The global eGRC market worth USD 134.8 billion by 2028, growing at a CAGR of 14.0 %

.jpg

)

The market size for global eGRC is anticipated to reach USD 89.48 billion by 2028. The growth of the integration of Artificial Intelligence and Blockchain Technologies has provided an opportunity to eGRC vendors for growth through Government Risk Compliance Solutions. Growing big data security breaches have led to stringent compliance mandates which have led to the growth of the market.

The demand for eGRC is likely to surge on account of growing demand from organizations across various verticals as well as a government organization. It has helped in decision making during application development and is essential for any organization. It has offered great opportunities in Telecom and IT vertical concerning the eGRC market. The increasing demand for smart government regulations and difficult compliance has led to the demand of the eGRC market.

eGRC Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | USD 134.8 billion |

| Growth Rate | CAGR of 14.0% during 2018-2028 |

| Segment Covered | Types, Deployment, Organization, Business Function, Vertical Segment, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | IBM Corporation, Microsoft Corporation, SAP SE, SAS Institute Inc., Oracle Corporation, and Thomson Reuter |

Segment Overview of eGRC Market

Types Overview, (USD Billion)

- Solutions

- Services

Deployment Mode Overview, (USD Billion)

- On-Premises

- On Cloud

Organization Size Overview, (USD Billion)

- SMEs

- Large Enterprises

Business Function Overview, (USD Billion)

- Finance

- Information Technology

- Legal

- Operations

Vertical Segment Overview, (USD Billion)

- Telecom and IT Vertical

- BFSI

- Construction and Engineering

- Energy & Utilities

- Government

- Healthcare

- Manufacturing

- Mining and Natural Resources

- Retail and Consumer Goods

- Transportation & Logistics

- Other Verticals

Regional Overview, (USD Billion)

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Mexico

- Rest of South America

- Middle East And Africa

- Middle East

- Africa

Reasons for the study

- The purpose of the study is to give an exhaustive outlook of the global workplace market.

- Ensure you remain competitive as innovations by existing key players to boost the market.

What does the report include?

- The study on the global eGRC Market includes qualitative factors such as drivers, restraints, and opportunities

- The study covers the competitive landscape of existing/prospective players in the eGRC Market and their strategic initiatives for the product development

- The study covers a qualitative and quantitative analysis of the market segmented based on Types, organization size, and vertical. Moreover, the study provides similar information for the key geographies.

- Actual market sizes and forecasts have been provided for all the above-mentioned segments.

Who should buy this report?

- This study is suitable for industry participants and stakeholders in the global eGRC Market. The report will benefit:

- Every stakeholder is involved in the eGRC Market.

- Managers within the Tech companies looking to publish recent and forecasted statistics about the global eGRC Market.

- Government organizations, regulatory authorities, policymakers, and organizations looking for investments in trends of global eGRC Market.

- Analysts, researchers, educators, strategy managers, and academic institutions looking for insights into the market to determine future strategies.

Frequently Asked Questions (FAQ) :

eGRC is an evolving and it is gaining pace as it offers a lot of benefits to employees and organizations with the evolving digital technology. The eGRC structure offers some benefits such as improved security and improved decision making. eGRC services are further categorized into Software and Services. Enterprise eGRC has the highest market share in 2018 and is expected to dominate the forecast period.

Types Segment

The market of the eGRC market is growing in cloud-based application delivery controllers. With good expertise and knowledge of the solution and software providers cater to specific challenges of the end-users and help in reducing risk and complexity. The Solution segment led the eGRC market

Organization Size Segment

The execution of eGRCis expected to result in reduced costs and improved business efficiency for Large Enterprises. The large enterprise segment is expected to be the fastest-growing segment in the eGRC market. Improved consistency, better scalability, user friendly, seamless integration, increased agility, are the key factors that are expected to encourage SMEs to adopt eGRC at a rapid pace. The segment has a huge potential to flourish in the eGRC market in the coming years

Vertical Segment

Based on the vertical, the market is segmented Telecommunication and IT- Enabled Services, Banking, Financial Services, and Insurance, Media and Entertainment, Retail and Consumer Goods, Manufacturing, Healthcare and Pharmaceuticals, Government and Public Sector, Others), The market for manufacturing segment is anticipated to possess a significant market share in 2018 since there is a growing trend of the eGRC adoption by telecom companies and service providers to analyze, manage, and optimize the complete digital infrastructure.

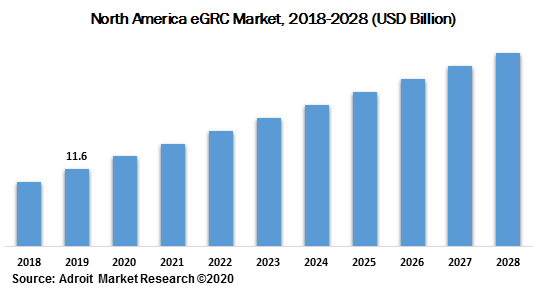

The global eGRC Market is a wide range to North America, Europe, APAC, South America, and the Middle East & Africa. North America will have the largest market size in the forecast period. Countries such as the US and Canada have the highest market share for the market in APAC. Rising internet traffic, virtualization, and using infrastructure-as-a-service solutions are major drivers for the market in North America. China, Japan, and India. They have the potential for the global application delivery controller vendors because of the availability of significant proportion of end-user verticals and widening services to these various regions, a drastic increase in the adoption rate of virtualization environment-based applications, and absence of intense competition for market entrants

The major players of the Digital Workplace Market are IBM Corporation, Microsoft Corporation, SAP SE, SAS Institute Inc., Oracle Corporation, and Thomson Reuter, and more. The eGRC market is fragmented with the existence of well-known global and domestic players across the globe.