E-commerce Apparel Market Analysis and Insights:

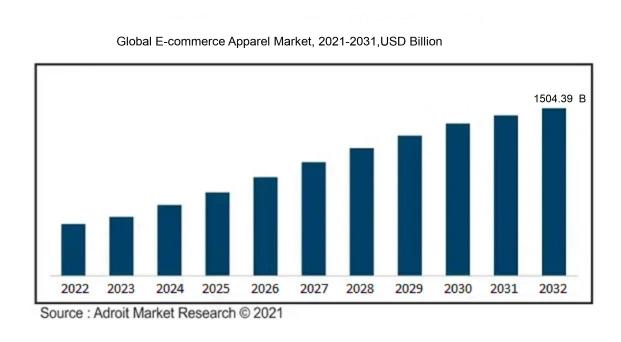

In 2023, the size of the worldwide E-commerce Apparel market was US$ 704.3 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 8.8% from 2024 to 2032, reaching US$ 1504.39 billion.

The growth of the e-commerce apparel sector is fueled by various pivotal factors, such as rapid technological progress, greater internet access, and the increasing popularity of mobile shopping. Consumers are increasingly opting for online shopping due to its convenience, as they can explore vast product ranges from the comfort of their homes. Furthermore, social media platforms significantly impact buying behaviors, with targeted advertising and influencer endorsements boosting brand awareness. The expansion of emerging markets, paired with a younger demographic that is technologically adept and seeks easily accessible fashion, plays a vital role in driving market expansion. Additionally, the rising emphasis on sustainability and ethical fashion is encouraging brands to evolve their offerings, in response to consumer demand for eco-friendly products. Improved logistics and delivery systems also enhance the efficiency of transactions, making online shopping an attractive option for apparel buyers.

E-commerce Apparel Market Definition

E-commerce apparel pertains to garments and fashion products marketed via online platforms, enabling consumers to explore, buy, and obtain clothing without the need to visit brick-and-mortar stores. This industry includes a diverse array of items such as everyday clothing, formal wear, and various accessories, all accessible through online shops.

Online clothing retail plays a vital role in reshaping consumer shopping habits by providing convenience, an extensive range of options, and easy access. The growth of digital commerce allows shoppers to explore vast selections from their own homes, improving their overall buying experience. It serves a worldwide market, overcoming geographical limitations and enabling brands to tap into varied demographics. Moreover, e-commerce platforms offer tailored shopping experiences facilitated by data analysis, allowing retailers to gain insights into customer preferences. This sector also gives small enterprises the opportunity to challenge larger brands, encouraging innovation and creativity while contributing to economic expansion through ened sales and employment opportunities.

E-commerce Apparel Market Segmental Analysis:

Insights On Product Type

Casual Wear

Casual Wear is expected to dominate the Global E-commerce Apparel Market due to the increasing trend towards comfortable and versatile clothing among consumers. The rise in remote work and casual lifestyles, particularly post-pandemic, has fueled a greater demand for leisure and everyday clothing. Consumers, especially millennials and Gen Z, prefer apparel that provides comfort while also being stylish, making casual wear a favored option. Furthermore, the rapid growth of online shopping platforms has made it easier for brands to reach their target audiences, contributing significantly to the booming market for casual attire. The flexibility and adaptability of casual clothing align well with current consumer preferences, solidifying its market dominance.

Formal Wear

Formal Wear occupies a niche market that is significantly influenced by events such as business meetings, weddings, and other formal occasions. Although its demand remains consistent, it is more susceptible to economic fluctuations and changes in work culture. With the rise of remote work and a more relaxed approach to business attire, Formal Wear has seen a decline in adoption outside traditional settings. However, it still holds relevance during specific seasons and occasions, catering to customers seeking premium and high-quality apparel for upscale events. The continued need for tailored clothing and smart attire ensures that Formal Wear retains a devoted customer base.

Insights On End User

Women

Women are expected to dominate the Global E-commerce Apparel Market primarily due to their greater inclination towards online shopping and an extensive variety of apparel options available for them. The rise in women's disposable income, the increasing influence of social media, and the thriving trend of fashion and lifestyle blogging have significantly contributed to the growth of women's apparel in e-commerce. Moreover, women tend to shop more frequently than men, driven by both necessity and the desire for fashion. This constant demand, coupled with retailers focusing more on women's collections and personalized shopping experiences, solidifies women's position as the leading consumer group in the online apparel market.

Men

Men's apparel in the E-commerce sector has been witnessing steady growth, driven by an evolving attitude towards fashion and online shopping convenience. In recent years, brands have focused on expanding their range from casual wear to formal attire, appealing to a broader male audience. Men are increasingly becoming more fashion-conscious and are more willing to spend on quality apparel, although their shopping frequency tends to be lower than that of women. Brands catering to men's fashion are also employing targeted marketing strategies, further enhancing their online presence and encouraging more male consumers to shop online.

Insights On Platform Type

Third Party Retailer

The Third Party Retailer is expected to dominate the Global E-commerce Apparel Market due to its extensive reach and established customer trust. Platforms such as Amazon, eBay, and other marketplace giants leverage their vast logistics networks and marketing capabilities, making them highly efficient in attracting a broad consumer base. These retailers often provide a wide variety of apparel from multiple brands, catering to diverse customer preferences and ensuring competitive pricing. Furthermore, the convenience of shopping across multiple brands in one place enhances the consumer experience, driving more buyers to utilize third-party platforms over individual company websites.

Company's Own

The Company's Own platform type has gained traction, particularly for brands wanting to maintain full control over their online presence and customer interactions. Established brands often develop their own e-commerce sites to ensure a unique brand experience, allowing direct engagement and acquisition of valuable customer data. Although this approach potentially leads to higher profit margins, the reach is typically limited compared to marketplace giants. Nonetheless, businesses in this category often implement loyalty programs and customization features, which can foster brand loyalty among consumers and create a dedicated customer base that opts for direct shopping experiences.

Global E-commerce Apparel Market Regional Insights:

Asia Pacific

The Asia Pacific region is poised to dominate the Global E-commerce Apparel market due to a combination of factors including rapid digital adoption, a vast population base, and a growing middle class with increasing disposable incomes. Countries such as China and India are at the forefront, exhibiting substantial growth in online shopping habits and preferences for fashionable apparel. The region also benefits from technological advancements and a flourishing logistics infrastructure that facilitates seamless online transactions. Moreover, a younger demographic is driving trends toward e-commerce, exemplifying the region's transition into a global e-commerce powerhouse. As a result, the Asia Pacific market is expected to lead the way in the e-commerce apparel landscape.

North America

North America holds a significant position in the Global E-commerce Apparel market, primarily driven by a highly developed e-commerce infrastructure and consumer willingness to adopt online shopping. The United States, in particular, is one of the largest e-commerce markets in the world, characterized by a rich array of renowned retail brands and advanced logistics services. Furthermore, the robust technological environment and high internet penetration rate empower consumers to enjoy an exceptional online shopping experience. The region demonstrates a marked preference for convenience and speed in shopping, thus firmly establishing North America as a major player in the e-commerce apparel space.

Europe

The European market for e-commerce apparel is characterized by strong consumer trust in online shopping and a growing trend towards sustainability and ethical fashion. Countries like the United Kingdom, Germany, and France significantly contribute to the overall market, fueled by diverse style preferences and innovative shopping platforms. However, the market faces challenges such as varied regulations, and currency fluctuations, which can hinder cross-border e-commerce. Despite these barriers, the emphasis on customer experience and quality is expected to foster growth within the region, making Europe a noteworthy in the global marketplace.

Latin America

Latin America is steadily gaining ground in the Global E-commerce Apparel market, thanks to increasing internet penetration and improvements in digital payment methods. Countries like Brazil and Mexico are leading the charge, driven by a youthful population eager to engage in online shopping. Nevertheless, logistical challenges and a lack of infrastructure still pose issues that can slow market growth. As platforms increasingly cater to local tastes and preferences, the region shows potential for substantial expansion. The gradual shift toward e-commerce is promising, yet it is currently overshadowed by the more established markets.

Middle East & Africa

The Middle East & Africa region represents an emerging opportunity within the Global E-commerce Apparel market, highlighted by rising smartphone usage and growing internet access. Countries such as the UAE and South Africa are experiencing increased investments in e-commerce platforms and increased consumer demand for online apparel shopping. However, significant infrastructural hurdles and varying levels of economic stability can impede rapid growth. Local brands are beginning to innovate and adapt to e-commerce trends, while international players are eyeing the region for potential expansion. The market outlook suggests growth, but it remains in developmental stages compared to other more mature regions.

E-commerce Apparel Market Competitive Landscape:

The global e-commerce apparel market is significantly influenced by prominent retailers and digital platforms that improve consumer access and offer diverse product selections. They utilize technological advancements to create tailored shopping experiences and streamline logistics. These players are at the forefront of innovation, fostering brand loyalty, and adjusting to evolving consumer trends within a competitive environment.

Prominent entities within the online clothing retail sector encompass Amazon, Alibaba Group, Zalando, ASOS, H&M, Nike, Adidas, Fast Retailing Co. (Uniqlo), Lulus, Boohoo, Nordstrom, Gap Inc., Macy's, Ralph Lauren, Arcadia Group, Farfetch, Rivet Ventures, J.C. Penney Company, Inc., Bonobos, and Stitch Fix.

Global E-commerce Apparel Market COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly expedited the expansion of the worldwide online clothing market, as shoppers transitioned to digital purchasing due to lockdowns and the need for social distancing.

The COVID-19 pandemic brought about a significant evolution in the e-commerce clothing sector, fast-tracking pre-existing trends. With brick-and-mortar stores closing their doors and people staying home, there was a marked transition to online platforms for clothing purchases. Several influencers contributed to this shift, including enhanced internet accessibility, the widespread use of mobile shopping applications, and a ened focus on convenience. Specific apparel s, notably activewear and loungewear, saw a surge in sales as consumers sought comfort during lockdowns. This situation also compelled brands to strengthen their online presence, refine their supply chains, and implement cutting-edge technologies like virtual fitting rooms to elevate the shopping experience. Nonetheless, challenges such as interruptions in supply chains and variable consumer demand surfaced, necessitating swift business adaptations. In summary, the pandemic has irrevocably reshaped consumer behavior, marking the beginning of a new phase in the e-commerce apparel domain, defined by a deepened reliance on digital platforms.

Latest Trends and Innovation in The Global E-commerce Apparel Market:

- In March 2023, Shopify announced a major integration with fulfillment provider Deliverr, aiming to simplify logistics for e-commerce apparel brands and enhance shipping capabilities for merchants on the Shopify platform.

- In February 2023, ASOS acquired the activewear brand ASOS 4505 to expand its offerings in the growing athleisure, reinforcing its commitment to diversifying product lines while targeting younger consumers.

- In January 2023, Zara, a brand under Inditex, unveiled a new technology initiative focused on recycling textiles and reducing environmental impact, launching a pilot program in select stores to improve sustainability in apparel production.

- In December 2022, Adidas joined forces with the start-up, Phantasm, to develop a new range of digital wearables designed for virtual environments, enhancing their presence in the metaverse and appealing to tech-savvy consumers.

- In November 2022, Lululemon announced the acquisition of Mirror, a home fitness startup, expanding its brand into the digital fitness realm and capitalizing on the trend of active lifestyle apparel catering to fitness-conscious consumers.

- In October 2022, H&M launched a circularity program aimed at promoting the resale and recycling of apparel items, reinforcing its efforts towards sustainability and responding to increasing consumer demand for eco-friendly practices.

- In September 2022, Revolve Group, a fashion e-commerce platform, reported a successful partnership with virtual influencers to enhance its marketing strategy, experiencing a notable increase in engagement rates among Gen Z consumers.

- In August 2022, Amazon announced the integration of its Prime Wardrobe service with augmented reality features, allowing customers to visualize how clothing items would fit before purchasing, thereby enhancing the online shopping experience.

- In July 2022, Nike announced a collaboration with technology company, Selfridges, to create an interactive shopping experience utilizing augmented reality, aimed at enlivening the in-store experience alongside its digital retail strategy.

E-commerce Apparel Market Growth Factors:

The primary drivers fueling growth in the e-commerce fashion sector encompass technological innovations, greater access to the internet, and a transformation in consumer tendencies favoring online retail.

The expansion of the online clothing market can be linked to several significant factors. Primarily, the widespread availability of the internet and the proliferation of smartphones have revolutionized the shopping experience, making it more convenient for consumers across the globe. Additionally, the prevalent fast fashion movement, characterized by rapid production and distribution of trendy apparel, has ened competition and prompted consumers to turn to online platforms for the latest trends. The growing variety of digital payment methods has further improved the ease and security of online purchases, bolstering consumer trust. Social media channels are crucial in amplifying the visibility of apparel brands, with influencer marketing effectively capturing the attention and participation of younger audiences. Moreover, the COVID-19 pandemic has dramatically accelerated the transition to online shopping, as stay-at-home measures encouraged consumers to seek e-commerce solutions for their clothing requirements. Brands are increasingly focusing on personalization technologies and flexible return policies to enhance the shopping experience, which in turn drives sales. Sustainability has also become a vital factor, with consumers showing a marked preference for brands that adopt eco-friendly practices. Lastly, ongoing advancements in logistics and supply chain management have resulted in faster delivery services, significantly improving customer satisfaction and building loyalty within the e-commerce clothing industry.

E-commerce Apparel Market Restaining Factors:

The e-commerce fashion industry faces several significant obstacles, such as fierce rivalry, intricate supply chain dynamics, and changing consumer tastes.

The growth of the e-commerce clothing sector is hindered by various factors, including fierce competition, difficulties within supply chains, and concerns over customer trust and satisfaction. With many brands competing for consumer engagement, market saturation often results in price competition and ened marketing expenditures, which can erode profits. Inefficiencies in supply chain operations, such as shipping delays and poor inventory management, further complicate the timely delivery of products, thereby affecting the overall customer experience. Additionally, challenges like inconsistent sizing, the inability to physically try on items, and difficulties in understanding fit contribute to consumer reluctance and increased return rates. Furthermore, apprehensions regarding online transaction security can undermine customer confidence, leading them to shy away from e-commerce platforms. To add to this, the evolving landscape of regulations related to data privacy and environmental sustainability creates additional compliance challenges and operational expenses. Nonetheless, despite these obstacles, the rapid evolution of technology and growing acceptance of online shopping offer significant potential for innovation and revenue growth, enabling the e-commerce apparel market to evolve and succeed in an ever-changing consumer environment.

Segments of the E-commerce Apparel Market

By Product Type

• Formal Wear

• Casual Wear

By End User

• Men

• Women

By Platform Type

• Third Party Retailer

• Company's Own

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America