Armored Vehicle Upgrade And Retrofit Market Analysis and Insights:

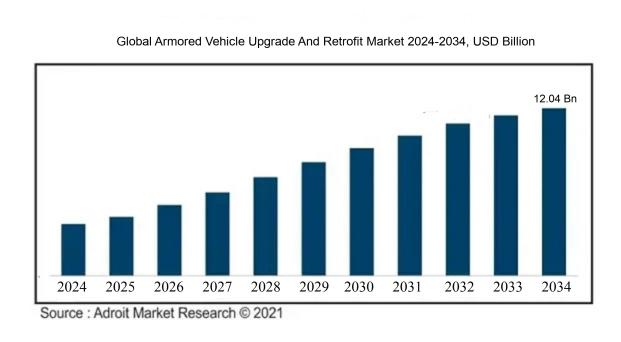

The size of the global market for Armored vehicle upgrades and retrofits was USD 8.12 billion in 2024, increased to USD 8.76 billion in 2025, and is projected to reach around USD 12.04 billion by 2034, with a compound annual growth rate (CAGR) of 5.5% from 2024 to 2034.

The market for upgrading and retrofitting armored vehicles is significantly influenced by several crucial elements. Firstly, escalating geopolitical uncertainties and the demand for enhanced military capabilities drive armed forces to enhance their current fleets rather than invest in new vehicles. Furthermore, technological advancements—including superior armor materials, automation features, and integrated systems—allow for upgrades that improve the performance and durability of these vehicles. Financial limitations also play a critical role, as updating existing vehicles can extend their operational lifespan and lower the expenses associated with developing new models. Additionally, the growing need for military and paramilitary units to respond to asymmetric warfare scenarios has boosted the emphasis on customizing vehicles to fulfill particular operational needs. Finally, partnerships between defense manufacturers and government bodies promote innovation and streamline the execution of retrofitting initiatives, further supporting market growth. Altogether, these factors create a strong drive for the development of the armored vehicle upgrade and retrofit industry.

Armored Vehicle Upgrade And Retrofit Market Definition

The enhancement and retrofitting of armored vehicles entails the process of upgrading existing models with state-of-the-art technologies, enhanced armor, and advanced systems to improve their functionality and resilience. This approach includes the incorporation of innovative equipment and alterations to ensure that older vehicles meet contemporary operational requirements.

Upgrading and retrofitting armored vehicles is crucial for boosting the safety, effectiveness, and versatility of military and law enforcement units. As threats evolve and technology progresses, it is essential to ensure that these vehicles are equipped to perform in a variety of operational settings. Retrofitting can lead to improved armor protection, modernized communication systems, and the integration of cutting-edge weaponry, all of which enhance operational readiness. Additionally, upgrades help to address the wear and tear that comes with aging vehicles, thereby extending their lifespan and reducing the necessity for expensive new purchases. Ultimately, these enhancements significantly improve mission success rates, enhance crew safety, and lead to more efficient responses to contemporary combat and security challenges.

Armored Vehicle Upgrade And Retrofit Market Segmental Analysis:

Insights On Vehicle Type

Infantry Fighting Vehicle (IFV)

The Infantry Fighting Vehicle (IFV) is expected to dominate the Global Armored Vehicle Upgrade and Retrofit Market. This prominence can be attributed to the increasing emphasis on multi-role capabilities of the IFV, enabling it to carry infantry while providing fire support. Nations globally recognize the need for versatile vehicles capable of integrating advanced technologies such as enhanced fire power, better situational awareness systems, and modern combat capabilities. Additionally, the rising operational demands in conflict zones has intensified the focus on upgrading existing fleets, thereby reinforcing the relevance of IFVs in modern warfare scenarios, further solidifying their leading status in the upgrade market.

Armored Personnel Carrier (APC)

Armored Personnel Carriers (APC) have steadily gained importance, particularly in peacekeeping and troop transport missions. Their adaptability for different operational roles, such as medical evacuation and command and control functions, enhances their market appeal. Various countries are recognized as investing in retrofitting their existing APC fleets to incorporate advanced protection and communication technologies. However, they face competition from the multifunctional aspects of IFVs, which are more favored in combat scenarios, limiting their growth in the upgrade sector.

Mine-Resistant Ambush Protected (MRAP)

Mine-Resistant Ambush Protected (MRAP) vehicles have significant importance, especially in regions with high risks of IED attacks. They are designed to enhance troop survivability in hostile environments, which drives the need for upgrades focused on armor enhancement and improved electronic warfare capabilities. As military forces prioritize soldier safety, investments in upgrading MRAPs are aligning with the ongoing global efforts to adapt to asymmetric warfare threats. However, MRAPs may face limitations due to their specialized design, which might restrict their versatility compared to the broader applications of IFVs.

Main Battle Tank (MBT)

Main Battle Tanks (MBT) continue to be a critical component of ground warfare, necessitating regular upgrades to maintain their effectiveness against evolving threats. This includes improvements in armor, firepower, and battlefield management systems. As military budgets are allocated to enhance the lethality and protection of MBTs, they remain a focal point for modernization efforts. Nonetheless, costs associated with upgrading MBTs can be significantly high relative to the enhanced capabilities, which may lead defense forces to invest more heavily in versatile platforms like IFVs for broader operational context, thereby moderating their dominance in upgrades compared to newer tactical systems.

Others

The category labeled "Others" encompasses various armored vehicle types not explicitly named, including specialized combat vehicles and support systems. While these vehicles play vital roles in assorted missions—ranging from reconnaissance to logistics support—they typically do not see the same level of investment in upgrades as IFVs or MBTs. The broad nature of this category makes it hard to pinpoint a consistent demand pattern, which affects its overall market strength. Hence, their contribution to the upgrade market is considered limited compared to more established vehicle types in the armored vehicle.

Insights On Design

Wheeled Armored Vehicles

Wheeled armored vehicles are poised to dominate the Global Armored Vehicle Upgrade and Retrofit Market primarily due to their versatility and the increasing demand for mobility in modern combat scenarios. These vehicles offer better speed and maneuverability, making them suitable for a wide range of operations from peacekeeping to full-scale military engagements. Additionally, advancements in technology have allowed for comprehensive upgrades to weapon systems, communication equipment, and protection measures. As global defense budgets continue to rise, many military forces are opting to enhance existing wheeled vehicles rather than procure new ones, thereby driving growth in this.

Tracked Armored Vehicles

Tracked armored vehicles serve a different purpose in defense operations, focusing on heavy firepower and enhanced survivability on rugged terrains. While they have essential capabilities for frontline combat and protection, their relatively lower mobility compared to wheeled counterparts limits their usage in dynamic battlefield scenarios. Nevertheless, they are critical for specific applications like armored personnel carriers and main battle tanks. Countries with substantial armored fleets will likely invest in retrofitting their tracked vehicles to extend their operational life and maintain combat readiness to counter evolving threats effectively.

Global Armored Vehicle Upgrade And Retrofit Market Regional Insights:

North America

North America is expected to dominate the Global Armored Vehicle Upgrade and Retrofit market due to several critical factors. The region is home to established defense manufacturers and a substantial military budget, which prioritizes modernization of existing fleets over acquiring new vehicles. In addition, growing concerns over regional security threats and geopolitical tensions have led to increased spending on defense upgrades. The presence of key players, such as Lockheed Martin and General Dynamics, further strengthens North America's position in the market. Additionally, advancements in technology and a focus on enhancing vehicle capabilities through upgrades solidify North America's dominant stance in this sector.

Latin America

Latin America has seen a gradual increase in defense budgets, particularly from countries like Brazil and Mexico. The need for modernization in aging military fleets has led to an interest in armored vehicle upgrades. However, limited budgets and varying political stability in the region often hinder significant investments. Nevertheless, as countries in Latin America continue to prioritize security and confront organized crime, the importance of upgraded armored vehicles may rise, leading to potential opportunities for growth in this.

Asia Pacific

The Asia Pacific region is poised for notable growth in the armored vehicle upgrade and retrofit market. Rapid industrialization, rising military expenditures, and looming security threats are primary drivers. Countries such as India, China, and Japan are investing heavily in defense modernization. The growing focus on indigenous defense production and partnerships with established global defense contractors will likely enhance the region's capability for vehicle upgrades. Furthermore, regional tensions, especially concerning border disputes, emphasize the need for advanced armored capabilities.

Europe

Europe is home to several advanced military forces, and defense procurement strategies have increasingly emphasized modernization over new acquisitions. The region benefits from a robust defense industry, with countries like the UK, Germany, and France leading the way in vehicle upgrades. Additionally, geopolitical tensions related to Russia and ongoing commitments to NATO provide a significant incentive for European nations to enhance their armored capabilities. However, the market may face challenges due to budget constraints resulting from varying economic conditions across the continent, particularly for smaller nations.

Middle East & Africa

The Middle East and Africa exhibit a mixed landscape for the armored vehicle upgrade and retrofit market. While countries in the Gulf Cooperation Council are boosting military spending to modernize their fleets, nations in sub-Saharan Africa may struggle with resources. However, the ongoing conflicts and security challenges in numerous regions create a persistent demand for advanced armored vehicles. The region's potential growth is largely dependent on foreign investment and collaboration with global defense firms eager to capitalize on emerging market opportunities.

Armored Vehicle Upgrade And Retrofit Competitive Landscape:

Major contributors in the global armored vehicle upgrade and retrofit sector concentrate on upgrading current military vehicles by incorporating cutting-edge technologies, enhancing operational capabilities, and extending their lifespan. Furthermore, they form strategic alliances and collaborations to meet the changing demands of defense and maintain a competitive edge in the market.

Prominent participants in the Armored Vehicle Upgrade and Retrofit Market comprise BAE Systems, General Dynamics Land Systems, Rheinmetall AG, Oshkosh Defense, Leonardo S.p.A., Navistar Defense, Thales Group, ST Engineering, AM General, and Lockheed Martin. Additionally, significant firms in this industry encompass Textron Systems, Ifa Samson, Elbit Systems, Northrop Grumman Corporation, and Patria. These organizations are engaged in advancing the functionality and effectiveness of armored vehicles by implementing diverse upgrade and retrofit strategies.

Global Armored Vehicle Upgrade And Retrofit COVID-19 Impact and Market Status:

The Covid-19 pandemic caused significant disruptions in supply chains and postponed defense procurement procedures, leading to a brief deceleration in the global market for armored vehicle upgrades and retrofits.

The COVID-19 pandemic profoundly affected the market for upgrading and retrofitting armored vehicles, primarily by disrupting supply chains and manufacturing operations. Restrictions and lockdowns resulted in a shortage of skilled labor and critical components, which in turn caused delays in projects and rising costs. Furthermore, many governments reassessed their defense budgets, choosing to focus on healthcare initiatives rather than military funding, which hindered investment in upgrade programs. Nevertheless, the imperative for improved security and protection from emerging threats has triggered a gradual recovery in this sector. As military organizations respond to evolving operational demands, there is a growing need for updated armored solutions, especially amid ongoing geopolitical tensions. Additionally, the pandemic has fast-tracked the integration of digital technologies in defense procurement, encouraging manufacturers to pursue more efficient approaches to upgrades and retrofitting. Thus, although the market encountered temporary challenges, it is anticipated to recover as defense spending increases and the demand for advanced military capabilities grows.

Latest Trends and Innovation in The Global Armored Vehicle Upgrade And Retrofit Market:

- In February 2023, BAE Systems announced the acquisition of the U.S.-based company, Army Technology, to enhance its offerings in armored vehicle upgrades and retrofitting solutions, extending its capabilities in the U.S. defense market.

- In June 2023, Rheinmetall AG unveiled its new modular upgrade kit for the Boxers vehicle, enhancing its survivability and battlefield capabilities. The upgrade includes improved armor and advanced electronic systems.

- In August 2023, General Dynamics Ordnance and Tactical Systems secured a contract from the U.S. Army to retrofit M109A6 Paladin self-propelled howitzers with state-of-the-art technology, focusing on improved fire control systems.

- In July 2023, Oshkosh Defense was awarded a contract by the U.S. Army to upgrade the Joint Light Tactical Vehicles (JLTV) with enhanced protection and mobility features, thereby increasing the operational capabilities of these vehicles in various theaters.

- In March 2023, Leonardo announced a collaboration with KMW (Krauss-Maffei Wegmann) to jointly develop upgrade solutions for the Leopard 2 tank, focusing on integrating advanced electronic warfare systems and improved lethality.

- In October 2023, Elbit Systems launched a comprehensive upgrade package for various legacy armored vehicles, aimed at extending their operational lifespan and performance, incorporating new sensor technology and networked capabilities.

- In September 2023, Nexter Systems announced the completion of a successful trial for its upgraded VAB (Véhicule de l'Avant Blindé) vehicle, which included advancements in remote weapon systems and enhanced armor protection.

Armored Vehicle Upgrade And Retrofit Market Growth Factors:

The market for upgrading and retrofitting armored vehicles is propelled by a surge in defense expenditure, escalating geopolitical conflicts, and the necessity for improved vehicle performance to counter emerging threats.

The expansion of the Armored Vehicle Upgrade and Retrofit Market is primarily influenced by a variety of significant factors. Foremost among these is the escalating requirement for enhanced protection of vehicles, driven by increasing global security threats such as terrorism and international conflicts. This situation compels military and defense agencies to modernize their existing fleets. Furthermore, technological advancements—encompassing superior armor materials, integrated communication systems, and advanced weaponry—play a crucial role in motivating these modernization efforts.

In addition, the financial viability of retrofitting outdated vehicles, as opposed to purchasing new ones, provides a substantial impetus, especially relevant in an environment of tightening defense budgets across many nations. The rising prevalence of urban warfare also demands vehicles that can swiftly adapt and operate effectively in intricate scenarios, thereby boosting market demand.

Government initiatives focused on enhancing defense capabilities through modernization schemes further contribute to this market growth. The emergence of non-state actors and the challenges posed by asymmetric warfare require military forces to uphold agility and operational efficiency, increasing the necessity for upgraded armored solutions.

Lastly, partnerships between defense manufacturers and technology enterprises foster innovation, resulting in enhanced retrofit alternatives that address shifting operational needs, thereby supporting sustainable long-term market growth.

Armored Vehicle Upgrade And Retrofit Market Restaining Factors:

Critical factors affecting the Armored Vehicle Upgrade and Retrofit Market encompass financial restrictions, compliance issues, and the swiftly advancing technological environment.

The Armored Vehicle Upgrade and Retrofit Market encounters numerous challenges that may impede its expansion. A primary obstacle is the substantial expense associated with upgrades, deterring military entities and defense contractors, particularly in scenarios with limited budgets. Additionally, the intricacy of technology can be a hindrance; the integration of sophisticated systems often necessitates expert knowledge and training, resulting in potential delays and higher costs. Furthermore, the strict regulations governing modifications to military vehicles complicate the retrofit process, as compliance with safety and operational standards is essential. Disruptions in the supply chain, along with a scarcity of high-quality components, can also delay upgrade initiatives. Geopolitical tensions may further influence defense expenditures and strategic priorities, creating uncertainty around funding for modernization efforts. Nevertheless, the market shows considerable potential, fueled by a growing commitment to enhancing operational effectiveness and an increasing requirement for robust protection against emerging threats. This environment offers opportunities for technological advancements and innovation. As global military forces acknowledge the significance of improved mobility and protective measures, we may witness an upsurge in investments within the armored vehicle upgrade and retrofit.

Key Segments of the Armored Vehicle Upgrade And Retrofit Market

By Vehicle Type

• Armored Personnel Carrier (APC)

• Infantry Fighting Vehicle (IFV)

• Mine-Resistant Ambush Protected (MRAP)

• Main Battle Tank (MBT)

• Others

By Design

• Wheeled Armored Vehicles

• Tracked Armored Vehicles

Regional Overview

North America

• US

• Canada

• Mexico

Europe

• Germany

• France

• U.K

• Rest of Europe

Asia Pacific

• China

• Japan

• India

• Rest of Asia Pacific

Middle East and Africa

• Saudi Arabia

• UAE

• Rest of Middle East and Africa

Latin America

• Brazil

• Argentina

• Rest of Latin America