BPO and ITO Services Market Analysis and Insights:

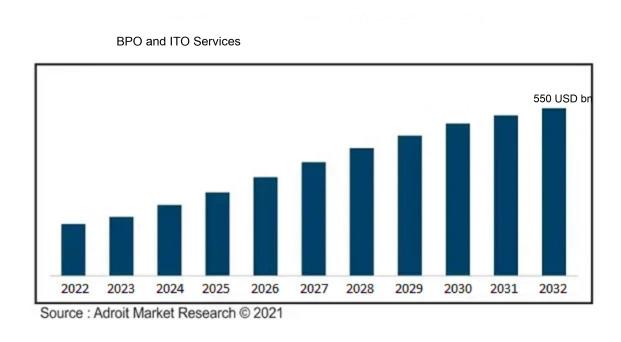

The Global BPO and ITO Services Market was estimated to be worth USD 330 billion in 2023, and from 2024 to 2032, it is anticipated to grow at a CAGR of 5.8%, with an expected value of USD 550 billion in 2032.

As digital transformation becomes a focal point, organizations are turning to specialized service providers to gain access to cutting-edge technologies and expertise while minimizing the need for considerable capital investments. The push for enhanced customer experiences, combined with the imperative to prioritize core business operations, drives enterprises to delegate non-essential tasks. Moreover, the swift globalization of markets enables businesses to access a varied talent pool across different regions, ensuring around-the-clock operations and uninterrupted services. Technological innovations, especially in automation and artificial intelligence, further strengthen this industry by streamlining processes and supporting the delivery of state-of-the-art solutions. As companies confront an increasingly competitive environment, these dynamics collectively foster the ongoing expansion of the BPO and ITO services market.

BPO and ITO Services Market Definition

Business Process Outsourcing (BPO) involves transferring particular operational tasks, like customer support or human resources, to external service providers. Conversely, Information Technology Outsourcing (ITO) focuses on contracting IT-related services, such as software development and technical support, to outside firms with the aim of improving efficiency and lowering expenses.

Organizations aiming for increased efficiency and cost savings find Business Process Outsourcing (BPO) and Information Technology Outsourcing (ITO) services to be indispensable. By delegating non-essential operations, firms can concentrate on their core functions, fostering greater productivity and inventive capabilities. BPO enhances operations related to areas such as customer support and human resources, while ITO fulfills technological requirements, which may include software engineering and IT assistance. These outsourcing solutions provide access to specialized expertise, cutting-edge technologies, and benefits of scale, which are crucial for maintaining competitiveness in a swiftly evolving marketplace. In sum, the strategic use of BPO and ITO leads to enhanced service quality and adaptability, forming a foundation for sustainable development.

BPO and ITO Services Market Segmental Analysis:

Insights On Service Type

IT Services

Among the various service types, IT Services is expected to dominate the Global BPO and ITO Services Market. The growing need for digital transformation across industries has led to a significant increase in demand for IT outsourcing services. Organizations are increasingly investing in advanced technologies, including cloud computing, artificial intelligence, and cybersecurity, pushing IT Services to the forefront. The ability of IT Services to enhance operational efficiency, reduce costs, and provide innovative solutions tailored to client needs makes this category particularly appealing. Additionally, with the ongoing digital revolution, companies are prioritizing IT Services to maintain a competitive edge, which solidifies its dominance in the market.

Customer Services

Customer Services represent a critical aspect of the BPO market, as companies strive to improve customer satisfaction and retention. With the rise of e-commerce and online interactions, organizations are outsourcing customer support to manage high volumes of inquiries effectively. The sector encompasses various channels, including phone, chat, and email support, tailored to meet the needs of diverse clients.

Finance & Accounting

The Finance & Accounting sector is vital for businesses looking to streamline their financial operations while ensuring compliance with regulations. Outsourcing these services allows organizations to focus on core competencies while benefiting from specialized expertise in areas such as tax preparation, payroll processing, and financial analysis. Moreover, organizations are recognizing the cost savings associated with outsourcing their finance and accounting functions, which strengthens this 's role in the broader market.

Human Resources

The Human Resources plays a pivotal role in optimizing workforce management through outsourcing. Companies are increasingly looking to external providers for services such as recruitment, payroll processing, and employee benefits administration. As businesses expand globally, managing HR complexities across different regulations and cultures fuels the demand for outsourced HR services, solidifying its importance in the BPO and ITO Services framework.

Procurement

Procurement services in the BPO market focus on optimizing sourcing and supply chain management processes. Organizations are increasingly outsourcing these functions to improve efficiency, reduce costs, and gain access to a broader range of supplier networks. By leveraging specialized procurement service providers, companies can enhance negotiation capabilities, streamline purchasing processes, and ensure compliance with procurement policies.

Others

The "Others" category encompasses a variety of additional services that may include market research, legal processing, and specialized consulting services. While not as dominant as the primary categories, these services still play a significant role in the overall BPO and ITO Services market by providing organizations with unique solutions tailored to their specific needs. The growing demand for niche services, complemented by the rise of technology-based solutions in various sectors, has allowed this category to maintain relevance. Companies are increasingly looking for innovative ways to address unique challenges, which helps sustain the demand for these additional offerings in the market.

Insights on End User

IT & Telecommunications

The IT & Telecommunications sector is expected to dominate the Global BPO and ITO Services Market. This dominance can be attributed to the industry's increasing reliance on outsourcing certain business processes and IT functions to enhance operational efficiency, reduce costs, and gain access to specialized expertise. Additionally, the growing demand for cloud services, cybersecurity solutions, and digital transformation initiatives drives organizations to leverage BPO and ITO services. With the rapid technological advancements and the need for agile business solutions, IT & Telecommunications organizations are increasingly seeking external support to stay competitive, further solidifying its position in the market.

BFSI

The Banking, Financial Services, and Insurance (BFSI) sector has been a robust user of BPO and ITO services, owing to its complex operations and regulatory requirements. Financial institutions leverage these services for various functions, including customer support, compliance management, and transaction processing. As digital banking grows, BFSI companies increasingly rely on external partnerships to enhance their service delivery and innovate while managing costs effectively. This reliance ensures that BFSI remains a significant player in the market, emphasizing the strategic importance of outsourcing.

Healthcare

In the Healthcare industry, the adoption of BPO and ITO services is driven by the need for improved patient care and operational efficiencies. With the increasing focus on data management, patient records, and compliance with strict regulations, healthcare organizations are turning to outsourcing to manage administrative tasks and harness advanced technology. This sector aims to streamline processes, reduce costs, and improve service delivery. The growing trend towards telemedicine and electronic health records further underscores the importance of these services, promoting a continued growth trajectory in healthcare outsourcing.

Manufacturing

The Manufacturing sector has adopted BPO and ITO services to enhance productivity and operational efficiency. Manufacturers leverage outsourcing for process automation, supply chain management, and customer service. As globalization continues to impact manufacturing strategies, organizations are increasingly utilizing these services to remain competitive and innovative in delivering quality products while streamlining their operations.

Retail

The Retail industry is leveraging BPO and ITO services to adapt to the evolving consumer landscape and improve customer experiences. Retailers use these services for customer support, inventory management, and e-commerce solutions to remain agile in a competitive market. As digital channels gain more prominence, outsourcing IT functions enhances retailers’ ability to manage complex systems efficiently.

Others

In the "Others" category, various industries including education, tourism, and logistics are increasingly turning to BPO and ITO services to enhance their operational capabilities. These sectors often rely on outsourcing to handle non-core functions such as customer service, data processing, and IT support. As diverse industries seek to adopt technology and improve service efficiency, the demand for outsourcing continues to grow. The expanding needs across these varied sectors highlight the versatility and necessity of BPO and ITO services in supporting businesses in managing operations effectively.

Insights on Deployment

Cloud

The cloud deployment model is expected to dominate the Global BPO and ITO Services Market due to its scalability, cost-effectiveness, and flexibility. Enterprises are increasingly favoring cloud solutions to reduce infrastructure costs and improve operational efficiency. The ability to scale resources based on demand and leverage advanced technologies such as AI and machine learning are driving factors in cloud adoption. Moreover, the growing trend of remote work has further accelerated the shift towards cloud solutions, making them an attractive option for businesses looking to innovate and remain competitive in a dynamic market landscape.

On-premises

The on-premises deployment model, while currently less favored than cloud solutions, still maintains a strong presence in industries with stringent regulatory requirements. Organizations dealing with sensitive data prefer this model as it provides them with enhanced control over data security and compliance. Additionally, large enterprises with legacy systems may find on-premises solutions more compatible with their existing infrastructure. However, the high maintenance costs and limited flexibility of on-premises deployment could restrict its growth as businesses increasingly lean towards modern cloud technologies.

Insights on Enterprise

Large Enterprise

The Global BPO and ITO Services Market is expected to be dominated by Large Enterprises. This is primarily due to their significant operational scale and higher budget allocations for outsourcing services in comparison to smaller firms. Large Enterprises often require intricate and specialized services, which encourage investment in advanced technologies and partnerships with third-party vendors. Moreover, as these organizations continuously expand their global footprint, the demand for comprehensive BPO and ITO solutions—such as cloud computing, customer support, HR outsourcing, and IT services—will further gain momentum; hence, they will drive growth in this market more effectively than smaller counterparts.

SMEs

Small and Medium Enterprises (SMEs) face distinct challenges compared to larger counterparts, particularly in terms of budget and resources. While their demand for BPO and ITO services is surging, largely to improve operational efficiency and reduce costs, they often lack the financial capacity to engage in extensive outsourcing agreements. Many SMEs seek scalable and affordable service solutions, making them depend more on basic outsourcing options. Their growth potential in the market is essential, but they typically focus on more cost-effective strategies, limiting their influence in the broader BPO and ITO services landscape.

Global BPO and ITO Services Market Regional Insights:

Asia Pacific

The Asia Pacific region is expected to dominate the Global BPO and ITO Services market due to a combination of factors that enhance its competitive edge. Countries like India, China, and the Philippines are leading in providing outsourcing services because of their large English-speaking populations, cost-efficient labor, and technological advancements. The presence of established IT hubs and continually evolving digital infrastructure further supports this growth. Additionally, the increasing demand for cloud services, machine learning, and artificial intelligence solutions among businesses enhances the appeal of this region as an outsourcing destination. As businesses increasingly seek efficiency and scalability, Asia Pacific's combination of resources and capabilities positions it at the forefront of the BPO and ITO services market.

North America

North America remains a significant player in the Global BPO and ITO Services market, primarily driven by companies looking to outsource non-core functions for enhanced operational efficiency. The region's proximity to advanced technologies and a robust education system fosters high innovation levels, making it attractive for high-value projects. However, labor costs are notably higher compared to Asia Pacific, which may hinder extensive outsourcing operations. Firms in this region emphasize quality and expertise, which leads to a focus on strategic partnerships with service providers to enhance their global competitiveness.

Europe

Europe presents a mixed landscape in the BPO and ITO Services market due to varying economic conditions across countries. While Western Europe, particularly regions like the UK, Germany, and France, continue to show robust demand for outsourcing services, Eastern European countries are becoming attractive alternatives due to lower costs and skilled labor. Localization and adherence to regulatory frameworks, such as GDPR, are crucial factors that influence the preferences of European companies, often opting for services that emphasize data privacy and compliance. The growing need for digital transformation also drives businesses to seek specialized IT services, enhancing the region's overall market presence.

Latin America

Latin America is emerging as a competitive outsourcing locale, especially for North American companies seeking to minimize costs while staying close to home due to time zone alignment. This region showcases a rapidly growing tech-savvy workforce, particularly in countries like Brazil and Mexico, which helps attract BPO contracts. The specialty in languages and a focus on nearshore engagements cater to the need for cultural affinity and effective communication.

Middle East & Africa

The Middle East & Africa region is still in the growing phase concerning BPO and ITO services, facing various challenges related to infrastructure and skilled labor shortages. However, with increasing investments in technology and human capital from both private and public sectors, there are noted improvements in service capabilities. Countries like South Africa are gaining traction for their outsourcing operations, while the UAE is focusing on becoming a regional hub for digital innovations. Despite its potential, the overall market remains smaller compared to more established regions, but it showcases promising opportunities for the future as the region continues to develop.

BPO and ITO Services Competitive Landscape:

Prominent entities within the global BPO and ITO services sector, comprising leading outsourcing companies and technology solution providers, propel innovation and efficiency by delivering tailored services that improve operational performance for organizations across the globe. Their collaborative alliances and financial commitments to technological advancements significantly influence industry developments and elevate customer satisfaction levels.

Prominent players in the outsourcing market for business processes (BPO) and information technology (ITO) encompass a diverse range of firms, including Accenture, IBM, Tata Consultancy Services (TCS), Cognizant, Infosys, Wipro, Genpact, Capgemini, HCL Technologies, Atos, DXC Technology, Teleperformance, Sitel Group, Concentrix, and Alorica. Additionally, companies like Arvato, Serco Group, SAP, NTT Data, TeleTech, Sykes Enterprises, Amdocs, Saviom, and WNS Global Services also contribute significantly to the industry. This collection of organizations includes both international giants and regional specialists dedicated to providing outsourcing solutions in various industries.

Global BPO and ITO Services COVID-19 Impact and Market Status:

The Covid-19 pandemic notably expedited the shift towards remote work and the digitization of processes within the global BPO and ITO Services sector. This transformation resulted in a ened demand for technology-centric solutions and fundamentally altered the frameworks through which services are provided.

The COVID-19 pandemic brought about a profound shift in the landscape of Business Process Outsourcing (BPO) and Information Technology Outsourcing (ITO) services, catalyzing a swift move towards digital innovation and remote working practices. As enterprises grappled with operational hurdles, the need for outsourcing solutions that could maintain business continuity surged. Organizations began to depend more heavily on BPO and ITO services to handle customer relations, bolster IT support, and improve overall efficiency while reducing expenses. The transition toward cloud services and automation accelerated, as businesses sought flexible and scalable options to adapt to fluctuating circumstances. This evolution fostered a competitive environment, compelling service providers to prioritize the development of innovative, technology-driven offerings. Additionally, new challenges surfaced concerning workforce management, data protection, and compliance with regulations, pushing service providers to refine and expand their service capabilities. Ultimately, the pandemic not only altered demand and operational approaches within the BPO and ITO sectors but also set the stage for enduring growth and adaptability in a post-pandemic world.

Latest Trends and Innovation in The Global BPO and ITO Services Market:

- In July 2023, Teleperformance announced its acquisition of Cyber Services, a specialized cybersecurity firm, to enhance its digital services and strengthen data protection for its clients.

- In August 2023, Accenture completed its acquisition of atNorth, a Nordic cloud services company, aiming to expand its capabilities in data center services and sustainable technology solutions.

- In September 2023, TTEC Holdings, Inc. acquired the digital engagement platform, VoiceFoundry, to deepen its voice technology competencies for improved customer interactions.

- In October 2023, Infosys partnered with Microsoft to launch a new AI-driven service development tool, enabling better digital transformation solutions for businesses.

- In May 2023, Wipro finalized the acquisition of multiple digital experience agencies to enhance its offerings in customer experience design and digital consulting services.

- In April 2023, HCL Technologies entered into a partnership with IBM to co-develop hybrid cloud solutions aimed at enterprise-level clients looking for improved operational efficiencies.

- In March 2023, Concentrix announced the acquisition of Digital Marketing Agency, Connexta, focusing on expanding its marketing and analytics services to its growing client base.

- In January 2023, Cognizant completed the acquisition of the technology consulting firm Brightline, enhancing its expertise in cloud and digital transformation services.

- In September 2022, Capgemini announced its merger with the digital consulting firm, TASC, which aimed at enriching its digital offerings and market competitiveness in the Asia-Pacific region.

BPO and ITO Services Market Growth Factors:

The market for BPO and ITO services is driven by a growing need for cost-effectiveness, the shift towards digital transformation, and improved strategies for customer engagement.

A rising need for enhanced operational efficiency and reduced costs has led organizations to delegate non-essential functions, enabling them to concentrate on their core missions. The swift evolution of technology, especially advancements in automation and artificial intelligence, has improved service delivery, making outsourcing a more appealing option for firms eager to capitalize on these innovations. Moreover, globalization has broadened market access, prompting companies to tap into skilled labor across the globe while keeping expenses in check. The growing acceptance of remote work, significantly accelerated by the COVID-19 pandemic, has also made the adoption of BPO and ITO services easier, offering greater flexibility and access to a wider talent pool. Businesses are increasingly emphasizing customer experience, leading them to outsource customer support to specialists in this field. Additionally, shifts in regulations and compliance requirements across various industries compel organizations to seek expert advice, further encouraging the use of external service providers. Collectively, these factors are cultivating a dynamic market landscape for BPO and ITO services, positioning them as strategic solutions for enterprises striving to improve performance and maintain a competitive edge.

BPO and ITO Services Market Restaining Factors:

The primary challenges hindering the growth of the BPO and ITO services sector encompass issues related to data protection, the risk of diminished oversight over operational processes, and difficulties associated with maintaining service quality across various regions.

Prominent among these obstacles are concerns surrounding data security and privacy, as organizations are required to safeguard sensitive data when utilizing external vendors, which in turn necessitates strict compliance with regulations. The swift pace of technological innovation also compels continuous skill enhancement within the workforce, leading to higher operational expenditures for service providers. Furthermore, language and cultural discrepancies can create complications, especially in international outsourcing scenarios, potentially undermining effective communication and service quality. Economic volatility and political unrest in outsourcing regions may deter businesses from entering into long-term agreements. Additionally, the increasing prevalence of automation and artificial intelligence poses a risk of displacing traditional outsourcing positions, contributing to uncertainty within the industry.

Nevertheless, the BPO and ITO sectors persist in their evolution, adapting to emerging technologies and shifting client needs. Advancements in artificial intelligence and automation are bolstering service delivery capabilities, enabling providers to enhance efficiency while lowering costs. As businesses continue to pursue adaptable and innovative solutions, there remains a wealth of opportunities for growth, solidifying the BPO and ITO sectors as essential components of global business operations.

BPO and ITO Services Market Key Segments:

By Service Type

- Customer Services

- Finance & Accounting

- Human Resources

- Procurement

- IT Services

- Others

By End User

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- IT & Telecommunications

- Manufacturing

- Retail

- Others

By Deployment

- Cloud

- On-premises

By Enterprise

- Large Enterprise

- SMEs (Small and Medium-sized Enterprises)

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America