Market Analysis and Insights:

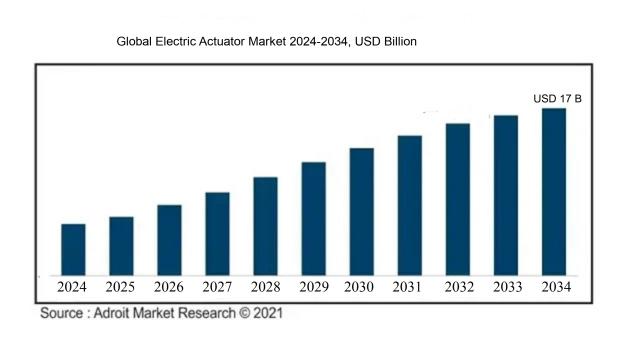

The market for Electric Actuators was estimated to be worth USD 9 billion in 2024, and from 2024 to 2034, it is anticipated to grow at a CAGR of 6.5%, with an expected value of USD 17 billion in 2034.

The market for electric actuators is significantly influenced by several pivotal elements. Notably, demand for automation is increasing across a variety of industries, including manufacturing, oil and gas, and aerospace. Furthermore, the increasing focus on energy efficiency and environmental sustainability stimulates market growth, given that electric actuators typically outperform pneumatic and hydraulic systems in efficiency. Innovations in technology, particularly with the incorporation of the Internet of Things (IoT), have augmented the capabilities of electric actuators, enhancing their functionality and user-friendliness. In addition, stringent regulations that advocate for the integration of electric and hybrid systems within transportation and utility sectors support market progression. Furthermore, substantial investments in infrastructure development and smart city projects act as significant drivers, necessitating dependable actuation solutions for a range of applications. Together, these dynamics create a favorable landscape for the global proliferation of the electric actuator market.

Electric Actuator Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2034 |

| Study Period | 2023-2034 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2034 | USD 17 billion |

| Growth Rate | CAGR of 6.5% during 2024-2034 |

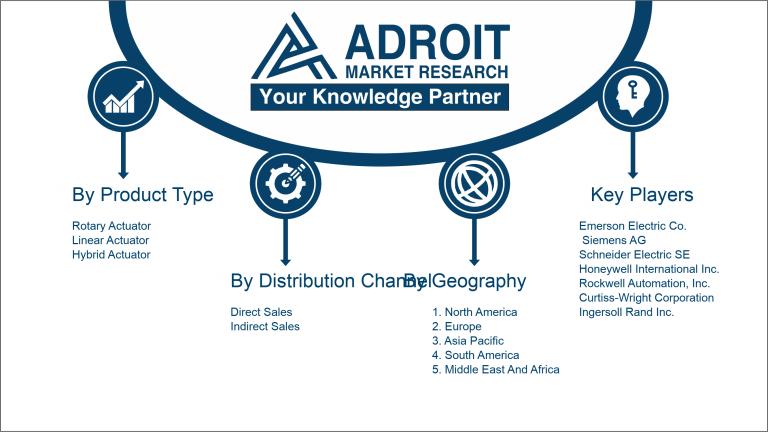

| Segment Covered | By Product Type, By End-use Industry, By Distribution Channel, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Emerson Electric Co., Siemens AG, Schneider Electric SE, Honeywell International Inc., and Rockwell Automation, Inc., Curtiss-Wright Corporation, Ingersoll Rand Inc., Parker Hannifin Corporation, Christian Bürkert GmbH & Co. KG, SMC Corporation, Linak A/S, Moog Inc., Rotork plc, and ABB Ltd. Furthermore, companies such as BINARY Electric Company, Auma Riester GmbH & Co. KG, Halma plc, and ASCO Valve, Inc. |

Market Definition

An electric actuator is a mechanism that transforms electrical energy into mechanical movement, enabling functionalities such as the opening, closing, or adjustment of various equipment. This device is frequently utilized in automation and control systems to facilitate accurate motion and operational tasks.

Electric actuators are integral to contemporary automation frameworks, functioning by transforming electrical energy into precise mechanical motion. This capability allows for meticulous control of numerous processes, significantly boosting efficiency while minimizing the need for manual intervention. Their value is further underscored by attributes such as precise positioning and rapid operation, which collectively enhance productivity. Moreover, electric actuators are characterized by their low maintenance needs, energy efficiency, and compatibility with sophisticated control mechanisms. These qualities render them particularly suitable for a wide range of sectors, including manufacturing, robotics, and HVAC systems, thereby fostering greater operational efficacy and reliability within automated environments.

Key Market Segmentation:

Insights On Key Product Type

Linear Actuator

Linear actuators are expected to dominate the Global Electric Actuator Market due to their versatile applications across various industries, particularly in automation and telecommunications. Their ability to provide precise control over linear motion makes them highly sought after in sectors such as automotive, aerospace, and manufacturing. As industries push for increased efficiency and precision, the demand for linear actuators is growing rapidly. Additionally, advances in technology are enhancing the performance and reliability of linear actuators, further contributing to their dominance in the market. The trend towards automation and industrial control systems also solidifies their leading position.

Rotary Actuator

Rotary actuators, while experiencing strong demand, are not leading the market like linear actuators. They are widely used in applications that require rotational motion, such as robotics and machinery automation. Their ability to perform complex movements and their integration into advanced robotics and automated systems make them essential in many industrial settings. However, the continuous preference for linear motion products, especially in automation, has slightly overshadowed the growth of rotary actuators compared to their linear counterparts.

Hybrid Actuator

Hybrid actuators combine the benefits of both rotary and linear actuators, but they are still carving out their niche in the market. They are particularly favored in environments where flexibility and adaptability are crucial, as they can offer more than one type of motion. Industries such as robotics and specialized machinery use hybrid actuators for their versatile functionality. However, the market still leans more toward linear and rotary actuators, which are more common and better understood in many manufacturing contexts. The growth potential is significant, but it lags behind the more established actuator types.

Insights On Key End-use Industry

Energy

The Energy sector is expected to dominate the Global Electric Actuator Market due to its increasing reliance on automation and precision control for various applications, including renewable energy systems, electricity grids, and power generation. The transition towards sustainable energy solutions requires devices that can provide reliable and efficient operation, allowing for improved control of energy consumption and management. As industries focus on reducing carbon emissions and optimizing energy production, electric actuators play a crucial role in enabling automated processes, thus driving demand in this industry. The rising investment in smart grids and renewable energy projects further supports the anticipated growth in this area.

Oil & Gas

The Oil & Gas industry utilizes electric actuators to enhance operational efficiency and safety in exploration and production processes. These devices are essential for remotely operating valves and control systems, reducing the need for manual interventions in hazardous environments. With increasing automation and smart technologies being adopted in this sector to minimize costs and improve extraction processes, the demand for electric actuators is expected to remain robust.

Aerospace & Defence

In the Aerospace & Defence sector, electric actuators are critical for controlling flight systems, landing gear, and other essential components. The emphasis on advanced technologies, such as fly-by-wire systems, has increased the need for precise and reliable actuator solutions. Furthermore, the growing trend of lightweight and compact designs ongoing in this industry is driving innovations, which in turn continues to propel utilization in various applications, making it a significant market player.

Automotive

Electric actuators are increasingly being used in automobiles to improve automation and fuel efficiency. They are used in applications such as throttle control, braking systems, and adjustable seating to provide precision and reliability. With the surge in electric vehicles and the push for autonomous driving technology, the need for enhanced actuator functionalities is expected to rise, reflecting a growing trend towards electric actuation in the automotive landscape.

Food & Beverages

The Food & Beverages industry employs electric actuators for automating processes such as bottling, packaging, and processing. The demand for efficiency and minimized human error in the food production line drives the need for more automated equipment. With strict regulations concerning hygiene and quality, electric actuators ensure consistent performance, thereby boosting operational efficiency and making them an essential component within this industry.

Agriculture

In the Agriculture sector, electric actuators are utilized for precision farming applications, enabling automated irrigation, seed planting, and crop monitoring. As the demand for increased productivity and optimal resource use grows, the need for automation in agricultural practices is enhancing the role of electric actuators. Technologies such as smart tractors and drones further highlight this trend, ensuring their relevance in modern agricultural operations.

Others

The 'Others' category includes a range of industries, such as manufacturing, pharmaceuticals, and HVAC systems, that use electric actuators. Every one of these industries understands how automation can improve operational accuracy and efficiency. While not as prominent as the leading industries, the growing trend towards mechanization and automation across diverse applications is fostering an increased demand for electric actuators, albeit at a smaller scale compared to the major sectors mentioned.

Insights On Key Distribution Channel

Direct Sales

Direct sales are anticipated to dominate the Global Electric Actuator Market. This channel allows manufacturers to connect directly with their customers, providing a more personalized experience, better understanding of customer needs, and the ability to offer tailored solutions. As industries globally are increasingly focusing on efficiency and custom solutions, the direct sales approach becomes appealing. Additionally, it grants manufacturers better control over branding, pricing, and communication with clients, thereby fostering stronger business relationships. The growing emphasis on automation and smart technologies further boosts the appeal of direct sales, as manufacturers can directly influence and educate end-users about the benefits of electric actuators tailored to their specific requirements.

Indirect Sales

Indirect sales encompass various intermediaries like distributors, agents, and retailers that facilitate products' reach to the end market. This channel can be beneficial for manufacturers who wish to tap into established networks and leverage the expertise of intermediaries in reaching diverse customer s. However, indirect sales may sometimes lead to reduced control over brand messaging and customer experience, as these entities act as middlemen. While there is potential for broad distribution, it can also lead to dilution of the technical knowledge regarding electric actuators compared to direct engagement with manufacturers.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is poised to dominate the Global Electric Actuator market due to rapid industrialization, significant investments in automation, and increasing demand from various sectors such as manufacturing, automotive, and oil & gas. With a strong emphasis on infrastructure development and enhanced manufacturing capabilities, nations like China and India are driving this growth. Additionally, the region's increasing focus on sustainable technologies and energy efficiency encourages the use of electric actuators. With advancements in technology, competitive pricing, and a robust supply chain, Asia Pacific is expected to maintain its leadership position in the electric actuator market for the foreseeable future.

North America

North America is expected to remain a significant player in the Global Electric Actuator market, benefitting from its advanced manufacturing sector and cutting-edge technological innovations. The region’s stringent regulations for energy efficiency and automation are driving industries to adopt electric actuators in various applications, including aerospace, automotive, and building automation. Furthermore, the presence of key players and continuous investments in R&D contribute to the region's competitive advantage in the electric actuator market.

Latin America

Latin America is gradually expanding its footprint in the Global Electric Actuator market, although it currently lags behind other regions. Growth is primarily driven by increasing urbanization, which necessitates improved infrastructure and automation within industries. Investment in renewable energy projects is also creating opportunities for electric actuator applications, particularly in wind and solar power systems. However, political and economic challenges could hinder faster growth in the region compared to its counterparts.

Europe

With a focus on sustainability and energy efficiency, Europe continues to be a crucial region in the global electric actuator market. Leading nations like Germany, France, and the UK are implementing electric actuators for a range of uses, especially in the manufacturing and renewable energy industries. However, the region faces competitiveness from Asia Pacific, which may affect its market share in the long run. Nevertheless, consistent investments in automation technologies and green initiatives provide growth opportunities for electric actuators in Europe.

Middle East & Africa

The Middle East & Africa region is showcasing potential in the Global Electric Actuator market, driven mainly by increasing oil and gas exploration activities, along with growing infrastructure projects. However, the market is currently limited by economic fluctuations and a reliance on traditional systems. Investment in renewable energy is gaining traction, which may improve opportunities for electric actuator applications over time. Overall, while the region has potential, it still trails behind other regions in terms of market share and growth dynamics.

Company Profiles:

Prominent figures in the global Electric Actuator market, including producers and vendors, propel innovation and competitive tactics, improve product lines, and broaden market presence via strategic alliances and technological progress. Their efforts have a profound impact on market expansion and customer contentment across diverse sectors.

The Electric Actuator Market features several prominent participants, including Emerson Electric Co., Siemens AG, Schneider Electric SE, Honeywell International Inc., and Rockwell Automation, Inc., Curtiss-Wright Corporation, Ingersoll Rand Inc., Parker Hannifin Corporation, Christian Bürkert GmbH & Co. KG, SMC Corporation, Linak A/S, Moog Inc., Rotork plc, and ABB Ltd. Furthermore, companies such as BINARY Electric Company, Auma Riester GmbH & Co. KG, Halma plc, and ASCO Valve, Inc. also have a significant impact on this industry, driving progress and technological advancements in electric actuator solutions.

COVID-19 Impact and Market Status:

The Global Electric Actuator market experienced substantial upheaval due to the Covid-19 pandemic, resulting in supply chain disruptions, decreased production levels, and shifting demand patterns in multiple industries.

The electric actuator market has felt the profound effects of the COVID-19 pandemic, leading to both obstacles and prospects. At the onset, supply chain interruptions and enforced lockdowns caused significant production delays and shortages of essential components for actuator systems. Key sectors such as automotive, aerospace, and manufacturing faced a downturn in demand as operations were suspended, which consequently hindered market expansion. However, a ened emphasis on automation and remote operations—instigated by the need for social distancing—has sparked growing demand for electric actuators in critical fields such as healthcare and energy. As industries begin to recover and adapt to revised operational standards, a resurgence in the demand for advanced actuator technologies is expected. Looking ahead, the market is likely to shift towards more intelligent and energy-efficient actuator systems, propelled by ongoing automation trends and an evolving industrial environment. Thus, while the immediate effects of the pandemic were challenging, the future may unveil new avenues for growth.

Latest Trends and Innovation:

-In March 2023, Emerson Electric Co. announced the acquisition of the intelligent actuator company, iAutomation, to enhance its capabilities in automation and control systems, strengthening its position in the electric actuator market.

-In February 2023, Siemens AG introduced its new Simatic ET 200SP open controller featuring innovative electric actuators designed for high-precision applications in manufacturing, enabling seamless integration with Siemens’ automation software.

-In April 2023, Parker Hannifin Corporation launched their new series of electric actuators, the P Series, designed for demanding applications in automotive and robotics, emphasizing energy efficiency and reduced maintenance needs.

-In January 2023, SMC Corporation expanded its electric actuator product line by incorporating new models with advanced communication protocols, allowing for better integration into Industry 4.0 environments.

-In June 2023, Schneider Electric partnered with a leading robotics firm to co-develop electric actuators designed specifically for automated packaging systems, enhancing their offering in the industrial automation sector.

-In September 2023, ABB Ltd. unveiled a new range of compact electric actuators aimed at optimizing water treatment processes, showcasing increased reliability and energy efficiency.

-In August 2023, Mitsubishi Electric launched an upgraded series of linear electric actuators featuring improved speed and load capacity, aimed at enhancing the performance in automation applications across various industries.

-In July 2023, Honeywell International Inc. announced that it had successfully integrated its new electric actuators into its existing building management systems, aiming to improve energy efficiency in commercial buildings.

-In May 2023, Bosch Rexroth Corporation expanded its presence in the electric actuator market by launching a new series of proportional electric actuators for the mobile machinery sector, focusing on sustainable solutions and improved performance.

Significant Growth Factors:

The market for electric actuators is expanding due to innovations in automation technologies, a rising need for energy-efficient alternatives, and an increasing range of applications in sectors like automotive, aerospace, and manufacturing.

A number of important factors are contributing to the electric actuator market's notable expansion. The growing need for automation across a range of industries, including manufacturing, automotive, and aerospace, where electric actuators are prized for their precision and operational effectiveness, is one major contributing factor. Furthermore, an increasing focus on energy conservation and sustainable practices is leading industries to transition from traditional pneumatic and hydraulic actuators to electric versions, which are more energy-efficient and generate lower emissions. Advancements in technology, particularly the incorporation of smart features and the Internet of Things (IoT), are improving the control and monitoring of these devices, making them more attractive to users.

Moreover, the surge in environmentally friendly building practices and stringent environmental regulations is ening the need for electric actuators, as they align well with eco-conscious operations. The expanding range of applications in fields such as healthcare, robotics, and renewable energy is also propelling market expansion. Additionally, the persistence of industrialization in developing countries and the movement toward upgrading existing systems with modern electric actuators are expected to create further opportunities for growth. Collectively, these aspects paint a promising picture for the electric actuator market, heavily influenced by innovation, efficiency, and sustainable development.

Restraining Factors:

The electric actuator market faces significant challenges due to the substantial upfront investment required and the restricted power output when compared to conventional pneumatic and hydraulic systems.

The electric actuator sector encounters various challenges that may influence its development. The substantial upfront costs linked to electric actuator systems can discourage smaller enterprises from embracing this technology, as they might struggle to validate the investment when compared to established pneumatic or hydraulic alternatives. Moreover, a lack of awareness and familiarity with electric actuators among end-users can lead to slower rates of adoption, especially in industries that typically rely on traditional actuation techniques. Adherence to strict regulations and safety standards can also complicate the market environment, necessitating additional financial and logistical efforts from manufacturers to comply. Additionally, the presence of competing actuation technologies might restrict market growth, particularly in areas where performance or cost remains a crucial factor. The reliance on a consistent supply chain for essential electronic and manufacturing components can further impede production and availability. Nevertheless, as industries put more emphasis on energy efficiency and automation, the future landscape for the electric actuator market appears promising. Ongoing innovations and an increasing focus on sustainable solutions are expected to foster greater market acceptance and expansion.

Key Segments of the Electric Actuator Market

By Product Type

• Rotary Actuator

• Linear Actuator

• Hybrid Actuator

By End-use Industry

• Oil & Gas

• Agriculture

• Food & Beverages

• Aerospace & Defence

• Automotive

• Energy

• Others

By Distribution Channel

• Direct Sales

• Indirect Sales

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America