Market Analysis and Insights:

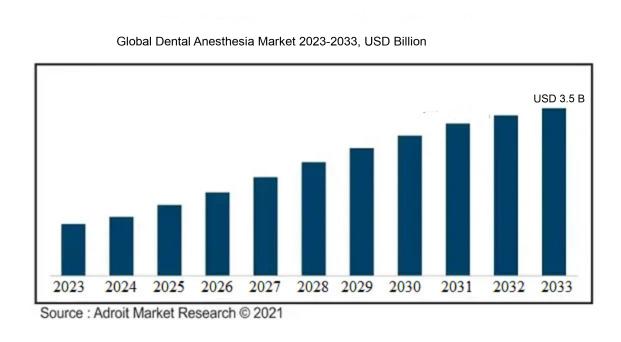

The market for Global Dental Anesthesia was estimated to be worth USD 2 billion in 2023, and from 2024 to 2033, it is anticipated to grow at a CAGR of 5%, with an expected value of USD 3.5 billion in 2033.

The dental anesthesia sector is largely influenced by a range of significant factors, including a rise in the incidence of dental ailments, growing awareness around preventive oral care, and innovations in anesthetic technologies. The increasing number of elderly individuals, who frequently encounter dental issues, further stimulates the necessity for effective anesthesia options. Additionally, the proliferation of dental clinics and a higher volume of dental procedures amplify market expansion, as dental professionals strive to improve patient comfort and the efficiency of treatments. Supportive regulations for the development of new anesthetic compounds, along with increased investments in dental healthcare facilities, further enhance the dynamics of this market. Furthermore, ongoing educational initiatives and training for dentists regarding contemporary anesthesia methods play a crucial role in promoting the adoption of these techniques. Together, these elements highlight the progressing landscape of dental anesthesia, with an emphasis on safety, patient satisfaction, and superior treatment outcomes driving future advancements.

Dental Anesthesia Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2033 |

| Study Period | 2023-2033 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2033 | USD 3.5 billion |

| Growth Rate | CAGR of 5% during 2024-2033 |

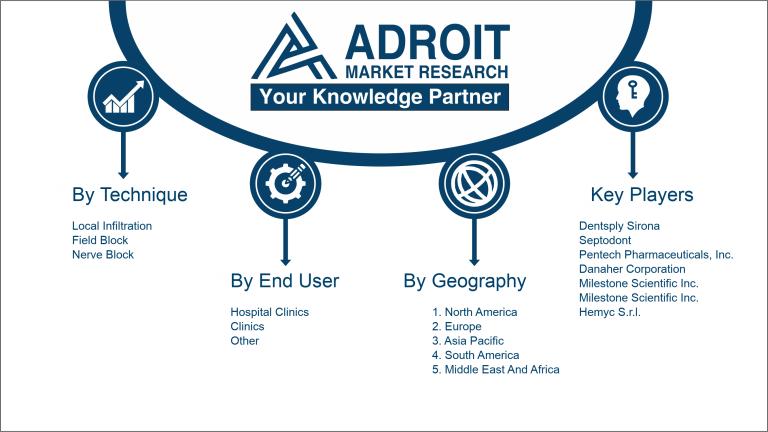

| Segment Covered | By Product Type, By Mode of Administration, By Technique, By Duration of Action, By End User, By Distribution Channel, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Dentsply Sirona, Septodont, Pentech Pharmaceuticals, Inc., Danaher Corporation, Milestone Scientific Inc., Hemyc S.r.l., Hager & Werken GmbH & Co. KG, Förmeth e.V., AnaConD, B. Braun Melsungen AG, 3M, A. Titan Instruments, Inc., Coltene Holding AG, and Carestream Dental. |

Market Definition

Dental anesthesia encompasses the administration of pharmaceutical agents designed to create a temporary absence of sensation within targeted regions of the oral cavity. This approach enables individuals to receive dental treatments painlessly. It can be delivered via local techniques or sedation methods to improve overall patient comfort and alleviate feelings of anxiety.

Dental anesthesia is essential for successful dental treatments, as it effectively alleviates pain and reduces anxiety, thereby ensuring patients feel comfortable. By numbing targeted regions of the mouth, it enables dentists to carry out essential procedures, including fillings, extractions, and root canals, without causing discomfort. This significantly enhances the overall patient experience and fosters better cooperation during treatments, which can result in more favorable outcomes. Additionally, for those who experience dental fear, the administration of anesthesia can motivate them to pursue necessary dental care, ultimately benefiting their oral health. Consequently, dental anesthesia is fundamental to achieving both clinical effectiveness and patient satisfaction in the field of dentistry.

Key Market Segmentation:

Insights On Key Product Type

Lidocaine

Lidocaine is expected to dominate the Global Dental Anesthesia Market due to its extensive usage and effectiveness. It is a well-established local anesthetic recognized for its rapid onset and moderate duration, making it ideal for various dental procedures. Lidocaine's versatility allows it to be used effectively in both simple and complex surgeries, as it can provide sufficient pain relief with minimal side effects. Furthermore, its familiarity among dental professionals contributes to its preference, ensuring its prominent role in dental anesthesia. The combination of proven efficacy, safety profile, and wide acceptability positions Lidocaine as the leading product type in this market.

Mepivacaine

Mepivacaine is another effective local anesthetic used in dental procedures, but its market penetration is comparatively lower than Lidocaine. While it offers rapid onset and a duration of action that is slightly longer than Lidocaine, Mepivacaine is often chosen for specific cases where epinephrine's vasoconstrictive properties are not desired. Its use in asymptomatic patients and certain procedures adds to its appeal, although it lacks the widespread acceptance of Lidocaine. Consequently, Mepivacaine remains a valuable option but does not dominate the market.

Prilocaine

Prilocaine is primarily preferred for its lower systemic toxicity and is often utilized in procedures requiring a rapid onset of action. Its application in dental anesthesia is significant, notably in combination with other anesthetics to enhance efficacy. However, despite its advantages, Prilocaine is not as commonly used as Lidocaine, resulting in a smaller share of the market. The specific scenarios in which Prilocaine is utilized somewhat limit its overall dominance, placing it behind Lidocaine in the overall hierarchy of local anesthetics.

Bupivacaine 0.5% with epinephrine 1: 200,000

Bupivacaine, particularly in combination with epinephrine, is recognized for its long-lasting effects, making it suitable for surgical dental procedures. Its prolonged duration of action is advantageous for procedures that require extensive anesthesia. However, the slower onset compared to other options like Lidocaine can influence its selection by practitioners. This characteristic restricts the application mainly to more complex interventions, hence limiting its market share. While Bupivacaine plays a critical role in specific cases, it does not achieve significant overall market dominance.

Articaine

Articaine has gained popularity due to its rapid onset and good diffusion properties, making it particularly effective in infiltration anesthesia techniques. Its unique structure allows for both infiltration and nerve block applications, catering to various dental procedures. Despite its benefits, Articaine's market presence is hampered by regulatory aspects and the necessity for more training among practitioners. In regions where it is widely accepted, Articaine can outperform others; however, on a global scale, its market share remains lesser than that of Lidocaine, solidifying its secondary position in the overall dental anesthesia market.

Others

The Others category encompasses alternative anesthetics and formulations that may be utilized in dental practices. This includes agents that are either less common or are emerging choices among practitioners. While there are efforts to innovate in this, including the development of new anesthetics with unique benefits, the overall market share from this category remains limited. Products in this category often face tough competition from established anesthetics like Lidocaine and Articaine, which significantly hinders their potential to dominate the market landscape.

Insights On Key Mode of Administration

Maxillary

The Maxillary administration route is anticipated to dominate the Global Dental Anesthesia Market due to several factors. Its preference among dental practitioners primarily arises from its ease of use and effectiveness in achieving adequate anesthesia in the upper jaw. Dentists commonly perform procedures involving the maxillary region, and this method allows for quick onset and reliable numbness, enabling patients to experience less discomfort during treatments. Additionally, advancements in techniques and equipment for administering maxillary anesthesia enhance its safety profile, making it the favored choice in various dental procedures, especially for extrusive or restorative work involving the maxillary teeth, thereby solidifying its leading position in the market.

Mandibular

The Mandibular administration route, while not the leader, remains a significant player in the Global Dental Anesthesia Market. It is essential for procedures involving the lower jaw where effective anesthesia is critical. Dentists often prefer this method when performing surgeries on molars or other lower teeth, as it provides profound anesthesia to the area. However, the technique can be challenging and occasionally may lead to higher discomfort and complications compared to maxillary anesthesia, which may restrict its usage in routine practices. Nonetheless, the Mandibular route's importance cannot be overlooked for specialized surgical procedures requiring a higher level of numbness in the lower jaw.

Others

The Others category encompasses various alternative methods of dental anesthesia that do not fall into the Maxillary or Mandibular categories. These methods include topical anesthesia and sedation techniques, which are utilized for specific patient needs or particular procedures. While this can cater to unique scenarios, such as treating pediatric patients or those with anxiety, it does not offer the widespread application or effectiveness of maxillary administration. This limits its overall market dominance but still holds a relevant position in specific dental practices where comprehensive alternatives are necessary.

Insights On Key Technique

Nerve Block

Among the various techniques utilized in dental anesthesia, nerve block is anticipated to dominate the Global Dental Anesthesia Market. Nerve blocks offer profound and lasting anesthesia, making them ideal for more extensive dental procedures where localized pain management is critical. They not only enhance patient comfort during complex surgeries but also reduce the need for higher doses of anesthetics, thereby minimizing potential side effects. Moreover, as dental practices evolve to adopt more sophisticated techniques, the demand for efficient and effective pain management solutions like nerve blocks will likely increase. This trend indicates that nerve blocks will remain the preferred choice for dental professionals, driving their prominence in the market.

Local Infiltration

Local infiltration refers to the administration of anesthetic agents directly into the tissues surrounding the targeted area. This technique is often used for minor dental procedures, such as simple restorations or extractions, making it a common choice for routine dental care. While effective for localized pain relief, its depth and duration of anesthesia are limited compared to other techniques. As a result, local infiltration may not be favored for more extensive or invasive procedures, impacting its growth potential in the overall market. However, it remains valuable in everyday dental practices for its simplicity and ease of application, capturing a share of the market driven by routine treatments.

Field Block

Field block is a technique where anesthetics are applied in a larger area surrounding a specified target, usually for procedures that involve multiple teeth or more extensive areas of the oral cavity. This method functions between local infiltration and nerve blocks, offering broader anesthesia without the complexity of a full nerve block. While its effectiveness makes it suitable for a range of dental procedures, especially in children or anxious patients, it does not provide the deep, long-lasting effects of nerve blocks. Consequently, field block may find its niche in specific situations but will likely lag behind nerve block in overall market preference due to the latter's enhanced efficacy.

Insights On Key Duration of Action

Medium

The medium duration of action category is anticipated to be the dominant within the global dental anesthesia market. This is mainly attributed to its balanced efficacy and convenience, offering enough anesthesia time for various dental procedures without prolonging recovery unnecessarily. Dentists commonly prefer medium-acting agents as they provide adequate pain relief during treatment while allowing for quicker patient turnover in clinical settings. Moreover, the versatility of medium-acting anesthetics makes them suitable for a broad range of dental procedures, appealing to both practitioners and patients. As a result, this aligns well with the growing demand for efficient and effective dental care solutions, ultimately solidifying its position in the market.

Short

The short duration of action category, while not leading, has a significant presence in the dental anesthesia market. It is often used in specific minor procedures where brief anesthesia is required, such as in certain periodontal treatments or pediatric dentistry. The preference for shorter-acting agents is driven by their rapid onset and cessation of action, reducing the risks of prolonged numbness and enhancing patient comfort post-procedure. This makes short-acting anesthetics appealing for quick interventions and to minimize recovery time, adding value in clinical scenarios where efficiency is highly sought after.

Long

The long duration of action category holds a more niche position in the dental anesthesia market. Though it is less commonly utilized compared to medium and short durations, its application is critical for specific complex procedures such as oral surgeries or extensive implant placements. Providers favor long-acting anesthetics for their extended pain relief, which can be beneficial for patients recovering from significant dental interventions. However, the potential for prolonged numbness can deter some practitioners and patients, limiting its broader appeal. Despite this, long-acting solutions remain important for cases that require sustained relief post-treatment.

Insights On Key End User

Clinics

Clinics are expected to dominate the Global Dental Anesthesia market because they offer a significant volume of routine dental procedures and specialized services, driving the demand for anesthesia solutions. These facilities frequently cater to both general and emergency dental care, requiring various anesthesia products like local anesthetics and sedation. Furthermore, the growing trend towards outpatient procedures in dentistry has led to an increased preference for services provided in clinics over hospitals. With dental practices aiming to enhance patient comfort and operational efficiency, clinics will increasingly invest in advanced anesthesia technologies. The accessibility and affordability of these services in clinics also attract a larger patient base, solidifying their positioning as a leading in the market.

Hospital Clinics

Hospital clinics serve as a crucial part of the healthcare system, providing comprehensive dental care often integrated with other medical services. Though they cater to a more specialized patient demographic requiring advanced dental procedures, their usage of anesthesia products is lower compared to regular clinics. Patients visiting hospital clinics typically need more complex procedures, but these are less frequent in volume than those conducted in standalone clinics. As dental care continues to evolve towards preventive measures and minimally invasive techniques, the hospital clinics might see a consistent demand for specific anesthetic solutions, but they will not capture as much market share as clinics due to their operational framework and patient flow.

Other

The Other category comprises dental facilities and services outside traditional clinics and hospital clinics, such as mobile dental units and educational institutions offering dental services. This, while providing valuable services, does not have the same volume of cases as clinics and hospital clinics. The demand for dental anesthesia in these settings can fluctuate greatly based on their specific services and regional regulations. Although there is growth potential driven by innovative service delivery models, overall participation in the market is limited. Therefore, while this part contributes to diversity in the dental anesthesia market, it remains less significant when examining overall market dominance.

Insights On Key Distribution Channel

E-Commerce

E-Commerce is expected to dominate the Global Dental Anesthesia Market due to the increasing trend of online shopping and the convenience it offers. With a growing number of consumers opting for purchasing healthcare products online, this distribution channel provides wider access to dental anesthesia products. The rise of telemedicine and increased awareness around dental procedures have led to a significant expansion of the online marketplace. Moreover, the e-commerce sector often features competitive pricing, customer reviews, and comprehensive product information, making it attractive for buyers. Technological advancements and enhancements in logistics further mean that consumers are increasingly confident in sourcing healthcare products through online platforms.

Pharmacies And Drug Stores

Pharmacies and drug stores remain a crucial channel in the Global Dental Anesthesia Market, primarily due to their established trust and physical presence in communities. Consumers often prefer to consult with pharmacists for guidance on dental anesthesia products, emphasizing the importance of personal interaction and immediate access to medications. The regulatory frameworks and health policies often favor the distribution of healthcare products through recognized local establishments, ensuring compliance and safety. As dental procedures require reliable solutions, the availability of anesthesia products at physical pharmacies makes this channel indispensable for many consumers seeking immediate and trusted access to dental care products.

Other

The category labeled as Other includes various niche distribution methods, which, while less dominant than e-commerce and pharmacies, still play an important role in the Global Dental Anesthesia Market. This may include hospitals and dental clinics that procure dental anesthesia directly for patient use, as well as specialized medical suppliers. Though this channel doesn't offer widespread consumer sales, it holds significance in ensuring that healthcare providers have adequate access to essential anesthesia products. Its reliance on professional relationships and direct sourcing often addresses specific needs of healthcare facilities, but its overall impact is limited compared to the more prominent channels.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Dental Anesthesia market due to several factors that create a conducive landscape for growth. This region has a robust healthcare infrastructure supported by high healthcare expenditure, providing advanced dental practices and technologies. The rising prevalence of dental diseases, coupled with an increasing emphasis on dental aesthetics, contributes to a significant demand for dental anesthesia. Furthermore, North America is home to several leading manufacturers and innovators in the dental anesthesia sector, which enhances product availability and variety. The region's regulatory frameworks ensure high standards of safety and efficacy, bolstering consumer confidence and further driving market growth.

Latin America

In Latin America, the dental anesthesia market shows promising growth but does not yet match the dominance seen in North America. The region has been witnessing expanding healthcare access and growing awareness of dental health. Increasing disposable income in emerging markets is leading to higher spending on dental care, stimulating demand for effective dental anesthesia solutions. However, challenges such as economic fluctuations and inconsistent healthcare quality may hinder rapid market growth compared to more established regions.

Asia Pacific

The Asia Pacific region has emerged as a rapidly growing in the Global Dental Anesthesia market. Factors such as a large population base, increasing dental health awareness, and rising disposable incomes in countries like India and China contribute significantly to market expansion. The region's diverse cultural attitudes toward dental care are evolving, leading to greater acceptance of dental aesthetics and associated procedures. Furthermore, technological advancements and the presence of local manufacturers are making dental anesthesia more accessible and affordable for the general populace.

Europe

Europe presents a considerable market for dental anesthesia, bolstered by well-established healthcare systems and a strong emphasis on preventative dental care. The region is characterized by diverse country-specific regulations and varying levels of healthcare funding, which can impact the uniformity of market growth. The rising demand for cosmetic dental procedures has also fueled interest in dental anesthesia as part of comprehensive treatment plans. Additionally, the presence of innovative players and ongoing research initiatives helps maintain a competitive environment that is necessary for market evolution.

Middle East & Africa

The Middle East & Africa region exhibits potential for growth in the dental anesthesia market, driven primarily by increasing investments in healthcare infrastructure and rising awareness of dental health. However, the market here faces various challenges, including regional disparities in healthcare access and economic instability in certain areas. The interest in dental care is gradually intensifying, especially in urban settings, leading to an increase in the adoption of advanced dental anesthesia technologies. Collaborations with international organizations may further enhance the market's growth trajectory in the coming years.

Company Profiles:

Major contributors to the Global Dental Anesthesia sector, encompassing both pharmaceutical firms and manufacturers of medical devices, are actively involved in the creation, production, and distribution of various anesthetic products and administration systems designed to provide safe and efficient pain relief during dental treatments. These entities prioritize ongoing innovation and adherence to regulatory requirements to align with changing healthcare standards and the demands of patients.

Prominent entities within the dental anesthesia sector consist of Dentsply Sirona, Septodont, Pentech Pharmaceuticals, Inc., Danaher Corporation, Milestone Scientific Inc., Hemyc S.r.l., Hager & Werken GmbH & Co. KG, Förmeth e.V., AnaConD, B. Braun Melsungen AG, 3M, A. Titan Instruments, Inc., Coltene Holding AG, and Carestream Dental.

COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the worldwide Dental Anesthesia market, causing a temporary suspension of non-essential dental treatments that ultimately diminished the need for anesthesia products and services.

The COVID-19 pandemic has had a profound effect on the dental anesthesia sector, primarily due to the disruption of elective dental services and the implementation of enhanced safety measures. At the onset, numerous dental offices halted their activities, resulting in a noticeable decline in the need for anesthesia products and associated services. As normal dental operations gradually resumed, there was a notable transition towards the use of more sophisticated and safer anesthesia methods designed to reduce the risk of infections. This shift included a greater emphasis on minimally invasive techniques and favoring local anesthesia over general anesthesia. Additionally, manufacturers began to concentrate on creating products that align with telehealth solutions and remote consultations. The crisis also led to a reassessment of supply chain logistics and inventory practices, encouraging companies to adopt more robust approaches. In summary, although the dental anesthesia market encountered immediate challenges, it is anticipated to realign with emerging consumer demands and safety requirements, potentially sparking innovation and growth in the aftermath of the pandemic.

Latest Trends and Innovation:

- In December 2021, Dentsply Sirona announced the acquisition of Byte, a leading provider of teledentistry solutions, aiming to enhance the delivery of dental care and expand their product offerings in the anesthesia market.

- In September 2022, Patterson Companies partnered with Verity Learning to integrate advanced artificial intelligence technology into their dental anesthesia systems, improving patient safety and experience during procedures.

- In November 2022, Henry Schein Inc. launched a new line of local anesthetics known as "Procare," which features a patented delivery system designed to reduce pain and anxiety during administration, marking a significant innovation in dental anesthesia.

- In January 2023, Carestream Dental introduced an upgraded imaging system that incorporates digital anesthesia delivery, allowing for improved procedural accuracy and enhanced patient comfort in dental practices.

- In March 2023, B.Braun Medical AG released a new range of regional anesthesia devices intended for dental applications, featuring improved safety mechanisms and user-friendly designs, aiming to streamline the dental anesthesia process.

- In July 2023, A-dec, a dental equipment manufacturer, announced a collaborative project with the University of Maryland School of Dentistry to research new modalities in sedation anesthesia for dental procedures, focusing on minimizing side effects and enhancing patient relaxation.

- In August 2023, the partnership between Nobel Biocare and local anesthetic manufacturers led to the development of a customizable anesthetic delivery system designed specifically for implant procedures, enhancing precision and patient care.

Significant Growth Factors:

The expansion of the dental anesthesia sector is fueled by a ened preference for minimally invasive dental treatments, innovations in anesthetic technologies, and growing consciousness regarding oral health.

The dental anesthesia sector is set to experience considerable expansion, driven by several pivotal elements. Firstly, the rising incidence of dental issues, along with an enhanced understanding of oral health, is fueling the need for effective anesthesia options during dental interventions. Technological innovations, such as the advent of needle-free anesthesia and sophisticated computerized delivery systems, significantly improve patient comfort and procedural efficiency, making dental care more attractive. Moreover, the increasing popularity of cosmetic dentistry, which frequently necessitates anesthesia for beauty procedures, further broadens the market's growth. The uptick in dental tourism highlights another important trend, as individuals seek high-quality dental treatment overseas, thereby increasing the demand for anesthesia services. Additionally, the expansion of dental practices prioritizing patient-focused care has led to a greater focus on effective pain management, resulting in the adoption of advanced anesthetic methods. Regulatory frameworks and the introduction of state-of-the-art products designed to minimize risks and enhance patient outcomes are also crucial components. Coupled with a growing global recognition of the significance of dental hygiene and treatment, these factors collectively create a promising trajectory for the dental anesthesia market, predicting marked growth in the years ahead.

Restraining Factors:

The dental anesthesia market faces several significant limitations, such as regulatory hurdles, the substantial expense associated with high-tech anesthesia devices, and the risk of negative side effects in patients.

The dental anesthesia sector encounters various obstacles that may impede its expansion. One significant challenge is the elevated expense associated with sophisticated anesthetic apparatus and the necessary training, which can discourage smaller dental practices from making such investments, thereby perpetuating the use of conventional techniques. Furthermore, stringent regulatory frameworks and guidelines concerning anesthetic use can delay the introduction and uptake of innovative products. Concerns about potential adverse effects, such as allergic reactions or systemic toxicity, may also induce caution among both dental practitioners and patients.

Additionally, the market's fragmentation, marked by a plethora of products and manufacturers, can result in confusion regarding product selection and inconsistencies in quality standards. The rising competition from alternative pain management solutions, like sedation dentistry and non-invasive analgesics, can further restrict the demand for traditional dental anesthesia methods. Nonetheless, continuous progress in dental technology, along with an increasing focus on patient safety and comfort, is creating pathways for groundbreaking developments in this field. As awareness of these innovations expands, the dental anesthesia market is poised for a hopeful future, suggesting that existing challenges can be redefined as opportunities for growth and enhancement.

Key Segments of the Dental Anesthesia Market

By Product Type

- Lidocaine

- Mepivacaine

- Prilocaine

- Bupivacaine 0.5% with epinephrine 1:200,000

- Articaine

- Others

By Mode of Administration

- Maxillary

- Mandibular

- Others

By Technique

- Local Infiltration

- Field Block

- Nerve Block

By Duration of Action

- Short

- Medium

- Long

By End User

- Hospital Clinics

- Clinics

- Other

By Distribution Channel

- Pharmacies And Drug Stores

- E-Commerce

- Other

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America