Building Integrated Photovoltaics Market Analysis and Insights:

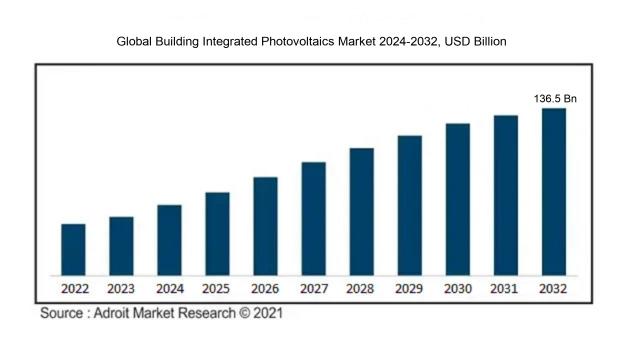

The size of the worldwide building integrated photovoltaics market was estimated at USD 25.02 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 22.5% from 2024 to 2032, from USD 30.03 billion in 2024 to USD 136.5 billion by 2032.

The market for Building Integrated Photovoltaics (BIPV) is significantly influenced by the escalating need for sustainable energy solutions in response to environmental challenges and a commitment to sustainability within the construction sector. Globally, governments are enacting favorable policies and offering incentives that facilitate the incorporation of solar technology into architectural designs. Increasing energy prices, along with the prospect of achieving energy autonomy and long-term financial savings, further encourage the adoption of BIPV systems. Technological innovations that boost the efficiency and visual appeal of photovoltaic materials are positioning BIPV as an attractive option for architects and builders alike. Additionally, the rise of urbanization and a ened focus on environmentally responsible building practices are driving the demand for energy-efficient constructions. The growing interest in multifunctional materials, which serve both as energy producers and structural components, also supports the expansion of this market. Moreover, rising consumer awareness about ecological consequences is leading to greater investments in BIPV systems, establishing them as a favored choice among environmentally conscious builders and homeowners.

Building Integrated Photovoltaics Market Definition

Building Integrated Photovoltaics (BIPV) are solar energy solutions that are intricately embedded within building components like roofing and wall surfaces. These innovative systems not only produce electricity but also contribute to the visual appeal and structural integrity of architectural designs.

Building Integrated Photovoltaics (BIPV) is essential for advancing sustainable energy practices by integrating solar technology directly into the structures of buildings, such as roofs and facades. This method facilitates the production of renewable energy without the necessity for extra land use, thereby optimizing spatial utilization. BIPV aids in the reduction of greenhouse gas emissions and decreases energy expenditures for buildings by utilizing solar energy for on-site consumption. Moreover, it improves the visual appeal of architectural designs, fostering a greater acceptance of solar technologies in urban settings. The synergistic advantages of energy production, cost efficiency, and eco-friendliness position BIPV as a crucial element in contemporary architecture and sustainability efforts.

Building Integrated Photovoltaics Market Segmental Analysis:

Insights On Technology

Crystalline Silicon (C-SI)

Crystalline Silicon (C-SI) is poised to dominate the Global Building Integrated Photovoltaics Market. With its high efficiency rates and established manufacturing processes, C-SI technology is recognized for its ability to effectively convert sunlight into electricity. Furthermore, C-SI has a long-standing reputation for durability and reliability, which appeals to both residential and commercial constructions. The availability of large-scale production and the ability to integrate seamlessly into building designs also enhance its appeal. As energy efficiency becomes increasingly paramount in building designs, C-SI technology's prominence is only expected to grow, as it combines performance with aesthetic integration into modern architecture.

Thin Film

Thin Film technology represents an innovative approach within the building integrated photovoltaics landscape, characterized by its lightweight and flexible design. This technology allows for easy installation on various surfaces, including curved and irregularly shaped buildings, where traditional panels might be impractical. Additionally, Thin Film cells tend to perform better in low light conditions, making them suitable for urban environments where shading often occurs. While they currently possess lower efficiency rates compared to C-SI, their adaptability and cost-effectiveness make them a compelling option, especially for new constructions or retrofits that prioritize versatility and aesthetics over maximum energy yield.

Others

The "Others" category encompasses various photovoltaic technologies such as organic photovoltaics and multijunction cells. While these technologies are not at the forefront in terms of market share compared to C-SI or Thin Film, they bring unique advantages that could cater to niche applications. For example, organic photovoltaics are known for their ease of integration into textiles and flexible surfaces. They also offer potential for lower production costs and environmental benefits due to the use of organic materials. Despite these advantages, they face challenges such as lower efficiency and shorter lifespans, limiting their immediate impact on the broader building integrated photovoltaics market.

Insights On Application

Roofs

Among the applications in the Global Building Integrated Photovoltaics Market, roofs are expected to dominate due to their large surface area and prominent visibility. Roof installations provide significant space for solar technology, making them an ideal canvas for photovoltaic integration. With the increasing focus on renewable energy and sustainability in urban development, more buildings are being designed with solar roofs as a norm. Moreover, regulations and incentives from governments globally to enhance energy efficiency further amplify the appeal of integrating photovoltaics into roofing systems. As a result, roofs are positioned to lead this market application, driven by functionality and aesthetic integration.

Walls

Walls are emerging as a significant application in the Building Integrated Photovoltaics Market, primarily due to the increasing trend of vertical solar systems. The growing urban space constraints compel architects and builders to utilize vertical surfaces for energy generation. Due to advancements in technology, photovoltaic materials can now be seamlessly integrated into walls, serving the dual purpose of aesthetics and energy production. Additionally, governments are encouraging developments that minimize land use for solar farms, making wall integration a viable and appealing option for building owners looking to enhance their energy efficiency.

Glass

Glass, as a part of the Building Integrated Photovoltaics Market, represents an innovative approach to energy generation within modern architecture. Transparent or semi-transparent solar glass can be utilized in various applications, such as skylights and glass facades, thereby maintaining the aesthetic appeal of buildings while enabling energy generation. The rising demand for green buildings and energy-efficient structures drives the use of this technology. However, challenges remain regarding cost and efficiency, which may limit wider adoption compared to other applications, though it will continue to grow in niche markets, particularly in commercial spaces.

Façade

Façade applications in the Building Integrated Photovoltaics Market are gaining traction with the focus on modern design and energy efficiency. The integration of photovoltaic elements into facades offers not only sustainability but also design flexibility, allowing architects to create innovative and attractive building exteriors. This approach helps to generate energy while enhancing the visual appeal of commercial and residential buildings. Nevertheless, the competitive nature of building materials and technology costs may hinder rapid widespread adoption, but the potential for aesthetic leverage in high-profile projects keeps façade integration as a promising of the market.

Windows

Windows as part of the Building Integrated Photovoltaics Market are currently a smaller application but are unique in offering energy generation without compromising natural light. Innovations like transparent solar panels allow windows to serve dual purposes, providing daylighting while also generating electricity. However, the high costs and lower efficiency compared to more traditional applications like roofs and walls have limited their widespread adoption. Despite these challenges, the increasing interest in integrating sustainability into everyday building functionalities means that window applications might see technological breakthroughs and gradual growth in this niche area.

Others

The "Others" category in the Building Integrated Photovoltaics Market encompasses various unconventional applications that do not fall into the main categories. This includes products like solar canopies and photovoltaic awnings, which can enhance aesthetic appeal while providing renewable energy solutions. While these applications can be innovative, their market presence remains marginal compared to primary applications like roofs and walls, due to cost considerations and practicality. However, the potential for creative designs in commercial and public spaces may shade the perception and utility of such applications, leading to niche growth.

Insights On End Use

Residential

The residential is expected to dominate the Global Building Integrated Photovoltaics Market due to several factors, including the increasing demand for sustainable energy solutions in homes, government incentives promoting solar energy adoption, and a growing awareness among homeowners about reducing energy costs. Technological advancements in solar materials have made BIPV systems more accessible and aesthetically pleasing to homeowners, further driving their adoption. Additionally, increasing energy prices and environmental concerns are prompting residential builders to incorporate photovoltaic technology into their designs. As a result, the residential sector is leading the market, supported by favorable regulations and a shift towards energy-efficient lifestyles.

Commercial

The commercial sector is witnessing significant growth in the Building Integrated Photovoltaics Market as businesses focus on sustainability and energy efficiency. Many companies prioritize renewable energy to reduce their carbon footprint, enhance their brand reputation, and comply with stricter environmental regulations. Additionally, the ability of BIPV to provide dual functionality in commercial buildings—serving as both a structural and energy-generating element—makes it an attractive option for businesses. As large-scale commercial constructions are increasingly integrated with photovoltaic technology, this sector is expected to experience notable growth, although it may not surpass residential in terms of market share.

Industrial

The industrial in the Building Integrated Photovoltaics Market is gaining traction but remains less dominant compared to residential and commercial sectors. Industries are gradually adopting solar technology to power their operations, driven by the need for energy independence and cost savings. However, the high upfront costs and longer payback periods associated with large industrial buildings pose challenges for broader adoption. While certain industries are pioneering the use of BIPV, the overall market share remains lower as enterprises often prioritize established energy sources. Therefore, while there is potential growth in this category, it currently lags behind both residential and commercial usages.

Global Building Integrated Photovoltaics Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global Building Integrated Photovoltaics market due to rapid urbanization, increasing energy demands, and favorable government policies promoting renewable energy. Countries like China and Japan are investing heavily in solar technology and integrating these systems into buildings for sustainable development. Moreover, the growing emphasis on green buildings and energy-efficient solutions further drives the adoption of building-integrated photovoltaics (BIPV). The combination of technological advancements and significant investments in renewable energy infrastructure leads to an accelerated growth trajectory for the BIPV market in this region, making it the clear frontrunner.

North America

North America, particularly the United States, shows substantial growth potential in the building integrated photovoltaics market driven by environmental regulations, consumer awareness, and the push for sustainable practices. Innovations in solar panel technology and financing options like solar leasing encourage businesses and homeowners to adopt BIPV solutions. Additionally, energy incentives from the government create a conducive environment for the growth of this market, aiming for cleaner energy alternatives.

Europe

Europe is experiencing an increasing trend toward sustainability and energy efficiency within the construction sector. European countries are heavily investing in building integrated photovoltaics to meet strict carbon emission regulations and environmental goals. This region has seen significant growth in innovations related to solar technology and an increasing number of renovation projects aimed at incorporating BIPV systems into existing buildings. As a result, Europe remains a strong market participant in the building integrated photovoltaics space.

Latin America

Latin America is gradually making strides in the building integrated photovoltaics market, driven by abundant sunlight and a growing need for renewable energy solutions. However, challenges such as limited infrastructure and higher initial costs keep this region from leading the market. Nevertheless, initiatives aimed at policy reform and the integration of solar technology into building projects abound. Countries like Brazil and Chile are slowly embracing BIPV solutions, which may elevate their position in the global market in the coming years.

Middle East & Africa

The Middle East and Africa exhibit significant potential for building integrated photovoltaics, primarily due to their vast solar resources. However, the market is currently underdeveloped, impacted by economic factors and varying levels of government support across countries. Despite these challenges, nations like UAE and South Africa are making notable efforts to diversify their energy portfolios by encouraging renewable energy investments. Increased urbanization and infrastructural development could pave the way for growth in the BIPV market, but challenges remain in achieving widespread adoption.

Building Integrated Photovoltaics Competitive Landscape:

Leading figures in the global market for Building Integrated Photovoltaics (BIPV), comprising manufacturers, developers, and installers, work together to foster innovation and the incorporation of solar technology within architectural frameworks. This collaboration aims to improve energy efficiency and promote sustainability. Their contributions involve advancing product development, expanding market reach, and offering installation services, all of which are essential for the widespread adoption and optimal performance of BIPV systems.

Prominent participants in the Building Integrated Photovoltaics sector comprise Tesla, SolarFrontier, SunPower Corporation, ONYX Solar, First Solar, Sharp Corporation, SolteQ Europe BV, Dow Solar, AGC Solar, Panasonic Corporation, Trina Solar Limited, and Sika AG. Other noteworthy firms in this industry include Saint-Gobain, LG Electronics, and Solaria Corporation. Moreover, entities such as LIXIL Corporation, Canadian Solar Inc., and 3M play essential roles in the marketplace.

Global Building Integrated Photovoltaics COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the global market for Building Integrated Photovoltaics, leading to delays in projects, disruptions in supply chains, and a decrease in investments resulting from economic instability.

The COVID-19 pandemic has profoundly impacted the Building Integrated Photovoltaics (BIPV) sector, presenting both obstacles and prospects. In the early stages of the crisis, the industry faced significant challenges such as project delays, interruptions in supply chains, and a downturn in construction activities, all of which impeded market expansion. Manufacturers struggled to procure raw materials, and labor shortages led to deferred installations and a decline in demand, particularly within the residential market. Nevertheless, as economies started to rebound and with a stronger focus on sustainability, the BIPV sector experienced a revival spurred by increased investments in green infrastructure and renewable energy initiatives. The rising recognition of the need for energy autonomy and resilience—especially given potential future global uncertainties—has intensified interest in BIPV technologies. Additionally, government incentives aimed at advancing clean energy solutions have further enhanced the market outlook, establishing BIPV as a promising alternative for the recovery period following the pandemic. Thus, while initial disruptions occurred, the pandemic has also laid the groundwork for sustained growth in the BIPV industry.

Latest Trends and Innovation in The Global Building Integrated Photovoltaics Market:

- In March 2023, Tesla Inc. announced the launch of its Solar Roof V4, which integrates advanced photovoltaic cells into roof tiles, offering improved aesthetics and efficiency for residential installations.

- In January 2023, Saint-Gobain acquired the startup Solar-Tectic LLC, which specializes in transparent solar technology, expanding its portfolio in the building integrated photovoltaics sector.

- In February 2023, Solaria Corporation introduced its new series of BIPV panels designed specifically for roofing systems, featuring higher energy conversion efficiency and a sleek design aimed at residential markets.

- In August 2023, the partnership between NREL (National Renewable Energy Laboratory) and Onyx Solar resulted in the development of a new type of building-integrated transparent photovoltaic glass, pushing the boundaries of aesthetics in architecture.

- In May 2023, the collaboration between Quanta Technology and CEA (French Alternative Energies and Atomic Energy Commission) focused on innovative BIPV solutions for commercial buildings, emphasizing energy management and sustainability.

- In April 2023, the architectural firm Architekten Von Gerkan, Marg und Partner (gmp) began utilizing BIPV technology in its latest projects, showcasing how integrated solar can blend seamlessly with modern architectural design.

- In June 2023, First Solar announced a breakthrough in their BIPV module efficiency, achieving 25% energy conversion, thus positioning themselves as leaders in the photovoltaic market for integrated building solutions.

- In July 2023, Sharp Corporation released a new line of building integrated solar systems with enhanced durability and performance metrics specifically targeting urban residential areas and commercial buildings.

- In September 2023, LG Electronics launched a new high-efficiency BIPV solar shingle that combines performance with design, entering the U.S. residential market in response to increasing consumer demand for solar-integrated solutions.

Building Integrated Photovoltaics Market Growth Factors:

The expansion of the Building Integrated Photovoltaics Market is fueled by a rising need for sustainable energy alternatives, technological progress in solar solutions, and favorable governmental initiatives encouraging eco-friendly construction methods.

The market for Building Integrated Photovoltaics (BIPV) is experiencing considerable expansion influenced by several pivotal elements. Primarily, the rising focus on eco-friendly construction methodologies and renewable energy solutions has intensified the demand for BIPV systems that effectively merge with building designs to improve energy efficiency. Advances in solar cell technology, both in performance and design, alongside a decrease in the cost of photovoltaic materials, have made BIPV options more inviting for architects and constructors. In addition, favorable governmental policies and financial incentives aimed at boosting renewable energy utilization are driving investments in BIPV projects. The trend of urban growth, coupled with an increase in energy consumption, further accelerates the need for inventive energy solutions, positioning BIPV as a practical choice that combines energy generation with aesthetic enhancements for building facades. Moreover, the escalating recognition of climate change issues and the necessity to minimize carbon emissions are encouraging both the commercial and residential sectors to embrace environmentally sustainable building technologies. Lastly, a growing number of collaborations between tech developers and building companies is nurturing innovation and broadening BIPV applications, thereby expanding its market reach. Together, these factors are fueling the substantial growth of the BIPV market as it adapts to contemporary energy requirements and sustainable construction goals.

Building Integrated Photovoltaics Market Restaining Factors:

Significant obstacles in the Building Integrated Photovoltaics Market involve elevated installation expenses and regulatory hurdles that impede broader implementation.

The market for Building Integrated Photovoltaics (BIPV) encounters numerous challenges that may restrict its broader implementation. One of the primary obstacles is the elevated initial investment required for installation, which often discourages developers and homeowners due to the longer return on investment compared with conventional solar panels. Additionally, the intricate process of embedding photovoltaic materials within building structures necessitates specialized knowledge, resulting in higher labor expenses and extended project durations.

Furthermore, regulatory discrepancies, including diverse building codes and standards across various locations, can complicate the installation process, potentially deterring interested parties. A lack of awareness and understanding regarding the advantages and capabilities of BIPV technologies among potential users might also impede market expansion, as misconceptions can foster reluctance toward adoption.

Concerns over energy efficiency, performance variability in different climatic conditions, and the longevity of integrated materials are other critical factors that could dissuade investment. Nevertheless, technological advancements and an increase in government incentives targeting renewable energy initiatives are fostering a more supportive environment for BIPV. As awareness improves and innovations lead to reduced costs and enhanced efficiency, the prospect of BIPV contributing to sustainable urban development appears optimistic, making it a promising field for future investments.

Key Segments of the Building Integrated Photovoltaics Market

By Technology

• Crystalline Silicon (C-SI)

• Thin Film

• Others

By Application

• Roofs

• Walls

• Glass

• Façade

• Windows

• Others

By End Use

• Residential

• Commercial

• Industrial

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America