Market Analysis and Insights:

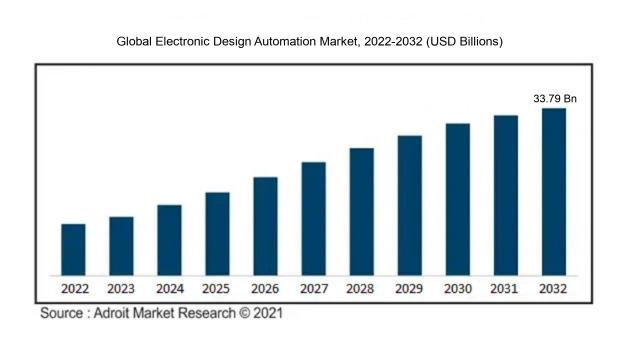

The market for Electronic Design Automation was estimated to be worth USD 14.31 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 9.46%, with an expected value of USD 33.79 billion in 2032.

The Electronic Design Automation (EDA) sector is being propelled by a variety of factors. Firstly, the escalating intricacy of electronic devices and the necessity for quicker time-to-market are motivating semiconductor manufacturers to utilize EDA tools. These tools offer effective methods for developing and simulating integrated circuits, thus refining the overall design workflow. Secondly, the increasing consumer demand for cutting-edge electronic products like smartphones, tablets, and wearable gadgets is driving the expansion of the EDA industry. These modern devices require complex chip designs to satisfy evolving consumer needs, consequently elevating the requirement for EDA tools. Moreover, the surging popularity of Internet of Things (IoT) gadgets is also contributing to the market's progress. These devices necessitate specialized chip designs and inventive solutions, which can be realized through EDA tools. Lastly, there is a growing emphasis on diminishing design expenses and enhancing productivity, leading to increased adoption of EDA tools. By streamlining the design process, EDA tools aid in reducing mistakes and boosting efficiency, thus cutting down on total production costs. These factors collectively are anticipated to steer the growth of the EDA market in the years ahead.

Electronic Design Automation Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 33.79 billion |

| Growth Rate | CAGR of 9.46% during 2024-2032 |

| Segment Covered | By Product, By Deployment, By End-Use, By Application, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Cadence Design Systems, Synopsys, Mentor Graphics, Siemens PLM Software, Ansys, Altium Limited, Zuken, Keysight Technologies, AWR Corporation, Silvaco Inc., and Xilinx. |

Market Definition

Electronic Design Automation (EDA) encompasses a range of software applications utilized by electronic designers for the creation and evaluation of electronic systems, encompassing integrated circuits and printed circuit boards. These tools facilitate the automation of diverse design processes in electronic system development, thereby elevating both efficiency and precision.

In the realm of modern technology, Electronic Design Automation (EDA) holds significant importance by serving as a fundamental component in the design, assessment, and production of electronic systems. EDA software tools play a pivotal role in supporting engineers to create intricate electronic circuits, chips, and systems with increased efficiency. These tools offer sophisticated features for simulation, validation, and enhancement, which are instrumental in developing top-performing and dependable products. Moreover, EDA is instrumental in minimizing both the duration and expenses associated with product development through the automation of repetitive and labor-intensive tasks, thereby enabling engineers to concentrate on fostering innovation and originality. By streamlining the design procedure and augmenting overall efficacy, EDA accelerates the time-to-market for electronics manufacturers, empowering them to introduce cutting-edge products that cater to the escalating demands of the market.

Key Market Segmentation:

Insights On Key Product

IC Physical Design & Verification

IC Physical Design & Verification is expected to dominate the Global Electronic Design Automation market. This part focuses on the physical layout and verification of integrated circuits, ensuring their functionality, reliability, and performance. With the increasing complexity of semiconductor designs and the need for advanced verification techniques, IC Physical Design & Verification plays a crucial role in the electronic design process. It offers tools and methodologies for designing and verifying the physical aspects of integrated circuits, including placement, routing, timing analysis, and design rule checking. As the demand for faster, smaller, and more power-efficient electronic devices continues to grow, the importance of IC Physical Design & Verification in the Global Electronic Design Automation Market is expected to increase significantly.

Computer-aided Engineering (CAE)

Computer-aided Engineering (CAE) is a product of the Electronic Design Automation (EDA) market that accounted for the largest market share of over 30% in 2022. The segment growth can be attributed to the increased outsourcing of manufacturing processes to emerging economies, the growing need for integrated software solutions to eliminate multiple prototype products and product recall concerns, and the drastic shift from on-premise computing to cloud-based computing. Cloud computing lowers the expenses of hardware purchasing, software licensing, installation, and support, which is projected to enhance the use of CAE software even further in the coming years. Furthermore, businesses are using the Hyper-Converged Infrastructure (HCI) platform to establish a private cloud that provides enhanced security and flexibility, which is expected to drive the growth of the CAE segment during the forecast period.

PCB & MCM

PCB & MCM is a product of the EDA market that is expected to grow at a significant CAGR during the forecast period. The increasing demand for smart wearable devices, smartphones, and smart speakers, coupled with the rising preference for connected homes and connected devices, is expected to drive the Electronic Design Automation (EDA) software market growth over the forecast period. The PCB & MCM segment is a critical part of this growth, as these components are used in the development of electronic devices. The rising demand for advanced electronic components to improve the operational efficiency of electronic devices creates a significant opportunity for the growth of the PCB & MCM segment during the forecast period. Companies operating in the EDA software market are adopting various business strategies such as integrating advanced technologies to strengthen their foothold in this subsegment.

Semiconductor IP

Semiconductor IP is a product of the EDA market that is expected to grow at a significant CAGR during the forecast period. The increasing demand for complex integrated circuits (ICs) is driving the growth of the EDA market, and Semiconductor IP is a critical part of this growth. The semiconductor IP market is expected to grow significantly due to the increasing demand for IP cores that can be used in the design and development of complex ICs. The growing adoption of smart wearable devices, smartphones, and smart speakers, coupled with the rising preference for connected homes and connected devices, is expected to drive the growth of the Semiconductor IP segment during the forecast period. Companies in the EDA software market are trying to strengthen their foothold by introducing innovative and advanced product offerings in this subsegment.

Services

Services is a product of the EDA market that is expected to grow at a significant CAGR during the forecast period. In EDA software, services comprise of methodology development, enterprise integration, large-scale deployment, and process design. The services segment is anticipated to grow at a CAGR of 10.6% during the forecast period. The increasing demand for EDA software solutions and the growing complexity of electronic devices are driving the growth of the services segment. Companies in the EDA software market are offering various services to help their customers design and develop complex electronic devices. These services include methodology development, enterprise integration, large-scale deployment, and process design, which are critical to the success of electronic device design and development projects.

Insights On Key Deployment

Cloud-based

The deployment expected to dominate the Global Electronic Design Automation Market is the Cloud-based deployment. The demand for cloud-based deployment in the electronic design automation market is rapidly increasing due to several factors. Firstly, the cloud-based deployment offers scalability and flexibility, allowing companies to easily expand and adapt to changing business needs. It also provides cost savings as it eliminates the need for expensive on-premises infrastructure and maintenance. Additionally, the cloud-based deployment offers improved collaboration and remote access, enabling teams to work together efficiently from different locations. The convenience and efficiency offered by cloud-based deployment make it the preferred choice for many companies, leading to its dominance in the global electronic design automation market.

On-premises

Although the Cloud-based deployment is expected to dominate the market, the On-premises deployment still holds significance in the Global Electronic Design Automation Market. Some companies may have specific security or compliance requirements that necessitate an on-premises deployment. Additionally, sensitive data or proprietary designs may be better protected on-premises rather than in the cloud. Furthermore, companies that have already invested heavily in on-premises infrastructure may choose to continue utilizing their existing systems. These factors contribute to the ongoing relevance of on-premises deployment in the electronic design automation market.

Insights On Key End-Use

Consumer Electronics Industry

The Consumer Electronics Industry is expected to dominate the Global Electronic Design Automation Market. This can be attributed to the increasing demand for electronic devices such as smartphones, tablets, laptops, and home appliances. The Consumer Electronics Industry heavily relies on electronic design automation tools to streamline the design and development process, improve efficiency, and meet market demands for innovative and advanced consumer electronics products. The industry's focus on miniaturization, power efficiency, and improved performance further underscore the importance of electronic design automation tools in this sector.

Automotive Industry

The Automotive Industry, while significant, is not expected to dominate the Global Electronic Design Automation Market. The industry relies on electronic design automation tools for designing and testing electronic systems in vehicles. However, the Consumer Electronics Industry surpasses the Automotive Industry in terms of market demand, product innovation, and overall usage of electronic design automation tools.

Healthcare Industry

The Healthcare Industry plays a crucial role in the adoption of electronic design automation tools, particularly in medical device manufacturing and healthcare equipment development. However, the Consumer Electronics Industry has a larger market size and extensive use of electronic design automation tools, making it the dominant part in the Global Electronic Design Automation Market.

Aerospace & Defense Industry

The Aerospace & Defense Industry is a vital sector for electronic design automation, considering the intricate electronic systems involved in aerospace and defense applications. However, the Consumer Electronics Industry still outweighs the Aerospace & Defense Industry in terms of market share and overall dominance in the Electronic Design Automation Market.

Telecom and Data Centre Industry

The Telecom and Data Centre Industry heavily rely on electronic design automation tools for network infrastructure, communication devices, and data center equipment. Although this sector has a significant demand for electronic design automation, it falls behind the Consumer Electronics Industry in terms of overall market dominance.

Industrial Sector

The Industrial Sector, encompassing various s such as manufacturing, machinery, energy, and automation, utilizes electronic design automation for optimizing industrial processes and improving productivity. Nevertheless, the Consumer Electronics Industry prevails as the dominant part due to its larger market size, broader applications, and higher demand for electronic design automation tools.

Others

The Others category, which includes niche industries and emerging sectors, it is unlikely to dominate the Global Electronic Design Automation Market. These industries may utilize electronic design automation tools for specific applications, but their overall market share and impact on the Electronic Design Automation Market are relatively smaller compared to the Consumer Electronics Industry.

Insights On Key Application

Microprocessors & Microcontrollers

Microprocessors & Microcontrollers application is expected to dominate the Global Electronic Design Automation Market. With the increasing demand for advanced computing devices and consumer electronics, the need for efficient and high-performance microprocessors and microcontrollers is growing rapidly. These components serve as the brain of electronic devices, enabling them to process and execute complex tasks. The continuous technological advancements and the rise of Internet of Things have further fueled the demand for microprocessors and microcontrollers in various industries such as automotive, telecommunications, and industrial automation. As a result, the microprocessors and microcontrollers part is projected to have the largest market share in the Global Electronic Design Automation Market.

Memory Management Units

Memory management units are another important player within the Application category of the Global Electronic Design Automation Market. These units play a crucial role in managing and optimizing the usage of memory resources in electronic devices. With the ever-increasing amount of data being processed and stored, efficient memory management has become essential for smooth functioning of electronic systems. Memory management units enable efficient handling of data storage, retrieval, and manipulation, ensuring optimal performance and reliability. Although this part holds substantial significance in the electronic design automation market, it is anticipated to have a smaller market share compared to microprocessors and microcontrollers due to the higher demand and technological advancements in the latter.

Others

The Others in the Application category encompasses various electronic components and devices that do not fall under the categories of microprocessors, microcontrollers, or memory management units. This part includes a wide range of applications such as sensors, power management units, interfaces, and signal processing units. While these components are vital for the overall functionality of electronic systems, they are not expected to dominate the Global Electronic Design Automation Market. The dominance is more likely to be driven by the demand for microprocessors and microcontrollers, which are the backbone of electronic devices, followed by the significance of memory management units in optimizing memory resources.

Insights on Regional Analysis:

North America

North America is expected to dominate the global electronic design automation (EDA) market. This region is home to key players in the EDA industry, such as Cadence Design Systems, Inc., Synopsys, Inc., and Mentor Graphics Corporation. The presence of these industry giants, along with a well-established infrastructure for technological advancement, gives North America a significant advantage in capturing the largest market share. Additionally, the region's highly developed semiconductor industry and a strong focus on innovation and research contribute to its dominance in the EDA market. North America is also known for its large consumer electronics market, which further drives the demand for EDA tools and services.

Latin America

Latin America is an emerging market for electronic design automation. Although it may not have the same level of dominance as North America, the region shows potential for growth in the EDA market. The increasing adoption of advanced technologies, coupled with favorable government initiatives and investments in infrastructure development, is driving the demand for EDA solutions in Latin America. The region's growing automotive and electronics industries also contribute to the market's expansion. However, challenges such as limited technological expertise and awareness, as well as economic and political uncertainties, may hinder Latin America from dominating the global EDA market.

Asia Pacific

Asia Pacific is another region that holds significant potential in the global electronic design automation market. With countries like China, Japan, and South Korea at the forefront of technological advancements, the region is witnessing rapid growth in industries such as automotive, consumer electronics, and telecommunications. The increasing demand for integrated circuits, semiconductor devices, and electronic components fuels the need for efficient EDA tools and services in Asia Pacific. Furthermore, the presence of major semiconductor foundries and leading electronic manufacturers in the region further drives the market's growth. While Asia Pacific may not dominate the global EDA market like North America, it has the potential to become a major player in the coming years.

Europe

Europe is also a significant region in the global electronic design automation market. It is home to several key players in the EDA industry, such as Siemens AG, Ansys, and Altium Limited. The region's strong automotive, aerospace, and defense industries create a demand for advanced EDA solutions. Additionally, Europe's focus on renewable energy and smart grid technology drives the need for efficient electronic design and optimization. While Europe may not dominate the global EDA market, its contributions to technological advancements and innovation cannot be ignored.

Middle East & Africa

The Middle East & Africa region is still in the nascent stages of development in the electronic design automation market. It faces challenges such as limited technological infrastructure, economic uncertainties, and political instability in certain countries. However, with the growing emphasis on diversifying economies and boosting technological capabilities, the region shows potential for growth in the EDA market. The increasing presence of semiconductor manufacturers and efforts towards digital transformation and innovation indicate a promising future for Middle East & Africa in the EDA sector. While it may not dominate the global market, the region's progress and potential cannot be overlooked.

Company Profiles:

Prominent figures in the worldwide Electronic Design Automation industry are engaged in the creation of software and technologies that aid in the design and creation of electronic systems and components. These individuals are pivotal in delivering cutting-edge solutions and technological progress to address the escalating needs of the sector.

Prominent companies in the Electronic Design Automation industry encompass Cadence Design Systems, Synopsys, Mentor Graphics, Siemens PLM Software, Ansys, Altium Limited, Zuken, Keysight Technologies, AWR Corporation, Silvaco Inc., and Xilinx. These entities furnish a diverse array of software solutions and support services aimed at aiding in the creation, validation, and examination of intricate integrated circuits, electronic frameworks, and semiconductor devices. Their contributions are pivotal in empowering electronics manufacturers to adeptly conceptualize and fabricate products, streamline time-to-market endeavors, and assure the caliber and dependability of their designs. By virtue of their industry-leading status, they continuously foster innovation and enhance their offerings to address the ever-evolving requisites and obstacles encountered within the sector, thereby exerting a significant influence in shaping the trajectory of the EDA sector.

COVID-19 Impact and Market Status:

The Electronic Design Automation (EDA) industry has been greatly affected by the Covid-19 pandemic on a global scale, leading to a decrease in demand and disturbances in supply chains.

The electronic design automation (EDA) market has been influenced in various ways by the COVID-19 pandemic. On one side, the surge in demand for electronic gadgets and the incorporation of cutting-edge technologies such as 5G and artificial intelligence have propelled the growth of the EDA sector. The global shift toward remote work and online education has significantly increased the requirement for effective software and hardware solutions.

Moreover, the growing popularity of virtual design and prototyping has further energized the EDA industry. Nonetheless, the pandemic has interfered with global supply chains and manufacturing processes, resulting in delays and shortages within the semiconductor field. Consequently, this has negatively impacted the EDA market as semiconductor companies encountered difficulties in product design and manufacturing. Additionally, the economic instability triggered by the pandemic has fostered a cautious investment approach, influencing the overall growth and expenditure in the EDA market. While the EDA sector benefits from certain positive growth catalysts, challenges persist due to disruptions and uncertainties arising from the pandemic, hindering its expansion.

Latest Trends and Innovation:

- Cadence Design Systems acquired AWR Corporation on February 20, 2019, to strengthen their RF and microwave design capabilities.

- Siemens AG merged its Electronic Design Automation (EDA) business unit with Mentor Graphics Corporation on March 1, 2017, to create a comprehensive digital twin solution for the industry.

- ANSYS, Inc. announced on December 13, 2018, the acquisition of Helic, Inc., a provider of electromagnetic crosstalk analysis tools for integrated circuits.

- Synopsys Inc. unveiled their Fusion Compiler on November 18, 2019, which offers up to 20% improvement in quality-of-results and time-to-results for designing advanced chips.

- Keysight Technologies Inc. introduced PathWave Design 2020 software on January 23, 2020, enabling electronic engineers to accelerate product development and improve design quality.

- Altium Limited launched the Altium Designer 20 on September 10, 2019, offering a unified design environment for electronic product development.

- Cadence Design Systems released the Clarity 3D Solver on September 12, 2017, providing electronic design teams with enhanced 3D modeling and analysis capabilities.

- Silvaco, Inc. acquired Coupling Wave Solutions S.A. on June 25, 2019, to expand its portfolio of device modeling solutions for advanced semiconductor technologies.

Significant Growth Factors:

The Electronic Design Automation Market is expected to experience significant growth, fueled by innovations in semiconductor technology and growing need for effective design solutions.

The electronic design automation (EDA) industry is witnessing remarkable expansion driven by various essential factors. Firstly, the escalating requirement for electronic devices across different sectors such as consumer electronics, automotive, and healthcare is propelling the necessity for effective and cutting-edge design solutions. This uptick in demand is spurred by advancements in technology, evolving consumer preferences, and the integration of sophisticated features in electronic devices. Secondly, the mounting intricacy of integrated circuits (ICs) and electronic systems necessitates the use of advanced EDA tools for designing and validating these intricate designs. Moreover, the increasing adoption of cloud computing and the Internet of Things (IoT) has accentuated the demand for EDA tools capable of managing the design and testing of high-performance, energy-efficient devices. In addition, the escalating emphasis on reducing time-to-market timelines and the quest for cost-efficient solutions have driven the uptake of EDA tools that facilitate the streamlining of design procedures, error reduction, and optimization of design integrity. Furthermore, the advent of cutting-edge technologies such as artificial intelligence (AI), machine learning, and big data analytics is poised to exert a notable influence on the EDA sector, empowering automation, optimization, and enhancement of design quality. In essence, the EDA market's growth can be attributed to the growing need for electronic devices, the increasing intricacy of designs, the emergence of innovative technologies, and the imperative for quicker and more effective design processes.

Restraining Factors:

The primary constraints of the Electronic Design Automation (EDA) sector stem from the significant expenses and intricacy associated with deploying EDA solutions, as well as the industry's concentration with only a handful of major participants holding sway.

The Electronic Design Automation (EDA) industry is experiencing notable growth, yet it is encountering various challenges that need addressing. One primary concern is the significant expenses linked to adopting and upkeeping EDA tools and software. Research and development for cutting-edge technologies like artificial intelligence and machine learning further contribute to the financial strain. Moreover, compatibility issues among different EDA software systems obstruct efficient collaboration and data sharing among design teams. Another obstacle arises from the escalating complexity of integrated circuits and chip designs, resulting in prolonged design processes and ened error risks, which in turn affect product launch timelines. The scarcity of proficient professionals in the EDA field also presents difficulties for companies in need of individuals skilled in design and verification methodologies. Additionally, stringent government regulations concerning data security and intellectual property rights add another layer of intricacy for EDA market players. Nonetheless, despite these challenges, the EDA sector is poised for favorable growth prospects. Technological advancements such as cloud-based EDA solutions and the integration of IoT capabilities into designs show promise in alleviating cost and interoperability complexities.

Furthermore, the rising demand for advanced electronic systems across industries like automotive, aerospace, and healthcare presents an encouraging opportunity for the EDA market to flourish.

Key Segments of the Electronic Design Automation Market

Product Overview

• Computer-aided Engineering (CAE)

• IC Physical Design & Verification

• PCB & MCM

• Semiconductor IP

• Services

Deployment Overview

• On-premises

• Cloud-based

End-Use Overview

• Automotive Industry

• Healthcare Industry

• Aerospace & Defense Industry

• Telecom and Data Centre Industry

• Consumer Electronics Industry

• Industrial Sector

• Others

Application Overview

• Microprocessors & Microcontrollers

• Memory Management Units

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America