Concentrated Nitric Acid Market Analysis and Insights:

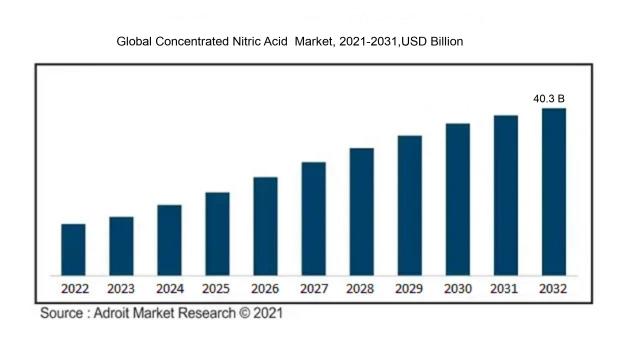

In 2023, the size of the worldwide Concentrated Nitric Acid market was US$ 28 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 4.3% from 2024 to 2032, reaching US$ 40.3 billion.

The market for concentrated nitric acid is significantly influenced by several critical factors. Primarily, its widespread use in fertilizer production, notably ammonium nitrate, drives demand as global agricultural practices continue to advance. Moreover, the essential function of nitric acid in explosive manufacturing and the burgeoning mining sector further supports market growth. The increasing enforcement of environmental regulations has ened the requirement for nitric acid in generating intermediates for pollution control solutions. Additionally, its application across various industrial sectors, including metal processing and the synthesis of organic chemicals, remains a vital aspect of its market development. Innovations in production methods and a ened emphasis on sustainable approaches are expected to improve efficiency and lower costs, positively impacting market trends. Together, these elements highlight the resilience of the concentrated nitric acid market and its capacity for growth in line with varying industrial needs.

Concentrated Nitric Acid Market Definition

Concentrated nitric acid is a highly corrosive mineral acid, usually comprising 68% or higher nitric acid by weight. Renowned for its powerful oxidizing capabilities, it is widely utilized in numerous industrial applications and laboratory settings.

Concentrated nitric acid is an essential chemical used in numerous industrial applications, primarily because of its potent oxidizing characteristics and its capacity to produce nitrates. It plays a crucial role as a reagent in the manufacture of fertilizers, explosives, and dyes, greatly influencing both agriculture and manufacturing industries. Additionally, it is utilized in metal treatment processes such as etching and passivation, which improve resistance to corrosion. Its significant involvement in the synthesis of nitric oxide and various organic compounds highlights its critical role in chemical research and the pharmaceutical field. As such, concentrated nitric acid is indispensable for fostering innovation and enhancing productivity in a variety of sectors, thereby contributing to economic advancement and development.

Concentrated Nitric Acid Market Segmental Analysis:

Insights On Type

Strong

The Strong category is expected to dominate the Global Concentrated Nitric Acid market due to its widespread applicability across numerous industries, including fertilizers, pharmaceuticals, and explosives. The robust demand for strong nitric acid, particularly in agricultural applications, drives its consistent growth. Strong nitric acid's versatility and compatibility with various industrial processes make it an essential material, contributing significantly to market dynamics. Furthermore, the growth of industries that heavily utilize strong nitric acid, such as manufacturing and construction, supports its market position. High production volumes and established supply chains further solidify the dominance of the Strong type in the concentrated nitric acid landscape.

Fuming

Fuming nitric acid, characterized by its high nitrogen dioxide content, finds significant applications in specialized areas such as research and niche chemical manufacturing. Though it holds a smaller market share compared to Strong nitric acid, the unique properties of fuming nitric acid make it indispensable for particular processes, particularly in the production of explosives and specialty chemicals. Its potent reactivity is favored in laboratories and industries that require precise and robust chemical interactions. However, its limited use in lower-demand sectors restricts its overall growth potential, positioning it as a specialized choice rather than a primary player in the larger market.

Insights On Application

Ammonium Nitrate

Ammonium nitrate is expected to dominate the Global Concentrated Nitric Acid Market due to its extensive use in fertilizers, which are vital for agricultural production. The rising global population and the subsequent demand for food have led to increased fertilizer consumption. Ammonium nitrate is favored for its high nitrogen content and effectiveness in promoting plant growth, making it indispensable in contemporary farming practices. Additionally, the global focus on sustainable agriculture and the adoption of precision farming techniques further boost the adoption of ammonium nitrate, paving the way for continuous growth in its demand and reinforcing its position as the leading application in this market.

Nitrobenzene

Nitrobenzene is primarily utilized in the manufacturing of aniline, which serves as a precursor for various dyes, pharmaceuticals, and rubber processing chemicals. While it doesn't dominate the market, it still plays a significant role due to its vital applications across diverse industries. The consistent demand for aniline derivatives reinforces a stable market for nitrobenzene. As industrial processes evolve and diversify, nitrobenzene's importance will continue to hold a considerable share, driven by its reliability and essentiality in several manufacturing processes.

Adipic Acid

Adipic acid is predominantly used as a key ingredient in the production of nylon and other synthetic fibers, marking its relevance in the textiles and automotive industries. With the increasing demand for lightweight materials and eco-friendly products, adipic acid continues to hold a notable position. The continuous growth of the textile sector, along with advancements in plastics and coatings, contributes to the steady demand for adipic acid. Its role in producing high-performance polymers underscores its significance, although it is not the leading application in the concentrated nitric acid market.

Trinitrotoluene

Trinitrotoluene, commonly known as TNT, is mainly used in explosive applications, making it essential in military and construction sectors. Although it has a defined market, the demand for TNT is generally driven by specific industry activities rather than broad applications. Regulatory measures and safety concerns surrounding the manufacturing and handling of explosives also impact its market dynamics. Therefore, while trinitrotoluene holds importance, its overall market share remains limited compared to other applications driven by broader industrial needs.

Toluene Diisocyanate

Toluene diisocyanate is primarily employed in producing polyurethane foams utilized in various applications, such as furniture, automotive, and insulation materials. The growing construction and automotive sectors significantly contribute to the demand for toluene diisocyanate, as it is crucial for manufacturing durable and energy-efficient products. Despite its vital applications, the reliance on polyurethanes means the market for toluene diisocyanate is subject to fluctuations driven by broader economic trends. Its importance remains steady, yet its relative share does not place it at the forefront compared to ammonium nitrate.

Other

The "Other" category includes various niche applications of concentrated nitric acid across different industries. While this captures some unique needs, its fragmentation and diverse applications prevent it from achieving substantial market dominance. Each of these unique applications may experience fluctuating demand based on market trends, technological advancements, and regulatory standards. Though it encompasses various uses, the lack of a dominant application or significant scale of operation makes it unlikely to lead the concentrated nitric acid market.

Insights On End User

Agrochemical

Agrochemical is expected to dominate the Global Concentrated Nitric Acid Market as concentrated nitric acid is primarily utilized to produce nitrogen fertilizers, such as ammonium nitrate, which is crucial for enhancing agricultural productivity. The rising global population and the increasing demand for food are driving the growth of the agrochemical market. As farmers seek ways to improve crop yields, the need for efficient fertilizers will continue to escalate, thereby supporting a consistent use of concentrated nitric acid in this. Although not as dominant as explosives, agrochemicals represent a significant portion of the total market.

Explosives

The Explosives is expected to grow in the Global Concentrated Nitric Acid Market. Nitric acid is a critical raw material in the production of explosives, particularly in the manufacture of ammonium nitrate-based explosives, which are widely used in mining, construction, and demolition industries. The growing demand for explosives in infrastructure development and resource extraction, coupled with advancements in mining technology, is driving the consumption of concentrated nitric acid in this sector. Furthermore, geopolitical factors and military needs may also contribute to increased demand for explosives, thereby cementing this sector's status as the leading end-user of concentrated nitric acid.

Electronics

The Electronics sector utilizes concentrated nitric acid mainly for cleaning and etching purposes in various electronic manufacturing processes. It is a vital component in the production of printed circuit boards and semiconductor devices. As technology continues to advance and the demand for electronic devices grows, so does the requirement for high-purity materials, including concentrated nitric acid. Despite its importance, this market does not experience growth rates as high as the explosives sector, which limits its dominance overall.

Automotive

The Automotive employs concentrated nitric acid primarily in the production of components, including catalytic converters and certain manufacturing processes. While it plays an essential role in the automotive industry's development toward sustainability and emission reductions, the growth in this area has been relatively stable rather than explosive. Increased vehicle electrification and the transition to greener technologies may impact the overall demand for nitric acid, but it is unlikely to rival the explosive category's rapid growth trajectory, ensuring that the automotive market remains a smaller part of the pie.

Other

The Other category encompasses diverse industrial applications of concentrated nitric acid that are not directly related to the previously mentioned sectors. This includes its use in pharmaceuticals, metal processing, and the production of various chemical intermediates. While it is a necessary component for many processes, the demand from this category fluctuates and does not have the same scale as the dominant sectors. Consequently, it plays a supportive role in the global market without emerging as a leading end-user of concentrated nitric acid.

Global Concentrated Nitric Acid Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Concentrated Nitric Acid market due to the region's expanding industrial base and increased demand from key end-use industries such as agriculture, fertilizers, and chemicals. Countries like China and India are significant contributors, with major investments in manufacturing and infrastructure projects. The rapid urbanization and growing population have accelerated agricultural practices, directly boosting nitric acid consumption for fertilizers. Additionally, the availability of raw materials and favorable government policies aimed at enhancing production capacity further solidify Asia Pacific's leading position in the market. The region's consistent growth rates indicate a strong trajectory, making it a powerhouse for concentrated nitric acid.

North America

North America is entrenched in a mature market for concentrated nitric acid, predominantly driven by advancements in the chemical industry and extensive use in agricultural applications. The United States, as a major player, is experiencing steady demand for nitric acid due to a robust agricultural sector that relies on fertilizers. Furthermore, environmental regulations spur the adoption of efficient processes in producing nitric acid, emphasizing sustainable practices and research innovations. The established infrastructure and the presence of leading manufacturers contribute to the market's stability, although growth rates may lag compared to the Asia Pacific region.

Europe

Europe holds a significant position in the Global Concentrated Nitric Acid market, propelled by stringent environmental regulations and a push for sustainable chemical processes. Advanced technologies and a focus on reducing emissions within the nitric acid production process foster innovation in the region. Countries such as Germany, France, and the UK are notable contributors, utilizing nitric acid extensively in fertilizers and explosives. However, market growth may be challenged by the region's transition towards greener alternatives and renewed emphasis on reducing ammonia emissions. Still, the existing market frameworks and high standards ensure that Europe remains a key player in the concentrated nitric acid sector.

Latin America

Latin America presents opportunities for growth in the concentrated nitric acid market, particularly driven by agricultural needs and natural resource availability. Nations like Brazil and Argentina exhibit increasing demand for fertilizers, which utilize nitric acid as a key component. However, the region faces challenges, such as economic instability and infrastructural limitations that may impede consistent growth. Efforts to improve agricultural productivity and promote chemical manufacturing may ultimately aid in enhancing the market's performance. As investments in infrastructure and industry rise, Latin America has the potential to establish a more significant foothold in the concentrated nitric acid sector.

Middle East & Africa

The Middle East & Africa region is gradually emerging in the concentrated nitric acid market, motivated by efforts to diversify economies and boost industrialization. Countries like South Africa and those in the Gulf Cooperation Council are exploring nitric acid production to support their agricultural sectors. Nonetheless, challenges such as limited infrastructure, varying regulatory environments, and reliance on imports hinder rapid expansion. As the region invests in sustainable agriculture and chemical industries, growth opportunities may arise, but the market remains relatively small compared to more established regions. The focus on modernization and development holds promise for future advancements in the concentrated nitric acid market.

Concentrated Nitric Acid Competitive Landscape:

The major contributors in the worldwide Concentrated Nitric Acid sector play crucial roles in manufacturing, innovation, and logistics management. By leveraging technological progress and forming strategic alliances, they catalyze market growth. Their decisions shape market trends, pricing structures, and adherence to regulations, thereby affecting the overall dynamics of the industry.

The Concentrated Nitric Acid market features several prominent entities, including BASF SE, Yara International ASA, Nutrien Ltd., Orica Limited, Huntsman Corporation, Koch Industries, Inc., Eastman Chemical Company, INEOS Group Holdings S.A., Saudi Basic Industries Corporation (SABIC), and Mitsubishi Gas Chemical Company, Inc. Furthermore, it also encompasses other significant players such as AkzoNobel N.V., CF Industries Holdings, Inc., Jiangshan Chemical Co., Ltd., Linde plc, and Shanxi Tianji Coal Chemical Industry Co., Ltd. These organizations are crucial for the manufacturing and distribution of concentrated nitric acid, serving a diverse array of applications and sectors.

Global Concentrated Nitric Acid COVID-19 Impact and Market Status:

The Covid-19 pandemic brought about substantial interruptions in the Global Concentrated Nitric Acid market, resulting in variations in both demand and supply as a consequence of production stoppages and shifts in industrial operations.

The COVID-19 pandemic had a profound effect on the concentrated nitric acid market, primarily due to interruptions in production and supply chains. The temporary closure of manufacturing facilities and workforce shortages led to a decline in nitric acid production capacity. Furthermore, a drop in demand from vital sectors such as automotive and aerospace, which experienced shutdowns and reduced economic activity, exacerbated the market's difficulties. Nevertheless, the agricultural sector's demand for fertilizers that incorporate nitric acid showed some resilience, helping to cushion the overall impact. Additionally, the pandemic spurred a pivot towards health and hygiene products, resulting in an increased utilization of nitric acid in sanitizers and disinfectants. As economies begin to recover and industrial operations resume, a resurgence in nitric acid demand is expected, supported by the revival of various industries and a ened focus on food security and sustainable agricultural methods. In summary, despite facing significant challenges, the market is beginning to unveil growth opportunities in the new post-pandemic environment.

Latest Trends and Innovation in The Global Concentrated Nitric Acid Market:

- In September 2023, BASF SE announced its acquisition of a specialty chemical facility in China, aiming to enhance its production capacity of concentrated nitric acid and support the growing demand from various sectors including fertilizers and explosives.

- In June 2023, Yara International ASA launched a new nitric acid production line in the Netherlands designed to utilize advanced technologies that significantly reduce emissions compared to conventional methods, strengthening their sustainability goals.

- In February 2023, CF Industries Holdings, Inc. revealed a strategic partnership with a leading renewable energy firm to develop a project that integrates renewable ammonia production with nitric acid manufacturing, enhancing sustainability efforts in their operations.

- In January 2023, Mitsubishi Gas Chemical Company, Inc. reported the commissioning of its new state-of-the-art concentrated nitric acid facility in the United States, which features improved energy efficiency and processes to mitigate environmental impact.

- In November 2022, OCP Group announced the expansion of its nitrogen fertilizer production capabilities in Morocco, which included investments in new concentrated nitric acid production technology, aimed at increasing their output by 30%.

- In April 2022, Dyno Nobel announced the successful integration of its recent acquisition of a nitric acid plant in Louisiana, which has enhanced its supply chain capabilities for explosives manufacturing in North America.

Concentrated Nitric Acid Market Growth Factors:

The expansion of the concentrated nitric acid market is fueled by ened demand across sectors like fertilizers, explosives, and chemical production, coupled with escalating environmental regulations that encourage more sustainable manufacturing practices.

The concentrated nitric acid market is propelled by several pivotal factors. Primarily, the escalating demand from the fertilizer industry, notably in agriculture, stands out as a significant growth driver, since nitric acid is essential for manufacturing ammonium nitrate, a widely utilized fertilizer. Moreover, the growing requirement for nitro compounds in explosives, especially within the mining and construction sectors, contributes to the market's expansion. The chemical industry's progress, particularly in the synthesis of diverse chemicals and polymers, is also increasing the need for concentrated nitric acid. Additionally, environmental regulations are reshaping the market landscape, as industries strive for more sustainable and compliant production processes, leading to innovations in nitric acid manufacturing techniques. The expanding automotive sector further enhances the demand, as nitric acid is vital for producing nitric oxide, which is crucial for emission control systems. Lastly, the rise of emerging economies, accompanied by ened industrial activity and infrastructure development, is anticipated to boost the consumption of concentrated nitric acid in these areas. Together, these elements form a strong foundation for the growth of the concentrated nitric acid market, ensuring its significant role across multiple industries.

Concentrated Nitric Acid Market Restaining Factors:

The concentrated nitric acid market faces several significant challenges, notably rigorous environmental regulations and safety issues associated with its handling and storage.

The market for concentrated nitric acid encounters various challenges that may hinder its expansion. Among these are stringent environmental regulations, fluctuating prices of raw materials, and safety issues related to its handling and storage. Globally, regulatory agencies enforce strict standards aimed at curbing emissions and mitigating potential risks, which complicates and raises production costs. Additionally, the unstable prices of essential raw materials like ammonia and nitrogen can squeeze profit margins for producers. Public perceptions of concentrated nitric acid as a dangerous chemical further complicate investment prospects and limit market growth. Moreover, the rise of competitive alternatives could also constrain market opportunities. Nonetheless, the concentrated nitric acid sector is well-positioned for resilience and potential growth, particularly through advancements in production technologies and increased demand from industries such as fertilizers, explosives, and pharmaceuticals, which may drive innovation and enhance efficiency. With appropriate strategies, stakeholders have the opportunity to navigate these challenges and leverage the evolving landscape of the concentrated nitric acid market.

Key Segments of the Concentrated Nitric Acid Market

By Type:

• Fuming

• Strong

By Application:

• Ammonium Nitrate

• Nitrobenzene

• Adipic Acid

• Trinitrotoluene

• Toluene Diisocyanate

• Other

By End User:

• Agrochemical

• Explosives

• Electronics

• Automotive

• Other

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America