Market Analysis and Insights:

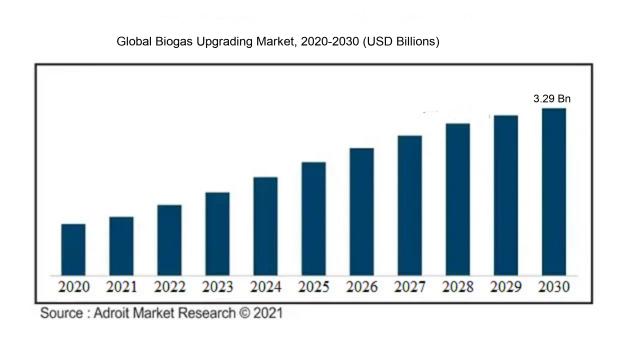

The market for Global Biogas Upgrading was estimated to be worth USD 1.28 billion in 2023, and from 2024 to 2030, it is anticipated to grow at a CAGR of 11.89%, with an expected value of USD 3.29 billion in 2030.

The biogas upgrading industry is influenced by various factors that are propelling its growth. Firstly, the global shift towards sustainable energy sources and the imperative to reduce carbon emissions are key drivers behind the increasing demand for biogas upgrading technologies.

Governments and institutions globally are introducing supportive policies and incentives to encourage the adoption of biogas as an eco-friendly alternative to traditional fossil fuels. Moreover, the rising energy requirements and the necessity for decentralized energy systems are further stimulating the expansion of the market. Biogas upgrading enables the production of biomethane, which can either be integrated into the existing natural gas infrastructure or utilized as a fuel for vehicles. Furthermore, continuous advancements and innovations in biogas upgrading methodologies have enhanced their efficiency and cost-effectiveness, thereby fostering market growth. Additionally, the escalating recognition of the advantages linked with biogas, including energy self-sufficiency, waste management, and ecological sustainability, is fostering a conducive atmosphere for the market's development. In essence, a convergence of supportive regulations, escalating energy needs, technological progress, and environmental consciousness stands out as the principal driving forces propelling the biogas upgrading market forward.

Biogas Upgrading Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 3.29 billion |

| Growth Rate | CAGR of 11.89% during 2024-2030 |

| Segment Covered | By Technology, By End-user, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Air Liquide, Ameresco, Inc., Carbotech, Clean Energy Fuels, EnviTec Biogas AG, Greenlane Renewables, Hitachi Zosen Inova, Pentair plc, PlanET Biogas Global GmbH, and Xebec Adsorption Inc. |

Market Definition

Biogas purification involves the refinement of unprocessed biogas originating from organic matter to improve its purity, eliminating contaminants, resulting in a clean gas ideal for a range of uses including heating, power generation, and potential integration into the existing natural gas infrastructure.

The enhancement of biogas holds significant importance for various reasons. Initially, it facilitates the transformation of biogas, a blend of methane and carbon dioxide, into biomethane, which is an extensively refined variant of methane. This refinement process eliminates impurities like CO2, water vapor, and minute pollutants, rendering biomethane suitable for injection into the natural gas network or for utilization as a fuel in vehicles. Through enhancing biogas, we can optimize its energy capacity while simultaneously diminishing the release of greenhouse gases. Additionally, this process enhances the adaptability and integration of biogas with current infrastructure, thereby encouraging its broader adoption as a sustainable energy source. Consequently, biogas enhancement plays a pivotal role in nurturing a sustainable and more environmentally friendly energy landscape.

Key Market Segmentation:

Insights On Key Technology

Pressure Swing Adsorption (PSA)

PSA technology is expected to dominate the Global Biogas Upgrading Market. PSA uses carbon molecular sieve adsorbents to selectively remove impurities such as CO2 and water vapor from biogas. This process is highly efficient and cost-effective, making it a preferred choice for biogas upgrading. PSA technology offers high purity levels, thus enabling the production of biomethane suitable for injection into the natural gas grid or other applications. Its robust performance and ability to handle varying biogas compositions make it a reliable solution for biogas upgrading.

Membrane

Membrane technology is another important player of the Biogas Upgrading Market. Membrane separation utilizes a selective permeation process to separate CO2 from biogas. While membrane technology offers advantages such as low energy consumption and compact system design, it may not achieve the same level of purity as PSA. Nevertheless, in specific applications where lower purity biomethane is acceptable, membrane technology can be a viable and cost-effective option.

Water Scrubber

Water scrubber technology involves using water as a scrubbing medium to remove impurities from biogas. It relies on the solubility of impurities in water and the mass transfer properties of the system. However, water scrubbing may not be as efficient as PSA or membrane technologies in terms of achieving high purity levels. It is commonly used in smaller-scale or decentralized biogas upgrading systems, where cost and simplicity are key considerations.

Chemical Scrubber

Chemical scrubbing is another player of the Biogas Upgrading Market that involves using a chemical solvent to absorb and remove impurities from biogas. Different solvents, such as amine solutions, are used to selectively target specific impurities like CO2. Chemical scrubbing can achieve high purity levels and is often used in larger-scale biogas upgrading facilities. However, this technology can be capital-intensive and requires careful handling of the chemical solvents.

Others

The Others category encompasses various emerging and niche technologies in biogas upgrading. These include technologies such as cryogenic upgrading, catalytic processes, and adsorption processes utilizing different materials. While these technologies show potential, they are currently less prevalent in the market due to factors such as higher costs, limited scalability, or technological limitations. However, ongoing research and development in this area may lead to advancements and wider adoption in the future.

Insights On Key End-user

Residential

The Residential end-user is expected to dominate the Global Biogas Upgrading Market. Biogas upgrading technologies have gained popularity in residential areas due to the increasing demand for renewable energy sources and the emphasis on reducing greenhouse gas emissions. Residential households, especially in developed countries, have been actively adopting biogas upgrading systems to produce clean biogas for various applications such as cooking, heating, and electricity generation. The Residential part is projected to dominate the market as more individuals recognize the environmental and economic benefits of biogas utilization in their homes. This trend is expected to continue with advancements in biogas upgrading technologies and government incentives for residential biogas projects.

Commercial

In the Global Biogas Upgrading Market, the Commercial end-user serves as a significant player. Commercial establishments, including hotels, restaurants, and institutions, are increasingly exploring biogas upgrading systems to meet their energy demands while reducing their carbon footprint. The commercial sector's growing demand for renewable energy sources and its ability to invest in advanced biogas upgrading technologies contribute to its dominance in the market. Commercial entities often have larger biogas production capacities and can utilize the upgraded biogas for various purposes, such as heating, power generation, and on-site consumption. Furthermore, the potential for cost savings in energy expenses and the positive brand image associated with sustainable practices drive the adoption of biogas upgrading systems in the Commercial part of the Global Biogas Upgrading Market.

Industrial

The Industrial end-user is also expected to hold a significant share in the Global Biogas Upgrading Market. Industries, particularly those in sectors such as manufacturing, food processing, and wastewater treatment, generate substantial amounts of biogas as a byproduct. Biogas upgrading systems offer these industries an opportunity to harness the renewable energy potential of biogas, leading to reduced reliance on fossil fuels and lower carbon emissions. The Industrial part dominates the market due to the large-scale biogas production capabilities of industries, allowing for the efficient utilization of upgraded biogas for heat and power generation, as well as feedstock for various industrial processes. The economic and environmental benefits associated with biogas utilization make the Industrial part a strong player in the Global Biogas Upgrading Market.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global Biogas Upgrading market. The region's dominance can be attributed to several factors. Firstly, Europe has a well-established and mature biogas industry, with many countries having implemented supportive policies and incentives for biogas production and upgrading. This has encouraged the development of biogas upgrading technologies and infrastructure across the region. Additionally, Europe has a strong focus on renewable energy and sustainability, with many countries actively working towards reducing their greenhouse gas emissions. Biogas upgrading plays a crucial role in achieving these targets by converting biogas into high-quality biomethane for injection into the natural gas grid or use as a transportation fuel. Moreover, Europe has a well-developed natural gas infrastructure, which facilitates the distribution and utilization of upgraded biogas. These factors position Europe as the dominating region in the Global Biogas Upgrading market.

Latin America

Latin America has immense potential for biogas upgrading due to significant agricultural activities and increasing recognition of the role of renewable energy in reducing greenhouse gas emissions. However, the region is still in the early stages of developing its biogas industry and upgrading infrastructure. Policy frameworks and incentives to promote biogas production and upgrading are needed to further drive market growth.

Asia Pacific

Asia Pacific is a region with diverse economies and varying levels of biogas utilization. Countries like China and India have substantial biogas potential due to their large agricultural sectors, but the market for biogas upgrading is still relatively nascent. Lack of supportive policies and adequate infrastructure are the key challenges hindering market growth in the region. However, increasing environmental concerns and the need for sustainable energy sources could drive the demand for biogas upgrading in the future.

North America

North America has a growing biogas industry, driven by increased focus on renewable energy and sustainability. The United States, in particular, has seen significant growth in the biogas sector, with several plants dedicated to biogas upgrading. However, the market is still in the early stages of development, and there is potential for further growth through favorable policies and government support.

Middle East & Africa

The Middle East & Africa region faces unique challenges and opportunities in the biogas upgrading market. While the region has substantial agricultural activities, the focus has mainly been on oil and gas production. Limited infrastructure and investment in renewable energy have hindered the growth of the biogas industry. However, increasing environmental concerns and the need for diversification of energy sources could drive the market for biogas upgrading in the future. Strong policy support and collaborations with international players can help unlock the region's biogas potential.

Company Profiles:

Prominent stakeholders within the worldwide Biogas Upgrading industry assume a critical function in advancing and executing effective biogas refinement technologies to guarantee the generation of premium-grade biomethane. Their efforts are instrumental in fostering market expansion through the delivery of inventive initiatives and facilitating the shift towards a sustainable energy landscape.

Leading companies in the Biogas Upgrading Market include Air Liquide, Ameresco, Inc., Carbotech, Clean Energy Fuels, EnviTec Biogas AG, Greenlane Renewables, Hitachi Zosen Inova, Pentair plc, PlanET Biogas Global GmbH, and Xebec Adsorption Inc. These organizations are actively involved in developing and enhancing biogas upgrading solutions, such as membrane separation, pressure swing adsorption, water scrubbing, and cryogenic technology. Leveraging their expertise and strong market presence, these industry leaders are driving the growth and advancement of the biogas upgrading sector, playing a pivotal role in the shift towards a sustainable energy landscape.

COVID-19 Impact and Market Status:

The global biogas upgrading market has been significantly impacted by the Covid-19 pandemic, leading to temporary disturbances in supply chains and project implementation delays.

The global biogas upgrading market has been significantly influenced by the COVID-19 pandemic. Various countries imposed stringent lockdown measures to contain the virus spread, affecting multiple industries including the biogas sector. Challenges encountered by the market included disrupted supply chains, reduced access to raw materials, and project delays due to movement restrictions and limited workforce availability. Furthermore, the drop in energy demand led to decreased gas prices, making biogas upgrading projects less economically feasible. Nonetheless, the pandemic underscored the significance of renewable energy sources, prompting governments worldwide to introduce financial support packages for economic recovery, potentially benefiting the biogas upgrading market in the long run. Despite initial setbacks, the market is projected to slowly recover, fueled by a growing focus on sustainability and the shift towards a more environmentally friendly energy mix.

Latest Trends and Innovation:

- Air Liquide, a French multinational company, announced the acquisition of a majority stake in Cryo Pur, a biogas upgrading technology provider, in September 2021.

- Brightmark, an American waste solutions company, successfully completed a Series C funding round of $260 million in July 2021, with significant investments from Chevron and the European Bank for Reconstruction and Development (EBRD).

- DMT Clear Gas Solutions, a Dutch biogas upgrading technology supplier, partnered with Dane Creek Capital Corp in January 2021 to expand its presence in the North American market and accelerate its growth.

- Xebec Adsorption Inc., a Canadian provider of gas purification solutions, acquired HyGear, a Dutch gas generation and purification solutions company, in June 2021 to enhance its biogas upgrading capabilities.

- Greenlane Renewables, a Canadian biogas upgrading systems provider, signed a $5.8 million (CAD) contract with Renewable Natural Gas Company, an Australian energy company, in February 2021 to supply biogas upgrading equipment for a landfill gas to renewable natural gas project.

- EnviTec Biogas AG, a German biogas plant manufacturer, successfully commissioned a biogas upgrading plant in Conisbrough, UK, in March 2021, further expanding its international presence.

- VERBIO AG, a German biofuel and renewable natural gas producer, announced a partnership with EVO, a German energy supplier, in May 2021 to jointly invest in two biomethane plants in Germany.

- Greenlane Renewables, formerly known as Pressure Technologies, rebranded itself and changed its name in March 2021 to reflect its core focus on renewable energy solutions, including biogas upgrading.

Significant Growth Factors:

Factors driving the expansion of the Biogas Upgrading Market encompass the rising need for sustainable energy sources, governmental efforts to encourage biogas utilization, and the progression of biogas upgrading technologies.

The uptrend in the biogas upgrading sector can be attributed to various crucial factors. Firstly, the mounting focus on curbing greenhouse gas emissions and accomplishing sustainability objectives has spurred a rise in the demand for renewable energy sources. Biogas derived from organic waste emerges as a sustainable and eco-conscious substitute for conventional fuels. Secondly, global governmental regulations and policies are actively advocating for the integration of biogas upgrading technologies to diminish the dependence on fossil fuels and enhance air quality. Incentives like tax exemptions and subsidies are provided by administrations to incentivize the establishment and operation of biogas upgrading facilities. Thirdly, the progressions in biogas upgrading technologies have boosted the efficacy and cost-effectiveness of the process, rendering it more appealing for commercial and industrial usage. Spearheading technologies like membrane separation and pressure swing adsorption have ened the purity and quality of the refined biogas, amplifying its applicability in various sectors like power generation and transportation. Additionally, the expansion of the biogas sector has given rise to fresh employment opportunities and bolstered regional economic progress. The escalating cognizance among corporations and industries regarding the advantages of biogas upgrading, like diminished operational expenses and enhanced corporate social responsibility, is propelling the market's expansion. Collectively, the amalgamation of environmental imperatives, supportive governmental measures, technological innovations, economic advantages, and growing industry consciousness is propelling the robust expansion of the global biogas upgrading market.

Restraining Factors:

Challenges to the expansion of the biogas upgrading market include restricted infrastructure and substantial investment requirements.

The biogas upgrading industry has experienced notable growth in recent times due to the rising demand for sustainable energy sources and the increasing recognition of the importance of decreasing greenhouse gas emissions. However, several factors are impeding the market's expansion. The significant initial investments required for biogas upgrading facilities discourage potential investors. Furthermore, inadequate infrastructure for biogas storage and distribution limits the market's prospects for growth. The complex regulatory environment concerning feed-in tariffs and incentives for biogas producers creates ambiguity and impedes market progress. Moreover, the variability and reliability of biogas feedstock can unpredictably influence the efficiency and cost-efficiency of the upgrading process. Lastly, the lack of technological advancements and standardized upgrading approaches obstruct the scalability and commercial feasibility of the biogas upgrading sector. Despite these challenges, the biogas upgrading industry offers substantial potential for a sustainable and low-carbon energy landscape. Through ongoing research, technological advancements, and supportive regulations, these inhibiting factors can be surmounted, leading to a favorable outlook for biogas upgrading.

Key Segmentation:

Technology Overview

• Pressure Swing Adsorption (PSA)

• Membrane

• Water Scrubber

• Chemical Scrubber

• Others

End-User Overview

• Residential

• Commercial

• Industrial

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America