market for Global End-User Computing was estimated to be worth USD 10.65 billion in 2022, and from 2023 to 2032, it is anticipated to grow at a CAGR of 11.56%, with an expected value of USD 28.91 billion in 2032.

The growth of the End-User Computing market can be attributed to various significant factors. Firstly, the increasing adoption of cloud computing services and mobile devices has played a crucial role in driving this market. With a rising number of organizations transitioning towards remote work and digital transformation, there is a growing demand for end-user computing solutions that offer secure and efficient access to applications and data from any location and device.

Additionally, the utilization of virtualization technology has also contributed to the expansion of this market by allowing organizations to centrally manage their end-user computing environments more effectively. Moreover, the increasing popularity of BYOD (Bring Your Own Device) policies in workplaces has further boosted the requirement for end-user computing solutions that ensure employee productivity while upholding security standards. Lastly, the escalating need for data protection, regulatory compliance, and enhanced data management practices has driven organizations to invest in advanced end-user computing solutions that provide robust data security and privacy features. In conclusion, these factors collectively contribute to the growth of the End-User Computing market.

End-User Computing Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 28.91 billion |

| Growth Rate | CAGR of 11.56% during 2023-2032 |

| Segment Covered | By Component, By Deployment Model, By Organization size, By Application, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | IBM Corporation, Microsoft Corporation, HP Inc., Dell Technologies Inc., Citrix Systems Inc., VMware Inc., Oracle Corporation, Samsung Electronics Co. Ltd, Toshiba Corporation, and Lenovo Group Ltd. |

Market Definition

End-User Computing involves the use of computer devices and applications by individuals to carry out various tasks in order to improve their overall productivity and effectiveness. This practice encompasses the utilization of software, hardware, and networking technologies for personal or business-related activities.

The adoption of End-User Computing (EUC) plays a crucial role in enhancing organizational productivity by equipping employees with the essential tools and technologies needed for their daily tasks. These tools can range from desktops and laptops to mobile devices, software applications, and various resources necessary for effective job performance. EUC facilitates streamlined workflows, fosters collaboration, and enhances communication, thereby boosting overall productivity. In today's scenario, where remote work is prevalent, the flexibility offered by EUC allows employees to work from any location and at any time. Furthermore, EUC contributes to ened data security through centralized data storage and the implementation of stringent security measures. Embracing EUC not only optimizes operational efficiency but also enhances employee satisfaction, leading to the successful achievement of organizational objectives.

Key Market Segmentation:

Insights On Key Component

Solution

The solution is expected to dominate the global end-user computing market.This is due to the increasing demand for technological advancements and the need for efficient and streamlined end-user computing solutions across various industries. Solutions such as virtualization, enterprise mobility management, and unified endpoint management are witnessing significant growth and adoption. Organizations are increasingly investing in end-user computing solutions to enhance productivity, improve security, and provide a seamless user experience. With the rising popularity of remote work and the need for flexible and efficient IT infrastructure, the solution is expected to experience a substantial market share in the global end-user computing market.

Services

services also holds significant importance. Services play a crucial role in supporting and maintaining the functionality of end-user computing solutions. These services include implementation, training, consulting, and support services. Organizations often require assistance from service providers to successfully deploy and optimize their end-user computing solutions. As the adoption of end-user computing solutions increases, the demand for services to support these solutions is also expected to grow. Although the services may not dominate the market, it will remain an essential component in enabling organizations to leverage the full potential of end-user computing technologies.

Insights On Key

Deployment Model Cloud

The Cloud is expected to dominate the Global End-User Computing Market. With the increasing adoption of cloud-based solutions and services, businesses are leveraging the benefits of scalability, flexibility, and cost-effectiveness offered by cloud deployment models. Cloud-based end-user computing solutions enable companies to provide remote access to applications and data, enhancing productivity and collaboration among end-users. Additionally, the cloud deployment model eliminates the need for on-premises infrastructure and offers centralized management and security, making it an attractive choice for organizations of all sizes.

On-premises

Although the Cloud is expected to dominate the Global End-User Computing Market, the On-premises still holds its relevance in certain industries and organizations. Some businesses have specific data security or compliance requirements that necessitate on-premises infrastructure. On-premises deployment models offer full control over hardware, software, and data management, ensuring data sovereignty and minimizing data transfer risks. While the cloud-based solutions may offer greater scalability and cost benefits, on-premises solutions provide a sense of control and customization options, making them a preferred choice for industries such as government, healthcare, and finance.

While the Cloud is expected to dominate the Global End-User Computing Market, the On-premises is still relevant for organizations with specific data security or compliance requirements. However, another worth mentioning is the Hybrid deployment model. Hybrid solutions combine the benefits of both cloud and on-premises models, providing a balanced approach.

This caters to businesses that seek to leverage the advantages of cloud while maintaining certain critical data or applications on-premises for enhanced security or reduced dependency on external networks. Hybrid deployment models offer flexibility, allowing organizations to optimize their end-user computing infrastructure based on their specific needs.

Insights On Key

Organization size Large organizations are expected to dominate the Global End-User Computing Market. This is primarily due to their larger scale of operations and higher purchasing power, allowing them to invest more in end-user computing solutions. Large organizations often have complex IT infrastructure and a higher number of employees, creating a greater need for advanced computing systems to enhance productivity and enable efficient operations. They are also more likely to have dedicated IT de ments and budgets specifically allocated for end-user computing solutions. As a result, large organizations are expected to be the dominant in the Global End-User Computing Market.

SMEs, on the other hand, are a significant in the Global End-User Computing Market. Despite not dominating the market, SMEs play a crucial role as they form a large number of businesses globally. SMEs often have limited resources and budgets compared to their larger counter s. However, they recognize the need for efficient end-user computing solutions to enhance productivity and streamline operations. With the increasing availability of cost-effective and scalable end-user computing technologies, SMEs are adopting these solutions to stay competitive in the market.

Insights On Key Application

Healthcare

The Healthcare sector is expected to dominate the Global End-User Computing Market. This is due to the increasing adoption of technology in the healthcare industry, driven by the need for efficient patient care and streamlined operations. With the advancement of electronic medical records, telehealth, and healthcare analytics, there is a significant demand for end-user computing solutions in this sector. End-user computing enables healthcare professionals to access patient information, perform data analysis, and collaborate effectively. Moreover, the integration of IoT devices and wearable technology in healthcare further boosts the demand for end-user computing solutions. The healthcare sector's focus on data privacy and security also necessitates robust end-user computing solutions. Overall, the healthcare sector is expected to dominate the Global End-User Computing Market, given its specific requirements and technological advancements.

BFSI

The BFSI (Banking, Financial Services, and Insurance) sector is another crucial of the Global End-User Computing Market. This sector relies heavily on end-user computing solutions for customer relationship management, data analysis, risk management, and secure transaction processing. The BFSI sector deals with a vast amount of sensitive data and requires efficient end-user computing systems to ensure data privacy and security. Additionally, the demand for digital banking solutions, online trading platforms, and mobile payment services further drives the need for robust end-user computing infrastructure. While healthcare is expected to dominate the market, the BFSI sector is likely to be a significant player in the Global End-User Computing Market due to its technological advancements and the growing demand for digital financial services.

IT & Telecom

The IT & Telecom sector is another important part of the Global End-User Computing Market. This sector heavily relies on end-user computing solutions to enable seamless collaboration, efficient IT infrastructure management, and effective customer support. With the growing need for remote work and mobile work environments, the IT & Telecom sector requires reliable and secure end-user computing systems to ensure smooth operations and enhanced productivity. Additionally, the demand for cloud computing, virtualization, and software-defined networking further drives the adoption of end-user computing solutions in this sector. While the healthcare sector is expected to dominate the market, the IT & Telecom sector remains a significant contributor to the Global End-User Computing Market due to its unique requirements and the continuous evolution of technology.

Education

The Education sector is an emerging part of the Global End-User Computing Market. As educational institutions increasingly adopt digital learning platforms and technology-driven teaching methods, the demand for end-user computing solutions in this sector is growing. End-user computing enables students, teachers, and administrators to access educational resources, collaborate, and manage administrative tasks more efficiently. With the increasing prevalence of online education and the deployment of educational apps and software, the Education sector presents significant potential for end-user computing solutions. While healthcare dominates the market, the Education sector is expected to play a notable role in the Global End-User Computing Market due to the shift towards digital learning and the integration of technology in educational institutions.

Retail

The Retail sector is also a significant section of the Global End-User Computing Market. With the rise of e-commerce and changing consumer behavior, retailers are seeking to enhance their digital capabilities and provide seamless shopping experiences. End-user computing solutions enable retailers to manage inventory, gather customer insights, and optimize their supply chain operations. The use of mobile devices, point-of-sale systems, and customer relationship management software drives the adoption of end-user computing in the Retail sector.

Although healthcare dominates the market, the Retail sector remains a crucial player in the Global End-User Computing Market due to its focus on digital transformation and improving the customer shopping experience.

Media & Entertainment

The Media & Entertainment sector is another significant part of the Global End-User Computing Market. This sector heavily relies on end-user computing solutions for content creation, distribution, and digital media management.

With the increasing demand for online streaming, social media platforms, and immersive experiences, media and entertainment companies require efficient end-user computing infrastructure to deliver high-quality content and engage with their audiences. The integration of virtual reality (VR) and augmented reality (AR) technologies in media and entertainment further drives the adoption of end-user computing solutions. While healthcare dominates the market, the Media & Entertainment sector plays a significant role in the Global End-User Computing Market due to its focus on digital content and technological innovation.

Government

The Government sector is also an important part in Global End-User Computing Market. Governments worldwide are embracing digital transformation to enhance citizen services and improve the efficiency of public administration.

End-user computing solutions enable government agencies to streamline operations, facilitate e-governance, and ensure data security. The integration of smart city initiatives, digital document management systems, and online citizen portals drives the adoption of end-user computing in the Government sector. While healthcare dominates the market, the Government sector is expected to be a significant contributor to the Global End-User Computing Market due to its focus on digitalization and citizen-centric services.

Others

The "Others" category represents of the Global End-User Computing Market not specifically mentioned above. This category may include industries such as manufacturing, transportation, energy, and more. While healthcare dominates the market, the Other sector s may also contribute to the Global End-User Computing Market to varying degrees. The adoption of end-user computing solutions in these industries depends on their specific requirements, digital transformation initiatives, and the integration of technology in their operations. Overall, while the dominating s may receive more attention, the Other sector s should not be overlooked in the Global End-Use Computing Market.

Insights on Regional Analysis:

North America

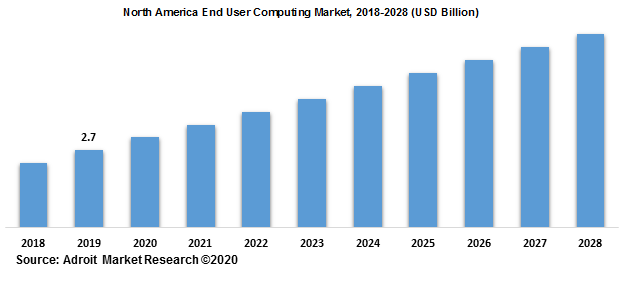

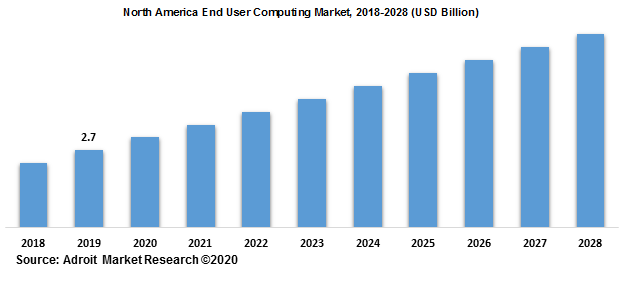

North America is expected to dominate the Global End-User Computing market. This region has a strong presence of major technology companies, advanced IT infrastructure, and a high adoption rate of new technologies. Additionally, the emphasis on digital transformation and the need for optimized end-user experiences in North American organizations further drives the market growth. The prominent players in this region offer a wide range of end-user computing solutions, including virtual desktop infrastructure, enterprise mobility management, and unified endpoint management, which cater to the diverse needs of businesses. Furthermore, the increasing demand for remote work solutions and the growing trend of BYOD (Bring Your Own Device) contribute to the dominance of North America in the Global End-User Computing market.

Asia Pacific

The Asia Pacific region is experiencing significant growth in the End-User Computing market. Factors such as the rapid economic growth, increasing IT investments, and expanding digitalization in countries like China, India, Japan, and South Korea are fueling the market demand. Moreover, the rising adoption of cloud-based solutions, the proliferation of mobile devices, and the inclination towards remote work policies contribute to the market growth in this region. Prominent players in the Asia Pacific region are focusing on expanding their product portfolios and strengthening their market presence through strategic nerships and acquisitions.

Europe

Europe is witnessing steady growth in the End-User Computing market. The region is characterized by a well-established IT infrastructure, stringent data protection regulations, and the presence of technologically advanced countries like Germany, the UK, and France. The increasing mobile workforce, digital transformation initiatives, and a growing awareness of the benefits offered by end-user computing solutions drive the market growth in Europe. Furthermore, the implementation of remote work policies, the adoption of cloud-based solutions, and the need for secure and efficient endpoint management contribute to the market's development in this region.

Latin America

Latin America is experiencing moderate growth in the End-User Computing market. Factors such as the increasing penetration of mobile devices, the rising demand for virtual desktop infrastructure solutions, and the need for enhanced mobility and productivity drive the market growth in this region. However, challenges like limited IT infrastructure, economic instability in certain countries, and the lack of awareness about end-user computing solutions hinder the market's growth potential. Nonetheless, the increasing investments in IT infrastructure development and the growing adoption of cloud-based solutions provide growth opportunities for stakeholders in Latin America.

Middle East & Africa

The Middle East & Africa region is witnessing gradual growth in the End-User Computing market. The region showcases diverse market dynamics with variations in technological advancements and infrastructure across different countries. Factors like the expansion of businesses, the adoption of digital transformation initiatives, and the rising demand for enhanced productivity contribute to the market growth in this region. However, challenges such as limited access to advanced technologies, concerns regarding data security, and economic uncertainties can hinder the adoption of end-user computing solutions. With ongoing efforts towards digitalization and IT infrastructure development, the Middle East & Africa region presents growth opportunities in the End-User Computing market.

Company Profiles:

The primary actors in the worldwide End-User Computing sector are tasked with offering goods and services that elevate and refine the user interface in computing. Their crucial contribution lies in the creation and provision of forward-thinking solutions designed to boost productivity and effectiveness for end-users across the globe.

Prominent companies in the End-User Computing sector comprise IBM Corporation, Microsoft Corporation, HP Inc., Dell Technologies Inc., Citrix Systems Inc., VMware Inc., Oracle Corporation, Samsung Electronics Co. Ltd, Toshiba Corporation, and Lenovo Group Ltd.

These entities are acknowledged for their notable advancements in the End-User Computing industry, delivering solutions that elevate user experiences, productivity, and security across various sectors. Noteworthy for their extensive enterprise offerings are IBM Corporation and Microsoft Corporation, while HP Inc. and Dell Technologies Inc. excel in providing top-tier hardware. Citrix Systems Inc. and VMware Inc. are distinguished for their expertise in virtualization and cloud computing technologies. Oracle Corporation offers a diverse array of end-user computing solutions encompassing database management systems and enterprise software. On the other hand, Samsung Electronics Co. Ltd, Toshiba Corporation, and Lenovo Group Ltd are lauded for their innovative and superior consumer products, including smartphones, tablets, laptops, and desktops.

COVID-19 Impact and Market Status:

The Global End-User Computing market has experienced a notable transformation due to the Covid-19 pandemic, leading to a surge in the utilization of remote work solutions and a ened need for technologies and tools that facilitate remote teamwork and efficiency.

The global end-user computing market has experienced profound effects due to the emergence of the COVID-19 pandemic. The enforcement of lockdowns and social distancing protocols prompted organizations to rapidly shift towards remote working setups. This sudden transition created a ened demand for various end-user computing solutions, including virtual desktop infrastructure and mobile devices, to accommodate the remote workforce effectively. Furthermore, the necessity for robust security measures to safeguard data and facilitate secure access from disparate locations experienced a significant upsurge.

Latest Trends and Innovation:

- In January 2021, Microsoft announced the acquisition of Affirmed Networks, a provider of virtualized mobile networks, with the aim to enhance their Azure cloud platform's capabilities in the 5G and edge computing space.

- In March 2021, VMware announced the acquisition of SaltStack, a company specializing in automation and configuration management solutions, to strengthen their end-to-end digital workspace offerings

- In April 2021, Citrix announced the acquisition of Wrike, a collaborative work management platform, aiming to integrate it into their digital workspace solutions for improved productivity and project management capabilities.

- In May 2021, Dell Technologies introduced the latest version of its Unified Workspace solution, offering simplified IT management, enhanced security, and personalized employee experiences.

- In June 2021, HP unveiled the acquisition of Teradici, a leading provider of remote desktop software, aiming to enhance their end-user computing portfolio with advanced remote access and virtualization technologies.

- In July 2021, BlackBerry announced a nership with Baidu, a Chinese tech giant, to develop and deploy BlackBerry's QNX operating system for use in Baidu's autonomous driving platform, Apollo.

- In August 2021, Lenovo introduced the ThinkEdge SE70, a powerful edge computing device designed to support artificial intelligence workloads at the network edge.

- In September 2021, IBM announced the acquisition of Instana, a provider of AI-powered application performance management solutions, to bolster their end-to-end observability capabilities for cloud-native and hybrid cloud environments.

- In October 2021, Cisco Systems launched the Catalyst 8000 Edge Platforms, a portfolio of ruggedized routers designed to deliver secure connectivity and real-time analytics at the network edge.

- In November 2021, Samsung Electronics unveiled the upcoming release of the Galaxy Book Odyssey, a powerful laptop equipped with an Nvidia GeForce RTX 3050 GPU, targeting gamers and creative professionals.

Significant Growth Factors:

The expansion of the End-User Computing sector is a result of various factors including the growing utilization of cloud computing, escalating request for mobility solutions, and the necessity for advanced data security measures. The market for End-User Computing (EUC) is expanding rapidly due to several key factors. Organizations are increasingly embracing digital transformation strategies, leading to a higher demand for EUC solutions to boost productivity, efficiency, and collaboration among employees working from different locations.

Moreover, the implementation of bring your own device (BYOD) policies in workplaces is driving the need for EUC solutions, allowing employees to utilize personal devices for work purposes, thereby enhancing productivity and convenience. The surge in remote working solutions post the COVID-19 pandemic has further propelled the adoption of EUC technologies, enabling organizations to ensure operational continuity and flexibility. Additionally, the evolution of cloud computing and virtualization technologies has democratized access to EUC solutions, making them more affordable and attainable for businesses of varying sizes. With a growing emphasis on data security and privacy, organizations are increasingly investing in EUC solutions that offer robust security features to safeguard sensitive information and mitigate risks. In summary, the substantial growth in the End-User Computing market can be attributed to the uptick in digital transformation strategies, the prevalence of BYOD policies, the demand for remote working solutions, advancements in cloud computing and virtualization technologies, and the focus on data security and privacy.

Restraining Factors:

Major impediments in the End-User Computing sector include the intricate integration procedures and apprehensions regarding data security. The End-User Computing sector encounters various impediments that impede its advancement and progress. To begin with, the swiftly evolving technological realm presents a hurdle as enterprises find it challenging to stay abreast of the latest innovations in hardware and software. Upgrading systems and educating staff on novel technologies can incur substantial costs and consume time. Moreover, concerns regarding security substantially constrain the sector. The escalating frequency of cyber threats and data breaches instills unease in businesses regarding the protection of their confidential data, ultimately fostering a reluctance to embrace new end-user computing solutions. Furthermore, compatibility issues persist, icularly within diverse IT environments. The integration of multiple devices, platforms, and applications can be intricate, resulting in compatibility issues and inefficiencies. Resistance to change also acts as a deterrent. Certain employees may exhibit hesitancy towards adopting new technologies due to fears of job redundancy or ened workloads while acclimating to unfamiliar systems. Lastly, financial constraints could pose obstacles to the deployment of end-user computing solutions, icularly for small and medium-sized enterprises. Despite these hurdles, the sector exhibits promise.

As technology progresses, firms will have the chance to surmount these challenges and unlock the potential of end-user computing. Through meticulous planning, robust security protocols, streamlined integration procedures, employee training, and appropriate budget provisions, organizations can harness the benefits of end-user computing to enhance productivity, collaboration, and efficiency, thereby fulfilling their objectives in an increasingly digital landscape.

Key Segments of the End-User Computing Market

Component Overview

• Solution

• Services

Deployment Model Overview

• Cloud

• On-premises

Organization Size Overview

• SMEs (Small and Medium-sized Enterprises)

• Large Organizations

Application Overview

• BFSI (Banking, Financial Services, and Insurance)

• Healthcare

• IT & Telecom

• Education

• Retail

• Media & Entertainment

• Government

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America

Frequently Asked Questions (FAQ) :

Companies across the globe are spending a huge amount invested in the cloud computing market. The trend has been enormous in some industries such as IT & Telecom, BFSI, Healthcare, and other verticals. On the other hand, large enterprise businesses have been desperately chasing to move their data to the cloud for security, scalable, and flexibility of the data. Many companies have been adopting the change to pace up with the demand of the customers and for the data to be secure due to which there has been in the end-user computing market

Solution Segment

The Solution segment is classified into Virtual Desktop Infrastructure and Unified Communication, Device Management, Software Asset Management. Virtual Desktop Infrastructure will have the largest market size as it holds system application and servers in a data center

Services Segment

The Services segment has been divided into Consulting, Support & Maintenance, Training & Education, System Integration, and Managed Services. System Integration will hold the largest market size due to the adoption of digital technologies

Vertical Segment

The vertical segment is divided into IT & Telecom, BFSI, Education, Healthcare, Government, Retail, Media & Entertainment. BFSI will have the largest market size due to the adoption of desktop virtualization technologies across this sector

The top players of the End User Computing Market are Genpact, Tech Mahindra, Mindtree, HCL Infosystems, and many more players.

The major players in the end-usaer computing market are Vricon, Airbus Bently Systems, Dassault Systems, Alphabet Inc, and many other players at the global and domestic level.