Market Analysis and Insights:

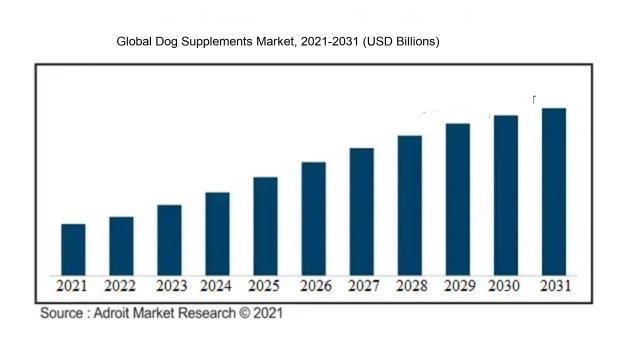

The market for Global Dog Supplements was estimated to be worth USD XX billion in 2021, and from 2021 to 2031, it is anticipated to grow at a CAGR of XX%, with an expected value of USD XX billion in 2031.

The market for dog supplements is experiencing growth due to various factors. One key driving force is the ened awareness among dog owners regarding the significance of maintaining their pets' health and nutrition. This increased awareness is leading pet owners to seek out nutritional supplements to ensure the well-being of their furry companions. Additionally, the market is benefiting from the rise in disposable income and the willingness of pet owners to invest in products that support their dogs' overall health and longevity, considering dogs as integral members of their families. The prevalence of age-related health concerns in dogs, such as joint problems and cognitive decline, is also fueling the demand for supplements tailored to address these specific issues. Moreover, the expanding pet population and the trend of humanizing pets present further opportunities for growth in the dog supplements market. As more individuals choose to have dogs as their companions, the need for products that enhance pets' overall health and quality of life is expected to rise. In essence, the growth of the dog supplements market is primarily attributed to the increasing focus on pet health, rising disposable income levels, age-related health challenges, and the growing number of pet owners.

Dog Supplements Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD XX billion |

| Growth Rate | CAGR of XX% during 2021-2031 |

| Segment Covered | By Product, By Application, By End-user, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Nestlé Purina PetCare Company, Zoetis Inc., Nutramax Laboratories, Inc., VetriScience Laboratories, Nutri-Pet Research Inc., Bayer AG, The J.M. Smucker Company, Platinum Performance, Inc., Blue Buffalo Co., Ltd., and Mars, Incorporated. |

Market Definition

Canine supplements are specialized dietary enhancements formulated to supply extra essential nutrients that aid in enhancing a dog's overall health and quality of life. They encompass a variety of substances such as vitamins, minerals, joint support components, and digestive aids, delivering precise support tailored to address particular requirements or inadequacies in dogs.

Canine nutritional supplements play a crucial role in providing essential nutrients that may be deficient in a dog's regular diet. These supplements are instrumental in promoting and sustaining the overall health and wellness of dogs, addressing specific issues such as joint function, skin and coat health, immune system reinforcement, and digestive well-being. Moreover, they offer a harmonious blend of vitamins, minerals, and antioxidants that enhance optimal health and vigor. Dog supplements prove especially advantageous for senior dogs, active or working canines, and those with preexisting health concerns. It is vital to note that these supplements should complement a balanced and nutritious diet, and seeking guidance from a veterinarian is recommended to ascertain the appropriate dosage and type of supplement tailored to each individual dog's requirements.

Key Market Segmentation:

Insights On Key Type

Digestive Health

The Digestive Health Type is expected to dominate the Global Dog Supplements Market. The digestive health of dogs is a crucial aspect of their overall well-being and is often a primary concern for dog owners. Issues such as diarrhea, constipation, and digestive upset are common in dogs, and many pet owners seek supplements to help improve their pet's digestive health. Digestive health supplements for dogs often contain probiotics, prebiotics, and digestive enzymes that aid in digestion and promote a healthy gut. With an increasing focus on preventive healthcare for dogs, the demand for digestive health supplements is expected to grow significantly.

Eye Care

While Digestive Health is projected to dominate the Global Dog Supplements Market, the Eye Care Type is expected to play a significant role as well. As dogs age, their vision may deteriorate, leading to conditions such as cataracts, glaucoma, and dry eyes. Eye care supplements for dogs often contain antioxidants and nutrients such as lutein and omega-3 fatty acids that help support eye health. With the growing awareness of the importance of eye care in dogs and the increasing prevalence of eye-related issues, the demand for eye care supplements is expected to rise.

Dental Care

In the Global Dog Supplements Market, the Dental Care Type is anticipated to have a notable presence. Dental health is crucial for dogs, as poor oral hygiene can lead to various dental problems, including gum disease and tooth decay. Dental care supplements for dogs usually contain ingredients like enzymes, probiotics, and minerals that promote healthy teeth and gums. With the increasing emphasis on pet dental hygiene and the rising number of pet owners seeking preventive oral care options, the demand for dental care supplements is expected to grow.

Skin & Coat Care

While Digestive Health is expected to dominate the Global Dog Supplements Market, the Skin & Coat Care Type is also expected to have a considerable share. Maintaining healthy skin and a shiny coat is important for the overall well-being and appearance of dogs. Skin and coat care supplements for dogs often contain ingredients like omega-3 fatty acids, biotin, and vitamins that support healthy skin, reduce shedding, and improve coat condition. With the rising concern for skin and coat issues in dogs, including dry skin, itching, and allergies, the demand for skin and coat care supplements is expected to increase.

Allergy & Immune System Health

Although Digestive Health is projected to dominate the Global Dog Supplements Market, the Allergy & Immune System Health Type is expected to have a significant presence. Many dogs suffer from allergies, including food allergies, environmental allergies, and allergies to flea bites. These allergies can lead to various symptoms, such as itching, redness, and inflammation, as well as a weakened immune system. Allergy and immune system health supplements for dogs often contain ingredients like omega-3 fatty acids, antioxidants, and immune-boosting herbs that help reduce allergy symptoms and strengthen the immune system. With the increasing prevalence of allergies in dogs and the growing focus on immune system support, the demand for allergy and immune system health supplements is expected to rise.

Hip & Joint Care

While Digestive Health is expected to dominate the Global Dog Supplements Market, the Hip & Joint Care Type is also expected to have a significant presence. Joint issues, such as arthritis and hip dysplasia, are common in dogs, particularly in older or large breed dogs. Hip and joint care supplements for dogs often contain ingredients like glucosamine, chondroitin, and MSM that help support joint health, reduce inflammation, and promote mobility. With the increasing awareness of joint health in dogs and the desire to improve their quality of life, the demand for hip and joint care supplements is expected to grow.

Brain & Heart Care

Although Digestive Health is projected to dominate the Global Dog Supplements Market, the Brain & Heart Care Type is expected to have a significant role. As dogs age, they may experience cognitive decline, including memory loss and confusion. Additionally, heart health is crucial for maintaining overall wellness in dogs. Brain and heart care supplements for dogs often contain ingredients like omega-3 fatty acids, antioxidants, and Coenzyme Q10 that support brain function and cardiovascular health. With the growing focus on senior dog care and the increasing awareness of cognitive and heart-related issues in dogs, the demand for brain and heart care supplements is expected to increase.

General Nutrition

While Digestive Health is projected to dominate the Global Dog Supplements Market, the General Nutrition Type is also expected to have a considerable presence. General nutrition supplements for dogs are designed to provide essential vitamins, minerals, and nutrients that may be lacking in their regular diet. These supplements aim to support overall health, boost immunity, and fill nutritional gaps. With the growing awareness of the importance of well-balanced nutrition in dogs and the desire to ensure optimal health and vitality, the demand for general nutrition supplements is expected to grow.

Insights On Key Application

Online Store

The Online Store application is expected to dominate the Global Dog Supplements Market. The convenience and accessibility offered by online platforms have significantly contributed to the growth of this part. Dog owners can easily browse through a wide variety of products, compare prices, and read customer reviews at the click of a button. Online stores also provide the convenience of doorstep delivery, making it an attractive option for busy pet owners. Additionally, online platforms often offer exclusive deals, discounts, and loyalty programs, further incentivizing customers to purchase dog supplements online. Given the increasing popularity and ease of online shopping, it is expected that the Online Store part will continue to dominate the Global Dog Supplements Market.

Supermarket

The Supermarket application of the Application category in the Global Dog Supplements Market is expected to hold a considerable share but not dominate the market. Supermarkets offer dog supplements as part of their pet care section, providing dog owners with a convenient option for purchasing these products while shopping for other household items. However, the limited variety and availability of dog supplements in supermarkets may restrict its domination in the market. While supermarkets cater to a wide range of pet owners, including those interested in dog supplements, the dominance of the Online Store part, with its extensive product range and convenience, is likely to keep the Supermarket part from becoming the dominant player in the Global Dog Supplements Market.

Chain Pet Care Store

The Chain Pet Care Store application is anticipated to have a significant presence in the Global Dog Supplements Market but is unlikely to dominate. Chain pet care stores, such as Petco and Petsmart, offer a range of products for pets, including dog supplements. These stores provide knowledgeable staff who can guide customers in choosing appropriate supplements for their dogs based on their individual needs. The presence of these well-established chains and their reputation in the market may attract a significant number of dog owners interested in purchasing supplements. However, the growing popularity and convenience of online stores, along with the wider variety of options they offer, may hamper the Chain Pet Care Store part's ability to dominate the market.

Private Pet Care Shop (Veterinarian)

While the Private Pet Care Shop application, specifically veterinarians, plays a crucial role in advising and recommending dog supplements to pet owners, it is not expected to dominate the Global Dog Supplements Market. Private pet care shops, including veterinary clinics, focus primarily on providing medical and healthcare services to pets. While they may offer a limited range of dog supplements, their primary focus remains on veterinary care rather than retailing pet products. Additionally, the relatively smaller scale of private pet care shops compared to other parts, along with the growing popularity of online platforms, limits the potential for this part to dominate the market.

Other

The Other application within the Application category encompasses various outlets or channels that are not specifically identified in the given options. These could include independent pet stores, specialty health food stores, and alternative distribution channels. Due to the diverse nature of this part, it is challenging to predict its dominance in the Global Dog Supplements Market. The success and growth of this part will depend on factors such as local market dynamics, consumer preferences, and the ability of these outlets to differentiate themselves from other established parts. Therefore, without specific data or market insights into the exact types of outlets included in the Other part, it is difficult to ascertain its potential for domination in the market.

Insights on Regional Analysis:

North America

North America is expected to dominate the global dog supplements market. The region has a well-established pet care industry and a high level of pet ownership and spending. In North America, pet owners are increasingly aware of the importance of providing nutritional supplements to their dogs to promote their overall health and well-being. The market is also driven by the growing demand for natural and organic products, as well as the increasing focus on preventive healthcare for pets. Furthermore, the presence of key market players, extensive distribution channels, and a favorable regulatory framework contribute to the dominance of the North American region in the global dog supplements market.

Latin America

Latin America is a growing market for pet care products, including dog supplements. The region has a significant pet population and rising disposable income, which is leading to increased spending on pet health and wellness. However, the market for dog supplements in Latin America is still relatively small compared to other regions. Factors such as limited awareness and access to such products, as well as economic constraints, hinder the market's growth potential. Despite the challenges, Latin America offers growth opportunities as pet owners become more conscious of their pets' health and start incorporating nutritional supplements into their routine.

Asia Pacific

Asia Pacific is a rapidly emerging market for dog supplements. The region's growing middle-class population, increasing disposable income, and changing lifestyles are contributing to the rising demand for pet care products. In countries like China, Japan, and India, pet ownership is on the rise, and pet owners are becoming more willing to invest in their pets' health and well-being. However, the market for dog supplements in Asia Pacific is still in the early stages of development. Limited awareness about the benefits of nutritional supplements for dogs, along with cultural differences and varying regulatory landscapes, pose challenges to market growth. Nevertheless, increasing urbanization, favorable pet ownership trends, and the entry of international brands are expected to drive the growth of the dog supplements market in Asia Pacific.

Europe

Europe is a mature market for pet care, including dog supplements. The region enjoys a high level of pet ownership and a well-developed pet industry. Pet owners in Europe are increasingly focused on providing proper nutrition to their dogs and are willing to spend on premium products. The market for dog supplements in Europe is driven by factors such as the growing trend of humanization of pets, increased awareness about pet health and wellness, and the demand for natural and organic products. However, market saturation and intense competition from established market players pose challenges to further market growth in Europe.

Middle East & Africa

The Middle East & Africa region is witnessing a steady growth in the dog supplements market. The region's pet population is increasing, driven by factors such as rising disposable income, urbanization, and changing lifestyles. Pet owners in the Middle East & Africa are becoming more aware of the importance of providing nutritional supplements to their dogs to address specific health concerns. However, the market for dog supplements in this region is relatively small compared to other regions, primarily due to factors such as limited product availability, low awareness, and cultural differences. Despite the challenges, increasing urbanization, changing consumer preferences, and a growing focus on pet health and wellness are expected to drive the growth of the dog supplements market in the Middle East & Africa.

Company Profiles:

Prominent participants within the worldwide canine supplements industry significantly contribute by providing a diverse array of supplements tailored to meet the distinctive requirements of canine health and well-being. These entities prioritize research and development, ingenuity in product offerings, and strategic collaborations to uphold their competitive standing within the market.

Prominent players in the canine supplements industry encompass Nestlé Purina PetCare Company, Zoetis Inc., Nutramax Laboratories, Inc., VetriScience Laboratories, Nutri-Pet Research Inc., Bayer AG, The J.M. Smucker Company, Platinum Performance, Inc., Blue Buffalo Co., Ltd., and Mars, Incorporated. These entities wield a strong market presence and offer a diverse array of canine supplement solutions to meet the rising demand for pet well-being and vitality. Each of these entities shapes the competitive dynamics of the market through ongoing innovation and the formulation of cutting-edge canine supplement products. Furthermore, they actively pursue strategic collaborations, acquisitions, and product introductions to extend their market footprint and secure a competitive advantage within the sector.

COVID-19 Impact and Market Status:

The worldwide market for canine supplements has seen a significant increase in interest as a result of the COVID-19 outbreak, with pet caregivers placing a growing emphasis on the well-being and dietary needs of their animals.

The canine supplements sector has been significantly influenced by the effects of the COVID-19 pandemic. Stay-at-home orders and social distancing guidelines have ened pet owners' concerns for the health and welfare of their loyal companions, driving up the demand for dog supplements.

Increasing recognition of the significance of pet well-being, along with a rise in expenditure on pet-related goods, has further fueled market expansion. Nonetheless, the pandemic has disrupted the supply chain, resulting in production and distribution setbacks for these supplements. Certain manufacturers have encountered difficulties in procuring raw materials, causing delays in product availability. Moreover, economic fluctuations and financial insecurities have led to a decrease in consumer expenditure, impacting the overall sales of dog supplements. Retail establishments have faced obstacles due to closures and limitations, prompting a shift towards online platforms and e-commerce sales. Consequently, although the dog supplements market has seen growth during the pandemic, it has also confronted notable challenges that necessitate resolution for sustained prosperity in the future.

Latest Trends and Innovation:

- In July 2020, Nestlé Purina PetCare Company, a subsidiary of Nestlé S.A., acquired Lily's Kitchen, a UK-based natural pet food company, to expand its presence in the dog supplement market.

- In September 2021, Mars Petcare, a subsidiary of Mars, Incorporated, announced the launch of "YuMove ADVANCE 360," an advanced dog supplement designed to support joint health.

- In October 2021, Zoetis Inc., a global animal health company, acquired Preventive Pet, a pet nutrition and wellness startup, to enhance its portfolio of dog supplements and expand its direct-to-consumer offerings.

- In December 2021, Hill's Pet Nutrition, a subsidiary of Colgate-Palmolive Company, introduced "Science Diet Perfect Digestion," a new line of dog supplements formulated to support digestive health in dogs.

- In January 2022, Petco Health and Wellness Company Inc. launched "Vital Care," a new line of dog supplements developed in partnership with The Honest Kitchen, an all-natural pet food company.

- In February 2022, Nutramax Laboratories Veterinary Sciences, Inc., a subsidiary of Nutramax Laboratories, Inc., unveiled "Cosequin Soft Chews with Omega-3," a new dog supplement specifically formulated to support joint health and mobility.

- In March 2022, Royal Canin, a subsidiary of Mars, Incorporated, introduced "Canine Care Nutrition," a range of dog supplements targeting specific health concerns such as weight management, digestion, and coat health.

- In May 2022, WellPet LLC announced the acquisition of Wholesome Pride Pet Treats, a manufacturer of natural dog supplements and treats, to expand its product offerings in the dog supplement market.

Significant Growth Factors:

The growth drivers of the Dog Supplements Market stem from the escalating rates of pet adoption, ened consciousness regarding pet well-being, and the increasing need for preventative healthcare options for dogs.

The market for dog supplements is experiencing a notable upsurge propelled by several pivotal factors. Primarily, the ened awareness regarding pet health and nutrition among dog owners is fostering a surge in the demand for supplements. As pet owners increasingly prioritize providing their dogs with a well-rounded diet, the incorporation of supplements to complement their regular food intake is becoming more prevalent. Additionally, the escalating prevalence of health issues like joint pain, allergies, obesity, and digestive ailments in dogs is spurring market growth. Tailored dog supplements designed to address these specific conditions are garnering ened interest. Furthermore, the expanding pet population, particularly in urban locales, is broadening the consumer demographic for dog supplements. The surge in disposable income levels and the prevailing trend of humanizing pets are propelling pet owners to allocate more resources towards the health and overall well-being of their animal companions, including the integration of supplements. Moreover, the wide assortment of dog supplements available across various distribution channels such as online platforms, pet specialty stores, and veterinary clinics is further augmenting market expansion.

Manufacturers are also actively engaged in fostering product innovation by introducing new and enhanced supplements featuring natural ingredients, novel formulations, and tailored nutritional compositions, thereby stimulating consumer engagement. The trajectory of the dog supplements market is anticipated to maintain growth momentum in tandem with the enduring trend of prioritizing pet health and wellness, coupled with the burgeoning focus on preventive healthcare measures for dogs.

Restraining Factors:

The lack of sufficient knowledge regarding the advantages of canine supplements among pet guardians serves as a hindrance to the expansion of the Dog Supplements Market.

The market for dog supplements is witnessing notable expansion, propelled by a growing awareness of the advantages these supplements offer for canine well-being. However, various factors might hamper the market's potential for growth. Primarily, the cost factor is a significant issue as high-quality supplements can be pricey, thus limiting access for cost-conscious consumers.

Additionally, the absence of standardized regulations in the market can result in the proliferation of substandard or counterfeit products, potentially eroding consumer confidence. Challenges also stem from the limited availability of specialized supplements for different health conditions and variations in the effectiveness of such products. Concerns about the safety and potential adverse effects of supplements may lead some pet owners to hesitate in using them. Moreover, the preference for natural and holistic remedies like homemade diets or alternative therapies could steer pet owners away from commercial supplements. Nevertheless, the Dog Supplements Market shows promise for sustained growth. The growing emphasis on pet health and wellness, alongside increasing disposable incomes, will boost the demand for top-quality supplements. Regulatory measures to standardize the market, combined with improved transparency from manufacturers, will bolster consumer trust and foster well-informed purchase decisions. Furthermore, advancements in research and development will introduce innovative products tailored to address specific health issues, expanding the market's product range. Ultimately, as pet owners acknowledge the positive impact of supplements on their pets' overall health and longevity, the market is set to thrive, creating opportunities for industry stakeholders.

Key Segments of the Dog Supplements Market

Type Overview

• Eye Care

• Dental Care

• Skin & Coat Care

• Digestive Health

• Allergy & Immune System Health

• Hip & Joint Care

• Brain & Heart Care

• General Nutrition

Application Overview

• Supermarkets

• Chain Pet Care Stores

• Private Pet Care Shops (Veterinarians)

• Online Stores

• Others

Regional Overview

North America

• United States

• Canada

• Mexico

Europe

• Germany

• France

• United Kingdom

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• United Arab Emirates

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America