Market Analysis and Insights:

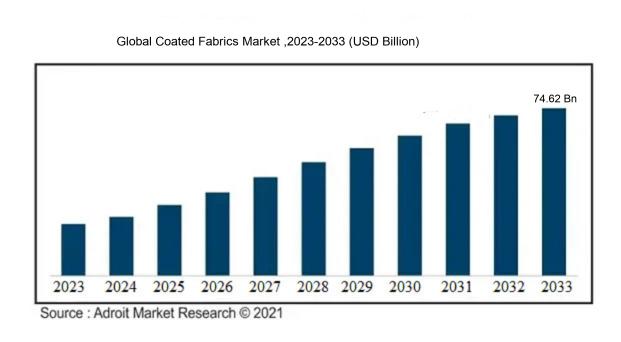

The market for Global coated fabrics was estimated to be worth USD 45.81 billion in 2023, and from 2024 to 2033, it is anticipated to grow at a CAGR of 5.12%, with an expected value of USD 74.62 billion in 2033.

The coated fabrics industry experiences significant growth propelled by the escalating demand across diverse sectors including automotive, construction, and healthcare. An important contributor to this growth is the automotive sector, wherein coated fabrics are extensively utilized for car interiors, upholstery, and airbags owing to their robustness, fire resistance, and visual appeal. Similarly, the expansion of the construction industry, icularly in developing nations, is driving the need for coated fabrics in various applications like roofing, upholstery, and protective garments. Moreover, an upsurge in the healthcare sector is witnessed with a rising requirement for medical-grade coated fabrics, applied in surgical gowns, mattress covers, and wheelchair upholstery, due to their infection prevention and ease of maintenance attributes. Furthermore, market demand is shifting towards eco-friendly coated fabrics, crafted from recycled materials and emitting reduced levels of volatile organic compounds (VOCs), in response to growing environmental concerns and sustainability awareness. These factors, in conjunction with advancements in coating technologies, are poised to accelerate the expansion of the coated fabrics market in the forthcoming years.

Coated Fabrics Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2033 |

| Study Period | 2018-2033 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2033 | USD 74.62 billion |

| Growth Rate | CAGR of 5.12% during 2024-2033 |

| Segment Covered | By Product, By Application,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Omnova Solutions Inc., Spradling International, Inc., Saint-Gobain SA, Sioen Industries NV, Continental AG, Low & Bonar PLC, Seaman Corporation, Trelleborg AB, Serge Ferrari Group, and Mauritzon, Inc. |

Market Definition

The coated textiles sector pertains to a division within the textile industry wherein a layer of polymer or alternative substances is applied to fabrics to elevate their overall performance and utility. By undergoing this treatment, the fabrics acquire resistance against water, fire, UV rays, and abrasion, thereby rendering them appropriate for a multitude of uses across industries like automotive, furniture, and healthcare.

The market for coated fabrics is of great significance due to its broad spectrum of applications and adaptability. Coated fabrics find use in numerous industries, including automotive, textile, aerospace, and medical sectors. These specialized fabrics are designed to offer added functionalities like waterproofing, fire resistance, and durability, thus making them suitable for outdoor and high-performance uses. The increasing demand for coated fabrics can be attributed to several factors such as the rise in disposable income, the expansion of the automotive industry, and an increasing awareness of the advantages of coated fabrics in enhancing product performance and lifespan. Furthermore, market growth is being propelled by advancements in coating technologies and the creation of environmentally friendly coatings. In essence, the coated fabrics market plays a crucial role in providing innovative and practical materials for various industries, thereby contributing to their advancement and sustainability.

Key Market Segmentation:

Insights On Key Product

Rubber Coated Fabric

Rubber Coated Fabric is expected to dominate the global coated fabrics market. This is due to its extensive use in various applications such as automotive, transportation, and industrial sectors. Rubber coated fabrics offer exceptional durability, resistance to abrasion, and flexibility, making them suitable for demanding environments. The automotive industry, in icular, utilizes rubber coated fabrics for manufacturing car interiors, seats, and various components. With the growing automotive sector, the demand for rubber coated fabrics is expected to increase significantly.

Polymer Coated Fabric

Polymer Coated Fabric is another significant part in the global coated fabrics market. Polymer coated fabrics offer excellent water resistance, UV protection, and durability, making them ideal for outdoor applications such as awnings, canopies, and outdoor furniture. These fabrics are also widely used in the construction and architecture industry for roofing materials and tension structures. The increasing emphasis on sustainability and eco-friendly materials further drives the demand for polymer coated fabrics.

Fabric Backed Wall Coverings

Fabric Backed Wall Coverings, although not expected to dominate the market, have their own unique applications. These fabrics are primarily used for interior decoration purposes, such as wall coverings, upholstery, and curtains. They offer a wide range of colors, patterns, and textures, allowing for creative and customized designs. The hospitality and residential sectors heavily rely on fabric backed wall coverings to enhance the aesthetics of their spaces. While not the dominating , the demand for fabric backed wall coverings remains steady in the global coated fabrics market.

Insights On Key Application

Protective Clothing

Protective clothing is expected to dominate the global coated fabrics market.

The demand for protective clothing is rapidly growing due to increasing safety concerns in various industries such as chemical, healthcare, and manufacturing. Coated fabrics offer enhanced protection against hazards such as chemicals, fire, and electricity, making them ideal for applications in protective clothing. Additionally, the stringent regulations imposed by various government bodies to ensure worker safety further drive the demand for protective clothing made from coated fabrics.

Transportation

Transportation is an important of the global coated fabrics market. Coated fabrics find extensive use in the automotive, aerospace, and marine industries.

In the automotive sector, coated fabrics are utilized for the manufacturing of vehicle interiors, seat covers, and airbags. In the aerospace industry, they are used in the production of aircraft interiors, seats, and cargo covers. In the marine industry, coated fabrics are employed for boat covers, upholstery, and other applications. The growing transportation sector, coupled with the increasing demand for lightweight and durable materials, fuels the demand for coated fabrics in this .

Furniture

The furniture is another significant part of the global coated fabrics market. Coated fabrics offer several advantages for furniture applications, including resistance to stains, liquids, and wear. They are commonly used in the production of upholstery, sofas, chairs, and other furniture items. Additionally, the growing demand for aesthetically pleasing and durable furniture further drives the market for coated fabrics in this . The availability of a wide range of colors, patterns, and textures in coated fabrics makes them a preferred choice for furniture manufacturers.

Industrial

The global coated fabrics market is dominated by the industrial sector. In the industrial sector, coated fabrics are widely used for awnings, tents, conveyor belts, and protective covers, among other things. For the industrial sector to survive challenging climatic conditions and offer weather protection, high-performance, long-lasting materials are needed. Coated fabrics are ideal for industrial applications because of their superior resistance to abrasion, weathering, and chemicals. The demand for coated fabrics in the industrial sector is driven by the requirement for cutting-edge materials with higher performance qualities.

Others

The "others" refers to the remaining applications of coated fabrics that do not fall under the dominant or other mentioned s. This category includes diverse applications such as medical equipment, geotextiles, sports equipment, and agriculture. While these applications may not individually dominate the market, they contribute to the overall growth of the coated fabrics market. The versatility and adaptability of coated fabrics make them suitable for a wide range of niche applications, driving the demand in the "others" .

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global coated fabrics market market. This can be attributed to various factors such as the presence of key market players, well-established manufacturing facilities, and a high demand for coated fabrics in industries such as automotive, aerospace, and upholstery. Additionally, Europe has stringent regulations concerning product quality and safety, which further drives the demand for coated fabrics in the region. The growing focus on sustainable and eco-friendly products also plays a significant role in Europe's dominance in the Global coated fabrics market market. Overall, Europe's strong industrial base, stringent regulations, and emphasis on sustainability propel it to be the leading region in this market .

North America

North America is an important region in the Global coated fabrics market market, although it may not dominate the market as a whole. The region has a well-developed manufacturing sector and a strong presence of major automotive and aerospace industries. These industries are the major consumers of coated fabrics for various applications such as seat covers, airbags, and interior trims. Moreover, the increasing demand for high-performance textiles, growing investments in research and development, and the presence of advanced technological infrastructure drive the coated fabrics market in North America.While North America may not dominate the market, it holds a significant market share and is an important player in the Global coated fabrics market market.

Latin America

Latin America has been witnessing a steady growth in the Global coated fabrics market market. The region benefits from a growing population, increasing disposable income, and rising urbanization, which contribute to the demand for coated fabrics in various applications. Additionally, the expanding automotive and construction sectors in countries like Brazil and Mexico also drive the market for coated fabrics in Latin America. However, while Latin America shows potential for growth, it may not dominate the Global coated fabrics market market due to infrastructure limitations, economic instability in some countries, and lower industrial production compared to other regions.

Asia Pacific

Asia Pacific is a rapidly developing region in the Global coated fabrics market market. The region is experiencing significant economic growth, industrialization, and urbanization, leading to an increased demand for coated fabrics in various sectors such as automotive, construction, and healthcare. The presence of a large population, rising income levels, and changing consumer preferences further contribute to the market growth in Asia Pacific. Moreover, the region is also a major hub for textile manufacturing, providing cost advantages and attracting investments in the coated fabrics industry. While the Asia Pacific region may not dominate the market market, it is poised for substantial growth and holds immense potential.

Middle East & Africa

The Middle East & Africa region is not expected to dominate the Global coated fabrics market market. The region faces challenges such as limited infrastructure, lower industrial production, and political instability in some countries. However, there are pockets of growth in the region, icularly in countries like United Arab Emirates and Saudi Arabia where significant infrastructure development and increasing urbanization are driving the demand for coated fabrics in applications such as construction and automotive. Nevertheless, the market share of the Middle East & Africa region remains relatively smaller compared to other regions, and it may not dominate the Global coated fabrics market market.

Company Profiles:

Prominent figures in the international market for coated fabrics encompass Trelleborg AB, recognized for its premier production of coated fabrics catering to diverse applications, OMNOVA Solutions Inc., esteemed for its expertise in performance chemicals and surfaces, and Saint-Gobain SA, a multinational corporation dedicated to providing sustainable solutions for various industries, with a strategic emphasis on coated fabrics.

Prominent companies operating in the coated fabrics market are Omnova Solutions Inc., Spradling International, Inc., Saint-Gobain SA, Sioen Industries NV, Continental AG, Low & Bonar PLC, Seaman Corporation, Trelleborg AB, Serge Ferrari Group, and Mauritzon, Inc.

These industry leaders are renowned for their proficiency in manufacturing and distributing diverse coated fabrics catering to sectors like automotive, aerospace, construction, and healthcare. Through a dedicated emphasis on pioneering technologies and continuous product enhancement, they strive to address changing customer needs and uphold a prominent position in the market.

COVID-19 Impact and Market Status:

The worldwide market for coated fabrics has experienced adverse effects as a result of the Covid-19 pandemic, causing a decrease in demand and disturbances in supply chains. The global market for coated fabrics has been significantly impacted by the COVID-19 pandemic, as extensive travel restrictions and business closures have led to reduced demand across various sectors including automotive, aerospace, and construction. The automotive industry has faced disruptions in production and sales due to plant closures and decreased consumer spending. Similarly, the aerospace sector has suffered from decreased air travel and delayed aircraft deliveries, resulting in lower demand for coated fabrics used in aircraft interiors. The construction industry has also experienced a slowdown with many projects being paused or delayed.

Despite the initial negative effects of the pandemic, the long-term prospects for the coated fabrics market remain positive. As economies recover and restrictions ease, there is expected to be a rebound in the demand for coated fabrics as industries resume operations and consumer confidence increases, thereby fostering market growth. Companies in the coated fabrics sector are anticipated to embrace innovation and align with emerging trends such as sustainability and hygiene consciousness to capitalize on new opportunities in the post-pandemic landscape. In conclusion, although the COVID-19 crisis has posed challenges for the coated fabrics market, it is poised to recover and thrive in the future as the global economy stabilizes.

Latest Trends and Innovation:

- In December 2020, Omnova Solutions Inc.

merged with Synthomer PLC, creating one of the world's largest specialty chemicals companies.

- In October 2020, Spradling International Inc., a leading coated fabrics manufacturer, announced its acquisition by Interface Performance Materials, a global leader in thermal management and high-performance adhesive solutions

- In July 2020, Trelleborg AB, a global engineering group, introduced its revolutionary rubber-coated fabric, the Coated Solution™, which offers enhanced protection against fire, chemicals, and extreme weather conditions.

- In February 2020, Continental AG, a leading automotive technology company, launched its latest coated fabrics innovation, Acella Eco, a sustainable and flame-retardant fabric that complies with strict emission standards.

- In September 2019, Saint-Gobain Performance Plastics Corporation, a subsidiary of Saint-Gobain SA, acquired HyComp LLC, a manufacturer of advanced composite components using coated fabric technology, further expanding its product portfolio and market reach.

Significant Growth Factors:

The growth of the coated fabrics market is being fueled by the swift expansion of industries like automotive, healthcare, and construction.

The market for coated fabrics has seen substantial growth recently, driven by multiple key factors. The rise in demand from diverse industries such as automotive, aerospace, and construction has significantly contributed to this growth. Coated fabrics are favored in these sectors for their robustness, high tensile strength, and ability to withstand chemicals and external elements. Additionally, the market has been boosted by the increasing preference for environmentally friendly and sustainable materials.

Coated fabrics are often crafted from recyclable sources, offering a more sustainable choice compared to traditional materials. Technological advancements, including the development of cutting-edge coatings and enhanced manufacturing techniques, have also played a vital role in driving market expansion. These innovations have improved the performance attributes of coated fabrics, making them more adaptable and suitable for a broader array of uses.

Furthermore, the surge in urbanization and infrastructure projects in emerging economies has spurred a need for coated fabrics in the construction industry. The growing disposable incomes and evolving lifestyles of consumers have led to a ened demand for coated fabrics in the fashion and apparel sector. In conclusion, the coated fabrics market is projected to maintain steady growth in the foreseeable future due to these significant factors driving its expansion.

Restraining Factors:

Challenges in the coated fabrics market stem from the variability in raw material costs and the growing influence of environmental legislation on manufacturing procedures.

The coated fabrics market is encountering several challenges that could hinder its expansion in the future. Fluctuating prices of raw materials, including polymers, resins, and fibers, present a notable obstacle for industry stakeholders due to their impact on profit margins. Furthermore, the industry is facing increasing compliance costs associated with strict government regulations pertaining to environmental sustainability and worker safety. These regulations necessitate the adoption of eco-friendly production methods and non-toxic chemicals, thereby imposing additional financial burdens and time-consuming compliance processes on coated fabric manufacturers. The COVID-19 pandemic has exacerbated the situation by disrupting supply chains and reducing consumer demand for coated fabrics in sectors such as automotive and construction. Additionally, intense market competition, icularly from manufacturers in Asia, is exerting downward pressure on prices and may restrict growth opportunities for companies in the sector.

Despite these challenges, the coated fabrics market exhibits substantial potential for growth. Growing consumer interest in innovative and high-performance textiles, icularly in emerging markets, is projected to drive market expansion. Furthermore, the increasing utilization of coated fabrics across diverse industries such as automotive, aerospace, and healthcare, owing to their durability, versatility, and ease of maintenance, presents a favorable outlook for the market's future. Ongoing research and development endeavors to create advanced coatings that offer improved functionality and sustainability are anticipated to contribute to the market's growth trajectory.

Key Segments of the Coated Fabrics Market

Product Overview

• Polymer Coated Fabric

• Rubber Coated Fabric

• Fabric Backed Wall Coverings

Application Overview

• Protective Clothing

• Transportation

• Furniture

• Industrial

• Others

Distribution Channel Overview

• Insurance Intermediaries

• Insurance Companies

• Banks

• Insurance Brokers

• Insurance Aggregators

End-User Overview

• Senior Citizens

• Education Travelers

• Business Travelers

• Family Travelers

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America