Market Analysis and Insights:

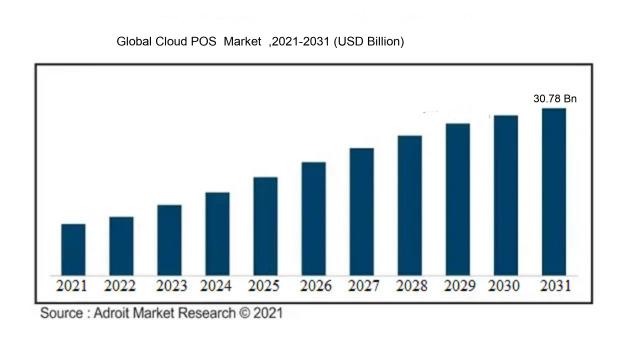

The market for Global Cloud POS was estimated to be worth USD 4.21 billion in 2022, and from 2023 to 2031, it is anticipated to grow at a CAGR of 24.81%, with an expected value of USD 30.78 billion in 2031.

The Cloud POS industry is witnessing notable growth driven by various factors. One key factor is the growing need for seamless and user-friendly payment solutions, which is spurring the adoption of Cloud POS systems. These systems provide instant access to data and streamline inventory management processes, ultimately boosting operational efficiency. Furthermore, the trend towards omnichannel retailing, where businesses operate across multiple platforms including physical stores and online channels, is pushing for Cloud POS systems that can consolidate data from different sources to deliver a cohesive customer experience. The increasing popularity of mobile and contactless payments is also fueling market growth, with Cloud POS systems enabling secure and swift transactions through mobile devices. Moreover, the flexibility and scalability of Cloud POS solutions are attracting small and medium-sized enterprises seeking cost-effective alternatives to traditional in-house systems. The proliferation of smartphones and internet connectivity, icularly in developing markets, is further driving demand for Cloud POS systems. In conclusion, these factors are driving a new era of operational efficiency, adaptability, and improved customer interactions in the Cloud POS market.

Cloud POS Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 30.78 billion |

| Growth Rate | CAGR of 24.81% during 2023-2031 |

| Segment Covered | By Component, By Type, By Organization Size, By Application, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Square Inc, Shopify, Lightspeed POS Inc, Oracle Corporation, Vend Limited, Toast Inc, Upserve Inc, B2B Soft, Omnico Group, and Revel Systems Inc. |

Market Definition

Cloud POS, also known as Cloud-based Point of Sale, is a solution that empowers enterprises to oversee their sales and transactions through a web-driven platform located on external servers. This setup facilitates instant data access and alignment across various devices and sites, offering ened adaptability and expansiveness in contrast to conventional POS setups.Cloud POS, also referred to as Point of Sale, represents a significant technological advancement within the retail sector. This cloud-based solution presents a multitude of benefits that are crucial for businesses in the contemporary business environment. Its primary advantage lies in providing businesses with real-time, easily accessible data from any location, facilitating enhanced inventory management and sales analysis. This innovative system also eliminates the requirement for costly servers and infrastructures, thereby reducing operational expenses for business proprietors. Furthermore, Cloud POS platforms offer exceptional scalability and flexibility, catering to the evolving needs and customization preferences of businesses. By means of secure remote accessibility, it improves operational efficiency and streamlines processes, enabling businesses to prioritize customer satisfaction. The increasing demand for Cloud POS underscores its pivotal role in empowering retailers with data-driven insights, adaptability, and cost-efficiency amidst today's competitive marketplace.

Key Market Segmentation:

Insights On Key Component

Solution

The Solution is expected to dominate the Global Cloud POS Market. This can be attributed to the increasing demand for efficient and effective solutions to streamline various aspects of retail operations.

Cloud-based POS solutions offer benefits such as real-time data syncing, inventory management, and sales analytics, which are crucial for businesses to enhance their operational capabilities. Moreover, these solutions enable seamless integration with other systems and applications, providing a comprehensive approach to managing retail operations. With the ongoing digital transformation and the need for flexible and scalable solutions, the Solution is expected to witness significant growth in the Global Cloud POS Market.

Services

Services also plays a crucial role in supporting the implementation, integration, and maintenance of cloud POS solutions. Services such as installation, training, customization, and ongoing support are essential for businesses to successfully deploy and utilize cloud-based POS systems. These services ensure that businesses can effectively leverage the features and functionalities of the solution, optimize their operations, and address any challenges that may arise. Although the Services might not dominate the market in terms of revenue generation, it remains an integral of the Global Cloud POS Market ecosystem by providing value-added services to complement the Solution .

Insights On Key Type

Mobile Point of Sale

Mobile Point of Sale is expected to dominate the Global Cloud POS Market. Mobile POS offers the advantage of portability and flexibility, allowing businesses to perform transactions anywhere, anytime. With the increasing popularity of smartphones and tablets, mobile POS systems have gained significant traction among small and medium-sized enterprises (SMEs) and industries such as retail and hospitality. The ability to accept payments on the go, streamline operations, and provide personalized customer experiences has contributed to the widespread adoption of mobile POS solutions. As a result, Mobile Point of Sale is expected to dominate the Global Cloud POS Market.

Fixed Point of Sale

Fixed Point of Sale, while not expected to dominate the Global Cloud POS Market, still holds a significant market share. Fixed POS systems are widely used in various industries, including retail, restaurants, and healthcare. These systems typically consist of a stationary terminal connected to a cash register, barcode scanner, receipt printer, and other peripherals. Although fixed POS lacks the mobility of its mobile counter , it offers robust features and functionality, making it suitable for larger businesses with complex operations. The stability and reliability of fixed POS systems continue to appeal to certain industries that prioritize a traditional and stationary approach to point of sale transactions.

Insights On Key

Organization Size Large Enterprise

The Large Enterprise is expected to dominate the Global Cloud POS Market. Large enterprises typically have bigger budgets and resources to adopt and implement innovative technologies, such as cloud-based POS systems. They have a higher demand for advanced features, scalability, and customizability, which are often offered by cloud-based solutions. Additionally, large enterprises usually have multiple locations and complex operations, making cloud POS systems an attractive option for centralizing and streamlining their operations. Furthermore, large enterprises are more likely to prioritize data security and compliance, which are key features provided by reputable cloud POS vendors. Overall, the Large Enterprise is anticipated to dominate the Global Cloud POS Market due to its capacity to invest in and benefit from advanced cloud-based solutions.

SME (Small and Medium Enterprises)

While the Large Enterprise is expected to dominate the Global Cloud POS Market, the SME is also anticipated to hold a significant share. SMEs often face budget constraints and limited IT resources, which can make cloud-based POS systems an attractive option. By opting for cloud POS, SMEs can avoid heavy upfront investments in hardware and software, and instead, pay a subscription-based fee that allows them to access the system through the internet. This cost-effective and scalable solution can enable SMEs to streamline their operations, improve customer service, and gain valuable insights from real-time data analytics. Moreover, cloud POS systems provide SMEs with the flexibility to add or remove features as per their changing requirements. Therefore, the SME is expected to be a formidable player in the Global Cloud POS Market, catering to the needs of small and medium-sized businesses.

Insights On Key Application

Retail & Consumer Goods

Retail & Consumer Goods is expected to dominate the Global Cloud POS market. This is primarily due to the increasing adoption of cloud-based point of sale systems in the retail sector. Retailers are realizing the advantages of cloud POS, such as real-time inventory management, seamless integration with e-commerce platforms, and improved customer experience. Cloud POS systems also offer scalability and cost-effectiveness, making them highly desirable for small and medium-sized retailers. Furthermore, the rising trend of omnichannel retailing, where customers expect a seamless shopping experience across multiple channels, further drives the demand for cloud POS solutions in the retail industry.

Travel & Hospitality

The Travel & Hospitality of the Global Cloud POS market is also expected to hold a significant share. Cloud POS systems bring numerous benefits to the travel and hospitality industry, including streamlined operations, enhanced customer service, and improved efficiency. Cloud POS enables hotels, restaurants, and travel agencies to manage bookings, reservations, and payments in real-time, offering a seamless experience to their customers. It also allows for mobility, enabling staff to easily process transactions and provide personalized services. With the growing demand for travel and tourism globally, the adoption of cloud POS in this sector is poised to increase.

Media & Entertainment

Media and Entertainment although not expected to dominate the Global Cloud POS market, the Media & Entertainment holds potential for growth. Cloud POS solutions in this sector are utilized primarily for ticketing, concessions, and merchandise sales in movie theaters, theme parks, and entertainment venues. Cloud POS systems offer flexibility and scalability to handle high transaction volumes during peak periods, while providing real-time insights into sales and inventory data. As the entertainment industry continues to evolve and modernize, the adoption of cloud POS solutions is likely to surge.

Transport & Logistics

Transport & Logistics of the Global Cloud POS market is not expected to dominate but presents opportunities for growth. Cloud POS systems can be leveraged in this sector to streamline ticketing and payment processes for various transportation modes, such as airlines, railways, and bus services. By integrating with other systems, cloud POS enables seamless passenger experiences, efficient fleet management, and real-time analytics. As the transportation and logistics industry embraces digitalization and seeks ways to enhance operational efficiency, the adoption of cloud POS solutions is expected to increase.

Healthcare

In Healthcare cloud POS adoption is relatively lower compared to other industries. However, it holds potential for growth as healthcare providers recognize the benefits of cloud-based systems. Cloud POS solutions can facilitate streamlined billing and payment processes, patient registration, and inventory management in healthcare facilities. Additionally, they offer enhanced data security and scalability, enabling healthcare providers to focus on patient care without the burden of managing complex IT infrastructure. As the healthcare industry becomes more digitized and patient-centric, the adoption of cloud POS in this is expected to rise.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Cloud POS market. This can be attributed to the high adoption rate of cloud technology in the region, along with the presence of major cloud POS solution providers and large-scale retailers. The region has a well-developed IT infrastructure, which facilitates the implementation of cloud-based systems. Additionally, the rising demand for advanced payment technologies, the growing popularity of e-commerce, and the increasing number of small and medium-sized enterprises in the retail sector are driving the growth of the Cloud POS market in North America.

Latin America

Latin America has immense potential for growth in the Cloud POS market. The region is witnessing a rapid increase in smartphone penetration and internet usage, which is driving the demand for cloud-based solutions. Additionally, the rising adoption of digital payment methods, government initiatives for promoting electronic transactions, and the growing retail sector are expected to boost the Cloud POS market in Latin America. However, the market is still in the nascent stage, and factors like data security concerns and limited IT infrastructure development might pose challenges to the widespread adoption of Cloud POS solutions in the region.

Asia Pacific

Asia Pacific is poised to witness significant growth in the Cloud POS market. The region has a large population and a growing retail industry, which creates a favorable environment for the adoption of Cloud POS solutions. Countries like China, India, and Japan are experiencing rapid urbanization, increasing disposable incomes, and the proliferation of smartphones, driving the demand for cloud-based technologies. Moreover, the presence of major cloud solution providers and the increasing popularity of mobile payments are further contributing to the growth of the Cloud POS market in Asia Pacific.

Europe

Europe is expected to witness steady growth in the Cloud POS market. The region has a well-established retail sector and a high level of technology adoption, which creates opportunities for the implementation of Cloud POS solutions. The growing demand for efficient and cost-effective payment systems, along with the increasing popularity of omnichannel retailing, is driving the adoption of Cloud POS solutions in Europe. Furthermore, the presence of stringent data protection regulations in the region is likely to boost the demand for secure cloud-based solutions.

Middle East & Africa

The Middle East & Africa region is expected to have moderate growth in the Cloud POS market. The region has a diverse retail sector, with countries like UAE, Saudi Arabia, and South Africa witnessing significant growth in the retail industry. Factors such as the increasing penetration of smartphones, the adoption of digital payment methods, and the expansion of organized retail are driving the demand for Cloud POS solutions in the region. However, challenges such as limited IT infrastructure, security concerns, and the prevalence of cash-based transactions might hinder the widespread adoption of Cloud POS systems in the Middle East & Africa.

Company Profiles:

Prominent figures in the worldwide Cloud POS market significantly influence the advancement of technology and delivery of cloud-centric point-of-sale options to various enterprises. Their expertise lies in creating, producing, and delivering cutting-edge POS systems and services that facilitate smooth and effective business operations in the retail and hospitality sectors on a global scale. Prominent figures in the Cloud POS industry include Square Inc, Shopify, Lightspeed POS Inc, Oracle Corporation, Vend Limited, Toast Inc, Upserve Inc, B2B Soft, Omnico Group, and Revel Systems Inc. These industry leaders are driving innovation in cloud-based point of sale systems, delivering functionalities such as inventory control, customer insights, and seamless integrations with online retail platforms. Square Inc is recognized for its user-friendly POS software tailored to small enterprises, while Shopify offers a comprehensive e-commerce and POS solution. Lightspeed POS Inc serves both retail and dining establishments, Oracle Corporation targets larger enterprises with its advanced solutions. Vend Limited specializes in cloud-based retail management software, Upserve Inc provides POS and restaurant management services, B2B Soft is dedicated to wireless retail and telecom sectors, Omnico Group focuses on hospitality POS solutions, and Revel Systems Inc supplies iPad-based POS solutions to diverse industries.

COVID-19 Impact and Market Status:

The global adoption of cloud-based point-of-sale (POS) systems has been greatly hastened by the impacts of the Covid-19 pandemic.

The global outbreak of COVID-19 has brought about significant implications for the Cloud Point of Sale (POS) industry. With strict lockdown measures and social distancing regulations enforced in many countries, physical retail stores have experienced closures or limited customer traffic. Consequently, there has been a notable shift towards online shopping and eCommerce activities. This trend has led businesses to increasingly embrace cloud-based POS platforms for digital management of their sales operations and inventory tracking.

Cloud POS systems offer various benefits, including remote access, scalability, and instant data analytics. The emphasis on reducing physical contact and promoting touchless transactions has further accelerated the adoption of cloud-based POS solutions. These systems facilitate mobile payments, online ordering, and efficient delivery management, ensuring uninterrupted business operations and enhancing customer experience. Moreover, the cost-effective nature of cloud-based POS systems makes them icularly appealing to businesses grappling with financial constraints during the pandemic.

It is anticipated that the demand for cloud POS solutions will witness considerable growth in the post-pandemic era as enterprises continue to prioritize digital transformation initiatives and align with evolving consumer preferences and behaviors.

Latest Trends and Innovation:

- In March 2021, Square announced the $297 million acquisition of TIDAL, a cloud-based point-of-sale (POS) software provider, expanding their portfolio in the Cloud POS market.

- In February 2021, Lightspeed POS completed the acquisition of ShopKeep, a leading cloud-based POS solution provider, for $440 million, enhancing their capabilities in the retail sector.

- In January 2021, Vend merged with Lightspeed POS, a provider of cloud-based commerce solutions, creating a powerful player in the Cloud POS market.

- In December 2020, Shopify acquired 6 River Systems, a developer of collaborative warehouse robotics, to strengthen their fulfillment network and further support their cloud-based POS solutions.

- In November 2020, Oracle announced the availability of Oracle MICROS Simphony Point-of-Sale Cloud Service on Oracle Cloud Infrastructure, providing customers with a secure and scalable Cloud POS solution.

- In October 2020, NCR Corporation acquired Cardtronics, a leading provider of ATM and retail POS solutions, to expand its reach in the Cloud POS market.

- In September 2020, Lightspeed POS successfully raised $166 million in funding to support its cloud-based POS operations and further enhance its product offerings.

- In August 2020, Toast, a cloud-based POS system provider, secured $400 million in Series F funding, valuing the company at $4.9 billion, enabling further innovation and expansion in the Cloud POS market.

- In July 2020, Clover, a cloud-based POS platform, unveiled Clover Flex, a versatile handheld POS solution, offering enhanced mobility and functionality to businesses.

- In June 2020, Square introduced Square for Restaurants, a Cloud POS system designed specifically for the restaurant industry, offering integrated tools for orders, payments, and more.

Significant Growth Factors:

The primary drivers fueling growth in the Cloud POS sector consist of the rising utilization of mobile and wireless technologies, increasing requirement for real-time analytics, and the necessity for economical and flexible solutions. The market for Cloud Point of Sale (POS) systems has experienced significant growth recently, propelled by several key factors. Firstly, the growing need for centralized data management and real-time tracking of inventory has driven businesses to adopt cloud-based POS solutions. Utilizing cloud technology enables businesses to access critical sales data and inventory information from any location, providing greater visibility and empowering more informed decision-making. Secondly, the cost efficiency of cloud POS solutions has played a crucial role in driving market expansion. By eliminating the need for costly hardware infrastructure and maintenance expenses, cloud-based systems have become more attainable for small and medium-sized enterprises. Moreover, the scalability and flexibility inherent in cloud POS solutions enable businesses to easily adjust and expand their operations, further fuelling market growth. The increasing popularity of mobile payments and digital wallets has also contributed to the market's expansion.

Cloud-based POS systems offer seamless integration with diverse payment methods, enabling quicker and more secure transactions.

Lastly, the proliferation of smartphones and tablets, alongside the burgeoning e-commerce sector, has bolstered the demand for cloud POS systems. This technology empowers businesses to utilize mobile devices for processing point of sale transactions, enhancing the customer experience and driving sales growth. In conclusion, the outlook for the cloud POS market remains positive, with continued growth expected due to its advantages in terms of data management, cost efficiency, scalability, and integration with mobile payment technologies.

Restraining Factors:

Security concerns and data privacy issues are significant factors that restrain the growth of the Cloud POS Market. The market for Cloud Point of Sale (POS) systems has experienced notable growth in recent times due to its various benefits including scalability, cost effectiveness, and remote accessibility. However, there are certain limitations that could impede the market's further expansion. Primarily, apprehensions relating to data security and privacy present a significant hurdle for businesses contemplating the adoption of cloud-based solutions. The concept of storing sensitive transaction and customer data on external servers raises concerns about potential breaches and unauthorized access. Furthermore, unreliable internet connectivity and infrastructure constraints may create operational challenges for businesses heavily reliant on cloud-based POS systems. In regions with inadequate internet connections or during network disturbances, businesses could face downtime and revenue loss. Moreover, the intricacy of transitioning from conventional POS systems to cloud-based alternatives could act as a barrier for many small and medium-sized enterprises. The technical knowledge and resources necessary for implementation and migration might be overwhelming. Additionally, resistance to change and hesitancy towards embracing new technologies can hinder the growth of the Cloud POS market.

Numerous businesses might opt to maintain their existing systems, fearing disruption or the steep learning curve associated with shifting to cloud-based solutions.

Key Segmentation:

Component Overview

• Cloud POS Solutions

• Cloud POS Services

Type Overview

• Fixed Point of Sale (POS)

• Mobile Point of Sale (POS)

Organization Size Overview

• Small and Medium Enterprises (SME)

• Large Enterprises

Application Overview

• Retail & Consumer Goods

• Travel & Hospitality

• Media & Entertainment

• Transport & Logistics

• Healthcare

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America

Frequently Asked Questions (FAQ) :

The primary factor for the cloud POS market is projected to be a growing affinity among end-users to embrace cloud technologies in all major realms. The benefits associated with the implementation of cloud POS, such as increased accessibility, versatility, and functionality, further assist end-users to implement cloud POS in their respective vertical industries. In addition to these factors, the low running costs associated with cloud POS are one of the key factors driving demand. Decreasing cashless transactions contribute to the rise of digital payments. This has a direct impact on the growth of the POS market. As a result, the Cloud POS demand is also projected to be stimulated during the forecast period.

Component Segment

In terms of components, the market is bifurcated into solutions and services. The service segment is expected to grow at the highest CAGR during the forecast period. POS-related services provide payment services, administration services, portal services, and maintenance services. These services allow companies to establish good customer relationships by consistently helping them during their corporate tenure. Also, these services can support companies by optimizing the utilization of capital, facilitating the delivery of the marketing project, and streamlining marketing operations. Traditional POS schemes typically charge a software-licensing fee per registry, followed by a recurring maintenance fee of 18–20 percent for updates. SaaS, on the other hand, is more of a relationship model in which subscription premiums are charged and no initial contributions are made, as in the case of the conventional POS scheme. These subscription payments cover software, maintenance, backup, and future updates.

Enterprise Size Segment

Based on the enterprise size, the market is segmented into small & medium, and large enterprises. The large enterprise segment leads the market growth in 2019 and it is anticipated to hold its position during the forecast years. Large enterprises are spending heavily to implement successful payment systems that would link all company divisions and their activities to a single network. Besides, they have several operating centers and different distribution & customer service, divisions. On the contrary, the small & medium enterprise segment is projected to accumulate major growth in forthcoming years.

End-User Segment

In terms of the end-user segment, the market is segmented into retail & consumer goods, travel & hospitality, media & entertainment, transportation & logistics, healthcare, and others. The media and entertainment segment expected to grow at the highest CAGR during the forecast period. This is primarily due to cloud-based POS technologies that are commonly used in media and entertainment application areas. In this sector, Cloud POS is installed in casinos, film theatres, amusement parks, museums, and sports arenas. It ensures a scalable and transparent entertainment business. It also provides improved customer support, which in turn continues to boost revenue.

The North American region dominated the overall market in 2019 and it is projected to keep its position during the forecast years 2018-2028. However, the Asia-Pacific region is anticipated to gather the highest growth over the forecast years. The market growth in this region is mostly ascribed to the rapidly rising consumer base, due to the importance of small and medium-sized businesses, combined with the decline in TCO. The growing retail sector and developing infrastructure in the area will further drive the growth of the cloud POS market in APAC.

.png)

The major players of the global Cloud POS market are Square Inc, Cegid, UTC RETAIL, Shop Keep, PAR Technology, Shopify, B2B Soft, and Intuit. Moreover, the market comprises several other prominent players in the market are Lightspeed, Oracle, and SalonTarget. The Cloud POS market consists of well-established global as well as local players. Besides, the previously recognized market players are coming up with new and advanced strategic solutions and services to stay competitive in the global market.