Market Analysis and Insights:

The market for Global Dental Suture was estimated to be worth USD 0.54 billion in 2024, and from 2024 to 2034, it is anticipated to grow at a CAGR of 6.9%, with an expected value of USD 0.98 billion in 2034.

.jpg)

The growth of the Dental Suture Market can be attributed to multiple critical factors. One significant driver is the increasing number of dental procedures that require surgical interventions, particularly in the areas of implants and periodontal treatments. Consumers are becoming more conscious of their oral health and aesthetic needs, which, alongside advancements in dental technology, is fueling market expansion. Furthermore, the aging population, who are typically more susceptible to dental complications, is leading to an uptick in surgical interventions that en the demand for specialized sutures.

The introduction of innovative suture materials, including absorbable and biocompatible choices, has been shown to improve patient outcomes and satisfaction, further contributing to the market's growth. Additionally, the approval and certification of dental sutures by regulatory bodies support their increased use in clinical environments. The rise in dental practices and investment in dental healthcare infrastructure across the globe signals a positive trajectory for the market, emphasizing the crucial role of sutures in enhancing surgical efficacy and expediting patient recovery.

Dental Suture Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2034 |

| Study Period | 2023-2034 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2034 | USD 0.98 billion |

| Growth Rate | CAGR of 6.9% during 2024-2034 |

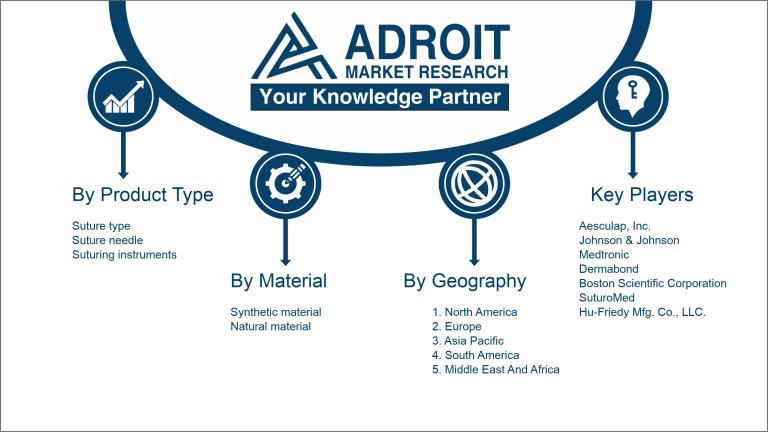

| Segment Covered | By Product Type, By Technique, By End Use, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Aesculap, Inc. (part of the B. Braun group), Johnson & Johnson, and Medtronic. Other notable contributors are Dermabond, Boston Scientific Corporation, SuturoMed, and Hu6.1. Friedy Mfg. Co., LLC. Significant names also include Assut Medical S.A., DemeTECH Corporation, and KLS Martin Group. Ethicon, Inc. (a subsidiary of Johnson & Johnson), ConMed Corporation |

Market Definition

A dental suture is a specific type of thread or material employed to close wounds or surgical incisions within the oral cavity, facilitating healing and the regeneration of tissues. It is crafted to hold tissues in place while still permitting essential movement during the recovery period.

Dental sutures are essential in both oral surgical operations and periodontal treatments, as they contribute significantly to effective wound healing and the reduction of complications. By securing soft tissues like the gums, these sutures ensure that surgical flaps remain stable, preventing any reopening that could result in infections or prolonged healing times. They help maintain the close positioning of tissues, which is vital for restoring the mouth's natural structure and achieving favorable aesthetic results. Furthermore, dental sutures play a role in alleviating postoperative pain and facilitating quicker recovery. Ultimately, their significance lies in their ability to enhance the success of surgical procedures and boost patient satisfaction throughout the recovery period following dental work.

Key Market Segmentation:

Insights On Key Product Type

Suture Type

The Suture Type category is expected to dominate the Global Dental Suture Market due to its extensive application across various dental procedures, including oral surgeries and periodontal treatments. These sutures are specifically designed to meet the needs of dental practitioners, ensuring effective wound closure and promoting faster healing. The increased prevalence of dental surgeries, along with advancements in suture materials that enhance performance and biocompatibility, gives this category a significant edge. Moreover, the growing demand for minimally invasive procedures drives the adoption of specific suture types that cater to sensitive and intricate dental work.

Suture Needle

The Suture Needle category plays a crucial role in the dental suturing process. These needles are engineered for precision and ease of use, facilitating effective puncturing and suturing of soft tissue in dental surgeries. As dental professionals continue to prioritize accuracy and efficiency in their procedures, the demand for innovative suture needles that maintain optimal sharpness and strength is expected to rise. This emphasizes their importance in enhancing surgical outcomes and minimizing patient discomfort, making them an essential component in dental suturing applications.

Suturing Instruments

The Suturing Instruments category encompasses various tools specifically used for the suturing process, enhancing the overall efficiency of dental procedures. Instruments like needle holders, forceps, and scalpels are crucial for dentists, providing them with the requisite support during intricate suturing tasks. The innovation and development of ergonomically designed tools make them more comfortable to use, contributing to their increased utilization in dental practices. As more practitioners recognize the benefits of high6.1. quality suturing instruments, this category will continue to see steady growth in alignment with rising dental surgery cases.

Insights On Key Material

Synthetic Material

The Global Dental Suture Market is expected to be dominated by synthetic materials due to their increasing applications in various dental procedures. Synthetic sutures are primarily made from materials like polyglactin and polydioxanone, which offer enhanced properties such as bacterial resistance, predictable absorption rates, and a reduced risk of inflammation compared to their natural counterparts. Furthermore, synthetic sutures provide better tensile strength, making them suitable for complex surgical procedures. With advancements in materials science and technology, dental professionals are increasingly adopting synthetic sutures for their reliability and performance, positioning this category as a leading choice in the market.

Natural Material

Natural materials such as silk and catgut, while historically significant in suturing, are experiencing a decline in popularity compared to synthetic options. These materials are often preferred for their biocompatibility and ease of handling. However, they can have limitations, including variably fast absorption rates and a higher risk of eliciting allergic reactions in some patients. Moreover, they may not offer the same level of consistency and performance as synthetic alternatives. As the dental field evolves with a focus on advanced materials, natural materials are gradually becoming a less preferred choice among practitioners who prioritize superior outcomes in patient care.

Insights On Key Technique

Interrupted Simple Sutures

Interrupted simple sutures are expected to dominate the Global Dental Suture Market due to their versatility and ease of use. This technique allows for precise control over wound closure, minimizing tension on tissue and promoting optimal healing. The ability to place sutures individually means that practitioners can cater to varying tissue types and wound characteristics, making this option ideal in various dental procedures, including periodontal surgeries and tooth extractions. Moreover, interrupted sutures tend to have a lower risk of failure since any single suture can be replaced without compromising adjacent sutures. This aspect appeals to dental professionals focusing on patient safety and successful outcomes.

Mattress Sutures

Mattress sutures represent a reliable technique particularly valued for their distribution of tension across the wound edges. By utilizing a far6.1. near and near6.1. far pattern, this method creates a secure closure, which is essential in procedures requiring high tensile strength, such as in cases of deep tissue involvement. Their relative complexity compared to simpler suture techniques means that mattress sutures are often preferred in specialized scenarios where additional support is necessary, enabling enhanced stability and reduced risk of dehiscence.

Crisscross Suture

The crisscross suture technique, while not as prevalent as others, offers unique attributes that can be advantageous in specific contexts. This method allows for a more extensive distribution of tension across the wound, making it suitable for larger or more irregularly shaped incisions. However, its complexity may limit its use to particular procedures, often necessitating a higher degree of skill from the dental surgeon. Thus, while effective, crisscross sutures do not command the same level of preference as more straightforward techniques like interrupted sutures.

Continuous Simple Sutures

Continuous simple sutures are recognized for their efficiency in closing long wounds quickly, offering a streamlined process that can be advantageous in busy dental practices. They are particularly useful for procedures involving long linear incisions, facilitating rapid closure and reducing operation time. However, the challenge lies in their tendency to distribute tension across multiple areas of the wound, which could present issues if a portion fails. Their risk of complications and the need for careful technique may limit their overall market dominance compared to interrupted simple sutures, which provide more individualized control during the stitching process.

Insights On Key End use

Dental Clinics

The dental clinics is expected to dominate the Global Dental Suture Market due to the increasing prevalence of dental procedures and surgeries, along with a growing emphasis on oral healthcare globally. Dental clinics often serve as primary facilities for patients seeking routine and specialized treatments, leading to a higher consumption of dental sutures. The rising number of dental professionals and advancements in dental technology, including minimally invasive surgical techniques, have also contributed to the demand for specialized sutures. Furthermore, as patient awareness regarding oral health increases, more patients are utilizing dental services, solidifying the role of dental clinics as the leading end user.

Hospitals

The hospitals represents a significant component of the Global Dental Suture Market due to their extensive surgical procedures and patient care needs. Hospitals equipped with dental departments or oral surgery units perform a variety of complex dental surgeries that require advanced suturing materials. The trend toward comprehensive surgical care in hospital settings emphasizes the use of quality sutures, which influences procurement patterns that tend to favor hospitals. Furthermore, the rise of outpatient surgical procedures within hospitals enhances the demand for dental sutures, making this an essential player in the overall market landscape.

Ambulatory Surgical Centers

Ambulatory surgical centers are gaining traction in the Global Dental Suture Market as they provide a specialized environment for various dental surgeries that do not require overnight hospitalization. These facilities are designed for efficiency, allowing patients to undergo procedures and return home the same day, which is attractive for both patients and insurance providers. The rise in minimally invasive procedures in these centers has prompted the need for high quality dental sutures tailored to specific surgical techniques. As the trend toward outpatient care continues, the role of ambulatory surgical centers in the dental suture market is expected to grow.

Other End Users

The other end users category in the Global Dental Suture Market encompasses various entities including instructional institutions, veterinary practices, and research facilities that may utilize dental sutures indirectly. While this may not demonstrate the same growth pace as dental clinics or hospitals, it still plays a crucial role in niche applications, especially in research and development settings. The ongoing advancements in dental technology and education further emphasize the need for sutures in non mainstream applications, ensuring that this part of the market remains relevant. Although smaller in scale, its contributions support advancements in dental suture design and usage.

Insights on Regional Analysis:

Asia Pacific

The Asia Pacific region is poised to dominate the global dental suture market primarily due to the increasing prevalence of dental disorders and a rapidly growing population. Key drivers include major investments in healthcare infrastructure, an expanding dental industry, and a rise in dental tourism. Countries like India and China contribute significantly to this growth as they improve access to dental care and cosmetic procedures. Additionally, technological advancements in dental suturing techniques and materials further support the region's upward trajectory. The increasing awareness about oral hygiene and the importance of dental procedures will also play a crucial role in solidifying the Asia Pacific's leading position in this market.

North America

North America holds a significant share of the global dental suture market due to advancements in dental technology and a well6.1. established healthcare infrastructure. The U.S. and Canada are key players, focusing on research and development which leads to innovative dental solutions. Additionally, a higher incidence of dental6.1. related issues among the aging population and increased dental insurance coverage further drive market growth in this region. Educational campaigns promoting oral health awareness have also ened overall demand for dental services, thus bolstering the dental suture market.

Europe

In Europe, the dental suture market is benefiting from a strong focus on healthcare quality and patient safety regulations. Various countries, notably Germany, the UK, and France, are investing in advanced dental procedures and products. An aging population requiring extensive dental care procedures, along with a growing emphasis on cosmetic dentistry, propels the demand for dental sutures. Integration of cutting6.1. edge technologies and a robust research base in dental materials also contribute to maintaining a stable market presence. However, market growth may be tempered by economic challenges in certain parts of the region.

Latin America

The Latin American dental suture market is expanding steadily, influenced by rising disposable incomes and an increasing demand for cosmetic dentistry. Brazil and Mexico lead in market size, fueled by improvements in dental practices and accessibility to dental care resources. Moreover, the growing awareness of oral health significantly affects the consumption of dental products, including sutures. Challenges such as economic fluctuations and varying healthcare regulations in different countries may hinder rapid growth, but overall prospects remain positive due to ongoing healthcare investments.

Middle East & Africa

In the Middle East and Africa, the dental suture market is gradually gaining traction owing to increased awareness about oral health and advancements in medical technology. Nations like the UAE and South Africa are making substantial investments in their healthcare systems, thereby enhancing access to dental care. Dental tourism is also emerging as a vital factor, with international patients seeking affordable and quality dental treatments. However, the region faces challenges related to economic instability and infrastructure limitations, which could impact the pace of market expansion despite a growing need for dental solutions.

Company Profiles:

Major contributors in the worldwide dental suture sector, encompassing producers and distributors, propel innovation through the creation of superior suturing materials and cutting6.1. edge technologies, while also maintaining product accessibility and adhering to regulatory requirements. Their collaborative alliances and efforts to expand into new markets play a crucial role in shaping competitive trends and improving patient results during dental treatments.

The dental suture market includes several major companies, such as Aesculap, Inc. (part of the B. Braun group), Johnson & Johnson, and Medtronic. Other notable contributors are Dermabond, Boston Scientific Corporation, SuturoMed, and Hu6.1. Friedy Mfg. Co., LLC. Significant names also include Assut Medical S.A., DemeTECH Corporation, and KLS Martin Group. Ethicon, Inc. (a subsidiary of Johnson & Johnson), ConMed Corporation, and 3M are key players. Additionally, Smith & Nephew, Stryker Corporation, and ACRObiosystems are active participants in the market. Internationally, Pfizer, Inc. and Nitinol Devices & Components are recognized contributors. Together, these companies are essential in advancing the dental suture market by offering a diverse range of products for dental applications.

COVID 19 Impact and Market Status:

The Covid 19 pandemic profoundly impacted the worldwide dental suture market, resulting in postponed dental treatments and surgeries. This situation contributed to a notable decline in the demand for dental sutures during the of lockdown measures.

The dental suture market experienced considerable challenges due to the COVID 19 pandemic, which disrupted dental services worldwide as healthcare facilities focused on combating the virus. Initially, there was a noticeable decrease in demand for dental sutures as non urgent dental treatments were delayed, resulting in a lower usage of surgical sutures. Moreover, interruptions in the supply chain led to issues with the availability of these products, as manufacturing facilities underwent temporary closures and faced shortages of raw materials. Nevertheless, with the gradual reopening of dental services and the implementation of strict infection control measures, the market has started to recover. Furthermore, a ened awareness of oral health and an increase in preventive care efforts in the post pandemic era have spurred demand for dental sutures as patients seek out elective procedures once more. Advances in suture technology, including the development of biocompatible and absorbable materials, have also played a significant role in driving market expansion. In summary, while the pandemic posed immediate obstacles, forecasts indicate that the dental suture market is poised for a rebound as dental practices evolve with the new landscape.

Latest Trends and Innovation:

In October 2022, Johnson & Johnson announced the acquisition of a dental device startup that specializes in innovative suturing systems designed for dental surgeries, aiming to expand its product offerings in the oral healthcare sector.

In November 2022, Aesculap, a division of B. Braun, launched a new line of resorbable sutures specifically designed for dental applications, incorporating advanced synthetic materials to improve patient outcomes and reduce healing times.

In March 2023, Sutures India expanded its product portfolio by introducing a range of biodegradable dental sutures, developed to minimize environmental impact while ensuring high performance in dental surgical procedures.

In June 2023, Medtronic and a leading dental research institute announced a collaborative partnership focused on developing next6.1. generation surgical sutures with antimicrobial properties to enhance dental surgery efficiency and reduce infection rates.

In August 2023, C. R. Bard, a subsidiary of Becton, Dickinson and Company, made headlines by launching a new type of polyester6.1. based dental suture, which features enhanced knot security and an innovative coating for ease of use during dental procedures.

In September 2023, Nobel Biocare entered into a strategic alliance with an emerging tech firm to integrate AI6.1. driven technology into their dental suturing products, aimed at improving precision in dental surgeries and reducing operation times.

In October 2023, Dentsply Sirona announced a merger with a dental implant company, facilitating a combined product line that includes suturing solutions designed to complement implant placement and oral surgical procedures.

Significant Growth Factors:

The primary drivers contributing to the expansion of the Dental Suture Market encompass a surge in dental interventions, innovations in suture technology, and ened public consciousness regarding oral hygiene.

The Dental Suture Market is witnessing substantial growth driven by various critical factors. A primary contributor is the rising incidence of dental ailments coupled with an increase in dental procedures, fueled by an aging demographic and greater awareness regarding oral health. Furthermore, advancements in dental techniques, particularly in minimally invasive surgeries, necessitate specialized sutures, enhancing market development. The growing consumer focus on aesthetics is also causing a rise in cosmetic dental operations, which subsequently boosts suture usage.

Technological progress in suture materials, notably the introduction of biodegradable and antimicrobial options, is improving both clinical results and patient experience, thus adding to market momentum. The surge in dental tourism, especially in emerging economies, presents additional opportunities for growth within the dental suture sector. Increased investment by manufacturers in dental research and innovation is broadening the range of products available. Lastly, the emergence of affordable and easily applicable surgical solutions is drawing in a wider array of dental practitioners, further boosting market demand. Together, these elements are creating a vigorous environment for growth in the Dental Suture Market.

Restraining Factors:

The dental suture market faces significant challenges such as strict regulatory requirements and the presence of alternative options for wound closure.

The dental suture industry encounters a variety of challenges that could impede its expansion. A primary obstacle is the growing rivalry from alternative methods of wound closure, including tissue adhesives and sealants, which provide quicker and less invasive options. Moreover, the stringent regulations related to the approval and utilization of medical devices can delay the launch of innovative suturing products. The escalating prices of raw materials and the complexities of manufacturing processes might adversely affect the profitability of dental suture producers. Additionally, insufficient knowledge and training among dental practitioners regarding modern suture techniques could restrict market growth. Ongoing economic instability in different regions might lead to a reduction in healthcare expenditures, which would impact the demand for dental treatments and, consequently, sutures. Lastly, the increasing preference for minimally invasive surgical procedures may lessen the necessity for conventional suturing methods. Nevertheless, advances in biocompatible materials and technological progress in dental practices provide promising opportunities for the market. As the dental sector continues to progress, these innovations are expected to facilitate the creation of superior suturing solutions, thereby contributing to a vibrant and adaptable market environment.

Key Segments of the Dental Suture Market

By Product Type

• Suture type

• Suture needle

• Suturing instruments

By Material

• Synthetic material

• Natural material

By Technique

• Mattress sutures

• Crisscross suture

• Interrupted simple sutures

• Continuous simple sutures

By End use

• Hospitals

• Dental clinics

• Ambulatory surgical centers

• Other end users

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America