Market Analysis and Insights:

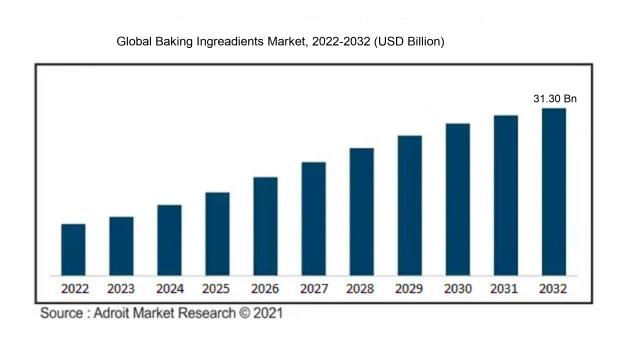

The market for Global Baking Ingredients was estimated to be worth USD 17.30 billion in 2022, and from 2023 to 2032, it is anticipated to grow at a CAGR of 6.15%, with an expected value of USD 31.30 billion in 2032.

The market for baking ingredients experiences growth and increased demand due to various contributing factors. To begin with, shifts in consumer lifestyles and preferences have sparked a ened interest in home baking. Many consumers now favor homemade baked goods for their perceived health benefits and cost-effectiveness over commercially produced items.

Furthermore, rising income levels in emerging economies have boosted consumer purchasing power, enabling them to invest more in premium baking ingredients. The surge in popularity of cooking programs and social media platforms has inspired individuals to explore baking, leading to a greater need for baking ingredients. The proliferation of bakery chains and cafes worldwide has also ened the demand for quality baking ingredients to meet the needs of these establishments' patrons. Finally, manufacturers are actively pursuing product innovations and creating healthier options such as gluten-free and organic baking ingredients in response to the increasing demand from health-conscious consumers. In combination, these factors fuel the expansion and development of the baking ingredients market.

Baking Ingreadients Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2032 |

| Study Period | 2018-2032 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2032 | USD 31.30 billion |

| Growth Rate | CAGR of 6.15% during 2023-2032 |

| Segment Covered | By Type, By Form, By Application, By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Archer Daniels Midland Company, Associated British Foods (ABF) plc, Cargill, Incorporated, Ingredion Incorporated, Kerry Group plc, Tate & Lyle PLC, Royal DSM N.V., Bunge Limited, Lallemand Inc., and Corbion N.V. |

Market Definition

Baking ingredients encompass a diverse selection of food elements utilized in culinary processes, predominantly linked to the art of baking and crafting delectable desserts and pastries. This assortment may consist of items such as flour, sugar, eggs, raising agents, fats, and flavorings, synergistically influencing the flavor, consistency, and composition of the ultimate baked delicacies.

The role of baking ingredients is crucial in determining the final outcome and quality of baked goods. Careful selection and proper utilization of these components are imperative to achieve the desired flavor, texture, and appearance of the baked products. Flour serves to provide structure and stability, while sugar im s sweetness and moisture. Leavening agents like baking powder and yeast are responsible for the leavening process, aiding in the rise of the dough or batter. Fats such as butter and oil contribute to tenderness and flavor. Additionally, ingredients like eggs, milk, and flavorings enhance the richness and taste of the baked goods. Consistency and success in baking can be ensured by using premium quality ingredients and adhering to precise measurements. Ultimately, the meticulous selection and correct application of baking ingredients are fundamental in producing delectable, visually pleasing, and satisfying baked delicacies.

Key Market Segmentation:

Insights On Key Type

Baking Powder & Mixes

Baking Powder & Mixes is expected to dominate the Global Baking Ingredients Market. Owing to its extensive use in a variety of baked goods and sweets, it is projected to hold the largest market share. Baking powder is an essential component in baking that helps with leavening, which gives baked goods their light, fluffy texture. Pre-mixes are also convenient and simple to utilize for commercial baking operations as well as home bakers. As baking continues to be a popular culinary activity around the world, there will likely be an increase in demand for baking mixes and powder.

Colors & Flavours

Colors & Flavours is one of the significant s within the Global Baking Ingredients Market. These ingredients play a crucial role in enhancing the visual appeal and taste of bakery products. Colors add vibrancy and attractiveness to baked goods, making them more visually appealing. Flavors, on the other hand, provide unique and delightful tastes to a wide range of baked treats. With the rise in consumer preferences for aesthetically pleasing and flavorful bakery products, the demand for colors and flavors is expected to experience steady growth.

Emulsifiers

Emulsifiers play a vital role in the Global Baking Ingredients Market. It help stabilize the mixture of water and oil-based ingredients, improving the texture, taste, and overall quality of baked goods. Emulsifiers provide better shelf life, enhanced volume, and improved crumb structure to baked products. With the rising demand for bakery items with longer shelf life and superior quality, the use of emulsifiers is expected to grow significantly.

Enzymes

Enzymes are a key in the Global Baking Ingredients Market. These ingredients are essential for various baking processes, such as dough conditioning, fermentation, and flavor development. Enzymes contribute to improved texture, volume, and flavor in baked goods. Furthermore, they help increase the efficiency of production processes and reduce baking time. With the increasing demand for consistent and high-quality bakery products, the demand for enzymes is expected to witness substantial growth.

Preservatives

Preservatives play a crucial role in the Global Baking Ingredients Market. These ingredients help extend the shelf life of bakery products by inhibiting microbial growth, delaying spoilage, and preserving freshness. Preservatives are icularly important for pre-packaged baked goods and industrial-scale baking operations. As consumer demand for convenience and longer-lasting products continues to rise, the use of preservatives in baked goods is expected to remain significant.

Oils, Fats, Shortenings

Oils, fats, and shortenings are essential s within the Global Baking Ingredients Market. These ingredients contribute to the flavor, texture, and moistness of baked goods. They also play a crucial role in creating flaky crusts and tender crumbs. Oils are commonly used in bread-making, while fats and shortenings are used for pastry and cake production. With the growing popularity of various baked products worldwide, the demand for oils, fats, and shortenings is expected to witness steady growth.

Starch

Starch is an important within the Global Baking Ingredients Market. It is used as a thickening agent in baked goods, providing structure and stability. Starch contributes to the desired texture and mouthfeel of bakery products, such as pies, custards, and fillings. With the increasing demand for bakery items with desirable texture and consistency, the use of starch is expected to remain significant.

Yeast

Yeast is a significant in the Global Baking Ingredients Market. It is a crucial ingredient in bread-making, assisting in the fermentation process and providing the characteristic rise and flavor to bread. With bread being a staple food in many cultures and the increasing popularity of artisanal bread and other yeast-based products, the demand for yeast is expected to be substantial.

Others

The "Others" within the Global Baking Ingredients Market includes various miscellaneous ingredients that are used in baking. These ingredients can vary widely and may include items such as leavening agents, stabilizers, fortifiers, and nutritional additives. While individually these ingredients may not dominate the market, their collective contribution to the overall baking industry is noteworthy. The demand for these miscellaneous ingredients depends on specific applications and consumer preferences.

Insights On Key Form

Dry

Dry baking ingredients are expected to dominate the Global Baking Ingredients Market. As baking requires precise measurements and control of moisture content, dry ingredients such as flour, sugar, baking powder, and spices are essential components in most baked goods. These dry ingredients provide structure, texture, and flavor to various bakery products. They are widely used in the production of bread, cakes, pastries, and cookies, which are popular around the world. Additionally, the longer shelf life and ease of storage of dry ingredients make them a preferred choice for both home bakers and commercial bakeries. Hence, the dry is expected to dominate the Global Baking Ingredients Market.

Liquid

Liquid baking ingredients, although crucial for specific baking recipes, are not expected to dominate the Global Baking Ingredients Market. While liquids such as water, milk, eggs, and various types of oils are necessary for the preparation of certain baked goods like puddings, custards, and some types of cakes, they do not have the same extensive usage as dry ingredients. Liquid ingredients tend to be more specific to certain recipes and are not as versatile as dry ingredients. Furthermore, the shorter shelf life and a higher likelihood of spoilage make them less preferred for large-scale production purposes. Therefore, while liquid ingredients are important, they are not expected to dominate the Global Baking Ingredients Market.

Insights On Key Application

Cakes & Pastries

The global market for baking ingredients is anticipated to be dominated by cakes and pastries. This is because there is a growing need worldwide for a diverse range of cakes and pastries. The appeal of bakery goods and consumers' increased desire in decadent desserts have led to this section's domination. Manufacturers of cakes and pastries are always looking for new and creative baking ingredients to improve the flavor, texture, and look of their goods. The growing popularity of making personalized cakes and pastries to celebrate special occasions also contributes to the increase in demand for baking ingredients in this area. Consequently, the Global Baking Ingredients Market is expected to be led by the Cakes & Pastries segment.

Bread

In the global market for baking ingredients, the bread segment has the most potential. Bread is a highly sought-after product because it is a staple item that is consumed in many different places. The need for packaged bread products that are handy is rising due to the growing trend of urbanization and hectic lifestyles. This increases the need for baking ingredients, which are essential to maintaining the caliber and durability of bread. These components include yeast, flour, and emulsifiers. The bread category is probably going to keep expanding as more people look for artisanal and healthier bread options. Additionally, the advent of functional bread variations and gluten-free bread versions opens up new possibilities for baking ingredients in this area.

Others

Although Cakes & Pastries and Bread are expected to dominate the Global Baking Ingredients Market, the Others holds its own significance. The Others comprises various baked goods such as cookies, biscuits, tarts, and pies. While the market share of this may be smaller compared to Cakes & Pastries and Bread, it still contributes to the overall growth of the baking ingredients market. The demand for cookies, biscuits, and other sweet treats remains robust, driven by factors like snacking habits, convenience, and the desire for indulgence. Baking ingredients like flavors, preservatives, and functional additives are essential to create these baked goods and to meet consumer preferences for taste, texture, and shelf life. As a result, the Others is expected to continue its growth in the Global Baking Ingredients Market. However, its dominance may remain overshadowed by the Cakes & Pastries and Bread s.

Insights on Regional Analysis:

Europe

Europe is expected to dominate the global Baking Ingredients market. The dominance of Europe can be attributed to the well-established baking industry in countries such as Germany, France, and Italy. These countries have a rich culinary tradition and a high consumer demand for bakery products, which drives the market growth. Additionally, the presence of major bakery ingredient manufacturers and suppliers, along with a strong distribution network, further contributes to the dominance of Europe in the global market. Furthermore, the increasing preference for innovative and premium baking ingredients, along with the rising popularity of artisanal bakery products, further fuels the growth of the market in this region.

North America

In the North American region, the Baking Ingredients market is highly competitive and is characterized by a diverse consumer base. The United States, in icular, is a significant contributor to the market, owing to a high demand for convenience food products and baked goods. The busy lifestyle of consumers and their preference for ready-to-eat and on-the-go food products drive the growth of the Baking Ingredients market in this region. Furthermore, the increasing trend of home baking and the growing popularity of healthy and organic baking ingredients also contribute to the market growth in North America.

Latin America

Latin America is witnessing a steady growth in the Baking Ingredients market. Countries like Brazil and Argentina are major contributors to the market growth in this region. The increasing disposable income, urbanization, and changing consumer preferences towards westernized food products fuel the demand for bakery ingredients. Furthermore, the rising number of bakeries and cafes, along with a growing interest in baking as a hobby or profession, further drives the market growth in Latin America. However, the market in this region is still at a developing stage compared to other regions.

Asia Pacific

The Asia Pacific region is emerging as a potential market for Baking Ingredients. Countries like China, India, and Japan are witnessing a growing demand for bakery products due to urbanization, changing demographics, and increasing disposable income. Furthermore, the influence of western food culture and the rising popularity of bakery chains and cafes contribute to the market growth. However, the market is still fragmented and faces challenges related to distribution channels and product quality control. Nonetheless, the increasing consumer awareness about healthy and organic baking ingredients presents significant growth opportunities in the Asia Pacific region.

Middle East & Africa

The Middle East & Africa region has a relatively smaller market share in the global Baking Ingredients market. However, the market is witnessing growth due to changing consumer preferences and the influence of western food culture. Countries like UAE, Saudi Arabia, and South Africa are key contributors to the market growth in this region. The demand for bakery products is driven by factors such as urbanization, an expanding young population, and increasing disposable income. Additionally, the growing tourism sector and the rising number of hotels, restaurants, and cafes also contribute to the market growth in the Middle East & Africa region.

Company Profiles:

Prominent participants in the worldwide Baking Ingredients sector serve a crucial function through providing a wide array of products tailored for different uses, upholding high standards of quality and safety, and continuously introducing new solutions to cater to changing customer needs. Their robust distribution channels and established brand identities establish them as frontrunners in the industry, fostering competitiveness and establishing standards for the sector.

Prominent companies in the Baking Ingredients Market include Archer Daniels Midland Company, Associated British Foods (ABF) plc, Cargill, Incorporated, Ingredion Incorporated, Kerry Group plc, Tate & Lyle PLC, Royal DSM N.V., Bunge Limited, Lallemand Inc., and Corbion N.V. These industry leaders offer a diverse selection of essential ingredients like flour, sugar, yeast, fats, and additives necessary for baking. Through their extensive product offerings and efficient distribution channels, these key players play a vital role in advancing the baking ingredients market's evolution and expansion.

COVID-19 Impact and Market Status:

The worldwide market for baking ingredients underwent substantial changes as a result of the Covid-19 pandemic, which included supply chain disturbances, diminished demand caused by lockdown measures, and a rise in home baking trends, resulting in a diverse overall market performance.

The baking ingredients market has been significantly influenced by the COVID-19 pandemic. Stay-at-home orders and social distancing protocols have resulted in an uptick in home baking activities as individuals spend more time in their residences. Consequently, there has been a surge in the consumption of baking essentials like flour, sugar, yeast, and baking powder.

Retailers have observed a notable uptick in the sales of these products, struggling to meet the escalating demand. Furthermore, the closure of dine-in eateries and cafes has prompted an increase in homemade baked goods, further fueling the need for baking ingredients. Nevertheless, the pandemic has disrupted supply chains, causing scarcities and price escalations for certain baking components. This circumstance has compelled some consumers to seek out alternative ingredients or DIY substitutions. Moreover, the economic repercussions of the pandemic have compelled certain individuals to cut back on their expenses, including non-essential items like baking ingredients. In essence, even though the baking ingredients market has seen a surge in demand attributed to the pandemic, it has encountered challenges due to disruptions in the supply chain and shifting consumer habits.

Latest Trends and Innovation:

- In January 2021, Archer Daniels Midland Company (ADM) announced the acquisition of the remaining minority stake in National Foods Limited, a leading provider of vegetable oils and baking ingredients in Australia.

- In March 2021, Ingredion Incorporated completed the acquisition of Sun Flour Industry Co., Ltd., expanding its presence in the South Korean baking ingredients market.

- In June 2021, Kerry Group acquired Niacet Corp, a key producer of functional ingredients for the bakery and processed meats industries.

- In July 2021, Associated British Foods plc announced the acquisition of Yeafield Investments Limited, the parent company of Hovis Limited, one of the largest baking ingredients and bread manufacturers in the UK.

- In September 2021, Cargill announced the introduction of MELJOY™, a new innovative ingredient that enhances the freshness of baked goods for an extended period.

- In October 2021, Dawn Foods announced the acquisition of Arista Cake & Pancake Mixes, expanding their portfolio of baking ingredient offerings.

- In December 2021, Corbion N.V. announced the launch of their new natural mold inhibitor, Verdad® MP100, specifically designed for use in bakery applications.

- In January 2022, Kerry Group announced the acquisition of Presidia, a company specializing in clean label ingredients for the bakery industry.

- In February 2022, Associated British Foods plc completed the acquisition of the remaining minority stake in AB Mauri, a global leader in yeast and baking ingredient solutions, further strengthening their position in the baking ingredients market.

Significant Growth Factors:

The continuous evolution of baking formulations and the growing inclination of consumers towards homemade baked products play a key role in propelling the expansion of the baking ingredients industry.

The Baking Ingredients Market is poised for substantial expansion in the foreseeable future, attributed to various pivotal factors. Firstly, the surge in interest towards baking and a rising population of baking enthusiasts are propelling the demand for baking ingredients. The trend towards homemade baked goods is on the upswing, resulting in an uptick in the consumption of baking ingredients. Secondly, the upsurge in disposable income and shifts in consumer lifestyles have fostered a growing preference for convenient and ready-to-use baking products, thereby amplifying the need for baking ingredients. Furthermore, the burgeoning industrial bakery sector encompassing bakeries, cafes, and restaurants is contributing significantly to the growth trajectory of the baking ingredients market. The proliferation of foodservice outlets worldwide is steadily escalating the demand for baking ingredients for commercial applications. Additionally, the escalating affinity towards healthier and organic baking ingredients is presenting abundant avenues for market expansion. Consumers are increasingly gravitating towards natural and organic options, spurring the innovation and introduction of a diverse range of clean-label baking ingredients. Collectively, these factors, in conjunction with the expanding consumer base and evolving culinary inclinations, are set to propel the global growth of the baking ingredients market. Nonetheless, challenges pertaining to quality control and safety standards associated with ingredients could potentially impede the market's progress.

Restraining Factors:

The market may face constraints due to the limited accessibility of premium baking ingredients.

The baking ingredients industry is currently experiencing obstacles that are impeding its progress. One of the factors contributing to this is the increasing awareness of health among consumers, leading them to opt for healthier dietary choices that often involve reducing their intake of baked goods. This shift in consumer behavior has led to a decline in the demand for traditional baking ingredients like sugar and refined flour. Additionally, the rise in food allergies and intolerances has had a negative impact on the market as more individuals are steering clear of ingredients such as gluten, dairy, and nuts, thereby limiting their use in baking. The surge in popularity of alternative products, including gluten-free and vegan options, has also contributed to a decrease in the demand for conventional baking ingredients. Economic uncertainty and inflation in various regions have further exacerbated the situation by prompting consumers to cut down on non-essential purchases, including baking ingredients. The global COVID-19 pandemic has further exacerbated challenges in the baking industry due to lockdown measures, disruptions in the supply chain, and reduced consumer expenditure. However, there are bright spots on the horizon for the baking ingredients market.

Manufacturers are adapting to shifting consumer preferences by introducing innovative and healthier baking ingredient choices that cater to a range of dietary restrictions and preferences. Moreover, the increased interest in home baking and DIY culinary projects presents opportunities for the market, as consumers are open to experimenting with new ingredients and recipes. By continually innovating and aligning with evolving consumer trends, the baking ingredients sector can surmount these obstacles and experience a resurgence in growth.

Key Segments of the Baking Ingredients Market

Ingredient Type Overview

• Baking Powder & Mixes

• Colors & Flavors

• Emulsifiers

• Enzymes

• Preservatives

• Oils

• Fats

• Shortenings

• Starch

• Yeast

• Others

Form Overview

• Dry

• Liquid

Application Overview

• Bread

• Cakes & Pastries

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America