Market Analysis and Insights:

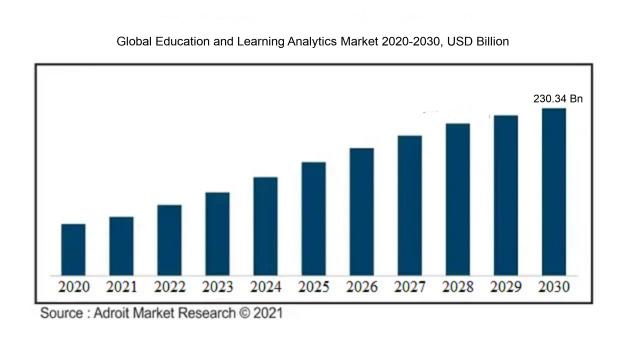

The market for Global Education and Learning Analytics was estimated to be worth USD 45.62 billion in 2022, and from 2022 to 2030, it is anticipated to grow at a CAGR of 21.78%, with an expected value of USD 230.34 billion in 2030.

The education sector is witnessing a significant surge in the application of learning analytics, propelled by various factors. An escalating utilization of digital learning platforms and e-learning solutions is a prominent driver behind the market's expansion. These platforms generate substantial data sets, which can be scrutinized to extract meaningful insights into students' learning behaviors, inclinations, and academic performance. Moreover, there is a growing trend towards personalized learning, leading to an increased demand for learning analytic tools capable of examining individual student information and offering customized recommendations for progress. Additionally, the integration of cutting-edge technologies like artificial intelligence (AI) and machine learning (ML) in the field of education is further propelling the market's growth trajectory. These technological advancements facilitate the creation of sophisticated analytical systems that can autonomously process extensive educational data and furnish actionable insights for educators and institutions. Lastly, the augmenting emphasis on student achievements and the imperative to enhance educational productivity and efficacy are also contributing to the adoption of learning analytics solutions.

Education and Learning Analytics Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 230.34 billion |

| Growth Rate | CAGR of 21.78% during 2022-2030 |

| Segment Covered | By Application, By Components, By Components, By End users, By Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Thermo Fisher Scientific Inc., Agilent Technologies Inc., Danaher Corporation, Shimadzu Corporation, PerkinElmer Inc., Horiba Ltd., Bruker Corporation, MilliporeSigma (Merck KGaA), Bio-Rad Laboratories Inc., and IDEXX Laboratories Inc. |

Market Definition

Education involves the acquisition of knowledge, skills, attitudes, and values through both formal and informal means. On the other hand, learning analytics focuses on collecting, examining, and understanding data to extract insights into the educational process and improve educational results.

In the modern era, the significance of education and learning analytics cannot be overstated, as it offers valuable insights into the efficacy of educational strategies and contributes to better student outcomes. Through the analysis of educational data encompassing student performance, engagement levels, and learning advancement, educators are able to discern patterns, trends, and areas for enhancement. Adopting this data-centric approach enables educators to craft curriculum, personalize instruction, and evaluate student requirements based on informed decision-making. Moreover, the application of learning analytics supports timely intervention for students encountering difficulties, encourages adaptive learning environments, and provides a means for institutions to gauge the impact of their educational initiatives. Ultimately, education and learning analytics empower educators and educational institutions to refine teaching methodologies, enhance student learning experiences, and nurture student achievement.

Key Market Segmentation:

Insights On Key Applications

People Acquisition and Retention

People Acquisition and Retention is expected to dominate the Global Education and Learning Analytics Market. With the rising demand for skilled and qualified professionals in various industries, companies and educational institutions are focusing on enhancing their recruitment and retention processes. Education and Learning Analytics provide valuable insights into the performance and engagement of students, helping institutions identify the most efficient methods for acquiring and retaining talent. By analyzing data on student demographics, learning outcomes, and engagement levels, institutions can tailor their recruitment strategies and resources towards the most effective channels and approaches. This part is crucial for ensuring the success and growth of educational institutions and organizations in the competitive market.

Curriculum Development and Intervention Management

Curriculum Development and Intervention Management is another important part of the Global Education and Learning Analytics Market. Analyzing data on student performance and learning outcomes enables educational institutions to identify areas of improvement in curriculum design and delivery. By gaining insights into the effectiveness of different teaching methods and materials, institutions can enhance their curriculum and make necessary interventions to support student learning and achievement. This part plays a key role in ensuring that educational programs are aligned with the needs and expectations of students, leading to improved learning outcomes and student satisfaction.

Performance Management

Performance Management is a significant part of the Global Education and Learning Analytics Market. Educational institutions and organizations are increasingly relying on data analytics to monitor and evaluate the performance of students, teachers, and staff. By analyzing data on student attendance, grades, and engagement, institutions can identify areas of success and areas that require improvement. This part helps institutions in setting performance targets, tracking progress, and implementing intervention strategies to enhance overall performance. It enables institutions to make data-driven decisions and fosters a culture of continuous improvement and accountability.

Budget and Finance Management

Budget and Finance Management is another part with a considerable impact on the Global Education and Learning Analytics Market. Education institutions and organizations need to effectively manage their financial resources to ensure sustainable operations and growth. By utilizing data analytics, educational institutions can gain insights into their financial performance, budget allocations, and expenditure patterns. This part enables institutions to identify cost-saving opportunities, optimize resource allocation, and improve financial planning and decision-making. It empowers institutions with the ability to allocate funds strategically, maximize returns on investments, and ensure long-term financial sustainability.

Operations Management

Operations Management is an essential part of the Global Education and Learning Analytics Market. Educational institutions and organizations need to efficiently manage their operations to deliver high-quality education and learning experiences. By analyzing data on various operational aspects such as student enrollment, class scheduling, and infrastructure utilization, institutions can optimize their operations and resources. This part enables institutions to identify bottlenecks, streamline processes, and improve overall operational efficiency. It helps institutions in providing a seamless experience for students, teachers, and staff, ultimately leading to improved educational outcomes.

Others

While the above-mentioned categories are expected to dominate the Global Education and Learning Analytics Market, the Others category encompasses various parts that may have specific applications and significance within the market. These parts may include areas such as student support services, alumni engagement, educational research, and more. While their individual impact may vary, they contribute to the overall growth and development of the education sector. The diverse nature of the "Others" category highlights the broad spectrum of applications and possibilities within the Education and Learning Analytics Market, allowing institutions to tailor their analytics strategies based on their unique needs and priorities.

Insights On Key Components

Software

The software is expected to dominate the Global Education and Learning Analytics market. With the growth of technology in the education sector, there is a increasing demand for analytics solutions that can effectively interpret and analyze data to enhance teaching and learning outcomes. Educational institutions are increasingly adopting learning management systems, student information systems, and other software applications, which generate vast amounts of data. To make sense of this data and derive actionable insights, software solutions are required. These analytics software provide valuable information on student performance, engagement, and learning patterns, thus enabling educators to personalize instruction and improve student outcomes. Therefore, the software part is expected to dominate the Global Education and

Learning Analytics market.

Services

While software is expected to dominate the Global Education and Learning Analytics market, the services part also plays a crucial role in supporting the adoption and integration of these analytics solutions. Services such as consulting, implementation, training, and maintenance are essential for ensuring smooth implementation, customization, and ongoing support of the software. Education institutions often require assistance in integrating analytics solutions into their existing infrastructure, training staff on how to use the software effectively, and obtaining ongoing technical support. As a result, the services part will continue to have a significant market share in the Global Education and Learning Analytics market, although not as dominant as the software part.

Insights On Key Deployment Model

On-premises

The On-premises is expected to dominate the Global Education and Learning Analytics Market. On-premises deployment model refers to the implementation of analytics solutions within the organization's own infrastructure. This part is likely to be dominant due to the data security concerns associated with the education sector. Educational institutions often handle sensitive student data, and therefore, prefer to keep their analytics operations on-premises to maintain full control over the data and ensure its privacy. Additionally, on-premises deployment allows for easier integration with existing systems and offers greater customization options to cater to specific needs. Hence, the On-premises part is expected to dominate the market.

Cloud

While the On-premises is expected to dominate the Global Education and Learning Analytics Market, the Cloud part also holds significant potential. Cloud deployment model involves hosting analytics solutions on third-party servers and accessing them through the internet. Cloud-based analytics solutions offer several advantages, such as scalability, cost-efficiency, and accessibility from anywhere. Educational institutions looking for flexibility, cost savings, and faster implementation often opt for cloud-based solutions. With advancements in cloud technology and increasing adoption of digital learning platforms, the demand for cloud-based learning analytics solutions is expected to grow. Although the Cloud part may not dominate the market, it holds a strong position as an alternative deployment model for education and learning analytics.

Insights On Key End users

Enterprise/Corporate:

The Enterprise/Corporate is expected to dominate the Global Education and Learning Analytics market. This is because enterprises and corporations have a significant need for data-driven insights and analytics to optimize their training and professional development programs. By leveraging powerful analytics tools, they can effectively track the performance and progress of their employees, identify skill gaps, and tailor learning experiences to individual needs. Furthermore, large corporations often have the resources to invest in advanced learning analytics platforms, making them major contributors to the market's growth. The Enterprise/Corporate part is likely to lead due to the high demand from organizations seeking to enhance employee learning and maximize their return on investment in training initiatives.

Academic:

While the Enterprise/Corporate part is expected to dominate the Global Education and Learning Analytics market, the Academic part also plays a significant role. Academic institutions, including schools, colleges, and universities, are increasingly adopting learning analytics solutions to improve educational outcomes and teaching methodologies. These institutions can utilize analytics to assess student performance, identify at-risk students, personalize learning experiences, and enhance overall academic efficiency. However, the Academic part may not dominate the market to the same extent as the Enterprise/Corporate part, as the former often faces budget constraints and slower adoption rates compared to the latter.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Education and Learning Analytics market. This region is known for its advanced infrastructure, technological prowess, and high adoption of analytics solutions in various sectors. The education system in North America is also well-developed, with a strong emphasis on data-driven decision making and personalized learning. The presence of major educational institutions and leading technology companies in this region further boosts the demand for education and learning analytics solutions. Additionally, North America has a mature market for education technology, with a high level of investment in research and development. These factors create a favorable environment for the growth and dominance of the Global Education and Learning Analytics market in North America.

Latin America

Latin America, while not expected to dominate the Global Education and Learning Analytics market, still holds significant potential for growth in this sector. The region has a large population with a growing need for quality education and access to learning analytics tools. Economic growth in countries like Brazil, Mexico, and Argentina has led to increased investment in education and technology, which creates opportunities for the adoption of analytics solutions. The government initiatives promoting digital learning and the increasing penetration of internet connectivity also contribute to the market growth. However, challenges such as inadequate infrastructure and limited resources may hinder the pace of adoption and market dominance in Latin America.

Asia Pacific

Asia Pacific is another region with immense potential for the Global Education and Learning Analytics market. The region houses some of the largest emerging economies, including China and India, which have a massive student population and an increased focus on improving the quality of education. Rapid advancements in technology and infrastructure, along with favorable government initiatives, are driving the adoption of education and learning analytics solutions in the region. Additionally, the rising demand for e-learning platforms and the growing popularity of smart devices further fuel the market growth. While Asia Pacific has a promising future, it faces challenges related to language diversity, varying educational systems, and digital divide in rural areas, which may impact the dominance of this region in the global market.

Europe

Europe, though not expected to dominate the Global Education and Learning Analytics market, holds a significant share in this space. The region boasts a well-established education system and a strong focus on research and innovation. European countries prioritize data-driven decision making in education, making them potential markets for analytics solutions. Moreover, initiatives by the European Union to promote digitalization in education and the increasing adoption of e-learning platforms contribute to market growth. However, the market in Europe faces challenges related to data privacy regulations, varying educational policies across countries, and budget constraints. These factors may limit the dominance of Europe in the global market.

Middle East & Africa

The Middle East & Africa region, while not expected to dominate the Global Education and Learning Analytics market, offers growth opportunities in this sector. The region has a growing demand for quality education and an increasing adoption of technology in the education sector. Countries like the United Arab Emirates, Saudi Arabia, and South Africa are investing in enhancing their education infrastructure and implementing digital learning solutions. However, factors such as the digital divide, limited access to technology and internet connectivity, and socio-economic disparities may pose challenges to the widespread adoption of education and learning analytics solutions. These challenges may impact the dominance of the Middle East & Africa in the global market.

Company Profiles:

Prominent participants within the worldwide Education and Learning Analytics industry are instrumental in delivering sophisticated analytical solutions and valuable insights to academic establishments. Their contributions facilitate evidence-based decision-making and tailored educational journeys. This group comprises leading tech corporations like IBM, Microsoft, and Google, alongside specialized analytics entities such as Blackboard and D2L, known for their provision of effective resources and strategies aimed at enhancing educational achievements.

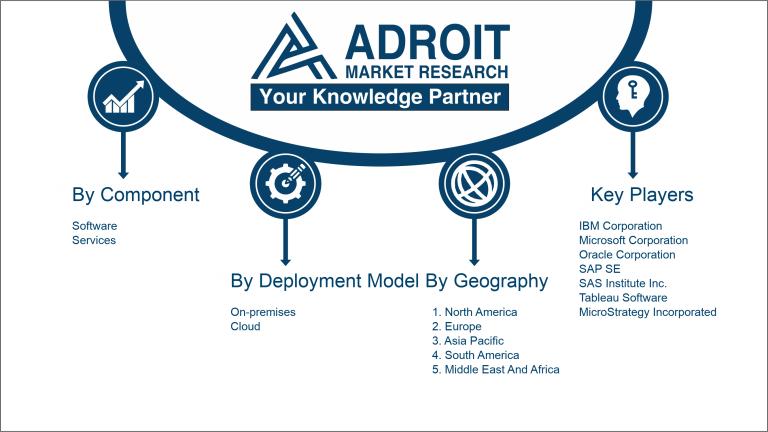

Leading participants in the field of education and learning analytics encompass renowned organizations such as IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., Tableau Software, MicroStrategy Incorporated, Alteryx Inc., D2L Corporation, and Blackboard Inc. These entities actively engage in crafting and deploying analytics innovations tailored for the educational domain to enhance student learning outcomes, streamline administrative functions, and provide data-centric insights to educational establishments. IBM Corporation and Microsoft Corporation, distinguished technology leaders, furnish cutting-edge analytics solutions tailored for educational bodies, while Oracle Corporation and SAP SE specialize in delivering robust data management and analytics ecosystems. SAS Institute Inc. stands out as a significant contender providing sophisticated analytics and machine learning resolutions, with Tableau Software and MicroStrategy Incorporated furnishing potent data visualization instruments for educational data scrutiny. Moreover, Alteryx Inc. delivers a robust data preparation and analytics platform, D2L Corporation excels in learning management systems, and Blackboard Inc. offers a diverse array of educational technology solutions.

COVID-19 Impact and Market Status:

The global education sector has experienced a rapid increase in the integration and utilization of learning analytics solutions due to the Covid-19 pandemic.

The education and learning analytics sector has experienced notable disruptions due to the global COVID-19 pandemic. The closure of traditional educational institutions and the widespread transition to remote learning have stimulated a ened demand for digital education platforms and analytic tools. As schools and universities have shifted to online platforms, there has been a remarkable uptick in the utilization of educational technology and learning analytics. Educational establishments are increasingly turning to analytics to monitor student advancement, participation, and achievements in virtual education, enabling them to customize their instructional approaches and target areas needing improvement. Consequently, a favorable market landscape has emerged for entities providing learning analytics solutions.

Moreover, the necessity to analyze and make sense of the substantial volume of data produced by virtual platforms has propelled innovation in the learning analytics sphere, leading to the advancement of sophisticated algorithms and machine learning methodologies by companies. Nonetheless, obstacles such as adapting to virtual learning environments, limited technology access, and privacy apprehensions present challenges to the widespread uptake of learning analytics. In spite of these impediments, the education and learning analytics sector is poised for significant expansion in the post-pandemic era as educational institutions prioritize data-informed decision-making and tailored learning interactions.

Latest Trends and Innovation:

- In May 2021, Blackboard, a leading education technology company, announced its acquisition by Anthology, a provider of enterprise software solutions for higher education institutions.

- In June 2021, Coursera, a leading online learning platform, went public on the New York Stock Exchange.

- In January 2022, Instructure, the company behind the popular learning management system Canvas, announced a partnership with Microsoft to integrate Microsoft Teams with Canvas.

- In September 2022, Turnitin, a provider of academic integrity and writing solutions, acquired ExamSoft, a provider of assessment solutions for education institutions.

- In November 2022, D2L Corporation, a global learning technology leader, announced a strategic partnership with IBM to leverage IBM Watson's AI capabilities in D2L's learning platform.

Significant Growth Factors:

The Education and Learning Analytics Market is experiencing growth driven by the rising utilization of cutting-edge technologies and the growing need for data-driven perspectives in the field of education.

The global market for Education and Learning Analytics is poised for substantial growth in the coming years. Various factors are driving this trend. Firstly, the surge in digital learning platforms and technologies within educational institutions is spurring the need for learning analytics solutions. These solutions enable educators to analyze student data, pinpoint strengths and weaknesses, and customize instructional approaches accordingly.

Additionally, the increasing focus on personalized learning is boosting the demand for analytics tools that can provide insights into individual student performance. The escalating importance of data-driven decision-making in the education sector is another significant driver of market growth. Educational institutions are increasingly turning to learning analytics to steer curriculum planning, allocate resources effectively, and implement intervention strategies.

Furthermore, advancements in big data and artificial intelligence technologies are facilitating more sophisticated analysis of educational data, ultimately resulting in enhanced student outcomes. Nevertheless, challenges like data privacy concerns and the scarcity of skilled analytics professionals may pose obstacles to market expansion. In sum, the Education and Learning Analytics market is expected to experience substantial growth, driven by the mounting adoption of digital learning, the emphasis on personalized education, and the need for data-driven decision-making in the education sector.

Restraining Factors:

The Education and Learning Analytics Market faces challenges due to intricate and varied data sets, as well as ethical and privacy considerations, which serve as inhibiting elements.

The Education and Learning Analytics Market has experienced notable growth recently due to the rising integration of technology in educational settings aimed at enhancing student learning achievements. Nevertheless, the market faces several hurdles that could hinder its expansion. Primarily, the substantial expenses associated with deploying advanced analytics tools and technologies present a challenge for educational institutions, particularly those operating under constrained budgets. Moreover, concerns relating to data privacy and security could discourage some institutions from embracing analytics solutions due to the necessity of complying with stringent regulations to safeguard student data. Additionally, the scarcity of proficient professionals capable of adeptly analyzing and interpreting the data generated by these analytics tools constitutes another barrier encountered by the market.

Furthermore, inadequate awareness and comprehension of the advantages of learning analytics among educational stakeholders may impede market progress. Despite these obstacles, it is crucial to acknowledge that the education sector increasingly acknowledges the significance of analytics in enhancing student outcomes and institutional efficacy. Consequently, efforts are underway to address these impediments through cost-efficient solutions, enhanced data security measures, and the cultivation of skilled professionals.

With ongoing technological advancements and ened awareness, the Education and Learning Analytics Market is poised to surmount these challenges and experience sustained growth in the foreseeable future.

Key Segments of the Education and Learning Analytics Market

Applications Overview

• People Acquisition and Retention

• Curriculum Development and Intervention Management

• Performance Management

• Budget and Finance Management

• Operations Management

• Others

Components Overview

• Software

• Services

Deployment Model Overview

• On-premises

• Cloud

End User Overview

• Academic

• Enterprise/Corporate

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America