The market for global automated breach & attack simulation is projected to reach at USD 1,120 million by 2025. The factors such as rising need for compliance as well as growing use of data quality tools and systems for data management is responsible for the global automated breach and attack simulation market growth. Continuous need for network performance management owing to the evolution of cyberattacks along with optimization solutions to proficiently handle changing intricate network environments is likely to promote the growth of automated breach and attack simulation market growth in the near future.

Automated breach & attack simulations facilitate secure and safe networks within the computer systems. These solutions require comparatively low maintenance cost and follow easy steps for installation.

The value of the Automated Breach and Attack Simulation market is projected to grow to USD 2134.2 billion with an estimated CAGR of 43.2% by 2030

.jpg)

For effective outcomes, most enterprise deploy this technology in the cloud based platforms. Attack and breach simulation provides security testing constantly to avoid losses through cyberattacks. With an upgradation in technology, these solutions also get upgraded so as to fight with new vulnerabilities.

Automated Breach and Attack Simulation Market Scope

| Metrics | Details |

| Base Year | 2023 |

| Historic Data | 2018-2022 |

| Forecast Period | 2024-2030 |

| Study Period | 2018-2030 |

| Forecast Unit | Value (USD) |

| Revenue forecast in 2030 | USD 2134.2 billion |

| Growth Rate | CAGR of 43.2% during 2020-2030 |

| Segment Covered | By Component, Regions |

| Regions Covered | North America, Europe, Asia Pacific, South America, Middle East and Africa |

| Key Players Profiled | XM Cyber (Israel), Cymulate (Israel), Aujas (US), Elasticito Limited (UK), SafeBreach Inc. (US), Optiv Security Inc. (US), Traxion (Netherlands), Layer 8 Solutions (Canada), Carbonsec (Slovenia), Marlabs Inc. (US), Netsecuris LLC (US), Guardicore (Israel), Larsen & Toubro Infotech Limited (India), eSafe IT (Ethiopia), and AttackIQ (US). |

Key Segment Of The Automated Breach and Attack Simulation Market

By Component (USD Billion)

• Solution

• Service

By Deployment, (USD Billion)

• On Premise

• Cloud Based

By Application, (USD Billion)

• Configuration Management

• Patch Management

• Credentials Management

• Threat Intelligence

• Others

Regional Overview, (USD Billion)

North America

• US

• Canada

Europe

• Germany

• France

• UK

• Rest of Europe

Asia Pacific

• China

• India

• Japan

• Rest of Asia Pacific

South America

• Mexico

• Brazil

• Rest of South America

Middle East and South Africa

Frequently Asked Questions (FAQ) :

Growing number of cyberattacks throughout the globe is the main factor for the automated breach and attack simulations market to grow enormously. .The BFSI as well as IT & telecom sectors have experienced numerous security breaches and attacks such as SQL injection, cross-site scripting, cookie poisoning, forceful browsing, Distributed Denial of Service (DDoS), botnets, among other. With facilities such as internet banking, mobile banking, and smart banking features, BFSI organizations need to prioritize security solutions to prevent from such cyber attacks on their systems. The cybersecurity and network security industry players are coming up with advanced security solutions to meet the dynamic nature of the business environment and tackle the growing intricacy of attacks. Moreover, the industry is fueled by increasing demand for the generation of quality tools to sustain the competitive scenario. On the other hand, the growing adoption of the Internet of Things (IoT), Artificial Intelligence (AI), and software defined network technologies are likely to offer lucrative prospects for the automated breach and attack simulation industry growth in the coming few years.

Offerings Segment

The global automated breach and attack simulation market contains both platforms and service segment. The platform segment has maximum revenue share within the global automated breach and attack simulation market in 2019. The industry participants within the automated breach and attack simulation market are focusing on building innovative solutions that can tackle security threats and phishing attacks against employees, ransomware, advanced persistent threats, denial-of-service-attacks, as well as securing mobile devices authorized for employees. However, the service segment is likely to grow at a staggering rate in the next five years.

Application Segment

Based on the application segment, the market is bifurcated into configuration management, patch management, team assessment, threat intelligence, others. In 2019, the configuration segment gathered the largest market revenue and it is anticipated to govern the automated breach and attack simulation market throughout the forecast period. However, the threat intelligence segment is anticipated to grow at a substantial growth rate over the forecast period.

End-User Segment

Based on the end-user, the market is segmented into data centers, enterprises, service providers. The market for enterprises is anticipated to possess the largest market share in 2019 since the Tech companies today are predominantly developing to match their user needs. Moreover, the growing regulatory scrutiny coupled with enhanced customer satisfaction, as well as advantages such as risk management, fraud detection, and customized solutions are some of the factors responsible for the automated breach and attack simulation demand.

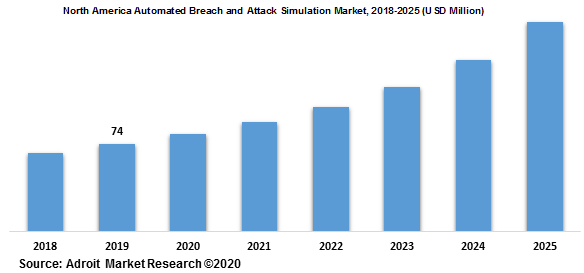

The global automated breach and attack simulation industry is a wide range to North America, Asia Pacific, Europe, South America, and the Middle East & Africa. North America is considered a mature market in the automated breach and attack simulation applications, owing to an outsized presence of organization with the availability of technical expertise and advanced IT infrastructure. The US and Canada are the highest contributory countries to the expansion of the automated breach and attack simulation market in North America.

The major players of the global automated breach and attack simulation market are NopSec, Qualys, Rapid7, DXC Technology, AttackIQ, Skybox Security, SafeBreach, Firemon, Cymulate, Verdoin, XM Cyber, and more. The automated breach and attack simulation market is fragmented with the existence of well-known global and domestic players across the globe.