Automotive Disruption Radar Market Analysis and Insights:

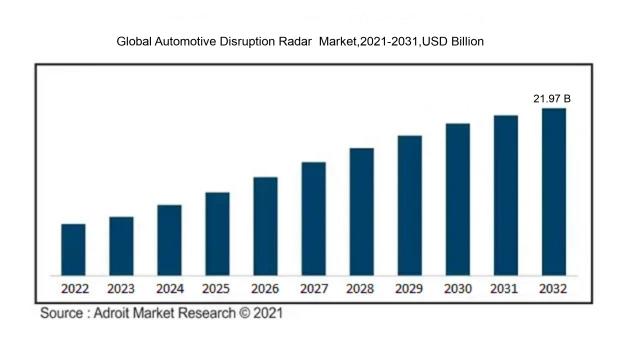

In 2023, the size of the worldwide Automotive Disruption Radar market was US$ 7.48 billion. Adroit Market Research projects that the market will increase at a compound annual growth rate (CAGR) of 12.6% from 2024 to 2032, reaching US$ 21.97 billion.

The Automotive Disruption Radar Market is significantly influenced by the swift evolution of technologies, especially in sectors like electric vehicles (EVs), self-driving capabilities, and connected automobile solutions. The growing consumer inclination towards eco-friendly mobility options is accelerating the shift to EVs, leading car manufacturers to make substantial investments in research and innovation. Additionally, mounting regulatory demands aimed at decreasing carbon footprints and improving vehicle safety are steering the industry towards groundbreaking solutions. The emergence of mobility-as-a-service (MaaS) frameworks is also reshaping conventional ownership models and fostering the expansion of shared mobility options. Moreover, progress in data analytics and artificial intelligence is allowing manufacturers to respond rapidly to market trends and consumer demands. Collaborative efforts between automotive companies and tech enterprises are playing a crucial role in developing smart infrastructure and advanced vehicle technologies, which profoundly impact market dynamics and enhance competitive positioning. Collectively, these interrelated elements are actively redefining the future of the automotive sector.

Automotive Disruption Radar Market Definition

The Automotive Disruption Radar serves as a resource for recognizing and examining new trends and technological advancements in the automotive sector. It enables stakeholders to grasp possible disruptions that may influence market dynamics and competitive environments.

The Automotive Disruption Radar serves as an essential tool, offering an in-depth perspective on the evolving trends and technologies that influence the automotive sector. By monitoring disruptions like electric vehicles, self-driving technology, shared transportation solutions, and connectivity advancements, this radar provides critical insights for stakeholders engaged in strategic planning and decision-making. It helps manufacturers, investors, and policymakers recognize both potential challenges and opportunities, enabling them to maintain a competitive edge in a fast-changing landscape. Additionally, the radar promotes innovation by illuminating shifts in consumer behavior and regulatory developments, empowering industry participants to adjust and succeed amid a growingly intricate environment.

Automotive Disruption Radar Market Segmental Analysis:

Insights On Range

Medium Range

The medium range is expected to dominate the Global Automotive Disruption Radar market due to its optimal balance between performance and cost. As automotive technologies evolve, the demand for advanced driver-assistance systems (ADAS) is growing, where medium-range radars provide adequate sensing capabilities for scenarios like adaptive cruise control and collision avoidance. These capabilities are crucial for enhancing vehicle safety and are becoming a standard feature in mid-tier automobiles. The versatility of medium-range radars in various weather conditions and diverse environments further solidifies their position, leading to increased adoption by automotive manufacturers aiming to meet regulatory compliance and consumer safety expectations.

Long Range

Long-range radars play a critical role in the automotive sector, particularly in applications that require detection of objects at greater distances, such as highway driving and automated driving solutions. Their ability to provide a broader field of vision makes them essential for advanced autonomous vehicles intending to navigate complex environments. However, they typically come at a higher cost and can be limited by environmental factors such as weather conditions. Consequently, while they are increasingly integrated into high-end models and luxury vehicles, their limited growth in broader applications sets them apart as less dominant compared to the medium range.

Short Range

Short-range radars are significant for applications like parking assistance, blind-spot detection, and collision warning in crowded environments. They excel in providing high-resolution data over shorter distances, enabling vehicles to perform well in tight spaces. Despite their importance in enhancing everyday driving experience, their impact on the overall automotive disruption radar market is limited because they cater typically to lower-tier vehicles and are more ancillary in nature. This niche application may result in slower growth compared to medium-range solutions, which cover a broader spectrum of functionalities critical for advanced safety and driver-assistance technologies.

Insights On Vehicle Type

Passenger Cars

The passenger cars category is expected to dominate the Global Automotive Disruption Radar Market. This trend is attributed to the significant transformation occurring within the automotive industry, especially with the rise of electric vehicles, autonomous driving technology, and smart integrations. Passenger cars make up a large share of the global vehicle market, and advancements in technology have led to increased investments in this sector. The consumer demand for enhanced safety features, fuel efficiency, and connectivity in personal vehicles drives innovation, making passenger cars a focal point for research and development. Additionally, the growing trend of urbanization has led to increasing registrations of passenger vehicles in metropolitan areas, further solidifying their dominance.

Commercial Vehicles

The commercial vehicles holds a position in the automotive market, catering to various applications such as freight transport, logistics, and service industries. The increasing demand for e-commerce has accelerated the need for efficient delivery solutions, leading to an uptick in commercial vehicle registrations. Technological advancements are also driving this sector, with many companies investing in telematics and fleet management solutions to optimize operations. Furthermore, sustainability trends are pushing the commercial vehicle industry towards electrification, enhancing its appeal in the face of regulatory pressures. Nonetheless, despite these positive trends, the volume of commercial vehicles typically trails behind passenger vehicles.

Insights On EV Preferences

Battery Electric Vehicles

Battery Electric Vehicles (BEVs) are expected to dominate the Global Automotive Disruption Radar market due to their increasing adoption fueled by advancements in battery technology, longer driving ranges, and zero tailpipe emissions. As governments worldwide implement stricter emissions regulations and provide incentives for electric vehicle purchases, BEV sales are experiencing exponential growth. Additionally, the expanding charging infrastructure is alleviating range anxiety, thus attracting more consumers toward BEVs. With a robust product pipeline from automakers and a deeper understanding of the eco-conscious consumer base, Battery Electric Vehicles are positioned for significant market leadership in the years to come.

Plug-in Hybrids

Plug-in Hybrids (PHEVs) serve as a bridge between conventional vehicles and fully electric models, appealing to consumers seeking flexibility. By combining internal combustion engines with electric propulsion, PHEVs offer extended range options and the convenience of refueling through traditional gasoline stations. This dual capability addresses concerns surrounding charging infrastructure and range anxiety. Additionally, as fuel prices fluctuate and environmental awareness rises, PHEVs continue to attract a of the population that values both performance and sustainability.

Fuel Cell Electric Vehicles

Fuel Cell Electric Vehicles (FCEVs) represent a lesser-known yet significant alternative in the electric vehicle landscape. These vehicles utilize hydrogen as fuel, offering rapid refueling times and substantial driving ranges similar to traditional vehicles. While the technology is promising, the lack of widespread hydrogen infrastructure limits their current market penetration. Nonetheless, FCEVs appeal to certain s focused on sustainability, and advancements in hydrogen production and storage technology may pave the way for increased adoption in the future.

Insights On Application

Autonomous Emergency Braking

Autonomous Emergency Braking (AEB) is anticipated to dominate the Global Automotive Disruption Radar Market due to its fundamental role in enhancing vehicle safety and mitigating accidents. AEB systems automatically detect potential collisions and apply the brakes if the driver does not respond in time, making it a crucial technology for both consumer protection and the advancement of autonomous driving functions. With increasing regulatory pressure and ened consumer awareness about safety features, the adoption of AEB systems has surged in recent years. Automakers are prioritizing AEB in their vehicle offerings, thus leading to its prominence in market growth as consumers increasingly favor vehicles that provide enhanced safety mechanisms.

Adaptive Cruise Control

Adaptive Cruise Control (ACC) is gaining traction in the automotive industry as it automates speed regulation based on surrounding traffic. This technology enhances the driving experience by allowing drivers to maintain a set speed while the system adjusts for the distance to the vehicle ahead. The rising demand for semi-autonomous driving features is propelling the adoption of ACC systems, especially in premium and luxury vehicles. Moreover, as more consumers seek convenience and automated driving assistance, the relevance of ACC in future vehicle models is expected to grow steadily.

Blind Spot Detection

Blind Spot Detection is essential for enhancing vehicle safety, especially on multi-lane highways. This technology provides drivers alerts about vehicles in their blind spots, significantly reducing the likelihood of accidents when changing lanes. The proliferation of vehicle sharing and increasing awareness of road safety are contributing to a ened demand for this feature. As manufacturers enhance their offerings with superior safety systems, Blind Spot Detection is becoming increasingly standard across various automotive classes, particularly in family and commercial vehicles.

Forward Collision Warning

Forward Collision Warning systems are vital in preventing rear-end collisions by alerting drivers when a potential crash is detected. This technology is being adopted rapidly, as it is often seen as a necessary component of comprehensive safety initiatives. With growing adoption driven by consumer expectations and regulations aimed at reducing road mishaps, Forward Collision Warning serves not only to fulfill safety requirements but also enhance the overall driving experience. As automakers strive to integrate advanced predictive technologies, Forward Collision Warning will remain a staple in vehicle safety frameworks.

Intelligent Park Assist

Intelligent Park Assist systems are increasingly being integrated into modern vehicles for their ability to autonomously guide drivers into parking spaces. This technology caters especially to urban drivers facing the challenges of tight parking spots. Convenience and ease of use, combined with technological advancements in sensors and algorithms, are driving consumer interest in Intelligent Park Assist. With an emphasis on creating user-friendly driving experiences, automakers realize this technology is crucial for meeting customer expectations in smart mobility.

Other ADAS Systems

Other ADAS systems encompass a range of advanced features, including lane-keeping assistance, traffic sign recognition, and more. Although not as widely recognized as some of the applications, these systems collectively enhance vehicle safety and driver experience. The increasing complexity of modern vehicles encourages manufacturers to improve overall functionality and safety, thus bolstering the adoption of these additional systems. As the industry gravitates toward comprehensive assistance technologies, these features will continue to gain traction among consumers, contributing to the broader adoption of advanced driver-assistance technologies.

Global Automotive Disruption Radar Market Regional Insights:

Asia Pacific

The Asia Pacific region is anticipated to dominate the Global Automotive Disruption Radar Market due to several compelling factors. The region houses major automotive manufacturing giants, such as Japan, South Korea, and China, which continue to lead in terms of innovation, production scales, and new automotive technologies. A rapidly growing middle class in countries like India and China is increasing the demand for advanced and connected vehicles. Additionally, governments in the Asia Pacific are heavily investing in smart city initiatives and electric vehicle incentives, further bolstering the automotive sector's growth. The confluence of technological advancements, substantial investment in research and development, and ened consumer interest positions Asia Pacific as the frontrunner in this market.

North America

In North America, the automotive sector is significantly driven by technological innovations and consumer preferences for high-performance vehicles. The United States, as a leading manufacturer and adopter of electric vehicles, is focusing heavily on sustainable practices and intelligent driving systems. However, while North America benefits from high disposable income and advanced technology, regulatory challenges and competition from emerging markets could impact its growth pace relative to Asia Pacific, preventing it from taking the dominant position.

Europe

Europe stands as a critical player in the automotive disruption market, largely due to its robust regulatory frameworks focused on sustainability and emissions reduction. Home to renowned automotive brands and a commitment to electric vehicle adoption, Europe is heavily investing in research and development of autonomous technologies. However, challenges such as economic fluctuations and the stringent regulatory landscape might hinder its ability to overtake the rapid growth seen in the Asia Pacific region.

Latin America

Latin America presents a mixed landscape for the automotive disruption radar market. The region has experienced modest growth due to economic instability and fluctuating consumer demand. However, emerging economies like Brazil and Mexico have shown potential for growth in automotive innovation, especially as they adapt to electric vehicles and connectivity. Enhanced investment in infrastructure and government incentives could catalyze future growth, but the region still lags behind other areas such as Asia Pacific and North America.

Middle East & Africa

The Middle East and Africa region shows potential for automotive market disruption due to increased urbanization and a growing interest in electric vehicles. Nonetheless, political and economic instability in some countries presents a challenge to consistent growth. Although initiatives promoting renewable energy and technological advancements are emerging, these markets are generally perceived as underdeveloped compared to their APAC and North American counterparts. Continued investment and improved economic conditions will be crucial for this region to play a more significant role in the global automotive landscape.

Automotive Disruption Radar Market Competitive Landscape:

Major participants in the Global Automotive Disruption Radar market foster innovation by creating cutting-edge technologies and solutions that improve vehicle efficiency and mobility. They are instrumental in influencing industry trends via strategic collaborations, investments, and the integration of sustainable practices.

Prominent entities within the Automotive Disruption Radar Market encompass Tesla, Waymo, Ford Motor Company, General Motors, BMW, Mercedes-Benz, Volkswagen AG, Toyota Motor Corporation, Nissan Motor Corporation, Hyundai Motor Company, Honda Motor Co., Ltd., Rivian, Lucid Motors, Baidu, Didi Chuxing, Aptiv, NVIDIA Corporation, Bosch, Continental AG, and ZF Friedrichshafen AG.

Global Automotive Disruption Radar Market COVID-19 Impact and Market Status:

The Covid-19 pandemic profoundly impacted the Global Automotive Disruption Radar market by transforming supply chains, hastening the shift towards digitalization, and changing consumer inclinations towards electric and self-driving vehicles.

The COVID-19 pandemic had a profound effect on the Automotive Disruption Radar market, resulting in a temporary contraction in both production and sales due to enforced lockdown measures and interruptions in supply chains. Initially, manufacturers encountered significant obstacles including the suspension of assembly operations and a critical shortage of semiconductor chips essential for cutting-edge automotive technology. Nonetheless, the pandemic acted as a catalyst for the swift adoption of innovative technologies, as the automotive industry adjusted to alterations in consumer behavior and a rising preference for contactless solutions. As the sector begins to recover, there is an increased emphasis on incorporating advanced driver-assistance systems (ADAS) alongside initiatives geared toward digital transformation, which is invigorating the growth of disruption radar technologies. Additionally, the ongoing transition to electric vehicles (EVs) and autonomous driving technologies is altering market dynamics, leading to greater investments in research and development. Looking ahead, the Automotive Disruption Radar market is set for rejuvenation and growth, propelled by the industry’s dedication to innovation and sustainable practices in the evolving post-pandemic environment.

Latest Trends and Innovation in The Global Automotive Disruption Radar Market:

- In January 2023, Ford Motor Company announced a strategic partnership with Google to enhance its data analytics and cloud capabilities, aiming to leverage AI and machine learning for better consumer insights and operational efficiency.

- In February 2023, General Motors acquired a 25% stake in the electric vehicle startup, Canoo, positioning itself to enhance its EV offerings while furthering its commitment to sustainable transportation.

- In April 2023, Volkswagen AG initiated a merger with Argo AI, a self-driving technology company, to advance its autonomous driving initiatives and expedite the rollout of self-driving vehicles.

- In June 2023, Rivian Automotive signed a deal with Amazon to increase production of electric delivery vans, enhancing Amazon's logistics capabilities while supporting Rivian's growth strategy.

- In August 2023, Stellantis N.V. completed the acquisition of a semiconductor manufacturer to strengthen its supply chain amid ongoing global chip shortages affecting the automotive industry.

- In September 2023, Tesla unveiled its latest advancements in battery technology at its annual Battery Day event, showcasing a new lithium iron phosphate battery that promises to lower costs and improve range for future models.

- In October 2023, BMW Group announced a collaboration with the tech giant Samsung SDI to develop next-generation batteries for electric vehicles and to ensure a sustainable supply chain for battery materials.

- In November 2023, Toyota Motor Corporation announced its plan to invest $8 billion into its EV production facilities in the United States, which aims to boost local manufacturing of electric vehicles and create thousands of jobs.

- In December 2023, Hyundai Motor Company launched a joint venture with businesses focused on hydrogen technology, cementing its role as a leader in hydrogen fuel cell development for vehicles.

Automotive Disruption Radar Market Growth Factors:

The Automotive Disruption Radar Market is driven by progress in electric vehicle technologies, breakthroughs in autonomous driving, and a growing emphasis on sustainability and interconnectedness within transportation solutions.

The Automotive Disruption Radar Market is witnessing notable expansion driven by numerous influential factors. Primarily, the swift advancement of technology—encompassing developments in electric vehicles (EVs), autonomous systems, and connected car technologies—is fueling innovation and attracting investments in the automotive realm. Manufacturers are increasingly focusing on sustainability to distinguish themselves, resulting in a surge in the production of environmentally friendly vehicles. Furthermore, evolving consumer tastes towards shared mobility and digital offerings are reshaping the industry, culminating in a ened demand for comprehensive mobility solutions. Government initiatives aimed at reducing emissions and promoting EV adoption are also acting as catalysts for market growth. The advent of digital technologies in automotive services, alongside the adoption of artificial intelligence and big data analytics to boost operational efficiency, plays a vital role in this growth trajectory. Additionally, the ongoing transition to Industry 4.0 methodologies is encouraging traditional manufacturers to become more adaptable and innovative, thereby creating a competitive landscape ripe for disruption. Ultimately, the growing importance of global supply chains and cooperative ventures within the automotive ecosystem is enhancing technological progress and market access, expanding growth prospects in the Automotive Disruption Radar Market.

Automotive Disruption Radar Market Restaining Factors:

Significant obstacles affecting the Automotive Disruption Radar Market encompass regulatory constraints, elevated development expenses, and diverse levels of consumer acceptance.

The Automotive Disruption Radar Market encounters numerous obstacles that could hinder its growth potential. One major challenge arises from the swift progression of technological innovations, which can outpace companies and render their current offerings obsolete. Additionally, the automotive industry's changing regulatory framework, characterized by rigorous emissions and safety standards, necessitates substantial investments in research and development, posing difficulties for smaller enterprises. The introduction of advanced technologies, including autonomous driving and electric vehicles, demands considerable financial investment and specialized knowledge, complicating adaptation efforts for some firms. Moreover, uneven infrastructure, particularly in the availability of electric vehicle charging stations, can impede widespread adoption. Consumer wariness regarding the safety and dependability of new technologies further complicates market acceptance. Nonetheless, the increasing demand for eco-friendly transportation solutions and cutting-edge automotive technologies offers substantial avenues for growth. As industry participants continue to collaborate and emphasize research and development, the market is set for significant evolution, paving the way for a more sustainable and efficient automotive ecosystem that aligns with both consumer expectations and environmental objectives.

Segments of the Automotive Disruption Radar Market

By Range

- Long Range

- Medium Range

- Short Range

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By EV Preferences

- Battery Electric Vehicles

- Plug-in Hybrids

- Fuel Cell Electric Vehicles

By Application:

- Adaptive Cruise Control

- Autonomous Emergency Braking

- Blind Spot Detection

- Forward Collision Warning,

- Intelligent Park Assist

- Other ADAS Systems

Regional Overview

North America

- US

- Canada

- Mexico

Europe

- Germany

- France

- U.K

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

Middle East and Africa

- Saudi Arabia

- UAE

- Rest of Middle East and Africa

Latin America

- Brazil

- Argentina

- Rest of Latin America