Automated And Closed Cell Therapy Processing System Market Analysis and Insights:

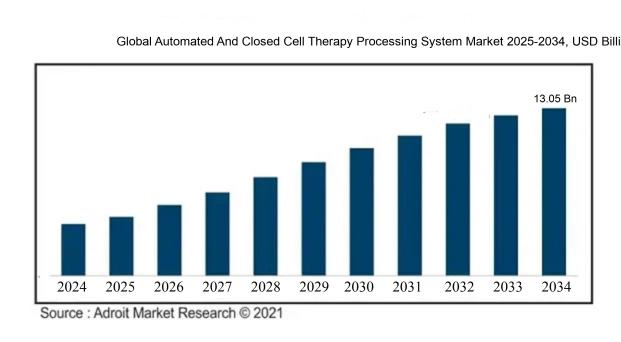

The size of the global market for automated and closed cell therapy processing systems was USD 2.34 billion in 2024, increased to USD 2.92 billion in 2025, and is projected to reach around USD 13.05 billion by 2034, with a compound annual growth rate (CAGR) of 24.20% from 2024 to 2034.

The market for Automated and Closed Cell Therapy Processing Systems is predominantly fueled by the growing interest in personalized medicine and advanced therapeutic options, especially in the fields of oncology and regenerative medicine. The rising incidence of chronic health conditions, paired with the demand for safe, effective, and scalable manufacturing solutions, significantly drives this market forward. Innovations in automation and robotics play a critical role, enhancing the precision and efficiency of cell processing while minimizing contamination risks and human error. Additionally, supportive regulatory frameworks and incentives aimed at advancing cell therapy development further enrich the landscape, promoting both innovation and investment. The increasing tendency to outsource production to Contract Development and Manufacturing Organizations (CDMOs) allows smaller enterprises to leverage advanced technologies, thereby broadening their market presence. As healthcare systems increasingly prioritize improved patient outcomes and cost-efficiency, the adoption of these automated systems is poised for rapid growth, fostering a vibrant environment in the cell therapy industry.

Automated And Closed Cell Therapy Processing System Market Definition

An Automated and Closed Cell Therapy Processing System is a meticulously regulated mechanism aimed at optimizing the preparation, handling, and evaluation of cellular therapies in a protected setting. This methodology reduces the likelihood of contamination and improves both the efficiency and consistency of the production process for cell-based therapies.

The Automated Closed Cell Therapy Processing System plays a pivotal role in optimizing both efficiency and safety in the manufacturing of cell therapies. By implementing automation, it significantly lowers the likelihood of human error and maintains a high standard of quality control, which is paramount for ensuring patient safety. The closed-loop design further mitigates contamination risks, safeguarding delicate cell cultures from external contaminants. Additionally, this technology enhances operational workflows, resulting in expedited therapy production times, particularly important in urgent care situations. It also facilitates scalable production methods, thereby increasing the accessibility and affordability of innovative therapies, ultimately leading to better patient outcomes and fostering advancements in regenerative medicine.

Automated And Closed Cell Therapy Processing System Market Segmental Analysis:

Insights On Workflow

Apheresis

Apheresis is expected to dominate the Global Automated and Closed Cell Therapy Processing System Market due to the increasing demand for therapeutic procedures that require the separation of blood components, such as plasma and platelets. This workflow is critical in the context of cell therapies, as it allows for the targeted collection of specific cells while discarding unwanted components. With advancements in technology leading to more efficient and automated apheresis systems, healthcare providers are increasingly adopting these solutions to improve patient outcomes and streamline processes. This trend, coupled with a rise in chronic diseases and a growing population of cancer patients requiring cellular therapies, positions apheresis as the leading workflow in this market.

Cryopreservation

Cryopreservation is a significant process in the cell therapy workflow that allows for the long-term storage of biological samples at extremely low temperatures. This technique is essential to maintain the viability of cells for later use in therapies, particularly with stem cell and regenerative medicine applications. The demand for effective cryopreservation methods has been growing as researchers and clinicians seek ways to ensure the quality and integrity of their cell products over time. Although it plays a crucial role, its market share is impacted by advancements in other workflows that offer more immediate processing benefits.

Fill-finish

Fill-finish is another important workflow responsible for the final preparation of cell therapeutic products before they are administered to patients. This includes activities such as filling the vials with the processed cell product and sealing them for sterilization and distribution. As regulatory standards become more stringent, the rise in demand for safe, effective, and high-quality therapeutic options is pushing the development of advanced automated fill-finish systems. However, the overall impact of this workflow is constrained by the fact that it does not directly influence the initial processing of cellular materials, which limits its dominance in the market.

Separation

Separation is a crucial phase involved in isolating specific cells from a heterogeneous mixture. The increasing prevalence of cell-based therapies has ened the need for sophisticated separation techniques that can ensure the purity and functionality of the desired cell populations. This workflow is vital for applications like regenerative medicine and immuno-oncology. Despite its importance, its market presence is often overshadowed by workflows like apheresis, which combine separation with more comprehensive processing and automation capabilities to meet the evolving needs of cell therapy.

Expansion

Expansion refers to the process of proliferating specific cell types in vitro to reach requisite quantities for therapeutic applications. This process is critical, particularly in CAR-T cell therapy, where a significant number of engineered immune cells are needed for effective treatments. However, the complexity and time requirements involved in expansion processes limit their competitive edge against more automated workflows. Innovations in bioreactor technologies and optimized media formulations are opening new avenues for expansion, but they still face challenges in speed and scalability compared to apheresis systems that directly assist in therapeutic harvests.

Others

The 'Others' category encompasses less frequently utilized workflows that provide specific functions within the broader spectrum of cell therapy processing. This might include technologies related to quality control, storage solutions, and specialized isolation techniques. While these processes contribute to various aspects of processing systems, they tend to be overshadowed by more dominant workflows like apheresis or cryopreservation, which fulfill essential roles driven by higher demand and visibility in therapeutic settings. As a result, 'Others' remains a smaller niche within the overall cell therapy processing market.

Insights On Type

Stem Cell Therapy

Stem Cell Therapy is expected to dominate the Global Automated And Closed Cell Therapy Processing System Market primarily due to the growing demand for regenerative medicine and advancements in stem cell research. This is gaining traction as it offers innovative solutions for a variety of conditions, including cancer, autoimmune diseases, and inherited disorders. The increasing investment in stem cell therapy by pharmaceutical companies and research institutions is enhancing its adoption. Furthermore, regulatory approvals and successful clinical trials are pushing the use of stem cells in therapeutics. Consequently, the expanding applications and scientific breakthroughs in this area position Stem Cell Therapy as the leading player in the market.

Non-stem Cell Therapy

Non-stem Cell Therapy is a critical component of the Global Automated And Closed Cell Therapy Processing System Market, albeit not the leader. This category often includes therapies that utilize differentiated immune cells or cytokine therapies to treat various diseases. The non-stem cell therapies are well-established in clinical practice, primarily due to their ease of administration and the relatively lower complexity of processing compared to stem cell therapies. The existing healthcare protocols support its growth, although it faces increasing competition from emerging stem cell therapies.

Insights On Scale

Commercial Scale

The Commercial Scale is expected to dominate the Global Automated and Closed Cell Therapy Processing System Market due to the increasing demand for advanced cell therapies in clinical settings and commercial applicability. The shift towards large-scale production capacity helps meet the rising patient needs and regulatory expectations for quality control in cell therapies. With an expanding market of treatments and the necessity for efficient processing systems, investment in commercial applications will escalate. Moreover, established companies are seeking to optimize production while maintaining efficacy and compliance, which drives the growth of systems tailored for commercial purposes.

R&D Scale

The R&D Scale plays a crucial role in advancing new technologies and protocols for cell therapy, supporting innovation and discovery. While it does not currently dominate the market, this is essential for developing new treatment methodologies and refining existing processes. Its focus on small-scale applications drives early-stage research, allowing for experimentation and adaptation in cellular therapies. As researchers explore new avenues, the R&D Scale remains an important component in shaping the future of automated and closed cell processing systems.

Global Automated And Closed Cell Therapy Processing System Market Regional Insights:

North America

North America is expected to dominate the Global Automated and Closed Cell Therapy Processing System market due to its robust healthcare infrastructure, leading research institutions, and significant investments in biopharmaceutical companies. The region benefits from an advanced regulatory framework and high adoption rates of automated technologies in healthcare settings, including hospitals and research facilities. Furthermore, the presence of major players in the industry, coupled with increasing demand for personalized medicine and cell therapy, enhances North America's position in the market. Overall, these factors create a favorable environment for the growth and expansion of automated and closed cell therapy processing systems in this region.

Latin America

Latin America presents a growing market for automated and closed cell therapy processing systems, primarily driven by increasing healthcare access and investment in medical technology. However, the region still faces challenges such as regulatory hurdles, varying healthcare standards, and a lack of funding for robust research initiatives. Countries like Brazil and Mexico are improving their healthcare infrastructure, leading to a gradual growing demand for advanced therapies. While Latin America may not lead the market, it is witnessing steady growth, advocating for more comprehensive healthcare access and technology adoption.

Asia Pacific

Asia Pacific is a rapidly evolving region in terms of healthcare innovation and access to advanced technologies. Countries like China and India are making substantial investments in biopharmaceuticals and healthcare research, which may lead to increased demand for automated and closed cell therapy processing systems. However, challenges such as regulatory complexities, varying economic conditions, and infrastructural limitations could hinder faster growth. Nonetheless, the growing prevalence of chronic diseases and rising awareness about cell therapy indicates potential market growth in this region over the coming years.

Europe

Europe, while representing a significant market for automated and closed cell therapy processing systems, faces increasing competition from North America and emerging markets in Asia. The region is characterized by stringent regulatory frameworks and advanced healthcare systems, which drive the demand for innovative treatment methods. However, diverse regulatory environments across countries may slow progress compared to more unified regions. Still, the increasing focus on personalized medicine and active collaborations between research institutions and healthcare providers are encouraging developments in this market.

Middle East & Africa

The Middle East and Africa region is in the early stages of adoption of automated and closed cell therapy processing systems, primarily due to limited healthcare infrastructure and lower investment levels compared to more developed regions. However, some countries are making strides to improve their medical facilities, which may pave the way for a gradual increase in technology adoption. As investments in healthcare systems grow and awareness about advanced therapies rises, the region may show potential for incremental growth in the future, albeit still lagging behind other global markets.

Global Automated And Closed Cell Therapy Processing System Market Competitive Landscape:

Leading figures in the global market for automated and closed cell therapy processing systems are pivotal in fostering innovation and boosting efficiency by leveraging cutting-edge technologies and optimized processes. Their strategic partnerships and financial commitments are focused on enhancing treatment effectiveness and broadening their presence in the market.

Prominent entities in the market for Automated and Closed Cell Therapy Processing Systems include Terumo BCT, Lonza Group AG, Cytiva (a subsidiary of GE Healthcare), Miltenyi Biotec, Kiyotaka Co., Ltd., Magenta Therapeutics, and Ruihong Biotechnology. Other notable firms consist of OriCell Therapeutics, Bio-Rad Laboratories, PromoCell GmbH, STEMCELL Technologies Inc., Tessa Therapeutics, and F. Hoffmann-La Roche Ltd. Furthermore, the market is also bolstered by contributions from Eppendorf AG, ABP Biosciences, Sangamo Therapeutics, and Ncardia Play.

Global Automated And Closed Cell Therapy Processing System COVID-19 Impact and Market Status:

The Covid-19 pandemic considerably hastened the integration of automated and closed cell therapy processing systems, driven by an escalating demand for safer and more efficient production techniques in response to health safety apprehensions.

The COVID-19 pandemic has significantly impacted the market for Automated and Closed Cell Therapy Processing Systems, leading to a pronounced emphasis on safety and efficiency in treatment methods. The crisis has ened the demand for sophisticated healthcare solutions, resulting in a rapid embrace of automation to decrease human involvement and lower contamination risks. Additionally, challenges in supply chains and the shift toward remote operations underscored the importance of having resilient and adaptable systems that guarantee reliable cell processing. With regulatory agencies implementing stricter quality control protocols, manufacturers have channeled investments into cutting-edge technologies to meet these requirements, spurring growth in this field. Although there were initial challenges, the urgent need for accelerated research and development in therapies related to COVID-19 has further driven investments in cell therapy processing systems. As a result, the market is anticipated to continue expanding as healthcare institutions increasingly advocate for automation and closed systems to boost treatment effectiveness and ensure patient safety in the aftermath of the pandemic.

Latest Trends and Innovation in The Global Automated And Closed Cell Therapy Processing System Market:

- In January 2023, Sartorius AG announced the acquisition of Xellbio, a company specializing in automated cell processing technologies. This strategic move aims to enhance Sartorius' ability to offer comprehensive solutions in the burgeoning cell and gene therapy markets.

- In February 2023, Thermo Fisher Scientific unveiled its new automated cell culture processing platform, the Thermo Scientific™ BioProduction™ System, designed to streamline and optimize the production of cell-based therapies, incorporating advanced analytics and AI-driven process controls.

- In March 2023, Beckman Coulter Life Sciences launched the new CE-marked Allegra X-15R centrifuge, which is capable of processing cell and gene therapies efficiently while maintaining high recovery rates of viable cells. This product is aimed at improving laboratory workflows in bioproduction.

- In April 2023, Merck KGaA, Darmstadt, Germany, expanded its Capto™ product line with the introduction of Capto™ Process Affinity resins specifically designed for enhanced purification of cell and gene therapies, addressing the increasing demand for advanced purification technologies in the market.

- In May 2023, Fujifilm Diosynth Biotechnologies announced the expansion of its biomanufacturing capabilities in North Carolina with a new state-of-the-art automated cell culture facility aimed at meeting the increasing demand for cell and gene therapies.

- In June 2023, Lonza Group announced a multi-year partnership with the University of Pennsylvania to advance cell and gene therapy research, including the development of automated manufacturing systems to boost scalability and efficiency for future therapeutic products.

- In August 2023, Siemens Healthineers launched the Atellica VTLi, an advanced lab automation system featuring increased throughput and data integration capabilities, significantly optimizing the workflow for cell therapy testing and processing.

- In September 2023, Celyad Oncology entered a strategic collaboration with Miltenyi Biotec to utilize Miltenyi's CliniMACS™ Prodigy technology in their CAR-T cell therapy developments, thereby enhancing the efficiency and safety of their production process.

- In October 2023, Catalent announced the opening of its new cell and gene therapy manufacturing facility in Maryland, which is equipped with advanced automation technologies to support large-scale production of autologous and allogeneic cell therapies.

Automated And Closed Cell Therapy Processing System Market Growth Factors:

The expansion of the Automated and Closed Cell Therapy Processing System Market can be attributed to several key elements, such as the growing need for tailored medical solutions, innovations in automation technologies, and an increasing emphasis on producing therapies that are both more efficient and safer.

The market for Automated and Closed Cell Therapy Processing Systems is witnessing notable expansion, influenced by various crucial elements. A primary driver is the increasing incidence of chronic illnesses, coupled with a ened demand for targeted and individualized treatment modalities, which in turn fosters progress in cell therapy innovations. The prioritization of automation within healthcare settings not only boosts operational efficiency but also mitigates the likelihood of human errors, ultimately enhancing patient care outcomes. Furthermore, the rising volume of research initiatives and clinical trials dedicated to regenerative medicine and immunotherapy supports market growth, as closed processing systems help lower contamination risks while maintaining rigorous safety protocols. Additionally, regulatory encouragement for advanced therapies is bolstering both innovation and uptake, with the biotechnology and pharmaceutical industries making substantial investments in cell therapy advancements. The incorporation of artificial intelligence and machine learning into automated frameworks is further refining process efficiency and scalability. The COVID-19 pandemic has also expedited the transition towards sophisticated therapeutic technologies, underscoring the essential need for robust processing systems. As global healthcare frameworks continue to transform and adapt to emerging therapeutic strategies, the demand for automated and closed cell therapy processing solutions is anticipated to rise significantly, presenting new prospects for manufacturers and market participants.

Automated And Closed Cell Therapy Processing System Market Restaining Factors:

Primary challenges in the market for Automated and Closed Cell Therapy Processing Systems consist of significant initial investment and the intricacies associated with adhering to regulatory standards.

The market for Automated and Closed Cell Therapy Processing Systems encounters various inhibiting factors that could impede its expansion. One primary challenge is the substantial upfront capital required for sophisticated processing technologies, which often serves as a deterrent for smaller entities and start-up organizations. Additionally, navigating the intricate landscape of regulatory standards for development and approval can significantly delay market entry, given the diverse regulations present in different geographical areas.

Moreover, there is a scarcity of skilled personnel adept in using these advanced systems. Organizations frequently find it difficult to recruit individuals who possess expertise in both cell therapy methodologies and automation technologies. The intricacies of incorporating these modern systems into existing healthcare frameworks can also dissuade potential adopters, particularly within institutions that utilize outdated technology. Lastly, concerns regarding the dependability and uniformity of automated solutions, in contrast to traditional manual processes, may lead to hesitation among conventional practitioners to fully adopt these innovations.

Despite these challenges, the market stands on the brink of substantial growth, fueled by ongoing advancements in the field of biotechnology and a surge in investments directed towards research and product innovation. This growth is further supported by a deepening comprehension of cell therapies and a rising need for more efficient processing methodologies.

Key Segments of the Automated And Closed Cell Therapy Processing System Market

Workflow Overview

• Cryopreservation

• Fill-finish

• Separation

• Expansion

• Apheresis

• Others

Type Overview

• Stem Cell Therapy

• Non-stem Cell Therapy

Scale Overview

• Commercial Scale

• R&D Scale

Distribution Channel Overview

• Insurance Intermediaries

• Insurance Companies

• Banks

• Insurance Brokers

• Insurance Aggregators

End-User Overview

• Senior Citizens

• Education Travelers

• Business Travelers

• Family Travelers

• Others

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America