The global Configuration Management market worth USD 5.81 Billion by 2028, growing at a CAGR of 16.26%

.jpg)

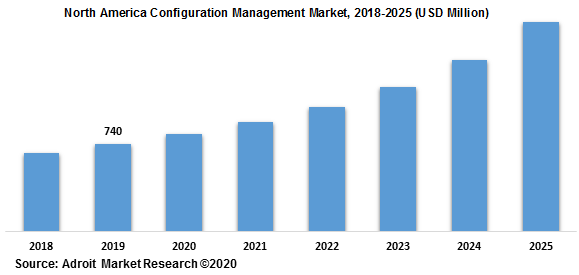

The market size for global configuration management is anticipated to reach at USD 4 billion by 2025. The adoption of cloud-based configuration within the organizations have increased in the past few years. Also, benefits such as low maintenance expenses and deployment cost, and remote access are likely to fuel the adoption of configuration management solutions.

Configuration management tracks modifications to make sure that the configurations are in a verified and trusted state. It maintains a precise historical record that enables in auditing information, repairing, and project management. Additionally, configuration management enhances efficiency, visibility, and stability that occur in an applications, and facilitates to streamline change control process.

Configuration Management Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | USD 5.81 Billion |

| Growth Rate | CAGR of 16.26% during 2018-2028 |

| Segment Covered | by Type, Regions |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, South America |

| Key Players Profiled | Microsoft (US), AWS (US), Oracle (US), BMC Software (US), IBM (US), Alibaba Cloud (China), CA Technologies (US), Puppet (US), Ansible (US), Chef (US), Micro Focus (UK), CloudBees (US), Northern Tech AS (Norway), Canonical (UK), SaltStack (US), Octopus Deplot (Australia), JetBrains (Czech Republic), Codenvy (US), and ServiceNow (US). |

Key Segment Of The Configuration Management Market

By Type (USD Billion)

• Solution

• Services

By Application (USD Billion)

• Managed Services

• Professional Services

Regional Overview (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

The demand for configuration management (CM) market globally to witnessed a considerable growth in the coming five years. In the recent years, DevOps has undergone from a fringe movement to a needed entity for any IT organization. Tasks that include deploying applications, provisioning environments, and maintaining infrastructures, were conventionally performed manually. To eradicate element of manual error related with these tasks, the configuration management tools were introduced. CM technological space has developed substantially in the last few years and the industry is likely to evolve in the future too. The present mainstream solutions are unforgiving, complicated and complex to maintain. Thus, the configuration management is projected to endure as one of the key concerns for all the DevOps teams over the next five to seven years.

Component Segment

The global configuration management market contains both solution and service segment. The solution segment has maximum revenue share within the global configuration management market in 2019. However, the services segment is anticipated to grow at a significant growth rate from 2020 to 2025.

Module Segment

Based on the module segment, the market is bifurcated into configuration management database (CMDB), service catalog, service definition, and others. In 2019, the configuration management database segment gathered the largest market revenue and it is anticipated to govern the configuration management market throughout the forecast period. However, the service catalogue segment is anticipated to grow at a substantial growth rate over the forecast period.

Application Segment

Based on the application, the market is segmented into BFSI, government & public sector, healthcare & life sciences, manufacturing , retail & consumer packaged goods, telecom and IT, others. The market for telecom & IT sector is anticipated to possess the largest market share in 2019 since the Tech companies today are predominantly developing to match their user needs. Moreover, the growing regulatory scrutiny coupled with enhanced customer satisfaction, as well as advantages such as risk management, and customized solutions are some of the factors responsible for the configuration management demand.

The global configuration management market is a wide range to North America, Europe, APAC, South America, and the Middle East & Africa. North America is considered a mature market in the configuration management applications, owing to an outsized presence of organization with the availability of technical expertise and advanced IT infrastructure. The US and Canada are the highest contributory countries to the expansion of the configuration management market in North America.

The major players of the global configuration management market are Microsoft, AWS, Oracle, BMC Software, IBM, Alibaba Cloud, CA Technologies, Puppet, Ansible, Chef, Micro Focus, CloudBees, Northern Tech AS, Canonical, and more. The configuration management market is fragmented with the existence of well-known global and domestic players across the globe.