Camping Coolers Market Analysis and Insights:

The market for Camping Coolers was estimated to be worth USD 940 million in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 5.3%, with an expected value of USD 1.5 billion in 2032.

.jpg)

The Camping Coolers Market is significantly influenced by several pivotal elements. The surge in outdoor recreational activities—such as camping, hiking, and picnicking—has increased the need for portable cooling solutions. Consumers are showing a marked preference for high-quality products that enhance their outdoor adventures, resulting in a notable uptick in the sales of premium coolers. Innovations in insulation technology and materials have further bolstered the durability and cooling performance of these products, appealing to a broader audience. Additionally, the growing emphasis on sustainable and eco-conscious camping equipment is guiding manufacturers towards using recyclable materials and developing energy-efficient designs. The expansion of social media and outdoor lifestyle branding has also ignited a ened interest in camping, consequently driving cooler sales. Moreover, the rise of e-commerce has facilitated easier access to a diverse array of cooler options, providing added convenience for consumers. Collectively, these dynamics are fueling the substantial growth of the camping coolers market.

Camping Coolers Market Scope :

| Metrics | Details |

| Base Year | 2024 |

| Historic Data | 2020-2023 |

| Forecast Period | 2024-2032 |

| Study Period | 2023-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 1.5 billion |

| Growth Rate | CAGR of 5.3% during 2024-2032 |

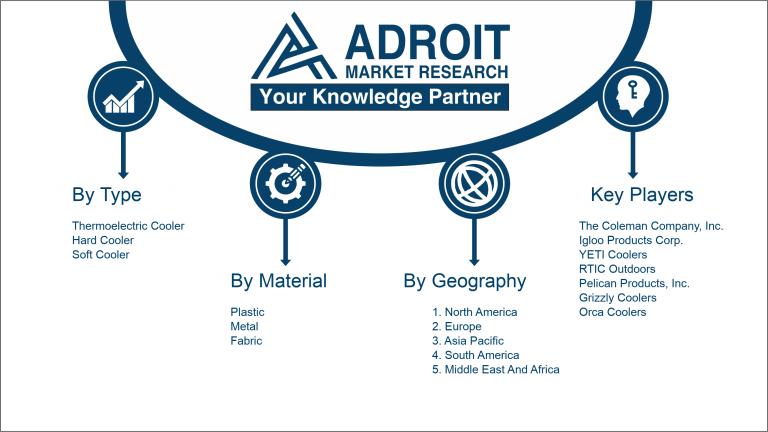

| Segment Covered | By Type, By Material, By Volume, By Distribution Channel, By Application, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Coleman Company, Inc., Igloo Products Corp., YETI Coolers, RTIC Outdoors, Pelican Products, Inc., Grizzly Coolers, Orca Coolers, Engel Coolers, Arctic Zone, and Rubbermaid. |

Camping Coolers Market Definition

Camping coolers are mobile storage units engineered to preserve the coldness of food and drinks while engaging in outdoor pursuits. They generally incorporate insulating materials along with ice or gel packs to sustain a chilly environment, thereby guaranteeing the freshness and safety of the contents.

Camping coolers are essential for outdoor excursions, as they effectively keep food and drinks at ideal temperatures, thereby enriching the camping experience. They safeguard against spoilage and help retain freshness, ensuring that campers can savor healthy meals and cold beverages even in remote settings. Moreover, superior coolers are designed for durability and efficient insulation, shielding their contents from changing weather conditions. These versatile tools can also function as extra seating or storage for equipment. By offering practicality and dependability, camping coolers play a crucial role in enhancing the pleasure and comfort of outdoor adventures, making them indispensable for campers and nature lovers.

Key Market Segmentation:

Insights On Key Type

Hard Cooler

Hard coolers are expected to dominate the Global Camping Coolers Market due to their robust performance, insulation efficiency, and durability. These coolers are especially favored among campers who require reliable and long-lasting cooling solutions for extended outdoor trips. The hard casing offers excellent temperature retention, protecting contents from environmental temperatures, which is essential for preserving food and beverages during multi-day camping adventures. Furthermore, hard coolers typically come equipped with advanced features such as strong latches, draining plugs, and rugged designs that cater to outdoor enthusiasts' specific needs. Their capacity to hold larger quantities and withstand rough handling makes them the preferred choice among consumers.

Thermoelectric Cooler

Thermoelectric coolers offer the convenience of temperature control without the need for ice, making them an attractive option for certain camping scenarios. They use electricity to provide cooling, which is particularly beneficial for car camping or locations with access to power sources. However, their reliance on electricity limits their attractiveness in more remote camping situations where energy isn’t readily available. As a result, while they remain popular for shorter trips or uses in vehicles, they cannot compete with the durability and versatility of hard coolers for extended outdoor excursions.

Soft Cooler

Soft coolers appeal to consumers prioritizing portability and lightweight design. They are ideal for casual day trips or hikes where ease of transport is essential. The soft exterior allows for flexibility and easier storage when not in use. Though they offer moderate insulation, they may not provide the same level of temperature retention as hard coolers. As such, soft coolers are favored by campers seeking convenience but may not be the top choice for those requiring superior cooling performance or durability for long camping trips.

Insights On Key Material

Plastic

Plastic is expected to dominate the Global Camping Coolers Market due to its lightweight, durability, and cost-effectiveness. This material is particularly favored by outdoor enthusiasts because it offers excellent insulation properties while remaining easy to transport. Furthermore, plastic camping coolers can be manufactured in various sizes and styles, catering to diverse consumer needs and preferences. The ability to mold plastic into intricate designs also allows for enhanced aesthetics and functionality, appealing to a broad market. Additionally, advancements in recycling technology are making plastic a more sustainable choice, further solidifying its position in the camping coolers market.

Metal

Metal coolers, notably those made from aluminum or stainless steel, offer superior durability and performance. While they can be heavier and more expensive than plastic options, metal models are often promoted for their longevity and ability to maintain temperature better for extended periods. These attributes appeal to premium consumers who prioritize quality and are willing to invest more in a rugged product for serious camping trips. Moreover, the sleek designs of metal coolers often attract a younger demographic seeking aesthetic appeal alongside functionality.

Fabric

Fabric-based coolers, typically employing insulated fabric and soft-sided designs, are gaining traction within specific markets. They are ultra-lightweight and easy to carry, making them ideal for casual outings, picnics, and day trips. Consumers who prioritize convenience and portability often lean toward these options. However, fabric coolers may not maintain temperatures as effectively as their plastic or metal counterparts, which could limit their usage during extended outdoor adventures. They cater well to families and casual users who appreciate an affordable and space-saving solution for cooling drinks and snacks.

Insights On Key Volume

> 50-75 Quarts

The 50-75 Quarts category is expected to dominate the Global Camping Coolers Market due to its optimal balance between capacity and portability. Consumers seek coolers that can hold sufficient food and beverages for short trips while still being easy to transport. Many camping occasions often require storage that does not compromise on space yet should remain manageable for individuals or small groups. As camping activities trend towards experiences that require extended stays outside, the demand for cooler sizes in this range is likely to escalate. This size effectively meets consumer needs, thus making it a leading choice.

> Less than 25 Quarts

The Less than 25 Quarts category primarily caters to casual campers or individuals who partake in day trips and require minimal storage for food and drinks. These coolers are lightweight and easily portable, making them highly appealing for quick outdoor activities or short picnics. Moreover, they offer convenience for individuals who prefer simple, smaller gatherings where extensive food storage is unnecessary. This maintains consistent demand, particularly among families and younger consumers who prioritize convenience and ease of use rather than extended camping experiences.

> 25-50 Quarts

The 25-50 Quarts range serves as a crucial middle ground for campers who may need a bit more capacity than smaller options without straying into larger coolers. This size is popular for family outings or small group trips, where a compact cooler offers sufficient storage without being cumbersome. The versatility of 25-50 Quarts coolers makes them suitable for various outdoor activities, from beaches to barbeques. As outdoor activities and social gatherings become more prevalent, this capacity is likely to see steady interest among consumers who value functionality and flexibility.

> 75-100 Quarts

The 75-100 Quarts category targets larger groups or longer camping trips, designed to accommodate the storage needs of those who pack for extended stays outdoors. These coolers are often heavy-duty and rugged, appealing to serious campers or those engaging in activities like hunting or fishing, where ample supplies are essential. The trade-off with this size is notable in weight, making them less portable for day trips but highly effective for longer excursions. While demand exists, it is largely influenced by the frequency of extended camping adventures among enthusiasts compared to the more casual outdoor crowd.

> >100 Quarts

The >100 Quarts category is tailored for serious outdoor enthusiasts who require substantial storage for extended trips. Coolers of this size are often employed by large groups or in situations where a significant quantity of perishable food and drinks must be kept fresh over several days. While they provide excellent insulation and longevity for bulky supplies, they tend to lack in portability, making them less appealing for short-term outings. The market for this size is relatively niche and tends to be dictated by adventurers seeking specific cooler features that support longer excursions and outdoor activities.

Insights On Key Distribution Channel

Online

The online distribution channel is expected to dominate the Global Camping Coolers Market due to the increasing trend of e-commerce and changing consumer purchasing behavior. Online platforms offer a wide range of products, competitive pricing, and convenience, allowing consumers to compare different models and prices easily. The growth of mobile commerce and advancements in logistics have further facilitated a seamless shopping experience, enabling outdoor enthusiasts to purchase coolers from the comfort of their homes. Furthermore, the impact of digital marketing strategies has led to greater brand awareness, encouraging consumers to opt for online purchases rather than traditional retail experiences.

Hypermarkets and Supermarkets

Hypermarkets and supermarkets are significant players in the distribution of camping coolers, attracting a large consumer base due to their one-stop shopping convenience. They offer a wide variety of brands and styles under one roof, allowing customers to make quick purchasing decisions. Additionally, promotional deals and discounts available in these venues can entice customers, making them a preferred choice for spontaneous purchases. The ability to see and experience products firsthand appeals to many buyers, even though online shopping is on the rise.

Specialty Stores

Specialty stores play an important role in the camping coolers market by providing expertly curated selections and personalized customer service. These stores focus on outdoor recreational products, allowing customers to find high-quality camping gear tailored to their specific needs. The knowledgeable staff can offer advice and recommendations, setting specialty stores apart from larger retail options. However, their reach is limited compared to broader distribution channels, which can restrict their market share despite the loyal customer base they can cultivate.

Others

The "Others" category, encompassing various alternative distribution channels such as department stores, discount retailers, and wholesalers, plays a supplementary role in the camping coolers market. While these outlets may attract a diverse client base, they don't specialize in outdoor products and lack the focused selection available in designated camping or sporting stores. Their pricing strategies can be competitive, but they often do not offer the same level of product expertise, potentially leading customers to prefer more specialized retailers or online platforms for their camping cooler needs.

Insights On Key Application

Backyard and Car Camping

The Backyard and Car Camping application is expected to dominate the Global Camping Coolers Market due to the rising trend of outdoor gatherings and staycations. As more people opt for convenient and affordable outdoor experiences rather than extensive traveling, this has seen significant growth. The ease of setting up camping equipment in one’s backyard or taking short road trips enhances its appeal. Additionally, with the increased consumer focus on family and friend bonding during leisure time, the demand for coolers suitable for picnics, barbecues, and casual outdoor activities has surged. Therefore, this application area is projected to lead the market due to its alignment with modern lifestyle preferences.

RV Camping

RV Camping is another notable sector within the Global Camping Coolers Market. The growth of the RV industry has led to increased demand for portable cooling solutions tailored for recreational vehicles. Many consumers are investing in RVs as a means of affordable travel, particularly post-pandemic, where social distancing has become a norm. Coolers are essential items for RV trips as they provide convenience and storage for perishables. This practical application ensures individuals can enjoy comfortable and prolonged outings, contributing to the growing popularity of RV Camping.

Backpacking

The Backpacking application represents a unique niche market in the Global Camping Coolers sector. This attracts avid hikers and adventure seekers looking for lightweight and compact cooling solutions that cater to their traveling needs. As outdoor enthusiasts prioritize minimal weight and versatility in their gear, evolution in cooler designs has catered specifically to this demand. Though smaller in size, these coolers still play a crucial role in keeping food and beverages fresh during extended trips and have garnered a dedicated following among passionate backpackers.

Ship and Fishing

The Ship and Fishing application makes up a specialized part of the Global Camping Coolers Market. This benefits from the need for effective storage solutions for catch and food when out at sea. Fishers often require reliable cooling mechanisms to preserve their catch and maintain quality, which drives the demand for durable and waterproof coolers. With an increase in outdoor and water-based recreational activities, the need for specialized fishing coolers designed to withstand marine conditions is likely to grow. These coolers are essential for both serious anglers and casual fishers alike.

Others

The Others category encompasses various applications that do not fit neatly into the defined groups, such as tailgating, festival-going, and beach outings. This has gained traction as consumers explore unique and diverse experiences that blend leisure with social interaction. The versatility these coolers offer makes them invaluable for events where portable storage is key. With the rise in popularity of outdoor festivals and events, the demand for this category is expected to continue, as coolers serve an essential role in enjoying food and drinks in various outdoor environments.

Insights on Regional Analysis:

North America

Based on comprehensive research and analysis, North America is expected to dominate the Global Camping Coolers market. The region benefits from a strong outdoor recreational culture, where camping and outdoor activities are widely embraced, contributing to higher demand for durable and efficient camping coolers. Well-established distribution channels, combined with significant consumer spending on outdoor leisure products, further enhance the growth potential for camping coolers. Additionally, the presence of leading manufacturers and technological innovations in cooler design foster competitive advantages that lead to higher adoption rates among consumers. As outdoor activities continue to rise in popularity, North America will remain at the forefront of this market.

Latin America

Latin America is witnessing a gradual increase in camping and outdoor activities, driven by its diverse landscapes and favorable climate. As disposable income rises, more consumers are investing in outdoor recreational equipment, including camping coolers. However, the market is still in a nascent stage compared to North America, with challenges such as less developed distribution networks and varying consumer preferences. While growth is expected, it may not reach the levels seen in North America due to these limitations.

Asia Pacific

The Asia Pacific region is emerging as a potential growth area for the camping coolers market, mainly due to the increasing popularity of outdoor activities among the growing middle class. Rising urbanization and improved living standards are resulting in greater disposable income, leading to increased camping trips and adventures. However, the market is fragmented, with a mix of local and international brands competing. Consumer awareness about the benefits of high-quality camping coolers is still developing, which might limit faster growth in comparison to more established regions.

Europe

In Europe, the camping coolers market is showing steady growth as outdoor activities, especially camping and hiking, gain popularity. However, the market is characterized by high competition and diverse consumer preferences across different countries. Stringent environmental regulations and a shift towards sustainable products contribute to the demand for eco-friendly coolers, which influences purchasing decisions. While the region has a solid outdoor culture, it faces challenges such as economic fluctuations that may impact consumer spending on non-essential goods like camping coolers.

Middle East & Africa

In the Middle East and Africa, the camping coolers market is still in its formative stages, with limited penetration and awareness compared to other regions. Outdoor activities are gaining traction especially in countries with vast landscapes and rich natural resources, but socio-economic factors often limit consumer spending on camping gear. While there is potential for growth driven by tourism and increased interest in outdoor leisure, challenges such as inadequate infrastructure and climatic conditions may hinder rapid market expansion. Consequently, this region is expected to be the slowest in terms of growth in the camping coolers market.

Company Profiles:

Prominent participants in the worldwide camping coolers industry are catalyzing advancements and product evolution by enhancing elements like insulation performance and ease of transport. Additionally, they pursue targeted marketing strategies and distribution methods to broaden their market presence and adapt to changing consumer demands.

The camping coolers industry features several prominent firms, including The Coleman Company, Inc., Igloo Products Corp., YETI Coolers, RTIC Outdoors, Pelican Products, Inc., Grizzly Coolers, Orca Coolers, Engel Coolers, Arctic Zone, and Rubbermaid. Additionally, other significant brands such as K2 Coolers, Camp Chef, Hydro Flask, Ozark Trail, Stanley, and Cabela's are also notable. Emerging companies like Arctic, Igloo, and Coolest are gaining traction as well. These organizations are acknowledged for their innovative approaches, robust designs, and extensive selection of cooler products that meet various consumer demands within the outdoor recreation market.

COVID-19 Impact and Camping Coolers??????? Market Status:

The Covid-19 pandemic greatly influenced the Global Camping Coolers industry, leading to a surge in outdoor pursuits and camping popularity as individuals sought safer leisure activities distanced from populated areas.

The COVID-19 pandemic profoundly influenced the camping coolers sector, triggering a marked increase in outdoor leisure pursuits as individuals sought safer options away from densely populated areas. With enforced travel limitations and social distancing practices, a significant number of consumers gravitated towards camping and outdoor activities, resulting in a ened demand for camping equipment, including coolers. Retailers observed a notable rise in sales, especially for portable and multifunctional cooler designs that aligned with this emerging trend. In response to supply chain challenges, manufacturers pivoted towards online retailing while enhancing product attributes, particularly focusing on sustainability and operational efficiency. Nevertheless, the market encountered obstacles such as variable raw material prices and workforce shortages that affected production capabilities. As outdoor recreation became a favored pastime during and after lockdown measures, the camping coolers market is poised for ongoing growth, fueled by shifting consumer interests in eco-friendly and practical outdoor solutions.

Latest Trends and Innovation:

In August 2023, YETI Holdings, Inc. announced the acquisition of a smaller competitor in the camping cooler , increasing their market share and expanding their product line to include more innovative designs tailored for outdoor enthusiasts.

In June 2023, Igloo Products Corp. introduced a new line of eco-friendly coolers made from recycled materials, reflecting a growing trend towards sustainability within the camping gear industry.

In April 2023, Pelican Products, Inc. unveiled a state-of-the-art cooler featuring advanced cooling technology that extends ice retention up to 10 days, solidifying their reputation as a leader in premium outdoor equipment.

In January 2023, ORCA Coolers launched a collaboration with outdoor lifestyle brand Realtree, resulting in a limited-edition camouflage cooler designed specifically for hunters and outdoor adventurers.

In September 2022, RTIC Outdoors expanded its distribution partnerships to include several major retail chains, significantly increasing its product availability and brand presence in the camping coolers market.

In November 2022, Coleman, a subsidiary of Newell Brands, debuted a new line of battery-operated coolers that feature integrated charging ports for electronic devices, appealing to tech-savvy campers.

In March 2022, North Face and Therm-a-Rest collaborated on a climate-controlled cooler that utilizes solar energy to maintain the internal temperature, gaining attention for its innovative approach to outdoor gear.

Significant Growth Factors:

The market for camping coolers is experiencing growth due to an uptick in outdoor recreational pursuits, a ened demand for robust and insulated cooling options, and an emerging preference for sustainable and environmentally-conscious products.

The Camping Coolers Market is witnessing remarkable expansion, fueled by several critical factors. Primarily, there is a notable rise in outdoor activities like camping and hiking, increasing the need for effective cooling solutions. As consumer preferences shift toward convenience and portability, advancements in cooler design and insulating technologies significantly improve product performance. Additionally, the growing awareness of environmental issues is inspiring manufacturers to develop coolers that are sustainable and eco-friendly, broadening their appeal.

The proliferation of e-commerce platforms also plays a vital role, providing consumers with easy access to a wide array of products, which in turn stimulates market growth by enhancing consumer accessibility. Moreover, the integration of smart technology within coolers, including features such as Bluetooth connectivity, caters to tech-savvy customers looking for innovative functionalities. Seasonal demand fluctuations, especially ened during summer and festive periods, further drive sales.

In addition, the focus on outdoor lifestyle branding has led companies to pursue partnerships with influencers and outdoor brands, enhancing their visibility in the market. Lastly, the rise in disposable income among consumers globally facilitates increased investment in premium and high-quality camping coolers, thereby advancing market progression. Collectively, these diverse factors point to a bright outlook for the Camping Coolers Market as it continues to respond to changing consumer trends and preferences.

Restraining Factors:

The Camping Coolers Market faces significant challenges such as escalating raw material expenses, competition from alternative cooling options, and growing environmental issues related to plastic waste.

The Camping Coolers Market encounters a variety of challenges that may hinder its expansion, such as intensified competition, escalating raw material expenses, and a shift in consumer priorities towards environmentally friendly options. The surge of new brands has sparked price battles and squeezed profit margins, compelling businesses to innovate continually while keeping prices competitive. Moreover, the volatility of essential materials like plastics and insulation can influence manufacturing costs, often leading producers to transfer these expenses to consumers, which could discourage purchases. Consumer trends are shifting, with a notable preference for sustainable and reusable products overshadowing conventional coolers, prompting brands to quickly adapt or face the risk of becoming obsolete. Additionally, economic fluctuations can affect discretionary spending in the outdoor recreation sector, including camping coolers. Nonetheless, these hurdles also pave the way for innovative opportunities. Firms that prioritize sustainability, focus on creating robust and versatile products, and strengthen customer relations can prosper in this evolving market, taking advantage of the growing interest in outdoor activities and securing a promising outlook for the Camping Coolers Market.

Key Segments of the Camping Coolers Market

By Type

- Thermoelectric Cooler

- Hard Cooler

- Soft Cooler

By Material

- Plastic

- Metal

- Fabric

By Volume

- Less than 25 Quarts

- 25-50 Quarts

- 50-75 Quarts

- 75-100 Quarts

- >100 Quarts

By Distribution Channel

- Hypermarkets and Supermarkets

- Specialty Stores

- Online

- Others

By Application

- Backyard and Car Camping

- RV Camping

- Backpacking

- Ship and Fishing

- Others

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America