Drug Development Market Analysis and Insights:

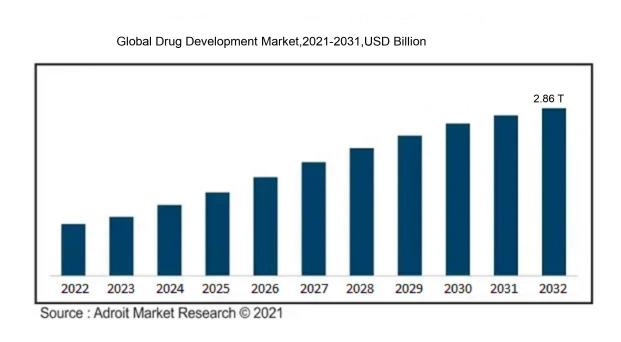

In 2023, the size of the worldwide Drug Development market was US$ 2.11 Trillion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 5.6 % from 2024 to 2032, reaching US$ 2.86 Trillion.

The market for drug development is largely influenced by several pivotal elements, such as innovations in biotechnology, the escalating incidence of chronic illnesses worldwide, and the increased occurrence of infectious diseases. Breakthrough technologies like artificial intelligence and big data analytics significantly improve the efficiency of drug discovery and clinical trial processes. Additionally, supportive regulatory frameworks and investments from both governmental and private entities promote research and development activities. The rising interest in personalized medicine drives funding toward customized therapies that leverage genetic information. Furthermore, the aging demographic demands the creation of innovative treatments for age-related health issues. Partnerships between pharmaceutical firms and academic institutions play a crucial role in accelerating innovation and introducing new solutions to the marketplace. Finally, an intensified focus on global health issues, highlighted by recent pandemics, underscores the urgency for swift drug development aimed at tackling emerging health threats.

Drug Development Market Definition

The process of drug development encompasses a thorough exploration and formulation of novel pharmaceuticals, which includes stages such as discovery, preclinical evaluation, and clinical trials to ascertain both safety and effectiveness. This complex journey ultimately leads to regulatory endorsement and the introduction of the drug into the marketplace.

The process of drug development is essential for the creation of novel therapies aimed at addressing various diseases, enhancing health results, and improving individuals' quality of life. This complex process encompasses extensive scientific investigation, clinical testing, and adherence to regulatory standards to ascertain both effectiveness and safety. The introduction of new pharmaceuticals can meet previously overlooked medical demands, respond to new health challenges, and alleviate the impact of chronic diseases. Additionally, successful drug development drives innovation in the pharmaceutical sector, promotes economic development, and can enhance the overall healthcare infrastructure. In essence, it is fundamental to public health, as it ensures the availability of effective treatments and better patient care.

Drug Development Market Segmental Analysis:

Insights On Dosage Form

Tablets

Tablets are expected to dominate the Global Drug Development Market primarily due to their widespread acceptance, ease of administration, shelf stability, and cost-effectiveness. Within the tablet category, immediate release tablets have a strong foothold due to their quick onset of action, while modified release formulations cater to patients needing longer-lasting effects. The growing prevalence of chronic diseases necessitates more efficient drug delivery systems, which further drives the demand for tablet formulations. Additionally, the convenience of manufacturing and packaging procedures associated with tablets also contribute to their dominance in the market.

Capsules

Capsules, including hard gelatin capsules and softgel capsules, represent a significant portion of the drug development market, appreciated for their ability to mask unpleasant tastes and deliver various types of medications effectively. Hard gelatin capsules are favored for solid oral dosage forms, offering flexibility in formulation. Softgel capsules are popular for their use in delivering oil-based substances and enhance bioavailability. These characteristics make capsules an appealing option for both pharmaceutical manufacturers and consumers, contributing to their noteworthy presence in the global market.

Powders & Granules

Powders and granules serve as a versatile form of medication administration, often utilized for formulations that can be reconstituted for oral consumption or delivered via inhalation. They are particularly valuable in pediatric and geriatric medicine, where ease of dosing is paramount. This dosage form allows for accurate dosing, particularly in tailored medication for patients requiring specific dosages. The adaptability in varying formulations and customization fosters a steady demand for powders and granules across different therapeutic categories.

Lozenges & Pastilles

Lozenges and pastilles are increasingly favored in the market, especially for localized treatments such as sore throats and cough relief. Their convenience and targeted delivery system provide a distinct advantage. This dosage form offers a pleasant way to deliver medication while also providing symptomatic relief. The market sees a growing interest in novel formulations that incorporate natural ingredients, appealing to health-conscious consumers, thus strengthening the standing of lozenges and pastilles.

Gummies

Gummies have gained traction as an innovative drug delivery method, especially among younger demographics and those averse to traditional pills. Their palatable nature and variety of flavors make them an attractive option for vitamins and supplements, as well as prescription medications. The surge in demand for gummy formulations can be attributed to consumer preferences towards enjoyable and convenient dosage forms, enhancing the market share they occupy within the overall drug development sector.

Parenteral Formulations

Parenteral formulations, encompassing solutions, suspensions, emulsions, and powders for injection, are critical for delivering drugs in situations where oral administration is not possible or effective. Their rapid onset of action makes them indispensable in emergency medicine and for certain therapeutic areas. The dynamics of this category are fueled by advancements in technology and the increasing prevalence of chronic diseases, which often require injectable forms of treatment. Consequently, parenteral formulations maintain robust growth within the market.

Topical Formulations

Topical formulations, including pastes, creams, ointments, and gels, are commonly employed in dermatological applications and localized treatment. The convenience of applying medications directly to affected areas enhances patient compliance. The versatility of these formulations allows for a wide array of therapeutic applications, from anti-inflammatory agents to cosmetic solutions. Growth in the demand for dermatological treatments and a rise in skin disorders play a pivotal role in the sustained demand for topical formulations.

Inhalation Formulations

Inhalation formulations, consisting of pressurized metered-dose inhalers, dry powder inhalers, and nebulizers, have gained prominence in treating respiratory diseases such as asthma and COPD. The effectiveness of delivering medication directly to the lungs ensures rapid therapeutic action. With rising awareness of respiratory disorders and advancements in inhalation technology, this of the market continues to expand. The increasing prevalence of respiratory conditions globally showcases the growing importance and necessity of inhalation-based drug delivery systems.

Insights On Indication

Cancer

Cancer is expected to dominate the Global Drug Development Market due to the rising incidence of various cancer types worldwide and increasing investments in oncological research and development. The complexity of this disease, coupled with a significant patient population and high unmet medical needs, drives persistent innovation in drug discovery and clinical trials. Additionally, breakthroughs in personalized medicine, immunotherapy, and targeted therapies have further spurred interest in this area. Pharmaceutical companies are channeling resources into developing next-generation cancer treatments, making it a primary focal point of the overall drug development landscape.

Infectious Diseases

The market for infectious diseases remains robust as emerging pathogens, antibiotic resistance, and global pandemics impose significant health challenges. The COVID-19 pandemic has accelerated the urgency for developing vaccines and antivirals, leading to increased funding and attention in this area. Continuous monitoring of infectious agents and rapid response capabilities keeps this vital in drug development, although it may be secondary compared to cancer currently.

Cardiovascular Diseases

Cardiovascular diseases continue to be a leading cause of mortality globally, driving the need for innovative drug therapies. The aging population, urbanization, and lifestyle changes contribute to rising cardiovascular conditions, prompting extensive research and development of new treatments. Novel therapies focusing on risk factor management, such as cholesterol lowering and hypertension, play a significant role in this sector, making it a critical part of drug development efforts.

Diabetes

Diabetes is a growing health concern due to increasing obesity rates and lifestyle changes worldwide. The need for better management therapies and potential cures enhances the focus on developing new drugs. Innovations in insulin delivery systems and oral medications have created opportunities in this area, although it faces stiff competition from the oncology market, which might overshadow its developmental progress.

Respiratory Diseases

Respiratory diseases, encompassing chronic obstructive pulmonary disease (COPD) and asthma, contribute significantly to global morbidity and mortality. The need for novel inhalation therapies and biologics has generated attention in this area, although challenges like high development costs and competition from existing treatments present hurdles. Nevertheless, the demand for effective solutions, particularly as air quality continues to decline, keeps this sector relevant in drug development discussions.

Central Nervous System Disorders

CNS disorders, including Alzheimer's and Parkinson's diseases, represent a substantial unmet medical need with increasing prevalence as populations age. The complexities of brain-related conditions pose unique challenges for drug development, but the potential for breakthrough therapies remains high. Industry interest in neurological research continues to grow, though it often lags when compared to the cancer sector and its rapid advancements.

Autoimmune Diseases

Autoimmune diseases affect millions of individuals worldwide, leading to chronic health conditions that require ongoing treatment. The development of biologics and targeted therapies specifically for conditions like rheumatoid arthritis and lupus has gained traction, marking significant progress. However, this area competes in a crowded market with several therapeutic options, making it a notable yet secondary focus in the broader drug development landscape.

Gastrointestinal Diseases

Gastrointestinal diseases, including inflammatory bowel disease (IBD) and irritable bowel syndrome (IBS), present substantial challenges in terms of patient management. Ongoing research into gut microbiome influences and novel biologic treatments is enhancing drug development efforts in this sector. While the market is growing, it generally attracts less attention relative to diseases like cancer due to the higher visibility and funding targeted towards malignancies.

Musculoskeletal Disorders

Musculoskeletal disorders, such as osteoarthritis and rheumatoid arthritis, significantly impact the quality of life for many individuals. Research is focused on developing disease-modifying treatments and addressing chronic pain management. Despite their prevalence, the market can sometimes struggle for resources and attention compared to more critical illness sectors like cancer, which have greater urgency and potential for pharmaceutical breakthroughs.

Dermatological Disorders

Dermatological conditions, ranging from psoriasis to eczema, present unique challenges for drug development. Interest in biologics and novel topical agents is growing, spurred by innovations in personalized medicine. However, despite the burgeoning interest, the dermatology market often remains overshadowed by more acute health challenges present in other categories, especially oncology, defining its secondary role within the drug development framework.

Insights On End User

Biotech Companies

Biotech companies are expected to dominate the Global Drug Development Market due to their increased focus on innovative therapies, particularly in areas like gene editing and monoclonal antibodies. Their agility and specialization allow them to adapt quickly to emerging research and capitalize on niche markets, which is crucial in a landscape defined by rapid technological advancement. Additionally, many biotech firms collaborate with larger pharmaceutical companies, leveraging their resources while maintaining their innovative edge. The growth in personalized medicine and biologics heavily influences the success of biotech firms, making them a vital part of the drug development ecosystem.

Big Pharma

Big pharmaceutical companies hold a significant share in the drug development market but tend to focus on established markets and blockbuster drugs. Their vast resources enable extensive research and development initiatives, along with strong regulatory capabilities. However, the challenges they face include high competition and pressure on pricing strategies governing the market. While they invest heavily in drug development, their slower speed to market compared to smaller firms can hinder their ability to capitalize on swiftly evolving medical advancements. Overall, their stronghold is firm, but their adaptability is sometimes hindered by their size and the complexity of their operations.

Small & Medium Size Pharma

Small and medium-sized pharmaceutical companies play a crucial role in the drug development market by addressing unmet medical needs and focusing on niche areas that larger corporations may overlook. Their leaner operations allow for greater flexibility and faster decision-making processes. They often specialize in unique therapies or orphan drugs, which can lead to high margins despite their smaller scale. However, their limited resources and funding may pose challenges in extensive clinical trial phases. This often seeks collaboration with larger firms, which can provide them with the necessary capital and infrastructure to bring their innovations to market effectively.

Global Drug Development Market Regional Insights:

North America

North America is anticipated to dominate the Global Drug Development market primarily due to the presence of a robust pharmaceutical landscape, extensive investment in R&D, and advanced regulatory frameworks. The U.S. is home to numerous leading pharmaceutical companies that are heavily involved in drug innovation and development. The region benefits from a high level of collaboration between academic institutions and industry, alongside significant government funding and supportive policies that encourage drug discovery and development. Furthermore, North America’s mature healthcare infrastructure and the increasing prevalence of chronic diseases are driving the demand for new therapies, solidifying its leadership in this.

Latin America

Latin America is increasingly becoming a noteworthy player in the Global Drug Development market, owing to a growing population and improving healthcare systems. Countries like Brazil and Mexico have seen investment in biotechnology and pharmaceutical development. While the region faces challenges such as regulatory hurdles and economic fluctuations, it has immense potential for growth as access to healthcare improves and local pharmaceutical companies begin to thrive, making it an interesting market for drug development in the future.

Asia Pacific

The Asia Pacific region is witnessing rapid growth in the Global Drug Development market, primarily driven by the increasing prevalence of diseases, rapid urbanization, and improving healthcare infrastructure. Countries such as China and India are becoming attractive hubs for clinical trials due to lower costs and a large patient pool. The region is also seeing significant investments in biotechnology and pharmaceuticals, which contribute to enhanced drug development capabilities, making it a player on the global stage despite facing regulatory and operational challenges.

Europe

Europe plays a significant role in the Global Drug Development market driven by its strong regulatory frameworks and collaborative research environment. The European Union promotes sharing of resources and data among member states, facilitating drug innovation. However, the market is increasingly competitive, with stringent regulations that can slow down the development process. Despite these challenges, Europe remains a high-investment region with promising advancements in personalized medicine and biotechnology, securing its position in the global landscape.

Middle East & Africa

The Middle East & Africa region is emerging in the Global Drug Development market, primarily driven by increasing investments in healthcare and a growing demand for innovative treatments. However, the region faces significant challenges such as a lack of infrastructure, regulatory complexities, and limited access to technology. Nonetheless, countries like South Africa and the UAE are working to improve their drug development capabilities and attract foreign investment, indicating potential growth in this sector, albeit at a slower pace compared to other regions.

Drug Development Market Competitive Landscape:

The primary contributors to the international drug development sector encompass pharmaceutical corporations, biotechnology firms, and contract research organizations (CROs). These entities foster innovation via meticulous research, extensive clinical testing, and adherence to regulatory standards. Their joint initiatives significantly improve the process of drug discovery and accelerate the availability of potent treatments for patients across the globe.

Prominent entities in the pharmaceutical development sector consist of Pfizer, Johnson & Johnson, Roche, Merck & Co., Novartis, Gilead Sciences, GlaxoSmithKline, Sanofi, AstraZeneca, Bristol Myers Squibb, Eli Lilly and Company, Amgen, AbbVie, Biogen, Takeda Pharmaceutical Company, Vertex Pharmaceuticals, Regeneron Pharmaceuticals, Moderna, Bayer, and Celgene.

Global Drug Development Market COVID-19 Impact and Market Status:

The Covid-19 pandemic acted as a catalyst for rapid innovation and adaptability within the global pharmaceutical development landscape, resulting in faster clinical trial processes and enhanced cooperation among various participants.

The COVID-19 pandemic has profoundly impacted the landscape of drug development, catalyzing the rapid integration of digital technologies and the use of adaptive trial methodologies. Regulatory bodies such as the FDA and EMA have streamlined their approval processes for therapeutics and vaccines, underscoring the critical necessity for swift action during public health emergencies. This pressing demand has resulted in increased funding and investment directed toward biopharmaceutical research, encouraging partnerships among government entities, academic institutions, and industry stakeholders.

However, the pandemic has also disrupted conventional clinical trial processes, causing difficulties with participant recruitment and extending timelines. The emphasis on developing COVID-19 treatments redirected resources away from research in other therapeutic domains, which could have lasting effects on those fields. Furthermore, the situation has amplified awareness regarding supply chain robustness and the essential need for innovation, leading stakeholders to reconsider their strategies for enhanced readiness in the future. In summary, while COVID-19 has presented immediate obstacles, it has simultaneously prompted revolutionary shifts within the drug development sector.

Latest Trends and Innovation in The Global Drug Development Market:

- In September 2023, Pfizer announced its acquisition of Seagen for approximately $43 billion, enhancing its oncology pipeline with Seagen's innovative cancer therapies.

- In August 2023, Amgen completed the acquisition of Horizon Therapeutics for $27.8 billion, gaining access to medicines for rare diseases, particularly focused on immune-mediated conditions, expanding Amgen’s portfolio significantly.

- In July 2023, Eli Lilly revealed the successful results from its phase 3 trial for the Alzheimer’s treatment, donanemab, indicating its potential in slowing cognitive decline, which could establish Lilly as a leader in this therapeutic area.

- In June 2023, Merck completed the acquisition of Prometheus Biosciences for $10.8 billion, aiming to strengthen its position in immunology with Prometheus’s promising treatments for inflammatory bowel disease.

- In May 2023, AstraZeneca and Evotec announced a strategic collaboration to develop new treatments for various diseases, leveraging Evotec’s innovative platform technologies for drug discovery.

- In April 2023, Novartis initiated a new partnership with the University of California, San Francisco for a collaboration focused on advancing gene therapies, aiming to enhance the accessibility and efficacy of gene-editing technologies.

- In March 2023, Johnson & Johnson agreed to acquire Abiomed for $16.6 billion, which specializes in heart pump technologies, thus expanding J&J's cardiovascular offerings.

- In February 2023, Roche launched its new digital platform designed for oncology clinical trials, which integrates artificial intelligence to streamline patient recruitment and enhance the data analytics process for drug development.

- In January 2023, Sanofi announced a merger with Bioverativ, aiming to strengthen its capabilities in hemophilia and potentially create novel treatments for blood disorders.

- In December 2022, GSK and 23andMe entered into a collaboration to develop new medicines using 23andMe's genetic database, which focuses on potential drug targets in various disease areas based on genetic insights.

Drug Development Market Growth Factors:

The pharmaceutical development sector is propelled by several elements, including technological progress, a growing incidence of chronic illnesses, and an escalating need for novel treatment options.

The drug development sector is experiencing remarkable expansion, fueled by several critical elements. Primarily, the rising incidence of chronic illnesses alongside an increasingly aging population is driving the demand for new and effective therapeutic options. Technological advancements, especially in genomics and bioinformatics, are enhancing the efficiency of drug discovery methods. Furthermore, the emergence of personalized medicine—where treatments are customized based on individual genetic profiles—is improving the efficacy of drug therapies and broadening market prospects.

Regulatory authorities are also making strides toward more streamlined approval processes, enabling quicker access for groundbreaking medications. Additionally, there is a noticeable uptick in research and development investments from both governmental bodies and private enterprises, pushing the envelope in drug formulation and delivery techniques. The globalization of clinical trials, combined with a growing partnership between pharmaceutical companies and research institutions, is yielding richer datasets and fostering therapeutic innovations.

Moreover, the integration of artificial intelligence and machine learning in forecasting drug interactions and outcomes is transforming traditional approaches, speeding up the development timelines. Collectively, these dynamics are not just accelerating market growth but are also heralding significant advancements within the broader healthcare arena.

Drug Development Market Restaining Factors:

Significant challenges in the pharmaceutical development industry encompass substantial research and development expenditures, protracted approval timelines, and rigorous regulatory standards.

The pharmaceuticals sector faces numerous challenges that can impede progress and innovation in drug development. One primary obstacle is the exorbitant expense linked to research and development, with costs often surpassing $2.6 billion for each new medication, which acts as a significant deterrent, particularly for smaller biotechnology firms. Additionally, the intricate regulatory landscape, including the rigorous approval processes implemented by agencies like the FDA, compounds these expenses due to the extensive data requirements and elongated timelines involved.

Moreover, the likelihood of failure during clinical trials remains a critical concern, as only around 10% of drugs that enter this phase secure eventual approval. The presence of generic and biosimilar alternatives also intensifies pricing competition, adversely affecting profitability and discouraging investments in novel research endeavors. Compounding these issues is the escalating complexity of diseases, necessitating more advanced and costly therapeutic solutions, which can further stretch available resources.

Challenges related to market access, particularly limited reimbursement options offered by healthcare systems and rising overall healthcare costs, also hinder progress. Nonetheless, technological advancements such as artificial intelligence and personalized medicine are revolutionizing the drug discovery and development landscape, potentially leading to more streamlined processes. Additionally, a rise in collaborations among academia, industry, and regulatory agencies, coupled with an increasing focus on patient-centered methodologies, offers hopeful prospects for overcoming these hurdles, ultimately fostering a more innovative and efficient environment for drug development in the future.

Segments of the Drug Development Market

By Dosage Form

- Tablets

- Immediate Release

- Modified Release

- Chewable

- Effervescent

- Capsules

- Hard Gelatin Capsules

- Softgel Capsules

- Others

- Powders & Granules

- Lozenges & Pastilles

- Gummies

- Parenteral Formulations

- Solutions

- Suspensions

- Emulsions for Injection or Infusion

- Powders for Injection or Infusion

- Gels for Injection Implants

- Topical Formulations

- Pastes

- Ointments and Oils

- Creams, Lotions, and Foams

- Gels, Tinctures, and Powders

- Sprays and Patches

- Inhalation Formulations

- Pressurized Metered Dose Inhaler

- Dry Powder Inhaler (DPI)

- Nebulizer

By Indication

- Infectious Diseases

- Cancer

- Cardiovascular Diseases

- Diabetes

- Respiratory Diseases

- Central Nervous System Disorders

- Autoimmune Diseases

- Gastrointestinal Diseases

- Musculoskeletal Disorders

- Dermatological Disorders

- Other

By End User

- Big Pharma

- Small & Medium Size Pharma

- Biotech Companies

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America