Blockchain In Energy Market Analysis and Insights:

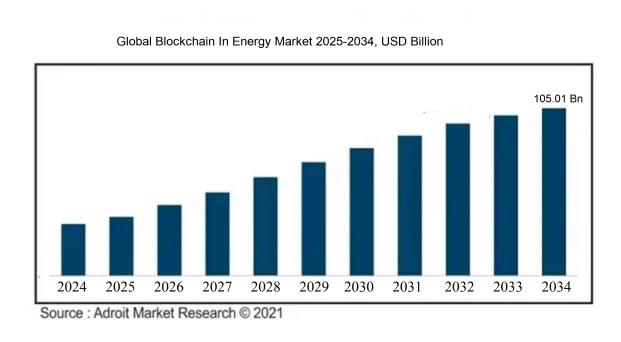

The worldwide blockchain in energy market was predicted to be worth USD 4.02 billion in 2024 and is projected to reach USD 105.01 billion by 2034, growing at a compound annual growth rate (CAGR) of 44.10% from 2025 to 2034.

The energy market's evolution towards blockchain technology is primarily fueled by the escalating need for decentralized energy frameworks that offer improved transparency and efficiency in transactions. Heightened apprehensions regarding energy security, alongside the demand for a more resilient grid, further accelerate the implementation of blockchain solutions, which enable real-time data management and sharing. Additionally, governmental support for renewable energy adoption promotes advancements in trading platforms, fostering peer-to-peer exchanges and the use of smart contracts. The increasing reliance on renewable energy sources—such as solar and wind—calls for advanced energy management systems, where blockchain plays a crucial role in ensuring smooth integration and maintaining data integrity. Significant investments from both public and private sectors into sustainable energy projects also play a vital role in propelling market growth. Finally, ongoing technological innovations, paired with a rising focus on sustainability and reducing carbon emissions, act as key drivers for incorporating blockchain technologies in the energy domain.

Blockchain In Energy Market Definition

Blockchain technology in the energy sector involves utilizing decentralized ledger systems to improve the clarity, security, and efficiency of energy-related transactions and data handling. This approach allows for direct trading of energy between individuals and supports the incorporation of renewable energy sources by optimizing operations and minimizing the need for intermediaries.

The application of blockchain technology in the energy sector plays a vital role in improving transparency, efficiency, and security. It empowers decentralized transactions, enabling consumers to engage in direct buying and selling of energy, thereby nurturing peer-to-peer connections. This innovative technology is instrumental in managing distributed energy resources effectively, simplifying verification processes, and lowering operational expenses by automating transactions with smart contracts. Furthermore, blockchain aids in the tracking of renewable energy certificates, thereby supporting sustainability initiatives and adherence to regulations. In summary, the incorporation of blockchain within the energy industry is essential for enhancing resource management and facilitating the shift toward a more robust and sustainable energy framework.

Blockchain In Energy Market Segmental Analysis:

Insights On Type

Public

The Public is expected to dominate the Global Blockchain In Energy Market due to its ability to facilitate transparency and data sharing among multiple stakeholders, including utility companies, consumers, and regulators. Public blockchains can support decentralized energy trading, allowing for peer-to-peer transactions that can empower consumers and increase efficiency. The growing emphasis on renewable energy sources and the shift toward smart grid technologies also lend themselves to public blockchain applications. Through enhanced transparency, public blockchains help in mitigating risks related to fraud, manipulation, and inefficiencies, thereby driving adoption among key players in the energy sector.

Private

The Private has its unique advantages, particularly in maintaining data privacy and offering high transaction speeds which are essential for large corporations and energy providers. Organizations often prefer private blockchains for their controlled environments, where permissions are tightly regulated, enabling them to safeguard sensitive information. This setup is beneficial for established companies looking to integrate blockchain technology without exposing critical data to the public domain.

Insights On Form

Services

The Services category is expected to dominate the Global Blockchain in Energy Market due to its critical role in supporting the implementation, management, and optimization of blockchain technologies within the energy sector. As utilities and energy providers increasingly look to implement complex blockchain solutions, the demand for comprehensive service offerings—such as consulting, integration, and maintenance—grows. Services facilitate the customization and adaptability necessary for various energy providers, allowing them to leverage blockchain’s capabilities effectively. Furthermore, the demand for skilled professionals to help navigate regulatory compliance and facilitate secure transactions underscores the growing reliance on services, thus positioning this category at the forefront of the market.

Platform

The Platform is associated with the development of blockchain infrastructure that enables data management, transaction processing, and smart contract execution specific to the energy industry. While this area provides significant tech capabilities and tools, it largely relies on effective implementation support from service-oriented companies. The Platform contributes toward establishing foundational elements that, although innovatively crucial, require the services to fully unlock their potential. Therefore, while platforms play a vital role in energy sector transformation, they currently do not dominate as strongly as services in addressing immediate market needs.

Insights On Application

Energy Trading

Energy Trading is expected to dominate the Global Blockchain In Energy Market due to the increasing complexity and volatility of energy markets. The integration of blockchain technology enables more efficient transactions, ensuring better transparency and security, which are paramount in energy trading. Moreover, blockchain facilitates peer-to-peer trading and reduces transaction costs, attracting numerous entities. As regulatory pressure mounts for cleaner energy solutions, blockchain’s capability in tracking and verifying renewable energy transactions further solidifies its position. These advantages make a compelling case for energy trading as the leading application within the blockchain in the energy sector.

Grid Management

Grid Management is a crucial part of the Global Blockchain In Energy Market due to the rising need for more decentralized energy systems and smart grids. The integration of blockchain enables real-time data sharing, enhancing grid stability and efficiency. It allows for better management of decentralized energy resources, improving demand response and reducing outages. By streamlining operations and reducing the likelihood of fraud through transparent records, grid management stands to significantly benefit from blockchain applications.

Government Risk and Compliance Market

In the context of the Global Blockchain In Energy Market, the Government Risk and Compliance Market plays an important role in ensuring that energy providers adhere to regulations. Blockchain's immutable ledger technology provides a reliable way to enforce compliance with energy laws and monitor sustainability practices. By creating transparent and auditable trails, it helps both regulators and companies reduce their risks and ensure accountability. Additionally, it fosters trust among consumers, making government compliance an essential area for blockchain implementation.

Payment Schemes

Payment Schemes within the Global Blockchain In Energy Market are gaining traction, facilitating seamless and secure transactions among various stakeholders, including consumers, suppliers, and grid operators. Blockchain enables quicker settlement times and reduces transaction costs associated with traditional payment systems. The technology’s ability to provide a decentralized payment model also eliminates intermediaries, leading to more direct and efficient transactions. As the energy sector increasingly embraces digital solutions, innovative payment schemes supported by blockchain are expected to rise.

Supply Chain Management

Supply Chain Management is another important aspect of the Global Blockchain In Energy Market. Blockchain technology enhances the traceability and transparency of energy commodities throughout the supply chain. It allows participants to track the origin and movement of energy in real time, helping to prevent fraud and ensure that all supply chain operations comply with regulatory standards. Improved traceability can also contribute to sustainability efforts, allowing consumers to make informed choices. Therefore, as the energy sector evolves, the role of blockchain in supply chain management will continue to grow substantially.

Others

The remaining areas categorized as 'Others' in the Global Blockchain In Energy Market encompass a variety of applications, including various innovative use cases such as energy asset management, microgrid applications, and carbon credit trading. While these applications might not dominate the market like energy trading, they still present opportunities for growth, particularly in niches that focus on increasing efficiency or enhancing energy resource utilization. As companies and governments continue to explore the full spectrum of blockchain applications in energy, these various other domains can contribute significant value in addressing specific challenges in the energy sector.

Insights On End-use

Power

In the Global Blockchain in Energy Market, the power sector is expected to dominate significantly. This is primarily due to the increasing adoption of renewable energy sources, coupled with the need for greater efficiency and transparency in power trading and distribution. Blockchain technology provides a decentralized framework that enhances the tracking and management of energy consumption, thus promoting peer-to-peer energy trading models. Furthermore, regulatory bodies are increasingly advocating for smart grid innovations, making the integration of blockchain in power management a progressive solution. This crucial intersection of technology and sustainability makes power the leading end-use sector in the blockchain energy landscape.

Oil & Gas

The oil sector is evolving to incorporate advanced technologies such as blockchain for improved operational efficiencies and supply chain transparency. While it may not dominate the market, its contribution is undeniable as organizations look to minimize fraud, streamline processes, and reduce costs in their vast networks. Blockchain's ability to create immutable records is particularly valuable in ensuring compliance and tracking the logistics involved in oil transportation. The gradual integration of this technology signifies a positive shift, albeit slower than the more rapidly evolving power sector, indicating its increasing relevance in the energy market. In the gas industry, blockchain is beginning to carve out a niche. The technology is being explored to enhance data management and improve the trading process among various stakeholders, from producers and distributors to end consumers. Its potential for real-time tracking and custody transfers could lead to more efficient operations and lower costs. However, the gas sector is significantly overshadowed by advancements in the power sector regarding blockchain adoption. While it is a promising avenue, its impact is currently modest and developing compared to the revolutionary changes anticipated in power applications.

Global Blockchain In Energy Market Regional Insights:

North America

North America is expected to dominate the Global Blockchain in Energy market primarily due to its advanced technological infrastructure, significant investment in renewable energy, and robust regulatory frameworks supporting innovative solutions. Major players like IBM, Microsoft, and Accenture are focusing on blockchain applications for tracking renewable energy sources, enhancing grid security, and optimizing energy trading. The region exhibits a high level of collaboration between public and private sectors, promoting research and development initiatives that leverage blockchain technology. Additionally, the increasing demand for transparency in energy transactions and the exploration of smart contracts further drive the growth of blockchain adoption in this region.

Latin America

Latin America is witnessing a growing interest in blockchain technology, particularly in countries like Brazil and Mexico, where energy sectors are undergoing modernization. However, the development is relatively nascent compared to North America. The region’s potential lies in its vast renewable resources, which can benefit from blockchain solutions for efficient energy trading and grid management. Recent public-private partnerships indicate an increasing realization of blockchain’s value, yet it still faces challenges related to regulatory frameworks and the need for significant investment in technology.

Asia Pacific

Asia Pacific is rapidly emerging as a critical player in the blockchain in energy market, driven by countries such as China, Japan, and Australia. The increasing focus on sustainable energy and smart city initiatives here fosters innovation in leveraging blockchain for decentralizing energy distribution and improving energy management systems. However, the fragmentation in regulations and the varying levels of technological adoption across countries pose challenges. Despite this, the region's extensive investments in fintech and governmental support for renewable energy projects are paving the way for significant growth in blockchain applications within the energy sector.

Europe

Europe shows a strong commitment to sustainability and innovation, positioning itself as a potential competitor in the blockchain in energy market. With the European Union’s Green Deal promoting renewable energies, blockchain could play a key role in enhancing energy efficiency and transparency across member states. Countries like Germany and the Netherlands are leading blockchain initiatives for energy trading. However, market fragmentation due to different regulatory environments across countries hampers a unified approach, which may slow down the overall growth compared to North America.

Middle East & Africa

The Middle East and Africa present a mixed landscape for blockchain technology application in the energy sector. While the region possesses abundant natural resources, the adoption of blockchain is hindered by limited infrastructure and varying degrees of technological readiness. Nevertheless, countries like the UAE are exploring blockchain for various applications in energy, including smart grids and peer-to-peer energy trading. The potential exists but would require significant investment and policy alignment to realize the benefits effectively.

Blockchain In Energy Competitive Landscape:

Prominent entities within the Global Blockchain in Energy sector promote the adoption of decentralized technologies to improve transparency, security, and efficiency in energy exchanges. They foster innovation by forming strategic alliances, creating smart contracts, and advancing renewable energy initiatives.

Prominent participants in the Blockchain in Energy sector consist of Power Ledger, Siemens AG, IBM, EnergiMine, LO3 Energy, R3, WePower, Electrify.Asia, Grid+ Inc., SunContract, SolarCoin, VeChain, BTL Group, and ConsenSys.

Global Blockchain In Energy COVID-19 Impact and Market Status:

The Covid-19 pandemic hastened the integration of blockchain technology within the energy industry by underscoring the necessity for robust, transparent, and decentralized frameworks to oversee supply chains and improve the efficiency of energy transactions.

The COVID-19 pandemic has profoundly impacted the Blockchain in Energy sector, propelling a rapid transition to digital innovations and intensifying the emphasis on decentralized energy frameworks. As conventional operations encountered significant interruptions, industry players began to appreciate the potential of blockchain technology to optimize energy transactions, improve transparency, and bolster supply chain durability. The necessity for remote oversight and data sharing surged, leading to ened interest in blockchain's role in energy trading, renewable energy certificates, and peer-to-peer energy platforms. Furthermore, the crisis increased the urgency for sustainable energy initiatives, encouraging investments in clean technologies and the adoption of renewable energy sources. Although initial financial investments may have experienced a slowdown due to economic uncertainties, the long-term perspective shows a promising recovery pathway as energy firms progressively integrate blockchain to enhance operational efficiency, lower costs, and comply with increasing environmental regulations. Ultimately, the pandemic has served as a catalyst for innovation within this sphere, laying the groundwork for transformed energy markets in the aftermath of COVID-19.

Latest Trends and Innovation in The Global Blockchain In Energy Market:

- In April 2023, AES Corporation announced a strategic partnership with Google Cloud to leverage advanced artificial intelligence and blockchain technology to enhance energy management solutions, aiming to optimize energy distribution and sustainability efforts.

- In February 2023, E.ON along with the blockchain startup GridSingularity launched a blockchain-based solution aimed at enabling the optimization of energy supply and demand, supporting the energy transition in Europe.

- In January 2023, BP completed its acquisition of the blockchain-based energy trading platform, Voltus, to enhance its capabilities in digital electricity trading, thus taking significant steps toward its goals of digital transformation in the energy sector.

- In December 2022, Power Ledger successfully expanded its operations in Europe by partnering with China Southern Power Grid to develop a blockchain-enabled renewable energy trading platform, allowing for peer-to-peer trading capabilities.

- In September 2022, Chevron announced an investment in the blockchain startup, Everledger, to explore the use of blockchain technology in securing and tracking energy resources, particularly in the trading of renewable energy certificates.

- In July 2022, the International Renewable Energy Agency (IRENA) and the Blockchain Energy Solutions partnered to begin a pilot project utilizing blockchain for renewable energy certificate tracking, aimed at improving transparency in sustainability reporting.

- In June 2022, Siemens launched a new blockchain-based energy management system aimed at increasing transparency in the supply chain and improving efficiency in the management of renewable energy resources.

- In March 2023, Enel X launched its own blockchain platform for electric vehicle charging, allowing users to optimize charging times and costs while increasing the integration of renewable energy sources in transportation.

- In May 2023, Shell invested in the startup, LO3 Energy, which is focused on utilizing blockchain to establish decentralized energy networks, enabling communities to trade locally sourced renewable energy.

Blockchain In Energy Market Growth Factors:

The expansion of blockchain technology within the energy sector is propelled by a rising thirst for decentralized renewable energy options, greater transparency in transactions, and the necessity for more effective grid management and operational efficiency.

The energy market is witnessing remarkable expansion due to several pivotal drivers associated with blockchain technology. Primarily, there is a ened demand for greater transparency and efficiency in energy transactions, which spurs interest in blockchain as it offers secure and decentralized record-keeping solutions. Additionally, the increasing integration of renewable energy sources requires more advanced grid management and peer-to-peer trading options, both of which are supported by blockchain's unique capabilities.

Furthermore, the backing from regulatory frameworks and the continuous drive towards sustainability motivate energy firms to investigate innovative technologies aimed at improving operational efficiency and reducing expenses. The rise of smart meters and the Internet of Things (IoT) contributes to the generation of substantial data volumes, which can be systematically processed and analyzed using blockchain, leading to optimized energy distribution and monitoring of consumption patterns.

The surge in electric vehicle (EV) usage acts as another stimulating factor, as blockchain has the potential to streamline charging infrastructure and facilitate payment processes. Last but not least, collaborations among technology developers, energy providers, and governmental entities are essential for the creation of comprehensive blockchain solutions, fostering enhanced innovation and cooperative efforts in the industry. Together, these elements are cultivating a vigorous landscape for the proliferation of blockchain applications within the energy sector, promoting a transition towards more sustainable energy methodologies.

Blockchain In Energy Market Restaining Factors:

The primary obstacles hindering the adoption of blockchain technology in the energy sector consist of ambiguous regulatory frameworks, elevated costs associated with implementation, and difficulties related to scalability.

The energy sector's blockchain landscape is confronted with numerous challenges that impede its expansion and acceptance. A primary issue is the difficulty in scaling blockchain technology, as current platforms often falter under the substantial transaction demands characteristic of energy markets. Furthermore, uncertainty in regulations and the absence of uniform standards can obstruct new entrants, complicating partnerships between energy providers and blockchain innovators. The significant upfront investments required for deploying blockchain solutions can also dissuade energy firms, particularly smaller entities with constrained financial resources. Additionally, there exists a considerable knowledge deficit, as many participants in the energy industry are not well-versed in blockchain technology, raising doubts about its dependability and security. Finally, integrating blockchain with current energy systems presents technological challenges, as older infrastructures may struggle to adapt to this cutting-edge approach. However, the rising focus on sustainable energy initiatives and digital transformation by governmental bodies and private enterprises offers a promising avenue for the advancement of blockchain solutions. As an increasing number of stakeholders begin to recognize the advantages of improved efficiency and transparency, the outlook for blockchain in the energy sector appears optimistic, fostering innovative strategies and contributing to a more robust energy ecosystem.

Key Segments of the Blockchain In Energy Market

By Type:

- Private

- Public

By Form:

- Platform

- Services

By Application:

- Grid Management

- Energy Trading

- Government Risk and Compliance Market

- Payment Schemes

- Supply Chain Management

- Others

By End-use:

- Power

- Oil & Gas

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America