The global commercial waste management market was valued USD 141.56 Bn in 2018 and is projected to show noteworthy growth with CAGR of 6.7% over the forecast period. Rapid growth in waste generation per capita, increase in consumer awareness for waste management and growing share of private firms are some of the key factors that are likely to augment the market growth over the forecast period.

The global Commercial Waste Management market is expected to develop 989.2 bn 2030, at a compound annual increase in price (CAGR) of 6.2% throughout the forecast period.

Commercial waste is defined as waste generated from hotels, restaurants, stores and commercial complexes. Waste generated includes cardboard, plastics, food waste, paper, metal, glass, packaging articles among others.

Commercial Waste Management Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 989.2 bn |

| Growth Rate | CAGR of 6.2 % during 2022-2030 |

| Segment Covered | Service Type, Waste Type, Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Waste Management, Suez, Valicor, Veolia, Waste Connections, Republic Services, Biffa, Clean Harbors, Covanta Holding |

Key factors impacting the market growth-

- Development of commercial estates and hospitality sector has driven the commercial waste management market growth over the recent years. According to the UN, the total investments (USD Billion) in commercial real estate including offices, retail, and hotels reached 40.7 in Manhattan, 35.9 in London, 23.7 in Paris, 5.9 in Frankfurt, and 6.1 in Berlin.

- Fast-paced development of the global hospitality sector has enhanced the waste generation rates in North America, Europe, and Asia Pacific. This, in turn, is expected to improve the overall commercial waste management practices in top scale hotels and restaurants in the coming years.

- Growth of the commercial real estate sector is considered to be one of the important aspects boosting commercial waste generation. This, is likely to drive the commercial waste management market growth during the forecast period

- According to World Bank’s, “What a Waste 2.0: A Global Snapshot of Solid Waste Management to 2050” report, the global waste is slated to increase by a whopping 70% from 2018 to 2050. The volume of global annual waste is expected to surpass 3.2 billion tons by the end of 2050.

Market competition scenario:

The global commercial waste management market is a fragmented industry with large number of players operating regionally. Furthermore, wide disparities in the waste treatment across different regions also varies the operations of the regional players. Veolia Environnement SA, Suez Environnement SA, Waste Management, Republic Services, Clean Harbors, Waste Connections, Covanta, Biffa, Rubicon Global are example of some of the key players operating in the commercial waste management market.

Frequently Asked Questions (FAQ) :

Porter’s five forces analysis:

1. Bargaining power of suppliers

Presence of numerous global and regional suppliers in the market have moderately increased the bargaining power in recent years. Key suppliers provide equipment and services for collection, disposal, and transfer of waste. High dependency on labor forces to perform complex task may increase the bargaining power. Additionally, waste management service providers obtain license and agreement from government to run landfill and dispose waste. High prices of equipment and high leasing prices of equipment providers is expected to maintain the moderate bargaining power of suppliers in the future.

2. Bargaining Power of Buyers

Numerous buyers from hotels to commercial offices have the liberty to allocate budgets for waste management. Furthermore, switching cost of suppliers is low. Hence, the bargaining power of buyers is high at present. With more complex operations and huge sizes across the nations, the customers require well-established service providers to serve its purpose. The constant need for buyers for implementing good waste management practices is likely to result in the moderation of their bargaining power during the forecast period.

3. Threat of New Entrants

Several barriers to entry exist for new players. Presence of well-known brand names in the market, requirement of economies of scale for profitability, and high capital investment are some of the major factors obstructing the new entrants in the market. Hence, the threat of new entrants is low at present. However, opportunities for new entrants lie in untapped and potentially growing markets such as India, Southeast Asia, and Central & South America. This, scenario is expected to provide a passage for new entrants and is expected to increase their bargaining power from low to high over the forecast period.

4. Threat of Substitutes

At present, there is no substitution for waste management services and equipment at this point of time. However, emergence of IoT and automation to a certain extent, in equipment and services sectors may result in internal substitution or alternatives for replacement of conventional process over the course of time. Hence, substitute threat is expected to remain low during the forecast period.

5. Intensity of Rivalry

M&A activities and new product development for sustaining the competition within the market, has intensified the rivalry over the recent years. Presence of well-established brands, integrated operations of global and regional players within the value chain, and firm industry growth is expected to intensify the rivalry among competitors during the forecast period. Hence, the intensity of rivalry is considered to remain high in the future.

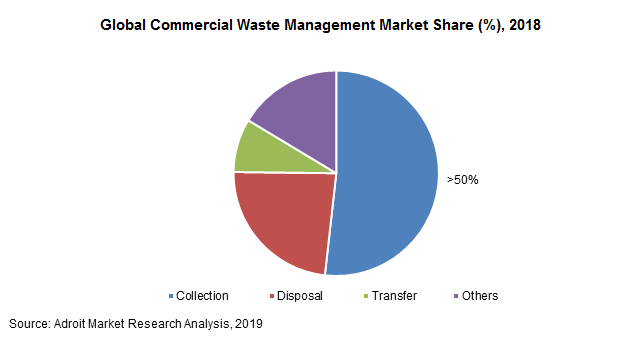

The global commercial waste management market is categorized on the basis of components, products, applications and regions. Based on components, the market is categorized into waste management equipment and services. On the basis of products, the market is segmented into food and non-food waste. By applications, the global commercial waste management market is segmented into major waste management process such as collection, transfer, disposal among others.

By components, service segment is poised to show high growth rate with a CAGR of 6.9% over the forecast period. Furthermore, service segment accounted for nearly one third of the market share in the global commercial waste management market. Waste management services include collection, transfer, disposal, recycling, and advanced treatment. Infrastructural advancements for waste management as well as growth in waste collection area are some of the key factors to supplement the growth of service segment. Growing indulgence of technology in waste management infrastructure is further projected to boost the waste management service industry.

By product, food waste segment is projected to be valued over USD 87 Bn by 2025. The segment is also projected to show noteworthy growth with CAGR 6.9% over the forecast period. Organic waste such as vegetable and fruit peels, liquid waste, and food leftovers /or non-consumed food are the types of wastes that are massively generated in hotel chains, restaurants, food cafes and outlets, and hypermarkets. Increasing dine out culture, increasing travels coupled with economic factors such as high per capita spending are some of the key factors that have led to the growth of food/organic waste since past few decades.

By product, food waste segment is projected to be valued over USD 87 Bn by 2025. The segment is also projected to show noteworthy growth with CAGR 6.9% over the forecast period. Organic waste such as vegetable and fruit peels, liquid waste, and food leftovers /or non-consumed food are the types of wastes that are massively generated in hotel chains, restaurants, food cafes and outlets, and hypermarkets. Increasing dine out culture, increasing travels coupled with economic factors such as high per capita spending are some of the key factors that have led to the growth of food/organic waste since past few decades.

By application, collection segment dominated the global commercial waste management market whereas disposal segment accounted for the highest growth over the forecast period. Advancements in disposal technologies in developing countries such as India and China is anticipated to support the growth of disposal segment; which is projected to grow at CAGR of 7.1% over the forecast period.

Geographically, the global commercial waste management market is categorized into key regions such as North America, Asia Pacific, Europe, Middle East & Africa and Central & South America.

The global market is dominated by Europe, closely followed by North America and Asia Pacific. Asia Pacific is projected to show the highest growth with CAGR of 7.5% over the forecast period. Furthermore, the region is projected to surpass Europe by the end of the forecast period. Overall, Asia Pacific is the key region to drive the growth of commercial waste management market across the globe.

.png)

Regional snapshot of key regions:

- North America

- North America is one of the most prominent markets in the global industry. According to world bank statistics (what a waste 2.0) North America generated 289 million tons of waste in 2017.

- When it comes to waste management processes, US and Canada follow similar collection methods and processing technologies; however, processing and waste diversion is different between the two.

- Much of the waste is recovered through composting in the region. US outnumbers Canada by a large margin when it comes to number of composting facilities in the region

- Europe

- Europe holds largest market share in the global commercial waste management. The region accounted for 31.0% of market share in 2018

- UK is one of the prominent markets for commercial waste industry with market share of 17.7% in the Europe

- Waste management sector in Europe, especially UK is well established. However, the country aims to further increase its target of waste recycling and utilize it in packing; thereby reducing the waste dumped in landfills.

- Asia Pacific

- Asia Pacific is projected to show significant growth in coming years owing to several factors such as rapid rate of urbanization, growing industrialization as well as growth in waste generation per capita

- Waste management industry in China and India is somewhere at preliminary stage where waste collection and sorting are performed using basic operations in many parts of these countries

- However, with the increase in amount of waste generation, these countries, especially India is projected to show significant growth with CAGR 9.5% over the forecast period

Commercial Waste Management Market Scope

| Metrics | Details |

| Base Year | 2019 |

| Historic Data | 2017-2018 |

| Forecast Period | 2020-2025 |

| Study Period | 2015-2025 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2025 | USD 141.56 Billion |

| Growth Rate | CAGR of 6.7% during 2021-2028 |

| Segment Covered | Component, Application, Product, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East & Africa |

| Key Players Profiled | Suez Environnement SA, Veolia Environnement SA, Republic Services, Waste Connections, Clean Harbors, Covanta, Rubicon Global, Waste Management and Biffa |

Key segments of the global commercial waste management market

Component Overview, 2015-2025 (USD Million)

- Equipment

- Service

Product Overview, 2015-2025 (USD Million)

- Non-food waste

- Food waste

Application Overview, 2015-2025 (USD Million)

- Collection

- Disposal

- Transfer

- Others

Regional Overview, 2015-2025 (USD Million)

- North America

- U.S.

- Canada

- Europe

- UK

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

- Central & South America

- Middle East & Africa

Reasons for the study

- The aim of this research study is to give a holistic view of commercial waste management industry

- We have been tracking the waste management sector for a considerable time in which commercial segment is witnessing significant growth over sometime

- Growth of the commercial segment along with growth in waste generation are some of the key factors that are augmenting the growth of the market

What does the report include?

- The research study on global commercial waste management market includes qualitative factors such as DRO (driver, restraint and opportunity) analysis

- Additionally, the market has been evaluated using the value chain and porter’s five forces analysis

- The study covers quantitative and qualitative analysis of market which is segmented on the basis of component, product, application and region (and country)

- Actual market estimates and forecasts have been given for above-mentioned segments

- The report includes the company profiles of key players in the market which have significant global/regional presence

Who should buy this report?

- Players associated in the commercial waste management supply chain

- Authorities in financial organizations seeking to publish statistics relating to commercial waste management industry

- Regulatory bodies, organizations, policymakers and government organizations active in the waste management industry

- Strategy managers, academic institutions, researchers, educators, analysts seeking insights to determine future policies