Market Analysis and Insights:

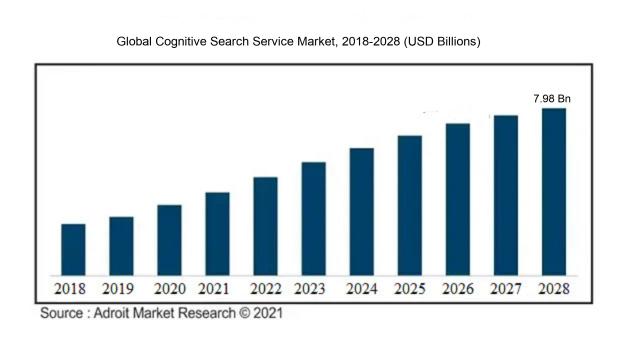

The market for Global Cognitive Search Services was estimated to be worth USD 3.25 billion in 2021, and from 2021 to 2028, it is anticipated to grow at a CAGR of 11.87%, with an expected value of USD 7.98 billion in 2028.

The Cognitive Search Services Market is being driven by various factors. One significant factor is the rising demand for efficient and precise search functionalities to manage extensive quantities of unstructured data effectively. Organizations are realizing the importance of extracting valuable insights from their data to facilitate quicker and more well-informed decision-making processes. Furthermore, the integration of artificial intelligence (AI) and machine learning technologies is transforming the search landscape by enabling sophisticated features such as natural language processing, context sensitivity, and personalized recommendations. Additionally, the widespread use of cloud computing and the proliferation of digital content are leading to a significant increase in data volumes, thereby intensifying the need for Cognitive Search Servicess. Moreover, the market is experiencing growth due to the introduction of novel applications like voice search and visual search. Lastly, substantial investments by key industry players in research and development endeavors aimed at enhancing the capabilities of Cognitive Search Servicess are propelling the expansion of the market.

Cognitive Search Service Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2028 |

| Study Period | 2018-2028 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2028 | USD 7.98 billion |

| Growth Rate | CAGR of 11.87% during 2021-2028 |

| Segment Covered | By Product, By Application, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Google Inc., IBM Corporation, Microsoft Corporation, Amazon Web Services, SAS Institute Inc., Coveo Solutions Inc., Lucidworks Inc., Attivio Inc., Algolia Inc., and Sinequa. |

Market Definition

Utilizing artificial intelligence and machine learning algorithms, Cognitive Search Services elevates the search process by interpreting user intent, retrieving pertinent data, and offering insightful suggestions. This technology optimizes the exploration and retrieval of relevant content within extensive data collections, resulting in precision and customization of search outcomes.

The Cognitive Search Services represents a significant advancement in information retrieval by fusing artificial intelligence with traditional search functions. By employing machine learning algorithms, it can grasp the nuances and context of user queries for more precise and tailored search outcomes. Through the utilization of natural language processing, entity recognition, and sentiment analysis, the service is adept at extracting relevant and insightful information from varied sources like documents, emails, and social media posts, even if they are unstructured. This tool empowers businesses to efficiently access and analyze vast data sets, thereby facilitating informed decision-making, enriching customer interactions, and fostering innovation across diverse sectors. Moreover, its seamless integration with existing platforms provides a scalable and adaptable solution that aligns with the evolving demands of enterprises. Ultimately, the Cognitive Search Services introduces a paradigm shift in search methodologies, empowering organizations to unleash the full potential of their data and secure a competitive advantage in the digital landscape.

Key Market Segmentation:

Insights On Key Product

Cloud-based

Cloud-based solutions are expected to dominate the Global Cognitive Search Services Market. The increasing demand for flexibility, scalability, and cost-efficiency in search services has propelled the adoption of cloud-based solutions. Cloud-based Cognitive Search Servicess offer organizations the ability to leverage powerful search capabilities without the need for complex infrastructure or on-premise installations. Additionally, the cloud-based model provides seamless integration with existing digital platforms and allows for easy customization and updates. With the growing trend of digital transformation and the need for real-time insights, the cloud-based part is poised to dominate the market.

On-Premise

On-premise solutions, while still prevalent in certain industries, are expected to have a smaller market share compared to cloud-based offerings. The primary drawback of on-premise Cognitive Search Servicess is the requirement for dedicated hardware and infrastructure. This significantly contributes to higher upfront costs, complexity in implementation, and limits scalability. However, some organizations with specific security or compliance concerns may still opt for on-premise solutions, especially in industries such as healthcare or finance, where data privacy regulations are stringent. Despite these niche use cases, the dominance of cloud-based solutions is expected to overshadow the on-premise part in the Global Cognitive Search Services Market.

Insights On Key Application

Large Enterprises

Large Enterprises are expected to dominate the Global Cognitive Search Services Market. This is due to their higher financial resources and larger scale of operations, allowing them to invest more in advanced technologies like Cognitive Search Servicess. Large enterprises typically have vast amounts of data that need to be efficiently managed and analyzed, making Cognitive Search Servicess essential for their business growth and decision-making processes. Moreover, large enterprises often have complex organizational structures and diverse data sources, which require robust cognitive search capabilities to manage and extract insights from their data. As a result, large enterprises are likely to be the major driver of growth in the global Cognitive Search Services market.

Small and Medium-sized Enterprises (SMEs)

Small and Medium-sized Enterprises (SMEs) may also play a significant role in the Global Cognitive Search Services Market. While they may not dominate the market like large enterprises, SMEs represent a substantial portion of businesses worldwide and are increasingly recognizing the importance of leveraging cognitive search technologies to improve their operations and competitiveness. As SMEs continue to adopt digital transformation initiatives and generate large volumes of data, they will require efficient search solutions to uncover valuable insights and enhance decision-making. Although their resources may be more limited compared to large enterprises, Cognitive Search Servicess tailored to the specific needs and budgets of SMEs are likely to be developed, enabling SMEs to benefit from the growing Cognitive Search Services market.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Cognitive Search Services market. This region has a highly developed technological infrastructure and a strong presence of key players in the Cognitive Search Services industry. The North American market is driven by factors such as the increasing adoption of artificial intelligence and cognitive technologies in various industries, such as healthcare, finance, and retail. Moreover, the region has a high level of digitalization and a large base of tech-savvy customers, which further fuels the demand for Cognitive Search Servicess. The presence of major market players, such as IBM and Microsoft, also contributes to the dominance of North America in this market.

Latin America

Latin America is witnessing a growing adoption of Cognitive Search Servicess due to the increasing digital transformation initiatives in the region. The market is primarily driven by the rapid growth in e-commerce and the rising need for efficient data management solutions. However, the market in Latin America is relatively smaller compared to North America, and it is expected to experience moderate growth in the coming years.

Asia Pacific

The Asia Pacific region is expected to register significant growth in the global Cognitive Search Services market. Factors such as the increasing penetration of smartphones, the rapid growth of e-commerce, and the adoption of advanced technologies in countries like China, India, and Japan, contribute to the growth potential of this region. Additionally, the rising investments in AI and cognitive technologies by key players in the region further fuel the market's expansion. While the market in Asia Pacific shows promising growth prospects, it still lags behind North America in terms of market size and overall dominance.

Europe

Europe is another important region in the global Cognitive Search Services market. The region experiences a high demand for Cognitive Search Servicess from various sectors, including healthcare, retail, and BFSI industries. Factors such as the growing focus on digital transformation, government initiatives, and the presence of key players in the region contribute to the market's growth. However, the market in Europe is expected to hold a smaller share compared to North America, primarily due to the region's slower adoption rate and comparatively smaller market size.

Middle East & Africa

The Middle East & Africa region is still in the nascent stage of adopting Cognitive Search Servicess. Factors like the increasing investments in AI and the digitalization initiatives taken by governments drive the market's growth in this region. However, the market still has a relatively smaller share compared to other regions. The low awareness and limited implementation of Cognitive Search Servicess in industries are the key challenges that impede the market's growth in the Middle East & Africa region.

Company Profiles:

Prominent stakeholders within the worldwide Cognitive Search Services industry are instrumental in spearheading innovation and progress in search technology. Their contributions empower enterprises to scrutinize, uncover, and derive valuable insights from vast volumes of structured and unstructured data. These stakeholders offer holistic cognitive search offerings that harness the power of artificial intelligence, machine learning, and natural language processing to provide improved search functionalities and customized user interactions.

Prominent companies in the Cognitive Search Services sector encompass major industry leaders such as Google Inc., IBM Corporation, Microsoft Corporation, Amazon Web Services, SAS Institute Inc., Coveo Solutions Inc., Lucidworks Inc., Attivio Inc., Algolia Inc., and Sinequa. These organizations are dedicated to delivering cutting-edge search functionalities driven by artificial intelligence and machine learning protocols. Their primary objective revolves around elevating data exploration and retrieval processes, intending to transform how enterprises access and capitalize on information for enhanced decision-making and customer engagement. Google Inc., IBM Corporation, and Microsoft Corporation stand out in the market due to their robust cognitive search solutions, while Amazon Web Services and SAS Institute Inc. are also making significant strides within the industry. Additionally, notable contributors such as Coveo Solutions Inc., Lucidworks Inc., Attivio Inc., Algolia Inc., and Sinequa play vital roles in propelling the rapid expansion and innovation observed in the Cognitive Search Services sector.

COVID-19 Impact and Market Status:

The Global Cognitive Search Services market has experienced a boost as a result of the Covid-19 pandemic, driven by the growing need for effective and sophisticated search tools in remote working settings.

The global outbreak of COVID-19 has significantly impacted multiple sectors, notably the Cognitive Search Services industry. As organizations swiftly transitioned to remote work setups and sought means to access information from various locations, the demand for Cognitive Search Servicess witnessed a notable increase. Companies are now reassessing their search capabilities and making investments in cutting-edge technologies to optimize their information retrieval and knowledge discovery processes. Cognitive Search Servicess empower users to effectively extract relevant data from extensive and intricate datasets, thereby enhancing decision-making processes and bolstering overall productivity. The current pandemic has ened the urgency for organizations to derive insights from their data swiftly and adapt promptly to evolving business landscapes. Furthermore, traditional search solutions are facing challenges in keeping pace with the sheer volume and intricacy of available information, prompting further growth in the Cognitive Search Servicess market. Despite encountering obstacles such as financial constraints and market uncertainty, as businesses strategically allocate their resources during times of economic flux, technological advancements and the escalating demand for streamlined and intelligent search solutions are expected to propel the expansion of the Cognitive Search Services sector. This growth trajectory remains intact despite the prevailing pandemic scenario.

Latest Trends and Innovation:

- In January 2021, Microsoft announced the acquisition of Nuance Communications, a leading provider of Conversational AI and cloud-based speech recognition solutions.

- In February 2021, Elastic, an open-source search and analytics company, acquired the cognitive search platform, Swiftype.

- In March 2021, Coveo, a leader in AI-powered search and recommendations, introduced Coveo for Commerce, a solution designed to enhance the eCommerce experience with AI-driven product recommendations and personalized search.

- In April 2021, Lucidworks, a leader in AI-powered search and discovery, launched Fusion 5.0, the latest version of their cognitive search platform that brings together data indexing, search, and machine learning capabilities.

- In May 2021, Sinequa, a provider of intelligent enterprise search solutions, announced a strategic partnership with Atos to deliver AI-powered search and analytics solutions to their enterprise customers.

- In June 2021, Adobe launched Adobe Sensei for search and discovery, an AI-powered solution that enables enterprises to deliver personalized and contextual search experiences across their digital platforms.

- In July 2021, Google announced the enhancement of their Cloud Search service with new AI capabilities, including natural language understanding and document ranking based on user behavior and preferences.

- In August 2021, Amazon Web Services (AWS) introduced Kendra, an intelligent search service powered by machine learning, which enables organizations to build and deploy AI-powered search experiences.

- In September 2021, IBM acquired Brazilian tech company Bluetab Solutions to strengthen their hybrid cloud and AI capabilities, including cognitive search.

- In October 2021, 3RDi Search, a leader in enterprise search and cognitive insights, announced a partnership with UiPath to offer AI-powered search solutions to automate and enhance enterprise workflows.

Significant Growth Factors:

The growth of the Cognitive Search Services market can be attributed to the rising need for precise and effective data retrieval tools across a range of sectors.

The market for Cognitive Search Servicess is witnessing notable growth driven by multiple factors. One significant factor is the escalating volume of big data and the consequent necessity to effectively manage and derive insights from extensive information repositories. This trend is prompting organizations to embrace Cognitive Search Servicess, recognizing the value of employing cutting-edge search technologies integrated with cognitive functionalities like natural language processing and machine learning to enhance search processes and facilitate better decision-making. Another key driver of market growth is the increasing demand for personalized and pertinent search encounters. As users increasingly expect search outcomes customized to their preferences and situational context, businesses are turning to cognitive search solutions to deliver more precise and curated search results. Additionally, the emphasis on bolstering knowledge management practices within enterprises is propelling the uptake of Cognitive Search Servicess. By harnessing cognitive capabilities, organizations can optimize the discovery, organization, and retrieval of their knowledge assets, thereby fostering more efficient collaboration and innovation. The burgeoning digital landscape and the imperative for advanced search capabilities across a spectrum of industries such as healthcare, e-commerce, and finance are also contributing to the expansion of the Cognitive Search Services market. Furthermore, the progress in artificial intelligence and natural language processing technologies is opening up new prospects for cognitive search, enabling more sophisticated and contextually aware search experiences. Collectively, these growth drivers are steering the pervasive adoption of Cognitive Search Servicess, propelling the market's advancement.

Restraining Factors:

The Cognitive Search Services Market is hindered in its growth by the scarcity of proficient professionals and the intricate nature of deploying cognitive search technology.

The market for Cognitive Search Servicess has experienced notable growth in recent times, yet encounters limitations that must be addressed. A significant impediment is the substantial upfront cost associated with implementing cognitive search technologies. The initial investment needed for deploying advanced software and hardware infrastructure can dissuade many organizations, particularly small and medium-sized enterprises. Moreover, the intricacy of integrating cognitive search solutions with existing systems and databases presents a challenge, necessitating specialized expertise and resources. Concerns regarding data privacy and security also impede the uptake of Cognitive Search Servicess, as organizations may hesitate to share delicate information with external providers. Furthermore, a lack of awareness and comprehension regarding the capabilities and potential advantages of cognitive search technology serves as a notable impediment to its widespread adoption. Many businesses may fail to recognize the value it offers in terms of improving productivity, enhancing customer experience, and facilitating decision-making. Notwithstanding these obstacles, the future outlook for the Cognitive Search Services market remains promising. Continued progress in machine learning and artificial intelligence is anticipated to reduce implementation costs over time. The increased adoption of Cognitive Search Servicess and enhancements in security measures should help allay concerns about data privacy and safeguarding. Moreover, as more organizations embrace digital transformation and realize the benefits of cognitive search, awareness is expected to increase, thereby stimulating higher demand and fostering further innovation in the sector.

Key Segments of the Cognitive Search Services Market

Product Overview

• On-Premise Cognitive Search Services

• Cloud-based Cognitive Search Services

Application Overview

• Small and Medium-sized Enterprises (SMEs)

• Large Enterprises

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America