Data Classification Market Analysis and Insights:

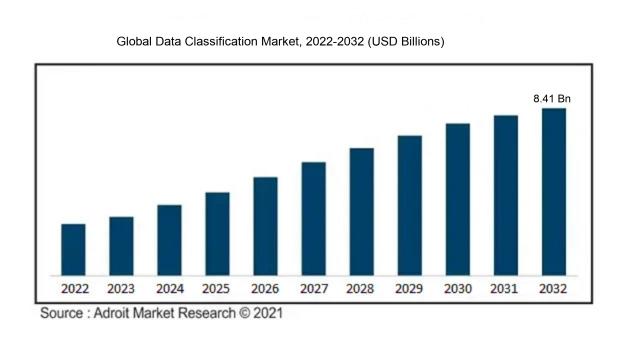

The market for Global Data Classification was estimated to be worth USD 1.42 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 21.53%, with an expected value of USD 8.41 billion in 2032.

The data classification industry experiences significant growth due to the escalating demand for data security and adherence to rigorous data privacy laws across a variety of sectors. Organizations are placing greater emphasis on the identification and categorization of sensitive data to ensure its secure handling, access, and transmission. The surge in data volumes generated by enterprises and the ened frequency of data breaches are key drivers behind the increased need for data classification solutions. Moreover, the surge in cloud computing adoption and the widespread use of mobile devices have sparked concerns regarding data security, underscoring the importance of data classification in protecting confidential information. Additionally, data classification supports effective data management and enhances the efficiency of data search and retrieval processes. The integration of cutting-edge technologies like artificial intelligence and machine learning further bolsters the growth of the data classification sector by enabling automated and precise classification of large datasets. In summary, the key factors propelling the data classification market encompass data protection and compliance prerequisites, escalating data volumes, data security apprehensions, enhancements in data management efficiency, and technological advancements.

Data Classification Market Definition

Data classification involves the systematic categorization of data according to defined parameters or criteria. This process aids in the structured organization and efficient management of data, thereby safeguarding its integrity and facilitating easy access.

Classification of data is crucial for organizations to effectively oversee and safeguard their data assets. By categorizing data according to its level of sensitivity, organizations can apply suitable security protocols to protect it from unauthorized access, breaches, and misuse. Moreover, data classification facilitates compliance with legal standards like GDPR or HIPAA by ensuring the implementation of necessary data protection measures. Additionally, classification supports data organization, making it easier to retrieve and analyze data for decision-making purposes. In essence, data classification is essential for safeguarding sensitive information, meeting regulatory requirements, and optimizing data management processes.

Data Classification Market Segmental Analysis:

Insights On Application

Access Control

Among the various players of Application category in the Global Data Classification Market, Access Control is expected to dominate. Access control systems play a crucial role in securing sensitive data by allowing only authorized individuals to access specific information. With the increasing volume of data and the growing concern for data privacy and security, organizations are prioritizing access control measures to safeguard their valuable information. Access control solutions provide the ability to enforce granular permissions, define user roles, and restrict unauthorized access, thus enabling organizations to maintain regulatory compliance and mitigate data breaches. As businesses focus on protecting their data assets, the demand for advanced access control solutions is expected to drive the dominance of this part in the Global Data Classification Market.

Web, E-Mail, and Mobile Protection

Web, E-Mail, and Mobile Protection is an essential sector within the Application category of the Global Data Classification Market. It addresses the need to safeguard data transmitted through web platforms, email communication, and mobile devices. With the rising number of cyber threats and attacks targeting web applications, email systems, and mobile devices, organizations are increasingly investing in protection measures. Web, E-Mail, and Mobile Protection solutions provide encryption, anti-malware, and anti-phishing capabilities to secure data across these channels. These solutions ensure that sensitive information exchanged through web browsers, email platforms, and mobile applications remains confidential and protected from unauthorized access. While this part is crucial in the data classification landscape, it is not expected to dominate the market as access control solutions take precedence in terms of overall demand and market share.

Centralized Management

Centralized Management is another important sector within the Application category of the Global Data Classification Market. It focuses on the centralization and streamlined management of data classification processes, policies, and controls. Centralized management solutions offer a unified platform to track, classify, and manage data across multiple systems, applications, and repositories. Such solutions enable organizations to define and enforce data classification policies consistently, facilitating effective data governance and compliance. While centralized management plays a vital role in data classification, it is not projected to dominate the Global Data Classification Market compared to access control.

GRC (Governance, Risk, and Compliance)

GRC, which stands for Governance, Risk, and Compliance, is a critical player within the Application category of the Global Data Classification Market. GRC solutions help organizations streamline and manage their information security and compliance activities. These solutions provide frameworks and tools to assess risks, monitor compliance with regulations, and enforce data classification policies. GRC solutions enable organizations to effectively manage their data classification processes in alignment with corporate policies and regulatory requirements. However, GRC is not expected to dominate the Global Data Classification Market compared to access control, as the latter has a more substantial impact on data security and protection.

Insights On Component

Consulting Service

The Consulting Service component is expected to dominate the Global Data Classification Market. This dominance can be attributed to the increasing demand for expert guidance and strategic advice in the implementation of data classification solutions. Consulting service providers offer specialized knowledge and expertise, helping organizations effectively classify their data, understand regulatory compliance requirements, and develop robust data management strategies. By leveraging consulting services, companies can optimize their data classification processes and ensure the efficient handling and protection of sensitive information. The Consulting Service part is anticipated to experience substantial growth as organizations prioritize data privacy and security.

Integration Service

The Integration Service component plays a crucial role in the Global Data Classification Market. Integration service providers enable seamless integration of data classification solutions with existing IT infrastructure and data management systems. By integrating data classification capabilities into various applications and platforms, organizations can effectively classify, tag, and label their data, ensuring proper handling, storage, and retrieval. Integration service providers offer customized solutions, addressing specific integration requirements and ensuring compatibility with different software and hardware components. This part is expected to witness significant growth as businesses realize the importance of integrating data classification functionalities across their ecosystem to streamline processes and enhance data governance.

Services

The Services component encompasses a wide range of offerings, including consulting, integration, support, and maintenance services. While the Consulting Service and Integration Service parts are expected to dominate the market, the overall Services category remains crucial in the Global Data Classification Market. Organizations often require a combination of services to successfully implement and maintain data classification solutions. Support services help address technical issues, troubleshoot problems, and provide ongoing assistance, ensuring the smooth operation of data classification systems. Maintenance services focus on regular updates, upgrades, and maintenance of the software, ensuring optimum performance and security. With the growing adoption of data classification solutions, the Services part will continue to play a significant role in fulfilling organizations' comprehensive requirements.

Support and Maintenance Service

The Support and Maintenance Service component provides essential post-implementation support and maintenance for data classification solutions. These services help organizations address any technical issues, software bugs, or performance-related concerns that may arise after the initial installation. Support and maintenance service providers offer timely assistance, ensuring uninterrupted operation of data classification systems and prompt resolution of any challenges faced by the organizations. Although this part may not dominate the Global Data Classification Market in terms of revenue generation, it plays a fundamental role in ensuring the long-term success and effective functioning of data classification solutions. Organizations rely on support and maintenance services to address any issues promptly, minimize downtime, and optimize the performance of their data classification systems.

Insights On Solution

Integrated Solutions

Integrated solutions are expected to dominate the global data classification market. Integrated solutions refer to the combination of various tools and techniques that are integrated into existing systems to provide comprehensive data classification capabilities. These solutions offer seamless integration with the organization's data management systems, allowing for efficient and consistent classification of data across different platforms and applications. Integrated solutions enable organizations to automate data classification processes, improve data accuracy, enhance compliance with regulatory requirements, and mitigate data security risks. With the increasing need for effective data management and protection, organizations are likely to adopt integrated solutions that provide a holistic approach to data classification.

Standalone Solutions

Standalone solutions, on the other hand, are expected to play a significant role but are not expected to dominate the global data classification market. Standalone solutions refer to dedicated software or tools specifically designed for data classification purposes. These solutions are independent of other systems and can be implemented separately within an organization. Standalone solutions often offer advanced features and functionalities for data classification, such as advanced machine learning algorithms and natural language processing capabilities. While standalone solutions provide comprehensive data classification capabilities, they may not offer the same level of integration and compatibility with existing systems as integrated solutions. As a result, organizations may opt for standalone solutions for specific data classification needs or as an initial step before integrating with existing systems.

Insights On Type

Content-Based

Content-Based data classification is expected to dominate the Global Data Classification Market. This part leverages the characteristics and attributes of the data itself to categorize and organize it. With the exponential growth of data being generated, organizations require a systematic approach to manage and protect their valuable information. Content-Based classification enables automated identification and tagging of data based on its content, ensuring efficient data governance and compliance. By analyzing the content of files, documents, emails, and other unstructured data, organizations can classify and secure sensitive information, mitigate risks, and enhance data discovery. Content-Based classification offers a comprehensive solution for data classification, making it the dominating part in the Global Data Classification Market.

Context-Based

Context-Based data classification provides another important approach to organizing and managing data. This part takes into account the context in which the data is created, shared, and used. By considering factors such as user behavior, location, and device, Context-Based classification enables organizations to enforce appropriate data protection policies based on specific contextual information. While Context-Based data classification plays a significant role in enhancing data security and privacy, it is not expected to dominate the Global Data Classification Market. However, it remains an essential part that adds value to overall data governance strategies and assists organizations in effectively managing their data.

User-Based

User-Based data classification focuses on the individuals or groups of users accessing and handling the data. This part classifies data based on user-defined rules and permissions, allowing for personalized data protection and access controls. User-Based classification takes into account factors such as user roles, privileges, and responsibilities. While User-Based classification is crucial for individualized data governance, it is unlikely to dominate the Global Data Classification Market. Instead, it serves as a complementary part, enabling organizations to implement fine-grained data security measures and meet specific regulatory requirements based on user-level classification policies.

Global Data Classification Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the global data classification market in the coming years. This can be attributed to the rapid digital transformation and the increasing adoption of cloud-based solutions in countries like China, India, Japan, and South Korea. The region has a large population and a growing number of businesses, which generates vast amounts of data that need to be classified and protected. Moreover, governments in the region are implementing strict data protection regulations, which further drive the demand for data classification solutions. With the presence of major technology players in the region and increasing investments in advanced technologies such as artificial intelligence and machine learning, Asia Pacific is likely to continue dominating the global data classification market in the foreseeable future.

North America

North America has a well-established technology infrastructure and a high level of data awareness, making it one of the major contributors to the global data classification market. The region has a mature market for data classification solutions, driven by the stringent data protection regulations and the increasing need for data classification and compliance management in industries such as healthcare, banking, and finance. Furthermore, the presence of key market players and the continuous advancements in technologies like cloud computing and big data analytics enhance the growth of the data classification market in North America.

Europe

Europe is another significant region in the global data classification market, characterized by the presence of developed economies like the UK, Germany, France, and Spain. The stringent data protection regulations such as the General Data Protection Regulation (GDPR) further drive the demand for data classification solutions in the region. Additionally, the increasing adoption of cloud-based services and the need for enhanced data security and privacy fuel the growth of the data classification market in Europe. However, the market growth in Europe might be hindered by factors such as complexities in regulatory compliance and lack of awareness about the benefits of data classification among small and medium-sized enterprises.

Latin America

Latin America is witnessing steady growth in the data classification market. The region is experiencing increasing adoption of digital technologies and has a growing number of small and medium-sized enterprises, which generate a significant amount of data. The need for data protection and compliance with regulations is becoming more apparent in this region, leading to the adoption of data classification solutions. However, challenges such as limited IT infrastructure and lack of awareness about data classification solutions may restrict the market growth in Latin America.

Middle East & Africa

Middle East & Africa is a developing region in terms of data classification adoption. The region has witnessed significant growth in data creation and digitization in various industries such as oil and gas, telecommunications, and banking. The increasing incidences of data breaches and the need for data compliance are driving the demand for data classification solutions in the region. However, factors like limited technology infrastructure, low awareness about data classification, and economic and political uncertainties may pose challenges to the market growth in the Middle East & Africa.

Global Data Classification Market Competitive Landscape:

Prominent figures within the worldwide data classification industry hold a significant responsibility in delivering cutting-edge data classification products and services to businesses spanning different fields. Their efforts are focused on driving the progress of state-of-the-art technologies that facilitate efficient data organization and safeguarding, addressing the escalating issues surrounding data security and regulatory adherence.

Prominent companies in the Data Classification Market encompass IBM Corporation, Microsoft Corporation, Amazon Web Services, Google LLC, Oracle Corporation, McAfee LLC, Symantec Corporation, Varonis Systems Inc., Informatica Corporation, and Netwrix Corporation. These organizations play a pivotal role within the industry by delivering diverse data classification solutions and services to a wide array of sectors. IBM Corporation and Microsoft Corporation stand out as key players, offering comprehensive data classification solutions, while Amazon Web Services and Google LLC specialize in cloud-based data classification services. The market also features established entities such as Oracle Corporation, McAfee LLC, and Symantec Corporation, renowned for their sophisticated data security and classification services. Additionally, Varonis Systems Inc., Informatica Corporation, and Netwrix Corporation are notable participants providing robust data classification solutions to aid businesses in efficiently categorizing and safeguarding their data.

Global Data Classification Market COVID-19 Impact and Market Status:

The global data classification market has experienced significant growth as a result of the increased demand for data security brought about by the rise in remote work during the Covid-19 pandemic.

The data classification market has experienced significant impacts due to the COVID-19 pandemic, presenting a mix of favorable and unfavorable consequences. One positive aspect is the ened reliance on remote work and digital communication, which has driven an upsurge in data creation and storage. Consequently, there has been a greater demand for data classification solutions to effectively manage and safeguard sensitive data as organizations swiftly transitioned to new operational models. Moreover, the escalating concerns related to data privacy and regulatory compliance have served as additional catalysts for the adoption of robust classification tools. Conversely, the economic downturn triggered by the pandemic has prompted cost-cutting measures across various sectors, leading to diminished investments in data classification solutions. Companies have redirected their resources towards critical areas like healthcare and safety, exhibiting a cautious stance towards non-essential technologies. In summary, the COVID-19 crisis has both posed challenges and unveiled opportunities for the data classification market, underscoring the ongoing importance of efficient data governance and security in an increasingly digitalized environment.

Recent Trends & Innovations in the Data Classification Market:

- In February 2020, Microsoft acquired BlueTalon, a provider of data privacy and governance solutions, to enhance its Azure Data Governance capabilities.

- In July 2020, OpenText acquired XMedius, a leader in secure information exchange solutions, to enhance its digital fax and secure content exchange offerings.

- In September 2020, McAfee announced the acquisition of Light Point Security, an innovative browser isolation technology provider, to strengthen its data protection capabilities.

- In November 2020, Google Cloud acquired Actifio, a global leader in data backup and disaster recovery solutions, to further enhance its data management and protection services.

- In December 2020, IBM acquired Instana, an application and infrastructure monitoring provider, to strengthen its AI-powered automation capabilities in managing hybrid cloud environments.

- In January 2021, Varonis introduced new enhancements to its Data Classification capabilities, offering organizations improved visibility and control over sensitive data.

- In March 2021, Symantec (now NortonLifeLock) announced the acquisition of Javelin Networks, a provider of advanced Active Directory security solutions, to enhance its endpoint protection offerings.

- In April 2021, Adobe announced the integration of data classification capabilities in its Document Cloud, allowing users to automatically categorize and protect sensitive data.

- In June 2021, NetApp acquired Data Mechanics, a leading provider of cloud-native Spark platform solutions, to strengthen its data analytics and AI capabilities.

- In August 2021, Dell Technologies introduced new features to its Dell EMC PowerProtect Data Manager, offering enhanced data classification and data governance functionalities.

Data Classification Market Growth Factors:

The data categorization sector is expected to witness significant advancement as a result of growing apprehensions regarding data security and confidentiality, alongside the increasing uptake of digital transformation projects.

The expansion of the data classification market is propelled by several pivotal factors. Firstly, the escalating volume of data produced by enterprises across diverse sectors necessitates proficient data classification solutions. The advancement of digital technology and the emergence of large-scale data analytics have led to organizations accumulating and analyzing extensive data sets. Consequently, it has become crucial to classify and structure this data to derive valuable insights. Secondly, stringent regulatory mandates and data protection laws like GDPR have ened the demand for data classification solutions. Companies are mandated to adhere to these regulations by integrating data classification tools to safeguard sensitive data, uphold customer privacy, and minimize the risk of data breaches. Thirdly, the increasing adoption of cloud computing and collaborative platforms has presented new complexities in data management and classification. With an increasing amount of data stored and exchanged in the cloud, robust data classification solutions are necessary to ensure data integrity, confidentiality, and accessibility. Lastly, the growing recognition of the advantages of data classification, such as enhanced data governance, improved decision-making processes, and ened operational efficiency, is fueling its integration across various industries. All in all, the data classification market is poised for continuous expansion, driven by the imperative for effective data management, compliance with regulations, and the acknowledgment of the benefits associated with well-organized data.

Data Classification Market Restraining Factors:

The lack of comprehensive knowledge and recognition of data classification within enterprises presents a notable obstacle to the advancement of the market.

The data classification industry is growing steadily as organizations seek to effectively manage and protect their data assets. However, there are various factors that could impede the market's advancement. The complexity of data classification algorithms and techniques can be a hurdle for organizations lacking the requisite expertise and resources for implementation. Moreover, the costs involved in deploying and sustaining data classification solutions could present a notable barrier for small and medium-sized businesses. In addition, a lack of awareness regarding the importance and advantages of data classification among organizations can hinder its widespread adoption. The rapid pace of technological advancements and the evolving threat landscape necessitate continuous upgrades and enhancements to data classification systems, posing challenges for both vendors and organizations. Concerns related to data privacy and potential misuse of classified data could result in regulatory constraints and opposition from consumers. Notwithstanding these obstacles, the data classification sector is promising as organizations increasingly acknowledge the imperative need to safeguard their data and adhere to regulatory requirements. With ongoing technological innovations, ened awareness, and regulatory support, the market is poised for significant growth.

Key Segments of the Data Classification Market

Application Overview

• Web

• Mobile Protection

• Centralized

• GRC (Governance, Risk, and Compliance)

• Access Control

Component Overview

• Services

• Integration Service

• Consulting Service

• Support and Maintenance Service

Solution Overview

• Integrated Solutions

• Standalone Solutions

Type Overview

• Content-Based

• Context-Based

• User-Based

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America