Market Analysis and Insights:

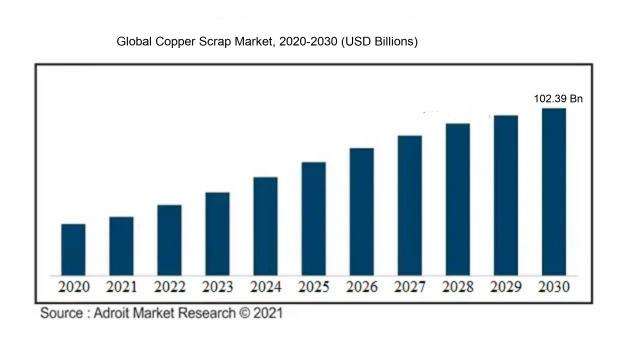

The market for Global Copper Scrap was estimated to be worth USD 61.95 billion in 2024, and from 2024 to 2030, it is anticipated to grow at a CAGR of 8.49%, with an expected value of USD 102.39 billion in 2030.

The Copper Scrap Market is driven by a multitude of factors stemming from the intricate interplay between supply and demand dynamics. The continuous rise in the availability of copper scrap stands out as a pivotal element on the supply side. This trend is primarily fueled by the robust expansion of the construction and infrastructure sectors, which generate substantial quantities of copper scrap through extensive demolition and renovation endeavors. Moreover, the surge in the recycling industry is amplifying the pool of copper scrap that can be salvaged and repurposed. Conversely, the escalating demand for copper across various key industries including electrical and electronics, automotive, and consumer goods is a significant force propelling the market forward. With its unparalleled electrical conductivity and resistance to corrosion, copper is indispensable in the production of electrical wiring, motors, transformers, and electronic gadgets. Additionally, the increasing emphasis on sustainability and eco-friendly practices is bolstering the demand for copper scrap as a means to lessen dependence on virgin copper. The market landscape is further shaped by variables such as the volatility in copper prices, the availability of substitute materials, and governmental regulations, all of which contribute substantially to the nuances of the copper scrap market.

Sodium Sulphide Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 102.39 billion |

| Growth Rate | CAGR of 8.49% during 2024-2030 |

| Segment Covered | By Grade, By Application, By Feed Material, By End-Use, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Aurubis AG, European Metal Recycling Ltd, Sims Metal Management Ltd, OmniSource Corporation, Schnitzer Steel Industries Inc, Metallon Recycling, AWA Refiners Ltd, Peel Scrap Metal Recycling Ltd, Metal Exchange Corporation, and Southern Copper Corporation. |

Market Definition

Copper scrap denotes abandoned copper elements like wires, tubes, or other copper items that are obsolete and eligible for recycling. This resource holds significant value in the realm of recycling and repurposing copper, thereby lessening the requirement for fresh raw materials and mitigating environmental repercussions.Copper scrap holds significant value for several key reasons. To

begin, copper possesses exceptional conductivity properties for both electricity and heat, making it an essential element across various sectors such as electronics manufacturing, power production, and telecommunications. The recycling of copper scrap plays a crucial role in satisfying the demand for this precious metal while diminishing the necessity for extensive mining activities, thereby lessening the overall environmental impact. Moreover, recycling copper scrap proves to be a financially prudent approach, given its reduced energy requirements compared to the extraction of fresh copper from its natural state. Furthermore, the recycling process aids in the preservation of natural resources and diminishes the volume of waste deposited in landfills. In essence, the significance of copper scrap lies in its promotion of sustainable practices, reduction of carbon footprints, and contribution to a closed-loop economy.

Key Market Segmentation:

Insights On Key Grade

#1 Copper Scrap

#1 Copper Scrap grade is expected to dominate the Global Copper Scrap Market. #1 Copper Scrap is the highest grade of copper scrap available, and it is typically obtained from clean, unalloyed copper. This type of scrap has a minimum copper content of 99%, making it highly desirable for recycling and reprocessing. Its high purity and quality make #1 Copper Scrap suitable for various applications in industries such as construction, electrical, and plumbing. Due to its superior copper content, #1 Copper Scrap commands a premium price compared to other grades, further contributing to its dominance in the global market.

Bare Bright

Bare Bright is another sector of Grade in the Global Copper Scrap Market. Bare Bright refers to clean, uncoated, and unalloyed copper wire with a minimum copper content of 99%. While Bare Bright holds significance in the scrap market, it is not expected to dominate as #1 Copper Scrap does. Bare Bright is primarily utilized in electrical and communication applications due to its high conductivity. However, the presence of other parts with higher copper content and relatively better quality makes Bare Bright a secondary choice for buyers and reduces its overall market dominance.

#2 Copper Scrap

#2 Copper Scrap is a player within the Grade category in the Global Copper Scrap Market. It refers to copper wire and cable scrap that may contain various levels of impurities, including alloys, insulation, and other metals. #2 Copper Scrap typically has a copper content of around 94-96%. While it has acceptable copper content for recycling purposes, it is not expected to dominate the global market due to its lower purity compared to #1 Copper Scrap. The presence of parts with higher copper content and better quality limits the market dominance of #2 Copper Scrap.

Other Grades

The Other Grades category within Grade encompasses various types of copper scrap that do not fall into the specific parts like #1 Copper Scrap, #2 Copper Scrap, or Bare Bright. These grades may include copper with lower purity levels, mixed scrap, or copper alloys with other metals. While Other Grades have their place in the global market, they are not expected to dominate due to their lower copper content and potential impurities. Other Grades of copper scrap often have limited applications and are commonly used for low-grade industrial purposes or further processing to extract copper content. Consequently, they have a smaller market share compared to the dominant parts like #1 Copper Scrap.

Insights On Key Application

Wire Rod Mills

Wire Rod Mills are expected to dominate the Global Copper Scrap Market. The demand for copper wire rods is high due to their various applications in industries such as electrical, automotive, and construction. These wire rods are used in the production of electrical cables, transformers, motors, and other electrical components. The increasing focus on renewable energy projects and electric vehicle production also contributes to the demand for copper wire rods. As a result, Wire Rod Mills are expected to hold a significant share in the Global Copper Scrap Market.

Brass Mills

Brass Mills, while not expected to dominate the Global Copper Scrap Market, still play a significant role. Brass is an alloy composed of copper and zinc, and it finds applications in various industries, including plumbing, electrical fittings, musical instruments, and decorative items. Although the demand for copper scrap in Brass Mills is not as high as wire rods, it remains a considerable part in the Global Copper Scrap Market.

Ingots Makers

The Ingots Makers application is not projected to dominate the Global Copper Scrap Market. Ingots are typically produced by melting copper scrap and then casting it into a solid form. These ingots find application in the production of copper alloys and other manufacturing processes. However, the demand for ingots is relatively lower compared to wire rods and brass mills due to their limited application scope. Hence, Ingots Makers are not expected to be the dominating part in the Global Copper Scrap Market.

Other Applications

Other Applications category refers to various industries and sectors where copper scrap is used for specific purposes. This part includes applications such as welding, plumbing, architectural structures, and heat exchangers. While these industries contribute to the overall demand for copper scrap, they are not expected to dominate the Global Copper Scrap Market. The demand from Wire Rod Mills and Brass Mills is considerably higher than in these other application areas. Therefore, Other Applications are not likely to be the dominating part in the Global Copper Scrap Market.

Insights On Key Feed Material

Old Scrap

Old Scrap is expected to dominate the Global Copper Scrap Market. This is primarily due to the fact that old scrap refers to copper materials that have already been used and discarded, such as copper wires, pipes, and electrical components. These materials are highly sought after for recycling purposes, as they contain a significant amount of copper that can be reprocessed and reused. The demand for old scrap is driven by various industries, including construction, automotive, and electronics, where copper is extensively used. Additionally, the recycling of old scrap aligns with sustainability goals, making it an attractive option for buyers in the market.

New Scrap

New Scrap, on the other hand, is not expected to dominate the Global Copper Scrap Market. New scrap refers to copper materials generated during manufacturing processes, such as excess or offcuts from copper sheet production or copper wire production. While new scrap does contribute to the copper scrap market, its dominance is limited compared to old scrap. This is mainly because new scrap is often retained within the manufacturing industry to be reused in production or sold directly to downstream manufacturers. The volume of new scrap available for recycling is generally lower compared to old scrap, which makes it less significant in terms of overall market dominance.

Insights On Key End-Use

Building & Construction

The Building & Construction end-use is expected to dominate the Global Copper Scrap Market. This is due to the strong demand for copper in various building and construction applications, such as electrical wiring, plumbing, and HVAC systems. As urbanization and infrastructural development continues to grow globally, the need for copper in these sectors is expected to increase. Copper is valued for its excellent conductivity, durability, and resistance to corrosion, making it an ideal choice for these construction applications. As a result, the Building & Construction part is projected to hold a significant share in the overall market.

Electrical & Electronics

The Electrical & Electronics end-use is another important component of the Global Copper Scrap Market. Copper is widely used in various electrical and electronic applications, including power generation, transmission, and distribution, as well as in the production of electronic devices and appliances. The increasing consumption of electronics and the growing trend towards renewable energy sources are driving the demand for copper in this part.

Industrial Machinery & Equipment

The Industrial Machinery & Equipment end-use also holds a significant share in the Global Copper Scrap Market. Copper is utilized in machinery and equipment manufacturing for its superior heat and electrical conductivity, as well as its corrosion resistance properties. Industries such as automotive, aerospace, and manufacturing heavily rely on copper-based components and systems, creating a steady demand for copper scrap within this part.

Transportation Equipment

The Transportation Equipment end-use is another notable sector of the Global Copper Scrap Market. Copper is widely used in the automotive industry for various applications, including wiring harnesses, radiators, and electrical connectors. The increasing demand for electric vehicles and the growing emphasis on fuel efficiency are further driving the utilization of copper in transportation equipment. As a result, the Transportation Equipment part is expected to contribute to the overall market growth.

Consumer and General Products

Although not dominating the Global Copper Scrap Market, the Consumer and General Products end-use still plays a significant role. Copper is used in various consumer products such as cookware, plumbing fixtures, and decorative items. Additionally, copper is utilized in general industrial applications like metalworking and construction equipment. While the demand from this part may not be as substantial as the others mentioned above, it still contributes to the overall demand for copper scrap in the market.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Copper Scrap market. Asia Pacific has a significant demand for copper due to its rapid industrialization and urbanization, particularly in countries such as China and India. These countries have a large manufacturing sector that relies heavily on copper for various applications, including electrical wiring, electronics, and construction. Additionally, Asia Pacific has a growing consumer electronics industry, which further drives the demand for copper. The region also benefits from a well-established scrap metal recycling industry, ensuring a steady supply of copper scrap. Therefore, with its strong demand, robust manufacturing sector, and efficient recycling practices, Asia Pacific is poised to dominate the Global Copper Scrap market.

North America

North America is expected to be a key player in the Global Copper Scrap market. The region has a mature industrial sector and a high consumption rate of copper in various industries, including construction, electrical, and automotive. The United States, in particular, has a substantial demand for copper scrap, driven by construction activities and the manufacturing of electrical equipment. Furthermore, North America has advanced recycling technologies and a well-developed scrap market, contributing to a steady supply of copper scrap. Thus, while it may not dominate the market like Asia Pacific, North America is expected to hold a significant share in the Global Copper Scrap market.

Latin America

Latin America is an emerging market in the Global Copper Scrap industry. The region has several copper-rich countries, such as Chile and Peru, which are major producers of copper ore. This provides Latin America with a steady supply of raw material for copper scrap production, as well as a strong base for the recycling industry. Additionally, the construction and automotive sectors in the region are growing steadily, leading to increased demand for copper scrap. While Latin America may not dominate the Global Copper Scrap market like Asia Pacific, its abundant copper resources and developing industries position it as a significant player in the market.

Europe

Europe is expected to be a significant player in the Global Copper Scrap market. The region has a well-established industrial sector and a strong emphasis on sustainability and circular economy principles. This has led to the development of advanced recycling technologies and efficient scrap metal markets in countries such as Germany and the Netherlands. Europe also has stringent environmental regulations and targets, which further drive the demand for recycled copper. Although Europe may not dominate the Global Copper Scrap market like Asia Pacific, its focus on sustainability and advanced recycling practices position it as a key player in the industry.

Middle East & Africa

The Middle East & Africa region is a growing market in the Global Copper Scrap industry. The region has various developing countries, including South Africa and the United Arab Emirates, which are witnessing rapid urbanization and infrastructure development. These factors fuel the demand for copper in construction and electrical applications. While the region may not dominate the Global Copper Scrap market compared to Asia Pacific, its growth potential and increasing demand make it an important player in the industry. The Middle East & Africa region also benefits from its proximity to the copper-rich countries of Africa, ensuring a steady supply of raw material for copper scrap production.

Company Profiles:

The primary participants in the international copper scrap industry hold significant significance in the supply network, as they engage in the collection, processing, and dissemination of copper scrap to address the worldwide need for recycling and production uses. Their involvement extends to enhancing industry standards through the implementation of eco-friendly methods and the integration of cutting-edge technologies to elevate the standards and effectiveness of copper scrap recycling processes.

Prominent companies in the copper scrap industry comprise Aurubis AG, European Metal Recycling Ltd, Sims Metal Management Ltd, OmniSource Corporation, Schnitzer Steel Industries Inc, Metallon Recycling, AWA Refiners Ltd, Peel Scrap Metal Recycling Ltd, Metal Exchange Corporation, and Southern Copper Corporation. These organizations are actively involved in the global collection, processing, and distribution of copper scrap, crucial for sustainable copper utilization and recycling. Their operations cater to the increasing demand for copper in diverse sectors including construction, automotive, electronics, and telecommunications. With their specialized knowledge and extensive networks, these industry leaders play a vital role in optimizing the supply chain of copper scrap, ensuring the provision of top-quality resources for manufacturers and mitigating the environmental repercussions associated with traditional mining and extraction methods.

COVID-19 Impact and Market Status:

The global copper scrap market has been significantly influenced by the effects of the Covid-19 pandemic, causing a reduction in demand, supply chain interruptions, price declines, and a ened sense of uncertainty within the market.

The copper scrap market has been significantly affected by the COVID-19 pandemic, mainly due to the global economic downturn and restrictions on movement implemented by governments worldwide. This has resulted in a decrease in industrial activities, leading to a reduced demand for copper and copper scrap. Key sectors such as manufacturing and construction, which are major consumers of copper scrap, have faced disruptions in their operations due to lockdown measures. As a result, the demand for copper scrap has decreased since these sectors play a vital role in overall copper consumption. Moreover, the disturbance in global supply chains has impeded the flow of copper scrap, causing challenges in sourcing and transportation.

Consequently, prices of copper scrap have experienced a decline, a trend that is expected to persist as long as the pandemic continues. Although sectors like renewable energy and electric vehicle manufacturing could potentially boost copper demand in the future, the general impact of the COVID-19 pandemic on the copper scrap market is predominantly negative, characterized by reduced demand and lower prices.

Latest Trends and Innovation:

- In July 2021, Boliden, a leading Swedish metals company, announced the acquisition of the Umicore DRC entity, expanding its copper recycling capacity and market presence in the Democratic Republic of Congo.

- In October 2020, Aurubis AG, a global copper recycling company based in Germany, announced its acquisition of Metallo Group, a Belgium-based specialist in the recycling of copper and other non-ferrous metals.

- In January 2021, Sims Limited, a leading global metal recycling company headquartered in Australia, completed the acquisition of SRS, a US-based independent scrap metal processor, strengthening its position in the North American copper recycling market.

- In March 2020, Mitsubishi Materials Corporation, a Japanese metals and mining company, launched a new copper recycling process utilizing bacteria to efficiently extract copper from low-grade scrap.

- In April 2021, Codelco, the Chilean state-owned copper mining company, announced a joint venture with Japanese trading house Mitsui & Co. to develop a new copper scrap recycling business in Japan.

- In September 2020, Glencore, a multinational commodity trading and mining company, signed an agreement with China's GEM Co. Ltd., a major battery maker, to supply copper concentrate and cobalt hydroxide for the production of electric vehicle batteries.

- In November 2021, European Metal Recycling (EMR), one of the world's largest metal recyclers, acquired certain assets of four copper and aluminum recycling facilities previously owned by Metal & Waste Recycling Ltd., expanding its presence in the UK copper scrap market.

- In February 2021, Jiangxi Copper Corporation, one of China's largest copper producers, announced the development of a new copper scrap processing facility in the Guangdong Province, further enhancing its capacity in recycling.

- In June 2020, Schnitzer Steel Industries, Inc., one of the largest scrap metal recyclers in the US, announced the opening of a new advanced auto recycling facility in Oregon, aiming to improve the recovery of valuable metals, including copper, from end-of-life vehicles.

- In December 2021, Saubermacher Dienstleistungs AG, an Austrian recycling company, signed a strategic partnership agreement with Andritz, an international technology group, to develop innovative processes for the recycling of electronic scrap, including copper-containing components.

Significant Growth Factors:

Factors driving the growth of the Copper Scrap Market encompass the upward trend in industrialization, surging desire for recycled goods, and ened consciousness regarding sustainable methodologies.

The copper scrap industry is poised for substantial expansion in the forthcoming years. This growth is underpinned by multiple factors, such as the escalating need for copper across diverse sectors including construction, automotive, electrical and electronics, and machinery. Copper's widespread usage in these industries is a result of its superior conductivity, resistance to corrosion, and recyclability. The emphasis on sustainable development and the circular economy is a key driver behind the escalating demand for copper scrap as a primary resource. Copper scrap plays a vital role as a fundamental input for copper smelting and refining processes, thereby diminishing the necessity for primary copper production and its ensuing environmental repercussions. Furthermore, the increasing awareness surrounding the environmental advantages of recycling copper, such as energy conservation and reduced greenhouse gas emissions, is spurring the demand for copper scrap. Additionally, the favorable governmental regulations and policies that advocate recycling and sustainable practices are acting as a catalyst for the growth of the copper scrap sector. The Asia-Pacific region, notably China and India, is experiencing substantial industrialization and urbanization, leading to a ened requirement for copper scrap. Nevertheless, challenges like the fluctuating copper prices and the presence of substitutes like aluminum pose a minor impediment to market expansion. In essence, the surge in copper demand across various industries, the enhanced focus on sustainability, and the supportive governmental initiatives are projected to drive remarkable growth in the copper scrap market in the foreseeable future.

Restraining Factors:

The Copper Scrap Market faces a growth challenge due to the scarcity of premium-grade copper scrap materials.

The copper scrap market is impacted by various factors that hinder its growth and potential. Price volatility in copper can lead to uncertain trading conditions and fluctuating profitability, affecting market stability. Furthermore, the availability and quality of copper scrap fluctuate, making it challenging for market participants to secure a consistent supply. Additionally, strict environmental regulations pose a significant obstacle as compliance necessitates investments in technology and infrastructure. Economic downturns, like the one experienced during the COVID-19 pandemic, result in reduced industrial activities and disrupted supply chains, influencing copper scrap demand. Despite these challenges, market players have the opportunity to innovate and adapt to changing circumstances. Technological advancements can enhance the efficiency of copper scrap recycling processes and ensure a sustainable supply. Collaboration between governments and industry stakeholders can lead to the development of supportive policies and initiatives that boost the growth of the copper scrap market while addressing environmental concerns. By employing strategic planning, effective risk management, and a focus on sustainability, the copper scrap market can navigate these challenges and continue flourishing in the future.

Key Segments of the Copper Scrap Market

Grade Overview

• Bare Bright

• #1 Copper Scrap

• #2 Copper Scrap

• Other Grades

Application Overview

• Wire Rod Mills

• Brass Mills

• Ingots Makers

• Other Applications

Feed Material Overview

• Old Scrap

• New Scrap

End-Use Overview

• Building & Construction

• Electrical & Electronics

• Industrial Machinery & Equipment

• Transportation Equipment

• Consumer and General Products

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America