Electric Fuse Market Analysis and Insights:

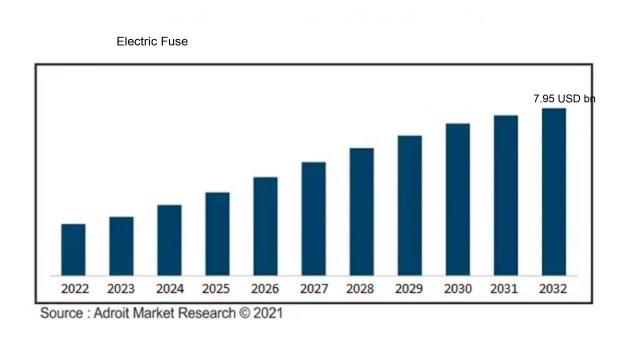

The market for Electric Fuse was estimated to be worth USD 3.92 billion in 2022, and from 2023 to 2032, it is anticipated to grow at a CAGR of 5.93%, with an expected value of USD 7.95 billion in 2032.

The market for electric fuses is largely propelled by a ened focus on electrical safety across diverse domains, such as residential, commercial, and industrial use. Moreover, innovations that improve the performance and dependability of fuses play a significant role in market growth. The surge in electric vehicle adoption and the corresponding requirement for advanced charging infrastructure present fresh avenues for manufacturers in this sector. The expansion of the market is further driven by increasing population figures and urban development, which lead to ened energy consumption and a corresponding rise in the need for protective devices. Finally, substantial investments in smart grid technologies are positively impacting the market, as these systems demand sophisticated protective solutions, including fuses, to maintain efficient and safe operations.

Electric Fuse Market Definition

An electrical fuse serves as a protective mechanism for circuits, designed to halt the current flow once it surpasses a specified threshold. It functions by melting a metallic component, such as a strip or wire, in response to the heat generated by an overcurrent condition.

Electric fuses serve a vital function within electrical systems by offering overcurrent protection, which is essential for preventing equipment damage and mitigating the risk of fire hazards. In scenarios where current levels exceed safe limits, the fuse will melt, thereby breaking the electrical circuit and protecting devices from possible injury. This straightforward yet efficient safety feature not only extends the lifespan and dependability of electrical systems but also adheres to established safety regulations. Furthermore, fuses are key to improving user safety, as they significantly reduce the likelihood of electric shocks and other dangers, establishing them as an indispensable part of both home and industrial electrical setups.

Electric Fuse Market Segmental Analysis:

Insights On Type

Cartridge and Plug Fuses

3D Printers

Among the various types of electric fuses, cartridge and plug fuses are anticipated to dominate the Global Electric Fuse Market. The increasing demand for compact and reliable protection devices in electrical panels across residential, commercial, and industrial applications drives the industry's preference towards these fuses. Their ease of installation and capability to handle overloads and short circuits efficiently make them highly favored. Additionally, technological advancements enhancing their performance and the global push for enhanced electrical safety are leading to a growing adoption of cartridge and plug fuses in critical applications, solidifying their top position in the market.

Power Fuse and Fuse Links

Power fuses and fuse links are vital components for safeguarding electrical systems from overloads and short circuits, especially in high-voltage applications. Their robust construction and reliability are essential in power distribution networks, contributing significantly to operational safety and efficiency. Despite their importance, they face stiff competition from cartridge and plug fuses, which are more versatile and straightforward to integrate into modern electrical systems.

Distribution Cutouts

Distribution cutouts hold a critical role in protecting overhead distribution systems. These devices ensure safety by disconnecting the circuit during faults, thus preventing equipment damage. However, their market share faces challenges from more compact, efficient fuse options that are easier to install in diverse applications. While essential, the demand for distribution cutouts might decline in favor of more innovative solutions, limiting their market dominance.

Others (Capacitor Fuses, Dropout Fuse, Battery Fuses, and Fuse Pullers)

The "Others" category plays a niche role in the electric fuse market. Each of these fuses serves specific applications, such as renewable energy systems or battery management in electric vehicles. However, their market presence remains smaller compared to the more widely adopted types. As industries evolve, this category may experience marginal growth but is unlikely to rival the more dominant types in terms of overall market share.

Insights On Voltage

Low Voltage

Low voltage electric fuses are projected to dominate the Global Electric Fuse Market due to their widespread application across residential and commercial settings. They play a critical role in the safety and functionality of various electrical appliances and systems, including lighting, heating, and consumer electronics. The rising global demand for energy-efficient and safer electrical installations is driving the market for low voltage fuses. Additionally, regulations focusing on electrical safety and standards are further boosting the adoption of low voltage fuses. The versatility of these fuses in different configurations makes them the preferred choice among consumers, contributing to their market leadership.

Medium Voltage

Medium voltage fuses occupy a significant niche within the electric fuse market, primarily catering to industrial and utility applications. Their usage is prevalent in substations, capacitor banks, and various medium voltage distribution systems where equipment requires protection against overloads and short circuits. The growing investments in infrastructure development and the expansion of renewable energy projects are expected to propel the medium voltage.

High Voltage

High voltage fuses represent a crucial part of the electric fuse market and are specifically designed for high energy applications, including transmission and distribution substations. They are utilized where the risk of short circuits is substantial and where protection of transformers and other large equipment is vital. The market for high voltage fuses is influenced by the expansion of high voltage power systems globally, as industries transition to smarter grids and pursue technologies that enhance power distribution efficiencies. However, their adoption is limited compared to lower voltage types, primarily due to the specialized applications they serve and the advanced safety standards required for their installation.

Insights On End Use

Utilities

Utilities are expected to dominate the Global Electric Fuse Market. This sector covers a significant portion of global electric infrastructure, handling the transmission and distribution of electrical power. With the ongoing expansion and modernization of utility networks, particularly in developing regions and the push towards renewable energy sources, the demand for robust and reliable fuse solutions is rising. Moreover, the necessity for increased safety standards and protection mechanisms to prevent equipment failures and outages makes utilities a crucial factor contributing to market growth.

Residential

The residential sector plays a vital role in the electric fuse market as households increasingly depend on electrical appliances and systems. With a growing emphasis on home automation and energy efficiency, the demand for high-quality fuses that can safeguard domestic electrical circuits is surging. Aging infrastructure in older homes also necessitates the replacement of outdated fuse systems to enhance safety and reliability. The increase in smart home devices and electric vehicles further drives the need for upgraded electrical setups, thus adding to the demand for fuses tailored for residential applications.

Commercial

In the commercial space, there is a constant need for dependable electrical systems to support various businesses, ranging from retail to office buildings. The growing trend towards energy efficiency and sustainable business practices leads to a higher demand for advanced electrical protection solutions, including fuses. As commercial establishments increase their reliance on technology and digital infrastructure, the necessity for robust electrical components that can ensure operational continuity and safety is crucial. Regulatory standards for workplace safety also contribute to the continuous procurement of high-quality fuses in commercial settings.

Industrial

The industrial significantly influences the electric fuse market due to its reliance on large machinery and complex electrical systems. Industries such as manufacturing, pharmaceuticals, and food processing require robust electrical infrastructure to maintain productivity. Increased automation and the adoption of Industry 4.0 practices are pushing for advanced electrical systems that can withstand higher loads and provide effective protection against failures. The escalating regulatory requirements regarding safety and equipment maintenance further amplify the demand for durable fuses in industrial facilities, ensuring operations run smoothly while minimizing downtime.

Transportation

In the transportation sector, electric fuses are essential for ensuring the safety and efficiency of various transportation modes, including railways, electric vehicles, and mass transit systems. The rise of electric and hybrid vehicles has created significant demand for reliable electric solutions that can handle fluctuating power demands and improve overall safety. Additionally, transportation systems undergoing modernization to adopt smart technologies require advanced electrical components to manage power distribution efficiently. Regulatory standards for safety and reliability in public transportation set stringent requirements for fuses, driving innovation and increased investment in this area, thereby impacting the market positively.

Global Electric Fuse Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Electric Fuse market due to various factors driving its growth. With rapid industrialization, urbanization, and the expansion of the manufacturing sector in countries like China, India, and Japan, there is increasing demand for electric fuses. Furthermore, the region's rising investments in renewable energy and the electrification of rural areas significantly contribute to the market's growth. The proliferation of electric vehicles (EVs) also enhances demand for electric components, including fuses. Additionally, supportive government policies and initiatives focused on enhancing electrical safety standards further bolster market expansion in this region.

North America

North America, particularly the United States, is a significant player in the Global Electric Fuse market, characterized by advanced technological infrastructure and stringent regulations pertaining to electrical safety. The market is driven by the increasing use of electric fuses in various applications, such as residential, commercial, and industrial sectors. The growing emphasis on upgrading aging electrical grids and the adoption of renewable energy technologies enhance the demand for electric fuses in this region. Furthermore, significant investments in smart grid technology are paving the way for improved efficiency and safety, thus positioning North America as a vital contributor to the electric fuse market.

Europe

Europe is a vital region in the Global Electric Fuse market, driven by stringent regulations and standards that focus on electrical safety and energy efficiency. The advancing automotive sector, particularly in countries like Germany and France, creates substantial demand for electric fuses in electric vehicles and hybrid technology. Furthermore, ongoing investments in renewable energy solutions and the modernization of electrical infrastructures within European nations foster the growth of the electric fuse market. The push towards sustainable solutions and rigorous compliance with safety standards play a crucial role in the region's market dynamics, making Europe a significant participant in the global landscape.

Latin America

Latin America's electric fuse market is witnessing gradual growth due to expanding urbanization and increasing investments in infrastructure development. Countries such as Brazil and Mexico are focusing on enhancing electrical systems and safety standards. The rising demand for reliable electrical systems in residential and industrial applications drives the need for electric fuses.

Middle East & Africa

The Middle East & Africa region demonstrates potential in the Global Electric Fuse market, primarily attributed to ongoing infrastructural developments and a growing emphasis on energy efficiency and safety. The rise in construction projects, particularly in the Gulf Cooperation Council (GCC) countries, promotes demand for electric fuses in residential and commercial applications. Moreover, the push towards renewable energy and electricity access expansion in various African nations creates a conducive environment for market growth. However, political instability and economic challenges may hinder rapid development, thus necessitating tailored strategies to harness the opportunities present in this diverse region.

Electric Fuse Competitive Landscape:

In the Global Electric Fuse market, essential participants including manufacturers and suppliers spearhead advancements and improve production efficiency. Their cooperative efforts foster innovation in product development, addressing the changing needs of consumers and complying with regulatory requirements.

The electric fuse market is significantly shaped by major corporations such as Siemens AG, Eaton Corporation, General Electric Company, Schneider Electric SE, Littelfuse Inc., Mersen S.A., ABB Ltd., Bel Fuse Inc., Panasonic Corporation, and Schurter AG. Furthermore, other important contributors include Ferraz Shawmut LLC, NHP Electrical Engineering Products Pty Ltd, Siba GmbH, TE Connectivity Ltd., and Tokyo Electric Power Company Holdings, Inc. Additionally, noteworthy firms like Honeywell International Inc., Molex LLC, and CBI Electric Pty Ltd play an influential role in the market through their advanced products and technological innovations.

Global Electric Fuse COVID-19 Impact and Market Status:

The Covid-19 pandemic profoundly affected the Global Electric Fuse market, resulting in supply chain disruptions and a decrease in demand from multiple end-user sectors, which caused a short-term drop in both production and sales.

The COVID-19 crisis had a profound effect on the electric fuse industry, resulting in supply chain disruptions and a temporary cessation of manufacturing due to lockdown measures and health guidelines. At first, there was a decline in construction activities and diminished demand from vital sectors such as automotive and consumer electronics, which negatively influenced sales. On the other hand, the pandemic spurred a shift towards renewable energy sources and ened the importance of electrical safety, leading to a resurgence in the demand for electric fuses, particularly in renewable energy projects and infrastructure enhancements. Additionally, the growth of remote work and home renovation initiatives led to an increase in residential electrical installations, further driving market expansion. As economic recovery began, the electric fuse market was poised for a rebound, propelled by pent-up consumer demand, ened investment in electrical infrastructure, and an increasing focus on safety compliance. This juxtaposition of initial decline followed by recovery encapsulates the intricate challenges encountered by the electric fuse sector during the pandemic.

Latest Trends and Innovation in The Global Electric Fuse Market:

- In October 2023, Siemens announced its acquisition of Varian Medical Systems' electrical fuse division, enhancing its product portfolio for medical technologies, particularly in radiation therapy equipment.

- In September 2023, Eaton Corporation launched its new line of smart circuit protection fuses, which integrate IoT technology for real-time monitoring and analytics, aimed at improving safety and efficiency in industrial applications.

- In August 2023, Littelfuse entered into a strategic partnership with SolarEdge Technologies to develop advanced fuses specifically designed for solar energy applications, promoting enhanced safety in photovoltaic systems.

- In July 2023, Schaffner Holding AG completed its merger with Fuses Electroniques, a French electronic fuses manufacturer, significantly expanding its reach in the European market and enhancing its product offerings with advanced electronic fuse technologies.

- In May 2023, Mersen acquired the assets of the electrical protection business from General Electric, bolstering its position in the high-performance fuse market and expanding its product line for industrial applications.

- In April 2023, Schneider Electric introduced a new line of modular fuses designed for data center applications, emphasizing energy efficiency and compact design to meet the growing demand for reliable power solutions in IT environments.

- In March 2023, TE Connectivity announced a technological advancement in polymer fuses incorporating advanced materials, which allow for a lighter and more efficient design ideal for the automotive sector, particularly in hybrid and electric vehicles.

Electric Fuse Market Growth Factors:

Critical drivers influencing the expansion of the electric fuse market encompass a ened need for electrical safety, technological innovations, and a growing integration of renewable energy solutions.

A key contributor is the elevated demand for safety devices in electrical configurations, prompted by greater awareness of potential fire risks and electrical malfunctions. Furthermore, the worldwide surge in industrial activities and urban growth has resulted in increased electricity usage, necessitating dependable protective devices such as fuses.

The growth of renewable energy technologies, specifically solar and wind, highlights the importance of effective electrical management, which further fuels the demand for fuses. Innovations in technology, including smart fuses integrated with advanced digital monitoring systems, play a significant role in fostering market growth by improving both efficiency and reliability.

Moreover, stringent governmental regulations related to electrical safety compel industries to update their systems with more modern fusing technologies. The automotive industry's shift towards electric vehicles (EVs) also serves as a powerful driver, as these vehicles demand advanced fusing solutions to manage their electrical frameworks effectively.

In addition, the increasing preference for energy-efficient solutions and the transition to sustainable electric systems are likely to stimulate the demand for enhanced fuses, positioning them as critical components in both residential and commercial sectors. Together, these elements suggest a strong and promising future for the Electric Fuse Market in the years ahead.

Electric Fuse Market Restaining Factors:

The electric fuse market faces significant challenges due to the growing preference for alternative protective technologies and ened competition posed by circuit breakers.

A primary obstacle is the rising utilization of alternative solutions, such as circuit breakers and intelligent fuses, which provide enhanced functionality and greater dependability. Additionally, fluctuations in the prices of essential raw materials, especially metals like copper and aluminum, can influence manufacturing expenses, resulting in price instability within the sector. Rigorous regulatory requirements related to safety and environmental standards also present hurdles, compelling manufacturers to allocate resources for compliance, which can escalate operational costs. Moreover, the increasing shift toward renewable energy necessitates the development of innovative fuse designs that may not correspond with current offerings, thereby creating discrepancies in market expectations. Supply chain interruptions, often intensified by global incidents or geopolitical conflicts, can further complicate the timely procurement of components, affecting the overall market's reliability. Nevertheless, the continuing emphasis on energy efficiency and the global expansion of electrical infrastructure present substantial prospects for innovation and growth in the electric fuse sector, indicating a potential for adaptation and strategic advancements to navigate these challenges.

Key Segments of the Electric Fuse Market

By Type

• Power fuse and fuse links

• Distribution cutouts

• Cartridge and plug fuses

• Others (Capacitor fuses, dropout fuse, battery fuses, and fuse pullers)

By Voltage

• Low

• Medium

• High

By End Use

• Residential

• Commercial

• Industrial

• Utilities

• Transportation

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America