The global care management solutions market was valued at USD 12,511.0 million in 2019 and is expected to grow at a CAGR of 12.5% over the forecast period. Various initiatives to shift the economic burden from payers to providers is anticipated to drive the global market in coming years.

The market for care management solutions is expected to grow at a compound annual growth rate (CAGR) of 15.4% from 2023 to 2032, from an estimated $14.01 billion in 2022 to over US$ 58.23 billion by that time.

.jpg

)

Rising geriatric population coupled with robust developments in healthcare IT is likely to benefit the market growth in coming years. Rapid penetration of data analytics outsourcing, artificial intelligence in healthcare informatics systems is likely to reduce the time required for diagnosis and reduce the burden of disease management in future. With such trends, chronic care management systems are likely to penetrate in emerging economies.

Emerging economies such as Japan, China, and India are anticipated to show tremendous growth in the demand for care management solutions. Due to government-led healthcare projects, enhanced use of innovative healthcare facilities is likely to be observed in emerging countries. Because of the rising incidence of chronic illnesses, as well as enhanced insurance coverage and affordability, countries such as China, Brazil, India, and many more are likely to see significantly enhanced use of healthcare facilities over next 5 years. In these countries, economic growth and increased healthcare awareness have ensured potential investment possibilities over the forecast period. The worldwide market share of emerging markets is anticipated to grow to one-third of the complete MedTech market by 2022, further encouraging important players in the industry to create long-term investments.

Care management solutions Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | US$ 58.23 billion |

| Growth Rate | CAGR of 15.4% during 2022-2032 |

| Segment Covered | By Component, By Mode of Delivery, By End User, By Application, Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | EXL Service Holdings, Inc., Casenet, LLC, Medecision Inc., ZeOmega Inc., Cognizant Technology Solutions, Cerner Corporation, Allscripts Healthcare Solutions, Inc., Epic Systems Corporation, Cerner Corporation, EXL Healthcare |

Key Segment Of The Care management solutions Market

By Component, (USD Million)

• Software

• Services

By Mode of Delivery, (USD Million)

• Web-based

• Cloud-based

• On premise

By End User, (USD Million)

• Healthcare providers

• Healthcare payers

• Others

By Application, (USD Million)

• Disease Management

• Case Management

• Utilization Management

• Others

Regional Overview, (USD Million)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

The healthcare IT sector is growing at a rapid pace and is projected to offer fresh opportunities to cut down growing healthcare costs and improve patient care. The progressing healthcare IT sector provides immense opportunities to make the health care system more effective and efficient. As per the reports of the Bureau of Labor Statistics, jobs for health information technicians are projected to grow by 15% through 2024 as per the current market which is faster than the average for all jobs. The 2009 HITECH act has fueled the usage of health information technology and is anticipated to grow with healthy CAGR over 5 years.

A study by the National Coordinator for Health Information Technology indicates that the health care system is experiencing unprecedented levels of electronic health exchange. For instance, 96% of hospitals and 78% of physician's offices use electronic health record technology. Nonetheless, much needs to be done to develop and refine the technology that offers great opportunities for new entrants.

Information technology in health care provides an opportunity for the use of data analytics in health care. Predictive analytics can assist in recognizing patients at risk of chronic disease and other medical conditions. This is accomplished by monitoring individual patient medical data alongside population-wide health patterns, and then cross-referencing the data with the medical history, socio-economic position and comorbidity of the patient. This helps health care systems to recognize patients for early, intensive intervention and treatment, to save long-term costs and to improve overall health.

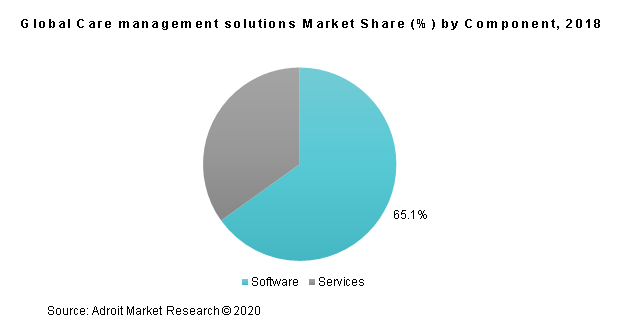

The global care management solutions market for software was valued at USD 7,301.5 million in 2019 and is expected to grow at a CAGR of 10.5% to surpass USD 14 billion by 2025.

Care management solutions software provide better quality of care and make better decisions to achieve best possible health. Medical practices, hospitals and other healthcare organizations are shifting to care management software for help complying with the increasingly complex medical coding and billing rules enforced by health insurance companies and government agencies. Software for healthcare administration can also help physicians and healthcare administrators tackle time-consuming activities such as management of electronic medical records (EMR) and medical credentialing.

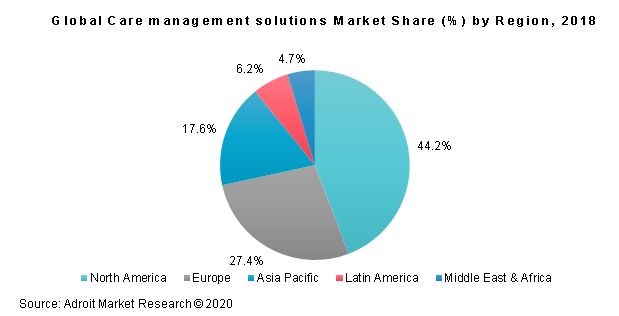

Based on regions, the global care management solutions market is segmented into North America, Europe, Asia Pacific, Latin South America and Middle East & Africa. North America currently leads the global care management solutions market, at a revenue share of 44.2% in 2018, followed by Europe. The dominance of these regions is collectively attributed to high healthcare expenditure, high investments in advanced IT solutions and its penetration in the healthcare system, and greater awareness. Growing requirement for cost containment for healthcare, optimum management of admitted patients and the growing need to reduce readmissions is also a key attribute to the dominant position of North America and Europe on the global front.

Additionally, Asia Pacific is anticipated to be the fastest growing regional market for care management solutions. Consistent improvement in patient footfall in both inpatient and outpatient settings, growing healthcare expenditure, and developing healthcare infrastructure form the key drivers of Asia Pacific market growth. Improving stronghold of medical tourism in Pacific region, and the corresponding requirement to offer the best healthcare form another key driver for this Asia Pacific market