Market Analysis and Insights:

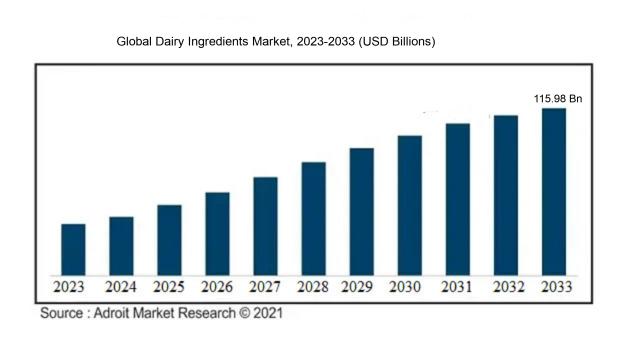

The market for Global Dairy Ingredients was estimated to be worth USD 63.59 billion in 2023, and from 2023 to 2033, it is anticipated to grow at a CAGR of 5.85%, with an expected value of USD 115.98 billion in 2033.

The dairy ingredients market experiences the influence of various catalysts that wield a significant impact on its progression and evolution. Primarily, the escalating consumer inclination towards dairy products, propelled by factors such as burgeoning population, evolving consumer predilections, and the trend towards healthier dietary selections, represents a prominent driver of market advancement. Furthermore, the mounting awareness concerning the nutritional advantages presented by dairy ingredients, encompassing proteins, vitamins, and minerals, is fostering an uptick in market demand.

Correspondingly, the surge in disposable incomes and urbanization rates across developing nations is also bolstering the expansion of the dairy ingredients market by stimulating the consumption of dairy-derived goods. Additionally, the technological progressions observed in the dairy sector, encompassing enhancements in production methodologies and processing approaches, are propelling the market landscape forward. Ultimately, the burgeoning integration of dairy ingredients across diverse industries, including bakery, confectionery, and beverages, is generating lucrative prospects for market enlargement. Cumulatively, these driving forces are driving the growth trajectory of the dairy ingredients market.

Dairy Ingredients Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2033 |

| Study Period | 2018-2033 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2033 | USD 115.98 billion |

| Growth Rate | CAGR of 5.85% during 2023-2033 |

| Segment Covered | By Product, By Application, By Form, By Distribution Channel, By Livestock, By Production Method, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Fonterra Co-operative Group Ltd., Nestle SA, Arla Foods amba, Danone SA, FrieslandCampina, Saputo Inc., Groupe Lactalis, Dairy Farmers of America Inc., Dean Foods Company, and Royal FrieslandCampina NV. |

Market Definition

Dairy components are derived from milk and are widely utilized in a variety of food and drink items. These components are pivotal in improving flavor, consistency, and nutritional benefits, providing an extensive array of possibilities for culinary utilizations.

Dairy ingredients play a significant role for various reasons. To begin with, they serve as a valuable source of fundamental nutrients such as calcium, protein, vitamin D, and potassium, essential for maintaining optimal bone strength, muscle health, and overall well-being. Moreover, they are vital components in a diverse array of food items, including dairy beverages, yogurts, cheeses, baked goods, confectioneries, and sauces, imparting distinctive flavors, textures, and functionalities. Additionally, the versatility of dairy ingredients makes them widely utilized in the food industry, offering ample opportunities for creating new products and enhancing existing ones. Lastly, the presence of dairy ingredients fosters economic development within the dairy sector, bolstering the livelihoods of farmers and businesses throughout the supply chain, while catering to the market's demand for dairy-infused goods.

Key Market Segmentation:

Insights On Key Product

Proteins

Proteins are expected to dominate the Global Dairy Ingredients Market. This is because proteins are essential components in various food and beverage products, including infant formula, sports nutrition, and functional foods. The increasing consumer demand for protein-enriched products, coupled with the growing awareness about the health benefits of proteins, is driving the demand for dairy protein ingredients. Additionally, advancements in protein extraction and purification technologies have improved the quality and functionality of dairy proteins, further contributing to their dominance in the market. Hence, proteins are expected to have the largest market share in the global dairy ingredients market.

Milk Powder

Milk powder is another significant product of the Global Dairy Ingredients Market. Milk powder has a longer shelf life, higher nutrient density, and easier storage compared to liquid milk, making it highly versatile and convenient for various applications. It is used in the production of confectionery, bakery, dairy, and nutritional products, among others. The increasing demand for milk-based products and the rising consumer preference for convenience foods are driving the growth of the milk powder in the dairy ingredients market.

Milk Fat Concentrates

Milk fat concentrates play an important role in the dairy ingredients market, especially in the manufacturing of butter, cheese, ice cream, and other dairy products. These concentrates provide the desired fat content and flavor to the end products. With the growing consumer demand for natural and indulgent food products, the milk fat concentrates part is expected to witness substantial growth in the global dairy ingredients market.

Casein and Caseinates

Casein and caseinates are widely used in the food industry as emulsifiers, stabilizers, and texturizing agents. They are extensively used in the production of processed cheese, yogurt, and nutritional beverages. The increasing demand for convenience foods and the trend of clean-label and natural products are expected to drive the growth of the casein and caseinates part in the dairy ingredients market.

Lactose and Its Derivatives

Lactose and its derivatives have various applications in the food and pharmaceutical industries. They are used as sweeteners, excipients in drug formulations, and texture enhancers in food products. The increasing prevalence of lactose intolerance and the demand for lactose-free products are driving the growth of lactose and its derivatives in the dairy ingredients market.

Whey

Whey is a by-product of cheese manufacturing and is rich in proteins, lactose, and minerals. It is extensively used in the production of protein powders, infant formula, bakery products, and beverages. The demand for high-quality protein sources, particularly among athletes and fitness enthusiasts, is driving the growth of the whey part in the dairy ingredients market.

Other Types

The Other Types category includes various dairy ingredients that do not fall under the major categories mentioned above. This part may comprise specialized ingredients like lactoferrin, colostrum, and milk phospholipids, which have specific functional properties and applications in the food and pharmaceutical industries. While the market potential for these ingredients is significant, their individual market shares may vary depending on factors such as product availability, consumer demand, and specific industry requirements.

Insights On Key Application

Dairy Products

Dairy Products application are expected to dominate the Global Dairy Ingredients Market. Dairy Products, such as milk, yogurt, cheese, and butter, have been extensively used in various food and beverage applications for their nutritional qualities and versatility. They form the backbone of the dairy ingredients market due to their widespread consumption and demand.

Bakery & Confectionery

Bakery and confectionery products have shown substantial growth in recent years, driven by changing consumer preferences and a growing demand for indulgent and innovative food options. The use of dairy ingredients such as milk, cream, butter, and whey powder in bakery and confectionery applications add flavor, texture, and nutritional value. This part holds promising opportunities for dairy ingredients manufacturers.

Sports Nutrition Products

As the global sports nutrition industry continues to gain momentum, the demand for dairy ingredients in this application is on the rise. Dairy proteins, such as whey and casein, are highly valued for their muscle-building and recovery properties. They are widely used in protein powders, amino acid supplements, and other sports nutrition products. The increasing emphasis on fitness and a healthy lifestyle is driving the growth of this part.

Infant Formulas

Infant formulas are a crucial application within the dairy ingredients market, catering to the nutritional needs of infants who cannot be breastfed. Dairy ingredients like milk powders, lactose, and whey proteins are essential components of infant formulas due to their high nutritional content. With the rising population and increasing birth rates in developing economies, the demand for infant formulas is expected to remain strong.

Cosmetics

Dairy ingredients have also found their application in the cosmetics industry. Ingredients such as milk proteins, lactose, and colostrum are used in various cosmetic products like creams, lotions, soaps, and shampoos. The presence of natural proteins and vitamins in dairy ingredients contribute to their moisturizing, nourishing, and rejuvenating properties. The cosmetic industry's growing focus on natural and sustainable ingredients presents opportunities for dairy ingredients in this part.

Pharmaceuticals

Pharmaceuticals represent another potential application for dairy ingredients. These ingredients, particularly lactose, are utilized as excipients and fillers in pharmaceutical preparations. Lactose offers unique properties such as compressibility, binding capacity, and taste masking, making it a widely used ingredient in tablet formulations. The pharmaceutical industry's growth and the increasing demand for generic drugs contribute to the relevance of dairy ingredients in this part.

Insights On Key Form

Powder

The Powder form is expected to dominate the Global Dairy Ingredients Market. Powdered dairy ingredients offer several advantages such as longer shelf life, ease of handling and transportation, and extended usage in various applications. Powdered dairy ingredients are widely used in the production of infant formula, bakery products, confectionery, and other food and beverage products. Additionally, the growing demand for convenience and functional foods has further boosted the demand for powdered dairy ingredients worldwide. Therefore, the Powder part is expected to be the dominating part in the Global Dairy Ingredients Market.

Liquid

While the Powder form is expected to dominate the Global Dairy Ingredients Market, the Liquid form also holds a significant share in the market. Liquid dairy ingredients include products such as liquid milk, cream, condensed milk, and whey. These products find application in various sectors such as food and beverage processing, bakery, confectionery, and dairy-based beverages. The demand for liquid dairy ingredients is driven by factors such as convenience, taste, and nutritional value. However, the Powder part is expected to have a higher market share due to its prolonged shelf life, easier storage and transportation, and wider range of applications.

Insights On Key Distribution Channel

E-Commerce

The E-Commerce distribution channel is expected to dominate the Global Dairy Ingredients Market. The rise of online shopping and the convenience it offers has led to increased sales of dairy ingredients through e-commerce platforms. Customers are increasingly turning to online shopping for their dairy ingredient needs due to factors such as convenience, wider product availability, and competitive pricing. E-commerce platforms provide a user-friendly interface and efficient delivery services, attracting a large customer base. As a result, the E-commerce part is projected to dominate the Global Dairy Ingredients Market.

Specialty Retailers

While the E-Commerce distribution channel is expected to dominate, the Specialty Retailers distribution channel will continue to hold a significant market share in the Global Dairy Ingredients Market. Specialty retailers cater to specific dietary or nutritional requirements and offer a wide range of premium dairy ingredient products. They provide expert advice, a personalized shopping experience, and unique product offerings that are not easily available through other distribution channels. As a result, many consumers who prefer specialized or high-quality dairy ingredients will continue to purchase from specialty retailers.

Supermarket & Hypermarket

The Supermarket & Hypermarket distribution channel, although not expected to dominate, will still maintain a considerable share in the Global Dairy Ingredients Market. Supermarkets and hypermarkets are convenient one-stop shops, offering a wide variety of dairy ingredient products to a diverse consumer base. These retail outlets have broad geographical coverage, making dairy ingredients easily accessible to a large number of consumers. However, the increasing popularity and convenience of online shopping may impact the growth potential of this part in the long run.

Others

The Others category, which includes various smaller distribution channels such as convenience stores, independent retailers, and foodservice providers, will play a smaller role compared to the dominant E-Commerce part. While these distribution channels cater to specific customer s, they may face challenges such as limited product variety and competition from larger retailers. However, they still serve as important distribution channels for dairy ingredients in certain regions or niche markets, providing convenience and localized product offerings to specific consumer groups. Nevertheless, they are unlikely to dominate the Global Dairy Ingredients Market due to their relatively smaller reach and market penetration.

Insights On Key Livestock

Cows

Cows are expected to dominate the Global Dairy Ingredients Market. Cows are the primary source of dairy ingredients worldwide. The production of cow milk and its subsequent processing into various dairy ingredients, such as milk powder, butter, cheese, and yogurt, significantly contribute to the global market. Cows, being the most common and widely available livestock for dairy purposes, have a larger presence and influence in the industry. With the high demand for dairy ingredients across different food and beverage sectors, cow-based dairy products are projected to maintain their dominance in the Global Dairy Ingredients Market.

Other Livestock

While cows are expected to dominate the Global Dairy Ingredients Market, other livestock, such as goats and sheep, also play a significant role in the industry. These animals are particularly important in specific regions where their milk and dairy products are culturally preferred or have unique qualities. Goat milk, for example, is known for its easy digestibility and distinct flavor, making it popular for specialty dairy products like goat cheese and goat milk powder. Similarly, sheep milk is valued for its richness and is often used in the production of high-quality cheese varieties. Although these other livestock parts might have a smaller overall market share compared to cows, they cater to niche markets and contribute to the diversity of dairy ingredients available globally.

Insights On Key Production Method

Membrane Separation

Membrane Separation method is expected to dominate the Global Dairy Ingredients Market. This method involves the separation of different components of milk using membranes, such as ultrafiltration, microfiltration, and nanofiltration. Membrane separation offers several advantages over the traditional method, including improved efficiency, higher product quality, and better control over the separation process. It allows for the retention of valuable dairy ingredients while removing impurities, resulting in higher purity and functionality of the final products. The increasing demand for premium and functional dairy ingredients in various food and beverage applications is driving the growth of the Membrane Separation method in the Global Dairy Ingredients Market.

Traditional Method

The Traditional Method, although not dominating, still holds significant importance in the Global Dairy Ingredients Market. This method involves the separation of milk components through conventional processes such as centrifugation and evaporation. While it may not offer the same level of precision and efficiency as membrane separation, the Traditional Method has been used for a long time and is still preferred for certain dairy ingredients. It can be more suitable for the production of ingredients like butter and cheese, where specific processes and traditional techniques are required to achieve the desired characteristics and flavors.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the global dairy ingredients market. With a strong dairy industry infrastructure, advanced technologies, and a high demand for dairy products, Europe is well-positioned to lead the market. Countries like Germany, France, and the Netherlands have a significant presence in the global dairy industry, with established dairy farms and processing facilities. Europe is known for its high-quality dairy products, such as cheese, butter, and milk powders, which are in high demand worldwide. Additionally, the growing focus on health and wellness, along with the increasing adoption of dairy-based functional foods and beverages, further supports the dominance of Europe in the global dairy ingredients market.

North America

North America is another significant region in the global dairy ingredients market. The region has a well-developed dairy industry, with countries like the United States and Canada playing a crucial role. The demand for dairy products, including cheese, yogurt, and ice cream, remains strong in North America. The region also has a growing health and wellness trend, resulting in increased consumption of dairy protein products and dairy-based ingredients. Additionally, technological advancements in the dairy sector, an emphasis on food safety standards, and high per capita dairy consumption contribute to the market's growth in North America.

Asia Pacific

Asia Pacific is witnessing rapid growth in the demand for dairy ingredients. Factors such as population growth, urbanization, changing dietary preferences, and an increasing middle-class population contribute to the region's prominence in the global dairy ingredients market. Countries like China, India, Japan, and Australia are major players in the Asia Pacific dairy industry. Rising disposable incomes, a shift towards Western dietary patterns, and the growing importance of protein-rich diets are driving the demand for dairy ingredients in the region. Furthermore, the increasing popularity of bakery and confectionery products and the rising demand for infant formula contribute to the market's growth in Asia Pacific.

Latin America

Latin America is an emerging player in the global dairy ingredients market. Countries like Brazil, Mexico, and Argentina have a significant presence in the region's dairy industry. The demand for dairy products, including milk, cheese, and yogurt, is steadily increasing in Latin America due to changing consumer preferences and a rising awareness of the nutritional benefits of dairy products. Additionally, the development of dairy product exports from countries like Argentina and Uruguay further drives the market's growth in Latin America. However, challenges such as limited technological infrastructure, high production costs, and political instability in some regions may hinder the market's full potential.

Middle East & Africa

The Middle East & Africa region has a relatively smaller market share in the global dairy ingredients market. Factors such as a predominantly hot climate, limited availability of land for dairy farming, and cultural preferences for non-dairy beverages contribute to the region's smaller market presence. However, there is a growing demand for dairy products in urban areas, driven by a shift towards Western diets and an increasing population. The region also imports a significant amount of dairy products to meet the local demand. With the implementation of technological advancements, investments in dairy infrastructure, and the promotion of dairy consumption, the Middle East & Africa region has the potential to increase its market share in the global dairy ingredients market.

Company Profiles:

The primary stakeholders in the worldwide Dairy Ingredients industry oversee the manufacturing, packaging, and delivery of a range of dairy products like powdered milk, whey protein, lactose, and casein to meet the increasing requirements for dairy-derived elements from the global food and beverage sector. Additionally, they are pivotal in driving research and development initiatives aimed at launching new and improved products while boosting the nutritional profile of dairy ingredients.

Prominent companies in the Dairy Ingredients Market comprise Fonterra Co-operative Group Ltd., Nestle SA, Arla Foods amba, Danone SA, FrieslandCampina, Saputo Inc., Groupe Lactalis, Dairy Farmers of America Inc., Dean Foods Company, and Royal FrieslandCampina NV. These leading organizations exert significant influence over the global market due to their robust market presence, diversified product portfolios, and expansive distribution channels. Through a continuous emphasis on innovation, research and development, as well as strategic collaborations, these industry giants uphold their market leadership positions and broaden their consumer reach.

These key market participants are committed to satisfying the growing consumer demand for premium dairy ingredients across various sectors including bakery, confectionery, dairy products, infant nutrition, ice cream, and beverages.

COVID-19 Impact and Market Status:

The worldwide dairy ingredients sector has experienced notable effects due to the Covid-19 outbreak, resulting in supply chain disturbances and reduced dairy product demand.

The dairy ingredients market has been significantly affected by the ongoing COVID-19 pandemic. The imposition of lockdowns and travel restrictions resulted in a notable decrease in demand for dairy products within the foodservice industry, leading to an excess of dairy ingredients. This surplus was further compounded by the shutdown of educational institutions and eating establishments, which are key consumers of dairy goods. Moreover, disruptions in the global supply chain, such as transportation issues and labor shortages, posed additional challenges for the dairy sector. Nevertheless, it is essential to recognize that the pandemic's impact on the dairy ingredients market was not entirely adverse. There was a surge in demand for dairy ingredients through retail channels as consumers increasingly engaged in home cooking and baking. Furthermore, the ened emphasis on health and immunity during the pandemic spurred interest in dairy ingredients like whey protein, which are perceived to offer health benefits. As the world gradually emerges from the pandemic, the dairy ingredients market is anticipated to stabilize and regain momentum, driven by the relaxation of restrictions and the recovery of the foodservice sector. Nonetheless, the enduring repercussions of the pandemic will continue to influence consumer behavior and market trends in the foreseeable future.

Latest Trends and Innovation:

- In January 2021, Lactalis Ingredients acquired Ehrmann Commonwealth Dairy a Greek yogurt maker, to strengthen their presence in the Greek yogurt market.

- In February 2020, Fonterra Co-operative Group launched a new protein ingredient called NZMP organic butter, following increasing demand for organic dairy products.

- In March 2021, Arla Foods Ingredients introduced a new whey protein hydrolysate for sports nutrition products, aimed at meeting the growing demand for high-quality protein.

- In July 2020, Glanbia Nutritionals announced the acquisition of Foodarom, a Canadian flavor and ingredient solutions provider, to expand their portfolio of flavors and solutions.

- In September 2021, FrieslandCampina Ingredients introduced a new protein ingredient called Nutri Whey Native, targeting the sports and active nutrition market.

- In November 2020, Kerry Group launched a new dairy ingredient called FizzicsT, designed to enhance carbonation stability in beverages.

- In May 2021, DMK Group announced a partnership with MILEI to produce high-quality whey protein hydrolysates and other lactose-based ingredients.

- In December 2020, Saputo Inc. completed the acquisition of Dairy Crest Group, a major player in the UK dairy industry, enhancing their presence in the European market.

- In June 2021, Valio Ltd. introduced a new lactose-free dairy powder ingredient suitable for various applications, meeting the increasing demand for lactose-free products.

- In October 2020, Royal FrieslandCampina N.V. launched a new protein ingredient called Nutri Whey Isolate Clear, targeting the clear protein beverage market.

Significant Growth Factors:

Factors driving the growth of the dairy ingredients market encompass elevated consumer interest in dairy products, ened recognition of their nutritional advantages, and the expanding utilization of dairy ingredients in diverse food and beverage sectors.

The dairy ingredients industry is observing substantial growth driven by various factors. The escalating demand for dairy products with their versatile applications in sectors like bakery, confectionery, and beverages is a primary catalyst for market expansion. Moreover, the increasing consumer inclination towards protein-enriched food choices is propelling the need for dairy ingredients, renowned for their high protein content. The market is further buoyed by the surge in health consciousness among individuals, combined with the growing awareness regarding the nutritional advantages offered by dairy ingredients. Additionally, the market benefits from the expanding global populace and the subsequent increase in disposable incomes, fostering the consumption of dairy-based items. Technological advancements in dairy processing methods are also contributing to the market's growth by elevating the quality and shelf life of dairy ingredients, thereby attracting a wider consumer base. Moreover, there is a notable uptick in the demand for organic and clean label products, further fueling market expansion. However, challenges such as price fluctuations in milk and intensifying competition from plant-based substitutes could potentially impede market growth. Despite these hurdles, the dairy ingredients industry is anticipated to maintain a positive growth trajectory in the foreseeable future, driven by these significant factors.

Restraining Factors:

Factors such as the volatility of milk prices, strict regulatory measures, and increasing consumer inclination towards plant-derived substitutes pose constraints on the Dairy Ingredients Market.

The dairy ingredients industry encounters various obstacles that impact its expansion and profitability. One major challenge is the volatility in the prices of key raw materials like milk and other dairy products, making it difficult for manufacturers to maintain consistent pricing for their ingredients. This can have a negative impact on their profit margins and competitiveness within the market. Additionally, stringent regulatory requirements and quality control standards enforced by government agencies can create obstacles for new entrants and smaller players. Complying with these standards necessitates significant investments in research, development, and the adoption of advanced manufacturing practices. The shifting consumer preferences towards plant-based alternatives due to health considerations have led to a decline in the demand for traditional dairy ingredients. This preference for lactose-free, cholesterol-free, and allergen-free options poses a threat to the conventional dairy sector. The disruption in supply chains and distribution channels caused by the COVID-19 pandemic has further complicated the availability and pricing of dairy ingredients. Despite these challenges, the dairy ingredients market possesses significant growth potential. The increasing desire for fortified and functional food items, coupled with the rising popularity of convenient food choices, presents opportunities for manufacturers to create novel dairy ingredients that cater to these evolving preferences. Moreover, the growing inclination towards natural and clean label products among consumers could offer a competitive advantage to companies offering dairy ingredients obtained from organic and sustainable sources. By overcoming these barriers, concentrating on product innovation, and ensuring high quality standards, the dairy ingredients market can navigate through changing market dynamics and thrive in the long term.

Key Segments of the Dairy Ingredients Market

Product Overview

• Proteins

• Milk Powder

• Milk Fat Concentrates

• Casein and Caseinates

• Lactose & Its Derivatives

• Whey

• Other Types

Application Overview

• Bakery & Confectionery

• Dairy Products

• Sports Nutrition Products

• Infant Formulas

• Cosmetics

• Pharmaceuticals

• Other Applications

Form Overview

• Powder

• Liquid

Distribution Channel Overview

• E-Commerce

• Specialty Retailers

• Supermarket & Hypermarket

• Others

Livestock Overview

• Cows

• Other Livestock

Production Method Overview

• Traditional Method

• Membrane Separation

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America