Colostrum Market Analysis and Insights:

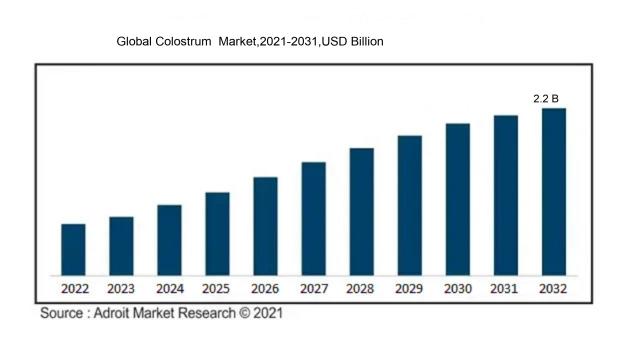

In 2023, the size of the worldwide Colostrum market was US$ 1.1 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 3.41 % from 2024 to 2032, reaching US$ 2.2 billion.

The colostrum market is significantly influenced by the growing recognition of its health advantages, especially its capacity to enhance immune function and support digestive health. The escalating incidence of health challenges such as gastrointestinal issues and immune system deficiencies has amplified consumer interest in natural supplements sourced from bovine and goat colostrum. Moreover, the expansion of the wellness and nutraceutical sectors has fostered a ened demand for colostrum-infused products across diverse industries, including food and beverages, pharmaceuticals, and cosmetics. The ongoing research that highlights the bioactive compounds within colostrum and their potential therapeutic benefits further enhances its market appeal. The shift towards preventive healthcare, along with rising disposable incomes and evolving lifestyles, is also driving the uptake of colostrum supplements among health-conscious individuals. Additionally, the increasing accessibility and innovation in product formulations are anticipated to further advance market growth.

Colostrum Market Definition

Colostrum is the initial type of milk secreted by mammals right after giving birth, abundant in antibodies and vital nutrients. This substance is essential for offering immune protection and sustenance to infants during their early days after birth.

Colostrum, the initial milk secreted by mammals post-delivery, plays a critical role in the well-being of newborns, as it is packed with vital nutrients, antibodies, and growth-promoting substances. This viscous, yellowish liquid significantly enhances the infant’s immune response, offering crucial protection against infections and ailments in the initial days following birth. The efficacy of colostrum stems from its abundant immunoglobulin content, which fortifies the immune system. Furthermore, it aids in proper digestion and supports the overall growth and development of the infant. Its distinctive formulation is essential in connecting maternal and neonatal nourishment, laying a robust groundwork for the child’s long-term health.

Colostrum Market Segmental Analysis:

Insights On Form

Powder

The powder form of colostrum is expected to dominate the global market due to its versatility and convenience in usage. Powdered colostrum can be easily integrated into various food products, supplements, and beverages. Moreover, this form has a long shelf life, allows for precise dosage measurements, and can be effectively used in both adult and pediatric populations, making it appealing to a broad range of consumers. The increasing awareness of the health benefits associated with colostrum, such as immune system support and gut health improvement, drives consumer preferences towards this form. Thus, the powder form stands out as the leading choice in the global colostrum market.

Capsules and Chewable Tablets

Capsules and chewable tablets offer a convenient and user-friendly method of consuming colostrum, especially for those who may have difficulty integrating powdered forms into their diets. This format caters well to consumers seeking on-the-go health solutions. Chewable tablets, in particular, have gained popularity among children and those who dislike swallowing pills, making them a more attractive option for families. However, while they serve a specific consumer base, their higher production cost and limited dosage flexibility compared to powder are potential drawbacks that may hinder their growth compared to powdered forms.

Liquids

Liquid forms of colostrum provide rapid absorption and are often perceived as a natural and effective option for enhancing wellness. They are particularly suitable for individuals who prefer ready-to-drink supplements. Liquids can be marketed as highly bioavailable, highlighting beneficial characteristics that appeal to health-conscious consumers. However, the liquid format often faces challenges such as shorter shelf life and potential flavor issues that can deter some consumers from choosing this option over the more versatile powdered form. Due to these factors, the liquid format may experience steady demand but is less likely to lead the market.

Insights On Distribution Channel

B2B

The B2B distribution channel is expected to dominate the Global Colostrum Market primarily due to the growing demand from various industries such as food and beverages, pharmaceuticals, and nutrition. Businesses often require bulk colostrum for product formulation and supply, benefiting from economies of scale. Partnerships with manufacturers, healthcare providers, and nutrition companies drive significant sales volumes, which is a crucial factor for sustained growth. Additionally, B2B transactions involve longer-term contracts and relationships, ensuring a steady demand pipeline. This channel's efficiency in delivering to larger enterprises further cements its leading role in the colostrum market landscape.

B2C

The B2C distribution channel caters directly to consumers, providing a wide range of colostrum products like supplements and functional foods. While it holds a smaller market share compared to B2B, its growth potential should not be underestimated. As health-conscious consumers increasingly seek out functional food options, B2C channels enable brands to engage with these end-users effectively. The rise of e-commerce platforms has made it easier for consumers to access colostrum products, presenting opportunities for direct-to-consumer sales. However, B2C still trails behind B2B in volume and overall market influence.

Global Colostrum Market Regional Insights:

North America

North America is expected to dominate the Global Colostrum Market due to its strong emphasis on health and wellness, a well-established dairy industry, and high consumer awareness regarding the benefits of colostrum supplements. The region is characterized by advanced nutritional research and innovative product development, which cultivates a competitive market for colostrum-derived products. Furthermore, the increasing trend of utilizing colostrum in infant nutrition and adult health supplements adds to its growth momentum. High disposable income, alongside the increasing popularity of dietary supplements, positions North America as the leading region in the global colostrum market.

Latin America

Latin America, while not leading the market, shows considerable potential for growth in the colostrum sector. The increasing awareness of health benefits and the rising demand for natural food products are significant factors contributing to this growth. Additionally, countries like Brazil and Argentina have robust dairy industries that can support colostrum production. However, the market is still emerging and faces challenges such as regulatory uncertainties and limited product availability, which could hinder faster growth compared to more developed regions.

Asia Pacific

The Asia Pacific region is witnessing a growing interest in colostrum products, primarily due to increasing health consciousness among consumers and a booming dietary supplement market. Countries like China and India are experiencing accelerated demand for whey protein and colostrum-based nutritional products. Although significant barriers exist, such as a fragmented market and varying health regulations, the region’s vast population and rising disposable incomes make it an attractive market for future developments in colostrum utilization.

Europe

Europe has a moderately growing colostrum market driven by strong health trends and consumer preferences for natural, functional foods. The region's stringent food safety regulations and quality control add credibility to colostrum products, attracting health-conscious consumers. While countries such as Germany and France lead in consumption, the overall market is hindered by the high competition from other dairy ingredients and limited awareness of colostrum's specific benefits, impacting its growth potential compared to North America.

Middle East & Africa

The Middle East & Africa region remains relatively untapped regarding the colostrum market. The potential exists due to increasing health awareness and dietary changes; however, economic factors and lower disposable income levels can limit consumer spending on high-priced nutritional supplements. The market is expected to grow slowly as education on colostrum benefits increases, but the overall adoption may take significant time to catch up with more developed regions.

Colostrum Market Competitive Landscape:

In the global colostrum market, prominent participants consist of producers dedicated to procuring premium colostrum and creating novel products, alongside distributors tasked with optimizing supply chain operations and reaching various markets. These entities work together to improve product visibility, guarantee quality, and increase consumer awareness.

Prominent entities within the colostrum industry comprise Lactalis Ingredients, Biostran Inc., Colostrum Bioactive, Immuno-Dynamics, Inc., Westland Milk Products, NAXA, Fonterra Co-operative Group Limited, Grove Fresh Farms, BSPG Laboratories, Neolife, Synlogic, and Zenith Nutrition. These organizations play a vital role in advancing, manufacturing, and distributing colostrum derivatives for diverse purposes in health and nutrition, thereby fostering a dynamic market environment.

Global Colostrum Market COVID-19 Impact and Market Status:

The Covid-19 pandemic brought considerable upheaval to the worldwide colostrum market, reshaping supply chains and driving ened demand for health-enhancing products as individuals prioritized their well-being.

The COVID-19 pandemic had a profound effect on the colostrum industry, primarily due to supply chain interruptions and variations in consumer demand. At the outset of the pandemic, ened awareness regarding health and immune function led to an increase in the demand for nutritional supplements, including colostrum, as individuals sought to bolster their immune systems. However, logistical obstacles such as transportation limitations and shortages of raw materials impeded production and distribution processes, resulting in price fluctuations. Furthermore, the closure of gyms and fitness facilities, where colostrum products are commonly utilized, also influenced the market landscape. As recovery unfolded and the industry adapted to new circumstances, consumer interest began to revive, especially through e-commerce platforms. The long-term outlook indicates a shift in emphasis towards health and wellness products, suggesting that the colostrum market may experience growth as consumers continue to prioritize immunity and overall health in the post-pandemic era.

Latest Trends and Innovation in The Global Colostrum Market:

- In December 2022, BIOMIN introduced its latest innovation in colostrum-derived products, focusing on improving gut health in livestock, marking its commitment to advancing animal nutrition through research and development.

- In July 2023, Goodlife Nutrition announced the acquisition of Immune Tree, a well-known producer of colostrum products. This strategic move is aimed at expanding Goodlife's portfolio and enhancing their position in the health and wellness market.

- In March 2023, AMI (Advanced Microbial Innovations) unveiled a new line of colostrum supplements designed specifically for athletes, utilizing cutting-edge technology to enhance bioavailability and absorption of nutrients.

- In May 2023, NIG Nutritionals launched a new colostrum powder enriched with immunoglobulins and growth factors, explicitly targeting the infant nutrition market, emphasizing their focus on early life nutrition.

- In August 2023, Gea Group announced a technological partnership with A2 Milk Company to develop a new processing method for colostrum that aims to retain maximum nutritional benefits while increasing efficiency in production.

- In October 2022, WestAdmin, a prominent supplier of bovine colostrum products, expanded its distribution channels significantly by partnering with several retailers in North America, allowing for improved access to their products.

- In January 2023, New Zealand-based colostrum brand, Colostrum Biotech, received a significant investment to enhance its research capabilities and expand its product offerings, particularly in the nutraceutical sector.

- In February 2023, the Canadian company, ImmunoPrecise Antibodies, announced a collaboration with a leading university research institution to explore new applications of colostrum-derived antibodies in therapeutic treatments.

Colostrum Market Growth Factors:

The expansion of the colostrum market can be attributed to ened consumer understanding of its health advantages, growing interest in natural supplements, and a significant rise in its application across multiple sectors, such as food and pharmaceuticals.

The colostrum market is witnessing robust expansion driven by several influential factors. Primarily, there is a notable rise in consumer awareness regarding the health advantages associated with colostrum, especially its role in enhancing immune function and promoting gastrointestinal health. This has led to a surge in demand, particularly among health-conscious individuals and athletes who are increasingly drawn to dietary supplements and functional foods.

Additionally, the growing preference for natural and organic products has ened the demand for colostrum sourced from grass-fed cows, which is often viewed as more nutritious and ethically produced. Technological advancements in processing methods have further improved the bioavailability of colostrum, making it not only more effective but also more appealing to consumers.

The growth of e-commerce has significantly increased accessibility to colostrum products, thereby improving market visibility and boosting sales. Concurrently, the rising incidence of health issues related to lifestyle choices is driving the demand for immune-supportive supplements, which in turn accelerates market growth. Moreover, the expanding use of colostrum in the pharmaceutical and cosmetic sectors, as a natural component in skincare and health formulations, adds to its market potential. Collectively, these elements are contributing to a strong upward trajectory for the colostrum market on a global scale.

Colostrum Market Restaining Factors:

Major limiting factors in the colostrum market consist of rigorous regulatory guidelines and a lack of consumer understanding regarding its advantages.

The colostrum market is encountering several obstacles that could impede its growth trajectory. A primary issue is the general lack of consumer awareness regarding the numerous health advantages associated with colostrum, which may suppress demand levels. Furthermore, the relatively high price point of colostrum products, especially those sourced from bovines, might dissuade price-sensitive consumers, thereby limiting market reach. Regulatory challenges add another layer of complexity, as inconsistent standards across various regions can hinder both production and distribution efforts. Additionally, lactose intolerance affecting a significant of the population may narrow the product's marketability, influencing overall sales potential. Concerns surrounding the sustainability of dairy farming practices could also foster negative perceptions among environmentally conscious shoppers. Nevertheless, the colostrum market is anticipated to grow owing to a surging interest in natural dietary supplements and greater recognition of colostrum's benefits for immune system support, gastrointestinal health, and athletic performance. As knowledge spreads and innovative product formulations are developed, the market is likely to evolve favorably, creating new opportunities for both manufacturers and consumers.

Segments of the Colostrum Market

By Form

• Powder

• Capsule and Chewable Tablets

• Liquids

By Distribution Channel

• B2B

• B2C

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America