Blood Bank Market Analysis and Insights:

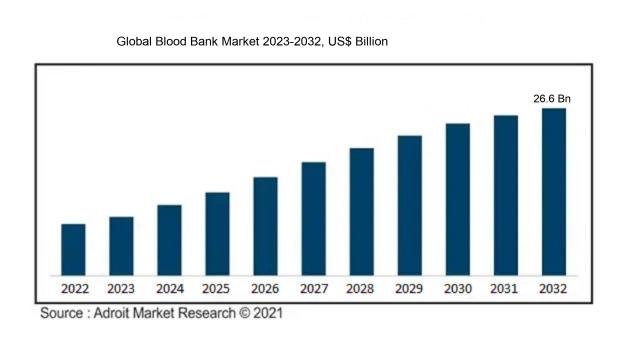

In 2023, the worldwide blood bank market was valued at US$18.4 billion. At a compound annual growth rate (CAGR) of 5.12% from 2023 to 2032, the market is expected to reach US$ 26.6 billion.

The Blood Bank Market is shaped by several crucial elements, including a rise in the occurrence of blood-related disorders, an elevating demand for blood and its derivatives due to surgical interventions, and ened awareness regarding the significance of blood donation. Innovations in blood preservation and testing technologies improve the safety and effectiveness of blood bank operations, encouraging broader adoption. Moreover, proactive government policies and regulations that support blood donation initiatives strengthen the donor community. The increasing number of elderly individuals and the growing incidence of chronic illnesses further en the requirement for blood transfusions. Additionally, the development of healthcare facilities and services in emerging regions plays a significant role in stimulating market growth. The anticipated deployment of artificial intelligence and automated systems in blood management is likely to enhance operational productivity within blood banks, facilitating further market progression. In summary, a confluence of health trends, technological advancements, and community involvement influences the evolution of the blood bank industry.

Blood Bank Market Definition

A blood bank functions as a dedicated establishment responsible for the collection, testing, processing, and preservation of blood and its derivatives intended for transfusion to individuals requiring such treatment. It plays a crucial role in guaranteeing the secure and effective distribution of blood products to medical facilities.

Blood banks are essential components of healthcare infrastructures, providing a consistent and secure supply of blood and its derivatives necessary for transfusion and medical procedures. They are instrumental in critical situations, surgical operations, and for individuals suffering from long-term health issues like anemia or cancer. To maintain the safety of the blood supply, blood banks implement strict testing protocols to detect infectious diseases. Additionally, they organize voluntary blood donation campaigns, encouraging community participation and raising awareness about the significance of blood donation. In summary, blood banks are vital for preserving lives and enhancing health outcomes across global communities.

Blood Bank Market Segmental Analysis:

Insights On Product Type

Red Blood Cells

Red Blood Cells (RBCs) is expected to dominate the Global Blood Bank Market due to the high demand for transfusions in various medical situations such as surgeries, trauma, and chronic conditions like anemia. The prevalence of blood disorders that require RBC transfusions, along with the increasing number of road accidents and complex surgeries that necessitate blood products, drives this 's growth. The ability to store and utilize RBCs efficiently, combined with the advancements in blood collection and processing technologies, reflects a sustained focus on ensuring the availability of these critical components, solidifying their lead in the market.

Whole Blood

Whole Blood remains a crucial component in the blood bank landscape, as it can be stored and used in emergency situations where multiple blood components are needed swiftly. Though often separated into its parts for specific treatments, the versatility of whole blood ensures its continued importance in transfusion medicine. However, due to the complexity of individual treatment requirements, its usage is slightly declining compared to more refined products like RBCs, which are preferred for their specific applications.

Platelet

Platelets hold significant relevance in the treatment of patients with clotting disorders and in cancer therapies. While their demand is steady, there are inherent challenges such as their shorter shelf life, necessitating more frequent donations and timely usage. Platelets are crucial for surgeries and emergency situations, contributing to their ongoing importance. However, this faces constraints that limit its dominating potential when juxtaposed with the more stable demand for Red Blood Cells.

Plasma

Plasma is critical in treating burn victims and individuals with clotting deficiencies. Its demand is primarily driven by therapeutic applications and the production of life-saving plasma-derived products. However, the market growth for plasma is constrained by regulations surrounding its collection and processing, as well as the current focus on more targeted blood components. Plasma’s unique role in medical treatments ensures its continued relevance, though it does not experience the same growth trajectory as Red Blood Cells in the broader blood bank market.

White Blood Cells

White Blood Cells mainly serve specialized medical roles, particularly in treatments for immune deficiencies and certain cancers. The demand for this product is niche, primarily due to its specific usage and the limited technology available for its collection and storage. While essential for treating specific conditions, the overall market for White Blood Cells is much smaller than for Red Blood Cells, which are consistently in demand due to larger medical applications. Consequently, this does not represent a dominating force in the Global Blood Bank Market.

Insights On Bank Type

Private Banks

Private banks are expected to dominate the Global Blood Bank Market due to their ability to operate with greater flexibility and innovation compared to their public counterparts. They generally have more resources allocated towards advanced technologies and systems that ensure efficient blood collection, testing, and distribution. The focus on patient-centric care also motivates private banks to improve operational processes, enhance donor engagement, and invest in marketing strategies that resonate with potential donors. Additionally, government policies that encourage partnerships with private entities for health services further bolster the performance of private banks in this sector, promoting a competitive environment that drives quality and service excellence.

Public Banks

Public banks play a crucial role in the Global Blood Bank Market, primarily by ensuring equitable access to blood products for all s of society. They are typically funded by government resources and are tasked with maintaining a steady supply of safe blood, which is essential in managing public health crises. However, these institutions can face challenges such as bureaucratic constraints and limited funding, which may impede their ability to innovate. Despite these challenges, public banks are often trusted entities owing to their non-profit nature, making them vital particularly in areas where private players may not operate, thus providing essential services to communities at large.

Hybrid Banks

Hybrid banks are a relatively new entity in the Global Blood Bank Market, combining aspects of both public and private blood banks. They are designed to leverage the strengths of both models, aiming to provide comprehensive and cost-effective blood services while also ensuring accessibility. By incorporating both private funding avenues and governmental support, hybrid banks can potentially address deficiencies seen in traditional models. This type of bank has the potential to attract a diverse donor base, yet their presence is still limited compared to private and public banks. Consequently, they function as a supplementary option but don't hold a dominating market position, as they are still in the early phases of establishment and recognition.

Insights On Function

Collection

Among the different functions in the Global Blood Bank Market, the Collection function is expected to dominate. This is primarily due to the essential nature of acquiring blood donations to ensure a sufficient supply for medical needs. Factors such as increasing awareness regarding blood donations and the expansion of blood donor campaigns by health organizations are propelling growth in this area. Additionally, advancements in collection technologies and the growing prevalence of automated collection methods make this critical, as they enhance efficiency and safety in the collection process. The ongoing public health initiatives are likely to sustain this momentum, ensuring that the collection function remains at the forefront of the blood bank market.

Processing

Processing is a key function within blood banking that focuses on separating and preparing blood components for transfusion and storage. It involves sophisticated techniques to ensure the highest standards of safety and effectiveness for patient care. Although this is vital to the overall blood bank operation, its growth is more dependent on technological advancements and regulatory compliance than on consumer demand. As medical practices evolve, they require more refined processing techniques to meet specific therapeutic needs. However, its relative growth is slower compared to the collection phase.

Testing

Testing plays a crucial role in ensuring the safety and compatibility of blood supplies. This function is focused on blood screening for infectious diseases and blood type identification, which are essential for patient safety. While important, the testing phase is often governed by regulatory requirements and technical approval processes, which can delay its expansion. The demand for rapid testing technologies is growing, but the generally follows the pace of blood collection and processing efforts. This phase has a supportive role but is not expected to lead market growth independently.

Storage

Storage is another essential function, focusing on maintaining blood products under optimal conditions to preserve their viability. While this aspect is critical to inventory management, it experiences moderate growth rates compared to collection. Innovations in storage solutions are arising to enhance shelf life and storage conditions, yet they rely heavily on advancements in collection and processing stages. Therefore, while storage facilities remain a necessary part of the blood bank infrastructure, their growth potential is more stable rather than explosive.

Transportation

Transportation is a vital aspect of blood banking, ensuring that blood and blood products reach their destinations promptly and in a controlled manner. Despite being important for maintaining the integrity of the blood supply chain, the transportation function is often overshadowed by the need for efficient collection and processing methods. The logistics required for transporting blood can be complex, and can face challenges like regulatory hurdles and the need for temperature-controlled environments. Thus, while necessary, this function does not typically dominate the market landscape but plays a critical support role in the overall efficiency of the blood supply chain.

Insights On End User

Hospitals

Hospitals are expected to dominate the Global Blood Bank Market due to their critical role in healthcare delivery and the increasing demand for blood transfusions. With a constant influx of patients requiring surgical procedures, trauma care, and treatment for various medical conditions, hospitals utilize a significant volume of blood products. As they operate 24/7 and deal with emergencies, hospitals maintain extensive inventory management systems for blood components to ensure immediate availability. The rise in awareness regarding blood donations and advancements in blood storage technologies further enhances the capacity for hospitals to manage and utilize blood supplies efficiently. Therefore, significant patient inflow and operational requirements place hospitals in a leading position within the blood bank sector.

Ambulatory Surgery Centers

Ambulatory Surgery Centers (ASCs) have gained traction as convenient and cost-effective alternatives to traditional hospitals for performing surgical procedures. These facilities generally focus on same-day discharge of patients, which may lead to a reduced need for large volumes of blood. However, as surgical procedures performed in ASCs increase and become more complex, the demand for blood products in this setting is anticipated to grow. With a focus on outpatient care, ASCs may rely on blood banks for timely access to blood products, particularly for higher-risk outpatient surgeries. Thus, while they currently play a smaller role compared to hospitals, their importance is expected to rise.

Pharmaceutical Companies

Pharmaceutical Companies contribute to the Global Blood Bank Market primarily through research and development of therapies that often require blood products for clinical trials and treatments. The increase in the production of biopharmaceuticals and innovative therapies utilizing components derived from blood, such as clotting factors for hemophilia or monoclonal antibodies, also drives demand. However, their reliance on blood banks is more peripheral compared to hospitals. The direct usage of blood products may not be as prevalent as in hospitals and ASCs, positioning pharmaceutical companies as a supporting yet crucial part of the ecosystem surrounding blood utilization.

Clinics and Nursing Homes

Clinics and Nursing Homes serve a unique of the healthcare landscape, primarily focusing on routine patient care and assisted living. Their need for blood products often arises in the context of chronic condition management and routine procedures, making the volumes smaller in comparison to hospitals or ASCs. While clinics may occasionally require blood for transfusions or specific treatments, it is not a primary function of these facilities. Nursing homes, on the other hand, may need blood for elderly patients with complex health issues, but the demand remains more limited and specific in nature. Hence, their overall impact on the blood bank market is comparatively lower.

Others

The "Others" category includes a variety of healthcare settings such as rehabilitation centers, home healthcare services, and specialized medical facilities. Generally, these institutions may have sporadic needs for blood products, focusing mainly on specific patient populations or treatments. The demand for blood from these facilities often depends on the type of services they provide, such as post-operative care or management of chronic illnesses. Given that their blood-related needs are less frequent and typically less substantial than those of hospitals, they contribute only a minor share to the overall market for blood banking.

Global Blood Bank Market Regional Insights:

North America

North America is poised to dominate the Global Blood Bank market, primarily due to its advanced healthcare infrastructure, significant investment in research and development, and a strong emphasis on blood safety regulations. The presence of major blood donation organizations and institutions, such as the American Red Cross, enhances blood collection and distribution efficiencies. Additionally, the growing awareness and initiatives around voluntary blood donation, coupled with innovations in blood screening technologies, further solidify North America's leadership position. The increasing incidence of chronic diseases requiring blood transfusions also contributes to the region's growing demand for blood bank services, making it the most prominent market on a global scale.

Asia Pacific

The Asia Pacific region is experiencing substantial growth in the Global Blood Bank market, driven by the rising population and increasing healthcare needs. Countries like India and China are witnessing a surge in demand for blood transfusions due to higher rates of accidents and various medical conditions requiring blood. Government initiatives aimed at enhancing healthcare services and blood donation awareness campaigns are also boosting market development. However, challenges such as underdeveloped blood bank infrastructures in certain areas can hinder its full potential despite the overall growth trajectory in the region.

Europe

Europe holds a significant share of the Global Blood Bank market, characterized by a well-established healthcare system and strong regulatory frameworks ensuring blood safety. The European Blood Alliance promotes voluntary blood donation, which remains the primary source of blood collections. However, the market is experiencing stagnation in some areas due to strict regulations and the aging population, which may reduce the donor pool in the long run. Innovations and collaborations among European countries are expected to enhance operational efficiencies in blood collection and processing, creating opportunities for market growth.

Latin America

Latin America is gradually emerging in the Global Blood Bank market, driven by increasing awareness of the importance of blood donations. However, the market faces challenges such as inadequate infrastructure and reliance on voluntary donations, which can sometimes fall short of demand. Government policies are evolving to promote safe blood practices and ensure accessibility to blood products, but disparities among different countries may hinder uniform growth. Continuous education and campaigns to increase donor involvement are crucial for enhancing this market 's growth potential.

Middle East & Africa

The Middle East & Africa region shows growth potential in the Global Blood Bank market, primarily due to rising healthcare expenditure and public health initiatives aimed at promoting blood donations. However, significant challenges persist, including limited access to healthcare facilities and a lack of awareness regarding voluntary blood donation. Many countries within this region are making efforts to improve blood bank services through international collaborations and investments from non-governmental organizations. Although it remains among the smaller markets compared to others, there is potential for substantial growth driven by improving healthcare systems and increasing healthcare access in underserved areas.

Blood Bank Competitive Landscape:

Central figures in the worldwide blood bank sector—comprising blood collection organizations, diagnostic equipment manufacturers, and software developers—are integral to optimizing blood donation procedures. They focus on ensuring safety and adherence to regulations, while also advancing inventory management through innovative technologies. Their partnerships enhance the efficiency of blood supply networks and bolster healthcare systems in addressing patient requirements.

Major participants in the blood bank sector consist of the American Red Cross, Cardinal Health, Terumo Corporation, Haemonetics Corporation, Grifols S.A., Roche Holding AG, Baxter International Inc., BloodCenter of Wisconsin, Fresenius Kabi AG, Macopharma, Samsung Biologics, and Iron Mountain Incorporated. Furthermore, firms such as Vitalant, Biomedica, Octapharma AG, and Everlife play a crucial role in this field. Additional influential entities include Cerus Corporation, HemaQuest Pharmaceuticals, LFB S.A., and Sysmex Corporation, all of which are instrumental in driving progress in blood donation, processing, and testing technologies.

Global Blood Bank COVID-19 Impact and Market Status:

The Covid-19 pandemic profoundly affected the Global Blood Bank sector, resulting in a decline in blood donations as a consequence of increased health anxieties and imposed lockdown restrictions, which in turn created severe shortages of blood supplies.

The COVID-19 pandemic profoundly impacted the blood bank industry, presenting a range of challenges and prompting necessary adaptations. At the onset, the implementation of lockdowns and social distancing measures led to a marked decrease in blood donations, as many routine collection events were canceled or rescheduled. This drop precipitated critical shortages, hindering hospitals' capacities to carry out vital surgeries and provide care to patients requiring transfusions. On the other hand, the crisis drove significant innovations in blood collection and testing methods, as blood banks established rigorous safety protocols to safeguard both donors and staff. There was also a notable shift towards mobile blood donation units and virtual outreach strategies to stimulate donor participation. Additionally, the ened demand for convalescent plasma therapy for COVID-19 patients opened new pathways for blood banks, steering their operational priorities. In summary, although the pandemic created substantial disruptions within the sector, it also catalyzed advancements that could yield long-term benefits for the blood bank market.

Latest Trends and Innovation in The Global Blood Bank Market:

- In October 2023, Terumo Corporation announced the acquisition of the U.S. company, KTO Inc., enhancing its capabilities in blood component separation technologies and expanding its product portfolio in the blood bank market.

- In September 2023, Grifols SA launched a new automated blood typing system called Grifols Erytra for blood banks, aimed at improving accuracy and efficiency in blood typing processes.

- In June 2023, Fresenius Kabi acquired BloodCenter of Wisconsin, significantly increasing its footprint in the North American blood market while enhancing its operational synergies and supply chain management.

- In April 2023, Bio-Rad Laboratories introduced a new quality control product for blood banking labs called Bio-Rad QC Manager, designed to streamline the quality assurance process and ensure regulatory compliance.

- In March 2023, Abbott Laboratories expanded its blood screening capabilities by acquiring Alere Inc., focusing on enhancing diagnostic services and technologies available to blood banks, thus improving patient safety.

- In February 2023, Cerus Corporation received FDA approval for its INTERCEPT Blood System for platelets, paving the way for increased market presence and evolving pathogen reduction processes in blood transfusion practices.

- In January 2023, Roche Diagnostics launched new blood screening assays, which utilize next-generation sequencing technology to improve the detection of transfusion-transmissible infections.

- In December 2022, Siemens Healthineers announced a partnership with the Australian Red Cross Lifeblood program to develop advanced diagnostics and technology solutions aimed at optimizing blood collection and inventory management.

- In November 2022, Hemocue, a part of the Radiometer group, unveiled its new portable hemoglobin analyzer to facilitate on-site testing for blood banks, thereby enhancing access to blood donation and transfusion services.

- In October 2022, the International Society of Blood Transfusion (ISBT) held its annual congress, focusing on emerging technologies and global collaborations in blood banking, showcasing significant advancements in the sector.

Blood Bank Market Growth Factors:

Significant drivers of expansion in the blood bank industry encompass a rising need for blood transfusions, innovations in blood collection methods, and demographic growth contributing to an uptick in chronic disease prevalence.

The Blood Bank sector is witnessing substantial expansion, influenced by several critical elements. To begin with, the rise in trauma incidents, surgical procedures, and urgent medical situations has created a pressing need for a reliable blood supply for transfusions, leading to ened demand for blood banking services. Moreover, increased public awareness regarding the significance of voluntary blood donations, spurred by health campaigns, has resulted in greater donor engagement, thereby strengthening the blood supply chain.

Innovations in blood storage, processing, and testing technologies—such as automated systems and advanced preservation methods—have been instrumental in boosting operational efficiency and broadening the functionalities of blood banks. In addition, the rising incidence of chronic illnesses, including cancer and hemophilia, which frequently require blood product treatments, further accelerates the market’s growth.

Support from regulatory agencies, aimed at ensuring safe and accessible blood services, also drives market development by imposing rigorous standards on blood collection and transfusion methods. Furthermore, the surge in healthcare spending and investments in medical infrastructure, especially in developing regions, enhances the growth potential of blood banks. Collectively, these factors highlight the essential role that blood banks fulfill within healthcare systems, propelling the industry's advancement.

Blood Bank Market Restaining Factors:

The blood bank sector faces several significant challenges, such as regulatory hurdles, a shortage of willing donors, and strict storage protocols.

The Blood Bank Market is confronted with various obstacles that could impede its expansion and effectiveness. A primary challenge is the rigorous regulatory landscape surrounding blood collection, testing, and preservation, which can escalate operational expenses and complicate compliance efforts. Furthermore, concerns regarding bloodborne pathogens and contamination jeopardize both donor safety and the quality of blood products, often leading to a decline in donor participation. Misunderstandings and a lack of awareness about blood donation within certain population groups also result in insufficient supply levels, while logistical challenges related to the transportation and storage of blood further complicate operations. In addition, the increasing popularity of alternative treatments, such as blood substitutes, presents a competitive challenge to conventional blood banking practices. Financial limitations may restrict investment in essential upgrades, technology, and infrastructure, all crucial for enhancing services and increasing outreach. Nevertheless, the Blood Bank Market is progressively evolving, leveraging technological advancements, improving public awareness, and building partnerships with healthcare institutions. This strategic approach positions the market favorably for a promising future, spurred by a growing demand for high-quality blood products and innovative donor engagement strategies.

Key Segments of the Blood Bank Market

By Product Type

• Whole Blood

• Red Blood Cells

• Platelet

• Plasma

• White Blood Cells

By Bank Type

• Private

• Public

By Function

• Collection

• Processing

• Testing

• Storage

• Transportation

By End User

• Hospital

• Ambulatory Surgery Centers

• Pharmaceutical Companies

• Clinics and Nursing Homes

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America