DNA Sequencing Market Analysis and Insights:

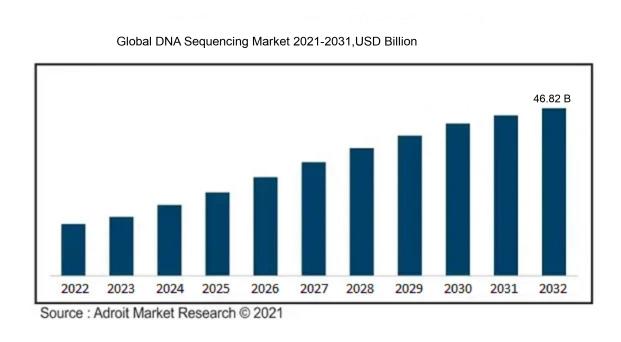

In 2023, the size of the worldwide DNA Sequencing market was US$ 13.25 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 12.87% from 2024 to 2032, reaching US$ 46.82 billion.

The market for DNA sequencing is predominantly propelled by innovations in sequencing technologies, which have markedly lowered costs while enhancing both speed and precision. The upward trend in genetic disorders and the ened focus on personalized medicine are driving the demand for sequencing services in clinical contexts. Furthermore, the broadening scope of genomics research, paired with increased financial investment from public and private sources, stimulates advancements and developments in sequencing methodologies. The integration of DNA sequencing across multiomics disciplines, such as genomics, transcriptomics, and proteomics, amplifies its applicability, especially in cancer research and pharmaceutical development. Additionally, the rising adoption of next-generation sequencing (NGS) in laboratories—due to its exceptional throughput capabilities—alongside the growing use of sequencing in agricultural and environmental applications, significantly fuels market expansion. Collectively, these elements generate a dynamic landscape for the ongoing growth of the DNA sequencing industry.

DNA Sequencing Market Definition

DNA sequencing is a cutting-edge biochemical method employed to ascertain the exact arrangement of nucleotides within a DNA strand. This technique yields vital insights that are essential for genetic studies, medical diagnostics, and various biotechnological applications.

DNA sequencing plays an essential role as it offers fundamental insights into genetic codes, which play a significant role in various biological functions and traits of organisms. By analyzing the exact sequence of nucleotides within a DNA strand, scientists can detect genetic variations associated with illnesses, explore evolutionary connections, and create customized treatments in the realm of personalized healthcare. Furthermore, DNA sequencing propels advancements in fields such as biotechnology, agriculture, and forensic science, facilitating the development of genetically engineered crops, enhancing resistance to diseases, and providing reliable identification methods in criminal cases.

DNA Sequencing Market Segmental Analysis:

Insights On Key Product

Consumable

Consumables are expected to dominate the Global DNA Sequencing Market due to their critical role in the sequencing process and the increasing volume of sequencing applications. As the demand for genomic data continues to rise in research and clinical settings, the reliance on reagents, enzymes, and sequencing kits has become paramount. These consumable products need to be replenished frequently, leading to recurring revenue streams for manufacturers. With advancements in technology resulting in more efficient and targeted sequencing protocols, the growth and development of consumables will be further amplified, making them the cornerstone of the DNA sequencing industry in the coming years.

Instrument

Instruments, while essential to the DNA sequencing process, are not expected to lead in market share growth compared to consumables. They represent a significant upfront investment and, although advancements in sequencing technologies are ongoing, the evolution of instruments tends to occur at a slower pace than the development of consumables. High-throughput sequencers are vital for laboratories; however, their sales can be cyclical and heavily influenced by market saturation. As research facilities expand their capabilities, they will invest in new instruments, but the long-term consumption and continuous demand for consumables will surpass the growth associated with instruments.

Service

Services related to DNA sequencing encompass a range of offerings, including maintenance, support, and bioinformatics analysis. While these services are important for the operational efficiency and accuracy of sequencing labs, they do not exhibit the same level of consistent demand as consumables. As the market matures, the demand for service agreements might grow, particularly as laboratories seek to optimize their investments in instruments. However, the reliance on regular replenishment of consumables means that while services play a supportive role, they are not expected to dominate the market like consumables will in the emerging landscape of DNA sequencing.

Insights On Key Technology

Sequencing by Ligation

Sequencing by ligation is expected to dominate in the DNA sequencing landscape known for its high accuracy and ability to read longer DNA fragments. This method uses DNA ligases to join labeled oligonucleotides to a template strand, providing highly specific and efficient sequencing results. It's particularly beneficial for applications requiring precise base calling. While this technology may not be the most dominant, its advantages in accuracy make it suitable for specialized research endeavors and clinical diagnostics, where error minimization is crucial.

Semiconductor Sequencing

Semiconductor sequencing is expected to grow in the Global DNA Sequencing market due to its cost-effectiveness, speed, and scalability. This technology allows for the parallel sequencing of DNA strands without the need for traditional optical methods, leading to faster results at a reduced price. As research and clinical applications increasingly demand high-throughput sequencing capabilities, semiconductor sequencing offers a compelling advantage. Furthermore, its integration into various research facilities and laboratories makes it more accessible and appealing to a broader audience. With continuous advancements in semiconductor technology, this method is well-positioned to lead the market in the coming years.

Pyrosequencing

Pyrosequencing is a method that utilizes DNA polymerase and releases pyrophosphate during DNA synthesis to produce a light signal proportional to the length of the DNA being sequenced. This technique is favored for its real-time analysis and ability to provide rapid results. Although it has some limitations concerning read lengths compared to other technologies, its unique features make it suitable for specific applications, such as single nucleotide polymorphism (SNP) genotyping and microbial identification. The technique's efficiency in smaller-scale projects and its real-time data generation is advantageous in many research contexts.

Insights On Key Application

Biomarker and Cancer

The biomarker and cancer-focused application is expected to dominate due to the emphasis on early cancer detection and targeted therapies. Researchers and healthcare professionals rely on DNA sequencing to discover and validate novel biomarkers associated with various cancers. This application supports personalized treatment strategies and enables the monitoring of therapeutic effectiveness in patients. The ongoing research and clinical trials in oncology, utilizing DNA sequencing, will likely increase its impact as a pivotal application in the healthcare landscape.

Personalized Medicine

Personalized medicine is expected to grow well in the global DNA sequencing market. This is driven by the increasing demand for tailored therapies that target specific genetic profiles of individuals. As healthcare shifts toward more individualized approaches, the relevance of DNA sequencing in developing personalized treatment plans becomes paramount. Additionally, advancements in sequencing technology have made it more accessible and affordable, allowing for broader utilization in clinical settings. The growing focus on precision medicine initiatives around the world and the increasing popularity of pharmacogenomics further amplify the role of DNA sequencing in facilitating personalized health solutions, thereby solidifying its position as the leading application in the market.

Diagnostics

Diagnostics is a crucial application in the DNA sequencing market, helping to identify genetic disorders and infectious diseases. With the rise of next-generation sequencing technologies, diagnostic applications have become more efficient and accurate. Healthcare providers are increasingly utilizing DNA sequencing for early detection and prevention strategies, which is a significant factor driving this application’s growth. Overall, the ability to swiftly and accurately diagnose conditions through DNA sequencing is enhancing patient care and influencing health outcomes significantly.

Reproductive Health

Reproductive health is another vital area where DNA sequencing is being increasingly utilized. The technology plays a key role in preconception and prenatal testing, allowing for the identification of genetic abnormalities in embryos and fetuses. By providing critical information about potential genetic disorders, DNA sequencing empowers families to make informed decisions regarding their reproductive options. The growing awareness and acceptance of genetic testing in reproductive health contexts are expected to drive this application forward in the global market.

Forensics

Forensics represents an essential application of DNA sequencing, particularly in criminal investigations and legal matters. The ability to analyze genetic material from various sources enables law enforcement agencies to solve crimes and identify suspects accurately. The growing emphasis on using advanced DNA techniques to enhance the reliability of forensic analyses is leading to increased investments and developments in this sector. As public interest in crime solving continues to rise, the forensic application of DNA sequencing will maintain a significant presence in the overall market landscape.

Insights On Key End User

Academic and Government Research Institutes

Academic and government research institutes are anticipated to dominate the Global DNA Sequencing as they play a significant role in advancing the field of genomics and DNA sequencing. They are often at the forefront of research, utilizing sequencing technologies for fundamental biological studies, genetic research, and public health initiatives. With a focus on innovation and exploring new genomics frontiers, these institutions often receive substantial funding to conduct research that can lead to significant scientific breakthroughs. However, while they contribute immensely to knowledge generation and training, their market uptake of DNA sequencing technologies may not match the commercial urgency and capital investment seen in the pharmaceutical sector.

Pharma companies

Pharma companies are growing rapidly due to their crucial role in drug discovery, development, and personalized medicine. The rising need for precision medicine, alongside advancements in genomic technologies, has prompted pharmaceutical firms to invest heavily in DNA sequencing. As they strive to develop more targeted therapies, the integration of sequencing into research and development is becoming vital. This trend is further fueled by collaborations with biotech companies and academic institutions, enhancing the capabilities and applications of DNA sequencing in drug development.

Biotech Companies

Biotech companies are heavily influenced by the advancements in DNA sequencing technologies which are critical to their operations, particularly in developing novel therapeutics and diagnostics. They leverage these technologies to understand genetic diseases better and enhance their product pipelines. The increasing investment in biotechnology, driven by the demand for innovative treatments and personalized healthcare solutions, is a clear indicator of their growing importance in the market. While they are making strides in utilizing DNA sequencing, they still tend to follow the lead of pharma companies when it comes to large-scale applications and commercial uptake.

Hospitals and Clinics

Hospitals and clinics are increasingly adopting DNA sequencing to improve patient diagnostics and personalized treatment plans. The integration of genomic data into clinical workflows enables healthcare providers to make more informed decisions regarding patient care, such as tailoring medications based on genetic profiles. While the applications in clinical settings are expanding, the uptake of DNA sequencing remains comparative to the more research-focused markets like pharmaceuticals and biotechs. Factors such as cost, regulatory landscape, and the need for specialized staff can hinder the rapid expansion of DNA sequencing in routine clinical practice, limiting its dominance in the market.

Global DNA Sequencing Market Regional Insights:

North America

North America is expected to dominate the Global DNA Sequencing market, primarily due to its advanced healthcare infrastructure, high investment in biotechnology research, and robust funding from both public and private sectors. The presence of leading companies and research institutions in this region fosters innovation and technology development, further propelling the market. The rapid adoption of next-generation sequencing (NGS) technologies and a favorable regulatory environment also contribute to North America's leadership in the DNA sequencing space. Additionally, a strong consumer base, coupled with increasing healthcare expenditure, enhances the region's position as a powerhouse in DNA sequencing applications.

Latin America

Latin America, while not the leading region, demonstrates significant potential for growth in the DNA sequencing market. Increased investments in healthcare research and development, alongside improved access to genomic technologies, are shaping its future. Collaborative efforts with global biotechnology companies and academic institutions are fostering advancements in personalized medicine, which could drive market expansion. However, challenges such as economic disparities and varied healthcare infrastructure across countries may hinder rapid progress in this.

Asia Pacific

The Asia Pacific region is increasingly emerging as a key player in the Global DNA Sequencing market, fueled by rapid technological advancements, a growing emphasis on personalized medicine, and large population bases that create demand for genomic research. Countries like China and India are leading investments in biotechnology and pharmaceuticals, with initiatives aimed at enhancing healthcare outcomes. Despite facing hurdles such as regulatory complexities and infrastructure disparities, the region's overall growth trajectory is promising, positioning it as a significant contender in the DNA sequencing landscape.

Europe

Europe holds a substantial share in the Global DNA Sequencing market due to its strong regulatory framework, high research investments, and a collaborative approach among public and private sectors. The region's focus on precision medicine and extensive genomics research contribute to market opportunities, though competition from North America might limit its growth rate. The presence of well-established healthcare systems and innovative startups enhances prospects, but the market could face fragmentation across countries, affecting regional cohesion in advancements.

Middle East & Africa

The Middle East & Africa region is currently the least dominant in the Global DNA Sequencing market, though it is gradually gaining traction. Increasing investments in healthcare and biotechnology are evident, along with initiatives aimed at incorporating genomic technologies into clinical practice. However, limited access to advanced sequencing technologies, economic challenges, and potential political instability impede significant progress. Regional collaborations and international partnerships focused on research and development could help accelerate growth in this market in the future.

DNA Sequencing Market Competitive Landscape:

Prominent entities in the worldwide DNA sequencing industry, including Illumina, Thermo Fisher Scientific, and BGI, spearhead advancements by creating cutting-edge sequencing technologies and broadening their usage in genomics, tailored healthcare, and agronomic studies. Their partnerships with academic and research institutions improve the availability and effectiveness of sequencing solutions on a global scale.

Major participants in the DNA sequencing industry comprise Illumina, Inc., Thermo Fisher Scientific Inc., BGI Group, PacBio (Pacific Biosciences of California, Inc.), Roche Sequencing Solutions, Oxford Nanopore Technologies, QIAGEN N.V., Genomatix Software GmbH, Eurofins Scientific, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Ambry Genetics, 10x Genomics, Inc., and Applied Biosystems (a subsidiary of Thermo Fisher Scientific).

Global DNA Sequencing Market COVID-19 Impact and Market Status:

The Covid-19 pandemic greatly expedited the need for DNA sequencing technologies, fueled by the critical necessity to comprehend the virus's genetic makeup and improve genomic monitoring.

The COVID-19 pandemic had a profound impact on the DNA sequencing industry, presenting both obstacles and avenues for growth. At the onset, disruptions to supply chains and the functioning of laboratories impeded research and development efforts. Conversely, the situation also led to an upsurge in the need for genomic sequencing, particularly for monitoring viral mutations and decoding the SARS-CoV-2 genome. Heightened government funding and collaborative initiatives were introduced to enhance genomic epidemiology, driving innovation in sequencing technologies and methodologies. Firms within the industry responded by improving their product offerings and prioritizing COVID-19 diagnostic solutions, resulting in a surge in the use of next-generation sequencing (NGS) instruments and reagents. Moreover, the pressing requirements for personalized medicine and the development of vaccines further fueled interest in DNA sequencing, setting the stage for significant market expansion in the aftermath of the pandemic. In summary, the interplay of operational hurdles and increased demand for genomic insights has transformed the DNA sequencing market, facilitating advancements that have implications beyond the realm of infectious disease research.

Latest Trends and Innovation in The Global DNA Sequencing Market:

- In October 2022, Illumina completed the acquisition of Grail, a company focused on multi-cancer early detection, enhancing Illumina's capabilities in genomic applications and early-stage cancer detection. The deal was valued at approximately $7.1 billion.

- In December 2022, Thermo Fisher Scientific announced an agreement to acquire The Binding Site Group, which specializes in specialized diagnostics including immunoassays to support research and applications in oncology and immune monitoring, broadening Thermo Fisher’s influence in the precision medicine arena.

- In April 2023, BGI Group launched the DNBSEQ-G99, a high-throughput sequencer capable of generating up to 6TB of sequence data in a single run. This technology aims to deliver faster and more cost-effective sequencing solutions to researchers worldwide.

- In August 2023, Oxford Nanopore Technologies secured a partnership with Genomics England to enhance the NHS's genomic testing capabilities, aiming to facilitate better genomic diagnosis and personalized treatment strategies within the UK healthcare system.

- In September 2023, Pacific Biosciences of California (PacBio) introduced its "HiFi" sequencing technology, which significantly improves the accuracy of DNA sequencing. This innovation aims to support applications in clinical research and diagnostic settings.

- In October 2023, Roche announced an investment in the development of next-generation sequencing technologies, focusing on enhancing the speed and scalability of genomic testing to support oncology and rare disease diagnostics better.

DNA Sequencing Market Growth Factors:

Advancements in technology, a growing emphasis on personalized medicine, and an escalating interest in genomic research are key factors propelling the DNA sequencing market.

The DNA sequencing industry is witnessing remarkable expansion, influenced by a variety of crucial elements. Primarily, innovations in sequencing technologies, especially next-generation sequencing (NGS), have significantly lowered costs while enhancing throughput, thereby making genetic analysis more widely available. The growing incidence of genetic conditions and the shift towards personalized medicine are intensifying the need for genetic testing and sequencing services, which is resulting in more applications in fields such as oncology, reproductive health, and the study of rare diseases.

Moreover, an increased emphasis on genomics in research and academic settings has led to greater funding and investment in DNA sequencing initiatives. Technological progress, including the creation of portable sequencing instruments and advancements in bioinformatics solutions, is further propelling market growth by facilitating quicker and more efficient data analysis. The diverse applications of DNA sequencing, ranging from agricultural enhancements to environmental assessments for biodiversity, also add to the market's vibrancy.

DNA Sequencing Market Restraining Factors:

The DNA sequencing market faces considerable obstacles, including elevated expenses, intricate technological requirements, and regulatory complications.

The DNA sequencing industry encounters a variety of challenges that may impede its growth trajectory. The substantial expenses linked to state-of-the-art sequencing technologies and apparatus can discourage widespread adoption, especially in lower to middle-income areas. Additionally, the intricate nature of sequencing processes and the necessity for qualified personnel to operate these technologies present hurdles for smaller laboratories and research facilities. Regulatory hurdles also significantly hinder progress, with inconsistent standards across different nations complicating the approval of novel sequencing techniques and instruments. Furthermore, issues related to data privacy and the ethical considerations surrounding the use of genomic information can delay the rollout of sequencing services. Inadequate reimbursement frameworks for genetic testing further restrict market advancements, as healthcare professionals might hesitate to invest in sequencing technologies without assured financial returns. Nevertheless, ongoing technological innovations and an increasing focus on personalized medicine are fostering advancements in this domain. As these challenges are progressively tackled through collaboration among industry players, the DNA sequencing market is likely to experience considerable growth in the near future, presenting promising prospects for both research and clinical applications.

Key Segments of the DNA Sequencing Market

By Product:

- Consumable

- Instrument

- Service

By Technology:

- Semiconductor sequencing

- Sequencing by ligation

- Pyrosequencing

By Application:

- Diagnostics

- Biomarker and cancer

- Reproductive health

- Personalized medicine

- Forensics

By End User:

- Academic and Government research institutes

- Pharma companies

- Biotech companies

- Hospitals and clinics

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America