Cryptocurrency Mining Market Analysis and Insights:

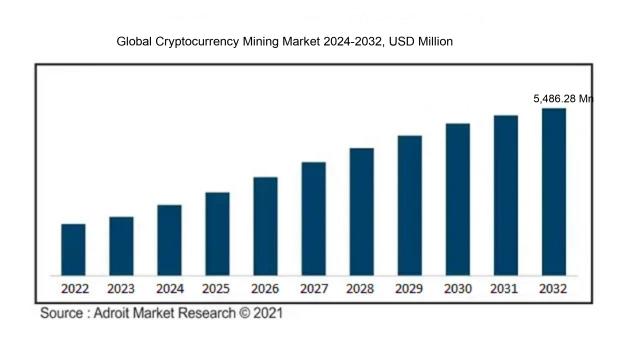

The cryptocurrency mining market is expected to expand at a compound annual growth rate (CAGR) of 10.05%, from USD 3,155 million in 2024 to USD 5,486.28 million by 2032.

The market for cryptocurrency mining is primarily influenced by several key factors, including the increasing acceptance of digital assets, advancements in technology, and the appreciation of cryptocurrency values. A surge in interest from both institutional and retail investors has ened the demand for mining operations as a revenue generation strategy. Moreover, the rising utilization of blockchain technology across diverse industries further stimulates mining activities, creating a more competitive environment.

Energy consumption remains a vital factor, with miners actively pursuing affordable and sustainable energy solutions to ensure profitability, thereby promoting innovation in renewable energy options. In certain regions, clear regulatory frameworks and supportive policies also play a significant role in fostering market expansion. Meanwhile, the growing awareness of environmental issues has led to the emergence of sustainable mining practices. Additionally, advancements in mining hardware and software enhance operational efficiency and reduce costs, enticing new players into the sector and driving overall growth. Collectively, these elements shape the trends and dynamics within the cryptocurrency mining landscape.

Cryptocurrency Mining Market Definition

The process of cryptocurrency mining involves the verification and incorporation of transactions into a blockchain through the resolution of intricate mathematical equations by utilizing computational resources. Individuals engaged in mining receive compensation in the form of newly generated coins or transaction fees, recognizing their crucial role in maintaining the network's security and operational integrity.

The practice of cryptocurrency mining plays a vital role in the ecosystem by fulfilling two main purposes: transaction validation and blockchain network security. This process enables the confirmation and recording of transactions on a public ledger, which promotes transparency and mitigates the risks of fraudulent activities. Additionally, mining facilitates the introduction of new coins into the marketplace, which not only increases the total supply but also provides incentives for miners to uphold the integrity of the network. Moreover, mining promotes decentralized economic systems, empowering users to conduct financial transactions independently of intermediaries. As the appeal of digital currencies continues to grow, optimized mining activities can bolster network security and address issues related to centralization, ultimately driving innovation and stability within the dynamic financial landscape.

Cryptocurrency Mining Market Segmental Analysis:

Insights On Mining Type

Cloud Mining Services

Cloud Mining Services is expected to dominate the Global Cryptocurrency Mining Market due to its increasing appeal among both novice and experienced miners. The model allows consumers to lease processing power from remote data centers without the need for substantial upfront investment in hardware or energy costs. Such accessibility and scalability make it an attractive option, particularly in regions facing high electricity costs or regulatory barriers. Moreover, the growing trend of institutional investments in cryptocurrency is catalyzing the demand for cloud mining solutions, which provide a more straightforward entry into the crypto ecosystem without the technical complexities of self-mining.

Self-Mining

Self-Mining has garnered attention, especially among dedicated cryptocurrency enthusiasts and professional miners who prefer full control over their mining operations. This approach typically involves substantial investment in mining hardware and infrastructure, coupled with the need for technical expertise. While it can yield significant rewards during bullish market phases, the high upfront costs and ongoing expenses associated with electricity, cooling, and maintenance limit its appeal to a wider audience. Additionally, as competitive difficulty levels rise and energy prices fluctuate, many aspiring miners may find it challenging to achieve profitability through self-mining.

Remote Hosting Services

Remote Hosting Services have carved out a niche appeal among miners who may not have the technological know-how or the physical space required to mine cryptocurrencies effectively. This option allows individuals to purchase mining rigs that are hosted in specialized data centers, handled by third-party professionals. It alleviates many operational burdens such as rig assembly, maintenance, and cooling solutions. However, the market for remote hosting remains challenged by higher operational costs and fluctuating service fees. Consequently, while it offers a solution for some, it does not match the accessibility and scalability that cloud mining services provide.

Insights On Hardware

ASIC

The ASIC (Application-Specific Integrated Circuit) is expected to dominate the Global Cryptocurrency Mining Market due to its unparalleled efficiency and performance specifically designed for cryptocurrency mining tasks. ASIC miners deliver a much higher hash rate compared to their counterparts, allowing miners to process transactions and solve complex cryptographic problems at significantly faster speeds. The increasing difficulty of mining Bitcoin and other cryptocurrencies requires specialized hardware that can keep up with performance demands. Consequently, the industry trend has been moving toward ASICs, and their market share is projected to grow rapidly, as they provide the best return on investment for miners.

GPU

The GPU (Graphics Processing Unit), while not the leading option, still holds a significant place in the cryptocurrency mining landscape. GPUs are known for their versatility and ability to mine a variety of cryptocurrencies beyond Bitcoin, making them an attractive choice for miners looking to diversify. Furthermore, the growing interest in altcoins that are more GPU-friendly can keep this relevant. However, with increasing competition from ASICs, the market share for GPUs may see a steady decline as miners seek higher efficiency and profitability.

CPU

The CPU (Central Processing Unit) has become less favorable for cryptocurrency mining due to its lower efficiency compared to specialized hardware like ASICs and GPUs. CPUs can still be used for mining less demanding cryptocurrencies, but as mining difficulty escalates, the performance gap widens. Consequently, the market for CPU mining is shrinking, as miners opt for options that offer better hash rates and energy consumption ratios. Despite this decline, some enthusiasts and hobbyists may still explore CPU mining for low-cap cryptocurrencies, but it does not represent a significant market force.

Others

The "Others" category encompasses various types of hardware used in cryptocurrency mining, which might include FPGAs (Field-Programmable Gate Arrays) and even cloud mining services. While these alternatives offer some level of flexibility and adaptability, they typically do not match the efficiency of ASICs or the broader applicability of GPUs in the current market climate. This is increasingly marginalized as specialized hardware becomes the standard for serious miners. Nonetheless, niche users may still find value in exploring these alternatives, although their impact on the overall market remains minimal.

Insights On Mining Enterprise

Large Miners

Large miners are expected to dominate the global cryptocurrency mining market due to their significant investments in advanced mining equipment and technology, allowing for greater efficiency and scalability. These enterprises can leverage their large-scale operations to achieve lower energy costs per unit of cryptocurrency produced. Furthermore, they enjoy better access to financing, enabling them to expand and innovate more rapidly than smaller competitors. Their established networks and partnerships also provide them with advantages in terms of market presence and access to the latest mining technology, solidifying their position as leaders in the cryptocurrency mining space.

Small Miners

Small miners typically operate on a much smaller scale, which limits their ability to invest in advanced technology compared to their larger counterparts. They often face higher operational costs, particularly in terms of energy consumption, which can severely impact their profitability. Additionally, small miners may struggle with market volatility and competitive pressures, making it challenging for them to sustain operations over time. While they can contribute to the diversity of the market and sometimes capitalize on niche opportunities, their overall impact is less significant compared to large miners.

Medium Miners

Medium miners occupy a niche space between large and small operations. Although they possess some advantages, such as a moderate level of investment and operational capacity, they often lack the economies of scale achieved by larger miners. Medium miners may benefit from flexibility and adaptability in their operations, allowing them to respond quickly to market changes. However, they still face challenges regarding access to capital and advanced technology, which can hinder their growth potential. Their success is often determined by their ability to find a balance between operational efficiency and market competitiveness.

Insights On Revenue Source

Block Rewards

The Block Rewards is expected to dominate the Global Cryptocurrency Mining Market primarily due to the ongoing reliance on the Proof of Work (PoW) consensus mechanism used by major cryptocurrencies like Bitcoin and Ethereum (at least until Ethereum made its transition to Proof of Stake). Block Rewards refer to the incentive incentivization miners receive for successfully validating and adding new transactions to the blockchain. With the increasing scarcity of newly mined coins as halving events occur and the rising difficulty of mining, the block rewards act as a significant draw for miners. The large monetary rewards and the potential for capital appreciation of mined coins significantly outweigh the relatively smaller and more variable income derived from transaction fees, making Block Rewards the primary focus for miners involved in cryptocurrency.

Transaction Fees

Transaction Fees represent the charges paid to miners by users for processing their transactions on the blockchain. While these fees play a role in the overall revenue for many miners, they are generally overshadowed by the more substantial block rewards. In times of low demand for transactions, the fees can decrease, particularly during periods of network congestion when miners prioritize higher-paying transactions. Given the potential volatility in transaction volumes and fee structures, many miners often view this revenue source as secondary or supplementary to the more consistent and lucrative block rewards. Thus, while Transaction Fees contribute to a miner's overall earnings, they are not the leading revenue source in the cryptocurrency mining landscape.

Block Rewards

Block Rewards are pivotal in the cryptocurrency mining ecosystem because they provide the primary financial motivation for miners. When a miner successfully validates and creates a new block, they receive a predetermined number of coins, which, for Bitcoin, currently stands at 6.25 BTC per block. As the mining process gets more competitive and blocks become harder to mine, these rewards become increasingly significant. Over time, the block reward effectively halves approximately every four years, which contributes to the value appreciation of cryptocurrencies as their supply diminishes. This scarcity combined with the changing landscape of crypto adoption makes block rewards a central focus for miners looking to maximize their returns.

Global Cryptocurrency Mining Market Regional Insights:

North America

North America is expected to dominate the Global Cryptocurrency Mining Market due to several compelling factors. The region boasts advanced technological infrastructure, a robust power grid, and a high availability of renewable energy sources, which are crucial for cost-effective mining operations. Furthermore, the presence of a large number of established mining companies, supportive governmental policies, and access to venture capital contribute to its leadership in the industry. The increasing interest from institutional investors and the rapid development of blockchain technology also play a significant role in enhancing North America's position as a dominant player in cryptocurrency mining.

Latin America

Latin America is emerging as a growing contender in the cryptocurrency mining market, driven by the accessibility of low-cost electricity in certain countries like Venezuela and Argentina. However, regulatory uncertainty and inconsistent technological infrastructure can pose challenges. Despite these issues, the region has potential, especially as its governments recognize the benefits of blockchain technologies, which may pave the way for increased investment in mining activities in the future.

Asia Pacific

Asia Pacific shows promise in the cryptocurrency mining sector, particularly in countries like China and Kazakhstan, which have previously hosted large mining operations due to low energy costs. However, regulatory crackdowns and increasing governmental scrutiny in countries like China have affected this. On the other hand, nations like Australia and Singapore are witnessing rising interest in cryptocurrency innovation, which could spur future growth in mining activities. The region's dynamic economic environment and varied regulatory framework create both opportunities and challenges for miners.

Europe

Europe has a diverse cryptocurrency mining landscape, with varying regulations and electricity costs across different countries. Nations like Iceland, Sweden, and Norway have attracted miners due to their renewable energy resources and favorable climates for efficient operations. However, regulatory challenges and a push for stricter environmental laws may hinder growth potential. Nevertheless, the European Union's focus on digital currency initiatives and blockchain technology may foster a conducive environment for mining activities in some regions.

Middle East & Africa

The Middle East & Africa region is still largely untapped in terms of cryptocurrency mining potential. Countries like South Africa are exploring blockchain technology and its applications, although the overall mining infrastructure remains underdeveloped. Energy prices and regulatory frameworks also vary widely throughout the region, influencing mining viability. However, as awareness of cryptocurrencies grows and investment in technology increases, there is potential for future developments that could enhance the region's standing in the global cryptocurrency mining market.

Cryptocurrency Mining Competitive Landscape:

Central figures in the worldwide cryptocurrency mining sector, including producers of hardware, operators of mining pools, and developers of software, propel advancements in technology and enhance mining productivity. Their interactions, marked by both cooperation and rivalry, significantly affect market trends, impacting profitability and the expansion of the industry.

Prominent entities in the cryptocurrency mining sector comprise Bitmain Technologies, NVIDIA Corporation, Advanced Micro Devices (AMD), Canaan Creative, MicroBT, Innosilicon, Ebang International Holdings, Hive Blockchain Technologies, Argo Blockchain, Marathon Digital Holdings, Riot Blockchain, Genesis Mining, Bitfury Group, Northern Data AG, and Compass Mining.

Global Cryptocurrency Mining COVID-19 Impact and Market Status:

The Covid-19 pandemic has profoundly impacted the worldwide cryptocurrency mining sector by leading to interruptions in supply chains, rising energy costs, and shifts in demand patterns. This situation has, in turn, hastened the movement toward more energy-efficient mining solutions.

The COVID-19 pandemic had a profound effect on the cryptocurrency mining sector, triggering interruptions in supply chains that resulted in shortages of equipment and erratic electricity supply due to lockdown protocols. Numerous mining operations, especially those dependent on specific hardware such as ASIC miners, encountered delays and escalated expenses as manufacturers struggled to fulfill demand. The pandemic also ignited ened retail enthusiasm for cryptocurrencies, which, in turn, led to a surge in prices and attracted a wave of new miners to the scene. This inflow increased competition, compelling existing miners to enhance their operational efficiency. On the other hand, some miners withdrew from the market due to diminished profitability stemming from price volatility and rising operational costs. In summary, while COVID-19 presented considerable obstacles, it simultaneously accelerated the cryptocurrency mining industry's growth and adaptation, showcasing its ability to withstand economic challenges. Additionally, advancements in renewable energy solutions for mining highlighted a broader transition towards more eco-friendly practices.

Latest Trends and Innovation in The Global Cryptocurrency Mining Market:

- In October 2023, Hive Blockchain Technologies Ltd. announced a partnership with a renewable energy provider to enhance its green energy sourcing for Bitcoin mining, aiming to reach 100% renewable energy utilization by mid-2024.

- In September 2023, Bitfarms Ltd. secured a $50 million credit facility with a major financial institution to expand its mining operations in Canada and improve its infrastructure, signaling aggressive growth plans amid fluctuating cryptocurrency prices.

- In August 2023, Marathon Digital Holdings, Inc. collaborated with Applied Blockchain, Inc. to develop a new mining facility in North Dakota that plans to leverage lower energy costs and maximize operational efficiency, set to launch within the first quarter of 2024.

- In July 2023, Hut 8 Mining Corp completed its merger with USBTC, resulting in one of the largest publicly traded bitcoin miners in North America. The merger is expected to boost operational capacity and market presence.

- In June 2023, Argo Blockchain Plc announced its acquisition of a new mining facility in the United States, significantly increasing its capacity by 200 PH/s and improving its position in the competitive North American market.

- In May 2023, Riot Platforms, Inc. launched a new artificial intelligence-based system to optimize power consumption across its mining operations, aiming to reduce costs by approximately 20% and enhance overall efficiency.

- In April 2023, Core Scientific, Inc. reported successful integration of new ASIC miners, which are expected to increase their hash rate by 30%, positioning them to capitalize on rising demand for Bitcoin mining.

- In March 2023, Northern Data AG expanded its mining operations into North America via a strategic partnership with Compute North, allowing the company to access more cost-effective energy solutions and expand its market share.

Cryptocurrency Mining Market Growth Factors:

Essential drivers of growth in the cryptocurrency mining sector encompass the growing acceptance of digital currencies, innovations in mining hardware technology, and enhanced initiatives focused on energy efficiency.

The cryptocurrency mining industry is witnessing substantial expansion, influenced by several key elements. Firstly, the rise in the adoption of cryptocurrencies and the growing interest in blockchain technology are driving the demand for mining activities, as both individuals and institutions increasingly look to invest in digital currencies. Additionally, innovations in mining hardware are improving operational efficiency and reducing energy consumption, making it easier for miners to achieve profitability. The emergence of decentralized finance (DeFi) and non-fungible tokens (NFTs) has broadened the cryptocurrency landscape, offering various avenues for mining ventures.

Moreover, supportive regulatory frameworks in specific areas, along with access to renewable energy sources, are fostering investments in mining infrastructure. The increasing engagement from institutional investors also signals a movement towards mainstream recognition, thus contributing to market growth. The demand for secure and transparent transactions necessitates robust mining operations, which further supports the sector's development. Lastly, educational programs focused on cryptocurrency and mining are attracting new participants, expanding the overall market. Together, these factors paint a promising outlook for the cryptocurrency mining sector as it evolves within a swiftly changing digital ecosystem and meets the rising consumer demand for blockchain technology.

Cryptocurrency Mining Market Restaining Factors:

The cryptocurrency mining sector encounters considerable limitations stemming from excessive energy usage, regulatory ambiguities, and environmental issues.

The cryptocurrency mining sector encounters numerous constraints that may hinder its expansion potential. A primary issue is the substantial operational expenses linked to electricity usage, which can markedly diminish miners' profit margins. Additionally, regulatory challenges represent a significant obstacle, as governments around the globe navigate the complexities of cryptocurrency governance, potentially resulting in prohibitive bans or stringent regulations that could discourage miners. The environmental implications associated with the high energy demands of mining operations have also sparked public opposition and ened scrutiny from authorities. Moreover, the escalating difficulty of mining, fueled by ened competition and the requirement for sophisticated technology, can render the field less approachable for newcomers. The fluctuating nature of cryptocurrency values adds another layer of uncertainty, complicating miners' ability to forecast sustainable profitability. Nevertheless, the industry is evolving, with advancements in energy-efficient mining practices, the establishment of renewable energy solutions, and the potential for regulatory frameworks that may foster a more conducive environment for growth. These elements indicate that, despite existing obstacles, the cryptocurrency mining domain shows potential for innovation and adaptability, ultimately leading toward a more sustainable and viable future.

Key Segments of the Cryptocurrency Mining Market

By Mining Type

- Self-Mining

- Cloud Mining Services

- Remote Hosting Services

By Hardware

- ASIC

- GPU

- CPU

- Others

By Mining Enterprise

- Large Miners

- Small Miners

By Revenue Source

- Transaction Fees

- Block Rewards

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America