Aviation Software Market Analysis and Insights:

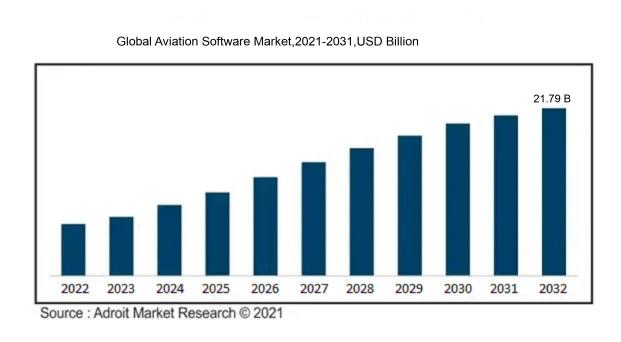

In 2023, the size of the worldwide Aviation Software market was US$ 10.45 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 8.6 % from 2024 to 2032, reaching US$ 21.79 billion.

The Aviation Software Market experiences robust growth due to a multitude of significant factors. A main driver is the escalating need for improved operational efficiency and safety measures within the aerospace sector. There is a growing appetite for real-time analytics and automation technologies, as airlines and operators aim to enhance fuel efficiency, maintenance practices, and scheduling systems. Compliance with regulatory standards and an emphasis on sustainable aviation are also steering investments toward software solutions that optimize operations while reducing ecological footprints. The proliferation of cloud-based services further accelerates market expansion, ensuring superior data management and fostering collaboration in international operations. Moreover, the increasingly prevalent trend of digital transformation across various industries, including aviation, stimulates innovation in software development, leading to improved customer engagement and operational productivity. As global air traffic rises, the need for advanced aviation software capable of tackling intricate operational challenges will undoubtedly increase.

Aviation Software Market Definition

Aviation software comprises purpose-built applications aimed at facilitating different functions within the aviation sector, encompassing flight operations, maintenance oversight, and adherence to regulatory standards. Such tools significantly improve operational efficiency, safety protocols, and data handling across all stages of the aviation process.

Aviation software is vital in the aerospace sector, significantly improving operational efficiency, safety measures, and compliance standards. It optimizes multiple functions, including flight planning, scheduling, maintenance oversight, and regulatory compliance, thereby minimizing human error risks. Through the provision of real-time data analysis and sophisticated reporting tools, this software aids in informed decision-making and enhances resource management. Moreover, it promotes effective communication between various stakeholders, such as airlines, airports, and regulatory organizations, leading to better service outcomes. In an industry where safety is of the highest importance, aviation software guarantees compliance with rigorous regulations while fostering ongoing enhancements in operational procedures.

Aviation Software Market Segmental Analysis:

Insights On Operation

Aeronautical

The Aeronautical is expected to dominate the Global Aviation Software Market primarily due to the extensive usage of technology in flight operations, aircraft maintenance, and compliance management. With airlines and aviation authorities increasingly investing in advanced software solutions to enhance operational efficiencies, streamline processes, and ensure safety, the need for Aeronautical software is growing significantly. Furthermore, the rising demand for air travel, coupled with regulatory requirements and the necessity for real-time data processing, further propels this 's growth. The trend toward digitization in aviation, along with the need for improved safety measures and operational reliability, strongly favors the Aeronautical category, making it the leading area for investment and development.

Non-Aeronautical

The Non-Aeronautical sector is also an important part of the Global Aviation Software Market; however, its growth lags behind that of Aeronautical solutions. This includes software related to airport operations, retail management, and ground handling services. While there is a consistent need for optimization in these areas—especially as airports expand and seek to enhance passenger experience—their reliance on Aeronautical operations and safety regulations limits their overall market appeal. Even so, as airports pursue new revenue streams through retail and commercial services, Non-Aeronautical solutions are likely to experience gradual growth driven by technological advancements and an increasing focus on operational efficiency.

Insights On Technology

Air Traffic Control (ATC)

The dominating in the Global Aviation Software Market is expected to be Air Traffic Control (ATC). This is primarily due to the increasing air traffic and the demand for enhanced safety measures, which have made ATC solutions crucial for efficient airspace management. Investments in modernizing ATC systems to incorporate advanced technologies like AI and machine learning are rising, as they boost operational efficiency, reduce delays, and improve the overall passenger experience. The growing emphasis on safety and compliance with international regulations further drives innovation and demand in this area, solidifying its position as a leader in aviation software.

Security System

Security System technology is a critical part of the aviation software landscape, focusing on ensuring the safety and protection of airports and airlines from various threats. With the rise of global travel and subsequent security challenges, there is an increased urgency to implement advanced software solutions for surveillance, threat detection, and identity verification. Technologies such as biometric scanning and AI-driven surveillance tools are gaining traction to enhance overall security protocols. This focus on security not only helps in mitigating risks but also plays a vital role in boosting passenger confidence, thus supporting the larger aviation industry's growth.

Communication System

Communication System solutions are pivotal as they facilitate seamless interactions within the aviation ecosystem. From cockpit communications to airport ground operations, effective communication technologies minimize errors, enhance coordination, and ensure timely information exchange. The advent of advanced systems, including satellite communication and data link systems, improves clarity and coverage, especially in congested airspaces. As airlines and airport operations seek to upgrade their communication infrastructure for better safety and efficiency, this area is witnessing steady growth, offering significant advancements that contribute to operational excellence.

Passenger, Cargo & Baggage Handling

The Passenger, Cargo & Baggage Handling technology is essential for improving passenger satisfaction and operational efficiency. This area incorporates software solutions that streamline processes like check-in, baggage tracking, and cargo management, addressing some of the primary pain points in air travel today. The advent of mobile technology and IoT solutions has revolutionized this, enabling real-time tracking and updates that enhance the customer experience. As the volume of air traffic continues to grow, investments in innovative handling systems will increase, ensuring a smoother travel process for passengers and optimizing logistical operations for airlines.

Others

The Others encompasses a variety of technologies that support different facets of the aviation software landscape. This includes niche solutions like maintenance management software, flight operations software, and weather tracking systems. While not the primary focus, these technologies play supportive roles by enhancing operational efficiency and safety. The growing complexity of aviation operations has resulted in increased demand for specialized software that ensures adherence to regulatory requirements and optimizes flight schedules. Thus, while smaller in share compared to other areas, these diverse solutions are integral to the holistic functioning of the aviation industry.

Insights On Application

Air Side

The Air Side application is expected to dominate the Global Aviation Software Market due to the increasing need for efficient flight operations, enhanced air traffic management, and the integration of advanced technology such as predictive analytics and real-time data processing. This aspect encompasses critical areas like flight scheduling, maintenance management, and crew management which are vital for optimizing airline operations. As air travel continues to grow, airlines are investing heavily in software solutions that improve safety, enhance customer service, and increase operational efficiency, driving demand for comprehensive Air Side software solutions.

Terminal Side

The Terminal Side application focuses on passenger processing and customer experience within airport terminals. This area incorporates software solutions that facilitate check-in, boarding, baggage handling, and security operations. As airports strive to enhance efficiency and reduce wait times, the adoption of innovative technologies such as biometric scanning and automated systems is on the rise. The growing emphasis on passenger experience plays a significant role in driving Terminal Side software developments, as airports seek to streamline operations while providing a seamless travel experience for passengers.

Land Side

The Land Side application governs the ground services and logistics of aircraft operations, including activities like fueling, cargo handling, and ground transportation management. This aspect is becoming increasingly important as airlines and ground service providers look to minimize turnaround times and enhance operational efficiency. The rise in e-commerce and the need for efficient logistics solutions also contribute to the growth in demand for Land Side applications. Furthermore, the growing focus on sustainability and reducing carbon footprints encourages investments in software solutions that optimize resource utilization and operational workflows in ground services.

Global Aviation Software Market Regional Insights:

North America

North America is expected to dominate the Global Aviation Software Market due to the presence of major industry players, significant investments in advanced technology, and a mature aviation sector. The region's strong regulatory framework fosters innovation and the adoption of cutting-edge software solutions. Furthermore, North America is a hub for technological advancements in aviation, including software for maintenance, flight operations, and regulatory compliance. The growing demand for enhanced operational efficiency and safety, coupled with the ongoing digital transformation of the aviation industry, positions North America as the leader in the aviation software market.

Latin America

Latin America is gradually emerging in the aviation software market, driven by increasing air travel demand and infrastructure development. While still developing compared to other regions, governmental initiatives to modernize airports and improve airline operations are encouraging the adoption of advanced software solutions. Additionally, partnerships with North American technology firms are bridging the gap and facilitating the introduction of modern aviation software in this region.

Asia Pacific

Asia Pacific is showing significant growth potential in the aviation software market due to the rapid expansion of the aviation industry and increasing passenger traffic. Countries like China and India are investing heavily in airport infrastructure and fleet expansion, which creates a pressing need for efficient aviation software solutions. Moreover, the rise of low-cost carriers and the growing trend of digitization are propelling the adoption of modern aviation software in this region.

Europe

Europe is a mature market for aviation software, with longstanding players and advanced technological capabilities. The European aviation sector is characterized by stringent regulations, which necessitate compliance-centric software solutions. Additionally, the focus on enhancing passenger experience and improving operational efficiency is leading to increased investments in innovative software products. However, the market is competitive, and the growth rate may lag compared to emerging markets.

Middle East & Africa

The Middle East & Africa region is witnessing growth in the aviation software market, primarily driven by burgeoning air travel and investments in airport infrastructure. Countries such as the UAE and South Africa are leading this growth, fostering partnerships that encourage the use of advanced aviation software. While there is potential in the region, the overall market size remains small compared to North America and Asia Pacific, presenting challenges in software adoption and technological advancement.

Aviation Software Market Competitive Landscape:

Prominent participants in the worldwide aviation software sector significantly improve operational efficiency and safety by creating sophisticated solutions for flight operations, maintenance, and logistics management. Their contributions are essential in fostering innovation and ensuring adherence to regulatory standards in the aviation field.

Prominent stakeholders in the Aviation Software Sector encompass Boeing, Airbus, Honeywell International Inc., Lufthansa Systems, Sabre Corporation, Oracle Corporation, Lockheed Martin, IBM, Dassault Systèmes, Rockwell Collins, Jeppesen, Ramco Systems, Aviolinx, SITA, and Amadeus IT Group.

Global Aviation Software Market COVID-19 Impact and Market Status:

The Covid-19 pandemic had a profound impact on the Global Aviation Software market, causing a notable decrease in demand as airlines reduced their activities and implemented cost-cutting measures in response to travel limitations and a drop in passenger volumes.

The COVID-19 pandemic had a significant effect on the aviation software industry, causing a notable downturn in air travel that directly influenced the demand for software solutions in this sector. Airlines encountered severe financial difficulties, which resulted in reduced spending on new technologies, especially in areas like flight operations, maintenance management, and passenger service systems. On the other hand, the crisis hastened the shift towards digital solutions, as organizations aimed to enhance operational efficiency and strengthen safety measures. During this time, technologies that facilitate remote work, contactless passenger interactions, and data-driven decision-making became increasingly popular. As the aviation sector slowly starts to rebound, there's a growing emphasis on building resilience and fostering innovation, leading to greater investments in cutting-edge software to prepare for future challenges. Overall, while the pandemic's immediate effects were harmful, it also opened the door for enduring changes in the aviation software landscape.

Latest Trends and Innovation in The Global Aviation Software Market:

- In July 2023, Honeywell International Inc. announced the acquisition of EMEA-based aviation software provider, TRAX, to enhance its capabilities in aircraft maintenance, repair, and overhaul (MRO) solutions. This move aims to integrate TRAX’s advanced maintenance software with Honeywell’s existing aviation services portfolio.

- In August 2023, Boeing launched a new digital platform named Boeing Operate to streamline operations for operators of commercial aircraft. This platform leverages artificial intelligence to provide real-time data analytics, enhancing decision-making processes for airline efficiency.

- In October 2023, Airbus completed the acquisition of Airspace Experience Technologies, a startup specializing in cloud-based aviation software solutions to improve passenger experience and operational efficiency. This merger aligns with Airbus's long-term strategy of digital transformation in aviation.

- In September 2023, Dassault Systèmes introduced an updated version of its 3DExperience platform tailored for the aviation sector. This technology innovation focuses on integrating digital twin capabilities for aircraft design, maintenance, and on-ground operations, aiming to reduce time-to-market and improve regulatory compliance.

- In November 2023, Oracle announced its collaboration with Singapore Airlines to implement its cloud-based data analytics solutions. This initiative aims to enhance operational efficiency and customer experience through better data-driven insights in flight operations and passenger management.

- In December 2022, SAP SE expanded its partnerships with several regional airlines to provide cloud solutions that enhance operational efficiency and predictive maintenance capabilities, marking a significant development in its aviation software offerings.

- In January 2023, IBM announced a collaboration with Delta Air Lines to create AI-driven solutions for predictive maintenance and flight operations management, further establishing its presence in the aviation software market.

Aviation Software Market Growth Factors:

The expansion of the Aviation Software Market is fueled by a rising need for improved operational effectiveness, technological innovations, and ened safety standards in the aerospace sector.

The Aviation Software Market is currently undergoing substantial growth driven by various pivotal factors. Primarily, the rising need for effective airline operations and enhanced customer satisfaction is compelling airlines to implement cutting-edge software for flight management, maintenance, and scheduling. In addition, the increased emphasis on operational efficiency and cost reduction through automation and analytics is fostering significant investments in aviation software. The surge in air travel, along with the proliferation of low-cost carriers, is ening the demand for software tailored to revenue management, crew scheduling, and passenger services. Furthermore, the enforcement of rigorous safety regulations and the necessity for compliance are prompting airlines to adopt comprehensive software systems for efficient monitoring and reporting. The swift evolution of technology, especially in the domains of data analytics, cloud computing, and artificial intelligence, is facilitating the development of sophisticated solutions that enhance fleet performance and enable predictive maintenance. The trend toward digitization within the aviation industry is further propelling the need for interconnected software solutions. Lastly, the ongoing revival of the aviation sector following the pandemic is expected to accelerate investments in innovative software that can bolster growth, scalability, and operational resilience, thereby contributing significantly to the market's future expansion.

Aviation Software Market Restaining Factors:

The Aviation Software Market faces significant challenges due to strict regulatory standards and elevated development expenses.

The Aviation Software Market encounters numerous obstacles that could hinder its expansion. Among the primary challenges are the substantial costs associated with both implementation and ongoing maintenance, which may discourage smaller operators from adopting sophisticated software solutions. Compounding this issue are stringent regulatory requirements that necessitate frequent updates and modifications, placing additional strain on both software developers and their users. The rapid evolution of technology further complicates matters, as existing software may swiftly become outdated, necessitating continuous financial commitments.

Additionally, growing concerns regarding cybersecurity related to sensitive aviation data compel organizations to invest heavily in security protocols, diverting attention and resources from innovative pursuits. The shortage of skilled professionals with expertise in aviation software makes effective implementation and usage more difficult, while the intricate nature of integrating new systems with legacy infrastructure can impede operational efficiency.

Nevertheless, the rising awareness of the critical role digital transformation plays in the aviation industry offers significant prospects for growth. As various stakeholders increasingly focus on improving operational efficiencies and enhancing passenger experiences, the market is poised for ened investment and innovation. These developments hold the potential to not only alleviate current challenges but also create new avenues for growth and collaboration within the aviation landscape.

Segments of the Aviation Software Market

By Operation

• Aeronautical

• Non-Aeronautical

By Technology

• Security System

• Communication System

• Passenger, Cargo & Baggage Handling

• Air Traffic Control (ATC)

• Others

By Application

• Land Side

• Terminal Side

• Air Side

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America