Market Analysis and Insights:

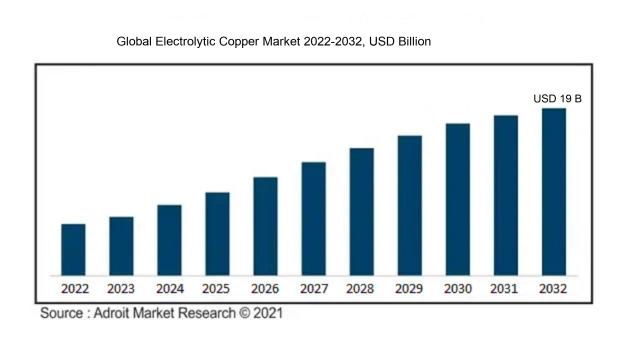

The market for Electrolytic Copper was estimated to be worth USD 12 billion in 2023, and from 2023 to 2032, it is anticipated to grow at a CAGR of 4.5%, with an expected value of USD 19 billion in 2032.

The market for electrolytic copper is significantly influenced by various crucial factors. One major driver is the increasing demand from the electrical and electronics sectors, where copper's role in conductors and components is vital. Additionally, the global transition towards renewable energy solutions, exemplified by the use of solar panels and wind turbines, plays a pivotal role in market expansion, given copper's necessity in these technologies. The growth of the construction industry, especially in emerging markets, further fuels the need for copper in wiring and plumbing applications.

Moreover, trade regulations and tariffs can profoundly affect market behavior, influencing both pricing structures and supply chains. Innovations in refining and extraction methods, which lower production costs, also make the market more appealing. Furthermore, environmental policies and sustainability efforts are encouraging the adoption of recycled copper, likely reshaping demand trends. Collectively, these elements define the strategic framework of the electrolytic copper market, affecting its pricing, supply chain dynamics, and overall demand.

Electrolytic Copper Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2023-2032 |

| Study Period | 2022-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 19 billion |

| Growth Rate | CAGR of 4.5% during 2023-2032 |

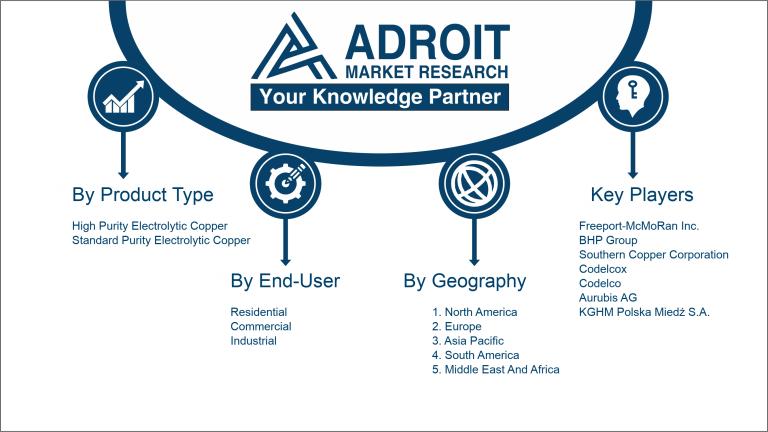

| Segment Covered | By Type, By Application, By End-User, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Freeport-McMoRan Inc., BHP Group, Southern Copper Corporation, Codelco, JX Nippon Mining & Metals Corporation, Aurubis AG, KGHM Polska Mied? S.A., Jiangxi Copper Corporation, Mitsubishi Materials Corporation, and Grupo México. First Quantum Minerals Ltd., Glencore International AG, Tongling Nonferrous Metals Group Holdings Co., Ltd., and China Northern Rare Earth Group High-Tech Co., Ltd. |

Market Definition

Electrolytic copper refers to extremely pure copper obtained via an electrolysis technique, in which copper ions are dissolved in a solution and subsequently deposited onto cathodic surfaces. This process yields copper with a remarkable purity of 99.99%, rendering it ideal for use in electrical and electronic sectors.

Electrolytic copper is essential for a multitude of industries, owing to its exceptional conductivity, resistance to corrosion, and outstanding malleability. It is predominantly utilized in electrical applications, serving as a fundamental material for wiring, connectors, and circuit boards that facilitate effective energy transmission. The high level of purity achieved through the electrolytic refining method boosts its performance in electronic devices and renewable energy technologies, particularly in solar power systems and wind turbines. Moreover, electrolytic copper is integral to the manufacturing of machinery and automotive parts, thereby supporting progress in electrical and electronic engineering. The growing demand for renewable energy solutions and advanced electronic products highlights its critical role in contemporary technology.

Key Market Segmentation:

Insights On Key Product Type

High Purity Electrolytic Copper

High Purity Electrolytic Copper is expected to dominate the Global Electrolytic Copper Market due to the increasing demand for advanced electronic applications, including semiconductors, telecommunications, and electric vehicles. The purity levels exceeding 99.9% ensure enhanced conductivity and performance, making them essential for high-tech applications. Furthermore, industries are progressively focusing on sustainability and efficient energy solutions, where high purity materials play a critical role. Additionally, foreseeable technological advancements and the shift towards renewable energy sources also bolster the consumption of high purity copper, thereby reinforcing its dominating position in the market.

Standard Purity Electrolytic Copper

Standard Purity Electrolytic Copper serves a different market, primarily focusing on applications in construction, plumbing, and general electrical wiring. Although it has lower purity levels compared to high purity options, its cost-effectiveness makes it preferable for many industrial applications. This grade of copper remains essential for producing various copper alloys and electrical products where ultra-high conductivity is not critical. It caters effectively to the growing demand across multiple sectors, maintaining a steady market share and relevance despite not being the market leader.

Insights On Key Application

Electrical and Electronics

The Electrical and Electronics sector is expected to dominate the Global Electrolytic Copper Market due to the increasing demand for high-performance electrical components and systems. As industries and consumers transition towards renewable energy sources, electrification in transportation, and advanced electronic devices, copper's remarkable conductivity and durability make it the preferred choice for wires, connectors, and electronic circuits. Furthermore, the rising production of electric vehicles (EVs) is significantly contributing to the demand for electrolytic copper, as they utilize copper extensively for batteries and wiring. With global initiatives for smart grids and energy-efficient technologies, this industry is poised for substantial growth, driving the electrolytic copper market.

Construction

The Construction sector has been a substantial consumer of electrolytic copper, primarily in wiring and plumbing applications. Copper's corrosion resistance and excellent conductivity make it a favored material for electrical installations in residential, commercial, and infrastructure projects. Given the trend towards smart buildings, which incorporate sophisticated electrical systems, the need for high-quality copper will continue to grow. Additionally, urbanization and governmental initiatives aiming to improve infrastructure projects globally contribute to the ongoing demand for electrolytic copper in construction, though it may take a backseat to the electrical and electronics industry in terms of market dominance.

Automotive

In the Automotive industry, the demand for electrolytic copper is also growing, largely driven by the electrification of vehicles. With the rise of hybrid and electric vehicles, the need for efficient energy transfer systems is paramount, resulting in increased copper usage in batteries and wiring harnesses. Traditional internal combustion engine vehicles also employ copper for various electrical components, signaling a robust market potential. However, as the shift to electric vehicles accelerates, the automotive sector is increasingly reliant on electrolytic copper, positioning it as a notable player, albeit secondary to the Electrical and Electronics industry.

Industrial Machinery

The Industrial Machinery utilizes electrolytic copper mainly in manufacturing processes and electrical equipment used in heavy machinery. Being an essential material for motor windings, transformers, and generators, copper ensures efficient operations and longevity. Although the industrial sector continues to grow as economies recover and manufacturing ramps up, its copper demands are largely driven by operational needs rather than the innovative applications seen in the Electrical and Electronics sector. As automation and technology integration enhance productivity, demand for electrolytic copper in industrial machinery will persist but will not reach the dominance of the Electrical and Electronics application.

Others

The 'Others' category encompasses a range of applications, including telecommunications, consumer goods, and renewable energy systems. While this reflects diverse uses of electrolytic copper, its overall market impact is diluted compared to more dominant sectors. For instance, telecommunications infrastructure employs copper for cabling; however, advancements in fiber optics create competition for its usage. Additionally, while renewable energy systems, such as solar panels, utilize copper, they do not account for as substantial a market share as electrical applications. Consequently, the 'Others' category, while important, is unlikely to dominate in comparison to the Electrical and Electronics sector.

Insights On Key End-User

Industrial

The industrial sector is anticipated to dominate the Global Electrolytic Copper Market due to its expansive application across various industries such as electrical, electronics, automotive, and construction. Electrolytic copper is a critical raw material for manufacturing high-performance electrical cables, motors, and transformers, which are integral to industrial processes. The rapid growth of industries and infrastructure development globally drives the demand for high-quality copper, especially given the increasing focus on energy efficiency and renewable energy sources. Moreover, industries require significant volumes of electrolytic copper for their operations, further strengthening its dominance in this market.

Residential

The residential market, while not the leading, is still notable in its consumption of electrolytic copper, primarily for wiring, plumbing, and electrical connections. With the rising trend in smart homes and energy-efficient appliances, there is a growing need for high-quality copper materials. As homeowners invest in renovations and upgrades, the demand for copper in residential construction projects is expected to grow. However, this 's impact is somewhat limited compared to the industrial sector due to its smaller scale of consumption.

Commercial

The commercial sector plays a significant role in the utilization of electrolytic copper, particularly in the construction of buildings, commercial electrical installations, and telecommunications systems. Commercial spaces require extensive wiring and infrastructure that rely on high-quality copper to ensure efficiency and safety. As more businesses enhance their technological capabilities and energy efficiency, the demand for copper continues to rise. However, while important, the commercial sector remains below the industrial sector in terms of overall volume and application scope, impacting its overall market dominance.

Insights on Regional Analysis:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Electrolytic Copper market due to several key factors. This area has seen rapid industrialization, particularly in countries like China and India, which are the largest consumers of copper in various applications, including electronics, construction, and renewable energy infrastructure. The persistent demand for copper in these sectors, paired with the robust growth of electric vehicles and advancements in technology, is fostering a strong market for electrolytic copper. Additionally, the presence of significant copper mining resources and improved production capacity in the region contributes to its leading position globally.

North America

North America, particularly the United States, plays a substantial role in the electrolytic copper market due to its strong economy and advanced technological capabilities. The region is witnessing a growing demand for electrification, including electric vehicles and renewable energy solutions, which further elevates the copper requirements. Additionally, the North American Free Trade Agreement (NAFTA) has facilitated trade within the region, promoting accessibility to raw materials and copper products. While facing competition from the Asia Pacific, North America is leveraging its innovative edge and regulatory frameworks to sustain its market presence.

Europe

Europe is witnessing a steady demand for electrolytic copper, primarily driven by renewable energy initiatives and growing industrial applications. The transition to sustainable technology, particularly in wind and solar energy, necessitates increased copper usage for wiring and infrastructure. Although Europe is not the largest market compared to Asia Pacific, it is committed to eco-friendly solutions, supporting an increase in demand. However, with heavy reliance on imports and the evolving energy landscape, the region faces challenges that could hinder its market position in the coming years.

Latin America

Latin America is significant in terms of copper production, as it houses some of the largest copper mines globally, particularly in Chile and Peru. However, in the electrolytic copper market, its dominance is limited mainly due to regional economic variables and lower technological advancement in manufacturing compared to Asia. While the mining sector remains strong, local demand does not match that of larger markets, causing dependency on exports. Future growth in electric vehicle production and renewable energy initiatives may provide opportunities for increased domestic consumption, but this progress will require focused industrial investment.

Middle East & Africa

The Middle East and Africa region is relatively nascent in the electrolytic copper market, with limited production capabilities and demand. The region does have mineral resources, but economic instability and infrastructural challenges have hindered the development of a robust copper market. Increased investments in construction and urban development projects may spur growth in copper demand, yet these regions still lag behind others due to their overall economic conditions and lower industrial output. Growing global emphasis on sustainability could open avenues for growth in the future, but significant challenges remain to fully capitalize on this potential.

Company Profiles:

The dynamics of the Global Electrolytic Copper market are significantly shaped by key participants, including leading manufacturers and suppliers. Their influence stems from production capabilities, advancements in technology, and collaborative ventures, which collectively affect pricing and supply levels. Additionally, their commitment to sustainable practices is vital in addressing rising environmental regulations and the growing consumer preference for ethically sourced materials.

Prominent entities in the electrolytic copper industry comprise Freeport-McMoRan Inc., BHP Group, Southern Copper Corporation, Codelco, JX Nippon Mining & Metals Corporation, Aurubis AG, KGHM Polska Mied? S.A., Jiangxi Copper Corporation, Mitsubishi Materials Corporation, and Grupo México. Other noteworthy firms include Sumitomo Metal Mining Co., Ltd., First Quantum Minerals Ltd., Glencore International AG, Tongling Nonferrous Metals Group Holdings Co., Ltd., and China Northern Rare Earth Group High-Tech Co., Ltd. Furthermore, Vedanta Resources Limited, Antofagasta PLC, Teck Resources Limited, and China Molybdenum Co., Ltd. also hold significant positions within the market.

COVID-19 Impact and Market Status:

The outbreak of the Covid-19 pandemic had a profound impact on the worldwide electrolytic copper market, resulting in disturbances in supply chains and varying levels of demand across different sectors. This situation culminated in increased market instability and volatility in pricing.

The COVID-19 pandemic profoundly influenced the electrolytic copper sector, primarily due to significant disruptions in production processes and supply networks. Health measures and lockdowns resulted in a noticeable reduction in mining operations and factory closures, which in turn decreased the supply of raw copper. Moreover, the prevailing economic uncertainties compelled various industries, notably construction and automotive, to reduce their project activities, thus lowering copper demand. Nonetheless, as recovery initiatives, especially in infrastructure enhancement and electric vehicle manufacturing, gained traction, the demand for electrolytic copper started to rise again. Additionally, the transition towards renewable energy sources contributed to an increased requirement for copper, given its essential role in electrical wiring and electronic devices. In summary, although the early stages of the pandemic presented considerable obstacles, the market gradually adjusted and began its recovery by 2021, driven by a global shift towards sustainable technologies and economic revitalization efforts.

Latest Trends and Innovation:

- In March 2021, KGHM Polska Mied? S.A. announced its acquisition of a 50% stake in the Sierra Gorda mine in Chile. This strategic move aimed to increase its copper production capacity and enhance its global market position.

- In October 2021, Freeport-McMoRan Inc. completed its acquisition of the remaining 50% interest in the Grasberg mine in Indonesia from Rio Tinto, which significantly expanded Freeport's production of copper and gold.

- In June 2022, Nexans SA launched its new generation of high-performance electrolytic copper wire, designed to improve energy efficiency in electrical applications. This innovation supports the growing demand for sustainable energy solutions.

- In August 2022, Southern Copper Corporation announced a $1.4 billion investment plan to expand production facilities in Peru, aiming to increase its electrolytic copper production and meet rising global demand.

- In February 2023, copper producer Aurubis AG signed a strategic partnership with a leading technology company to develop advanced recycling methods for copper scrap, enhancing its electrolytic copper production process.

- In May 2023, Turquoise Hill Resources Ltd. reported progress in the Oyu Tolgoi project in Mongolia, which is expected to significantly boost its electrolytic copper output upon completion, contributing to the global supply chain.

- In September 2023, the International Copper Study Group published a report indicating a projected increase in global copper demand, driven by advancements in electric vehicle technology and renewable energy systems, impacting the electrolytic copper market.

Significant Growth Factors:

The expansion of the Electrolytic Copper Market is largely fueled by the rising need for renewable energy solutions, electric transportation, and innovations in electrical applications.

The market for electrolytic copper is experiencing remarkable expansion, driven by several fundamental factors. A primary catalyst is the increasing requirement for copper in various electrical applications, such as wiring, motors, and electronic devices. This surge is further fueled by the worldwide transition towards electrification and renewable energy initiatives. The growth of the electric vehicle (EV) sector exacerbates this demand, as copper plays a crucial role in batteries and charging infrastructures.

Additionally, rapid urbanization and infrastructure projects, particularly within developing nations, are creating a ened need for copper in construction and industrial sectors. Environmental regulations and a greater focus on sustainability are shaping the market, resulting in a shift towards the production of high-quality, recyclable copper. Technological innovations in mining and refining have also contributed to improved efficiency and higher production outputs.

The anticipated recovery of the global economy in the aftermath of the pandemic is likely to stimulate industrial activities, further increasing copper consumption. Moreover, geopolitical influences and trade policies pertinent to major copper-producing nations could introduce supply fluctuations, thereby affecting market trends. Collectively, these factors present substantial growth prospects for the electrolytic copper market, in line with overarching trends in technology, sustainability, and economic progress.

Restraining Factors:

The Electrolytic Copper Market faces significant challenges, notably the volatility of raw material costs and the impact of strict environmental regulations on manufacturing operations.

The Electrolytic Copper Market encounters various obstacles that may impede its expansion. A primary concern is the unpredictability of raw material prices, particularly copper ore, which directly impacts production expenses and profit margins. Additionally, the rise in environmental regulations and the emphasis on sustainable practices could lead to more stringent mining operations, resulting in increased costs and limitations on activities. Demand fluctuations from major industries, such as construction and electronics, also play a role, as these are sensitive to economic shifts. Geopolitical strains and trade conflicts can disrupt supply chains, further complicating market consistency. Moreover, the introduction of alternative materials and advancements in recycling technologies create competition by providing potentially more affordable and eco-friendly solutions. Nevertheless, technological innovations and the surging demand for electric vehicles and renewable energy systems offer avenues for growth and creativity in the electrolytic copper industry. The sector's capacity to adapt and embrace sustainable practices could foster future development, suggesting a hopeful outlook as it addresses these challenges.

Key Segments of the Electrolytic Copper Market

By Product Type

• High Purity Electrolytic Copper

• Standard Purity Electrolytic Copper

By Application

• Electrical and Electronics

• Construction

• Automotive

• Industrial Machinery

• Others

By End-User

• Residential

• Commercial

• Industrial

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America