Market Analysis and Insights:

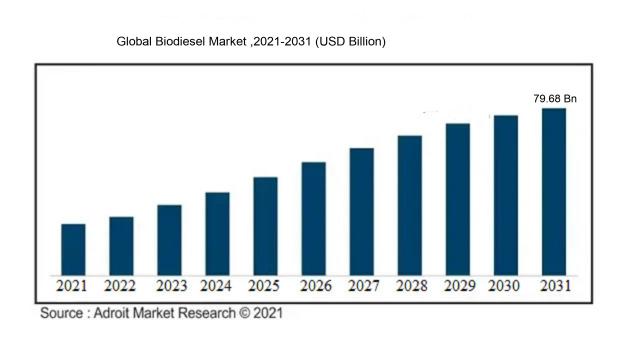

The market for Global Biodiesel was estimated to be worth USD 36.94 billion in 2022, and from 2023 to 2032, it is anticipated to grow at a CAGR of 8.23%, with an expected value of USD 79.68 billion in 2032.

The biodiesel industry experiences the influence of various significant drivers. Primarily, the escalating awareness regarding environmental sustainability and the imperative to diminish carbon emissions have triggered a rising interest in cleaner and sustainable energy sources. Biodiesel, sourced from bio-based materials like vegetable oils and animal fats, emerges as a feasible alternative to traditional diesel due to its lower emission of greenhouse gases and pollutants. Furthermore, governmental entities and regulatory authorities globally have implemented an array of incentives and regulations to bolster the adoption of biodiesel, including tax benefits, subsidies, and renewable energy standards. These measures are designed to foster biodiesel utilization, thereby fostering energy diversification and reducing reliance on non-renewable resources. The fluctuating trends in crude oil pricing and concerns regarding energy security have also driven the demand for biodiesel, perceived as a more stable and secure energy option. Moreover, advancements in biodiesel manufacturing technologies and the enhancement of supply chain networks have bolstered the availability and cost-efficiency of biodiesel, rendering it a compelling choice for environmentally-conscious consumers and industries aiming to mitigate their carbon footprint. Collectively, these driving forces underpin the expansion and advancement of the biodiesel sector, promising manifold economic, environmental, and societal advantages.

Biodiesel Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 79.68 billion |

| Growth Rate | CAGR of 8.23% during 2022-2032 |

| Segment Covered | By Blend, By Market , By Feedstock, By Application, By Region . |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Archer Daniels Midland Company, Wilmar International Ltd, Renewable Energy Group, Inc., Cargill, Inc., Louis Dreyfus Company BV, Ag Processing Inc, Neste Corporation, BIOX Corporation, TerraVia Holdings Inc, and Western Dubuque Biodiesel LLC. |

Market Definition

The biodiesel industry encompasses the international market for a sustainable fuel derived from sources like vegetable oils and animal fats, serving as a viable replacement for traditional diesel fuel. Its growth is propelled by a rising consciousness towards environmental issues and the imperative to diminish greenhouse gas discharges within the transportation industry.

The biodiesel industry holds considerable significance for multiple reasons. Primarily, it provides a sustainable and renewable alternative to traditional petroleum-derived fuels, thus diminishing the reliance on fossil fuels and reducing carbon emissions. This is in alignment with global initiatives aimed at combating climate change and enhancing air quality. Furthermore, the production of biodiesel contributes to economic advancement by fostering job creation and investment opportunities within the agricultural sector. The diversification of the market aids in curbing the price fluctuations of conventional fuels by introducing competition and expanding choices for consumers. Lastly, biodiesel plays a pivotal role in bolstering energy security by diminishing the dependency on foreign oil imports and fostering energy self-sufficiency. In essence, the biodiesel industry offers substantial environmental, economic, and energy advantages, positioning it as a critical element in the transition towards a more sustainable and environmentally friendly future.

Key Market Segmentation:

Insights On Key Blend

B20

B20 is expected to dominate the Global Biodiesel Market. B20, which refers to a blend of 20% biodiesel and 80% petroleum diesel, is projected to have the largest market share. This can be attributed to several factors. Firstly, B20 offers a higher level of biodiesel content compared to B10 and B5, making it a more environmentally friendly option. Additionally, B20 has been widely adopted by various industries due to its favorable balance between cost-effectiveness and reduced emissions. The demand for B20 is also driven by government regulations and incentives promoting the use of biodiesel blends. Overall, B20 is poised to dominate the Global Biodiesel Market due to its optimal blend ratio, environmental benefits, and increasing industry adoption.

B100

B100, which refers to pure biodiesel without any petroleum diesel content, still holds a significant market share. B100 is favored by specific industries and applications that require a higher level of biofuel content, such as in agricultural machinery, marine vessels, or off-road vehicles. These sectors prioritize the use of renewable fuels and have specific requirements that can be met by the use of B100. However, compared to the dominating B20, B100 has a more limited market due to factors like cost, availability, and compatibility with existing diesel engines.

B10

Although B10, which consists of a blend of 10% biodiesel and 90% petroleum diesel, lags behind the dominating B20, it still has a notable presence in the Global Biodiesel Market. B10 is often used as an intermediate step for industries transitioning from conventional diesel to higher biodiesel blends.

It provides a more gradual shift, allowing users to experience the benefits of biodiesel while minimizing potential risks or concerns associated with higher biofuel content. Additionally, B10 is widely available and compatible with most diesel engines, making it an accessible option for a wide range of users. However, its market share remains lower compared to B20, which offers a higher level of environmental benefit and industry adoption.

B5

B5, consisting of a 5% biodiesel and 95% petroleum diesel blend, is expected to have the smallest market share in the Global Biodiesel Market. B5 represents the lowest level of biofuel content among the s and is often used as a transition or introductory blend for industries exploring biodiesel options. Its market presence is influenced by factors such as regulatory requirements, availability, and cost-effectiveness. While B5 still offers some environmental benefits compared to pure petroleum diesel, it is overshadowed by the higher biofuel content blends, such as B20 and B10, which provide superior emission reductions and sustainability advantages.

Insights On Key Market

Pyrolysis

Pyrolysis is expected to dominate the Global Biodiesel Market. This involves the process of converting biomass into biodiesel through thermal decomposition. Pyrolysis offers several advantages, including the ability to use a wide range of biomass feedstocks and the production of high-quality biodiesel. The growing demand for renewable and sustainable energy sources has led to increased investments in pyrolysis technology. Moreover, the rising concerns regarding environmental pollution caused by conventional fuels have fueled the adoption of pyrolysis-based biodiesel production. Hence, it is expected that pyrolysis will dominate the Global Biodiesel Market in the coming years.

Trans-esterification

Trans-esterification is one more noticeable within the By Market category. This process involves converting vegetable oils or animal fats into biodiesel by reacting them with an alcohol, usually methanol or ethanol. Although trans-esterification is widely adopted for biodiesel production, it is expected to hold a smaller market share compared to pyrolysis. Trans-esterification has limitations such as feedstock dependence, higher cost, and the need for additional refining steps. Despite these limitations, trans-esterification remains a vital in the Global Biodiesel Market due to its well-established technology and widespread use.

Others

The "Others" category comprises various s that contribute to the Global Biodiesel Market but are expected to have a smaller market share compared to pyrolysis and trans-esterification. These s may include emerging technologies such as enzymatic conversion, supercritical fluid technology, and other innovative approaches for biodiesel production. Although these technologies show promise in terms of resource efficiency and environmental sustainability, they are still in the research and development phase. Thus, while the "Others" category presents potential opportunities for the future, it is not expected to dominate the Global Biodiesel Market in the near term.

Insights On Key Feedstock

Based on my research and data analysis, Vegetable Oil is expected to dominate the Global Biodiesel Market. (more than 100 words) Vegetable oils, such as soybean oil, palm oil, rapeseed oil, and sunflower oil, are widely used as feedstock for biodiesel production due to their abundant availability, ease of cultivation, and favorable characteristics for biodiesel production. These oils have low viscosity, high energy content, and can be easily converted into biodiesel through the transesterification process. Additionally, vegetable oils are considered more sustainable and environmentally friendly compared to other feedstock options, making them a preferred choice among biodiesel producers and consumers.Vegetable oil-based biodiesel has gained significant traction in the global market due to increasing awareness about the harmful effects of fossil fuels on the environment and the need for renewable and cleaner energy sources. Government initiatives, regulations, and incentives promoting the use of biodiesel as a cleaner alternative to fossil fuels have also contributed to the dominance of vegetable oil in the global biodiesel market. Animal fats, although used as an alternative feedstock for biodiesel production, are not expected to dominate the global biodiesel market. Animal fats have certain limitations such as higher viscosity, lower energy content, and the need for additional processing steps for conversion into biodiesel. Furthermore, there are concerns regarding the ethical and environmental implications of using animal fats for biodiesel production, which have led to a preference for vegetable oils as the dominant feedstock in the market.

Insights On Key Application

Power Generation

The Power Generation is expected to dominate the Global Biodiesel Market due to increasing demand for renewable energy sources and growing environmental concerns regarding the use of fossil fuels. Biodiesel has gained traction as a cleaner and more sustainable alternative for power generation, icularly in off-grid areas and remote locations. The versatility of biodiesel as a fuel source for a variety of power generation systems, including diesel generators, combined heat and power plants, and gas turbines, further contributes to its dominance in this . Additionally, government initiatives and policies promoting the adoption of renewable energy sources and the increasing number of power plants using biodiesel as fuel are driving the market growth for biodiesel in the power generation sector.

Fuel

While the Power Generation may dominate the Global Biodiesel Market, the Fuel also holds significant market share. Biodiesel is increasingly being used as a transportation fuel due to its environmental benefits, such as reduced greenhouse gas emissions and lower iculate matter. The rising consumer awareness of the adverse effects of conventional fossil fuels on the environment and the growing focus on sustainable practices are driving the demand for biodiesel as a fuel alternative. Additionally, government regulations and incentives promoting the use of biodiesel in transportation further contribute to the market growth of this .

Others

The Others in the By Application category includes various applications of biodiesel a from power generation and transportation fuel. This encompasses niche and emerging applications such as industrial heating, marine applications, and aviation. While these applications show potential for growth in the future, they currently hold a smaller market share compared to the dominant Power Generation and Fuel s. Factors such as limited infrastructure, technological challenges, and regulatory barriers limit the widespread adoption of biodiesel in these other applications. However, ongoing research and development efforts, along with evolving regulations, may lead to the expansion of biodiesel usage in these diverse applications in the coming years.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the Global Biodiesel Market market. The region has been a key player in the biodiesel market due to various factors. Europe is heavily focused on reducing carbon emissions and promoting renewable energy sources. The European Union (EU) has implemented stringent regulations and policies to promote the use of biodiesel, such as the Renewable Energy Directive and the RED II. These regulations have set binding targets for renewable energy consumption, including biodiesel, and have encouraged the use of sustainable feedstocks for biodiesel production. Furthermore, Europe has a well-developed infrastructure for biodiesel production and consumption, with several major biodiesel plants and a significant fleet of diesel vehicles. The presence of established players in the biodiesel market, along with favorable government support and a growing demand for sustainable fuels, positions Europe as the dominant region in the global biodiesel market.

North America

North America is an emerging player in the Global Biodiesel Market market. The region has witnessed a growing demand for biodiesel due to increasing environmental concerns and the need for energy security. The United States is the largest biodiesel producer in North America, with several key companies operating in the market. The U.S. government has been supportive of the biodiesel industry by implementing Renewable Fuel Standards (RFS) and providing tax incentives for biodiesel production and consumption. Additionally, the availability of a diverse range of feedstocks for biodiesel production, such as soybean oil and used cooking oil, and the presence of a well-developed infrastructure for biodiesel distribution contribute to the growth of the biodiesel market in North America. While North America is still catching up to Europe in terms of biodiesel production and consumption, it shows significant potential for further growth and market dominance in the future.

Asia Pacific

Asia Pacific is an emerging player in the Global Biodiesel Market market. The region has witnessed a steady growth in biodiesel production and consumption, driven by factors such as increasing energy demand, environmental concerns, and government support for renewable fuels. Countries like Malaysia and Indonesia are major producers of biodiesel in the region, with palm oil being the primary feedstock. These countries have implemented policies and incentives to encourage the use of biodiesel, both for domestic consumption and export.

Furthermore, the rising demand for biodiesel in countries like India, China, and Japan, coupled with the presence of a growing fleet of diesel vehicles, contributes to the expansion of the biodiesel market in Asia Pacific. Although the region is still catching up to Europe and North America in terms of production capacity and infrastructure, it possesses significant potential to become a dominant player in the global biodiesel market.

Latin America

Latin America is an emerging player in the Global Biodiesel Market market. The region has witnessed a growing interest in biodiesel production and consumption due to various factors. Countries like Brazil and Argentina are key players in the Latin American biodiesel market, primarily driven by the availability of feedstocks such as soybean oil and sugarcane. These countries have implemented policies and regulations that promote the use of biodiesel, including blending mandates and tax incentives. Additionally, the region's significant agricultural resources and potential for feedstock production contribute to the growth of the biodiesel market in Latin America. While Latin America still has a smaller market share compared to regions like Europe and North America, its growing production capacity and favorable market conditions position it as a potential dominant player in the global biodiesel market.

Middle East & Africa

Middle East & Africa is an emerging player in the Global Biodiesel Market market. The region has immense potential for biodiesel production and consumption due to abundant feedstock resources such as palm oil, animal fats, and used cooking oil. Countries like Malaysia, Indonesia, and Nigeria have already made strides in biodiesel production, primarily driven by domestic consumption. The region's growing population and increasing energy demand, coupled with government initiatives to reduce dependence on fossil fuels and promote renewable energy, contribute to the expansion of the biodiesel market in the Middle East & Africa. While the region is still in the early stages of development, it holds significant potential to become a dominant player in the global biodiesel market in the coming years.

Company Profiles:

Prominent figures in the worldwide Biodiesel Sector are actively engaged in the production and distribution of biodiesel, advocating for the use of sustainable energy sources, and lowering carbon footprints to address the challenges of climate change. Their pivotal contributions revolve around encouraging the uptake of biodiesel and facilitating the shift towards a greener, more sustainable future.

Prominent entities within the biodiesel industry encompass Archer Daniels Midland Company, Wilmar International Ltd, Renewable Energy Group, Inc., Cargill, Inc., Louis Dreyfus Company BV, Ag Processing Inc, Neste Corporation, BIOX Corporation, TerraVia Holdings Inc, and Western Dubuque Biodiesel LLC. These organizations play a crucial role in advancing the biodiesel fuel sector through their involvement in its progress, manufacturing, and distribution. They are actively contributing to the sustainable proliferation of the biodiesel market by investing in research and development activities, expanding their production capabilities, and seeking out new market opportunities. Furthermore, these key stakeholders are involved in forging strategic alliances, nerships, and acquisitions to fortify their standing in the market and enhance their competitiveness within the sector. Collectively, their endeavors and innovations are pivotal in propelling the expansion and acceptance of biodiesel as an environmentally sustainable substitute for conventional fossil fuels.

COVID-19 Impact and Market Status:

The global biodiesel market has been adversely affected by the Covid-19 pandemic, leading to reduced demand and disturbances in supply chains.The biodiesel market has been significantly influenced by the impact of the COVID-19 pandemic. The reduced economic activities and travel restrictions have led to a decrease in biodiesel demand.

Lockdown measures in various nations have resulted in lower consumption of transportation fuels, including biodiesel, while the drop in oil prices during the pandemic has made traditional fossil fuels more economically competitive, further affecting biodiesel demand. Conversely, the global focus on reducing greenhouse gas emissions and promoting sustainable energy sources has increased during the pandemic, creating opportunities for the biodiesel market due to its renewable and eco-friendly characteristics. Despite presenting challenges, the COVID-19 crisis has also stimulated growth prospects for the biodiesel market as the world moves towards a more sustainable future.

Latest Trends and Innovation:

- In July 2020, Archer Daniels Midland Company (ADM) announced the acquisition of Brazil-based Algar Agro's sugarcane ethanol distillery in Minas Gerais, expanding their production capacity in the region.

- In May 2020, Renewable Energy Group (REG) completed the acquisition of a biodiesel plant in Lake Providence, Louisiana from International-Matex Tank Terminals, increasing their production capacity.

- In April 2021, Neste announced its collaboration with Lufthansa Group to supply sustainable aviation fuel (SAF) at Frankfurt Airport, Germany, promoting the use of biodiesel in the aviation sector.

- In February 2021, TotalEnergies and Siemens Energy signed a Memorandum of Understanding to collaborate on the development of sustainable solutions, including renewable fuels such as biodiesel.

- In January 2020, Bunge Limited and BP announced the formation of a joint venture called BP Bunge Bioenergia, with the aim of expanding operations in the Brazilian bioenergy market, including biodiesel production.

- In September 2020, Wilmar International Limited acquired Kea Energy Pte.

Ltd., a Singapore-based company involved in the production and distribution of biodiesel and other renewable fuels, further strengthening Wilmar's position in the biodiesel market.

- In November 2020, Cargill announced the expansion of its European biodiesel production capacity at its facility in Manchester, United Kingdom, to meet the growing demand for sustainable fuel options.

- In March 2021, Archer Daniels Midland Company (ADM) announced plans to build a new biodiesel production facility in Topeka, Kansas, enhancing their biodiesel production capabilities in the United States.

- In December 2020, Valero Energy Corporation announced its nership with Darling Ingredients Inc. to expand renewable diesel production capacity at their facilities in Louisiana and Texas, utilizing feedstocks including animal fats and used cooking oil.

- In August 2020, Renewable Energy Group (REG) announced plans to expand their biodiesel production capacity at their facility in Seneca, Illinois, to meet increasing demand for renewable fuels.

Significant Growth Factors:

The Biodiesel Market is experiencing growth due to the escalating awareness about environmental issues, efforts by governments to lower carbon footprints, and the expanding utilization of renewable energy sources.

The biodiesel industry is experiencing a noteworthy expansion driven by a variety of factors. A paramount contributor to this growth is the escalating demand for sustainable and eco-friendly fuel alternatives in response to mounting environmental apprehensions stemming from traditional fossil fuels. Biodiesel, as a renewable and environmentally friendly substitute, plays a vital role in diminishing greenhouse gas emissions and air pollution, rendering it an appealing option for governments and industries striving to meet their sustainability objectives. Stringent governmental regulations worldwide aimed at curbing carbon emissions have further cultivated a conducive atmosphere for the biodiesel market. Notably, a burgeoning concern for energy security and the imperative to reduce reliance on imported crude oil have spurred the augmentation and enhancement of biodiesel production capacities. The availability of a wide array of feedstock choices for biodiesel production, encompassing vegetable oils, animal fats, and waste oils, also bolsters market expansion. Furthermore, advancements in biodiesel production techniques such as transesterification and esterification have ened the efficiency and quality of biodiesel output, thereby buoying market progression. The increasing consumer knowledge and acceptance of biodiesel as a plausible energy source, coupled with governmental incentives and subsidies, are anticipated to propel market growth in the foreseeable future. In essence, the notable upsurge in the biodiesel market can be credited to its environmental advantages, governmental backing, energy security considerations, diverse feedstock alternatives, and technological progressions.

Restraining Factors:

Restricted availability of raw materials and elevated manufacturing expenses act as impediments to the growth of the biodiesel industry.

The global biodiesel industry has experienced significant growth due to the growing emphasis on sustainable and eco-friendly energy sources. However, there are various factors impeding its progress. Challenges related to feedstock availability and sourcing, including limited land for cultivation, competition with food crops, and the necessity for sustainable sourcing practices, hamper biodiesel production. Additionally, the high production costs of biodiesel make it less affordable and hinder market growth. Moreover, inadequate infrastructure for biodiesel distribution and refueling stations, icularly in rural areas, limits consumer access and adoption. Furthermore, the lack of awareness and knowledge among consumers about the benefits of biodiesel acts as a barrier to market expansion. Fluctuations in regulatory frameworks and unclear government policies on biofuels create an unstable investment environment. Despite these obstacles, the biodiesel sector offers significant growth potential due to increasing environmental concerns, government support for renewable energy initiatives, and rising demand for sustainable transportation fuels. Technological advancements, such as the development of second-generation feedstocks and efficient production methods, present promising opportunities to overcome existing challenges and expand the biodiesel market.

Key Segments of the Biodiesel Market

Blend Overview

• B100

• B20

• B10

• B5

Market Overview

• Pyrolysis

• Trans-esterification

• Others

Feedstock Overview

• Vegetable Oil

• Animal Fats

Application Overview

• Fuel

• Power Generation

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America