The global digital railway market size is anticipated to reach USD 68 billion By 2025. Factors such as government initiatives and Public-Private security Partnership (PPP), hyper-urbanization, and high demographic growth, along with the adoption of automation technologies to improve optimization are anticipated to fuel the digital railway industry growth in the coming few years.

Trains convey millions of passengers and freight every year, and rail organizations completely depend on reliable and efficient rail asset management operations to successfully meet the increasing demand for rail operations.

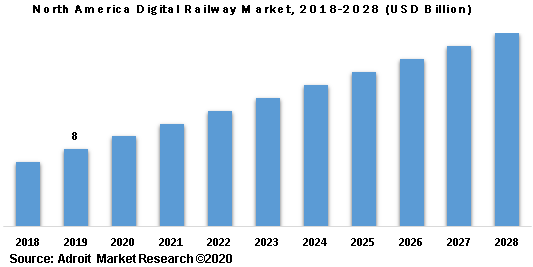

It’s being expected that by 2028, the Digital Railway market cap will hit $103.7 billion at a CAGR growth of about 9.2%.

.jpg)

Information & Communication Technology has contributed significantly to delivering operations & asset management solutions for the rail companies. To construct a smarter railway infrastructure, railway experts require advanced and efficient digital railway solutions that are likely to promote the industry growth in the coming future.

Digital Railway Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2012 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | $ 103.7 billion |

| Growth Rate | CAGR of 9.2%. during 2018-2028 |

| Segment Covered | By Offering, By Application, Regional |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Siemens, Hitachi, Alstom, Cisco, IBM, ABB, Huawei, Fujitsu, DXC, Indra, Thales, Atkins, Toshiba, and more |

Key Segment Of The Digital Railway Market

By Offering, (USD Billion)

o Solutions

• Remote Monitoring

• Network Management

• Route Optimization And Scheduling

• Predictive Maintenance

• Analytics

• Security

• Others

o Services

• Professional Services

• Managed Services

By Application, (USD Billion)

• Rail Operations Management

• Asset Management

• Passenger Information System

• Other

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

Governments throughout the globe are undertaking strategic investments within the rail industry to upgrade the current railway infrastructure, thus, enhancing the rail transportation system of the nation. The Digital Railway system provides enhanced control and operation, traffic planning, passenger and staff information management, data analytics, among others. Additionally, advanced train management solutions implement on-train processing and advanced digital communication to keep track of the location and speed of trains. On the other hand, the digital railway also delivers disaster management, which is upheld to be essential for the safeguarding of human lives and assets.

In March 2019, Siemens Mobility introduced Digital Lab, a project for its Intelligent Traffic System situated in Germany. This would help to streamline the railway traffic digitally, thus, decreasing road congestion and population. On the other hand, growing smart city projects and metro transportation within the developing economies is anticipated to have a positive impact on the digital railway industry growth.

Offerings Segment

Based on the offerings segment, the market is bifurcated into two sub-segments that are solutions, and services. The solutions segment is further classified into remote monitoring, route optimization, and scheduling, analytics, network management, predictive maintenance, security, others. Whereas the services segment is further classified into managed services, and professional services.

The predictive maintenance segment is anticipated to grow at a significant CAGR over the forecast period. However, the network management segment to witness the largest market share in 2019. The major share of segment revenue is likely to come from the European region, owing to a wide application of modern rail infrastructure within the rail industry.

Application Segment

Based on the application, the market is segmented into rail operations management, passenger information system, asset management, and others. The market for a passenger information system is anticipated to possess the largest market share in 2019. However, rail operation management is likely to grow at the highest growth rate from 2020 to 2028.

The global digital railway market is a wide range to North America, Europe, APAC, South America, and the Middle East & Africa. Europe is considered a mature market in the digital railway applications, owing to an outsized presence of an organization with the availability of technical expertise and advanced IT infrastructure. Nations from Western Europe including France, Germany, and the UK, have well-established railway infrastructure equipped with advanced digital railway systems. Moreover, Social, as well as trade agreements within the European Union nations, have encouraged cross-border trade, as well as passenger traffic commute in Europe.

The major players of the global digital railway market are Siemens, Hitachi, Alstom, Cisco, IBM, ABB, Huawei, Fujitsu, DXC, Indra, Thales, Atkins, Toshiba, and more. The digital railway market is fragmented with the existence of well-known global and domestic players across the globe.