Busbar Market Analysis and Insights:

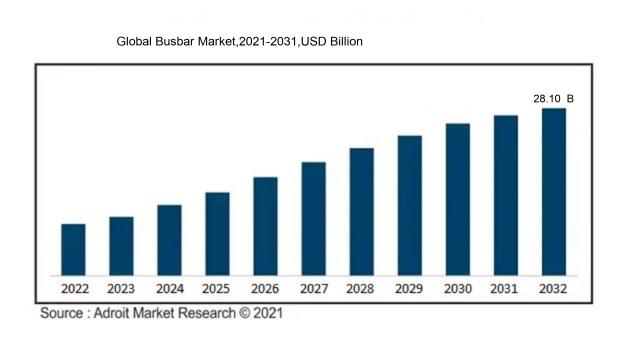

In 2023, the size of the worldwide Busbar market was US$ 18.5 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 4.82 % from 2024 to 2032, reaching US$ 28.10 billion.

The Busbar Market is fundamentally influenced by the rising necessity for efficient energy distribution systems across industrial and commercial landscapes. As urban areas expand and energy usage intensifies, the demand for reliable power supply mechanisms has become vital. Moreover, the transition towards renewable energy sources plays a crucial role, as there is a growing need for resilient connectivity solutions to effectively integrate solar and wind energy into current power grids. Alongside this, technological advancements—including the emergence of smart grids and improvements in busbar materials—are driving market advancement by enhancing energy efficiency and lowering operational expenses. Additionally, regulatory initiatives that advocate for energy efficiency and sustainability stimulate investments in busbar technologies. The ongoing expansion of infrastructure projects worldwide, especially in emerging economies, is further elevating the need for cutting-edge electrical solutions, with busbars being essential for efficient power distribution and management. Collectively, these elements are creating a vibrant growth landscape in the busbar sector.

Busbar Market Definition

A busbar is a conductive element, often in the form of a bar or strip, designed to transport electrical current across different circuits in a power system. It acts as a shared connection hub for several electrical devices, enabling effective management and distribution of power.

A busbar is an essential part of electrical infrastructures, acting as a centralized conductor that distributes electrical energy to multiple circuits within a facility. Its importance is highlighted by its ability to enhance reliability and safety within the system; by shortening the electrical pathways, it effectively reduces energy losses and improves overall efficiency. Furthermore, busbars allow for straightforward maintenance and alterations in electrical setups, which enhances design flexibility. They are critical for handling high current loads, making them indispensable in substations, industrial facilities, and power distribution systems. In summary, busbars are key components for effective power management and are vital to contemporary electrical frameworks.

Busbar Market Segmental Analysis:

Insights On Conductor

Copper Busbar

Copper busbars are expected to dominate the global market due to their superior electrical conductivity, which leads to enhanced performance in various applications. The increasing demand for energy-efficient solutions in power distribution systems and renewable energy applications drives the preference for copper. Additionally, copper’s resistance to corrosion and lower maintenance costs make it an attractive choice for many industries, including construction, automotive, and manufacturing. With ongoing advancements in technology and growing investments in electrical infrastructure, the copper busbar is poised for significant growth, outperforming its competitors in functionality and efficiency.

Aluminum Busbar

Aluminum busbars are gaining traction in certain applications primarily because they are lighter and more cost-effective than copper alternatives. While their conductivity is lower than copper's, aluminum busbars can still serve efficiently in various scenarios, especially where weight reduction is essential. The construction and automotive sectors increasingly adopt aluminum busbars due to their lower material costs and ease of handling. Furthermore, the rising focus on sustainable building practices makes aluminum a desirable option as it is recyclable and has a lower carbon footprint compared to copper.

Brass Busbar

Brass busbars, while less common, also play a role in niche markets where specific properties are required. They provide good electrical conductivity and improved durability against wear and corrosion, making them suitable for specialized applications such as marine environments or high-contact electrical settings. However, the higher cost compared to aluminum and copper limits their broader application. They are often used for custom projects or in artistic works where aesthetics combined with functionality play a critical role, thus maintaining a steady, albeit smaller, market share.

Insights On Power Ratings

Medium Power

The Medium Power category (125 A–800 A) is anticipated to dominate the Global Busbar Market due to its wide application across various industries such as manufacturing, infrastructure, and renewable energy sectors. These industries demand efficient energy distribution systems that accommodate mid-range power loads effectively. Medium power busbars offer a balance of capacity and flexibility, allowing for scalability in installations. As modern electrical systems become increasingly complex, the adoption of Medium Power busbars is likely to surge, driven by the need for reliability and performance, catering to a large portion of users who require significant but not maximum power capacity in their operations.

Low Power (Below 125 A)

The Low Power category (Below 125 A) serves specific applications where minimal power requirements are sufficient, such as in residential or small commercial buildings. This sees steady demand primarily due to energy-efficient solutions growing in popularity. While it may not be the leading, its consistent usage in low-energy environments and specialized machinery ensures a niche market presence. The adoption is generally stable, although growth is limited compared to higher power classifications which cater to larger-scale operations.

High Power (Above 800 A)

The High Power category (Above 800 A) is characterized by its use in heavy industrial applications and large power distribution systems. Though it caters to a critical, the overall growth potential is limited compared to Medium Power solutions, primarily due to the high cost of installation and maintenance. This section serves specific needs such as power plants and large manufacturing facilities, creating a strong but more specialized market. Its dominance is dependent on vertical industries requiring large capacities, which may limit widespread application compared to more adaptable power ratings.

Insights On End User

Utilities

Utilities are expected to dominate the Global Busbar Market due to the increasing demand for efficient power distribution systems. The rise in renewable energy sources, particularly in the utility sector, necessitates robust busbar systems for optimal power management and distribution. Utilities require high-capacity busbars that can handle increased electrical loads while maintaining reliability and safety. Moreover, governments across the globe are investing heavily in infrastructure upgrades to improve grid resilience, further driving the need for advanced busbar systems. This aligns with the ongoing trends in smart grid development, which enhances the attractiveness of busbars for utility applications.

Industrial (Chemicals & Petroleum, Metals & Mining, Manufacturing, Others)

The industrial sector, particularly in chemicals and petroleum, metals and mining, and manufacturing, represents a significant portion of busbar consumption. Industries utilize busbars for connecting power sources to large machinery and equipment efficiently. The growing industrial activities, especially in emerging economies, are driving a demand for electrical systems that ensure operational reliability and safety. Automation and expansion of processes in these sectors contribute to a steady requirement for robust and customized busbar solutions tailored to high-capacity needs.

Commercial

The commercial is also witnessing steady growth in the busbar market owing to the rising establishment of commercial complexes and skyscrapers. The need for efficient power distribution systems in expanding retail spaces, offices, and mixed-use buildings is propelling the demand for busbars. Additionally, as energy efficiency gains prominence in building regulations, developers are increasingly adopting advanced busbar systems to optimize energy consumption and manage electrical load distribution effectively.

Residential

In the residential sector, the demand for busbars is comparatively lower but still relevant due to the increasing shift towards smart homes. Busbars provide an efficient means of power distribution in residential electrical systems, particularly in new housing developments that prioritize modern electrical solutions. With the rise of electric vehicles and home energy systems, homeowners are gradually recognizing the benefits of busbars for enhanced electrical performance, even if this remains overshadowed by larger industrial and utility applications.

Global Busbar Market Regional Insights:

Asia Pacific

Asia Pacific is expected to dominate the Global Busbar market due to its rapid industrialization and urbanization. The region has witnessed significant growth in construction and infrastructure development, especially in countries like China and India. Increased investments in renewable energy projects and smart grid initiatives are further driving demand for busbars, which are integral for efficient power distribution. With a growing population and rising energy needs, the Asia Pacific region is poised to expand its market share significantly. The presence of numerous manufacturers and suppliers in countries like Japan and South Korea also contributes to the competitive landscape, enhancing innovation and lowering costs, solidifying the region's dominance.

North America

North America is a strong contender in the Global Busbar market, driven primarily by the United States and Canada. The region benefits from advanced technologies and a stable industrial sector that emphasizes efficient energy management solutions. Increasing investments in electrical infrastructure and a growing focus on renewable energy adoption catalyze the demand for busbars. With strong regulatory support and the adoption of smart technologies, North America continues to make significant strides in enhancing energy efficiency and reducing carbon footprints.

Latin America

Latin America is gradually emerging in the Global Busbar market, largely due to ongoing energy reforms and infrastructural development. Countries like Brazil and Mexico are investing in expanding their energy capabilities to support economic growth. While the market is still developing compared to other regions, initiatives aimed at improving energy infrastructure and increasing access to electricity are expected to drive busbar demand. However, economic and political challenges often hinder faster growth potential in this region.

Europe

Europe showcases a robust busbar market, primarily driven by its goal for sustainable energy initiatives and decarbonization strategies. Many European countries are investing heavily in renewable energy sources, enhancing the demand for efficient power distribution solutions like busbars. The region's advanced technological ecosystem fosters innovation and the development of smart grid solutions. Nevertheless, the market faces challenges such as stringent regulations that can impact the speed of market entry for new products and solutions.

Middle East & Africa

In the Middle East & Africa, the busbar market is poised for gradual growth. The region’s ongoing investment in infrastructural development, especially in the Gulf Cooperation Council (GCC) countries, is likely to drive demand. With urbanization and increasing energy needs, particularly in urban centers, the region's future demand for busbars looks promising. However, challenges such as political instability and economic fluctuations can impede faster market progression compared to more stable regions like Asia Pacific and North America.

Busbar Market Competitive Landscape:

Major contributors in the worldwide busbar sector stimulate creative advancements and optimize manufacturing efficiency, leading to the progress of sophisticated electrical distribution systems. Their collaborative alliances and investments in technology bolster system dependability and align with the changing needs of diverse industries.

Prominent entities in the busbar industry comprise Schneider Electric SE, Siemens AG, ABB Ltd., Eaton Corporation PLC, General Electric Company, Legrand SA, Busbar Services Ltd., Prysmian Group, Nexans S.A., Belden Inc., Thomas & Betts Corporation (a subsidiary of ABB), Merkamp GmbH, Rittal GmbH & Co. KG, C27 Corporation, and EATON Electric.

Global Busbar Market COVID-19 Impact and Market Status:

The Covid-19 pandemic significantly impacted the global busbar industry, leading to supply chain interruptions and a decline in demand across multiple sectors. This situation ultimately resulted in extended project timelines and decreased investment activities.

The busbar market has experienced profound effects due to the COVID-19 pandemic, which led to significant interruptions in manufacturing and supply chains as a result of imposed lockdowns and regulations. Initially, the suspension of construction activities and a downturn in infrastructure funding resulted in decreased demand for busbar systems. Nevertheless, as economies adjusted and started to recover, the demand for efficient electrical distribution networks, especially within the realms of renewable energy and industrial sectors, began to rise. There was an intensified emphasis on modernizing and upgrading electrical grids to bolster their resilience against potential future challenges, further driving market expansion. Moreover, the transition towards cleaner energy solutions and electrification projects has increased the appetite for innovative busbar technologies. As organizations and governmental bodies gradually recover from the pandemic’s repercussions, investments in infrastructure and energy efficiency are projected to enhance the busbar market, underscoring the crucial role of innovation and sustainability in fostering a more robust energy landscape. Overall, the market is anticipated to experience a steady recovery and growth as industrial activities return to pre-pandemic levels.

Latest Trends and Innovation in The Global Busbar Market:

- In March 2023, ABB Ltd announced the acquisition of Powertech Converter, enhancing its capabilities in energy distribution systems and reinforcing its position in the busbar market with innovative solutions.

- In June 2022, Siemens AG launched a new range of compact and customizable busbar systems designed for industrial applications, significantly improving energy efficiency and space utilization in commercial buildings.

- In September 2022, Schneider Electric introduced its new EcoStruxure Power Architecture, which includes advanced busbar systems that leverage IoT technology to optimize energy management and improve operational efficiencies.

- In January 2022, General Electric (GE) unveiled a new generation of busducts that support higher power ratings and are tailored for data centers and renewable energy applications, marking a step towards more sustainable energy infrastructures.

- In April 2023, Eaton Corporation Plc completed the integration of its recent acquisition of Royal Power Solutions, thereby expanding its busbar offerings and enhancing the development of power distribution equipment.

- In February 2023, Legrand announced its partnership with a leading technology firm to co-develop smart busbar systems that integrate seamlessly with building management systems, focusing on improving energy consumption monitoring.

- In August 2023, Hitachi Ltd revealed advancements in its busbar technology aimed at electrification of public transportation, streamlining the electrification of buses and improving operational efficiency.

- In November 2022, CBI Electric launched a next-gen busbar solution featuring enhanced safety measures and reliability for industrial facilities, which received positive feedback during industry trade shows.

- In May 2023, Siemens Energy and Siemens AG combined resources in innovative busbar technology for offshore wind applications, strengthening their competitive edge in renewable energy sectors.

Busbar Market Growth Factors:

The primary drivers of growth in the busbar market encompass the growing need for effective power distribution systems, upgrades in electrical infrastructure, and a ened emphasis on integrating renewable energy sources.

The Busbar sector is witnessing remarkable expansion, propelled by a variety of influential factors. A primary driver is the rising necessity for effective power distribution frameworks in urban locales, with busbars emerging as a dependable and space-efficient means to manage substantial electrical loads. Moreover, the worldwide shift toward renewable energy alternatives, including solar and wind power, requires upgraded power grid systems, which consequently amplifies the demand for busbar installations.

The industrial domain's movement toward automation and modernization also plays a crucial role in this market's growth, as companies aim to boost efficacy and curtail energy wastage. Furthermore, advancements in material science and production techniques have resulted in the creation of lighter and sturdier busbars that provide superior performance.

Government initiatives focused on expanding electrical grid capabilities and enhancing infrastructure dependability are critical, particularly in regions that are still developing. Additionally, the increasing miniaturization of electronic gadgets is spurring the desire for compact busbar options, suitable for both commercial and residential use. With rising investments in smart grid technology and energy management systems, the busbar market is set for vigorous growth, driven by these interconnected elements that improve operational effectiveness and promote sustainability in energy distribution.

Busbar Market Restaining Factors:

Significant obstacles in the busbar industry comprise difficulties in adhering to regulatory standards and the substantial upfront expenses linked to both installation and upkeep.

The Busbar Market encounters various obstacles that could hinder its growth potential. A significant issue is the substantial initial investment required for installation, which may discourage smaller enterprises from adopting busbar systems, especially in emerging markets. Furthermore, the integration complexity with current electrical frameworks imposes challenges, necessitating skilled professionals for both installation and maintenance. Compliance with rigorous safety standards and regulatory requirements can also impede market growth, as manufacturers need to modify their offerings to align with diverse international guidelines. In addition, the rising competition from alternative technologies, such as cable systems, may affect the uptake of busbars due to their perceived advantages in cost and ease of use. Market volatility, particularly concerning the prices of raw materials like copper and aluminum, introduces further unpredictability in manufacturing expenses. Despite these hurdles, the Busbar Market is projected to thrive, driven by technological advancements that enhance both efficiency and reliability, along with an increasing demand for energy management solutions in sectors such as renewable energy and smart grids. Hence, adopting proactive strategies and innovative solutions could transform challenges into growth opportunities in this evolving market.

Key Segments of the Busbar Market

By Conductor

• Copper Busbar

• Aluminum Busbar

• Brass Busbar

By Power Ratings

• Low Power (Below 125 A)

• Medium Power (125 A–800 A)

• High Power (Above 800 A)

By End User

• Utilities

• Industrial

- Chemicals & Petroleum

- Metals & Mining

- Manufacturing

- Others

• Commercial

• Residential

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America