Chemical Sensors Market Analysis and Insights:

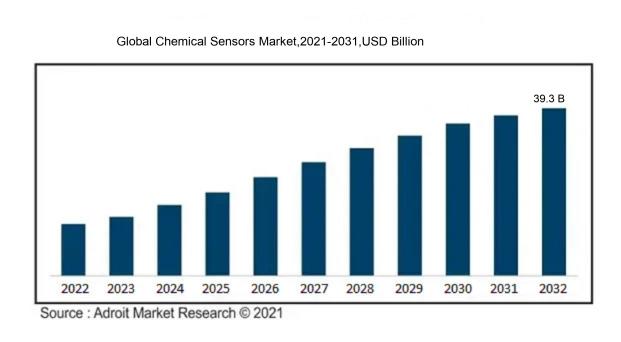

In 2023, the size of the worldwide Chemical Sensors market was US$ 24 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 5.4 % from 2024 to 2032, reaching US$ 39.3 billion.

The market for chemical sensors is primarily propelled by the ened necessity for safety and environmental surveillance across a diverse range of sectors, including healthcare, automotive, and manufacturing. Increasing apprehensions about air and water quality, alongside rigorous regulatory standards, have sparked the demand for sophisticated sensor technologies capable of accurately identifying hazardous materials and pollutants. The growing integration of IoT-enabled devices further amplifies the functionality of chemical sensors, facilitating real-time monitoring and comprehensive data analysis. Additionally, advancements in technology, such as sensor miniaturization and enhanced sensitivity, are significant factors driving market growth. The rising requirement for effective process management in industrial contexts, along with the expanding market for portable and wearable sensors, is also fueling demand. As industries strive to optimize operational efficiency and adhere to safety regulations, the chemical sensors market is anticipated to experience substantial growth in the near future.

Chemical Sensors Market Definition

Chemical sensors are instruments designed to identify and measure specific chemical compounds by transforming their concentration levels into a quantifiable signal. These devices usually comprise a sensing component along with a transducer that facilitates the signal processing necessary for subsequent analysis.

Chemical sensors are essential instruments utilized across numerous domains such as environmental surveillance, medical diagnostics, and industrial applications. They facilitate the identification and quantification of particular chemical compounds, which is critical for ensuring safety, maintaining quality standards, and adhering to regulatory requirements. These sensors significantly improve our capability to assess the quality of air and water, allowing for the swift detection of contaminants and hazardous materials, thereby safeguarding public health. In the medical field, they play a vital role in diagnosing and managing illnesses through the identification of biomarkers. Moreover, chemical sensors promote sustainable practices by enabling accurate monitoring and control in production processes, leading to decreased waste generation and enhanced operational efficiency.

Chemical Sensors Market Segmental Analysis:

Insights On Product Type

Electrochemical

Electrochemical sensors are expected to dominate the Global Chemical Sensors Market due to their wide-ranging applicability, cost-effectiveness, and enhanced sensitivity. These sensors are primarily employed in industrial applications and environmental monitoring, which is growing in importance amid increasing regulatory standards. Their ability to detect a variety of gases and chemicals makes them versatile and widely accepted among various sectors, including healthcare, manufacturing, and environmental services. Furthermore, advancements in technology allowing for miniaturization and improved precision are amplifying their appeal. Considering these factors, the electrochemical category stands out as the leading product type driving the market forward.

Optical

Optical sensors are gaining traction due to their non-destructive measurement techniques and ability to detect various chemical components with high precision. They utilize light-based technology to analyze samples, making them suitable for applications in pharmaceuticals, food safety, and industrial processes. The demand for real-time monitoring and advanced analytics in sectors like healthcare and environmental management is also propelling the growth of this. Moreover, the increasing research and development in optical technologies further bolster its potential, though it might lag behind the electrochemical sector in market share.

Pellistor/Catalytic Bead

Pellistor and catalytic bead sensors are essential in gas detection applications, particularly in the oil and gas industry, where flammable gases need constant monitoring. Their ability to operate in harsh environments and deliver reliable readings has made them a preferred choice for certain applications. However, they face competition from more advanced sensor technologies that offer broader detection ranges and faster response times. Despite this, the demand for pellistor-based sensors remains steady, especially in safety-critical industries where reliable gas detection is paramount.

Semiconductor

Semiconductor sensors are increasingly popular due to their compact size and the ability to integrate them into electronic devices. They provide quick responses and are commonly used in consumer applications, healthcare, and automotive sectors for detecting gases like carbon monoxide and volatile organic compounds. However, their sensitivity to temperature and humidity can present limitations, impacting their reliability in outdoor conditions. As a result, while semiconductor sensors contribute to the overall market, they are typically overshadowed by the robustness and versatility of electrochemical sensors.

Others

The "Others" category includes various niche technologies and innovative sensor solutions that may not fit neatly into the defined product lines. This category can include microelectromechanical systems (MEMS) sensors, infrared sensors, and other emerging technologies that are being developed to meet specific market needs. While these technologies are promising and might cater to specialized applications, they currently hold a smaller share of the market. Their growth depends heavily on continuous innovation and market acceptance, which could see them gain traction in the future but still currently lags behind the dominant types like electrochemical sensors.

Insights On Analyte

Solid

The solid portion of the market is anticipated to dominate the global chemical sensors market due to its applications in fields such as material characterization and surface analysis. Innovative solid-state sensors are being developed, allowing for improved sensing capabilities in various environments. Industrial applications, including manufacturing and construction, are increasingly relying on solid chemical sensors to monitor material integrity and identify potential hazards. Consequently, advancements in solid sensor technologies are anticipated to enhance their adoption, although they may not reach the same level of prominence as liquid sensors.

Liquid

The liquid section is growing due to its extensive applications across various industries, such as pharmaceuticals, food and beverage, environmental monitoring, and chemical manufacturing. Liquid sensors are crucial for analyzing chemical properties, ensuring that products meet regulatory standards and quality control guidelines. The rise in pollution and stringent regulatory measures for water quality monitoring has further intensified the demand for liquid chemical sensors. Additionally, advancements in sensor technology and materials have led to more efficient and precise liquid sensors, making them increasingly indispensable in analytical applications. As a result, the liquid is expected to hold a significant market share and drive growth in the chemical sensors industry.

Gas

In the gas category, chemical sensors are vital for ensuring workplace safety and environmental protection by detecting toxic and flammable gases. Industries such as oil and gas, automotive, and manufacturing utilize gas sensors for monitoring air quality and preventing hazardous situations. The increasing emphasis on industrial safety regulations and the growing awareness of air pollution have bolstered the demand for gas chemical sensors. Though this is crucial, its growth is somewhat limited compared to the more versatile liquid sensors, which cater to a broader range of applications.

Insights On Application

Industrial

The industrial application is expected to dominate the Global Chemical Sensors Market primarily due to the increasing adoption of automation and process control across various manufacturing sectors. Industries like petrochemicals, pharmaceuticals, and food and beverage are integrating advanced sensor technologies for monitoring and control purposes. These sensors play a critical role in ensuring compliance with safety and regulatory standards, enhancing the efficiency of operations, and minimizing waste. As industry leaders seek to improve productivity and reduce costs, the demand for reliable and precise chemical sensors in industrial applications is projected to grow significantly, solidifying its position as the leading sector in this market.

Environmental Monitoring

The environmental monitoring application is crucial as growing concerns about air and water quality drive the need for accurate monitoring systems. Governments and organizations are increasingly investing in technologies that allow for real-time detection of pollutants. Chemical sensors help in assessing environmental changes, facilitating timely interventions to protect ecosystems and public health. This 's growth is propelled by stringent environmental regulations and the global push for sustainability, making it a significant player in the chemical sensors market.

Medical

The medical application of chemical sensors is witnessing significant advancements, particularly in diagnostics and patient monitoring. Technologies such as biosensors are being developed to detect biomarkers for various diseases. The rise in chronic conditions has led to an increased demand for innovative medical devices that ensure accurate and timely results. With ongoing research and development in this field, the medical sector continues to be a critical area of growth, although it currently holds a smaller share compared to industrial applications.

Defense and Homeland Security

In the defense and homeland security sector, chemical sensors are essential for detecting hazardous materials and potential threats. This application has seen growth due to geopolitical tensions and the need for enhanced safety measures. The military and security agencies increasingly rely on these technologies for air quality monitoring, chemical hazard detection, and surveillance. As threats evolve, the demand for sophisticated sensors to ensure national security will continue to rise, positioning it as a notable consideration in the chemical sensors landscape.

Others

The "Others" category includes various niche applications that do not fall into the primary sectors. This can include food safety, agriculture, and research applications where chemical sensors are utilized for specific needs. While this is diversified, its growth is slower compared to the more dominant areas like industrial and environmental monitoring. Innovations in technology may see an increase in interest in these applications, leading to gradual market expansion, but they will remain overshadowed by the larger markets for the foreseeable future.

Global Chemical Sensors Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Chemical Sensors market due to several factors. Rapid industrialization, urbanization, and increased investments in various sectors such as automotive, healthcare, and manufacturing significantly drive the demand for chemical sensors in the region. Moreover, countries like China, Japan, and India are increasingly focusing on technological advancements and innovation in sensor technology, which further supports market growth. The high population density and regulatory changes aimed at improving safety and environmental monitoring contribute to a robust demand for chemical sensors. Consequently, the Asia Pacific region's combination of economic growth, technological development, and regulatory frameworks position it as the leading in the chemical sensors market.

North America

North America holds a significant portion of the Global Chemical Sensors market, primarily driven by advanced technology adoption and extensive research and development activities. The presence of major players and well-established industries in sectors like healthcare, automotive, and environmental monitoring contributes to a stable demand for chemical sensors. Furthermore, regulatory initiatives aimed at enhancing safety standards and the incorporation of chemical sensors in smart technologies are expected to bolster market growth in this region. The competitive landscape encourages innovation, leading to the development of more sophisticated and efficient sensor technologies.

Europe

The European market for chemical sensors is characterized by strict regulatory standards regarding environmental monitoring and safety. This regulatory push drives innovation and market growth. The presence of manufacturers and a strong focus on research and development play a crucial role in the advancement of sensor technologies. Additionally, industries such as automotive and healthcare continue to integrate chemical sensors to comply with safety regulations. Despite healthy competition and advancements, the region faces challenges from emerging markets, which may limit its growth compared to more rapidly developing regions.

Latin America

In Latin America, the chemical sensors market is evolving, driven by increasing industrial activities and a growing emphasis on environmental safety. While the region lags behind others in technology adoption, efforts to enhance infrastructure and boost regulatory frameworks for monitoring air, water, and soil quality are creating opportunities for market expansion. The region is seeing investments aimed at modernizing industries, leading to a gradual adoption of advanced chemical sensors. However, political and economic instability in certain countries could pose challenges to sustained growth.

Middle East & Africa

The Middle East & Africa region is witnessing a steady growth in the chemical sensors market, spurred mainly by initiatives aimed at environmental protection and safety regulations in industrial applications. The oil and gas industry in particular holds potential for the use of chemical sensors for monitoring and safety purposes. However, the market is relatively nascent compared to other regions due to infrastructural challenges and economic fluctuations affecting investment in technology. Despite these hurdles, growing awareness of the importance of monitoring systems is paving the way for gradual market development in this diverse region.

Chemical Sensors Market Competitive Landscape:

Prominent participants in the worldwide chemical sensors industry play a crucial role in fostering innovation and broadening their product range, prioritizing improvements in sensor precision and sensitivity. These companies work in partnership with multiple sectors to create customized solutions that address a variety of environmental and safety monitoring requirements.

Prominent entities in the chemical sensors sector comprise 3M Company, Honeywell International Inc., Siemens AG, Bosch Sensortec GmbH, Teledyne Technologies Incorporated, ams AG, Figaro Engineering Inc., Micronas GmbH, Ion Science Ltd., and OMRON Corporation. Additionally, Emerson Electric Co., SICK AG, several members of the ABB Group, and General Electric Company contribute significantly to this market. Other noteworthy companies involved include NextSense GmbH, Sensirion AG, Analytical Technology, Inc., Aeroqual Ltd., and Lake Shore Cryotronics, Inc. Moreover, YSI Inc. (affiliated with Xylem), Winthrop Engineering Ltd, and Ametek Inc. are also participants in this industry.

Global Chemical Sensors Market COVID-19 Impact and Market Status:

The Covid-19 pandemic notably intensified the need for advancements in chemical sensors, especially within the healthcare and environmental monitoring fields, as various sectors adapted to updated health regulations and safety protocols.

The COVID-19 pandemic had a profound effect on the chemical sensors sector, mainly driven by a ened demand for health and safety protocols. The increased focus on air quality monitoring and pollutant detection led to greater sensor adoption in industries, particularly healthcare and environmental surveillance. The push for touchless solutions spurred advancements in chemical sensor technologies, with significant developments in areas such as pathogen detection and environmental protection. Although initial supply chain disruptions hindered production, the industry adapted by prioritizing local production and exploring alternative sourcing methods. Furthermore, the pandemic catalyzed a surge in investments in smart technologies and the integration of the Internet of Things (IoT) within the chemical sensors field. As global economies recuperate, the market's sustained expansion is anticipated to be reinforced by a growing emphasis on public health and safety awareness and an increasing commitment to sustainable and eco-friendly practices across multiple sectors. This dynamic shift suggests a promising and resilient future for the chemical sensors market in the post-pandemic era.

Latest Trends and Innovation in The Global Chemical Sensors Market:

- In March 2023, Honeywell launched a new line of advanced electrochemical sensors designed for environmental monitoring. These sensors utilize innovative technology to detect harmful gases, enhancing safety in industrial applications.

- In June 2023, Amphenol Corporation completed its acquisition of FCI Technologies, a leading manufacturer of chemical sensors for the automotive industry, aiming to strengthen its portfolio in sensor technologies and expand into new markets.

- In August 2023, Siemens announced a partnership with the University of California, Berkeley, focused on developing nextgeneration chemical sensors utilizing nanotechnology. This collaboration is expected to lead to breakthroughs in environmental monitoring and smart manufacturing.

- In October 2023, Bosch Sensortec introduced a new microelectromechanical systems (MEMS) gas sensor that is capable of detecting multiple gases simultaneously, marking a significant innovation in consumer electronics and air quality monitoring applications.

- In September 2023, Emerson Electric Co. unveiled its first wireless chemical sensor system designed for industryspecific applications, which allows realtime monitoring and alerts, improving operational efficiency and safety in various sectors.

- In July 2023, TE Connectivity announced the expansion of its chemical sensor product line with the introduction of enhanced sensors for the oil and gas industry, focusing on reliability and durability in harsh environments.

- In February 2023, Figure Technologies, specialized in smart sensor technology, secured a funding round that will be used to accelerate the development of its innovative chemical sensors for agricultural applications, aimed at improving crop management.

Chemical Sensors Market Growth Factors:

The expansion of the chemical sensors market is fueled by technological innovations, a ened emphasis on environmental surveillance, and an escalating requirement for safety measures within industrial settings.

The chemical sensors market is experiencing significant growth due to a variety of influential factors. A primary driver is the ened necessity for safety and security across multiple sectors, such as oil and gas, automotive, and healthcare, which underscores the importance of sophisticated chemical detection technologies. Additionally, the rising trend of smart technologies and automation in manufacturing is amplifying the demand for effective monitoring systems that can identify chemical leaks and hazardous materials.

In parallel, increasing awareness of environmental issues, combined with stringent regulatory requirements aimed at ensuring safety, plays a critical role in boosting the need for chemical sensors. Advancements in nanotechnology and materials science have propelled sensor capabilities, leading to the creation of more sensitive, selective, and dependable devices. The burgeoning Internet of Things (IoT) landscape is another factor enhancing market expansion, as interconnected systems necessitate real-time data processing and environmental surveillance.

Moreover, escalating investments in research and development are spurring innovations within sensor technology, allowing for a wider array of applications, which includes food safety, air quality assessment, and automation in industrial settings. Finally, a global transition towards sustainability and environmentally-friendly practices is promoting the utilization of chemical sensors to ensure adherence to environmental standards and to advance safer industrial processes.

Chemical Sensors Market Restaining Factors:

The market for chemical sensors encounters considerable obstacles stemming from rigorous regulatory standards and elevated manufacturing expenses, which may impede both innovation and broad acceptance.

The chemical sensors industry encounters several obstacles that may impede its expansion, such as technological constraints, elevated production expenses, and regulatory hurdles. Numerous current sensors exhibit limitations in terms of precision, sensitivity, and selectivity, impacting their utility across diverse applications. Furthermore, producing advanced chemical sensors frequently necessitates the use of costly materials and intricate technologies, resulting in high costs that may discourage prospective customers. Additionally, the regulatory landscape can be challenging, as adherence to stringent safety and environmental regulations demands ongoing monitoring and validation processes, which are often resource-intensive. The industry also contends with competition from alternative solutions, like biosensors and electronic noses, which might provide simpler integration or more user-friendly attributes. Nonetheless, the continual progress in nanotechnology, materials science, and the integration of the Internet of Things (IoT) presents exciting opportunities for innovation. As research efforts expand and cross-industry collaboration deepens, the potential for enhanced sensor performance and cost reductions can foster a more resilient and versatile chemical sensors market. By leveraging these prospects, stakeholders can unite to address existing challenges and stimulate growth in this crucial industry.

Segments of the Chemical Sensors Market

By Product Type

• Electrochemical

• Optical

• Pellistor/Catalytic Bead

• Semiconductor

• Others

By Analyte

• Solid

• Liquid

• Gas

By Application

• Industrial

• Environmental Monitoring

• Medical

• Defense and Homeland Security

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America