Market Analysis and Insights:

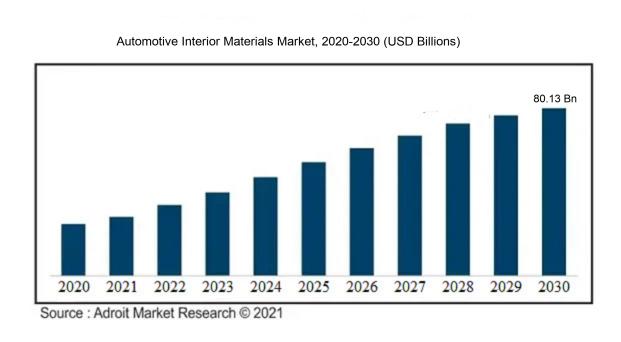

The market for Global Automotive Interior Materials was estimated to be worth USD 55.31 billion in 2020, and from 2021 to 2030, it is anticipated to grow at a CAGR of 3.93%, with an expected value of USD 80.13 billion in 2030.

The growth of the Automotive Interior Materials Market is propelled by various significant factors. One key factor is the escalating desire for opulent and cozy vehicle interiors driving market expansion. Consumers are increasingly inclined towards high-quality and visually pleasing interiors, resulting in the incorporation of sophisticated materials in automotive interiors. Furthermore, the increasing trend of customized vehicles contributes to the demand for a diverse array of interior materials like leather, fabric, and synthetic options to cater to the varied consumer preferences. The market is also influenced by the rising emphasis on sustainability and environmental issues, prompting the utilization of eco-friendly materials in automotive interiors, thereby stimulating market growth. Additionally, technological advancements such as the integration of smart materials, advanced infotainment systems, and enhanced safety features play a vital role in boosting market growth. In conclusion, these factors are projected to drive the expansion of the Automotive Interior Materials Market in the foreseeable future.

Automotive Interior Materials Market Scope:

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 80.13 billion |

| Growth Rate | CAGR of 3.93% during 2021-2030 |

| Segment Covered | By Type, By Vehicle Type, By Application,By Region. |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | Adient plc, Toyoda Gosei Co., Ltd., Lear Corporation, Faurecia, Grupo Antolin, Yanfeng Automotive Interiors, Toyota Boshoku Corporation, Sage Automotive Interiors, Benecke-Kaliko AG, and DK Schweizer Exklusivschneider GmbH. |

Market Definition

The sector of automotive interior materials pertains to the realm of manufacturing and distributing resources employed in the interior elements of automobiles, encompassing elements like upholstery, seating, dashboard, door panels, and various interior trim components. This market encapsulates an extensive array of materials like textiles, synthetic polymers, leather, and natural fibers, all serving the purpose of elevating comfort, aesthetics, and functionality within vehicles.

The automotive industry relies heavily on the Automotive Interior Materials Market to enhance customer experience and satisfaction. These materials, such as fabrics, plastics, and leather, are essential for creating attractive, comfortable, and functional vehicle interiors. They play a vital role in improving the aesthetics, safety, durability, and overall comfort of the vehicle, enriching the driving experience for customers. Furthermore, the selection of interior materials also serves as a reflection of the automobile manufacturer's brand image and quality, impacting consumer purchasing behavior. Therefore, the Automotive Interior Materials Market is crucial for meeting customer demands and staying competitive in the automotive sector.

Key Market Segmentation:

Insights On Key Type

Plastics

Plastics are expected to dominate the Global Automotive Interior Materials Market. Plastics offer numerous advantages such as lightweight, durability, and flexibility, making them ideal for various automotive interior applications. They can be easily molded into different shapes and sizes, allowing for innovative designs and customization options. Additionally, plastics are cost-effective compared to other materials, which further contributes to their dominance in the market.

Fabric

Fabric is another significant part of the Global Automotive Interior Materials Market. It is widely used in the automotive industry for seat covers, headliners, door panels, and other interior applications. Fabric provides a comfortable and aesthetic appeal to the car interiors. Moreover, advancements in fabric technology such as stain resistance, easy cleaning, and fire resistance have further increased its demand in the automotive sector.

Leather

Leather is a premium part within the Global Automotive Interior Materials Market. It is highly sought after for its luxurious and high-end appeal. Leather upholstery enhances the overall feel and appearance of the automotive interior, providing a touch of elegance and sophistication. Although leather might not dominate the market in terms of volume, it dominates in terms of value due to its premium nature and higher price points.

Composites

Composites, made of a combination of various materials such as fiber-reinforced polymers and metals, are a promising part in the Global Automotive Interior Materials Market. Composites offer high strength-to-weight ratio, improved fuel efficiency, and excellent resistance to corrosion. They are increasingly being used in interior applications such as door panels, instrument panels, and seat components. With the growing demand for lightweight materials and the focus on sustainability, composites are expected to gain traction in the automotive industry.

Metals

Metals, although not the dominant part, play a vital role in the Global Automotive Interior Materials Market. They are commonly used for structural components such as frames, supports, and fasteners. Metals offer rigidity, durability, and heat resistance, making them suitable for demanding automotive applications. However, with the advancements in lightweight materials and the increasing emphasis on fuel efficiency, metals face competition from other materials like plastics and composites.

Others

The "Others" type includes materials such as wood, natural fibers, and foams. While these materials have specific applications in automotive interior design, they are not expected to dominate the Global Automotive Interior Materials Market. These materials are often used for accent pieces or for adding a unique touch to the interior, but they have a limited market share compared to other parts.

Insights On Key Vehicle Type

Passenger Cars

Passenger Cars are expected to dominate the Global Automotive Interior Materials Market. This part holds the largest share in the automotive industry and is experiencing significant growth worldwide. With increasing consumer demand for comfortable and stylish interiors, car manufacturers are focusing on enhancing the interior aesthetics and functionality. This has led to a higher demand for automotive interior materials such as leather, fabrics, plastics, and composites. Passenger car sales have been consistently high, particularly in emerging markets and urban areas, where individuals prefer personal transportation. Moreover, the rising trend of electric vehicles, coupled with the need for lighter and more sustainable interior materials, further contributes to the dominance of passenger cars in the Global Automotive Interior Materials Market.

Light Commercial Vehicles

Light Commercial Vehicles (LCVs) are another important vehicle type in the Global Automotive Interior Materials Market. LCVs are widely used for commercial purposes such as delivery, transportation, and small-scale businesses. Although passenger cars dominate the market, LCVs are expected to witness steady growth due to their practicality and versatility. The interior materials used in LCVs revolve around durability, ease of maintenance, and cost-effectiveness. This part benefits from the growth of e-commerce and last-mile delivery services, which drive the demand for LCVs. Additionally, the emerging trend of electric LCVs creates opportunities for innovative interior materials that are lightweight, energy-efficient, and sustainable.

Heavy Commercial Vehicles

Heavy Commercial Vehicles (HCVs) comprise trucks, trailers, and other heavy-duty vehicles used for logistics, construction, and transportation of goods. While HCVs do not hold the largest market share in terms of automotive interior materials, they are significant players in the Global Automotive Interior Materials Market. The interior materials used in HCVs prioritize durability, strength, and safety, given the demanding nature of these vehicles. With the growth of e-commerce and globalization, the demand for efficient and reliable transportation of goods is increasing. This drives the demand for HCVs and subsequently the demand for suitable interior materials.

Buses and Coaches

Buses and Coaches form another vehicle type in the Global Automotive Interior Materials Market. These vehicles are mainly used for public transportation and long-distance travel. The interior materials for buses and coaches prioritize durability, comfort, and low maintenance. As more attention is given to the passenger experience in public transportation, bus and coach manufacturers are investing in high-quality interior materials that enhance comfort, aesthetics, and functionality. This part benefits from urbanization, infrastructure development, and government initiatives for sustainable public transportation systems. With the growing urban population and increasing emphasis on sustainable transport, the demand for buses and coaches is expected to steadily rise, driving the demand for automotive interior materials.

Insights On Key Application

Seats

Seats are expected to dominate the Global Automotive Interior Materials Market. With the rising demand for comfortable and aesthetically appealing car interiors, automakers are focusing on enhancing the quality of seats and upholstery. As a result, there is an increasing need for high-quality and durable materials that provide both comfort and style. Additionally, advancements in automotive seating technologies, such as smart seats and adjustable seating configurations, are driving the demand for innovative interior materials. Thus, the Seats part is anticipated to be the dominant part in the Global Automotive Interior Materials Market.

Dashboard

The Dashboard part in the Application category is an influential part of the automotive interior but is not expected to dominate the Global Automotive Interior Materials Market. While the dashboard plays a crucial role in housing various control panels, devices, and instruments, the demand for innovative interior materials specific to dashboards is relatively lower compared to other parts. Additionally, advancements in dashboard materials, such as the increasing use of high-quality plastics and composites, have provided automakers with cost-effective and durable options. However, the dominance of materials in the dashboard part is limited due to its relatively smaller market size compared to other parts.

Door Panel

The Door Panel is another significant part of the automotive interior. However, it is not anticipated to dominate the Global Automotive Interior Materials Market. While door panels contribute to the overall aesthetics and functionality of the vehicle interior, the demand for unique and innovative materials specifically for door panels is relatively lower compared to other parts of the interior. Automakers have adopted various materials such as high-quality plastics, composites, and fabric, which offer durability and aesthetic appeal. Therefore, the Door Panel part is not expected to be the dominating part in the Global Automotive Interior Materials Market.

Floor Carpets

Floor Carpets, while an essential application is not projected to dominate the Global Automotive Interior Materials Market. Although floor carpets play a crucial role in enhancing the overall comfort, aesthetics, and noise reduction within the vehicle, the demand for specific and innovative interior materials specifically for floor carpets is relatively lower compared to other parts. Additionally, advancements in carpeting materials, such as the use of durable and stain-resistant textiles and synthetic materials, have provided automakers with reliable options. Consequently, the Floor Carpets part is not expected to be the dominating part in the Global Automotive Interior Materials Market.

Others

The Other application covers various smaller or niche applications within the automotive interior, such as ceiling panels, armrests, headliners, and storage compartments. While these parts play a vital role in enhancing the overall comfort and functionality of the vehicle interior, they are not expected to dominate the Global Automotive Interior Materials Market individually. The demand for innovative interior materials in these smaller or niche applications tends to be comparatively lower than the dominant parts mentioned earlier. However, collectively, these smaller parts contribute to the overall growth and diversification of the Global Automotive Interior Materials Market.

Insights on Regional Analysis:

North America

North America is expected to dominate the Global Automotive Interior Materials Market market. The region has a well-established automotive industry with a high demand for advanced and premium interior materials. The presence of major automotive manufacturers, technological advancements, and a strong focus on innovation contribute to the dominance of North America in the market. Additionally, changing consumer preferences towards luxurious and high-quality interiors further drive the demand for automotive interior materials in this region.

Asia Pacific

Asia Pacific is an emerging market in the Global Automotive Interior Materials Market. The region has witnessed significant growth in the automotive sector, primarily driven by countries like China, Japan, and India. These countries have a large consumer base, rapid urbanization, and increasing disposable incomes, which fuel the demand for automobiles. As a result, the need for high-quality interior materials has also increased. Furthermore, the presence of several automotive manufacturing hubs and the rising trend of electric vehicles in the region further contribute to the growth of the automotive interior materials market in Asia Pacific.

Europe

Europe holds a substantial share in the Global Automotive Interior Materials Market market. The region is home to some of the leading automotive manufacturers and has a strong focus on technology and innovation. European consumers have a preference for luxurious and comfortable interiors, leading to the demand for high-quality automotive interior materials. Additionally, strict regulations regarding safety and environmental standards also drive the market in this region. However, due to the growing competition from other regions and economic uncertainties, Europe's dominance in the market is gradually declining.

Latin America

Latin America has a significant potential to grow in the Global Automotive Interior Materials Market market. The region is witnessing an increase in automotive production and sales, especially in countries like Brazil and Mexico. Rising consumer incomes, urbanization, and changing lifestyles contribute to the growing demand for automobiles and interior materials. However, challenges such as currency fluctuations, political instability, and economic uncertainties in the region pose as barriers to the steady growth of the market.

Middle East & Africa

Middle East & Africa have a relatively small market share in the Global Automotive Interior Materials Market market. The region's automotive sector is still developing, and the demand for interior materials is relatively low compared to other regions. Factors such as limited consumer purchasing power, economic instability, and underdeveloped infrastructure hinder the market's growth in this region. However, with the increasing investments in the automotive industry and the rising population, there is a potential for growth in the future.

Company Profiles:

Prominent participants within the worldwide automotive interior materials sector are pivotal in the production and delivery of superior materials designed for vehicle interiors. They cater to the needs of car manufacturers, elevating the driving experience through their offerings.

Prominent companies in the Automotive Interior Materials Market comprise Adient plc, Toyoda Gosei Co., Ltd., Lear Corporation, Faurecia, Grupo Antolin, Yanfeng Automotive Interiors, Toyota Boshoku Corporation, Sage Automotive Interiors, Benecke-Kaliko AG, and DK Schweizer Exklusivschneider GmbH. These industry leaders play a crucial role in providing a diverse array of materials including upholstery, dashboard components, seat belts, door panels, and flooring materials for the automotive sector. Through ongoing research and development endeavors, they strive to elevate the quality and longevity of their offerings while adhering to regulatory frameworks and meeting evolving consumer preferences. Their notable market presence and inventive product portfolios are instrumental in propelling the growth and competitiveness of the automotive interior materials market.

COVID-19 Impact and Market Status:

The global automotive interior materials market has been notably affected by the Covid-19 pandemic, resulting in a decrease in both demand and production as a result of supply chain interruptions and a decrease in consumer expenditure.

The automotive interior materials market has experienced a substantial impact as a result of the COVID-19 pandemic. The automotive sector has faced reduced production and sales due to various factors such as lockdown measures, economic instability, and decreased consumer expenditure. This downturn has directly influenced the need for automotive interior materials, leading to decreased production as a result of manufacturing limitations, disruptions in the supply chain, and labor deficiencies. In addition, consumers have exhibited more restraint in their spending on non-essential items like automotive interiors. Consequently, there has been a decline in the demand for materials like leather, fabric, and plastics utilized in car interiors.

Nonetheless, there is optimism for a gradual market recovery as the pandemic situation improves, and the automotive industry returns to normal operations. Market players are concentrating on creating innovative and environmentally friendly interior materials to satisfy evolving consumer preferences and the increasing interest in sustainable products.

Latest Trends and Innovation:

- In November 2020, Toyota announced its partnership with Panasonic Corporation to develop a prismatic battery for electric vehicles. This collaboration aims to reduce costs and improve the performance of batteries used in Toyota's electric vehicles.

- In January 2021, Faurecia, a leading automotive technology company, completed the acquisition of Clarion, a global automotive electronics manufacturer. This acquisition enhances Faurecia's capabilities in the areas of in-vehicle infotainment systems and advanced driver assistance systems.

- Ford Motor Company unveiled its new all-electric Mustang Mach-E SUV in November 2019. This electric vehicle marks Ford's entry into the electric vehicle market and showcases the company's commitment to sustainable mobility solutions.

- In December 2020, Johnson Controls, a global leader in automotive seating, announced its collaboration with Faurecia to develop sustainable seating solutions for electric vehicles. This collaboration focuses on reducing the environmental footprint of automotive interior materials.

- In October 2020, BMW introduced its seventh-generation BMW 3 Series, featuring an upgraded interior with various advancements in technology, design, and comfort. This new model showcases BMW's dedication to providing premium automotive interior experiences.

- In March 2021, Magna International, a leading global automotive supplier, announced its acquisition of Veoneer, a manufacturer of advanced driver assistance systems. This acquisition further strengthens Magna's position in the automotive technology market.

- General Motors (GM) introduced its all-new electric vehicle platform, Ultium, in March 2020. This platform enables GM to produce a wide range of electric vehicles with various body styles and performance characteristics.

- In September 2020, Continental AG, a leading automotive technology company, unveiled its Natural &Tech design concept for automotive interiors, focusing on sustainability and natural elements. This concept showcases Continental's commitment to eco-friendly interior materials.

Significant Growth Factors:

Factors fueling the growth of the Automotive Interior Materials Market encompass the growing need for personalization, advancements in technology, and a ened emphasis on enhancing safety and comfort.

The forecasted period is set to witness a notable expansion in the automotive interior materials sector, driven by various factors. The market growth is primarily fueled by the escalating desire for opulence and convenience in vehicles. Modern consumers exhibit a preference for automobiles that offer ened comfort and visual appeal, leading to an increased demand for premium interior materials. Furthermore, the uptick in disposable income among consumers in emerging markets like China, India, and Brazil is propelling automobile sales, consequently bolstering the need for automotive interior materials. Moreover, the mounting consciousness regarding the environmental implications of vehicles has spurred the development of sustainable interior materials, thereby enhancing market growth as eco-conscious consumers gravitate towards recyclable options. Technological progress has revolutionized interior material offerings, introducing lightweight variants that boast enhanced durability and design adaptability. These technological strides are attracting both consumers and manufacturers, further propelling market expansion. Finally, the overall growth of the automotive industry, along with the surge in electric vehicle production, is poised to have a positive influence on the market landscape. Collectively, these factors are set to underpin a substantial upsurge in the automotive interior materials market in the foreseeable future.

Restraining Factors:

The restricted supply of sustainable materials presents a hurdle for the expansion of the Automotive Interior Materials Market.

The market for automotive interior materials encounters several obstacles that impede its progress and advancement. Primarily, strict regulatory standards mandated by government entities pertaining to vehicle safety, emissions, and environmental sustainability present difficulties for manufacturers. Adhering to these regulations often necessitates investments in research and development, alongside the utilization of costly materials, thereby escalating overall production expenses. Moreover, the elevated prices of premium automotive interior materials like leather or wood veneers constrain their acceptance in mainstream vehicles, rendering them unattainable for the average buyer. Additionally, the prevailing global economic slowdown impacts consumer buying capacity, resulting in diminished car sales and subsequently affecting the demand for automotive interior materials. Furthermore, the deficiency of skilled workforce and proficiency in the manufacturing and installation procedures of these materials poses a considerable hurdle for the sector. The scarcity of raw materials such as authentic leather or exotic wood types required for automotive interior materials also restricts their accessibility in the marketplace. Nevertheless, notwithstanding these challenges, the automotive interior materials exhibits growth potential. Manufacturers can surmount these hurdles by investing in research and development to devise innovative, cost-efficient alternatives to expensive materials. Furthermore, partnerships with suppliers and industry specialists can aid in alleviating raw material shortages and fostering sustainable solutions. By prioritizing technological advancements and adapting to evolving consumer preferences, the automotive interior materials market can sustain its prosperity.

Key Segments of the Automotive Interior Materials Market

Type Overview

• Composites

• Others

• Plastics

• Metals

• Fabric

• Leather

Vehicle Type Overview

• Light Commercial Vehicle

• Heavy Commercial Vehicle

• Passenger Cars

• Buses and Coaches

Application Overview

• Dashboard

• Door Panel

• Seats

• Floor Carpets

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America