Market Analysis and Insights:

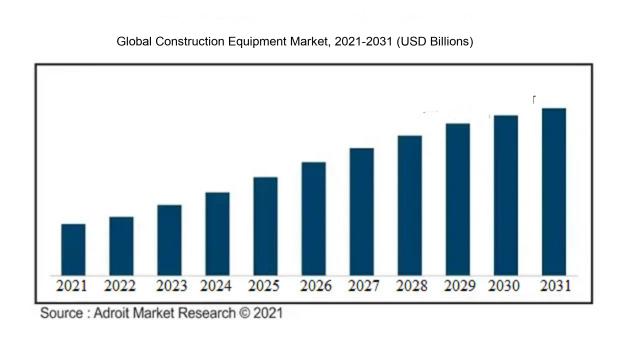

The market for Global Construction Equipment was estimated to be worth USD XX billion in 2021, and from 2021 to 2031, it is anticipated to grow at a CAGR of XX%, with an expected value of USD XX billion in 2031.

The global construction equipment market receives its momentum from various significant drivers. One vital factor is the continuous progression of urbanization and industrialization processes worldwide, which is leading to an increased need for construction activities and consequently driving the market for construction equipment. Furthermore, governmental initiatives aimed at infrastructure development and the promotion of sustainable construction ventures are playing a pivotal role in boosting market growth. The uptake of advanced construction machinery such as excavators, loaders, and cranes by construction firms to augment efficiency and reduce manual labor is serving as a positive catalyst for the market. Additionally, the surge in investments in both residential and commercial construction ventures, particularly in emerging markets, is significantly bolstering the demand for construction equipment. The integration of technologies like telematics and the Internet of Things (IoT) in construction equipment is also proving to be a crucial factor in the market's growth trajectory. Moreover, the increasing emphasis on energy-efficient and environmentally friendly construction equipment is gaining traction and contributing to the expansion of the market. In summary, these combined factors are actively driving the growth and evolution of the construction equipment sector.

Construction Equipment Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD XX billion |

| Growth Rate | CAGR of XX% during 2021-2031 |

| Segment Covered | By Product, By Equipment Type, By Propulsion Type, By Engine Capacity, By Power Output, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment AB, Hitachi Construction Machinery Co., Ltd., Liebherr-International AG, Terex Corporation, Sany Group Co., Ltd., Doosan Infracore Co., Ltd., JCB India Limited, and CNH Industrial N.V. |

Market Definition

Construction equipment encompasses a diverse array of machinery, implements, and vehicles employed in construction endeavors to carry out a multitude of operations such as excavation, hoisting, transportation, and material compression. Their roles are pivotal in augmenting productivity, effectiveness, and protection at construction sites.

The role of construction equipment is paramount in shaping the infrastructure and fostering the advancement of communities worldwide. As urbanization accelerates and populations expand, the demand for construction endeavors continues to rise steadily. Excavators, bulldozers, cranes, and loaders are among the machinery that facilitates the efficient implementation of these projects. The significance of construction equipment lies in its capacity to enhance productivity, streamline operations, and uphold safety standards within the construction sector. These tools mechanize and simplify a variety of tasks, such as excavation, lifting, and transportation, which would otherwise demand significant time and labor investments. By leveraging construction equipment, construction firms can expedite project completion, curtail expenses, and mitigate potential hazards. The resultant productivity gains directly contribute to economic advancement, employment opportunities, and ened living standards for communities. Furthermore, construction equipment plays a pivotal role in advancing sustainability objectives by enabling the adoption of environmentally friendly materials and more efficient construction methods. Consequently, the indispensable nature of construction equipment cannot be understated, as it propels the progress of construction initiatives and bolsters the holistic development of societies.

Key Market Segmentation:

Insights On Key Product

Earth Moving Machinery

Earth Moving Machinery is expected to dominate the Global Construction Equipment Market. This part includes machines such as excavators, loaders, bulldozers, and motor graders, which are essential for various construction activities. Earth moving machinery plays a crucial role in moving large volumes of earth, rocks, and debris during the construction process, making it an integral part of any construction project. The demand for earth moving machinery is driven by factors such as infrastructure development, urbanization, and the need for efficient and cost-effective construction methods. With the growing demand for construction and infrastructure projects worldwide, the dominance of earth moving machinery in the construction equipment market is expected to continue.

Material Handling Machinery

Material Handling Machinery is another significant product of the Global Construction Equipment Market. This includes machines such as forklifts, cranes, and hoists, which are used for handling, transporting, and lifting materials at construction sites. Material handling machinery is essential for efficient and safe operations in various construction activities, including loading and unloading materials, moving heavy objects, and constructing tall structures. The demand for material handling machinery is driven by factors such as the growth of the logistics and warehousing industry, increased focus on safety regulations, and the need for improved productivity in construction operations.

Concrete and Road Construction Machinery

Concrete and Road Construction Machinery is another product in the Global Construction Equipment Market. This includes machines such as concrete mixers, asphalt pavers, and road rollers, which are specifically designed for construction related to concrete and road infrastructure. Concrete and road construction machinery are essential for activities such as mixing and transporting concrete, laying asphalt, and compacting road surfaces. The demand for concrete and road construction machinery is driven by factors such as the increasing need for infrastructure development, maintenance, and repair of roads, as well as the growth of the construction industry in general.

Insights On Key Equipment Type

Heavy Construction Equipment

The Heavy Construction Equipment type is expected to dominate the Global Construction Equipment Market. Heavy construction equipment, including earthmoving machinery, excavators, loaders, bulldozers, and cranes, holds a significant market share due to its capability to handle large-scale construction projects. With the rise in infrastructure development and urbanization globally, the demand for heavy construction equipment is expected to grow rapidly. Moreover, heavy equipment offers superior power, efficiency, and durability, making it suitable for various construction applications. Thus, it is anticipated that the part of Heavy Construction Equipment will continue to dominate the Global Construction Equipment Market.

Compact Construction Equipment

While the Heavy Construction Equipment type is expected to dominate the Global Construction Equipment Market, the Compact Construction Equipment type is also witnessing steady growth and has its unique significance. Compact construction equipment, including compact excavators, compact loaders, skid steer loaders, and compact track loaders, is characterized by its smaller size and versatility. These machines are widely used in urban areas, residential construction sites, and projects with space constraints. Compact equipment offers maneuverability, ease of transportation, and enhanced productivity in confined spaces. It caters to the needs of small and medium-sized contractors and is popular for its ability to perform various tasks efficiently. Although the share of Compact Construction Equipment might be relatively smaller compared to Heavy Construction Equipment, its importance cannot be overlooked in specific construction applications.

Insights On Key Propulsion Type

Electric

The electric propulsion type is expected to dominate the Global Construction Equipment Market. With the growing emphasis on environmental sustainability and the need for reduced emissions, electric construction equipment is becoming increasingly popular. Electric equipment offers several advantages over traditional internal combustion engines (ICE), including lower operating costs, reduced noise pollution, and zero emissions. Additionally, advancements in battery technology have improved the performance and range of electric construction equipment, making it more efficient and reliable. As governments worldwide implement stricter regulations and provide incentives for adopting clean technologies, the demand for electric construction equipment is projected to soar.

ICE (Internal Combustion Engine)

ICE construction equipment has been the dominant sector in the global construction equipment market for many years. These machines are widely utilized in construction activities due to their power, durability, and high productivity. The internal combustion engine allows for greater torque and higher operational speeds, making them suitable for heavy-duty applications. However, with the growing concerns over environmental pollution and the global shift towards sustainable practices, the demand for ICE construction equipment is expected to decline in the long run.

CNG/LNG (Compressed Natural Gas/Liquefied Natural Gas)

The CNG/LNG propulsion type holds promise in the global construction equipment market due to its cleaner-burning properties compared to conventional fuels. Compressed natural gas (CNG) and liquefied natural gas (LNG) are considered greener alternatives to diesel and gasoline, as they produce lower levels of pollutants. Although CNG/LNG construction equipment is gaining traction in some regions, such as Europe, the adoption remains relatively low compared to electric and ICE equipment. Limited refueling infrastructure and higher upfront costs pose challenges to the widespread adoption of CNG/LNG construction equipment. However, with advancements in infrastructure and the increasing availability of cleaner fuel options, the CNG/LNG part is expected to grow steadily in the near future.

Insights On Key Engine Capacity

Up to 250 HP

The Up to 250 HP engine capacity is expected to dominate the Global Construction Equipment Market. This can be attributed to several factors. Firstly, construction equipment with engine capacity up to 250 HP is ideally suited for smaller construction projects and applications. These equipment are more cost-effective and efficient for tasks such as light excavation, landscaping, and maintenance work. Additionally, they are easier to maneuver and operate in confined spaces, making them a popular choice for urban construction projects. Furthermore, the increasing focus on sustainability and fuel efficiency has driven demand for smaller construction equipment with lower power output. Due to these reasons, the part of "Up to 250 HP" is anticipated to dominate the Global Construction Equipment Market.

250-500 HP

The 250-500 HP engine capacity in the Global Construction Equipment Market is expected to hold significant market share. This range of engine capacity offers a balance between power and versatility, making it suitable for a wide range of construction applications. With the ability to handle medium to large-scale projects, construction equipment falling within this engine capacity category finds demand across various sectors, including infrastructure development, road construction, and mining. The higher power output enables efficient operations in challenging environments and increases productivity. As a result, the part of "250-500 HP" is likely to be a key player in the Global Construction Equipment Market.

More than 500 HP

The More than 500 HP engine capacity in the Global Construction Equipment Market is expected to have a niche market position. Equipment with engine capacity exceeding 500 HP is typically used for heavy-duty applications and large-scale construction projects requiring substantial power and performance. These include tasks such as mining, quarrying, and heavy infrastructure development. However, due to their specialized nature and higher costs, demand for construction equipment with engine capacity above 500 HP is relatively limited compared to the other parts. While they play a crucial role in specific industries, the dominance of this part in the overall Global Construction Equipment Market is expected to be comparatively lower.

Insights On Key Power Output

201-400 HP

The construction equipment with power output ranging from 201 to 400 HP is expected to dominate the global construction equipment market. This can be attributed to several reasons. Firstly, construction projects such as commercial buildings, infrastructure development, and mining activities often require heavy machinery that falls within this power range. The power output of 201-400 HP strikes a balance between efficiency and capability, making it suitable for a wide range of applications. Additionally, this part caters to the needs of both small and large-scale construction projects, making it a preferred choice for various industry players.

<100 HP

The construction equipment with power output less than 100 HP is also expected to have a significant presence in the global construction equipment market. This part finds extensive usage in residential construction projects, landscaping, and smaller infrastructure developments. The equipment falling under this power range is compact, versatile, and ideal for maneuvering in confined spaces. The demand for smaller construction projects is growing steadily, and the requirement for equipment with lower power output is expected to remain strong in these sectors.

101-200 HP

While the 101-200 HP range of construction equipment may not dominate the global market, it is still expected to have a significant market share. Equipment with power output in this range is commonly used in medium-scale construction projects, such as mid-sized commercial buildings, road construction, and residential complexes. The versatility, affordability, and moderate power output of equipment within this part make them a popular choice for contractors engaged in such projects.

>401 HP

The construction equipment with power output exceeding 401 HP is likely to have a smaller market share compared to the dominating sector. Equipment falling under this high-power range is typically utilized in large-scale infrastructure projects, such as industrial construction, mining, and major roadwork. Although the demand for equipment with higher power output is essential for specific applications, the market size may be limited due to the specialized nature and cost associated with acquiring and operating such machinery.

Insights on Regional Analysis:

Asia Pacific

Asia Pacific is expected to dominate the Global Construction Equipment market. This region has witnessed exponential growth in the construction industry, mainly driven by rapid urbanization, infrastructure development, and economic progress. Countries such as China, India, Japan, and South Korea have significant construction activities, leading to high demand for construction equipment. Moreover, the governments in these countries have implemented various initiatives and policies to boost infrastructure development, further driving the market growth. Additionally, the rising population and increasing disposable incomes in the region have also contributed to the growth of the construction industry, thereby increasing the demand for construction equipment.

Europe

Europe is a significant player in the Global Construction Equipment market, but it is not expected to dominate the market. The region has a well-established construction industry, with countries like Germany, France, and the United Kingdom being the major contributors. The demand for construction equipment in Europe is driven by infrastructure investments, urban renewal projects, and sustainable construction practices. However, the market growth in Europe is relatively slower compared to Asia Pacific due to economic uncertainties and stricter regulations in the region. Nevertheless, technological advancements and the adoption of advanced construction equipment are expected to fuel the market growth in Europe.

North America

North America is another prominent player in the Global Construction Equipment market. The United States, in particular, has a robust construction industry, fueled by commercial and residential construction, infrastructure projects, and government investments. The construction market in North America is driven by the need for infrastructure upgrades and replacements, as well as the increasing trend towards sustainable and energy-efficient construction practices. However, the growth in the North American market is expected to be moderate compared to Asia Pacific, primarily due to market maturity and a slower pace of infrastructure development.

Latin America

Latin America is a region with significant market potential in the Global Construction Equipment market. The region has witnessed substantial growth in the construction industry, driven by infrastructure projects, urbanization, and economic development. Countries such as Brazil, Mexico, and Argentina have been investing in infrastructure development, leading to increased demand for construction equipment. Moreover, the increasing focus on sustainable construction practices and the need for better transportation and public facilities are expected to further boost the market growth in Latin America.

Middle East & Africa

The Middle East & Africa region is also anticipated to have a notable presence in the Global Construction Equipment market. The construction industry in this region is driven by factors such as rapid urbanization, infrastructure projects, and government initiatives. Countries like Saudi Arabia, UAE, and Qatar have significant construction activities, particularly in the areas of residential, commercial, and infrastructure development. Additionally, the region's focus on megaprojects such as the FIFA World Cup in Qatar and Expo 2020 in Dubai is expected to create a substantial demand for construction equipment. However, the market growth in the Middle East & Africa is projected to be slower compared to other regions due to political and economic uncertainties, as well as volatile oil prices.

Company Profiles:

Caterpillar Inc. is recognized as a leading figure in the international construction equipment sector, asserting its influence through a diverse selection of robust machinery and cutting-edge technologies that boost operational effectiveness and output at construction locations. Komatsu Ltd., a significant contender in the industry, provides an extensive array of construction machinery such as excavators, bulldozers, and loaders, prioritizing sustainability and digital innovation to address the changing demands within the sector.

Prominent companies in the construction equipment industry comprise Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment AB, Hitachi Construction Machinery Co., Ltd., Liebherr-International AG, Terex Corporation, Sany Group Co., Ltd., Doosan Infracore Co., Ltd., JCB India Limited, and CNH Industrial N.V.

COVID-19 Impact and Market Status:

The global market for construction equipment has faced notable repercussions due to the Covid-19 pandemic, resulting in a decrease in demand and the disturbance of supply chains on a worldwide scale.

The construction equipment market has been significantly impacted by the COVID-19 pandemic, as the global construction industry faced disruptions from government-imposed lockdowns and restrictions aimed at curbing the virus's spread. This has led to delays in projects, reduced investments in infrastructure development, and a decrease in demand for construction equipment. Supply chain disruptions, such as temporary factory closures and restrictions on the movement of goods, have further hindered the production and availability of construction equipment. Consequently, companies operating in this market have experienced a decline in both sales and revenue.

Nonetheless, amidst the challenges, there have been positive developments observed. Regions like Asia-Pacific have begun to witness a recovery in the construction sector, resulting in an uptick in the demand for construction equipment. Moreover, the emphasis on infrastructure development to jumpstart economic growth post-pandemic is expected to bolster the future demand for construction equipment. While the impact of COVID-19 on the construction equipment market has been predominantly negative, signs of gradual recovery and growth prospects are emerging.

Latest Trends and Innovation:

- In November 2020, Caterpillar announced the acquisition of Weir Group's oil and gas division, expanding their product offerings in the construction equipment market.

- In October 2020, Volvo Construction Equipment unveiled its prototype autonomous hauler, the HX2, marking a significant technological innovation in the industry.

- In July 2020, Komatsu announced a collaboration with NVIDIA to develop AI-powered technology for construction and mining equipment, showcasing their commitment to technological advancements.

- In March 2021, John Deere launched their new 700L and 750L dozers with advanced technology and improved performance, showcasing their continuous focus on product innovation.

- In September 2020, Hitachi Construction Machinery entered into a joint venture with KTEG (Kobelco Construction Machinery), creating a strategic partnership to strengthen their market presence.

- In December 2020, Liebherr introduced the world's first fully electric 5-tonne compact excavator, the R 540, showcasing their commitment towards sustainable solutions in construction equipment.

Significant Growth Factors:

The Construction Equipment Market experiences growth due to increased investments in infrastructure, advancements in technology, and the growing need for urban development.

The construction equipment industry is experiencing notable expansion as a result of various factors. Firstly, the surge in urbanization and industrialization has led to a ened demand for construction activities globally, necessitating advanced and more efficient equipment. Furthermore, governments worldwide are making substantial investments in infrastructure projects such as roads, airports, and railways, thus contributing to the increased need for construction machinery. Moreover, the real estate sector is witnessing growing investments, particularly in emerging economies, which is fueling the market's growth. Additionally, advancements in construction equipment technology, including the introduction of smart and interconnected machinery, are improving productivity and safety at construction sites, driving market growth. There is also a notable shift towards environmentally conscious and energy-efficient equipment, driven by escalating environmental worries and stringent regulations, which is positively influencing the market.

Lastly, the rising popularity of rental and leasing services for construction equipment, offering flexibility and cost benefits to construction firms, is further boosting market expansion. In summary, the construction equipment market is experiencing substantial growth as a result of various factors such as urbanization, infrastructure development, technological progress, environmental considerations, and the increased utilization of rental services.

Restraining Factors:

Factors that are limiting the expansion of the Construction Equipment Market consist of strict regulatory policies imposed by the government and the significant upfront expenses required.

The growth and progress of the Construction Equipment Market are facing various challenges that are impeding its advancement. Firstly, the significant cost associated with construction equipment acts as a major barrier for numerous construction firms, particularly smaller ones, as it necessitates a substantial financial commitment that may be beyond their means. In addition, the scarcity of skilled labor and operators presents a hurdle for the sector since proficient professionals are required to operate sophisticated and advanced equipment. Furthermore, the limited availability of financing alternatives further obstructs the uptake of construction equipment, as companies encounter difficulties in securing funding to meet their equipment requirements. Additionally, strict government regulations and concerns regarding environmental impact act as limitations, given the association of construction equipment with emissions of pollution and noise. Lastly, global events such as the recent COVID-19 pandemic have disrupted supply chains worldwide and decelerated construction operations, negatively impacting the market. Despite these obstacles, the Construction Equipment Market exhibits substantial growth potential fueled by escalating infrastructure development initiatives in various nations, technological innovations in equipment, and ened awareness of sustainable construction practices. Through effective strategies encompassing economical financing options, training initiatives, and adherence to regulatory standards, the market can surmount these challenges and sustain its upward trajectory toward further expansion and advancement.

Key Segments of the Construction Equipment Market

Product Overview

• Earth Moving Machinery

• Material Handling Machinery

• Concrete and Road Construction Machinery

Equipment Type Overview

• Heavy Construction Equipment

• Compact Construction Equipment

Propulsion Type Overview

• Internal Combustion Engine (ICE)

• Electric

• Compressed Natural Gas (CNG)/Liquefied Natural Gas (LNG)

Engine Capacity Overview

• Up to 250 HP

• 250-500 HP

• More than 500 HP

Power Output Overview

• Less than 100 HP

• 101-200 HP

• 201-400 HP

• More than 401 HP

Regional Overview

North America

• United States

• Canada

• Mexico

Europe

• Germany

• France

• United Kingdom

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• United Arab Emirates

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America