Cancer Vaccines Market Analysis and Insights:

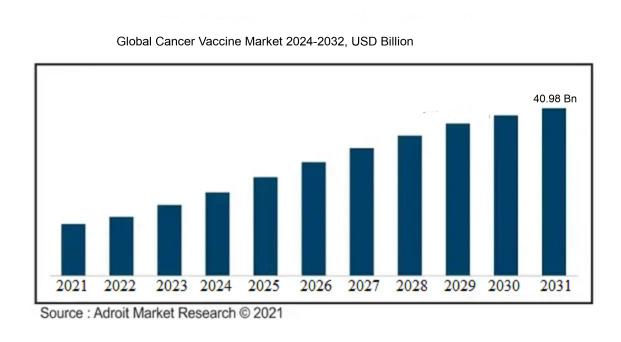

In 2023, the global market for cancer Vacciness was estimated to be worth USD 11.14 billion. The market is anticipated to expand at a compound annual growth rate (CAGR) of 18.02%, from USD 13.15 billion in 2024 to USD 40.98 billion by 2032.

The cancer Vaccines sector is primarily propelled by several critical factors. One of the foremost is the increasing global incidence of cancer, which underscores the urgent need for innovative treatment options. Breakthroughs in biotechnology and immunotherapy have facilitated the emergence of new Vaccines candidates that offer improved effectiveness and better safety profiles. Additionally, ened investment in research and clinical trials by both governmental and private entities promotes innovation and accelerates growth within the market. Supportive government initiatives and regulatory measures designed to streamline Vaccines approval processes also play a pivotal role in market advancement.

Moreover, the rising recognition of personalized medicine and the significance of preventive healthcare further boost the demand for cancer Vacciness. Strategic partnerships between pharmaceutical companies, research organizations, and biotechnology firms aim to harness collective expertise and resources, driving the market's progress. Collectively, these factors establish a conducive environment for the cancer Vaccines market to prosper in the years ahead.

Cancer Vaccines Market Definition

A cancer Vaccines represents a form of immunotherapy intended to enhance the immune system’s ability to identify and combat cancerous cells. This approach can serve a dual purpose: it may function as a preventive measure to reduce the risk of cancer onset or as a therapeutic solution aimed at managing and treating already established cancers.

The cancer Vaccines plays a vital role in the proactive strategy for both preventing and treating cancer. By activating the immune system to identify and eliminate cancerous cells, these Vacciness have the ability to considerably lower the risk of certain cancers, including cervical cancer linked to HPV and liver cancer associated with hepatitis B. Furthermore, cancer Vacciness may augment the efficacy of current treatments, improve survival outcomes for patients, and reduce the financial burden related to advanced cancer care. Their advancement signifies a major leap forward in personalized medicine, presenting patients with the promise of more tailored and less aggressive treatment alternatives.

Cancer Vaccines Market Segmental Analysis:

Insights On Key Type

Therapeutic

The therapeutic category is anticipated to dominate the Global Cancer Vaccines Market due to the increasing prevalence of cancer and the growing demand for effective treatment options. Therapeutic Vacciness, designed to stimulate the immune system to attack existing tumors, offer promising solutions for patients with various cancer types. The rising investments in research and development, alongside positive clinical trial outcomes, contribute significantly to this 's growth. As healthcare professionals seek to enhance patient outcomes and offer personalized treatment plans, the therapeutic approach is gaining traction. Moreover, with the ongoing advancements in immunotherapy and personalized medicine, the therapeutic category's market share is likely to strengthen further.

Preventive

The preventive category plays a crucial role in the Global Cancer Vaccines Market, primarily aimed at preventing cancer from developing in healthy individuals. The growing awareness about cancer prevention through vaccination has led to increased initiatives and government support in various regions. Notably, Vacciness such as the HPV Vaccines have demonstrated significant efficacy in reducing certain cancers. Despite its lower market share compared to therapeutic Vacciness, preventive measures are essential for public health, which can lead to early intervention and reduced healthcare costs in the long run. As vaccination programs continue to expand, their influence in the market is expected to rise steadily.

Insights On Key Technology

Molecular-based

Molecular-based technology is anticipated to dominate the Global Cancer Vaccines Market due to its increasing efficacy and specificity in targeting cancer cells. This approach utilizes a variety of techniques, such as DNA and RNA Vacciness, which have shown significant promise in stimulating the body’s immune response to recognize and attack cancerous cells specifically. Researchers are consistently developing innovative formulations that enhance delivery methods, making it more attractive for clinical use. Additionally, molecular-based Vacciness are often less complex and quicker to produce than their counterparts, which aligns well with the increasing demand for personalized medicine, thus positioning them as a leading force in this market.

Vector-based

Vector-based technology is another important area within the Global Cancer Vaccines Market. This involves using viruses or bacteria as delivery vehicles to carry genetic material into cancer cells, ultimately triggering a robust immune response. While it has shown potential in several clinical trials, challenges such as safety concerns and the immune response to the vector itself may hinder its widespread adoption. However, ongoing research and advancements in vector design are paving the way for innovative applications, especially in the development of personalized Vacciness.

Cell-based

Cell-based technology encompasses various approaches, including the use of dendritic cells to present tumor antigens and activate T-cells. Despite its potential benefits, such as the ability to create tailored therapies for individual patients, this method often involves complex manufacturing processes and higher costs. Consequently, it has seen slower market penetration compared to molecular-based solutions. Nevertheless, the unique advantage of generating a comprehensive immune response continues to garner interest among researchers and healthcare professionals, contributing to ongoing developments in the field.

Insights On Key Indication

Prostate Cancer

Prostate cancer Vacciness are expected to dominate the Global Cancer Vaccines Market due to several pivotal factors. This type of cancer has high prevalence rates, particularly in males over the age of 50, ensuring a substantial patient base seeking treatments. The development of personalized and therapeutic Vacciness like Provenge has established a foothold in the market, demonstrating effectiveness and enhancing patient outcomes. Furthermore, the increased awareness around screening and prevention is leading to timely diagnoses, thus driving demand for innovative Vaccines solutions. Coupled with ongoing research and funding in immunotherapy, the prostate cancer is positioned for significant growth in the coming years.

Cervical Cancer

Cervical cancer Vacciness, particularly those targeting the human papillomavirus (HPV), are making a significant impact globally. The introduction of Vacciness like Gardasil and Cervarix has greatly contributed to prevention strategies in young females, especially in regions with high HPV prevalence. Governments and health organizations are strongly advocating for vaccination programs, increasing awareness and access. Furthermore, the consistent decline in cervical cancer rates where vaccination programs are implemented reflects a positive trajectory. With ongoing research into therapeutic Vacciness and public health initiatives focusing on education and prevention, this holds considerable potential in the cancer Vaccines market.

Bladder Cancer

Bladder cancer is another crucial area within the cancer Vaccines landscape. Efforts to develop effective Vacciness aim to address high recurrence rates associated with this disease. Historical difficulties in managing bladder cancer have spurred research, leading to innovative candidates like the Bacillus Calmette-Guérin (BCG) Vaccines, which is already in use for superficial bladder cancer. The increasing incidence of bladder cancer, especially among older adults and smokers, creates a robust market opportunity for vaccination strategies. As more advancements are achieved in immunotherapy and Vaccines technology, the bladder cancer will continue to gain attention.

Lung Cancer

Lung cancer is a significant contributor to cancer-related mortality worldwide, creating urgency within the Vaccines market. Ongoing research has produced promising results in Vaccines development aimed at targeting tumor antigens associated with non-small cell lung cancer (NSCLC). While currently, there are no approved Vacciness for lung cancer, advancements in personalized medicine and immunotherapy herald potential breakthroughs. The high prevalence of lung cancer encourages ongoing investment in Vaccines research, focusing on improving outcomes and patient survival rates. The continued push towards innovations in treatment could elevate this area of the market as research and trials progress.

Others

The "Others" category within cancer Vacciness includes various cancers such as melanoma and breast cancer, which are seeing increasing interest in Vaccines development. While this does not dominate, there is growing research, particularly in areas like therapeutic Vacciness for melanoma, which has demonstrated remarkable efficacy in certain patient populations. Diverse research initiatives are exploring combinations of existing therapies with novel Vacciness, indicating a potential growth trajectory. Public and private sector investments in clinical trials and research across these cancers are critical, paving the way for future developments. Each represents emerging possibilities but remains competitive against the more established s.

Insights On Key Distribution

Government & Organization Supply

The Government & Organization Supply will likely dominate the Global Cancer Vaccines Market due to several critical factors. Governments across various regions are increasingly investing in cancer prevention and treatment initiatives to combat the rising incidence of cancer worldwide. They provide subsidies and support for Vaccines development, facilitating quicker access to patients. Moreover, organizations dedicated to public health contribute significantly to Vaccines distribution, ensuring a wider reach and effectiveness of vaccination programs. These dynamics, combined with increasing awareness campaigns led by governmental entities, further solidify the influence of this arm in successfully distributing cancer Vacciness, making it an essential player in the market.

Hospitals

Hospitals play a vital role in the administration of cancer Vacciness, serving as frontline healthcare institutions where patients receive treatment and preventive care. While hospitals are crucial in providing direct patient care, their influence is somewhat diminished compared to governmental initiatives, especially in public health campaigns. Moreover, many patients rely on hospitals for information and services related to vaccinations, particularly in regions with expansive healthcare networks. However, the reliance on hospitals can also hinder the speed of Vaccines distribution in some areas, as organizational capacities may constrain the efficiency of these healthcare facilities in delivering cancer Vacciness at scale.

Others

The "Others" category encompasses various private healthcare providers, clinics, and pharmacies that contribute to the distribution of cancer Vacciness. While this does have a presence in the market, its impact is significantly less than that of government bodies and hospitals. Though some private entities offer cancer Vacciness, the overall market for Vaccines distribution remains focused on larger, more established channels. These alternative distribution methods can play a supportive role; however, they face challenges related to resource availability and public trust, limiting their potential to challenge the dominating roles of governments and hospital networks in the market.

Global Cancer Vaccines Market Regional Insights:

North America

North America is poised to dominate the global cancer Vaccines market, primarily driven by significant investments in research and development, advanced healthcare infrastructure, and a higher prevalence of cancer, which necessitates innovative treatment solutions. The presence of key pharmaceutical companies and biotech firms in the region also accelerates product development and commercialization efforts. Additionally, regulatory support from agencies like the FDA promotes the timely approval of cancer Vacciness, contributing to North America's leading position. Increased awareness among healthcare providers and the population about preventive healthcare and immunotherapy’s role in cancer treatment further bolster market growth in this region.

Latin America

Latin America presents a growing opportunity in the cancer Vaccines market, although it currently lags behind North America. The prevalence of cancer is increasing, creating a rising demand for effective treatments. However, challenges such as economic disparities and varying healthcare standards can limit the speed of market growth. Emerging partnerships between local governments and international organizations aim to enhance Vaccines access and healthcare infrastructure, paving the way for future advancements. As countries in the region improve their healthcare systems, the potential for market expansion will become more pronounced.

Asia Pacific

The Asia Pacific region is rapidly emerging in the global cancer Vaccines market, given its large population and increasing cancer incidence rates. Countries like China and India are beginning to prioritize cancer prevention and treatment, reflecting in growing investments in healthcare. However, the market faces hurdles such as a lack of awareness and financial constraints among the population. Government initiatives and collaborations with global healthcare players are essential for overcoming these challenges, and as awareness increases, the market is expected to see robust growth in the coming years.

Europe

Europe represents a significant share of the global cancer Vaccines market, driven by strong regulatory frameworks and high healthcare expenditure. The region's emphasis on research and development, particularly in immuno-oncology, has fostered innovation in cancer Vacciness. Collaborative efforts among European nations further support clinical trials and accessibility to advanced therapies. Despite facing budgetary constraints in some countries and varying healthcare policies, opportunities for growth remain strong as European citizens increasingly recognize the importance of vaccination in cancer prevention and treatment.

Middle East & Africa

The Middle East and Africa region currently holds a smaller share of the global cancer Vaccines market but is seen as an area poised for growth. Challenges such as limited resources, healthcare infrastructure disparities, and varying levels of health awareness inhibit widespread Vaccines adoption. However, recent initiatives focusing on public health and international collaborations with healthcare organizations show promise. As governments enhance healthcare delivery and invest in cancer care programs, the potential for expansion and greater market participation could become more evident in the near future.

Cancer Vaccines Competitive Landscape:

Prominent participants in the worldwide cancer Vaccines sector, comprising pharmaceutical firms and biotechnology companies, are deeply involved in rigorous research and development aimed at creating and bringing to market effective Vacciness. They adeptly maneuver through regulatory frameworks and devise strategic marketing approaches to fulfill patient requirements. Additionally, their partnerships with healthcare providers and research organizations bolster the progress and availability of cancer immunotherapies.

Prominent participants in the cancer Vaccines sector consist of Merck & Co., Bristol-Myers Squibb, Pfizer, Roche, Moderna, Novartis, GlaxoSmithKline (GSK), AstraZeneca, Elicio Therapeutics, OncoOne, Tesaro (a subsidiary of GSK), Adaptimmune Therapeutics, BioNTech, NewLink Genetics, and Celgene.

Global Cancer Vaccines COVID-19 Impact and Market Status:

The Covid-19 pandemic caused substantial interruptions in the worldwide market for cancer Vacciness, leading to postponed clinical trials and restricted patient access to immunizations, which in turn hindered progress in the development of cancer immunotherapy.

The COVID-19 pandemic had a profound effect on the market for cancer Vacciness, leading to significant interruptions in clinical trials, research initiatives, and product development processes. As healthcare providers concentrated their efforts on responding to the pandemic, many oncology-related projects experienced delays, resulting in the postponement or suspension of numerous clinical trials. This shift caused a deceleration in innovation and a reallocation of funding towards the development of COVID-19 Vacciness, effectively diverting resources from cancer research efforts. Moreover, the fear of contracting the virus caused many patients to hesitate in seeking medical care, further affecting vaccination rates and participation in clinical trials. On a positive note, the advancements gained from the expedited development of COVID-19 Vacciness have ignited interest and investment in mRNA technology, which shows great potential for enhancing cancer Vacciness. In the aftermath of the pandemic, there is an increasing emphasis on refining cancer Vaccines strategies, particularly through combination therapies and personalized medicine approaches. As the market begins to stabilize, it is anticipated to experience growth fueled by these innovations along with a revival of clinical activities as healthcare systems gradually restore normalcy.

Latest Trends and Innovation in The Global Cancer Vaccines Market:

- In October 2023, Moderna announced positive results from Phase 2 trials of its personalized cancer Vaccines, mRNA-4157, in collaboration with Merck. The trial focused on patients with high-risk melanoma, demonstrating enhanced immunity and improved overall survival rates.

- In September 2023, BioNTech SE entered into an agreement with Aetna and Cigna to expand the patient access to its cancer Vaccines candidate, BNT111, which is being developed for the treatment of melanoma. This initiative seeks to increase coverage for innovative cancer therapies.

- In July 2023, AstraZeneca acquired the clinical-stage biopharmaceutical company TeneoOne for $325 million to strengthen its oncology pipeline, particularly focusing on Teneos’ immunotherapy programs aimed at developing personalized cancer Vacciness.

- In June 2023, GSK (GlaxoSmithKline) received FDA approval for its cancer Vaccines candidate, GSK415. This Vaccines showed promising results in clinical trials for head and neck cancers, marking a significant breakthrough for GSK in the oncology space.

- In April 2023, Genentech, a member of the Roche Group, announced the launch of a novel immunotherapy approach called atezolizumab (Tecentriq) in combination with their candidate cancer Vaccines for the treatment of triple-negative breast cancer, highlighting advancements in combined treatment strategies.

- In February 2023, Inovio Pharmaceuticals signed a strategic partnership with the European biotech company iOnctura to co-develop a next-generation DNA-based cancer Vaccines. The joint research focuses on leveraging innovative technologies in Vaccines design and delivery.

- In January 2023, Eli Lilly and Company completed the acquisition of the biotechnology firm Prevail Therapeutics, primarily to enhance its capabilities in developing innovative cancer Vaccines therapies, aiming at treating various forms of cancer more effectively through gene therapy approaches.

- In December 2022, CureVac announced a collaboration with the biopharmaceutical company Arcturus Therapeutics for the joint development of mRNA-based cancer Vacciness. This collaboration aims to expedite the commercialization of innovative cancer therapies using mRNA technology.

Cancer Vaccines Market Growth Factors:

Significant contributors to the expansion of the cancer Vaccines sector encompass progress in personalized medicine, ened funding for immunotherapy research, and a growing incidence of cancer on a global scale.

The market for cancer Vacciness is witnessing remarkable expansion fueled by several pivotal elements. An escalating occurrence of diverse cancer types across the globe has generated a ened need for both preventive and therapeutic Vacciness, prompting healthcare systems to seek potent solutions in the fight against cancer. Innovations in biotechnology and immunology are driving advancements in Vaccines creation, improving both effectiveness and safety. In addition, supportive government policies and increased funding for cancer research are advancing the market, establishing a favorable climate for clinical trials and the introduction of new products. Growing public awareness regarding cancer prevention through vaccination, especially in high-risk groups, is also playing a vital role in market growth. Moreover, partnerships between pharmaceutical firms and research institutions are speeding up Vaccines development, and the rise of personalized medicine is leading to the creation of tailored cancer Vacciness that cater to specific patient needs. Finally, escalating investments in healthcare infrastructure and growing health expenditures in developing nations are enhancing access to groundbreaking cancer treatments, further fueling the need for efficient cancer Vacciness. Collectively, these dynamics foster a thriving landscape for growth in the cancer Vaccines sector, underscoring its potential to revolutionize cancer treatment and preventive measures.

Cancer Vaccines Market Restaining Factors:

The cancer Vaccines sector faces significant obstacles, such as substantial expenses associated with development, stringent regulatory requirements, and a lack of widespread knowledge regarding the advantages of Vacciness.

The market for cancer Vacciness encounters numerous limitations that impede its expansion, notably high costs associated with development and protracted regulatory frameworks. The intricate nature of cancer biology complicates the creation of viable Vacciness, resulting in longer durations for clinical trials and obtaining approvals. Additionally, the inconsistent responses from patients to Vacciness can create difficulties in evaluating their effectiveness, which may jeopardize the returns on investment. The substantial financial demands of research coupled with the requirement for comprehensive clinical trials often dissuade smaller biotechnology companies from participating in this sector. Furthermore, recruiting patients for clinical trials poses a significant challenge, especially for rarer cancer types. Public hesitance regarding Vaccines safety, along with varying healthcare regulations in different regions, can negatively influence acceptance and uptake rates. Nonetheless, progress in technology and enhanced cooperation between research entities and pharmaceutical firms are encouraging innovations within the cancer Vaccines domain. The rising focus on personalized medicine and immunotherapy is boosting interest and investment, indicating a possibility for significant advancements that could ultimately reshape the market and improve patient outcomes in the future.

Key Segments of the Cancer Vaccines Market

By Type

• Preventive

• Therapeutic

By Technology

• Molecular-based

• Vector-based

• Cell-based

By Indication

• Cervical Cancer

• Bladder Cancer

• Prostate Cancer

• Lung Cancer

• Others

By Distribution

• Hospitals

• Government & Organization Supply

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America

Frequently Asked Questions (FAQ) :