Commercial Drones Market Analysis and Insights:

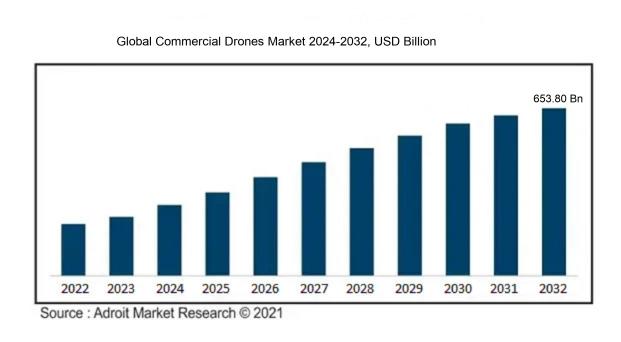

In 2023, the Commercial Drones Market reached a valuation of around USD 42.35 billion. During the 2024–2032 projection period, the market is anticipated to expand at a compound annual growth rate (CAGR) of 36.10%, reaching around USD 653.80 billion by 2032.

The commercial drones market is primarily propelled by several key elements, including advancements in technology, a growing appetite for aerial imaging and data services, and improved operational efficiencies across a range of industries. The diverse applications of drones in fields such as agriculture, construction, logistics, and surveillance demonstrate their adaptability and cost-effectiveness. Moreover, the increasing focus on automation along with the incorporation of artificial intelligence into drone operations enhances their attractiveness. The evolution of regulatory standards is also fostering safer drone usage and broadening their commercial applications. In addition, escalating investments from both private entities and governmental bodies are stimulating innovation and research, driving market development. The boom in e-commerce and the demand for efficient delivery mechanisms further boost the need for commercial drones, providing solutions to last-mile delivery issues. Together, these dynamics position the commercial drone industry for notable growth in the years ahead, as businesses become more aware of their strategic benefits.

Commercial Drones Market Definition

Commercial drones, or unmanned aerial vehicles (UAVs), are specialized machines tailored for a range of professional uses, such as capturing aerial imagery, supporting agricultural practices, conducting surveillance, and facilitating delivery operations. Generally, they function in accordance with guidelines established by aviation regulatory bodies, aiming to optimize operational efficiency and decrease expenses across multiple sectors.

Commercial drones are essential in numerous fields, significantly improving efficiency, cutting expenses, and offering creative approaches for data acquisition and distribution. In agriculture, they streamline the monitoring and management of crops, while in construction, they aid in surveying sites and tracking project progress. These aerial devices also improve logistics and last-mile delivery, ensuring quicker and more precise shipments. Moreover, they play a vital role in environmental assessment and disaster response, delivering crucial real-time information. With ongoing technological advancements, the impact of commercial drones is set to expand, influencing operational practices across various industries.

Commercial Drones Market Segmental Analysis:

Insights on Key Product Type

Rotary Blade

The Rotary Blade category is projected to dominate the Global Commercial Drones Market due to its versatile application across different industries such as agriculture, logistics, surveillance, and entertainment. Their ability to hover and maneuver easily in confined spaces makes them especially appealing for inspections and deliveries in urban areas. The increasing demand for drone deliveries and temporary usages in emergency services further enhances their market attractiveness. Additionally, the advancements in battery technology and flight capabilities, along with high consumer acceptance and regulatory support, are significantly contributing to the growth of Rotary Blade drones.

Fixed Wing

The Fixed Wing category holds a notable presence in the commercial drones market, particularly in applications requiring long-range surveillance and extensive coverage, such as mapping, agriculture, and environmental monitoring. These drones can fly for extended periods due to their efficient aerodynamics and energy consumption, making them ideal for tasks like surveying vast agricultural fields or large infrastructure. However, their reliance on runways for takeoff and landing limits their flexibility compared to Rotary Blade drones, making them a less dominant choice for urban environments. Nevertheless, they offer outstanding capabilities for large-scale operations.

Hybrid

The Hybrid category combines elements of both Fixed Wing and Rotary Blade designs, enabling versatile applications in commercial sectors. This flexibility allows Hybrid drones to take off and land vertically while maintaining the fuel efficiency associated with Fixed Wing models during forward flight. This benefits industries requiring a range of functionalities, such as search and rescue or surveying. Despite their advantages, the Hybrid drones generally have higher manufacturing and maintenance costs, which can deter widespread adoption compared to the more established Rotary Blade and Fixed Wing models. Yet, they remain a valuable option for specific use-cases needing adaptability.

Insights on Key Application

Surveillance and Monitoring

The Surveillance and Monitoring sector is anticipated to dominate the Global Commercial Drones Market due to the increasing demand for security and surveillance applications across various industries. With the growing need for real-time data collection and analysis in urban areas, infrastructure, and private properties, businesses are investing in advanced drone technology for effective monitoring. Moreover, regulatory measures for safety and security are driving adoption, leading to innovations such as AI integration in drones for improved detection capabilities. These factors are creating a robust growth trajectory, positioning this as the leader in commercial drone applications.

Filming and Photography

The Filming and Photography sector is experiencing substantial growth, fueled by the expanding use of drones in the entertainment industry and social media. As content creators and videographers seek unique perspectives and aerial shots, the demand for high-quality aerial imaging solutions is on the rise. Furthermore, advancements in drone technology, including stabilization and editing features, have attracted more professionals to adopt drones for commercial use. This application continues to thrive, especially with the increase in events, weddings, and promotional content creation, suggesting a healthy market presence.

Inspection and Maintenance

The Inspection and Maintenance is gaining traction as industries adopt drones for routine and safety inspections. This application is particularly prominent in sectors such as construction, oil and gas, and utilities, where drones are utilized for inspecting infrastructure without requiring costly scaffolding or shutdowns. The deployment of drones significantly enhances the efficiency, safety, and precision of inspections. As regulations grow stricter regarding asset maintenance, the reliability of drones for these purposes is being recognized, fostering significant market growth.

Mapping and Surveying

Mapping and Surveying remain crucial applications for commercial drones, especially in sectors like geology, agriculture, and urban planning. Drones provide precise and efficient data collection for cartography and land surveys, enabling professionals to analyze vast areas quickly. The increased adoption of mapping drones, particularly in conjunction with GIS technology, reflects the industry's shift towards data-driven decision-making. As the need for accurate geographic information systems expands, this application will continue to demonstrate significant market relevance.

Precision Agriculture

Precision Agriculture is increasingly recognized for its capacity to enhance farming practices through data analytics and real-time monitoring. Farmers are leveraging drones to gather detailed information about crop health, soil conditions, and irrigation needs, which allows them to optimize resource usage and boost productivity. As global food demand rises alongside sustainable agricultural practices, aerial technologies including drones are becoming vital tools for efficiency and yield improvement. Thus, this application plays an important role in the evolving agricultural landscape, promoting growth in this area.

Others

The others category encompasses diverse applications such as delivery services, environmental monitoring, and disaster response, showcasing the adaptability of drone technology. Although this sector is smaller compared to the leading applications, it presents significant growth potential as industries explore innovative uses for drones. For example, drone delivery solutions are gaining traction as e-commerce grows, while aerial assessment tools are becoming indispensable in emergency response situations. This diverse range of uses will likely enhance the significance of this category in the overall market over time.

Insights on Key End Use

Delivery and Logistics

The Delivery and Logistics sector is expected to dominate the Global Commercial Drones Market due to the increasing demand for efficient and timely shipment solutions. With the rise of e-commerce and the consumer expectation for fast delivery, companies are investing in drone technology to enhance their delivery systems. Drones offer a cost-effective, rapid, and environmentally friendly option for transporting goods over short distances. Additionally, advancements in drone technology, such as improved payload capacity and navigation systems, have made them a practical choice for last-mile delivery. As urban populations rise and congestion becomes a bigger issue, the continued adoption of drones in logistics is anticipated to outpace other sectors.

Agriculture

Agriculture stands as a significant area of implementation for commercial drones, thanks to their ability to optimize farming practices. Farmers are increasingly utilizing drones for crop monitoring, planting seeds, and managing livestock. The technology allows for high-resolution aerial imagery, enabling better assessment of crop health and yields. Moreover, the precision agriculture trend is seeing a surge, as drones can facilitate targeted pesticide and fertilizer applications, leading to reduced costs and improved sustainability. This growing adoption is driven by the need for increased agricultural productivity amidst rising food demand.

Energy

The energy sector is witnessing a growing reliance on drone technology for infrastructure inspection, maintenance, and environmental monitoring. Drones provide an efficient means to survey expansive areas, particularly for energy installations like wind turbines, solar farms, and power lines. Their ability to offer real-time data and high-resolution imaging helps companies minimize downtime and ensure compliance with safety regulations. The increasing push for renewable energy and the need for enhanced efficiency in energy production contribute to drones becoming vital tools in this industry's operational strategies.

Media and Entertainment

In the Media and Entertainment realm, drones have transformed content creation, particularly in filmmaking, photography, and broadcasting. Their capability to capture stunning aerial footage provides unique perspectives that were once challenging to achieve manually. Drones are also being employed in live events and sports for immersive broadcasting experiences. As the demand for high-quality visual content continues to rise, the utilization of drones for creative purposes is anticipated to grow, establishing it as a valuable tool within the industry.

Real Estate and Construction

The Real Estate and Construction industry increasingly relies on drone technology for site surveying, aerial photography, and progress monitoring. Drones can quickly capture detailed imagery and topographic data, aiding in more accurate planning and analysis. In real estate, aerial views can enhance property listings, making them more appealing to potential buyers. Additionally, construction companies utilize drones to track project progress and ensure safety compliance, leading to better project management and cost reductions. The trend toward leveraging advanced technology in real estate conceptions is likely to fuel further adoption.

Security and Law Enforcement

Security and Law Enforcement applications for drones are rapidly expanding as they offer enhanced surveillance capabilities and situational awareness. These flying devices allow law enforcement agencies to monitor large areas quickly and efficiently, aiding in disaster response, crime prevention, and crowd control during events. With technological advancements enhancing drone capabilities, from facial recognition to thermal imaging, their role in security operations is becoming increasingly vital. Moreover, the strategic deployment of drones during major incidents shows potential for improved safety and response times, making this sector an essential component of the broader drone market.

Others

The 'Others' category includes various applications of commercial drones, such as surveying, telecommunications, and environmental monitoring. This demonstrates versatility, as drones are employed in industries like mining for site exploration and mapping. In telecommunications, drones are used to inspect towers and facilitate network operations. Environmental monitoring with drones has gained traction, enabling real-time data collection on wildlife and natural disaster impacts. While substantial, this sector's growth is generally propelled by niche requirements and innovative applications that enhance operations across diverse fields.

Global Commercial Drones Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Commercial Drones market primarily due to its rapid technological advancements, increasing adoption across various sectors, and significant investments in infrastructure development. Countries like China and India are at the forefront, showcasing ened demand for drone applications in agriculture, surveillance, and delivery services. The growing urbanization in this region combined with rising consumer expectations for efficient logistics and transportation fuels further market growth. Additionally, the supportive regulatory frameworks and innovation ecosystems in markets like Japan and Australia enhance the global competitiveness of the Asian drone industry, solidifying its position as a market leader.

North America

North America takes a close second in the commercial drone market, driven largely by the United States and its well-established regulatory environment. The country boasts significant investments in drone technology, particularly in sectors like agriculture, energy, and emergency services. Moreover, the presence of major drone manufacturers and a burgeoning start-up ecosystem focused on innovative drone applications ensures strong market growth. The increasing emphasis on public safety, logistics, and infrastructure maintenance further amplifies the demand, making North America a key player in the commercial drone’s landscape.

Europe

Europe shows a steady growth trajectory in the commercial drones market, bolstered by various applications in logistics, agriculture, and infrastructure inspection. Countries like the UK, Germany, and France are adopting drone technologies rapidly due to favorable government policies and funding opportunities. The European Union's emphasis on the integration of drones into airspace through regulatory initiatives enhances market confidence. However, the fragmented market across different countries and varying regulations pose challenges that could inhibit faster growth compared to its global counterparts.

Latin America

Latin America is witnessing gradual market development in the commercial drones sector, spearheaded by countries like Brazil and Mexico. The increasing focus on agriculture and environmental monitoring spurs demand for drones, particularly in resource management and crop spraying. However, challenges such as limited regulation and infrastructure hinder widespread adoption. As local businesses begin to recognize the potential benefits of drones for transportation and surveillance, the market may see growth in the coming years, albeit at a slower pace compared to Asia Pacific or North America.

Middle East & Africa

The Middle East & Africa region is currently in the nascent stages of commercial drone adoption, with potential growth driven primarily by sectors such as logistics, agriculture, and security. Investments in infrastructure and a growing interest in technological solutions are starting to emerge, particularly in countries like the UAE and South Africa. Nonetheless, a lack of cohesive regulatory frameworks and high initial costs are significant obstacles to widespread drone deployment in this region. As these challenges are addressed, the market could gain traction, but it still lags behind other global leaders in the commercial drone space.

Commercial Drones Competitive Landscape:

Key contributors to the Global Commercial Drones sector, including manufacturers and tech providers, propel innovation and maintain competitive dynamics through the creation of sophisticated drone technologies. They also influence regulatory policies and market benchmarks. By partnering with various industry participants, they enhance applications in diverse fields such as agriculture, logistics, and surveillance, thereby fostering the growth of this swiftly evolving market.

Prominent entities in the commercial drone sector encompass DJI Technology Co., Ltd., Parrot SA, Skydio, Inc., AeroVironment, Inc., and senseFly (a subsidiary of Parrot). Also noteworthy are Yuneec International Co. Ltd., Northrop Grumman Corporation, General Atomics, 3D Robotics, and GoPro, Inc. Furthermore, the industry is significantly influenced by firms such as Intel Corporation, Hexagon AB, AgEagle Aerial Systems Inc., Delair, Insitu Inc. (part of Boeing), Kespry, Inc., and Quantum Systems GmbH. Other influential players include Flyability SA, Flytrex Aviation Ltd., EHang Holdings Limited, and Teledyne Technologies Incorporated, all of which contribute to diverse applications within the commercial drone ecosystem.

Global Commercial Drones COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly expedited the integration of commercial drones into multiple industries, as organizations sought alternatives that minimized direct interaction for delivery and oversight in response to health safety issues.

The COVID-19 pandemic profoundly influenced the commercial drone industry, leading to both challenges and opportunities for innovation. At the outset, disruptions in the supply chain and a drop in demand from industries such as tourism and logistics hindered growth. However, as different sectors began to adjust to the realities imposed by the pandemic, the adaptability of drones became increasingly evident. They found utility in areas such as delivery services, transporting essential medical supplies, and conducting surveillance, highlighting their effectiveness in managing crises. The ened emphasis on contactless delivery and remote monitoring spurred greater interest in drone technology. Furthermore, regulatory frameworks governing drone operations became more accommodating, facilitating quicker approvals for commercial activities. Consequently, the industry is anticipated to recover and thrive in the post-pandemic landscape, with a forecasted compound annual growth rate (CAGR) fueled by technological advancements, broader applications in numerous sectors, and increasing public acceptance of drone use. In summary, while the pandemic presented initial obstacles, it also created a fertile ground for innovation and expansion in the commercial drone market.

Latest Trends and Innovation in the Global Commercial Drones Market:

- In September 2023, DJI announced the launch of its new enterprise drone, the Matrice 30, aimed at search and rescue, inspection, and mapping tasks, incorporating advanced AI capabilities for obstacle avoidance and automated flight planning.

- In July 2023, Skydio, a leader in autonomous drone technology, raised $100 million in a funding round, allowing them to enhance their AI-driven autonomous flying features and expand their operations within the defense and public safety sectors.

- In August 2023, Parrot partnered with the European Space Agency to develop a new program for environmental monitoring, leveraging drone technology to gather data for climate research and disaster management.

- In June 2023, Zipline announced its partnership with Walmart to deliver medications and health products to customers in several rural locations across the United States, expanding their drone delivery services significantly.

- In May 2023, Aurora Flight Sciences, a subsidiary of Boeing, successfully completed a series of test flights for its hybrid-electric cargo drone, aimed at reducing the environmental impact of logistics and delivery operations.

- In April 2023, Airbus unveiled its new Aerial Mobility division, focused on developing urban air mobility solutions utilizing drones and advanced air vehicles, and announced plans for pilot projects in multiple cities globally.

- In March 2023, Amazon's Prime Air received FAA approval for their commercial drone delivery service, marking a significant step toward the realization of retail drone delivery in urban areas.

- In February 2023, Wing, a subsidiary of Alphabet Inc., expanded its drone delivery services to new regions in Australia and the United States, highlighting a growing trend toward last-mile delivery solutions.

- In January 2023, the drone manufacturer Delair launched its new UX11 UAV, designed for industrial inspections and mapping, featuring enhanced imaging capabilities and a longer flight duration for operational efficiency.

- In December 2022, Yuneec International entered into a strategic partnership with Intel to integrate advanced sensing technologies into their drone platforms, aiming to enhance aerial surveying and inspection processes across various industries.

Commercial Drones Market Growth Factors:

Essential drivers of growth in the commercial drone sector encompass technological innovations, a rising need for aerial data acquisition, and the broadening range of applications across diverse fields, including agriculture, logistics, and surveillance.

The market for commercial drones is witnessing remarkable expansion, propelled by several pivotal elements. Primarily, the evolution of drone technology—characterized by enhancements in battery performance, increased payload capabilities, and superior navigation systems—has expanded their applicability across diverse industries. Sectors such as agriculture, construction, and logistics are increasingly utilizing drones for activities such as aerial surveys, crop monitoring, and package delivery. Moreover, the backing of regulatory bodies worldwide, which are instituting safety frameworks for drone operations and commercial applications, significantly contributes to the market's growth.

The rising need for data acquisition and real-time analytics has spurred interest in drones outfitted with advanced sensors and imaging capabilities. Additionally, the escalating e-commerce sector has driven the demand for novel delivery methods, positioning drones as a practical solution for last-mile logistics. Environmental sustainability concerns and the shift towards eco-friendly practices are further encouraging the adoption of drones for precision farming, minimizing the reliance on harmful pesticides. Lastly, the increasing focus on urban air mobility and the development of autonomous drones herald a significant transformation in transportation and logistics, opening up fresh market opportunities. Together, these dynamics highlight the commercial drones market's promising trajectory for substantial growth in the years ahead.

Commercial Drones Market Restaining Factors:

The expansion of the commercial drone market is notably hindered by regulatory limitations, elevated operational expenses, and apprehensions surrounding safety and privacy issues.

The Commercial Drones Market is encountering various constraints that could impede its expansion. One of the primary challenges is regulatory complexities, given that many nations are still in the process of formulating effective airspace and drone operation policies, which creates uncertainty for enterprises. Additionally, concerns related to safety, security, and privacy, along with the risks of accidents and misuse of drone technology, remain widespread, leading to reluctance among stakeholders and consumers. The substantial upfront expenses associated with purchasing and maintaining drones can also dissuade smaller firms from participating in the market. Operational limitations, such as restricted battery life and limited payload capacity, further constrain the versatility and effectiveness of drones across different applications. There is also a significant learning curve linked to managing sophisticated drone systems, necessitating specialized training that may not be readily accessible. Moreover, competition from superior alternatives, including automation technologies and traditional delivery methods, may restrict the market's growth. Nevertheless, the Commercial Drones Market is on track for advancement, as evolving technological innovations and regulatory structures create opportunities for novel applications and greater acceptance, indicating a promising future in this vibrant sector.

Key Segments of the Commercial Drones Market

By Product Type

- Fixed Wing

- Rotary Blade

- Hybrid

By Application

- Filming and Photography

- Inspection and Maintenance

- Mapping and Surveying

- Precision Agriculture

- Surveillance and Monitoring

- Others

By End Use

- Agriculture

- Delivery and Logistics

- Energy

- Media and Entertainment

- Real Estate and Construction

- Security and Law Enforcement

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America