Market Analysis and Insights:

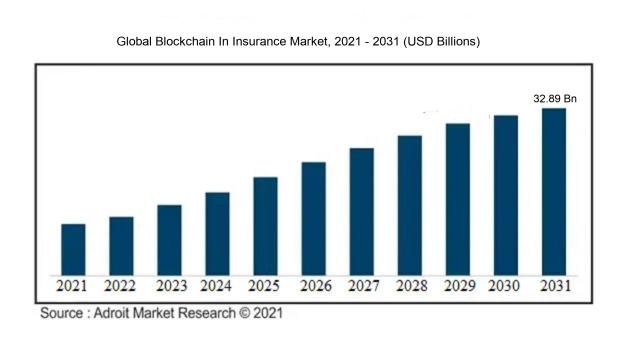

The market for Global Blockchain In Insurance Market was estimated to be worth USD 496.85 million in 2021, and from 2022 to 2030, it is anticipated to grow at a CAGR of 52.43%, with an expected value of USD 32.89 billion in 2031.

The expansion of the Blockchain in Insurance Market is being fueled by various pivotal factors. Initially, this technology offers ened efficiency and transparency, enabling streamlined processes and decreased potential for fraudulent activities. This aspect is particularly attractive to insurance companies, allowing them to reap the benefits of cutting out middlemen and automating claims and underwriting procedures. Moreover, through digitally verifying and encrypting transactions and data, blockchain offers ened security, thereby minimizing the vulnerability to cyberattacks. Furthermore, the decentralized nature of blockchain permits improved data management and sharing, empowering insurers to tap into a more inclusive and reliable information network. Consequently, this facilitates enhanced risk evaluation and pricing strategies, leading to the formulation of more precise policies and coverage choices. Lastly, the insurance industry's increasing digitalization and the escalating demand for personalized and on-demand services are steering the uptake of blockchain technology, as it enables the provision of more effective and customer-centric solutions. In essence, these forces are driving the growth of the Blockchain in Insurance Market, as the industry aims to capitalize on the advantages offered by this cutting-edge technology.

Blockchain In Insurance Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2031 |

| Study Period | 2018-2031 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2031 | USD 32.89 billion |

| Growth Rate | CAGR of 52.43% during 2022-2031 |

| Segment Covered | By Provider, By Provider, By Application, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | IBM Corporation, Accenture PLC, Amazon Web Services, Oracle Corporation, Microsoft Corporation, SAP SE, Capgemini, Deloitte Touche Tohmatsu Limited, Bitfury Group Limited, and BTL Group Ltd. |

Market Definition

The integration of distributed ledger technology, known as blockchain, within the insurance sector aims to improve transparency, security, and operational efficiency by revolutionizing key processes like policy issuance, claims settlement, and customer information verification. This technology ensures secure and unalterable record-keeping, facilitates instantaneous data exchange between multiple stakeholders, and enables the execution of automated smart contracts. Ultimately, these advancements contribute to a decrease in fraudulent activities, smoother operations, and an enhanced level of service for customers.

The significance of Blockchain in the insurance sector lies in its ability to deliver multiple advantages. To begin with, blockchain technology fosters transparency through a decentralized and unchangeable record that grants access to insurers, clients, and various stakeholders for data verification, thereby enhancing trust levels and mitigating fraud risks. Furthermore, the utilization of smart contracts streamlines insurance procedures such as policy issuance and claims resolutions, resulting in swifter and more effective transactions. Moreover, blockchain facilitates secure and immediate data sharing, empowering insurers to acquire precise and timely information for improved underwriting and risk evaluation. Lastly, integrating blockchain in the insurance realm contributes to the optimization of back-office operations, diminished paperwork, and decreased administrative expenses.

Key Market Segmentation:

Insights On Key Provider

Infrastructure and Protocols Provider

Infrastructure and Protocols Provider is expected to dominate the Global Blockchain In Insurance Market. As blockchain technology relies on a robust and secure infrastructure, the demand for infrastructure and protocols providers is expected to be significant. These providers offer the necessary tools, networks, and protocols required for the smooth functioning of blockchain applications in the insurance industry. With their expertise in developing and maintaining scalable and secure infrastructure, they play a crucial role in enabling the adoption of blockchain technology in insurance. The dominance of Infrastructure and Protocols Provider part can be attributed to their ability to address the industry's need for reliable and secure infrastructure solutions for blockchain implementation.

Application and Solution Provider

Application and Solution Provider is an important component of the Global Blockchain In Insurance Market. These providers develop and offer blockchain-based applications and solutions tailored to the needs of the insurance industry. They focus on providing user-friendly interfaces and functionalities that enhance operational efficiency, streamline processes, and facilitate communication and collaboration among insurance participants. With their wide range of application offerings, Application and Solution Providers contribute to the growth and adoption of blockchain technology in the insurance market. However, compared to the dominating Infrastructure and Protocols Provider part, their market share may be relatively lower as infrastructure and protocol requirements take precedence in the initial stages of blockchain implementation.

Middleware Provider

The Middleware Provider part serves as an intermediary between the Infrastructure and Protocols Providers and the Application and Solution Providers in the Global Blockchain In Insurance Market. These providers offer middleware solutions that enable seamless integration and interoperability between different blockchain platforms and applications. By bridging the communication gap between infrastructure and applications, Middleware Providers ensure the smooth functioning and compatibility of blockchain systems. While their role is vital for the overall ecosystem, their market dominance may be lower compared to the Infrastructure and Protocols Provider part due to the focus on foundational infrastructure requirements and the application-specific needs addressed by other parts.

Insights On Key Enterprise Type

Large Enterprises

It is expected that Large Enterprises will dominate the Global Blockchain In Insurance Market. Large enterprises typically have more financial resources, established infrastructure, and extensive networks, which provide them with a competitive advantage in implementing blockchain technology in the insurance industry. These companies can afford the necessary investments and expertise required to develop and deploy blockchain solutions effectively. Furthermore, large enterprises often have existing partnerships and collaborations with other industry players, which can facilitate the adoption of blockchain in insurance. The size and influence of large enterprises enable them to drive the market and play a significant role in shaping the future of blockchain in the insurance sector.

SMEs

Small and Medium-sized Enterprises (SMEs) hold a substantial potential for growth and innovation within the Global Blockchain In Insurance Market. While SMEs may not dominate the market in terms of overall market share, their agility, flexibility, and ability to adapt quickly to changing market dynamics can lead to significant advancements in the sector. SMEs often specialize in niche areas and can provide customized blockchain solutions that cater to specific insurance requirements. This targeted approach can be highly valuable to certain s of the insurance market and offer unique value propositions. As blockchain technology continues to mature, SMEs have the opportunity to leverage their innovative spirit and out-of-the-box thinking to establish themselves as key players and disruptors within the industry.

Insights On Key Application

GRC Management

GRC Management is expected to dominate the Global Blockchain in Insurance market. GRC Management, which stands for Governance, Risk, and Compliance Management, focuses on ensuring regulatory compliance and managing risk within the insurance industry. With the implementation of blockchain technology, GRC Management can benefit from increased transparency, streamlined processes, and improved data security. As the insurance sector continues to prioritize regulatory compliance and risk management, the adoption of blockchain in GRC Management is poised to drive its dominance in the global market.

Claims Management

Claims Management is another significant part within the Application category of the Global Blockchain in Insurance Market. Efficient claims processing is crucial for insurance companies to maintain customer satisfaction and enhance operational efficiency. By leveraging blockchain technology, claims management can be significantly improved with automated and transparent processes, faster settlements, and reduced fraud. Although Claims Management is an essential aspect of the insurance industry, its dominance in the global market may not surpass that of GRC Management due to the broader industry focus on risk management and compliance.

GRC Identity Management and Fraud Detection

GRC Identity Management and Fraud Detection is another application of the Global Blockchain in Insurance Market. This part pertains to leveraging blockchain technology to enhance identity management and detect fraudulent activities within the insurance industry. By storing and verifying customer information securely on the blockchain, GRC Identity Management can mitigate identity theft and improve customer trust. Additionally, blockchain's immutability and transparency can aid in fraud detection and prevention. While GRC Identity Management and Fraud Detection is a crucial aspect of the insurance industry, its dominance may not surpass that of Claims Management or GRC Management, as risk management and compliance remain top priorities.

Payments

Payments focuses on leveraging blockchain technology to enhance payment processes within the insurance industry. By utilizing blockchain's decentralized nature, payments can become more secure, efficient, and cost-effective. However, while blockchain has the potential to disrupt traditional payment systems, this part may not dominate the global market as prominently as GRC Management, Claims Management, or GRC Identity Management and Fraud Detection, as these areas are more central to the core operations of the insurance industry.

Smart Contracts

Smart contracts utilize blockchain technology to automate contract execution, enforcement, and fulfillment processes in the insurance industry. By applying self-executing and tamper-proof digital contracts, insurers can streamline claims processing, reduce administrative costs, and increase trust between parties. However, similar to the Payments part, Smart Contracts may not dominate the global market as significantly as GRC Management, Claims Management, or GRC Identity Management and Fraud Detection, as these areas address broader industry challenges related to compliance, risk management, and fraud prevention.

Others (Customer Communication etc.)

The Other includes various applications, such as customer communication, that are not specifically categorized under GRC Management, Claims Management, GRC Identity Management and Fraud Detection, Payments, or Smart Contracts. While these applications play a crucial role in enhancing the customer experience and improving operational efficiency, their dominance in the global market may be relatively limited compared to other parts. The adoption and impact of blockchain in these areas may vary depending on the specific needs and priorities of insurance companies, with a greater focus on GRC Management and risk-related applications.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global Blockchain In Insurance Market market. Europe has been at the forefront of technological advancements and has a robust financial services sector. The region has witnessed significant adoption of blockchain technology in various industries, including the insurance sector. European countries such as the United Kingdom, Germany, and Switzerland have shown a strong interest in implementing blockchain in insurance processes to enhance efficiency, transparency, and security. The European market is also characterized by the presence of major insurance companies and the availability of advanced infrastructure to support blockchain implementation. Additionally, the regulatory environment in Europe is relatively favorable towards blockchain technology, fostering innovation and driving the adoption of blockchain in insurance. Therefore, Europe is likely to dominate the global blockchain in insurance market.

North America

North America is one of the major regions driving the adoption of blockchain technology in the insurance sector. The region has a well-established insurance industry and a high level of technological advancements. The United States, in particular, has witnessed several initiatives and investments in blockchain technology by insurance companies. The presence of major insurance players, such as Lloyd's of London, and technological hubs like Silicon Valley, contribute to the growth of blockchain in insurance in North America. However, despite these developments, Europe is expected to dominate the global blockchain in insurance market due to its advanced infrastructure, regulatory environment, and early adoption of blockchain technology.

Asia Pacific

Asia Pacific is a region with immense potential for the adoption of blockchain in insurance. Countries like China, Singapore, and India are witnessing significant traction in blockchain technology in various sectors. In the insurance industry, blockchain can help address challenges such as fraud prevention, streamlining claims processes, and improving customer trust. However, the Asia Pacific region is still in the early stages of blockchain adoption in insurance compared to Europe. The regulatory landscape varies across different countries, which may hinder the widespread adoption of blockchain in the region. Therefore, while Asia Pacific has promising growth opportunities for blockchain in insurance, it is not expected to dominate the global market at present.

Latin America

Latin America is slowly embracing blockchain technology in the insurance sector. Countries like Brazil, Mexico, and Argentina are exploring the potential of blockchain to enhance operational efficiency and reduce fraud in the insurance industry. However, the region faces challenges such as limited technological infrastructure and regulatory barriers that may impede the widespread adoption of blockchain in insurance. As a result, Latin America is not likely to dominate the global blockchain in insurance market in the near future.

Middle East & Africa

The Middle East & Africa region is gradually adopting blockchain technology in the insurance sector. Countries like the United Arab Emirates and South Africa have shown interest in leveraging blockchain for insurance processes.

Blockchain can help improve efficiency, reduce fraud, and enhance customer experience in the insurance industry of the region. However, the pace of blockchain adoption in the Middle East & Africa is relatively slower compared to other regions like Europe and North America. Factors such as limited awareness and resources, regulatory constraints, and fragmented markets may hinder the widespread adoption of blockchain in the insurance sector. Therefore, the Middle East & Africa is not likely to dominate the global blockchain in insurance market in the foreseeable future.

Company Profiles:

Primary individuals within the worldwide insurance sector who are critical influencers in advancing innovation and acceptance of blockchain technology are pivotal in delivering blockchain-based solutions that optimize the effectiveness, visibility, and protection of insurance operations, ultimately offering advantages to insurers and clients alike.

Leading companies in the Insurance Industry's Blockchain sector include IBM Corporation, Accenture PLC, Amazon Web Services, Oracle Corporation, Microsoft Corporation, SAP SE, Capgemini, Deloitte Touche Tohmatsu Limited, Bitfury Group Limited, and BTL Group Ltd.

COVID-19 Impact and Market Status:

The significant influence of the Covid-19 pandemic on the worldwide insurance sector's utilization of blockchain technology has resulted in a notable rise in its adoption. This surge is driven by the need for improved transparency, security, and operational efficiency within insurance processes.

The global upheaval caused by the COVID-19 pandemic has had far-reaching implications across multiple industries, including the insurance sector's integration of blockchain technology. The crisis has underscored the necessity for digital modernization and the incorporation of blockchain solutions, as conventional operations faced obstacles amidst lockdowns and social distancing measures. Consequently, there is a projected rise in the adoption of blockchain in insurance as organizations aim to capitalize on its advantages, such as enhanced transparency, operational efficiency, and data security. Moreover, the pandemic has accentuated the deficiencies and susceptibilities within current insurance frameworks, with issues like delayed claims processing and fraud becoming more pronounced. In this context, blockchain technology in insurance can present remedies that streamline procedures, cultivate trust among involved parties, and diminish instances of fraudulent activities. Nonetheless, challenges persist within the market, manifested through financial constraints due to the economic downturn triggered by the pandemic, leading to reduced investment capabilities for numerous insurance entities. Furthermore, uncertainties surrounding regulatory frameworks concerning blockchain pose obstacles to its widespread implementation in the insurance domain. Despite these hurdles, the mounting acknowledgment of blockchain's potential benefits in insurance is expected to propel the market towards recovery and sustained growth in the aftermath of the pandemic.

Latest Trends and Innovation:

- In July 2021, LumenLab, MetLife's innovation center in Asia, partnered with Kyobo Life Insurance to develop a blockchain-powered insurance solution to simplify and enhance the customer claim experience.

- In June 2021, IBM announced its collaboration with European insurance company Aon and insurance broker Standard Chartered to launch a blockchain-based platform called "SmartClaim." The platform aims to improve efficiency in the claims process by securely sharing relevant information across different parties.

- In March 2021, Allianz launched a blockchain-based solution to streamline the process of issuing insurance guarantees for its corporate clients. The solution, called "Allianz Blockchain Shield," enables secure and transparent transactions for guarantee issuance and management.

- In January 2021, Insurwave, a joint venture between EY, Maersk, ACORD, and Microsoft, announced the successful completion of its global marine insurance blockchain platform. The platform offers enhanced transparency, efficiency, and security for the insurance industry.

- In December 2020, B3i Services AG, a consortium of insurers and reinsurers, completed a successful trial of its blockchain-based Catastrophe Excess of Loss (Cat XL) reinsurance solution. The platform aims to simplify and expedite the placement and administration of Cat XL reinsurance contracts.

- In November 2020, Rakuten Inc., one of the largest e-commerce companies in Japan, partnered with MS&AD Insurance Group, one of the country's largest insurers, to launch a blockchain-based platform for automobile insurance claims. The platform aims to automate and streamline the claims settlement process.

- In September 2020, ZhongAn Online P&C Insurance Co., Ltd., a leading online insurer in China, introduced a blockchain-based platform called "E-Surety" for the insurance industry. The platform enables real-time data sharing, fraud prevention, and enhanced customer trust.

- In August 2020, AXA XL, a subsidiary of insurance giant AXA, partnered with Accenture and other industry participants to launch a blockchain-based platform for streamlining the aviation insurance placement process. The platform, called "Insurwave Aviation," aims to enhance transparency, efficiency, and trust among stakeholders.

- In July 2020, R3, a leading provider of blockchain technology, announced its partnership with SBI Insurance, a subsidiary of SBI Holdings, to develop a blockchain-based platform for the insurance industry in Japan. The platform aims to streamline processes, reduce costs, and enhance customer experience.

- In May 2020, Swiss Re, one of the world's largest reinsurers, successfully piloted a blockchain-based solution for managing insurance-linked securities (ILS). The solution, built on the Swiss Re's "Blockchain for ILS" platform, aims to enhance transparency and efficiency in the ILS market.

Significant Growth Factors:

The expansion of the insurance sector's Blockchain Market is fueled by the rising need for transparency, enhanced operational efficiency, and ened security within insurance processes.

The expansion of the Blockchain In Insurance Market in recent years can be attributed to several factors. A significant driver is the escalating demand for enhanced data transparency and security across the insurance sector.

Blockchain technology serves as a decentralized and immutable ledger, fostering trust and eliminating the reliance on intermediaries. This not only boosts efficiency but also reduces costs within the insurance value chain, encompassing underwriting, claims settlement, and fraud prevention. Another catalyst for this growth is the rising integration of smart contracts in insurance processes. Through automating policy administration and claims handling, smart contracts enhance precision, swiftness, and diminish administrative expenses. Furthermore, blockchain facilitates improved data sharing among insurers, reinsurers, and other industry participants, leading to enhanced risk evaluation, fraud identification, and collaborative opportunities within the market. The technology also streamlines the incorporation of emerging insurtech solutions like IoT, AI, and big data analytics, promoting the development of innovative insurance products and customized customer interactions. Regulatory initiatives, such as the EU's Blockchain Observatory and Forum's emphasis on blockchain's potential in insurance, are instrumental in propelling market advancement. Nonetheless, challenges such as scalability, interoperability, and regulatory apprehensions concerning data confidentiality and safeguarding persist as hurdles. Despite these obstacles, the trajectory of the blockchain in insurance market is poised for sustained growth, given its transformative capabilities in revolutionizing the insurance sector.

Restraining Factors:

The gradual development of regulatory structures and the ongoing issues surrounding data privacy and security are presenting challenges within the Blockchain in the Insurance Market.

The emergence of Blockchain technology in the insurance sector has drawn considerable interest for its potential to transform the industry. However, various obstacles must be taken into account. One key challenge is the absence of an established regulatory framework and standardization for blockchain technology, causing uncertainty and reservations among insurance providers. Additionally, integrating blockchain into existing insurance systems is a complex task that demands advanced technical capabilities and significant financial investment. Moreover, issues related to the compatibility of different blockchain platforms can impede the smooth interaction among various participants in the insurance value chain. Concerns over data privacy and security also loom large due to the unalterable nature of blockchain, potentially giving rise to legal and ethical dilemmas. Furthermore, the traditional resistance to change within the insurance sector presents a barrier to the adoption of blockchain technology. Despite these challenges, the possibilities for enhancing transparency, efficiency, fraud prevention, and simplifying claims procedures through blockchain in insurance are extensive. Overcoming these obstacles as technology advances will empower the insurance industry to fully leverage the potential of blockchain, fostering a more secure, effective, and customer-focused environment

Key Segments of the Blockchain In Insurance Market

Provider Overview

• Application and Solution Provider

• Middleware Provider

• Infrastructure and Protocols Provider

Enterprise Type Overview

• SMEs (Small and Medium Enterprises)

• Large Enterprises

Application Overview

• GRC Management

• Claims Management

• GRC Identity Management and Fraud Detection

• Payments

• Smart Contracts

• Others (Customer Communication etc.)

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America