Market Analysis and Insights:

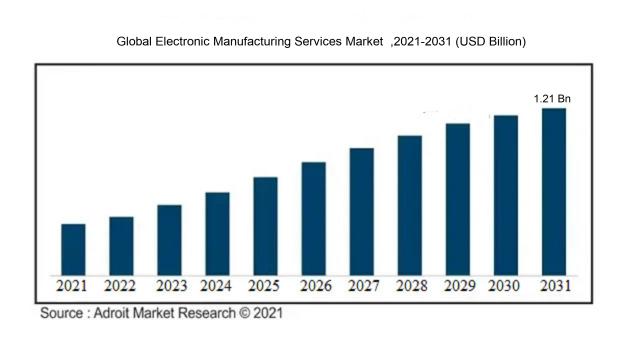

The market for electronic manufacturing services was estimated to be worth USD 0.72 billion in 2023, and from 2024 to 2031, it is anticipated to grow at a CAGR of 7.21%, with an expected value of USD 1.21 billion in 2031.

The electronic manufacturing services sector is experiencing growth driven by various factors. One key driver is the rising demand for consumer electronics like smartphones, laptops, and gaming consoles. As these devices undergo rapid technological advancements, companies are increasingly turning to specialized electronic manufacturers for production needs. Another contributing factor is the trend towards personalized electronic products to meet specific consumer requirements, leading to a greater need for flexible manufacturing solutions. Companies are seeking ways to adapt to evolving consumer preferences while focusing on cost efficiency and operational effectiveness. By outsourcing manufacturing functions to electronic manufacturing service providers, organizations can streamline their operations and concentrate on core activities. Moreover, the expanding use of Internet of Things (IoT) devices and smart technologies across industries such as automotive, healthcare, and industrial sectors is further boosting demand for electronic manufacturing services. Given the intricate assembly and testing requirements of these devices, collaborating with expert manufacturers has become crucial. Overall, the electronic manufacturing services market is poised for substantial growth driven by these key factors.

Electronic Manufacturing Services Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 1.21 billion |

| Growth Rate | CAGR of 7.21% during 2024-2031 |

| Segment Covered | By Service, By Industry , By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Foxconn Technology Group, Flex Ltd., Jabil Inc., Hon Hai Precision Industry Co., Ltd., Sanmina Corporation, Celestica Inc., Plexus Corp., Benchmark Electronics, Inc., Pegatron Corporation, and Wistron Corporation. |

Market Definition

Electronic Manufacturing Services (EMS) encompass a group of enterprises offering a wide array of services such as design, fabrication, testing, and packaging of electronic components and goods for external entities. These services facilitate organizations in contracting out their electronic manufacturing processes and enhancing the efficiency of their supply chain operations.

Electronic Manufacturing Services (EMS) are integral to the electronics sector as they offer a diverse range of specialized services covering design, manufacturing, testing, and distribution. EMS firms undertake the full spectrum of tasks involved in the lifecycle of electronic products, supporting businesses in optimizing their operations and competitiveness. By entrusting manufacturing duties to EMS ners, companies can prioritize their core strengths, reduce time to market, and manage the risks associated with production and supply chain oversight. Moreover, EMS providers bring valuable technical knowledge, operational scale advantages, and cost efficiencies that are often unattainable for individual enterprises. Consequently, the utilization of EMS services is crucial for firms seeking to streamline production processes, enhance product quality and reliability, and secure a competitive advantage in the vibrant electronics industry.

Key Market Segmentation:

Insights On Key Service

Electronics Manufacturing Services

Electronics Manufacturing Services is expected to dominate the Global Electronic Manufacturing Services Market. This is because Electronics Manufacturing Services encompass a wide range of activities related to the manufacturing of electronic components and devices. From printed circuit board assembly to product testing and quality control, Electronics Manufacturing Services cover the entire spectrum of the manufacturing process. With the increasing demand for electronic products globally, the need for efficient and reliable manufacturing services is on the rise, making Electronics Manufacturing Services the dominant in the market.

Engineering Services

Engineering Services is one more noticeable within the Global Electronic Manufacturing Services Market. Engineering Services involve the design, development, and prototyping of electronic products. This plays a crucial role in transforming ideas into viable and marketable products. Companies providing specialized engineering services have the expertise and resources to assist clients in product development, ensuring efficiency, innovation, and compliance with industry standards. With the constant need for product innovation and technological advancements, the demand for Engineering Services remains strong, and it is expected to be a notable in the market.

Test & Development Implementation

Test & Development Implementation is an important within the Global Electronic Manufacturing Services Market. It focuses on testing and validating electronic products to ensure quality and reliability. By conducting thorough testing procedures and implementing necessary improvements, companies offering Test & Development Implementation services help in enhancing product performance and reducing manufacturing defects. As the market becomes increasingly competitive, the importance of rigorous testing and effective implementation strategies for electronic products is growing, establishing Test & Development Implementation as a prominent .

Logistics Services

Logistics Services is a vital within the Global Electronic Manufacturing Services Market. It involves the efficient management and transportation of electronic components, subassemblies, and finished products. Logistics Services play a critical role in ensuring the smooth flow of materials and products between various stages of the supply chain, including procurement, manufacturing, distribution, and after-sales support. With the globalization of the electronics industry and the need for streamlined supply chain operations, Logistics Services continue to be a significant in the market.

Others

The "Others" in the Global Electronic Manufacturing Services Market encompasses various services that do not fall under the aforementioned s. These may include specialized services such as product customization, component sourcing, repair and refurbishment, and other value-added services. While these services may cater to specific niche requirements, they are not expected to dominate the market as the level of demand and market share remains relatively smaller compared to the dominant s. Nonetheless, these specialized services provide important support and customization options for specific customer needs.

Insights On Key Industry

Consumer Electronics

Consumer Electronics is expected to dominate the Global Electronic Manufacturing Services Market. The increasing demand for smartphones, tablets, wearable devices, and other consumer electronic products is driving the growth of this . With rapid technological advancements and changing consumer preferences, manufacturers are relying on Electronic Manufacturing Services (EMS) to outsource their production processes. EMS providers offer cost-effective solutions, efficient manufacturing processes, and shorter time-to-market, making them an attractive choice for consumer electronics companies. Additionally, the rising trend of smart homes and the Internet of Things (IoT) further contribute to the domination of the Consumer Electronics in the Global Electronic Manufacturing Services Market.

Automotive

In the Global Electronic Manufacturing Services Market, the Automotive is also poised for significant growth. The increasing integration of electronics in vehicles, such as infotainment systems, advanced driver assistance systems (ADAS), and electric vehicle components, creates a demand for EMS providers. These providers offer expertise in designing, manufacturing, and testing automotive electronics, ensuring compliance with industry standards and regulations. As the automotive industry continues to incorporate advanced technologies and develop autonomous vehicles, the Automotive is expected to witness continued domination in the Global Electronic Manufacturing Services Market.

Heavy Industrial Manufacturing

Although the Heavy Industrial Manufacturing may not dominate the Global Electronic Manufacturing Services Market, it plays a crucial role in supporting various industries. In heavy industrial manufacturing, electronic components and assemblies are utilized in machinery, equipment, and infrastructure projects. EMS providers assist in the production, assembly, and testing of these electronic systems, providing specialized expertise in industrial applications. While the Heavy Industrial Manufacturing may not have the largest market share, it remains an important market within the Global Electronic Manufacturing Services Market.

Aerospace and Defense

The Aerospace and Defense is another significant of the Global Electronic Manufacturing Services Market. The aerospace and defense industries demand highly sophisticated and reliable electronic solutions for communication systems, avionics, radars, missiles, and satellite components. EMS providers play a vital role in the manufacturing and assembly of these complex electronic systems, ensuring compliance with strict industry regulations and standards. With the continuous advancements in aerospace technology and growing defense budgets, the Aerospace and Defense is expected to maintain its dominance in the Global Electronic Manufacturing Services Market.

Healthcare

The Healthcare is expected to have a notable presence in the Global Electronic Manufacturing Services Market. With the increasing demand for medical devices, diagnostic equipment, and wearable healthcare gadgets, EMS providers offer specialized manufacturing and assembly services for the Healthcare industry. These services include adherence to stringent quality standards, certifications, and regulations specific to the healthcare sector.The COVID-19 pandemic has further boosted the demand for electronic medical devices, such as ventilators and monitoring systems. As the healthcare industry continues to prioritize innovation and advances in medical technology, the Healthcare is expected to hold a significant market share in the Global Electronic Manufacturing Services Market.

IT and Telecom

The IT and Telecom plays a crucial role in the Global Electronic Manufacturing Services Market. With the ever-growing demand for smartphones, networking equipment, data storage systems, and communication devices, EMS providers offer efficient and cost-effective solutions to IT and Telecom companies. The constant need for new and upgraded devices, combined with the shorter product life cycles, drives the demand for EMS services in this As technology continues to advance and the world becomes more interconnected, the IT and Telecom is expected to maintain its dominance in the Global Electronic Manufacturing Services Market.

Others

The "Others" encompasses various industries not explicitly mentioned but still utilizing electronic manufacturing services. It includes sectors such as industrial automation, energy, semiconductors, and gaming. While these industries may not individually dominate the Global Electronic Manufacturing Services Market, they collectively contribute to its growth and diversification. Each of these industries has specific electronic manufacturing requirements, and EMS providers cater to their unique needs. The "Others" represents an essential of the market, ensuring a diverse customer base for EMS providers and expanding opportunities for growth in the Global Electronic Manufacturing Services Market.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Electronic Manufacturing Services market. This region has a strong presence of electronics manufacturing companies and a high demand for electronic products, both domestically and internationally. Countries like China, Japan, South Korea, Taiwan, and Singapore are major players in the electronic manufacturing industry and have established themselves as global manufacturing hubs. These countries offer competitive production costs, advanced technological capabilities, and a large pool of skilled labor. Additionally, the region benefits from the growing consumer electronics market, rapid industrialization, and increasing investments in research and development. With these factors, Asia Pacific is poised to remain the dominant region in the Global Electronic Manufacturing Services market.

North America

North America has a significant presence in the electronic manufacturing industry, icularly in the United States. The region is home to several large electronics companies and technology giants, including Apple, Microsoft, Intel, and IBM. The advanced infrastructure, technological innovation, and strong focus on research and development make North America a key player in the global market. However, compared to Asia Pacific, the region faces challenges such as higher labor costs and intense competition. Despite these factors, North America still holds a significant share in the Global Electronic Manufacturing Services market, icularly in high-value s like aerospace, defense, and medical electronics.

Europe

Europe also has a notable presence in the Global Electronic Manufacturing Services market. Countries like Germany, France, UK, and Switzerland are known for their advanced manufacturing capabilities and innovation in electronics. The region benefits from a highly skilled workforce, strong intellectual property protection, and access to an extensive supply chain network. Europe's focus on cutting-edge technologies like automotive electronics, renewable energy systems, and smart devices further strengthens its position in the market. However, the region faces challenges such as increasing competition from Asia Pacific, cost pressures, and geopolitical uncertainties.

Latin America

Latin America has a growing presence in the Global Electronic Manufacturing Services market, although it does not currently dominate the industry. Countries like Mexico, Brazil, and Argentina are emerging as manufacturing hubs for electronic products. The region offers advantages such as proximity to major markets like the United States, favorable labor costs, and government incentives. However, Latin America still faces challenges such as infrastructure limitations, political instability, and lower technological capabilities compared to other regions.

Middle East & Africa

Middle East & Africa currently has a limited presence in the Global Electronic Manufacturing Services market. The region is primarily a consumer of electronic products rather than a major manufacturer. However, there are efforts to develop the electronics manufacturing industry in the region, driven by increased government support and investment. Countries like the United Arab Emirates and Saudi Arabia are focusing on diversifying their economies and developing high-tech industries, which could lead to opportunities in the electronic manufacturing sector. Despite the potential, Middle East & Africa still faces challenges such as limited technological capabilities, lack of skilled labor, and geopolitical uncertainties.

Company Profiles:

Prominent figures in the worldwide Electronic Manufacturing Services industry have a significant impact by delivering comprehensive manufacturing and production solutions for electronic gadgets across diverse sectors. Their proficiency in design, engineering, assembly, and supply chain oversight guarantees streamlined and top-notch manufacturing procedures for their customer base.

Prominent contributors to the Electronic Manufacturing Services industry comprise Foxconn Technology Group, Flex Ltd., Jabil Inc., Hon Hai Precision Industry Co., Ltd., Sanmina Corporation, Celestica Inc., Plexus Corp., Benchmark Electronics, Inc., Pegatron Corporation, and Wistron Corporation. These firms play a vital role in delivering diverse electronic manufacturing services encompassing design, engineering, fabrication, assembly, and testing of electronic components, devices, and systems for a variety of sectors such as consumer electronics, automotive, aerospace, healthcare, and telecommunications. Through their technical knowledge and operational capabilities, these industry leaders drive growth and innovation within the electronic manufacturing services domain by providing cutting-edge solutions and fostering enduring client nerships.

COVID-19 Impact and Market Status:

The global electronic manufacturing services market has experienced significant disturbances due to the Covid-19 pandemic, resulting in supply chain interruptions, delayed production schedules, and a downturn in consumer demand.

The EMS industry has experienced significant challenges as a result of the global COVID-19 pandemic. The enforcement of lockdown measures worldwide to curb the virus spread has had profound effects on supply chains, manufacturing processes, and consumer demand for electronic goods. The temporary shutdowns of factories and limitations on transportation have led to delays in production and decreased efficiency within the EMS sector. A number of companies have encountered difficulties in procuring raw materials and electronic components, causing further disruptions in their manufacturing activities. Moreover, the decrease in consumer expenditures and wariness towards non-essential purchases have dampened the need for electronics, impacting the EMS market. Nonetheless, amidst these challenges, the pandemic has also created opportunities for the EMS industry, icularly in the realm of healthcare electronics such as medical devices and equipment which have seen increased demand, ially offsetting the decline in other sectors. As the world strives to recover from the pandemic, the EMS market is anticipated to gradually recover, with an emphasis on diversifying supply chains, integrating automation, and embracing digital transformation to bolster resilience and flexibility. In summary, while the COVID-19 crisis has posed formidable obstacles for the EMS market, the industry is proactively adjusting to navigate these disruptions and seeking out new avenues for growth

Latest Trends and Innovation:

- July 2021: Benchmark Electronics completed the acquisition of Secure Communication Systems, a provider of advanced systems integration and engineering services.

- May 2021: Plexus announced the acquisition of KCB Solutions, a leading provider of advanced automation and design services.

- April 2021: Flex, a multinational electronics manufacturing services company, nered with Nike to create the new Nike Adventure Club smart shoe.

- March 2021: Jabil Inc. introduced its Additive Manufacturing Network, a digital supply chain system that connects manufacturers with 3D printing capabilities.

- February 2021: Sanmina Corporation, a leading integrated manufacturing solutions provider, collaborated with Avnet to develop a new, secure, and scalable Internet of Things (IoT) manufacturing platform.

- January 2021: Foxconn announced a nership with Fisker Inc. to manufacture electric vehicles through Project PEAR (Personal Electric Automotive Revolution).

- December 2020: Celestica Inc. acquired Atrenne Integrated Solutions, expanding its portfolio and capabilities in the aerospace and defense industry.

- November 2020: Wistron Corporation, a Taiwanese ODM (Original Design Manufacturer), nered with Optiemus Infracom to manufacture smartphones in India for Indian brands.

- October 2020: Quanta Computer Inc. collaborated with Facebook to develop and manufacture Open Rack-compatible hardware solutions for telecommunications infrastructures.

- September 2020: Hon Hai Precision Industry, better known as Foxconn, announced plans to build a new facility in Wisconsin, USA, to manufacture high-tech LCD panels.

Significant Growth Factors:

The expansion of the Electronic Manufacturing Services industry is fueled by a rising need for consumer electronics, continuous technological innovations, and the delegation of manufacturing operations to drive cost efficiencies and enhance speed-to-market.

The global electronic manufacturing services (EMS) industry has experienced remarkable growth recently due to various significant factors. Primarily, the escalating demand for consumer electronics and electronic gadgets, such as smartphones, tablets, and wearable technology, has driven the expansion of the EMS market. This surge can be attributed to the increasing consumer preference for cutting-edge devices and the necessity for streamlined manufacturing processes, which are efficiently provided by EMS companies. Furthermore, the adoption of advanced technologies like the Internet of Things (IoT) and artificial intelligence (AI) has further spurred the requirement for EMS services, given that these innovations demand specialized manufacturing knowledge. The ongoing trend of device miniaturization in the electronics sector has opened up avenues for EMS providers due to their expertise and capabilities in producing compact and lightweight electronic products.

Additionally, the practice of outsourcing electronic manufacturing tasks from original equipment manufacturers (OEMs) to EMS companies has played a pivotal role in boosting the market. Outsourcing allows OEMs to concentrate on their core strengths while leveraging the proficiency and cost-effectiveness of EMS providers. Finally, the mounting emphasis on sustainability and environmental regulations has encouraged OEMs to collaborate with EMS firms that adhere to stringent environmental guidelines. This shift has spurred the growth of EMS providers offering eco-friendly manufacturing practices and advocating for the use of sustainable materials. Together, these factors have propelled the expansion of the EMS market, with projections indicating continued growth in the foreseeable future.

Restraining Factors:

The Electronic Manufacturing Services Market faces obstacles due to the complex regulatory landscape and increasing production expenses. The electronic manufacturing services sector is projected to encounter various challenges in the foreseeable future.

The ongoing advancements in technology and the rapid turnover of electronic products could present obstacles for manufacturers striving to stay abreast with the latest developments. Moreover, the substantial initial capital investment needed to establish manufacturing facilities and acquire cutting-edge equipment may dissuade potential new players from entering the industry. Competition from countries offering low-cost manufacturing solutions, notably China and India, could compel manufacturers to lower prices, potentially impacting their profit margins. Additionally, stringent regulatory frameworks and compliance standards within the electronics domain could introduce added intricacies and elevate operational expenses for manufacturers.

Geopolitical uncertainties, trade disputes, and disruptions in global supply chains might disrupt the supply of essential raw materials and components, leading to production and delivery delays. Further, the escalating concerns surrounding environmental sustainability and the imperative to curtail electronic waste may necessitate the adoption of eco-friendly practices by manufacturers, potentially resulting in increased costs. Nonetheless, notwithstanding these challenges, the electronic manufacturing services market presents promising prospects for expansion and innovation. The surge in demand for electronic devices, driven by technological advancements like the Internet of Things and artificial intelligence, is poised to propel growth. The sector can counter the restraining factors by embracing digital transformation, prioritizing investments in research and development, optimizing supply chains, and integrating sustainable manufacturing approaches.

Key Segments of the Electronic Manufacturing Services Market

Service Overview

• Electronics Manufacturing Services

• Engineering Services

• Test & Development Implementation

• Logistics Services

• Others

Industry Overview

• Consumer Electronics

• Automotive

• Heavy Industrial Manufacturing

• Aerospace and Defense

• Healthcare

• IT and Telecom

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America