The value of the Digital Signature market is projected to grow to US$ 17.5 Billion with an estimated CAGR of 20.6% by 2032

.jpg)

The market size for global digital signature is anticipated to reach at USD 5 billion by 2025. The factors that include enhanced security with a seamless and controlled workflow, along with growing investments on electronic document analysis by private enterprises and governments are responsible for the global digital signature industry growth in the coming few years. Several advanced technologies are evolving to facilitate the internet authentication.

During online communication, the digital signatures facilitate enterprises to assure and authenticate client’s records and identity. Digital signatures provide highly precious prospects for businesses to enter into noncommercial agreements. For instance, if the law authenticates digital signature as valid signatures, an electronic email marketing offer would be considered as legal, similar to sending it as a hard copy duly signed by the candidate. Digital signature recognizes e-documents similarly as the printed handwritten signatures validate documents. The digital signature industry growth is fueled by promoting technological innovations to eradicate fraud, and enhance scalability, transparency, and data integrity.

Digital Signature Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | US$ 17.5 Billion |

| Growth Rate | CAGR of 20.6% during 2022-2032 |

| Segment Covered | By Deployment, Industry Vertical,Regional |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Adobe, Gemalto, Ascertia, OneSpan, DocuSign, Entrust Datacard, Secured Signing, Identrust, SIGNiX, Kofax, RPost Technologies, and more. |

Key Segment Of The Digital Signature Market

By Deployment (USD Billion)

• Cloud based Digital Signature

• On Premises Digital Signature

Industry Vertical, (USD Billion)

• Digital Signature for BFSI

• Digital Signature for Real Estate

• Digital Signature for Education

• Digital Signature for Government

• Digital Signature for Healthcare

• Digital Signature for Retail

• Digital Signature for Transportation

• Digital Signature for Legal Processes

• Digital Signature for Other Verticals

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

Use of paper during getting approvals, signing agreements or contracts, and performing transactions, involves a chain of tasks such as printing and scanning, among others, which increases the possibilities of errors. Moreover, the paper is likely to get damaged over period. Digital signature provides an enterprise-grade automation process which can lessen the amount of errors into the process through digital signature solutions. It also facilitates quicker and easier validation and cross-referencing. This in turn, assists businesses cut down expenditure and improve customer service, as digitally signed documents make sure that all agreed procedures are followed even during the ad-hoc transaction failure. Such factors encourage businesses to implement digital signature solutions, hence, boosting the industry growth.

Component Segment

The global digital signature market contains both solution and service segment. The solution is further segregated into software and services. The software segment has maximum revenue share within the global digital signature market in 2019. This is predominantly owing to a high demand for software solutions adoption and enhanced use as compared to the hardware solutions, and availability of deployment alternatives for various mobile devices. The services segment is anticipated to grow at a significant growth rate from 2020 to 2025.

Deployment Segment

Based on the deployment segment, the market is bifurcated into two sub-segments that are on-premise, and cloud. In 2019, the on-premise segment gathered the largest market revenue and it is anticipated to dominate the market throughout the forecast period. However, the cloud segment is anticipated to grow at a substantial growth rate over the forecast period. The cloud enables organizations with unified platform with SaaS based services providing improved security.

Application Segment

Based on the application, the market is segmented into BFSI, telecom & IT, healthcare, education, real estate, government, and others. The market for telecom & IT sector is anticipated to possess the largest market share in 2019 since the manufacturing companies today are predominantly developing to match their user needs. Moreover, accelerated cash flow and invoicing, real-time visibility, and enhanced compliance in the intricate document processes are some of the factors responsible for the digital signature demand.

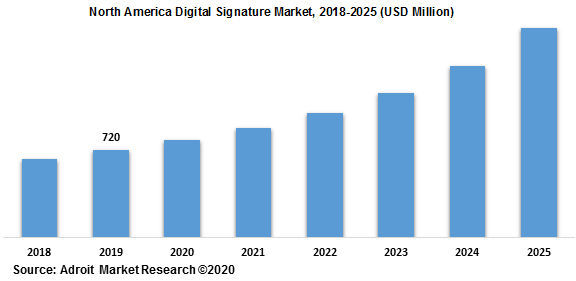

The global digital signature industry is a wide range to North America, Asia Pacific, South America, Europe, and the Middle East & Africa. North America is considered a mature market in the digital signature applications, owing to an outsized presence of organization with the availability of technical expertise and advanced IT infrastructure. The US and Canada are the highest contributory countries to the expansion of the digital signature market in North America.

The major players of the global digital signature market are Adobe, Gemalto, Ascertia, OneSpan, DocuSign, Entrust Datacard, Secured Signing, Identrust, SIGNiX, Kofax, RPost Technologies, and more. The digital signature market is fragmented with the existence of well-known global and domestic players across the globe.